Global Omnichannel Order Management Market Size, Share, Growth Analysis By Component (Software, Services), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Applications (Retail & E-commerce, Wholesale & Distribution, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163434

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

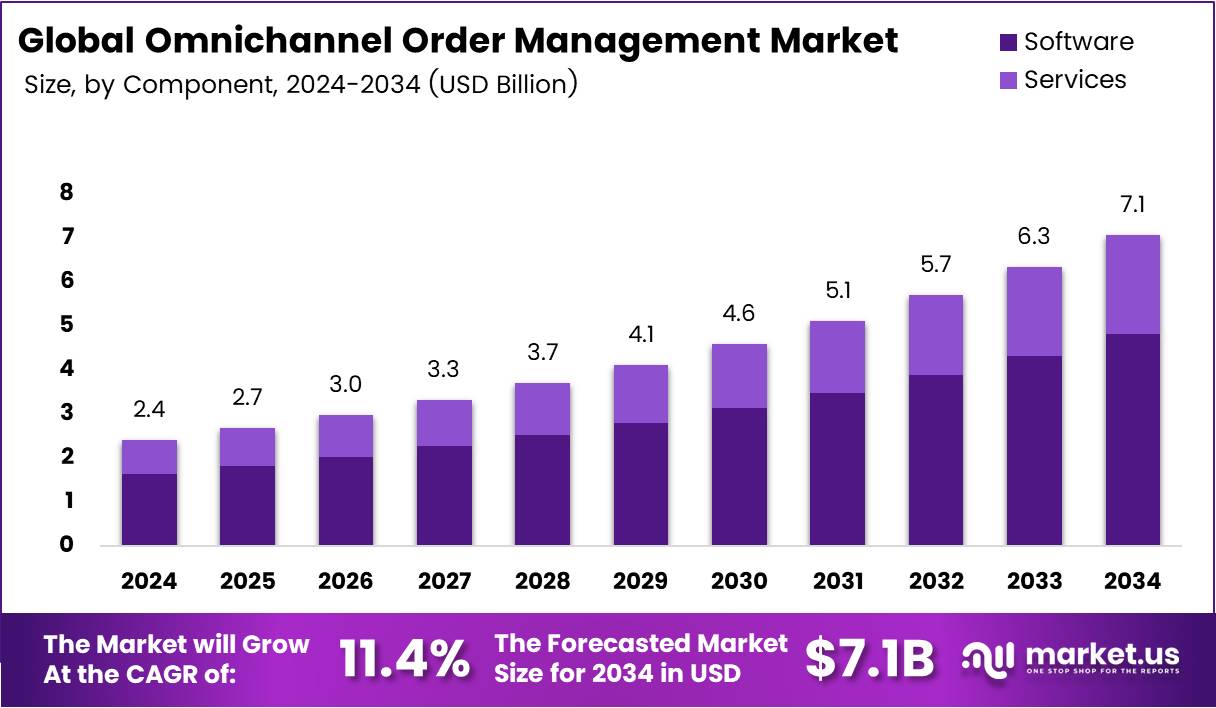

The Global Omnichannel Order Management Market size is expected to be worth around USD 7.1 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

The Omnichannel Order Management Market represents an integrated ecosystem that enables businesses to manage, track, and fulfill orders seamlessly across multiple sales channels—online, offline, and mobile. This system ensures consistent customer experience, optimized inventory utilization, and real-time visibility, empowering retailers and brands to meet evolving consumer expectations efficiently.

Omnichannel Order Management (OMS) has become a critical enabler of digital retail transformation. It bridges fragmented sales and fulfillment systems, enhancing operational agility. Businesses increasingly invest in OMS to synchronize back-end logistics with front-end experiences, improving delivery accuracy, inventory transparency, and customer satisfaction in a highly competitive market environment.

Moreover, the Omnichannel Order Management Market is witnessing robust growth driven by rapid digitalization and expanding e-commerce. As businesses adapt to hybrid shopping patterns, OMS platforms streamline complex order routing and ensure faster, cost-effective fulfillment. This market evolution is also supported by technological advancements in AI-driven analytics, cloud computing, and API integration.

In addition, growing opportunities arise from the demand for real-time data synchronization across multiple touchpoints. Enterprises across retail, manufacturing, and logistics sectors are adopting intelligent order management solutions to improve decision-making and resource allocation. The scalability and flexibility of cloud-based OMS platforms further attract small and mid-sized enterprises to embrace digital commerce ecosystems.

