Global On-demand Insurance Market Size, Share Analysis By Coverage (Car Insurance, Home Appliances Insurance, Entertainment Insurance, Contractor Insurance, Electronic Equipment Insurance, Others), By End-user (Individuals, Businesses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155298

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Strategic Insights

- Role of AI

- Analysts’ Viewpoint

- US Market Size

- Top Growth Drivers

- Key Trends & Innovations

- By Coverage – Car Insurance (25.5%)

- By End-User – Businesses (72.0%)

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

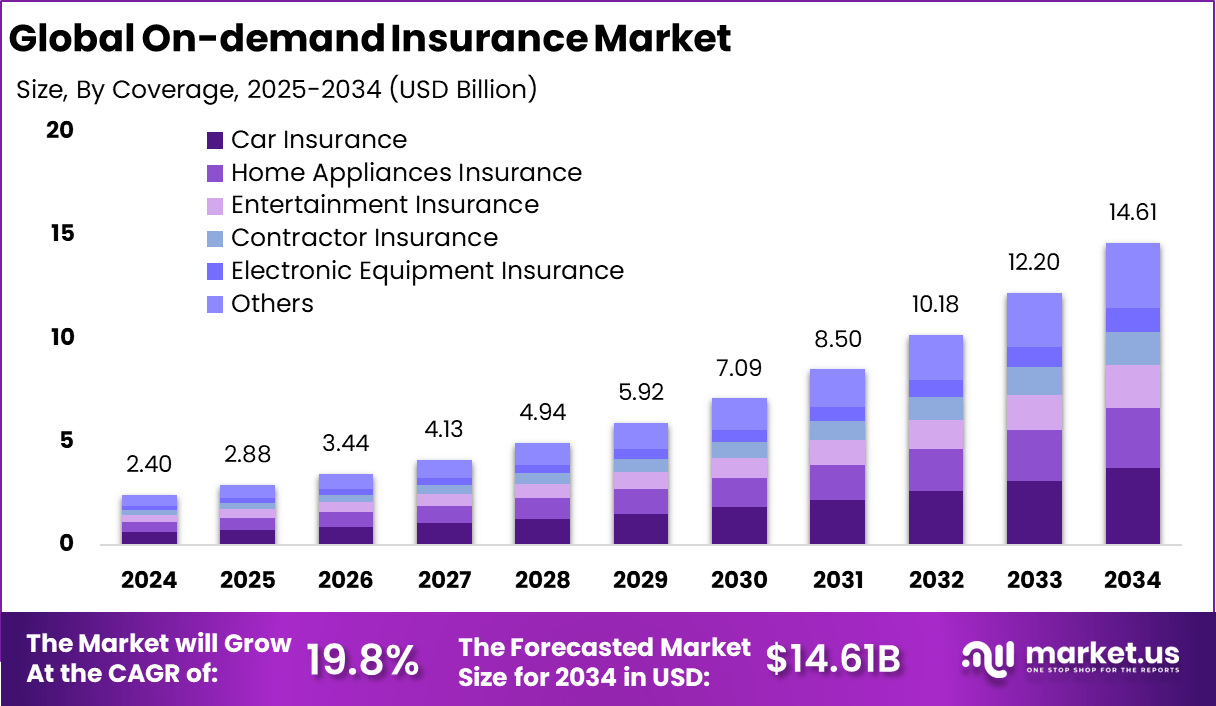

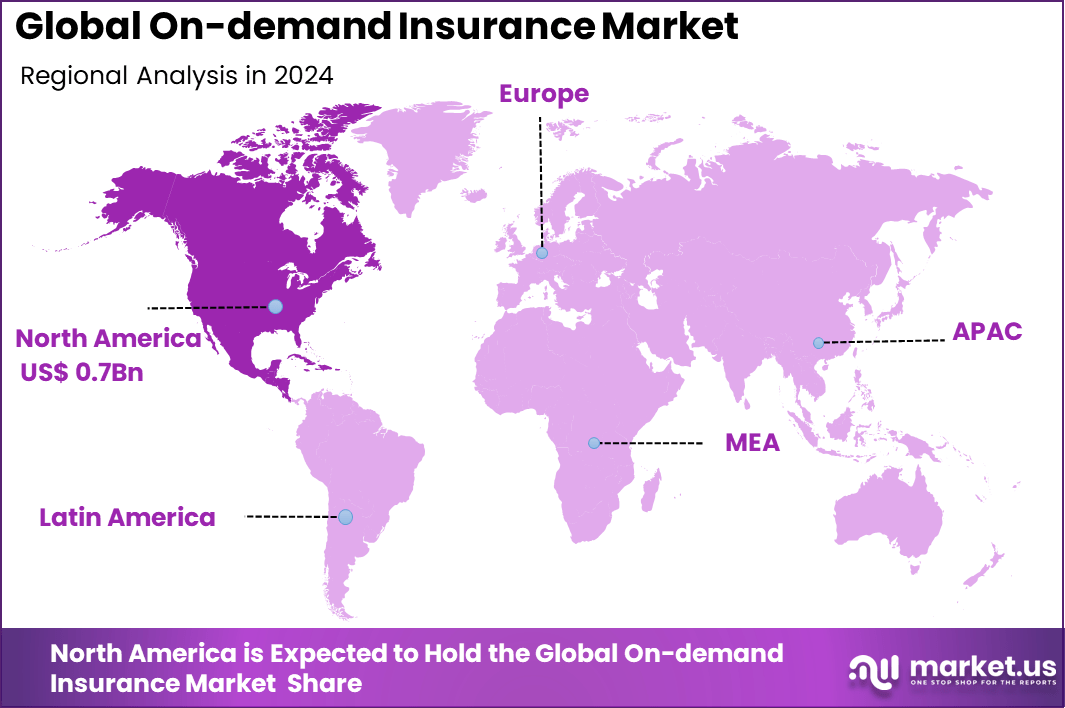

The Global On-demand Insurance Market size is expected to be worth around USD 14.61 Billion By 2034, from USD 2.40 billion in 2024, growing at a CAGR of 19.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 31.2% share, holding USD 0.7 Billion revenue.

The On‑Demand Insurance Market is defined by coverage that may be activated by users precisely when it is needed, often via mobile applications or digital platforms, rather than through continuous, long-term policies. It is commonly applied to sectors such as travel, personal belongings, short-term vehicle use, and event-specific scenarios. In its essence, this model offers episodic protection tailored to user activity and risk exposure.

Based on data from forbes, In 2024, total premiums paid for individual life insurance in the U.S. reached $16.2 billion, marking a historic peak and the fourth consecutive annual record, according to LIMRA. Policy volumes remained largely unchanged from 2023, suggesting that the increase in premium value, rather than the number of policies, drove growth.

Data from the American Council of Life Insurers (ACLI) indicates that 134,193,000 individual life insurance policies were in force in 2023, alongside more than 118,000,000 group life insurance policies. This strong dual presence underscores the widespread reliance on both personal and employer-sponsored coverage, reinforcing life insurance as a central pillar of long-term financial planning in the U.S.

Strategic Insights

- By coverage type, Car Insurance led the market with a 25.5% share, supported by rising demand for flexible, usage-based policies catering to short-term and infrequent drivers.

