Global Oleic Acid Market Size, Share, And Business Benefits By Source (Plant-based, Animal-based), By Grade (Food Grade, Pharmaceutical Grade, Technical Grade), By End Use (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162526

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

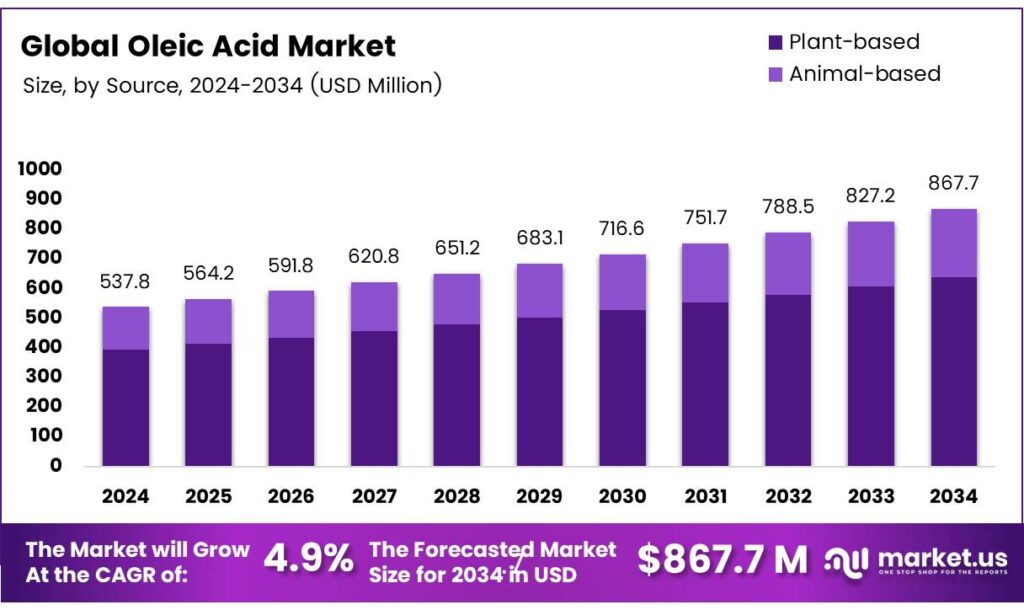

The Global Oleic Acid Market size is expected to be worth around USD 867.7 Million by 2034, from USD 537.8 Million in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Oleic acid, a monounsaturated omega-9 fatty acid, is prevalent in animal and vegetable sources, notably comprising the majority of olive oil’s triglyceride esters. It influences meat quality by increasing monounsaturated and polyunsaturated fatty acid content while reducing saturated fatty acids in animal fat. As an excipient in pharmaceuticals, it serves as an emulsifying or solubilizing agent in aerosol products. Oleic acid may also mitigate adrenoleukodystrophy progression, a severe disease affecting the brain and adrenal glands, and enhance memory.

Chemically, oleic acid is a long-chain carboxylic acid with a cis double bond between the ninth and tenth carbon atoms. It exists as a solid with two crystalline forms: the α-form (melting point 13.4 °C) and the β-form (melting point 16.3 °C). Obtained through olive oil hydrolysis, it is insoluble in water but highly soluble in alcohol. In topical formulations, it reacts with alkalis to form emulgent soaps, aiding emulsion stability. This property makes it valuable in pharmaceutical and cosmetic applications.

In dietary contexts, consuming more unsaturated fats like oleic acid, as opposed to saturated fats, helps lower low-density lipoprotein (LDL) cholesterol, reducing heart-related health risks. The liver produces about 75% of the body’s cholesterol, with only 25% derived from diet, emphasizing the importance of dietary fat composition. Unsaturated fats are essential for bodily functions and protect against illness. Oleic acid’s role in olive oil contributes to its heart-healthy reputation. A balanced mix of dietary fats is critical for optimal cholesterol levels.

In medical studies, oleic acid supplementation in severe short bowel syndrome reduced energy absorption by 14%, compared to a 3% reduction with placebo. While peptide YY concentrations increased, transit time, fat, protein, and fluid absorption remained largely unaffected. The supplements did not significantly impact diarrhea or body weight, possibly due to limited study power. Oleic acid’s role as a percutaneous absorption enhancer disrupts the stratum corneum’s lipid structure, improving drug permeation.