Government initiatives supporting digital infrastructure, logistics modernization, and smart retail technologies also stimulate market expansion. Regulatory frameworks encouraging data transparency, cross-border e-commerce, and supply chain resilience are fostering innovation in OMS adoption. Public sector investments in digital commerce ecosystems strengthen both B2B and B2C fulfillment networks across key markets.

According to an industry report, digitally influenced sales exceed 60% of all retail in the U.S. by 2025, highlighting the growing need for unified shopping experiences across channels. Furthermore, U.S. consumers spent $331.6 billion online in the first four months of 2024, up 7% YoY, according to industry data—showing the immense volume that modern OMS solutions must manage and optimize effectively.

Key Takeaways

- The Global Omnichannel Order Management Market is projected to reach USD 7.1 Billion by 2034, growing from USD 2.4 Billion in 2024.

- The market is expected to expand at a CAGR of 11.4% during 2025–2034.

- Software led the component segment with a 67.9% share in 2024.

- Large Enterprises dominated the enterprise-size segment with a 69.4% share in 2024.

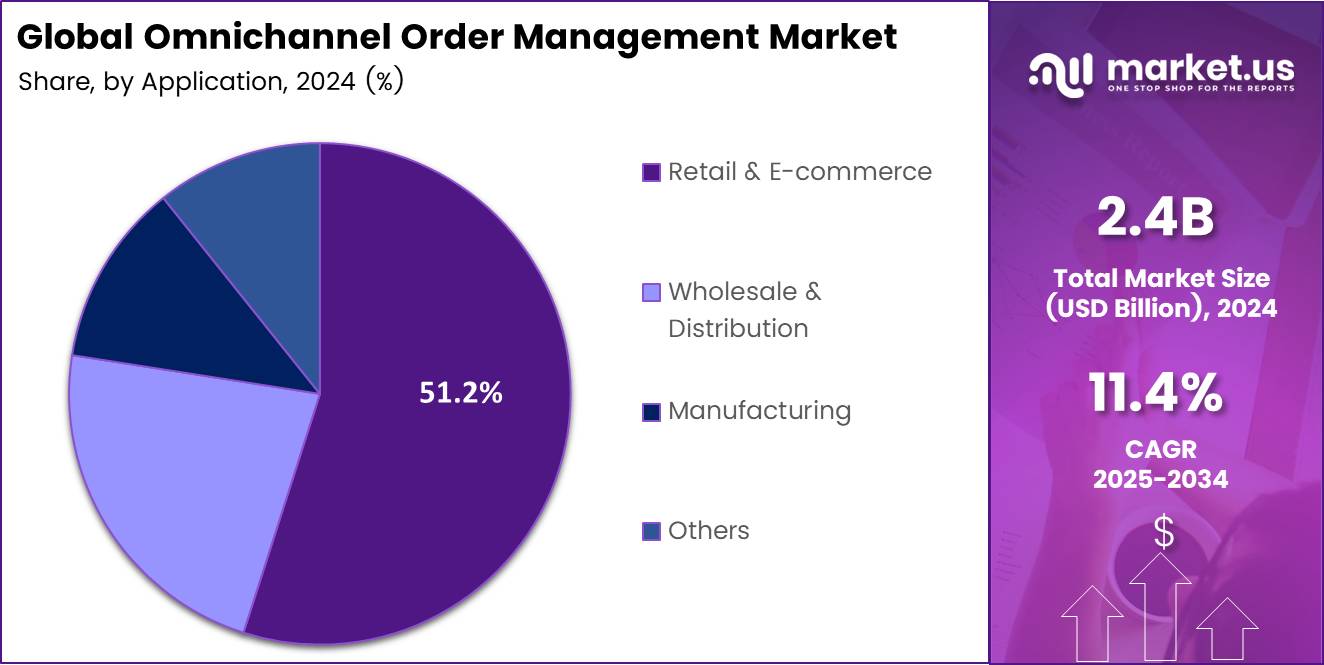

- Retail & E-commerce accounted for the largest application share of 51.2% in 2024.

