Global Oil Refining Market Size, Share, And Enhanced Productivity By Product Type (Light Distillates, Middle Distillates, Fuel Oil, Others), By Application (Transportation, Aviation, Marine Bunker, Petrochemical, Residential and Commercial, Agriculture, Electricity, Rail and Domestic Waterways, Others), By Complexity Type (Topping, Hydro-Skimming, Conversion, Deep Conversion, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173891

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

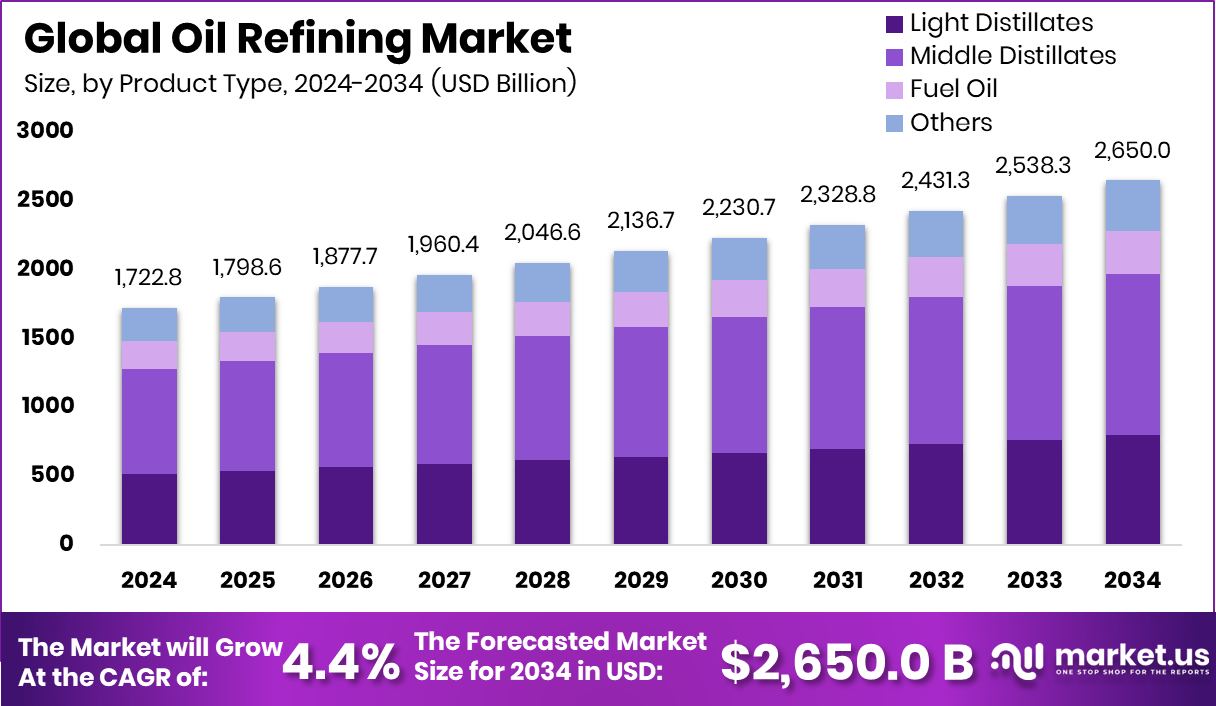

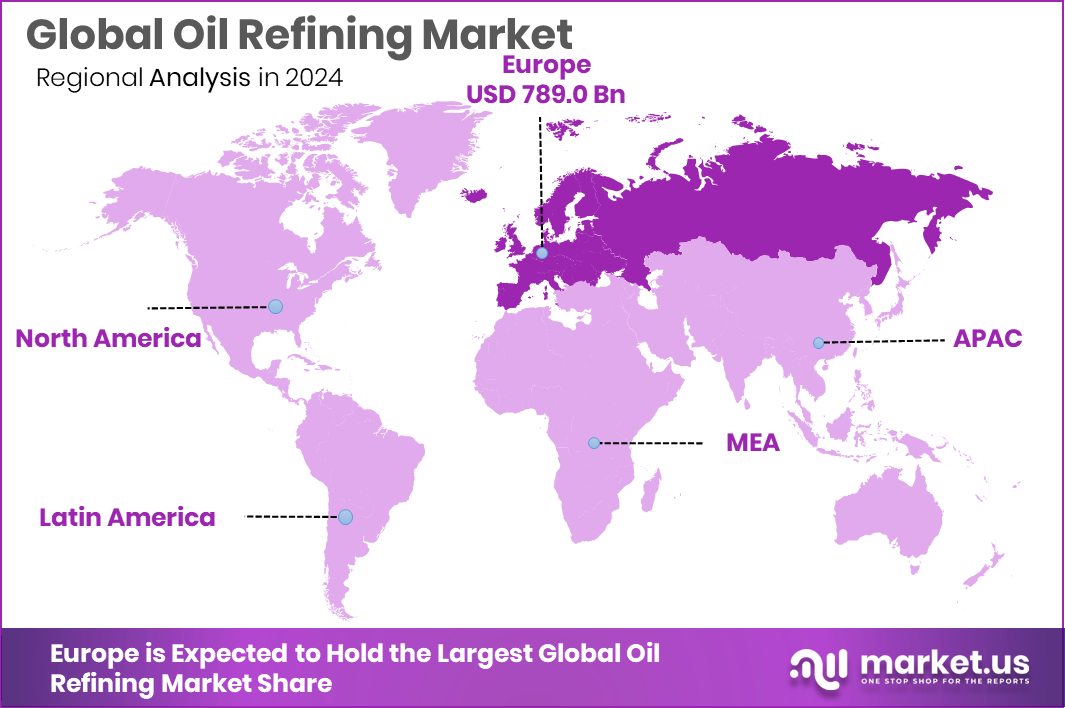

The Global Oil Refining Market is expected to be worth around USD 2,650.0 billion by 2034, up from USD 1722.8 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Europe dominates the oil refining market at 45.80%, generating revenues of USD 789.0 Bn.

Oil refining is the industrial process that turns crude oil into usable products such as petrol, diesel, jet fuel, and other fuels. It works by separating crude oil into different components and then upgrading them to meet quality and safety standards. Refineries are essential for keeping transport systems, industries, and power generation running smoothly, especially in economies that depend heavily on fossil fuels.

The oil refining market refers to the global system of refineries, infrastructure, and trade that supports this conversion of crude oil into finished products. It includes refinery construction, upgrades, capacity expansion, and distribution of refined fuels. Governments and financial institutions continue to influence this market through policy decisions and infrastructure approvals that shape long-term supply security.

One major growth factor is new refinery investment. Georgia’s Development Fund allocated $8.2M to the Kulevi oil refinery construction, supporting regional processing capacity. In another case, the Reserve Bank of India notified a $700 million Exim Bank line of credit to Mongolia for building a crude oil refinery, strengthening cross-border energy and trade links.

Demand is driven by energy security and transport needs. In Nigeria, a planned $50 billion oil refinery received a major regulatory green light, highlighting strong domestic demand for locally refined fuels. At the same time, global pressure is reshaping capital flows, as Australia’s Future Fund was urged to withdraw $175m from a Russian oil refiner.

Opportunities are emerging in large-scale projects backed by strong financing. A leading African financier disclosed over $4b invested in the Dangote refinery, showing how private capital supports mega-refineries that reduce fuel imports, create jobs, and stabilize regional fuel supply.

Key Takeaways

- The Global Oil Refining Market is expected to be worth around USD 2,650.0 billion by 2034, up from USD 1722.8 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In Oil Refining Market, middle distillates lead product types, capturing 44.2% share through fuel demand.

- In Oil Refining Market applications, transportation dominates usage with 39.7% share driven by mobility growth.

