Global Oil and Gas EPC Market By Service Type(Engineering, Procurement, Construction, Fabrication), By Type(Upstream EPC, Midstream EPC, Downstream EPC), By Application(Onshore, Offshore), By End-Use(Exploration and Production, Refining and Petrochemicals, LNG and Gas Processing, Pipeline and Transportation, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122961

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

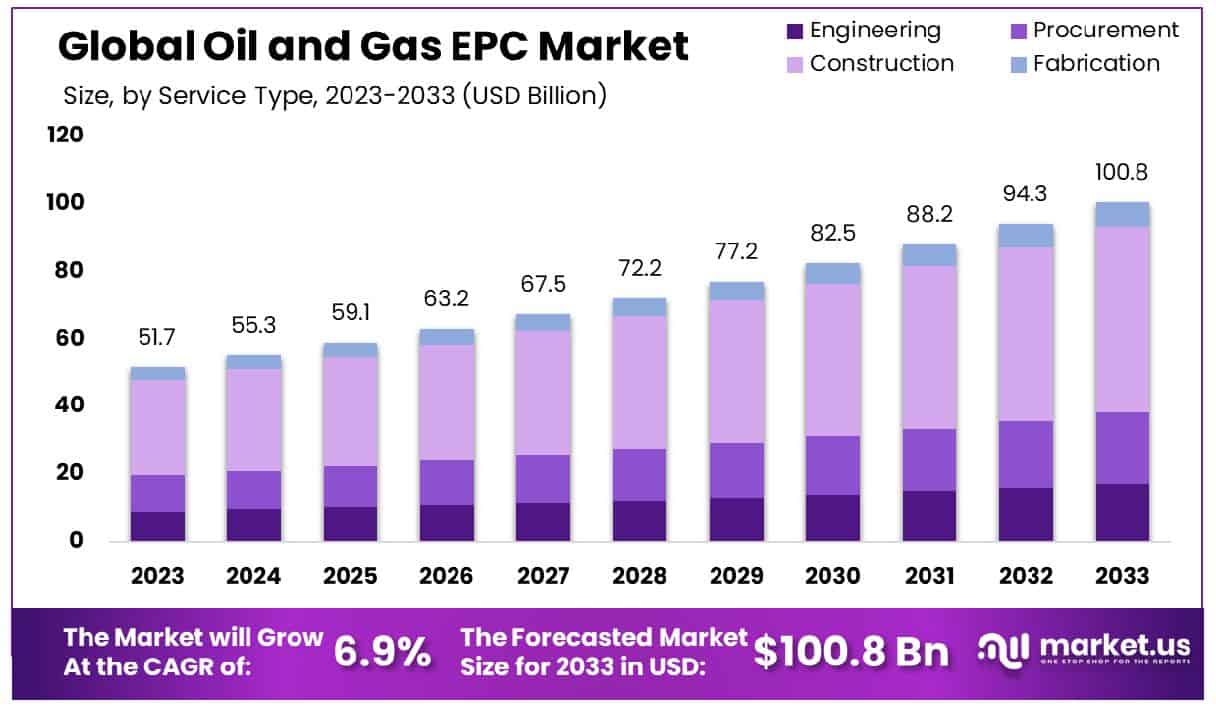

The Global Oil and Gas EPC Market size is expected to be worth around USD 100.8 Billion by 2033, From USD 51.7 Billion by 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

The Oil and Gas Engineering, Procurement, and Construction (EPC) Market encompasses the comprehensive services provided by EPC contractors to the oil and gas industry. These services cover the design, engineering, procurement of necessary materials and equipment, and construction of oil and gas infrastructure. EPC contracts are pivotal in facilitating the streamlined execution of oil and gas projects, ensuring adherence to project timelines, cost estimates, and technical specifications.

The Oil and Gas Engineering, Procurement, and Construction (EPC) Market is poised at a critical juncture, shaped by significant mergers and acquisitions, shifting global demand, and technological disruptions. In 2023, the oil and gas sector witnessed a robust consolidation with 1,571 M&A deals, underscored by ExxonMobil’s acquisition of Pioneer Natural Resources for $64.5 billion and Chevron’s $60 billion acquisition of Hess’ assets in Guyana.

These transactions not only underscore the strategic realignment focusing on resource-rich areas but also highlight the capital intensity and the scale economies sought by major industry players. Amid these market consolidations, global oil demand growth is experiencing a notable deceleration, projected to slow to 0.4 million barrels per day (mbpd) annually until 2027 from the previous rate of 1.6 mbpd up to 2023.