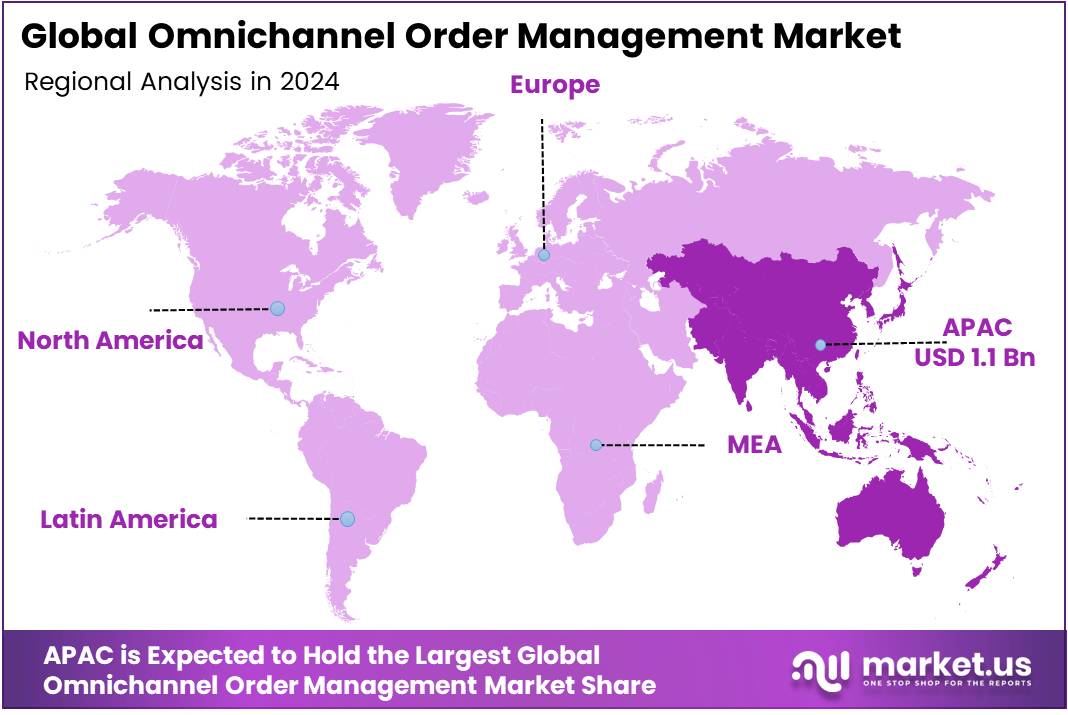

- Asia Pacific held the leading regional share of 46.9%, valued at USD 1.1 Billion in 2024.

By Component Analysis

Software dominates with 67.9% due to its critical role in driving automation and centralized order visibility across multiple sales channels.

In 2024, Software held a dominant market position in the By Component segment of the Omnichannel Order Management Market, with a 67.9% share. This dominance is attributed to the growing adoption of digital retail platforms, AI-driven analytics, and inventory synchronization tools. Businesses increasingly prefer software-based solutions for real-time tracking and seamless integration, enhancing customer satisfaction and operational efficiency.

Services also play a vital role in supporting software implementation and maintenance. With the rise of cloud-based order management systems, service providers offer consulting, customization, and technical support. These services ensure scalability, optimize system performance, and enable enterprises to adapt to rapidly changing omnichannel retail environments efficiently.

By Enterprise Size Analysis

Large Enterprises dominate with 69.4% owing to their advanced infrastructure and greater investment capabilities.

In 2024, Large Enterprises held a dominant market position in the By Enterprise Size segment of the Omnichannel Order Management Market, with a 69.4% share. These organizations leverage comprehensive order management platforms to manage vast product lines, multiple sales channels, and global operations. Their strategic focus on digital transformation accelerates adoption rates significantly.

Small and Medium-sized Enterprises (SMEs) are also witnessing steady adoption of omnichannel order management systems. Cloud-based and subscription models are enabling SMEs to access advanced tools without heavy upfront costs. This segment is increasingly investing in technology to enhance competitiveness, improve customer experiences, and streamline fulfillment processes effectively.

By Applications Analysis

Retail & E-commerce dominates with 51.2% due to the sector’s high reliance on multi-channel order integration and inventory visibility.

In 2024, Retail & E-commerce held a dominant market position in the By Applications segment of the Omnichannel Order Management Market, with a 51.2% share. The surge in online shopping and hybrid buying models like BOPIS (Buy Online, Pick-up In Store) has accelerated the adoption of these solutions, ensuring seamless order fulfillment and enhanced customer satisfaction.

Wholesale & Distribution is increasingly integrating omnichannel order management systems to optimize logistics and manage large-scale inventories efficiently. Real-time order tracking and intelligent routing capabilities support distributors in meeting client expectations while minimizing operational costs and improving delivery accuracy.

Manufacturing applications focus on coordinating supply chains and managing multi-tier distribution networks. The integration of omnichannel systems allows manufacturers to balance production with real-time demand, reducing delays and excess inventory while improving supplier collaboration and operational agility.

