Global Oil and Gas Nuclear Magnetic Resonance (NMR) Market Size, Share, And Industry Analysis Report By Technology (Continuous Wave (CW) NMR, Pulsed NMR), By Application (Reservoir Characterization, Fluid Typing, Formation Evaluation, Well Logging, Others), By Deployment Type (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176152

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

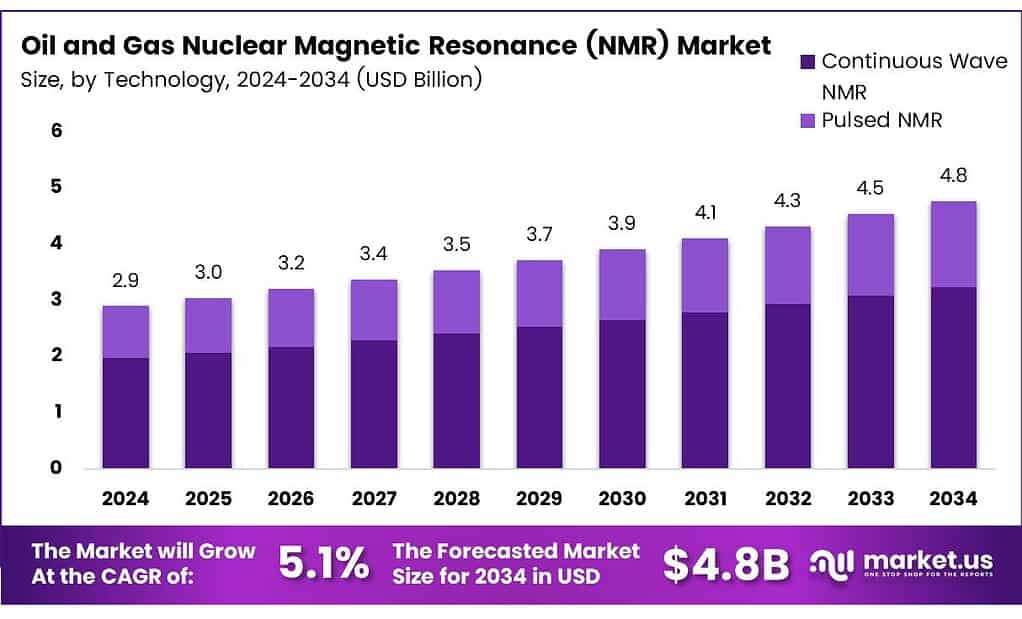

The Global Oil and Gas Nuclear Magnetic Resonance (NMR) Market size is expected to be worth around USD 4.8 billion by 2034, from USD 2.9 billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Oil and Gas Nuclear Magnetic Resonance (NMR) Market focuses on advanced subsurface evaluation tools that measure porosity, permeability, and fluid typing without requiring core extraction. It enables real-time reservoir characterization and improves well-planning decisions, supporting operators in optimizing production efficiency, reducing drilling risks, and improving asset recovery across complex geological formations worldwide.

The market continues to grow as operators shift toward precision-based logging technologies. Increasing exploration in unconventional reservoirs encourages the adoption of NMR tools due to their ability to differentiate bound and free fluids. Additionally, digitalization and downhole sensor innovations accelerate value creation, helping companies reduce uncertainty during early drilling phases using reliable formation-evaluation measurements.

- NMR measurements work only with nuclei that have an odd number of protons or neutrons, such as hydrogen (¹H), carbon (¹³C), and sodium (²³Na), because these nuclei carry a magnetic moment detectable by logging tools. In oilfield applications, the NMR tip angle follows the relationship θ ∝ B₁τ, meaning it increases when the magnetic field strength or pulse duration rises, delivering more energy to the proton spins. Logging-while-drilling tools use short π (180°) and π/2 (90°) pulses to tip the magnetization into the transverse plane, allowing the nuclei to precess coherently for reservoir evaluation.

