Global Oilseeds Market Size, Share, Upcoming Investments Report By Oilseed Type (Copra, Cottonseed, Palm Kernel, Peanut, Rapeseed, Soybean, Sunflower Seed), By Product (Animal Feed, Edible Oil), By Breeding Type (Genetically Modified, Conventional), By Biotech Trait (Herbicide Tolerant, Insecticide Resistant, Others), By Application (Oilseed Meal, Vegetable Meal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140184

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

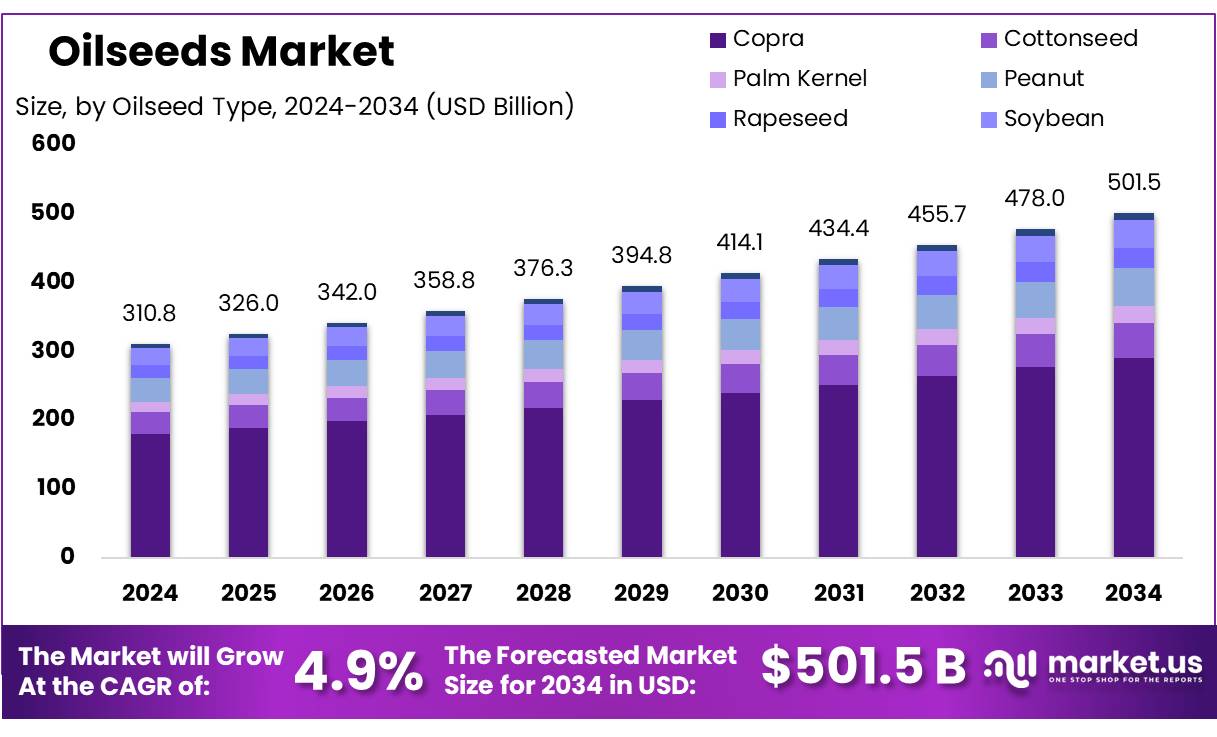

The Global Oilseeds Market size is expected to be worth around USD 501.5 Bn by 2034, from USD 310.8 Bn in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. The demand for healthy and organic oilseed-processed products, public-private partnerships in varietal development, and molecular breeding in oilseeds are some of the factors driving the growth of the oilseeds market.

The oilseeds market plays a pivotal role in the global agricultural industry, providing raw materials for various sectors, including food and beverages, cosmetics, biofuels, and animal feed. Oilseeds, such as soybeans, canola, sunflower seeds, cotton seeds, and palm kernels, are processed to produce vegetable oils used in a wide range of applications. These seeds are also valuable as a source of protein, and their by-products serve as key ingredients in animal feed.

The demand for vegetable oils from the biodiesel industry is another key driver of the oilseeds market. As countries increasingly move away from conventional fuels, the biodiesel sector’s growth has directly influenced the demand for oilseeds and vegetable oils. In 2023, the global biodiesel production reached 46.9 million metric tons, and oilseeds remained the primary feedstock, underscoring the critical role of oilseeds in biofuel production.