Others include sectors such as healthcare, automotive, and consumer goods. These industries utilize omnichannel order management systems to streamline complex order cycles, enhance traceability, and deliver a unified customer experience across various digital and physical channels effectively.

Key Market Segments

By Component

- Software

- Services

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Applications

- Retail & E-commerce

- Wholesale & Distribution

- Manufacturing

- Others

Drivers

Rising Demand for Unified Customer Experience Across Sales Channels Drives Market Growth

The Omnichannel Order Management (OMS) market is growing rapidly as businesses focus on providing a seamless customer experience across online and offline sales channels. Customers today expect consistency, whether they shop in-store, on mobile, or through social platforms. This rising demand for a unified experience is pushing retailers to adopt advanced OMS solutions that synchronize inventory, pricing, and order data across all touchpoints.

The expansion of e-commerce and digital retail ecosystems further boosts this market. With the surge in online shopping and multiple sales channels, retailers need systems that ensure quick order processing and real-time inventory visibility.

Additionally, the integration of AI and predictive analytics in order fulfillment is transforming how companies manage demand and optimize delivery times. These technologies enable smarter decisions and reduce operational costs.

Cloud-based OMS platforms are also gaining popularity due to their scalability and flexibility. Businesses prefer cloud deployment as it allows easy updates, lower upfront costs, and better collaboration among teams globally.

Restraints

Data Privacy and Security Challenges in Multi-Channel Operations Restrain Market Growth

Despite strong market potential, data privacy and security challenges remain key restraints for the omnichannel order management market. Handling customer information across multiple digital platforms increases the risk of cyberattacks and data breaches. Businesses must invest heavily in secure infrastructure and compliance measures to maintain customer trust.

Another major restraint is the integration complexity with legacy enterprise systems. Many companies still rely on outdated software that is not compatible with modern OMS solutions. This creates challenges in data migration, real-time synchronization, and system performance, delaying digital transformation efforts.

The shortage of skilled professionals who can implement and optimize OMS platforms also limits market growth. Businesses struggle to find experts who understand both technology and retail operations. This skill gap slows adoption and reduces the effectiveness of deployed systems.

To overcome these challenges, companies are focusing on upskilling employees and partnering with technology vendors to ensure secure and efficient system integration.

Growth Factors

Growing Penetration of Omnichannel Strategies Among SMEs Creates Growth Opportunities

Small and medium-sized enterprises (SMEs) are increasingly adopting omnichannel strategies to compete with large retailers. As digital tools become more affordable, SMEs are investing in order management systems to improve their customer reach and streamline operations. This growing participation is expected to create significant market opportunities.

The use of IoT and real-time inventory visibility tools is another key driver of growth. These technologies help businesses monitor stock levels across warehouses and stores, enabling faster order fulfillment and fewer stockouts.

Rising investment in last-mile delivery optimization is also boosting the market. Companies are focusing on improving delivery speed and efficiency, using route optimization and automation to enhance customer satisfaction.

Moreover, automation and robotics are playing a larger role in warehousing operations. Automated picking, packaging, and sorting systems reduce manual errors and improve productivity, making omnichannel fulfillment faster and more reliable.

Emerging Trends

Adoption of AI-Powered Demand Forecasting and Inventory Replenishment Shapes Market Trends

The Omnichannel Order Management market is witnessing strong trends driven by advanced technologies. AI-powered demand forecasting and automated inventory replenishment are helping businesses predict customer needs more accurately, minimizing overstocking and shortages.

The shift toward headless commerce and API-driven architectures is also transforming OMS design. This flexible approach allows retailers to quickly adapt to new sales channels and create customized shopping experiences without disrupting backend systems.

Blockchain technology is emerging as a valuable tool for transparent order tracking and verification. It ensures data accuracy, improves trust between supply chain partners, and enhances visibility from order placement to delivery.

Sustainability is another key trend shaping the industry. Retailers are adopting carbon-neutral and eco-friendly fulfillment models to reduce environmental impact. This focus on green logistics not only supports corporate social responsibility goals but also attracts environmentally conscious consumers.

Regional Analysis

Asia Pacific Dominates the Omnichannel Order Management Market with a Market Share of 46.9%, Valued at USD 1.1 Billion

The Asia Pacific region leads the global Omnichannel Order Management market, holding a significant 46.9% share, valued at approximately USD 1.1 Billion. This dominance is attributed to rapid digital transformation, the expansion of e-commerce platforms, and the growing adoption of cloud-based retail management systems. Increasing consumer demand for seamless online and offline experiences and strong investments in retail infrastructure across emerging economies like China, India, and Japan are further propelling market growth in this region.