Demand remains strong due to rising interest in reservoir stimulation, carbon-management projects, and geothermal assessments. NMR tools help quantify fluid mobility, enabling operators to design better completion strategies and waterflooding plans. With increasing focus on reducing operational risks, companies favor NMR-based measurements that provide consistent data in high-temperature and high-pressure environments.

Key Takeaways

- The Global Oil and Gas NMR Market is projected to grow from USD 2.9 billion by 2024 to USD 4.8 billion by 2034 at a 5.1% CAGR (2025–2034).

- Continuous Wave (CW) NMR dominates the technology segment with a 59.2% market share.

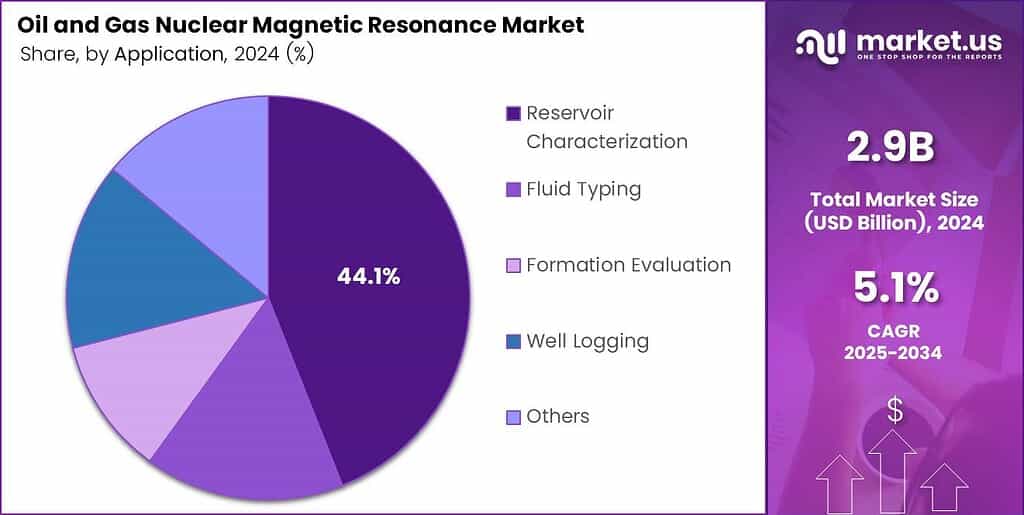

- Reservoir Characterization leads the application segment with a 44.1% share.

- Onshore deployment remains dominant, capturing 68.4% of total market demand.