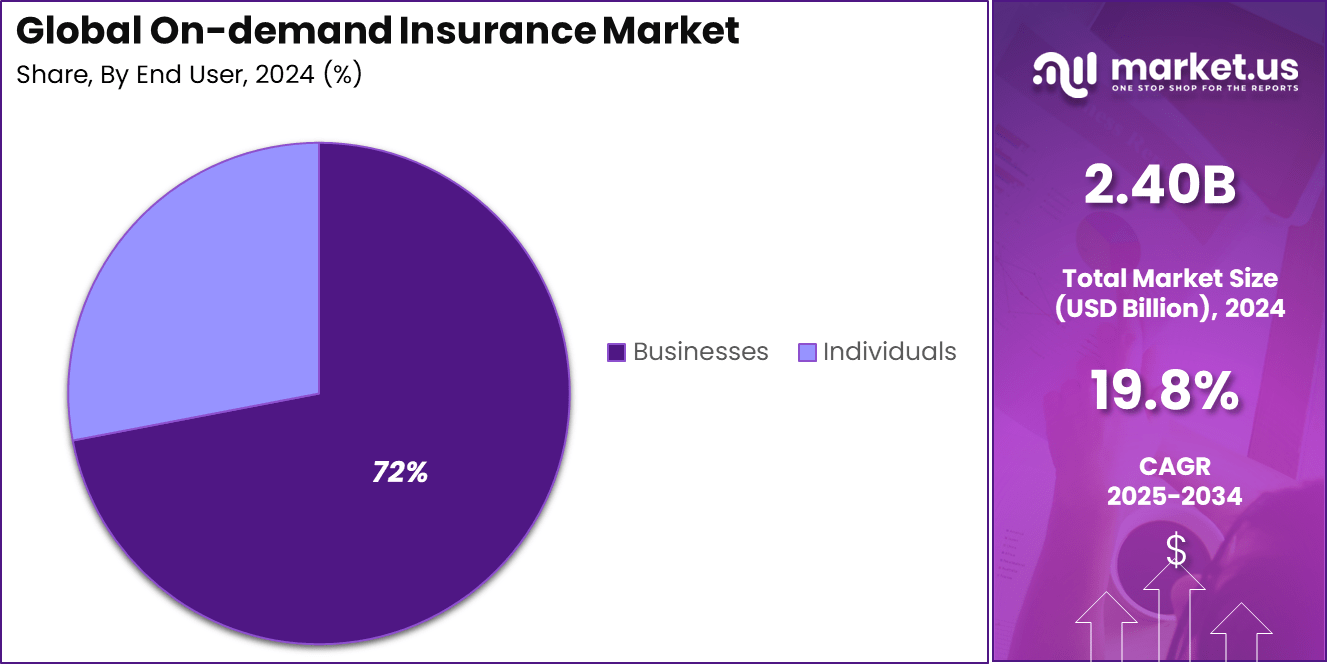

- By end-user, Businesses dominated with a 72.0% share, reflecting the strong uptake among fleet operators, mobility services, and enterprises seeking scalable insurance models.

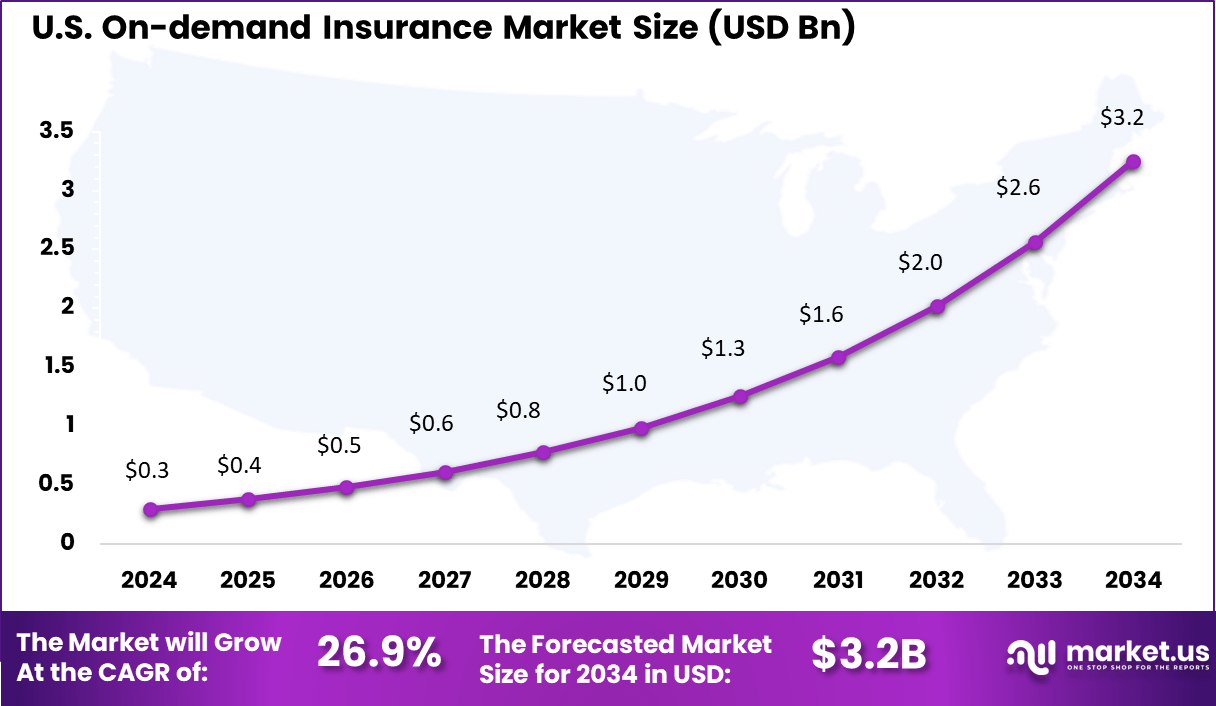

- The U.S. market was valued at USD 0.3 billion in 2024 and is projected to grow at a robust CAGR of 26.9%, driven by the expansion of gig economy platforms, rental services, and digital insurance adoption.