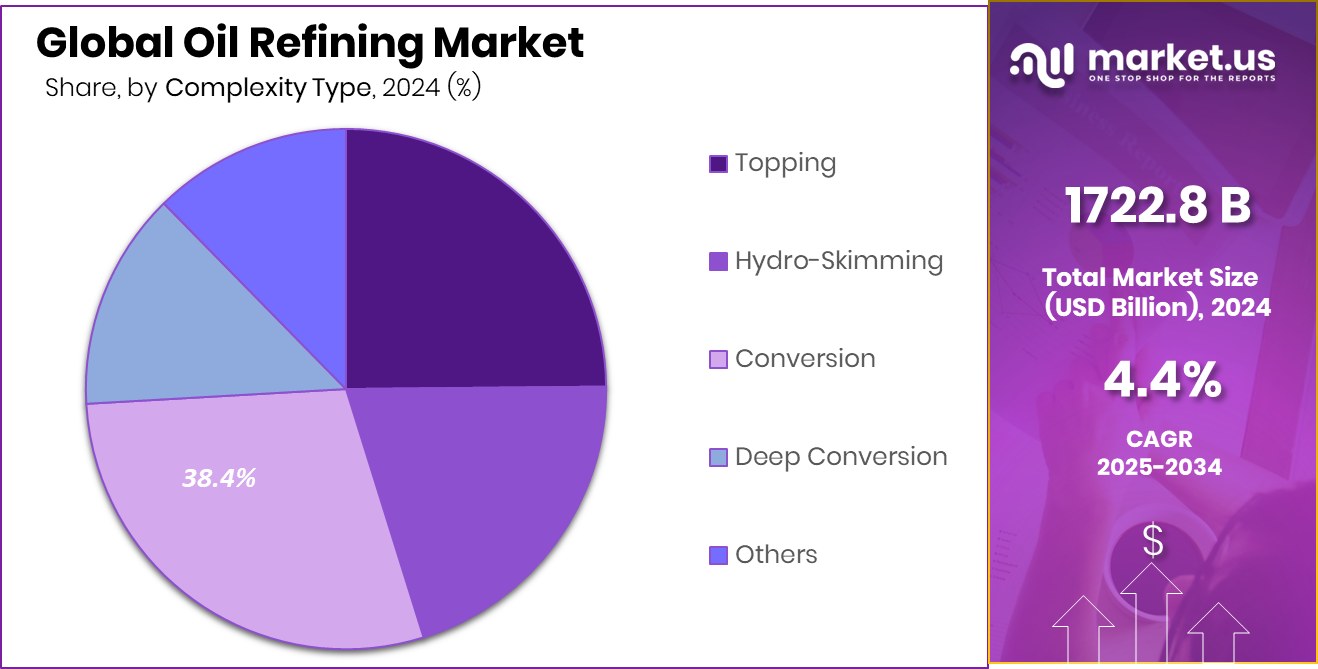

- By complexity type, conversion processes dominate Oil Refining Market operations, holding 38.4% share worldwide today.

- In Europe, the oil refining market reached USD 789.0 Bn, holding a 45.80% share overall.

By Product Type Analysis

In the oil refining market, middle distillates lead the product type with a 44.2% share.

In 2024, Middle Distillates held a 44.2% share by product type in the Oil Refining Market, reflecting their critical role in meeting global fuel demand. Products such as diesel, jet fuel, and heating oil remain essential for industrial activity, aviation, and freight movement. Refiners continue to prioritize middle distillate yields due to their stable consumption patterns and relatively higher margins compared to lighter products.

Rising infrastructure development, mining activity, and cross-border trade have further strengthened demand. Additionally, many refineries have optimized hydrocracking and distillation units to increase middle distillate output, aligning production with market needs. This focus also helps refiners balance volatility in gasoline demand while supporting energy security across both developed and emerging economies worldwide.

By Application Analysis

Transportation dominates the application in the oil refining market, accounting for 39.7% of demand globally.

In 2024, Transportation accounted for 39.7% of application demand in the Oil Refining Market, underlining the sector’s dependence on refined petroleum fuels. Road freight, marine shipping, and aviation continue to rely heavily on diesel and jet fuel, particularly in regions with limited electric mobility penetration. Expanding logistics networks, e-commerce growth, and rising passenger travel have sustained fuel consumption despite efficiency improvements.