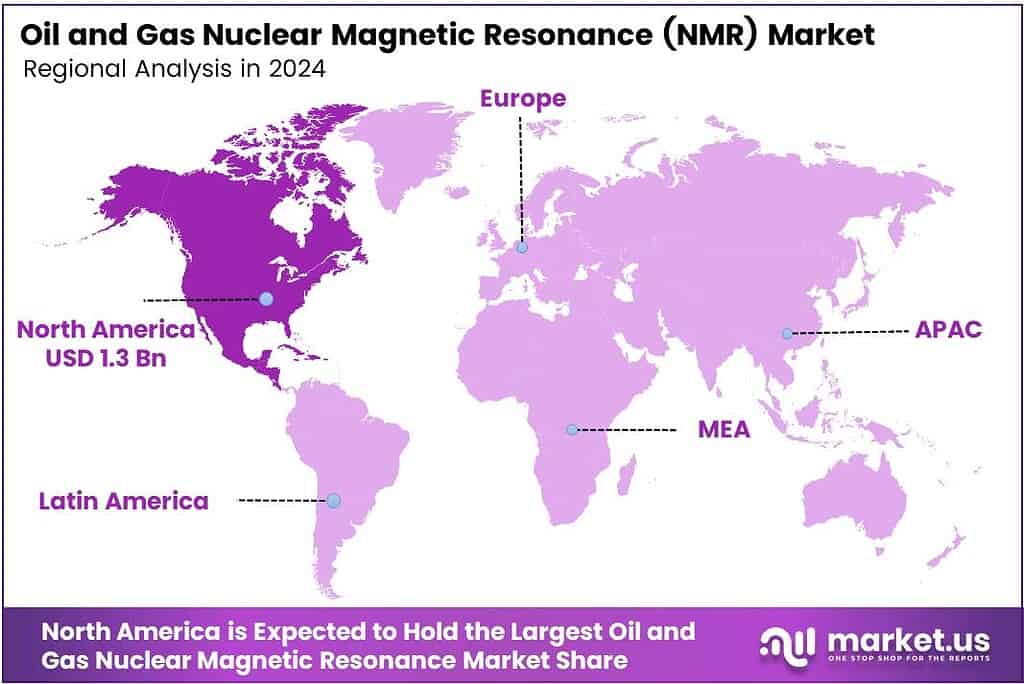

- North America holds the largest regional share at 44.3%, valued at USD 1.3 billion.

By Technology Analysis

Continuous Wave (CW) NMR dominates with 59.2% due to its stable signal measurement and wider industrial use.

In 2025, Continuous Wave (CW) NMR held a dominant market position in the By Technology Analysis segment of the Oil and Gas Nuclear Magnetic Resonance (NMR) Market, with a 59.2% share. This segment benefits from its long-standing adoption across logging tools, steady frequency output, and dependable operation under downhole pressure conditions. As oilfield operators prioritize consistent data acquisition, CW NMR continues to support scalable reservoir studies.

The Pulsed NMR segment grows steadily as operators adopt advanced pulse sequences for faster measurements. Although it does not match the market dominance of CW NMR, it remains important for labs and high-resolution formation studies. Its ability to measure T1/T2 relaxation accurately helps engineers gain deeper insight into fluids, porosity, and permeability patterns.

By Application Analysis

Reservoir Characterization leads with a 44.1% share, driven by its essential role in subsurface evaluation.

In 2025, Reservoir Characterization held a dominant market position in the By Application segment of the Oil and Gas NMR Market, with a 44.1% share. This segment gains strength from its ability to map pore structures, assess hydrocarbon volumes, and predict recovery rates. Its continuous relevance supports drilling planning and long-term field development.

The Fluid Typing segment remains crucial as NMR distinguishes between oil, gas, and water using relaxation trends. This accuracy helps operators limit uncertainty in well operations. Its integration into complex reservoir models ensures fluid differentiation even in tight or heterogeneous formations, supporting more informed extraction decisions.

The Formation Evaluation segment expands with NMR-based porosity and saturation measurements. Engineers rely on these insights to refine drilling programs and reduce non-productive time. Although not the leading segment, its technical value drives widespread adoption in both new wells and workover programs.

The Well Logging segment continues to be a backbone for downhole data acquisition. NMR logging tools provide real-time formation signals, enabling better completion planning. While its market share is lower than that of reservoir characterization, it remains vital for accurate subsurface interpretation.

By Deployment Type Analysis

Onshore dominates the market with a 68.4% share due to higher drilling activity and lower operational complexity.

In 2025, Onshore held a dominant position in the By Deployment Type segment of the Oil and Gas NMR Market, with a 68.4% share. Its leadership stems from extensive land-based drilling programs, lower deployment costs, and broader accessibility for NMR logging tools. Stable project timelines further strengthen onshore adoption.

The Offshore segment, although smaller, plays a crucial role in deepwater and ultra-deepwater exploration. NMR tools help assess complex reservoirs where drilling risks and costs are higher. As offshore investments rise in selective regions, this segment gradually gains momentum through precision-focused reservoir studies.

Key Market Segments

By Technology

- Continuous Wave (CW) NMR

- Pulsed NMR

By Application

- Reservoir Characterization

- Fluid Typing

- Formation Evaluation

- Well Logging

- Others

By Deployment Type

- Onshore

- Offshore

Emerging Trends

Growing Adoption of Digital NMR Technologies Shapes Market Trends

One of the strongest trends is the adoption of digital and cloud-enhanced NMR platforms. Companies are increasingly using software tools to analyze relaxation times, pore distribution, and fluid mobility more efficiently. This shift toward digital workflows reduces human error and speeds up decision-making.