- Olive oil grades, such as extra-virgin and virgin, are distinguished by their free fatty acid content, expressed as oleic acid. Extra-virgin olive oil, with a free fatty acid content of 0.8 g or less per 100 g, is free of defects and has a fruity flavor. Virgin olive oil has a higher free fatty acid content (0.8–2 g per 100 g), while refined olive oil, with 0.3 g or less, is flavorless and odorless. Lampante virgin olive oil, with poor flavor and odor, is unfit for consumption without processing.

Key Takeaways

- The Global Oleic Acid Market is projected to grow from USD 537.8 million in 2024 to USD 867.7 million by 2034, with a CAGR of 4.9%.

- Plant-based sources dominated in 2024, holding over 73.5% of the market due to demand for sustainable and eco-friendly raw materials.

- Food-grade oleic acid captured a 42.3% market share in 2024, driven by its use in food processing and healthy edible oils.

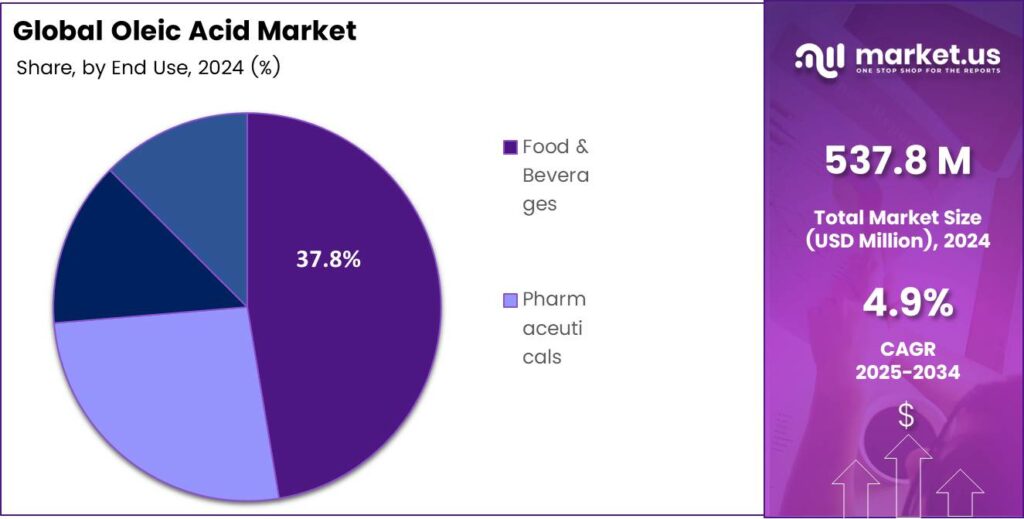

- The food and beverages sector led with a 37.8% share in 2024, fueled by oleic acid’s role as an emulsifier and flavor enhancer.