- North America held a 31.2% global share, supported by advanced insurtech ecosystems, regulatory flexibility, and high smartphone penetration enabling instant policy access.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 2.40 Bn Forecast Revenue (2034) USD 14.61 Bn CAGR(2025-2034) 19.8% Leading Segment By End-user – Businesses: 72.0% Top driving factors include the rise of digital platforms and mobile apps that have made insurance more accessible and easier to manage. Consumers today demand greater flexibility, and on-demand insurance meets this by allowing policyholders to tailor coverage based on real-time needs, avoiding payment for unnecessary protection.

The growth of gig economy workers, freelancers, and the sharing economy has also fueled demand since these groups often require episodic or usage-based insurance solutions that traditional policies cannot adequately provide. Technological advancements such as IoT, AI, machine learning, and blockchain are enhancing risk assessment, underwriting, and claims processing, enabling insurers to offer faster, more accurate, and fraud-resistant services.

According to Market.us, The global insurance software market is projected to reach approximately USD 6.6 billion by 2033, increasing from USD 3.7 billion in 2023, with a compound annual growth rate (CAGR) of 5.9% between 2024 and 2033. This growth is driven by the adoption of digital platforms, automation, and analytics to improve policy management, claims, risk assessment, and compliance.

In parallel, the global generative AI in life insurance market is expected to grow significantly, rising from USD 138.8 million in 2023 to approximately USD 1,739.9 million by 2033, at a notable CAGR of 28.77%. This surge is driven by the technology’s ability to automate underwriting, personalize policy recommendations, detect fraudulent claims, and improve customer interactions through AI-generated communications.

The increasing adoption of technologies such as AI-powered data analytics, IoT devices for real-time monitoring, and blockchain for secure transactions drives the market by improving operational efficiency and customer trust. These technologies enable insurers to dynamically adjust premiums, detect fraudulent claims swiftly, and offer hyper-personalized insurance products.

Role of AI

Role/Function Description AI/ML Chatbots Automated onboarding, 24/7 customer support, and claims handling for frictionless experience Usage-Based/Personalized Pricing AI analyzes real-time behavior and IoT/telematics data to set premiums and assess risk Automated Underwriting ML reduces manual intervention, allowing near-instant issuance and flexible micro-policies Predictive Analytics Big data and AI enable targeted recommendations and improved risk modeling Blockchain Integration Secures transactions, enables transparent peer-to-peer and micro-insurance models IoT/Telematics Integration Triggers coverage activation/deactivation, supports event-based insurance Analysts’ Viewpoint

Investment opportunities in the on-demand insurance market are abundant, characterized by technological innovation and expanding consumer demand. Investors find promising potential in developing advanced AI algorithms for risk modeling, expanding product portfolios to serve niche segments, and tapping into underserved regions.

From a business benefits perspective, on-demand insurance improves operational agility by automating underwriting and claims processes, reducing administrative costs and time. It offers insurers a competitive edge through superior customer engagement, increased market penetration, and the ability to rapidly respond to evolving consumer needs.

The regulatory environment in the on-demand insurance market is complex and evolving, with emphasis on compliance with licensing requirements, data privacy laws like GDPR, and fraud prevention. Regulators strive to balance fostering innovation with protecting consumers, leading to ongoing adjustments in policies governing digital insurance products.

US Market Size

The U.S. On-demand Insurance Market was valued at USD 0.3 Billion in 2024 and is anticipated to reach approximately USD 3.2 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 26.9% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 31.2% of the On-demand Insurance Market and generating around USD 0.7 billion in revenue. This leadership is attributed to the region’s advanced digital infrastructure, high penetration of smartphones, and widespread adoption of app-based financial services.

Consumers in the United States and Canada are increasingly seeking flexible insurance solutions that can be activated or canceled in real time, aligning with evolving lifestyle patterns and gig economy requirements. Strong venture capital funding and strategic partnerships between insurers and technology providers have further accelerated adoption.