The rising consumer demand for vegetable oils, particularly in emerging economies with growing middle-class populations, is boosting market growth. According to FAO, global vegetable oil consumption reached 202.4 million metric tons in 2023, with palm oil and soybean oil together comprising over 60% of this demand.

Technological advancements in oil extraction and seed genetics are boosting oilseed yields and oil content, making production more cost-effective and sustainable. For instance, genetic modifications have enhanced soybean oil yields by 15-20%. However, climate change poses challenges, with adverse weather conditions impacting crop yields in key regions. In 2023, Brazil’s soybean yield dropped by 4.3% due to drought, leading to potential price volatility and supply chain disruptions.

Key Takeaways

- The Global Oilseeds Market is projected to grow from USD 310.8 billion in 2024 to USD 501.5 billion by 2034, at a CAGR of 4.9%.

- Soybeans dominated the oilseeds market with a 58.4% share in 2024, with rapeseed following closely.

- Edible oil accounted for 73.2% of the oilseeds market in 2024 due to rising health-conscious consumer demand.

- Genetically Modified oilseeds held a 68.3% market share in 2024, boosting crop yields and reducing environmental stress.

- Herbicide Tolerant oilseeds made up 58.4% of the oilseeds market share in 2024.

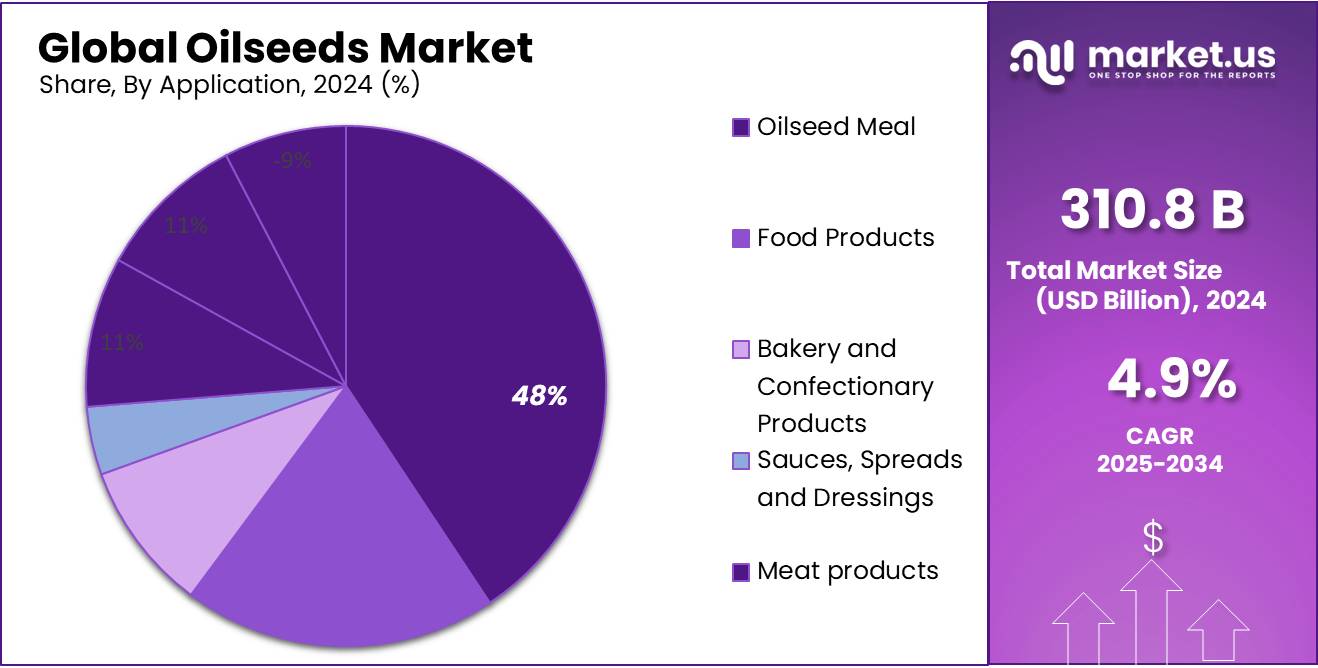

- Oilseed Meal held a dominant market position, capturing more than a 43.3% share