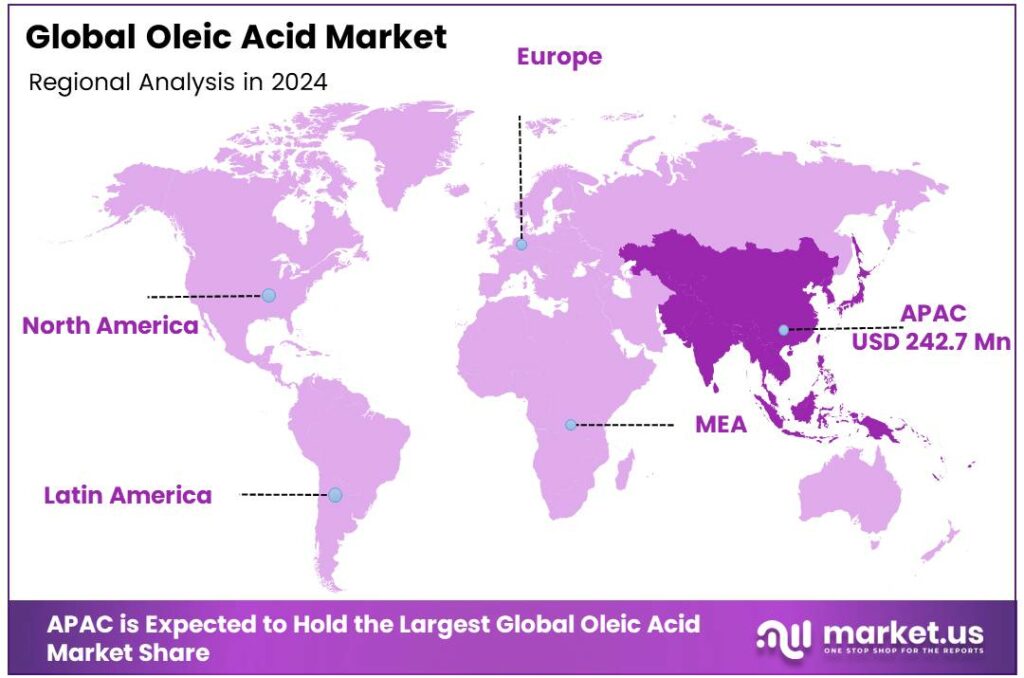

- Asia-Pacific held a 45.2% market share in 2024, valued at USD 242.7 million, due to abundant raw material availability.

By Source

Plant-Based Dominance Driving Oleic Acid Market – 73.5% Share

In 2024, plant-based sources held a dominant market position, capturing over 73.5% share in the global oleic acid market. This strong dominance is primarily driven by the increasing demand for sustainable, renewable, and eco-friendly raw materials across industries such as food, personal care, and bio-lubricants.

Plant-derived oleic acid, mainly extracted from sunflower, soybean, palm, and olive oils, has gained wide acceptance due to its lower environmental impact and stable price compared to animal-based alternatives. The rise of plant-based diets and vegan formulations has further accelerated the shift, especially in Europe and the Asia-Pacific, where consumer preference for natural ingredients remains strong.

The plant-based oleic acid segment continues to expand, supported by advancements in green extraction technologies and higher oleic oil crop yields. Governments promoting bio-based industrial feedstocks—such as the EU’s Bioeconomy Strategy and India’s National Mission on Edible Oils are enhancing the value chain efficiency for plant-based oleic acid. The product’s versatility in applications like surfactants, soaps, lubricants, and cosmetics ensures sustained industrial adoption.

By Grade

Food Grade Oleic Acid Leads with 42.3% Market Share

In 2024, food-grade oleic acid held a dominant market position, capturing over 42.3% share of the global market. Its dominance is mainly attributed to the growing consumption of oleic acid in food processing, flavoring, and nutritional products. The rising demand for healthy edible oils with high monounsaturated fat content has strengthened their use in food formulations, particularly in baked goods, snacks, and dairy alternatives.

Consumers are increasingly preferring products made with natural fatty acids that support heart health and meet clean-label requirements, driving steady adoption of food-grade variants across developed and emerging economies. The segment continues to gain traction as food manufacturers focus on reformulating products with sustainable and plant-derived oleic acid.

Regulatory approvals for oleic acid as a safe additive in food applications further support its demand in regions like North America and Europe. Additionally, the expansion of functional food and fortified product categories boosts usage in emulsifiers and stabilizers. The food-grade segment’s consistent growth reflects a broader industry shift toward healthier, naturally sourced ingredients that align with evolving dietary preferences and sustainability goals worldwide.

By End Use

Food and Beverages Segment Leads with 37.8% Share

In 2024, the food and beverages sector held a dominant market position, capturing more than a 37.8% share in the global oleic acid market. This leadership is mainly due to the growing use of oleic acid as a natural emulsifier, stabilizer, and flavor enhancer in processed foods and cooking oils. Rising health awareness has pushed consumers toward products rich in monounsaturated fats, which are linked to heart health and lower cholesterol levels.

Food manufacturers are increasingly incorporating oleic acid into baked goods, dairy alternatives, and snack formulations to meet clean-label and healthier product standards. The food and beverages segment continues to expand as demand for plant-based and fortified products increases globally. The shift toward bio-based and natural food additives supports the use of oleic acid derived from sustainable sources such as sunflower and olive oils.

Governments promoting healthier diets through nutrition policies also drive product reformulation using oleic acid. The segment’s steady growth reflects changing dietary trends, expanding processed food industries, and technological advancements that ensure consistent quality and functionality in food applications.