- A widely cited multiband NMR logging approach reported 800 echoes collected in a single CPMG pulse sequence at an echo spacing of 1.2 ms, giving a total acquisition window of about 1 second. That kind of compact acquisition design supports near-real-time interpretation and makes NMR easier to integrate with other logs during the same run.

Another trend is the development of portable and compact NMR instruments for both lab and field use. These systems help operators test core samples rapidly without depending on large laboratory setups, making reservoir assessment faster and more accessible.

Drivers

Rising Need for Accurate Reservoir Characterization Drives Market Growth

The Oil & Gas NMR market is mainly driven by the growing demand for precise reservoir insights. As exploration shifts toward deeper, more complex formations, operators increasingly rely on NMR tools to measure porosity, permeability, and fluid types more accurately. This push for better data quality encourages companies to adopt advanced downhole NMR technologies during drilling and logging operations.

- NMR measurements allow operators to avoid non-productive time by identifying water saturation and formation quality early in the process. The U.S. active oil-and-gas rig count was 544, with 411 oil rigs and 122 gas rigs. Even with year-on-year declines, this is still a large base of activity where logging programs compete to deliver more value per run, exactly the environment where NMR’s “data density” matters.

Increasing investments in unconventional resources also support market expansion. Shale and tight reservoirs require sophisticated analysis tools, and NMR techniques offer unique advantages in assessing bound fluids and predicting production potential. Rapid digitalization across oilfield operations further strengthens adoption, as NMR data integrates well with real-time drilling systems.

Restraints

High Equipment Cost Limits Wider Market Adoption

The market faces limitations mainly due to the high cost of NMR logging tools and supporting systems. These instruments require sophisticated magnets, sensors, and electronics, making them expensive to manufacture and maintain. Small and mid-sized operators often avoid using NMR because of its higher service pricing compared to conventional well-logging technologies.

- In the U.S., the federal 45Q incentive (as updated) increased the potential value of permanent storage to $85 per metric ton (and up to $180 per metric ton for direct air capture storage) for projects meeting wage and apprenticeship requirements, which is a meaningful driver for more subsurface measurement and verification activity where NMR-derived porosity and fluid partitioning can help.

NMR tools require skilled professionals to interpret spin-echo signals and relaxation profiles. In many emerging regions, a shortage of trained specialists limits adoption, slowing market penetration. The reduced effectiveness of NMR tools in highly conductive or extremely high-temperature environments. This makes some deep-water or geothermal wells challenging for NMR deployment.

Growth Factors

Expanding Use of NMR in Unconventional Reservoirs Unlocks New Opportunities

Growing exploration activity in shale, tight sandstone, and carbonate formations creates strong opportunities for NMR service providers. These reservoirs require detailed fluid-type detection, and NMR’s ability to differentiate movable and bound fluids offers a unique competitive edge. Companies expanding into unconventional plays can benefit from integrating NMR logging in early-stage reservoir evaluation.

Technological advancements such as miniaturized NMR logging-while-drilling tools provide another major growth area. Smaller, more robust systems allow operators to capture real-time NMR measurements during drilling, enhancing well-site decision-making and reducing delays.

Increasing investment in energy security by governments also opens room for growth. National oil companies in the Middle East and Asia are boosting exploration budgets, and many are adopting advanced NMR tools to maximize domestic production. Research initiatives supporting digital oilfields and advanced reservoir modeling further expand market potential.

Regional Analysis

North America Dominates the Oil and Gas Nuclear Magnetic Resonance (NMR) Market with a Market Share of 44.3%, Valued at USD 1.3 Billion

North America leads the global Oil and Gas Nuclear Magnetic Resonance (NMR) market due to its strong upstream exploration activities and early adoption of advanced reservoir evaluation technologies. The region’s dominance, with a 44.3% share valued at USD 1.3 billion, is supported by continuous shale development and greater investment in precision-based well logging.