North America Omnichannel Order Management Market Trends

North America remains a mature and technologically advanced market for omnichannel order management solutions. The region benefits from a well-established e-commerce ecosystem, strong digital infrastructure, and high consumer expectations for unified shopping experiences. Continuous innovation in retail technologies and widespread adoption of automation and analytics tools are key drivers supporting the steady growth of the market in this region.

Europe Omnichannel Order Management Market Trends

Europe showcases robust growth in the omnichannel order management landscape, driven by the rising integration of digital commerce platforms and the increasing emphasis on enhancing customer engagement. The market’s expansion is supported by the adoption of advanced supply chain management solutions and the ongoing digital transformation of traditional retail sectors. Western European nations, particularly the UK, Germany, and France, are at the forefront of these advancements.

Middle East and Africa Omnichannel Order Management Market Trends

The Middle East and Africa region is gradually emerging as a potential growth market for omnichannel order management systems. Increasing internet penetration, the rise of mobile commerce, and growing retail modernization initiatives are key factors driving market adoption. Countries such as the UAE and Saudi Arabia are witnessing a surge in digital retail investments, creating favorable opportunities for omnichannel platform deployment.

Latin America Omnichannel Order Management Market Trends

Latin America is experiencing a steady rise in the adoption of omnichannel order management solutions as retailers aim to enhance operational efficiency and customer satisfaction. The region’s growing e-commerce sector, combined with the expansion of logistics and fulfillment networks, is fueling market growth. Brazil and Mexico, in particular, are leading the digital retail transformation, supported by increasing smartphone usage and evolving consumer behavior.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Omnichannel Order Management Company Insights

The global Omnichannel Order Management Market in 2024 is witnessing robust growth driven by the increasing need for seamless customer experiences and unified commerce strategies. Among the leading players, each company demonstrates a distinct approach to innovation and customer-centric solutions.

Aptos continues to strengthen its market position through its unified commerce platform that integrates order management, POS, and customer engagement tools. Its focus on delivering end-to-end retail technology solutions enables retailers to enhance inventory visibility and streamline fulfillment processes efficiently.

enVista is leveraging its cloud-native Omnichannel Order Management System (OMS) to deliver flexibility and speed for retailers and brands. The company’s emphasis on unified commerce and microservices-based architecture allows for scalability and rapid deployment, helping clients respond swiftly to changing consumer demands.

Fluent Commerce stands out with its modular, API-first OMS platform that offers retailers real-time inventory data and intelligent order routing capabilities. Its commitment to composable commerce and partnership-driven ecosystem provides businesses with agility in managing global order fulfillment.

IBM maintains a strong foothold through its advanced AI and hybrid cloud-based solutions for order management. The company’s technology enables businesses to orchestrate complex omnichannel operations, leveraging automation and analytics to optimize inventory, logistics, and customer satisfaction.

Overall, these key players are focusing on scalability, flexibility, and integration across multiple sales channels to drive growth. Their continuous innovation in cloud, AI, and data-driven order management systems underscores the evolution of the global Omnichannel Order Management Market in 2024.

Top Key Players in the Market

- Aptos

- enVista

- Fluent Commerce

- IBM

- Kibo

- Manhattan Associates

- Mi9 Retail

- OneView Commerce

- Radial

Recent Developments

- In June 2025, REWE Group invested USD 17 million in fulfilmenttools to accelerate its strategic ambition of becoming a global leader in distributed order-management systems (DOMS). This investment strengthens REWE’s technological edge in omnichannel retail and logistics innovation.

- In September 2024, ChannelEngine launched an advanced integration with SAP Order Management Services, enabling AI-optimized marketplace management across over 950+ sales channels. The move enhances automated product listings, synchronization, and cross-channel visibility for global retailers.

- In May 2025, Stord acquired Ware2Go from UPS, integrating its WMS, OMS, and CX technologies into 21 fulfilment centres and serving hundreds of customers. This acquisition expands Stord’s logistics ecosystem and improves distributed fulfilment capabilities across North America.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Applications (Retail & E-commerce, Wholesale & Distribution, Manufacturing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aptos, enVista, Fluent Commerce, IBM, Kibo, Manhattan Associates, Mi9 Retail, OneView Commerce, Radial Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Omnichannel Order Management MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Omnichannel Order Management MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aptos

- enVista

- Fluent Commerce

- IBM

- Kibo

- Manhattan Associates

- Mi9 Retail

- OneView Commerce

- Radial