Key Market Segments

By Source

- Plant-based

- Animal-based

By Grade

- Food Grade

- Pharmaceutical Grade

- Technical Grade

By End Use

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Others

Emerging Trends

certified, high-oleic, plant-based sourcing

Food, personal care, and lubricant makers are quietly standardizing on certified, high-oleic, plant-based feedstocks for oleic acid. The signal is strong on the sustainability side: the Roundtable on Sustainable Palm Oil reports 5.2 million hectares of certified oil palm across 23 countries, and notes 16.2 million tonnes of Certified Sustainable Palm Oil (CSPO) available in 2024, evidence that large buyers can now source oleochemicals, including oleic acid, with audited origins at a meaningful scale.

- The EU Renewable Energy Directive (EU/2023/2413) tightened sustainability criteria for bio-based inputs, reinforcing traceability and land-use safeguards that align with brand goals for low-risk oleochemical supply chains. The United Soybean Board notes 800,000 acres of high-oleic soybeans were planted in 2024 across 16 U.S. states, with potential to scale toward 3 million acres—useful for food-grade and industrial oleic acid where oxidation stability matters.

USDA/NASS also pegs total U.S. soybean plantings at 86.1 million acres in 2024, underscoring the breadth of oilseed supply supporting oleochemical conversion. Funding flows are reinforcing the shift. In January 2025, the U.S. Department of Energy’s Bioenergy Technologies Office announced up to $23 million for R&D that converts biomass and waste into renewable chemicals and fuels, a bucket that includes oleochemical pathways and process intensification relevant to oleic acid.

Drivers

Surge in Sustainable Feedstock & Regulatory Support

One major driving force behind the growth of the oleic acid market is the growing demand for sustainable and bio-based feedstocks, coupled with strong regulatory and government backing for renewable chemicals. The shift away from fossil-derived inputs toward plant-based sources is becoming a defining characteristic of oleochemical markets, benefiting oleic acid in particular.

On the regulatory side, the European Chemical Industry Council (CEFIC) underlines that the upcoming EU Bioeconomy Strategy will support a full industrial framework for sustainable chemicals. This kind of government action helps reduce the risk for investment into new biobased supply chains, which supports expanded production of high-oleic oils and oleochemicals such as oleic acid.

From the demand side, companies are looking for ingredients that carry both performance and sustainability credentials. For instance, plant-derived oleic acid offers improved oxidative stability in formulations such as personal care products, lubricants, and food emulsifiers, which helps manufacturers meet both functional and regulatory demands.

Restraints

Feedstock Quality and Availability Pressure

- One of the major restraints facing the growth of the oleic acid industry is the quality and availability of suitable oleochemical feedstocks, particularly palm oil and other high-oleic oils. Recent industry insight noted that in September 2025, average free fatty acid (FFA) levels in crude palm oil (CPO) used for oleic-acid-grade feedstock were approaching the 5% threshold, and higher FFA meant extra refining costs of USD 30–50 per tonne.

In addition, the pool of fully traceable, regulation-compliant palm oil under the EU Deforestation‑Free Regulation (EUDR) is still estimated at less than 25% of the total supply, creating a supply-quality squeeze for oleic acid producers. Such limitations mean that even if volume is adequate, the grade or specification needed for high-purity oleic acid might not be met, constraining the ability of producers to deliver specialty grades at competitive cost.

Beyond quality, availability is affected by upstream competition: an article on oleochemical supply noted increasing uncertainty because raw tallow, rapeseed, and other oils are being redirected to alternative applications like bio-diesel and renewable feedstocks, reducing their availability for oleic acid derivation.

Opportunity

expanding certified, high-oleic plant feedstocks

A powerful growth engine for oleic acid is the rapid expansion of certified and high-oleic plant feedstocks, backed by public policy and funding. On supply, the Roundtable on Sustainable Palm Oil (RSPO) reports that in 2024, its members accounted for 31.4 million tonnes of global palm oil, and audited feedstock for oleochemicals like oleic acid is now widely available.

- Certified oil-palm area spans 5.2 million hectares across 23 countries, creating predictable, traceable inputs for food, personal care, and industrial uses, with long-term potential toward 3 million acres broadening non-palm routes to oleic acid for formulators who value oxidative stability and clean-label positioning. underscoring the depth of oilseed supply that can feed oleochemical conversion.