Top Growth Drivers

Growth Factor Description Digital Transformation & Mobile-first Increased smartphone use and digital ecosystems propel easy access to on-demand policies Gig Economy Expansion More contractors/freelancers demand episodic, flexible coverage Personalization Expectations Consumers favor insurance tailored to their usage, needs, and events Embedded & Embedded Insurance Channels Seamless insurance embedded in travel, auto rentals, e-commerce, and fintech apps Regulatory Support & Sandboxes Sandbox initiatives and flexible regulations foster digital innovation Key Trends & Innovations

Trend/Innovation Description Micro-duration/Micro-coverage Policies Policies for hours/days/projects, or for single devices/trips, increasing flexibility Usage-based and Telematics Insurance Pay-as-you-drive, motion-activated auto/motor insurance (ex: Zuno SWITCH app) AI-driven Claims & Underwriting Automated claim review, risk scoring, and instant payments Embedded Insurance & API Ecosystems Insurance offered instantly in checkout flows or as part of third-party digital platforms Peer-to-Peer & Group Models Communities pool risk using digital platforms Growth in APAC & Emerging Markets Rapid adoption driven by tech, underinsurance, and regulatory innovation By Coverage – Car Insurance (25.5%)

In 2024, Car insurance accounts for 25.5% of the on-demand insurance market. This significant share highlights the growing popularity of flexible insurance coverage options for vehicle owners who require protection only when their car is in use, rather than through traditional annual policies. On-demand car insurance makes it convenient for users to activate or deactivate coverage via mobile apps, catering to individuals who drive infrequently or use shared mobility services.

The appeal of on-demand models in car insurance is driven by evolving lifestyles and a shift toward pay-as-you-go solutions that align with actual usage patterns. This approach allows consumers to control insurance costs, easily manage policies, and ensure immediate coverage for temporary driving, rental, or car-sharing needs.

By End-User – Businesses (72.0%)

In 2024, Businesses represent 72.0% of the on-demand insurance market’s end-user segment. Organizations often require flexible insurance products to cover assets, employees, or operations for specific durations, such as during corporate travel, project work, event hosting, or equipment rentals.

On-demand insurance solutions help businesses manage risk more efficiently by providing real-time coverage tailored to short-term or variable needs. The dominance of business adoption is influenced by the demand for cost savings and operational efficiency.

Companies can quickly adapt coverage to changing requirements, avoiding over-insurance and streamlining claims processes, which makes on-demand insurance a preferred choice for modern, agile business operations.

Key Market Segments

By Coverage

- Car Insurance

- Home Appliances Insurance

- Entertainment Insurance

- Contractor Insurance

- Electronic Equipment Insurance

- Others

By End-user

- Individuals

- Businesses

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Changing Consumer Behavior and Technology Adoption

One of the primary drivers fueling the growth of on-demand insurance is the evolving behavior of consumers who increasingly prioritize convenience and flexibility. Modern customers, particularly younger generations and gig economy workers, want the option to pay solely for the coverage they actively use, on their own terms.

This demand coincides with the widespread adoption of smartphones and mobile apps, which make it easier than ever to access, activate, and manage insurance policies anytime and anywhere. The ability to receive instant quotes and purchase insurance within moments aligns well with today’s fast-paced lifestyles and preference for on-the-go service.

In addition to consumer expectations, technological advances play a critical role in enabling this model. Artificial intelligence, machine learning, IoT devices, and big data analytics collectively allow insurers to assess risk accurately, automate underwriting, and personalize pricing in real time. These technological capabilities transform insurance from a static product into a dynamic service tailored to actual usage patterns and risk profiles.

Restraint Analysis

Regulatory Complexity and Compliance Challenges

Despite the promising growth and innovation in on-demand insurance, regulatory complexity remains a significant restraint. Insurance is a heavily regulated industry with rules that vary widely by region, jurisdiction, and coverage type. On-demand insurance products, often designed for short durations or specific use cases, do not always fit neatly within existing regulatory frameworks. This creates legal ambiguities and compliance burdens that can slow market entry or increase operational costs for providers.

Moreover, because on-demand insurance relies extensively on data collection and analysis – including sensitive personal information – compliance with data protection laws such as GDPR adds another layer of challenge. Insurers must maintain robust data security measures and ensure transparency to preserve consumer trust.

The evolving nature of these regulations demands constant adaptation, which can be particularly difficult for newer or smaller insurers lacking extensive legal and compliance teams. Consequently, regulatory uncertainty and associated compliance costs pose ongoing hurdles for broader adoption and seamless scaling of on-demand insurance.