Europe remains a stable and technology-driven market for NMR tools as operators focus on improving reservoir characterization in mature oilfields. The region sees consistent adoption of advanced logging tools for maximizing recovery rates. Additionally, supportive regulatory frameworks for optimized hydrocarbon extraction and investments in the North Sea’s redevelopment projects further strengthen its market presence.

Asia Pacific shows strong growth potential driven by increasing offshore exploration in countries such as China, India, and Australia. Rising energy consumption and expanding drilling activities across deep-water basins are accelerating the use of NMR technologies for improved subsurface evaluation. Government-driven exploration initiatives and growing investments in domestic hydrocarbon production contribute to the region’s expanding market demand.

The Middle East & Africa region continues to strengthen its demand for NMR tools due to heavy reliance on advanced reservoir monitoring across large conventional fields. National oil companies increasingly adopt high-precision technologies to optimize well placement and enhance recovery. Additionally, new exploration programs in Africa’s emerging basins contribute to steady market growth in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Oil and Gas Nuclear Magnetic Resonance (NMR) market continues to evolve as operators push for higher reservoir clarity, better formation evaluation, and faster decision-making in complex wells. Among major contributors,

Schlumberger Limited maintains a leading role, driven by its advanced NMR logging-while-drilling systems that improve fluid typing and pore-size distribution analysis. The company’s continued investment in tool miniaturization helps operators acquire high-quality NMR data in challenging unconventional environments.

Halliburton Company remains another strong player, focusing on improving NMR-based reservoir diagnostics for deep and ultra-deep wells. Its emphasis on integrating NMR with digital workflows enhances real-time reservoir evaluation, helping operators reduce uncertainty in complex formations. In 2025, Halliburton’s efforts to optimize downhole tools for harsher drilling conditions further strengthen its competitive positioning.

Baker Hughes Company continues to expand its NMR technology portfolio with tools designed for both LWD and wireline applications. The company’s advancements in T1–T2 relaxation measurements allow more accurate differentiation between movable and bound fluids, supporting better reservoir productivity assessments. Baker Hughes’ push toward energy-efficient and ruggedized NMR systems aligns well with industry requirements.

Weatherford International plc also contributes significantly by offering specialized NMR logging technologies that support tight-reservoir evaluation. Weatherford’s tools provide enhanced porosity and permeability insights, especially in shale and carbonate plays. Its upgrades to tool reliability and data-processing algorithms in 2025 help operators gain clearer subsurface visibility.

Scientific Drilling International and CNPC Logging Co., Ltd. round out the competitive landscape with region-focused NMR innovations, strengthening global adoption and expanding access to NMR solutions across diverse drilling programs.

Top Key Players in the Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Scientific Drilling International

- CNPC Logging Co., Ltd.

- Others

Recent Developments

- In 2025, Recent developments in the NMR sector for SLB primarily revolve around advancements in low-field NMR (LF-NMR) applications for crude oil characterization and reservoir analysis. A comprehensive review highlights SLB’s historical role in pioneering NMR well-logging tools since the 1970s, with ongoing innovations improving sensitivity, resolution, and portability for field use.

- In 2025, Baker Hughes has not disclosed direct NMR advancements, but the company is advancing reservoir characterization through collaborations and technology integrations. Focus has shifted to LNG and power systems, with acquisitions like Chart Industries in 2025 enhancing clean-energy capabilities, which could indirectly support NMR-related data analytics in gas reservoirs.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 4.8 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Continuous Wave (CW) NMR, Pulsed NMR), By Application (Reservoir Characterization, Fluid Typing, Formation Evaluation, Well Logging, Others), By Deployment Type (Onshore, Offshore) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Scientific Drilling International, CNPC Logging Co., Ltd., Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Oil and Gas Nuclear Magnetic Resonance (NMR) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Oil and Gas Nuclear Magnetic Resonance (NMR) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Scientific Drilling International

- CNPC Logging Co., Ltd.

- Others