Developing economies have seen strong transport fuel demand due to urbanization and highway expansion. Even as alternative fuels gain attention, conventional refined fuels remain dominant for long-haul and heavy-duty transport. This keeps transportation as a core demand anchor for refineries, influencing capacity planning and product slate decisions globally.

By Complexity Type Analysis

Conversion complexity type prevails in the oil refining market, representing 38.4% capacity worldwide.

In 2024, Conversion processes represented 38.4% by complexity type in the Oil Refining Market, highlighting the industry’s shift toward higher-value processing. Conversion refineries use advanced units such as catalytic crackers, hydrocrackers, and cokers to transform heavy crude fractions into lighter, more valuable products. This complexity allows refiners to handle heavier and sour crude oils while maximizing output of middle distillates and transportation fuels.

Rising crude quality variation and margin pressure have encouraged investments in conversion capacity. These refineries are better positioned to respond to changing fuel specifications and demand patterns. As a result, conversion complexity remains a strategic advantage, supporting profitability and long-term competitiveness in global refining operations.

Key Market Segments

By Product Type

- Light Distillates

- Middle Distillates

- Fuel Oil

- Others

By Application

- Transportation

- Aviation

- Marine Bunker

- Petrochemical

- Residential and Commercial

- Agriculture

- Electricity

- Rail and Domestic Waterways

- Others

By Complexity Type

- Topping

- Hydro-Skimming

- Conversion

- Deep Conversion

- Others

Driving Factors

Large-Scale Refinery Investments Drive Market Expansion

A major driving factor for the Oil Refining Market is strong funding support for new large-scale refinery projects. Recently, a firm secured $50bn funding for the Ondo Refinery and Free Trade Zone project, highlighting investor confidence in long-term fuel demand. Such large investments help expand refining capacity, reduce fuel imports, and support industrial growth around refinery hubs. These projects also create jobs, improve supply reliability, and strengthen downstream value chains such as petrochemicals and logistics.

When funding of this size is committed, it signals confidence in sustained fuel consumption from transportation, industry, and power generation. As a result, governments and private players increasingly view refinery development as a strategic infrastructure priority, especially in regions aiming to improve energy security and trade balances.

Restraining Factors

Policy Uncertainty And Transition Pressure Restrain Refining

One key restraining factor in the Oil Refining Market is rising policy uncertainty around existing refinery sites. In the UK, Keir Starmer pledged £200m for the Grangemouth oil refinery site, reflecting efforts to manage transition risks rather than expand traditional refining. While this funding supports site continuity and workforce stability, it also highlights pressure on older refineries facing environmental targets and long-term transition plans.

Regulatory scrutiny, carbon reduction goals, and political debate create hesitation for fresh private investment. Refiners must balance compliance costs with operational viability, which can slow capacity upgrades. These pressures make long-term planning difficult, especially in mature markets where demand growth is limited.

Growth Opportunity

Africa-Focused Refining Projects Unlock Long-Term Growth

A strong growth opportunity lies in Africa’s push for domestic refining capacity. Afreximbank set up a $3bn fund to finance refined oil products across the continent, improving regional fuel availability. At the same time, Uganda plans to fund a $4B oil refinery through equity, aiming to process local crude and reduce imports. These initiatives support energy independence, stabilize fuel prices, and encourage regional trade. As more countries invest in local refining, opportunities grow for infrastructure development, logistics services, and long-term supply contracts tied to domestic fuel demand.

Latest Trends

Short-Term Crude Financing Signals Refining Cash Management

A notable latest trend in the Oil Refining Market is increased short-term financing to manage crude procurement. Hengyuan recently made a cash call of RM300m to fund crude oil purchases, showing how refiners actively manage working capital amid price volatility. This trend reflects tighter margins and the need for flexible financing to secure feedstock without disrupting operations.

Rather than large expansions, many refiners focus on liquidity, inventory planning, and operational efficiency. Such funding actions highlight how day-to-day financial management has become as important as long-term investment, especially during periods of fluctuating crude prices and uncertain demand conditions.