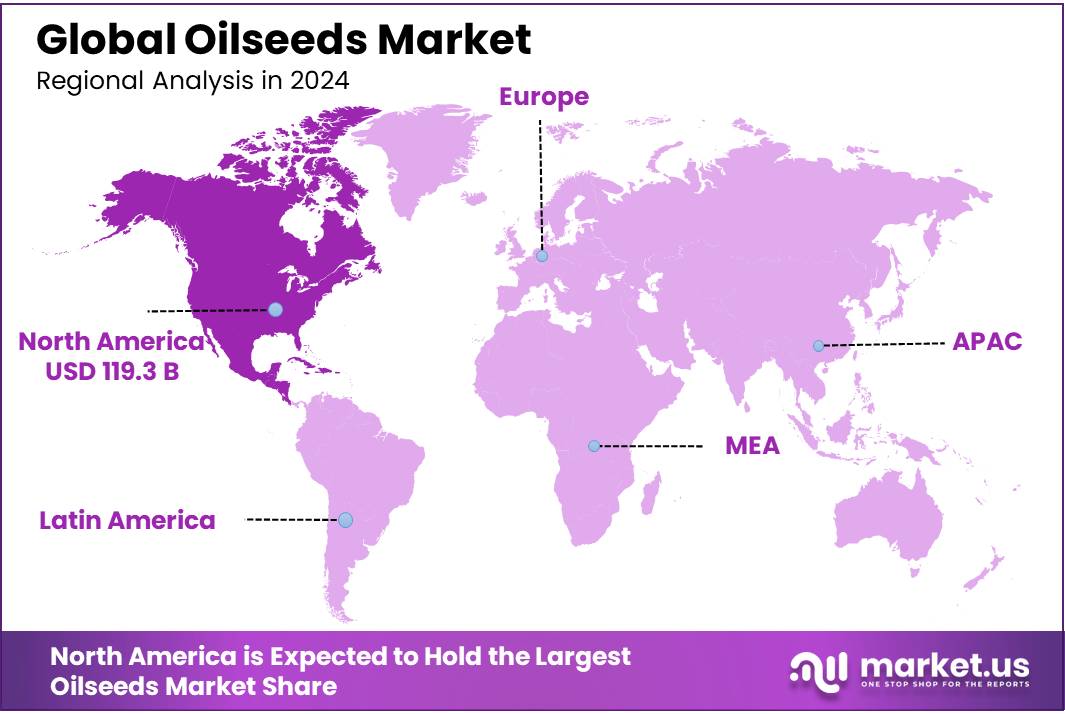

- North America held a dominant position in the oilseeds market, capturing a substantial 38.4% share, with a market value of approximately USD 119.3 billion.

By Oilseed Type

In 2024, Soybean held a dominant market position, capturing more than a 58.4% share of the global oilseeds market. This continued dominance is largely driven by its versatility and widespread use in oil extraction, food products, animal feed, and biodiesel production.

Rapeseed followed as a key player in the oilseeds market, holding a notable share, with demand steadily increasing year on year. Its oil is commonly used for culinary purposes and as a key component in biodiesel, particularly in Europe and parts of Asia. Over the years, rapeseed oil’s lower saturated fat content has also boosted its popularity among health-conscious consumers.

In contrast, Sunflower seed oil has consistently performed well, particularly in Eastern Europe, Russia, and parts of Africa. Its light flavor and high vitamin E content have made it a preferred choice for consumers seeking a healthier alternative to other vegetable oils. By 2025, sunflower seed oil is expected to continue gaining traction, driven by consumer demand for healthier cooking oils.

Peanut and Cottonseed oilseeds have seen moderate growth in the market, with peanut oil being especially popular in Southeast Asia and parts of the Americas. Cottonseed oil, while less popular in recent years, is still significant in certain regions, particularly for industrial purposes and in the production of processed food products.

Palm Kernel oil, on the other hand, remains a major player in the market, primarily in Southeast Asia, where it is used widely in food production, cosmetics, and soap manufacturing. Its market share has seen consistent growth due to its cost-effectiveness and high yield per hectare compared to other oilseeds.