Despite this slowdown, oil demand crossed the 100 mbpd mark for the first time in 2023, signifying a complex interplay between legacy energy systems and emerging consumption patterns influenced by the rise in electric vehicle (EV) adoption, which saw over a 35% increase in sales in 2023, making up one in seven new cars sold.

The upstream oil sector remains robust with an anticipated $580 billion in hydrocarbon investments in 2024, expected to generate over $800 billion in free cash flow. However, the refining sub-sector faces challenges, evidenced by a contraction of global refining capacity by 4.5 mbpd since 2019.

Key Takeaways

- The Global Oil and Gas EPC Market is projected to grow from USD 51.7 billion in 2023 to USD 100.8 billion by 2033, with a CAGR of 6.9%.

- North America leads the Oil and Gas EPC Market with 38.4%, totaling USD 19.8 billion.

- Construction dominates the service segment with 54.6% in the Oil and Gas EPC Market.

- Upstream EPC captures 42.6% of the market, reflecting significant project involvement.

- Onshore projects lead with 68.4%, showing a strong preference for applications.

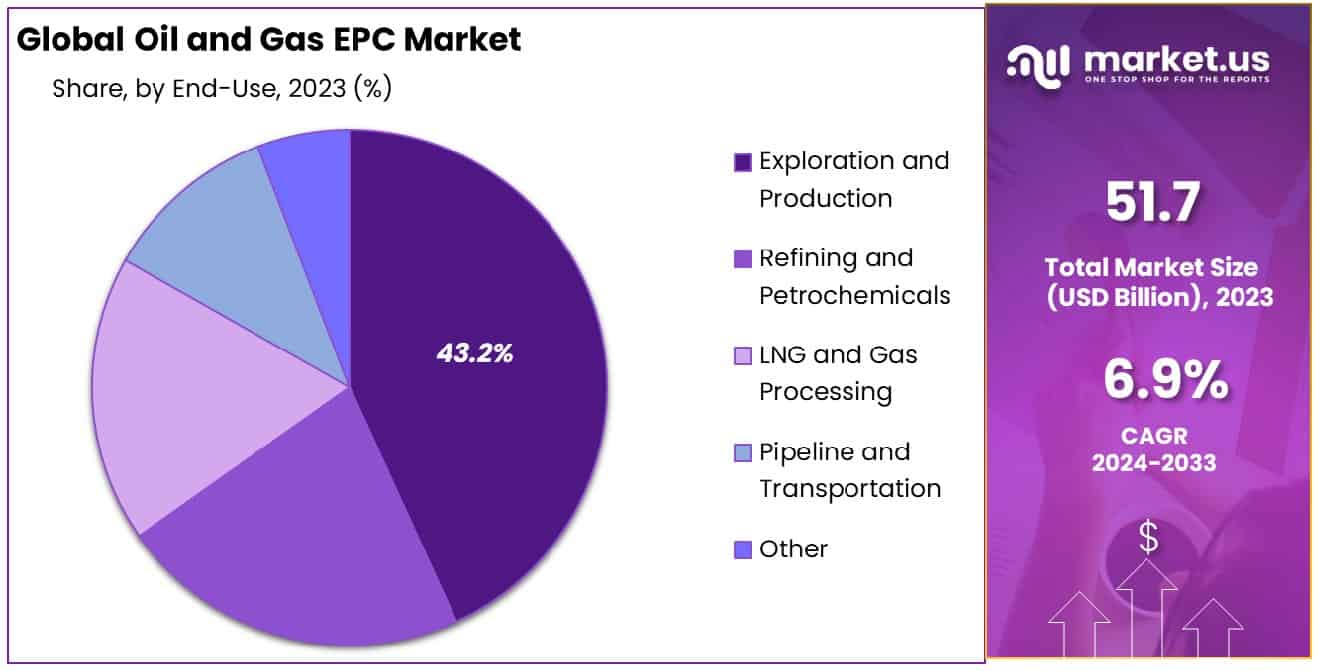

- Exploration and production are major end-uses, constituting 43.2% of the market.

Driving Factors

Increasing Investments in Offshore and Onshore Oil and Gas Projects

The escalation in capital allocation toward both offshore and onshore oil and gas projects serves as a primary catalyst for the expansion of the Oil and Gas Engineering, Procurement, and Construction (EPC) Market. As global energy demands continue to climb, driven by industrial growth and economic expansion, significant investment flows into the exploration and development of new oil and gas reserves.