Regional Analysis

Europe leads the Oil Refining Market with 45.80% share valued at USD 789.0 Bn.

In the global Oil Refining Market, regional performance varies based on demand structure, refining complexity, and crude availability. Europe remains the dominating region, accounting for 45.80% of the market and generating USD 789.0 Bn, supported by a dense network of complex refineries, strong transportation fuel demand, and consistent intra-regional trade. European refiners emphasize middle distillates and conversion capacity to meet stringent fuel specifications and stable logistics requirements.

North America shows strong operational efficiency, driven by integrated refining and petrochemical systems and steady demand from freight and aviation, while maintaining flexibility in crude sourcing. Asia Pacific continues to expand refining activity due to rapid industrialization, rising vehicle ownership, and growing domestic fuel consumption across major economies.

Middle East & Africa benefit from proximity to crude reserves and export-oriented refining hubs that supply international fuel markets. Meanwhile, Latin America remains focused on regional energy security, with refineries aligned to meet local transportation and industrial fuel needs. Collectively, these regions shape global refining flows, with Europe clearly leading in market share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aramco continues to play a central role in the global oil refining market through its scale, integration, and operational resilience. The company’s refining strategy is closely aligned with upstream strength, allowing stable feedstock access and cost control. Aramco’s focus on complex refining enables efficient processing of varied crude slates while supporting strong middle-distillate output. Its global refining footprint strengthens supply reliability and positions the company as a long-term stabilizer in refined fuel markets.

Sinopec remains a key force in 2024, driven by its extensive domestic refining network and strong alignment with regional fuel demand. The company benefits from large-scale downstream operations that support transportation, industrial, and chemical value chains. Sinopec’s refining approach emphasizes volume stability and operational optimization, enabling it to balance domestic consumption needs with efficiency goals. Its role is critical in supporting Asia’s fuel security and refining self-sufficiency.

In 2024, ExxonMobil stands out for its disciplined refining operations and technology-driven process optimization. The company leverages advanced conversion units to maximize value from diverse crude inputs. ExxonMobil’s refining assets are tightly integrated with logistics and downstream distribution, supporting margin stability. Its focus on reliability, operational excellence, and long-cycle asset performance reinforces its competitive position in the global refining landscape.

Top Key Players in the Market

- Aramco

- Sinopec

- ExxonMobil

- Royal Dutch Shell

- Total Energies

- Chevron Corporation

- Rosneft

- Valero Energy Corporation

- Phillips 66

- Marathon Petroleum Corporation

Recent Developments

- In October 2025, Aramco completed acquiring an additional 22.5% stake in Petro Rabigh, a major refining and petrochemicals joint venture in Saudi Arabia. This move made Aramco the majority owner with around 60% ownership, giving it stronger control over refining output and downstream products. The deal supports planned upgrades to improve yields and reliability at Petro Rabigh’s facilities.

- In October 2025, six Marathon refineries received 2025 Energy Star® certifications from the U.S. EPA for energy efficiency. These recognitions highlight strong operational performance across multiple refining facilities, placing Marathon among the top-performing refiners in the U.S. for energy use.

Report Scope

Report Features Description Market Value (2024) USD 1722.8 Billion Forecast Revenue (2034) USD 2,650.0 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Light Distillates, Middle Distillates, Fuel Oil, Others), By Application (Transportation, Aviation, Marine Bunker, Petrochemical, Residential and Commercial, Agriculture, Electricity, Rail and Domestic Waterways, Others), By Complexity Type (Topping, Hydro-Skimming, Conversion, Deep Conversion, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aramco, Sinopec, ExxonMobil, Royal Dutch Shell, Total Energies, Chevron Corporation, Rosneft, Valero Energy Corporation, Phillips 66, Marathon Petroleum Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aramco

- Sinopec

- ExxonMobil

- Royal Dutch Shell

- Total Energies

- Chevron Corporation

- Rosneft

- Valero Energy Corporation

- Phillips 66

- Marathon Petroleum Corporation