The EU’s revised Renewable Energy Directive hardens sustainability criteria for bio-based inputs, pushing traceability and land-use safeguards that align with brand procurement standards for lower-risk oleochemical chains. In the U.S., the Department of Energy’s Bioenergy Technologies Office announced R&D to convert biomass and waste into renewable chemicals and fuels, helping derisk process innovation relevant to oleic-acid pathways.

Regional Analysis

Asia-Pacific leads with a 45.2% share and a USD 242.7 Million market value.

In 2024, Asia-Pacific held a dominant market position, capturing around 45.2% share, valued at approximately USD 242.7 million. This strong presence is primarily driven by the abundant availability of raw materials such as palm oil and high-oleic vegetable oils, which are widely produced across Malaysia, Indonesia, China, and India.

The region’s expanding chemical, food processing, and personal care industries have significantly increased the demand for oleic acid as a key ingredient in soaps, surfactants, emulsifiers, and lubricants. Rising urbanization, coupled with growing consumer preference for bio-based and sustainable products, further strengthens regional market growth.

China remains a leading contributor within Asia-Pacific, supported by large-scale oleochemical manufacturing and rising demand in food additives and pharmaceutical applications. India and Southeast Asian nations are also witnessing steady growth owing to increasing government support for bio-based chemical production and export-oriented oleochemical industries.

Regional manufacturers are expected to invest more in refining technologies and sustainable sourcing practices to meet international quality standards. The integration of advanced processing units and the presence of cost-effective labor and feedstock continue to make Asia-Pacific the most competitive hub for oleic acid production. With strong industrialization and supportive government frameworks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AkzoNobel is a major consumer of oleic acid. The company utilizes it as a key raw material in producing alkyd resins, which are essential for durable industrial and decorative paints. Their market position is driven by extensive R&D and a vast distribution network. Sustainability initiatives also influence their sourcing, pushing for high-purity, bio-based oleic acid to meet the demand for eco-friendly products in the coatings industry.

BASF’s involvement in the oleic acid market is multifaceted. The company leverages oleic acid as a crucial intermediate for manufacturing oleochemicals, surfactants, and plasticizers. Its immense production scale and integrated supply chain provide a significant competitive edge. BASF focuses on developing high-value derivatives for applications in personal care, cleaning agents, and lubricants, driving innovation and setting quality standards within the global oleochemicals market.

Emery Oleochemicals is a pure-play specialist with a deep focus on oleochemicals, including oleic acid. The company excels in producing high-purity grades from natural triglycerides. Its strength lies in tailored solutions for niche markets like lubricants, plastics, and personal care. Emery emphasizes sustainable and bio-based production processes, catering to the growing demand for green alternatives. This specialized approach allows them to compete effectively against larger, diversified chemical corporations through product quality and application expertise.

Top Key Players in the Market

- AkzoNobel N.V.

- BASF SE

- Emery Oleochemicals

- Vantage Specialty Chemicals

- KLK Oleo

- IOI Oleochemicals.

- Others

Recent Developments

- In 2024, BASF announced a partnership with Acies Bio to develop a synthetic‐biology (fermentation) platform converting renewable methanol into various chemical raw materials, including fatty acids and derivatives for home & personal care. The OneCarbonBio platform will enable BASF’s Care Chemicals division to diversify raw material feedstocks for fatty acid derivatives.

- In 2024, Emery announced a new application development lab for its Green Polymer Additives (GPA) business in Rayong, Thailand, to support global product and application development. Emery announced that it expanded its 100% biobased portfolio (certified by the USDA BioPreferred Program) with four pelargonic acid products.

Report Scope

Report Features Description Market Value (2024) USD 537.8 Million Forecast Revenue (2034) USD 867.7 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-based, Animal-based), By Grade (Food Grade, Pharmaceutical Grade, Technical Grade), By End Use (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AkzoNobel N.V., BASF SE, Emery Oleochemicals, Vantage Specialty Chemicals, KLK Oleo, IOI Oleochemicals, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- AkzoNobel N.V.

- BASF SE

- Emery Oleochemicals

- Vantage Specialty Chemicals

- KLK Oleo

- IOI Oleochemicals.

- Others