The enhanced funding not only supports the advancement of existing fields but also facilitates the exploration of untapped resources, thereby extending the operational scope for EPC contractors. This factor directly correlates with an increased demand for EPC services, as these complex projects require comprehensive management capabilities ranging from design to construction and maintenance.

Advancements in Drilling Technologies

Technological advancements in drilling, such as hydraulic fracturing and directional drilling, have profoundly impacted the Oil and Gas EPC Market by reducing operational risks and costs, and by increasing efficiency and output. These innovations enable the exploitation of previously inaccessible or non-viable reserves, expanding the market for oil and gas extraction and, consequently, for EPC services.

The integration of modern technologies into EPC projects not only optimizes the extraction process but also ensures environmental compliance and safety, which are increasingly prioritized in project specifications. As a result, EPC firms that adapt to incorporate advanced technologies are likely to witness substantial growth opportunities.

Surge in Demand for Natural Gas and Crude Oil

The increasing global demand for energy, particularly natural gas and crude oil, underpins the growth of the Oil and Gas EPC Market. This surge is propelled by the growing energy consumption in emerging economies and the ongoing reliance on fossil fuels as primary energy sources worldwide. As market dynamics favor higher production to meet this burgeoning demand, the role of EPC firms becomes more critical.

These firms are essential in designing, constructing, and maintaining the infrastructure needed to boost production capacity effectively and sustainably. The correlation between rising energy demands and EPC services underscores a robust growth trajectory for the market, driven by both the volume and complexity of required infrastructure projects.

Restraining Factors

Environmental Regulations and Sustainability Concerns

Environmental regulations and sustainability concerns significantly shape the trajectory of the Oil and Gas EPC Market. Stringent environmental standards and policies necessitate the adoption of cleaner, more sustainable technologies during the extraction and processing phases of oil and gas projects. These regulations compel EPC contractors to innovate and adapt, integrating environmental management and pollution control measures into their project designs and operations.

While this shift poses initial challenges and increases costs due to the need for compliance with complex regulatory frameworks, it also opens avenues for diversification and differentiation among EPC providers. Companies that can offer cost-effective, compliant solutions are better positioned to capture market share, particularly in regions with strict environmental oversight.

Volatile Oil Prices

The volatility of oil prices is a critical restraining factor for the Oil and Gas EPC Market. Fluctuating oil prices affect the economic viability of projects, influencing investment decisions and timelines. When prices are low, oil and gas companies may delay or cancel new projects, directly impacting the demand for EPC services. Conversely, when prices stabilize at a higher level, the market may experience a sudden surge in project initiations, challenging EPC firms to scale operations rapidly.

The interplay between these price dynamics and environmental concerns creates a complex market environment where EPC firms must demonstrate agility and resilience, adapting their strategies to manage risks associated with financial and regulatory fluctuations effectively.

By Service Type Analysis

Construction dominates the market, holding a 54.6% share due to extensive infrastructure development needs.

In 2023, the Oil and Gas EPC Market was segmented into four key service types: Engineering, Procurement, Construction, and Fabrication. Among these, Construction held a dominant market position, capturing more than 54.6% of the market share. This segment’s prominence can be attributed to escalating demands for infrastructure development and maintenance in the extraction and processing facilities within the oil and gas sector.

The Engineering segment also played a crucial role, focusing on the design and planning of projects, which are vital in ensuring compliance with environmental regulations and operational efficiency. Meanwhile, Procurement was essential in sourcing high-quality materials and equipment required to support the robust construction activities.

Fabrication, although smaller in comparison to its counterparts, was integral in the creation of specialized components necessary for both upstream and downstream operations. This segment’s contributions are critical in customizing solutions that meet specific operational requirements of oil and gas projects, thereby enhancing the overall efficiency and safety of operations.

Collectively, these segments synergize to propel the Oil and Gas EPC market forward, with Construction leading the way due to its extensive involvement in building and maintaining the physical assets required for oil and gas extraction and processing.

The data underscores the sector’s reliance on robust construction capabilities to meet its infrastructural needs, thereby driving substantial market growth within this segment. As the industry continues to evolve, the interplay among these service types will be crucial in addressing the challenges and opportunities that lie ahead in the oil and gas sector.

By Type Analysis

Upstream EPC claims 42.6% of the market, driven by increased investment in exploration and drilling activities.