Copra, derived from coconuts, has maintained a steady presence in the market, largely due to its use in tropical regions for cooking oils and cosmetics. While the Copra oil market has faced challenges from other oilseeds in recent years, it continues to hold a smaller yet significant share, with demand projected to stay stable in the near future.

By Product

In 2024, Edible Oil held a dominant market position, capturing more than a 73.2% share of the global oilseeds market. This significant share is driven by the growing demand for vegetable oils in cooking and food processing. Edible oils, derived from a variety of oilseeds such as soybean, sunflower, and palm kernel, are used in daily household cooking, commercial food production, and the food service industry. The shift towards healthier oil options, such as sunflower and canola oils, has also contributed to the strong growth of this segment, with consumers increasingly opting for oils that are lower in saturated fats and higher in omega-3 fatty acids.

As the demand for healthier food products continues to rise, edible oil is expected to maintain a dominant position in the coming years. The increasing consumption of processed foods and convenience products, especially in emerging markets, further fuels the demand for edible oils. By 2025, this segment is expected to continue growing steadily, with a strong focus on oils that cater to both taste and health-conscious consumers.

On the other hand, the Animal Feed segment, although smaller in comparison, has shown consistent growth. Animal feed made from oilseed cakes and meal, a by-product of oil extraction, is a critical ingredient in the livestock industry, particularly in regions like North America, Europe, and parts of Asia. In 2024, the animal feed market accounted for a smaller share but is still expected to grow, driven by the increasing demand for meat and dairy products worldwide. The trend of using high-protein feed for livestock to improve productivity is anticipated to boost this segment’s growth further.

While edible oils continue to dominate the market, the demand for oilseed-based animal feed is likely to remain a steady contributor to the overall market, especially as global meat consumption rises and farming practices evolve to include more efficient, protein-rich feed. By 2025, the animal feed segment is expected to experience moderate growth, driven by agricultural developments and the increasing importance of sustainable and cost-effective feed solutions.

By Breeding Type

In 2024, Genetically Modified (GM) oilseeds held a dominant market position, capturing more than a 68.3% share of the global oilseeds market. The widespread adoption of GM oilseeds, particularly soybeans, cotton, and canola, has been driven by the growing demand for higher crop yields, pest resistance, and improved resilience to environmental stress.

The continuous improvements in GM seed technologies have further propelled their adoption. In 2024, the market for GM oilseeds is expected to continue expanding, with a focus on developing seeds that offer enhanced nutritional profiles, such as oils with healthier fatty acid compositions or higher omega-3 content.

On the other hand, Conventional oilseeds, while making up a smaller portion of the market, continue to serve as a crucial part of global oilseed production. These oilseeds, which are grown without genetic modification, are preferred by consumers who prioritize non-GMO products and by regions with strict regulations regarding genetically modified crops.

Despite the growth of GM oilseeds, there is a consistent demand for Conventional oilseeds, particularly in organic farming and markets where GMO products are less accepted. In regions like Europe, where GMO regulations are stricter, Conventional oilseeds maintain a more substantial share of the market. By 2025, this segment is expected to grow moderately, driven by consumer demand for organic and non-GMO certified products, especially in the food and oil markets.

By Biotech Trait

In 2024, Herbicide Tolerant oilseeds held a dominant market position, capturing more than a 58.4% share of the global oilseeds market. The widespread adoption of herbicide-tolerant crops has been largely driven by the increased efficiency and cost-effectiveness they offer to farmers. These oilseeds, engineered to resist specific herbicides, allow farmers to control weeds more effectively without damaging the crops themselves.

The market for herbicide-tolerant oilseeds is expected to remain dominant through 2025, with advancements in biotechnology continuing to improve the effectiveness of these crops. New traits aimed at making crops resistant to a broader range of herbicides, or improving soil and environmental adaptability, are likely to drive further adoption. As farmers continue to seek ways to reduce input costs and increase production efficiency, the demand for herbicide-tolerant oilseeds is projected to grow steadily in the coming years.

Insecticide Resistant oilseeds, while holding a smaller share of the market, continue to gain traction. These crops, engineered to resist insect pests, are particularly valuable in regions where pest damage is a significant concern, such as in parts of Africa, Asia, and the Americas. In 2024, the market for insecticide-resistant oilseeds represented a growing but smaller portion compared to herbicide-tolerant varieties. The demand for these crops is driven by the need to reduce the use of chemical insecticides, which can be expensive and harmful to the environment.