Opportunity Analysis

Expansion into Emerging and Underserved Markets

The expanding appetite for on-demand insurance presents a significant opportunity to tap into emerging and underserved markets globally. Large population segments in regions such as Asia-Pacific, Latin America, and Africa remain inadequately protected by traditional insurance models, often due to affordability issues or lack of tailored product offerings.

The flexibility and cost-effectiveness of on-demand insurance, which allows pay-per-use or event-specific coverage, align well with the needs of these markets. This model enables insurers to design products that suit local conditions and consumer behaviors, including micro-insurance or short-term policies accessible via mobile devices.

The use of digital platforms helps overcome distribution challenges common in these regions. By adopting on-demand insurance, providers can foster financial inclusion, extend protection to broader demographics, and open new revenue streams. The consumer shift towards personalized services also enables insurers to innovate niche products such as on-demand travel, pet, or event insurance, capturing specific customer segments more effectively.

Challenge Analysis

Building Consumer Awareness and Trust

A crucial challenge facing the on-demand insurance market is the need to build widespread consumer awareness and trust. Many potential customers remain unfamiliar with how on-demand insurance works or doubt its reliability compared to traditional policies.

Misinformation and lack of understanding can cause hesitation in adopting these newer models, especially among less tech-savvy consumers or those accustomed to conventional insurance purchasing methods. Educating customers about the benefits, flexibility, and security of on-demand insurance is essential to overcome skepticism. Insurers need to simplify policy terms and enhance transparency to foster confidence.

Additionally, protecting consumer data and ensuring smooth claims processes are vital to maintaining trust in a market heavily reliant on digital platforms. Creating strong brand reputation and customer loyalty requires ongoing efforts to demonstrate value and service quality in this relatively novel insurance space.

Competitive Analysis

Slice Insurance Technologies Inc., VSure.life, and Xceedance, Inc. have strengthened their positions in the on-demand insurance market by offering flexible, technology-enabled solutions. These companies focus on digital platforms that enable quick policy issuance, micro-duration coverage, and seamless claims processing. Advanced data analytics and AI-driven risk assessment have been integrated to improve underwriting efficiency.

SkyWatch Insurance Services, Inc., Zuno General Insurance Limited, and JaSure have expanded market reach by introducing niche, usage-based insurance models. These solutions target specific industries such as mobility services, travel, and event-based coverage. By adopting telematics, IoT integration, and real-time risk monitoring, they provide dynamic pricing and enhanced customer engagement.

Thimble, JAUNTIN, Cuvva, Snap-it Cover, and other emerging providers are reshaping competitive dynamics through user-first mobile applications and embedded insurance models. Their emphasis lies in subscription-based plans, instant activation, and cancellation flexibility. These companies also invest in AI-powered chatbots and digital claims assistants to reduce processing times and improve customer satisfaction.

Top Key Players in the Market

- Slice Insurance Technologies Inc.

- VSure.life

- Xceedance, Inc.

- SkyWatch Insurance Services, Inc.

- Zuno General Insurance Limited

- JaSure

- Thimble

- JAUNTIN

- Cuvva

- Snap-it Cover

Recent Developments

- In January 2024, NFP acquired Advanced Insurance Consultants Limited in London, expanding its commercial insurance footprint and capability to offer integrated risk mitigation solutions in key sectors like agriculture and construction.

- In January 2024, Travelers completed its $435 million acquisition of Corvus Insurance, enhancing its cyber underwriting and risk management capabilities to address evolving digital risks. This acquisition highlighted the strategic focus on technology-driven specialized insurance solutions.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage (Car Insurance, Home Appliances Insurance, Entertainment Insurance, Contractor Insurance, Electronic Equipment Insurance, Others), By End-user (Individuals, Businesses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Slice Insurance Technologies Inc., VSure.life, Xceedance, Inc., SkyWatch Insurance Services, Inc., Zuno General Insurance Limited, JaSure, Thimble, JAUNTIN, Cuvva, Snap-it Cover Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  On-demand Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

On-demand Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Slice Insurance Technologies Inc.

- VSure.life

- Xceedance, Inc.

- SkyWatch Insurance Services, Inc.

- Zuno General Insurance Limited

- JaSure

- Thimble

- JAUNTIN

- Cuvva

- Snap-it Cover