In 2023, the Oil and Gas EPC Market was segmented by type into three main categories: Upstream EPC, Midstream EPC, and Downstream EPC. Upstream EPC held a dominant market position, capturing more than 42.6% of the market share. This segment’s leadership is primarily driven by the intensive exploration and production activities that characterize the upstream sector of the oil and gas industry.

Upstream EPC services are critical in the development of oil and gas fields, including geological surveys, drilling, and well completion. The demand for these services is bolstered by the continuous need for new resource discoveries and the development of technically challenging and geographically remote fields.

Midstream EPC, which focuses on transportation and storage solutions, including pipelines, storage facilities, and export terminals, also plays a vital role. It links the upstream production sites with downstream processing facilities, ensuring the seamless flow of oil and gas resources.

Downstream EPC encompasses the services required for refining and processing of oil and gas into end products such as gasoline, diesel, and other petrochemicals. Although it accounts for a smaller share of the market compared to the upstream, the downstream segment is critical for adding value to raw extracts.

The prominence of Upstream EPC in 2023 highlights the sector’s ongoing prioritization of exploration and production capabilities, essential for sustaining the global energy supply. The strategic emphasis on upstream activities underscores the industry’s response to increasing energy demands and the technological advancements that are making remote and deep-water exploration more feasible.

By Application Analysis

Onshore projects lead with 68.4%, favored for their accessibility and lower operational complexities compared to offshore.

In 2023, the Oil and Gas EPC Market was categorized by application into two primary segments: Onshore and Offshore. Onshore EPC held a dominant market position, capturing more than 68.4% of the market share. This substantial proportion underscores the segment’s pivotal role in the oil and gas industry, largely due to the extensive development of land-based oil and gas projects which are typically more accessible and cost-effective compared to their offshore counterparts.

The Onshore segment benefits from lower operational and logistical costs, as well as less stringent regulatory challenges, making it a more attractive option for many oil and gas companies. These advantages facilitate quicker project completion times and reduce complexities in supply chain management, driving the segment’s growth. Moreover, technological advancements and improved efficiencies in extraction and production techniques have further bolstered the economic viability of onshore projects.

Conversely, the Offshore segment, while smaller in market share, involves the development of oil and gas resources located in oceanic environments. Despite higher costs and technical challenges, offshore EPC is crucial for accessing untapped reserves in deep-water and ultra-deep-water locations, which are increasingly important as onshore reserves become depleted.

The overwhelming dominance of the Onshore segment in 2023 is reflective of the industry’s focus on maximizing returns from more accessible resources, aligning with global trends toward optimizing cost efficiencies. However, the strategic importance of the Offshore segment remains significant, driven by the ongoing need to explore new frontiers in the oil and gas domain.

By End-Use Analysis

Exploration and Production activities constitute 43.2% of the market, reflecting ongoing global demands for oil and gas.

In 2023, the Oil and Gas EPC Market was segmented by end-use into five categories: Exploration and Production, Refining and Petrochemicals, LNG and Gas Processing, Pipeline and Transportation, and Others.

Exploration and Production (E&P) held a dominant market position, capturing more than 43.2% of the market share. This leadership underscores the critical role of E&P activities in driving the upstream sector of the oil and gas industry, which focuses on the search for underground or underwater oil and gas fields, drilling exploratory wells, and subsequently drilling and operating the wells that recover and bring the crude oil or raw natural gas to the surface.

The significant share held by the E&P segment is attributed to ongoing global energy demands that necessitate sustained investments in oil and gas exploration and the development of new production sites. Additionally, technological advancements in E&P techniques, such as hydraulic fracturing and horizontal drilling, have enabled more efficient extraction of oil and gas resources, further propelling this segment’s growth.

Refining and Petrochemicals, another crucial segment, involves transforming crude oil into usable products including fuels and lubricants, and processing raw natural gas into marketable products. The LNG and Gas Processing segment, focused on liquefaction and purification, is pivotal for enabling the transport of gas over long distances, particularly from gas-rich but market-distant regions.

Pipeline and Transportation infrastructure remains essential for the distribution of oil and gas from extraction sites to processing plants and end markets, highlighting the integrated nature of the Oil and Gas EPC market. Each segment collectively supports the industry’s infrastructure and responds dynamically to changes in the global energy landscape.