By Application

In 2024, Oilseed Meal held a dominant market position, capturing more than a 43.3% share of the global oilseeds market. Oilseed meal, which is the by-product left after oil extraction, is primarily used as animal feed. This segment has seen robust demand due to the growing global need for livestock products and the increasing emphasis on efficient, high-protein feeds.

In the Food Products segment, oilseeds play a crucial role in the production of edible oils, which are used widely across households and food industries. This category is expected to grow steadily in 2024 and 2025, driven by increasing consumer demand for cooking oils, processed foods, and health-conscious alternatives like low-fat and omega-3 rich oils.

The Bakery and Confectionery Products segment also continues to show steady growth. Oils extracted from oilseeds, such as sunflower and palm oil, are key ingredients in baked goods and confectionery items due to their ability to enhance texture, shelf life, and flavor. In 2024, this segment is expected to see increased demand, particularly in regions like North America and Europe, where packaged and ready-to-eat bakery products are in high demand.

In the Sauces, Spreads, and Dressings segment, oilseeds contribute to the production of various cooking oils and emulsifiers. Sunflower oil, for example, is commonly used in salad dressings, mayonnaise, and cooking sauces, thanks to its neutral flavor and high smoking point.

Meat Products, although a smaller segment compared to oilseed meal, also contributes to the demand for oilseeds. Oils are often used in meat processing to improve texture, flavor, and moisture content. As meat consumption increases globally, especially in emerging markets, this segment is expected to show moderate growth.

Key Market Segments

By Oilseed Type

- Copra

- Cottonseed

- Palm Kernel

- Peanut

- Rapeseed

- Soybean

- Sunflower Seed

By Product

- Animal Feed

- Edible Oil

By Breeding Type

- Genetically Modified

- Conventional

By Biotech Trait

- Herbicide Tolerant

- Insecticide Resistant

- Others

By Application

- Oilseed Meal

- Food Products

- Bakery and Confectionary Products

- Sauces, Spreads and Dressings

- Meat products

- Other include

- Vegetable Meal

Drivers

Growing Demand for Healthier Cooking Oils

One of the major driving factors for the oilseeds market is the increasing global demand for healthier cooking oils, which has significantly boosted the consumption of oilseeds like soybean, sunflower, and canola. Consumers are becoming more health-conscious, leading to a shift in preference from traditional, saturated fat-rich oils to those that offer better nutritional profiles, such as those high in unsaturated fats, omega-3 fatty acids, and antioxidants.

According to the Food and Agriculture Organization (FAO), global vegetable oil consumption has been rising steadily, with an estimated increase in global consumption from around 183 million metric tons in 2020 to approximately 189 million metric tons in 2023. This reflects the growing awareness of the health benefits of oils like sunflower oil and olive oil, which are seen as healthier alternatives compared to palm and coconut oils, which have higher saturated fat content.

In addition, industry organizations like the International Food Policy Research Institute (IFPRI) point out that the growing popularity of plant-based diets is further contributing to this trend. As more people turn to plant-based food options, they are also more likely to choose oils derived from seeds, as they are seen as more sustainable and nutritious sources of fat. This trend is evident in the growing market for oils used in vegetarian and vegan food products.

Government initiatives also play a role in this shift. Various policies worldwide, such as those supporting the development of healthier food products, continue to encourage the use of heart-healthy oils. The U.S. Department of Agriculture (USDA), for example, has promoted the use of oils that are low in saturated fats, further contributing to the increasing demand for oilseeds as key ingredients in health-oriented food products.

Restraints

Environmental Concerns and Land Use Limitations

One major restraining factor for the oilseeds market is the environmental impact of oilseed production, particularly concerning land use, water consumption, and soil degradation. As global demand for oilseeds continues to rise, there are increasing concerns about the sustainability of expanding agricultural land dedicated to oilseed crops. The environmental toll associated with large-scale oilseed farming can have long-term consequences for both ecosystems and food security.

According to the Food and Agriculture Organization (FAO), the expansion of oilseed cultivation, particularly for crops like soybeans, has been a significant driver of deforestation, especially in countries like Brazil. In 2020, the FAO reported that over 8 million hectares of forest were cleared globally for agricultural purposes, with a large portion of that land being used for soybean farming. This expansion leads to loss of biodiversity, disruption of carbon storage, and contributes to climate change. Furthermore, growing oilseeds in regions with limited water resources can lead to water scarcity, making the agricultural practice less sustainable in the long run.

The World Resources Institute (WRI) also highlights the increasing concern over water usage in oilseed farming, particularly in regions like India and the U.S., where water stress is becoming a significant issue. With more than 2.7 billion people expected to live in water-scarce areas by 2025, oilseeds that require large amounts of irrigation may face stricter regulations in the near future. WRI notes that nearly 70% of freshwater withdrawals worldwide are used for agriculture, and oilseeds are among the key crops that heavily depend on irrigation.

Governments around the world are taking steps to mitigate these issues. For example, Brazil has implemented stricter regulations on deforestation, including the Forest Code, which aims to reduce illegal land clearing for agriculture. Similarly, the U.S. Environmental Protection Agency (EPA) has been working to encourage more sustainable farming practices through initiatives like the Conservation Stewardship Program (CSP), which incentivizes farmers to adopt land management practices that improve soil health and water use efficiency.

Opportunity

Expansion of Plant-Based and Sustainable Foods

One of the major growth opportunities for the oilseeds market lies in the expanding demand for plant-based and sustainable food products. As more consumers shift toward plant-based diets for health, environmental, and ethical reasons, the demand for oilseeds, especially those used in plant-based oils and food products, is set to rise.

In 2024, the Plant-Based Foods Association (PBFA) reported a remarkable 27% growth in the plant-based food sector in the U.S. alone, reaching $7 billion in sales. This trend is driven by increasing consumer awareness about the benefits of plant-based diets, which include lower cholesterol levels and reduced risks of heart disease, along with the environmental benefits of reducing animal agriculture’s carbon footprint. Oilseeds such as soybeans, canola, and sunflower are crucial in providing plant-based oils that are widely used in meat alternatives, dairy substitutes, and packaged foods.

Governments are also supporting the growth of plant-based food industries through various incentives and policies. The European Union (EU) has launched initiatives like the Farm to Fork strategy, which promotes sustainable food systems, including plant-based and plant-derived products. Similarly, the U.S. Department of Agriculture (USDA) is encouraging the production of plant-based proteins and oils through grants and research support, aiming to make plant-based products more accessible and affordable to a wider population.

Trends

Rise in Demand for Health-Conscious and Sustainable Oils

One of the latest trends in the oilseeds market is the growing consumer demand for healthier, more sustainable oils. This trend is largely driven by increased health awareness and the growing concern about the environmental impact of food production. Consumers are seeking oils that are not only better for their health but also produced in environmentally friendly ways, leading to a shift toward oils like sunflower, canola, and olive oil, which are seen as healthier alternatives to traditional oils like palm oil.

The U.S. Department of Agriculture (USDA) reported that in 2023, U.S. consumers increasingly opted for oils that were lower in saturated fats, such as sunflower oil, which is high in unsaturated fats and vitamin E. The demand for such oils has been rising, with sales of healthier oils growing by 4-6% annually in the past few years. This shift is in line with recommendations from organizations like the American Heart Association, which advocates for the reduction of saturated fats in the diet to improve heart health.

Another significant trend is the push toward sustainable farming practices in oilseed production. The European Union has implemented strict regulations under its Farm to Fork Strategy, aiming to reduce the environmental footprint of food systems. This has led to a growing demand for oilseeds that are produced through sustainable, eco-friendly farming methods, such as organic farming and no-till practices. The EU’s goal to have 25% of its agricultural land under organic farming by 2030 is influencing the production of oilseeds, encouraging the use of practices that minimize pesticide use and reduce carbon emissions.

Additionally, with the rise of plant-based diets and the popularity of vegan and vegetarian food products, the need for plant-based oils from oilseeds is expanding. The Plant-Based Foods Association highlighted that plant-based foods in the U.S. grew by 27% in 2024, with many products like plant-based meats and dairy alternatives relying heavily on oils derived from oilseeds like soy and sunflower.

Regional Analysis

In 2024, North America held a dominant position in the oilseeds market, capturing a substantial 38.4% share, with a market value of approximately USD 119.3 billion. The region’s strong market position is primarily driven by the U.S., which is one of the largest producers and consumers of oilseeds, particularly soybeans. The demand for oilseeds in North America is largely fueled by the extensive use of oilseed-based products in food processing, animal feed, and biodiesel production. Additionally, innovations in biotech traits, such as herbicide-tolerant and insect-resistant oilseeds, have further boosted the region’s market growth.

Europe follows as another key market, where demand for oilseeds is driven by both food and industrial applications, especially in countries like France, Germany, and Russia. The region’s focus on sustainability and organic farming practices is shaping oilseed production trends, particularly for non-GMO and organic oilseeds. By 2025, the European oilseeds market is expected to continue its steady growth, supported by the EU’s sustainability initiatives, such as the Farm to Fork strategy.

Asia Pacific is witnessing rapid growth in the oilseeds market, driven by emerging economies like China and India. The growing population, expanding urbanization, and rising disposable income are fueling the demand for oilseeds, particularly for edible oils and animal feed. In addition, China’s large-scale soybean imports contribute significantly to the region’s market expansion.

The Middle East & Africa and Latin America are also experiencing growth, with Latin America playing a key role in soybean production, particularly in Brazil and Argentina, while the Middle East sees increasing demand for vegetable oils and animal feed.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The oilseeds market is highly competitive, with several key players contributing to its growth and development across various regions. Cargill, Archer Daniels Midland (ADM), and Bunge Limited are some of the dominant global players in the market, providing a wide range of oilseeds and related products, such as oils, meal, and animal feed. These companies have established strong supply chains and distribution networks worldwide, particularly in North America, South America, and Asia.

Bühler Group, AGT Food and Ingredients, and Louis Dreyfus Company, which are also key participants in oilseed processing and trading. Wilmar International is another major player with a strong presence in Asia, offering a variety of oilseeds, edible oils, and meal products. Companies like Mountain States Oilseeds, Soni Soya Products Limited, and Cootamundra Oilseeds cater to niche markets, focusing on regional production and specialized oilseed products. Kanematsu Corporation, CHS Inc., and Oilseeds International are also active in the global oilseed trading and export sectors, contributing to market diversification and expansion.

Additionally, Bora Agro Foods, ETG Agro Private Ltd, and ETG Agro play an important role in the emerging markets, especially in Africa and Asia, where they focus on both local production and the export of oilseeds, particularly soybeans and sunflower. These companies are leveraging regional advantages, including favorable agricultural conditions and growing demand for edible oils and animal feed in developing economies.

Top Key Players

- Cargill

- Archer Daniels Midland

- Bühler Group

- Bunge Limited

- AGT Food and Ingredients

- Louis Dreyfus Company

- Mountain States Oilseeds

- Soni Soya Products Limited

- Kanematsu Corporation

- CHS Inc.

- Oilseeds International

- Wilmar International

- Cootamundra Oilseeds

- Bora Agro Foods

- ETG Agro Private Ltd

Recent Developments

In 2024, Cargill’s oilseed business generates billions in revenue, with oilseed and grain handling contributing to approximately 30% of its annual revenue, estimated at around $160 billion in 2024.

In 2024, ADM continues to be one of the top global processors of oilseeds, handling approximately 40 million metric tons of soybeans and other oilseeds each year across its extensive network of processing facilities.

Report Scope

Report Features Description Market Value (2024) USD 310.8 Bn Forecast Revenue (2034) USD 501.5 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Oilseed Type (Copra, Cottonseed, Palm Kernel, Peanut, Rapeseed, Soybean, Sunflower Seed), By Product (Animal Feed, Edible Oil), By Breeding Type (Genetically Modified, Conventional), By Biotech Trait (Herbicide Tolerant, Insecticide Resistant, Others), By Application (Oilseed Meal, Vegetable Meal) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Archer Daniels Midland, Bühler Group, Bunge Limited, AGT Food and Ingredients, Louis Dreyfus Company, Mountain States Oilseeds, Soni Soya Products Limited, Kanematsu Corporation, CHS Inc., Oilseeds International, Wilmar International, Cootamundra Oilseeds, Bora Agro Foods, ETG Agro Private Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill

- Archer Daniels Midland

- Bühler Group

- Bunge Limited

- AGT Food and Ingredients

- Louis Dreyfus Company

- Mountain States Oilseeds

- Soni Soya Products Limited

- Kanematsu Corporation

- CHS Inc.

- Oilseeds International

- Wilmar International

- Cootamundra Oilseeds

- Bora Agro Foods

- ETG Agro Private Ltd