Key Market Segments

By Service Type

- Engineering

- Procurement

- Construction

- Fabrication

By Type

- Upstream EPC

- Midstream EPC

- Downstream EPC

By Application

- Onshore

- Offshore

By End-Use

- Exploration and Production

- Refining and Petrochemicals

- LNG and Gas Processing

- Pipeline and Transportation

- Other

Growth Opportunities

Expansion into Emerging Markets

The 2023 landscape for the global Oil and Gas EPC Market presents compelling growth opportunities, particularly through expansion into emerging markets. Countries in regions such as Africa, Southeast Asia, and Latin America are experiencing rapid industrialization and urbanization, leading to an increased demand for energy. These markets offer a fertile ground for the development of oil and gas infrastructure, which is less saturated compared to more developed markets.

The strategic entry into these regions not only diversifies the geographic footprint of EPC firms but also mitigates risks associated with mature markets where competition is intense and growth rates may be slowing. Moreover, the local government’s initiatives to attract foreign investments through regulatory reforms and incentives provide a conducive environment for EPC projects. EPC companies that can navigate these emerging markets effectively, understanding local regulations and cultural nuances, stand to gain a significant first-mover advantage, thereby securing long-term growth prospects.

Adoption of Digital Technologies and Automation in EPC Projects

Another significant growth avenue in 2023 for the Oil and Gas EPC Market lies in the adoption of digital technologies and automation. The integration of digital tools such as AI, IoT, and cloud computing in EPC projects enhances efficiency, reduces project timelines, and minimizes costs through improved project management and execution. Automation in construction and monitoring can significantly enhance safety and precision in hazardous environments typical of oil and gas projects.

By adopting these technologies, EPC firms not only streamline operations but also enhance their competitive edge by delivering projects faster and with higher quality standards. Furthermore, digital integration facilitates better data analytics, enabling predictive maintenance and real-time decision-making, which are crucial for project success and client satisfaction. As the industry continues to evolve, the EPC companies that prioritize technological advancements will likely experience robust growth and improved market positioning.

Latest Trends

Integration of Renewable Energy Projects with Oil and Gas Operations

In 2023, a notable trend in the global Oil and Gas EPC Market is the integration of renewable energy projects with traditional oil and gas operations. This trend is driven by increasing global pressure for sustainability and the industry’s acknowledgment of the need to reduce carbon footprints. Oil and gas companies are progressively investing in renewable energy sources such as smart solar, wind, and bioenergy to create a more sustainable energy mix.

This shift not only helps these companies meet stricter environmental regulations but also aligns them with global climate goals and investor expectations. For EPC firms, this trend opens up new business avenues in project management, design, and construction, specifically tailored to integrate renewable technologies with existing oil and gas infrastructures. As such, EPC companies that adapt to offer dual expertise in both oil and gas and renewables are likely to capture a significant competitive advantage in the market.

Increased Focus on Modular Construction in EPC Projects

Another emerging trend in the 2023 Oil and Gas EPC Market is the increased focus on modular construction. This method involves constructing components or entire modules of a project off-site, and then transporting them to the final location for assembly. Modular construction offers several advantages, including reduced construction time, lower costs, and minimized on-site risks, which are particularly beneficial in remote or environmentally sensitive oil and gas project locations.

Additionally, it allows for better quality control and reduces the need for skilled labor on-site, which can be a significant advantage given the current global shortage of skilled construction workers. As the oil and gas industry continues to seek more efficient and cost-effective project solutions, the adoption of modular construction techniques is expected to rise, providing substantial growth opportunities for EPC firms specializing in these practices.

Regional Analysis

North America leads the Oil and Gas EPC Market with a 38.4% share, totaling USD 19.8 billion.

In 2023, the global Oil and Gas Engineering, Procurement, and Construction (EPC) Market showcases significant regional segmentation and diverse market dynamics across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America remains the dominating region in the Oil and Gas EPC market, accounting for 38.4% of the global market share and generating USD 19.8 billion in revenue. This dominance is largely driven by the advanced technological infrastructure and substantial investments in both unconventional and offshore resources, particularly in the United States and Canada.

Europe follows, characterized by a robust regulatory framework and an increasing focus on integrating renewable energy sources within the oil and gas infrastructure. The region’s drive towards sustainability is compelling EPC contractors to innovate and adapt, thereby stimulating the market.

Asia Pacific is identified as a rapidly growing segment within the Oil and Gas EPC market. The growth is fueled by increasing energy demands from emerging economies such as China and India, coupled with a surge in offshore exploration activities. This region benefits from significant government support and foreign investments aimed at developing its oil and gas infrastructure.

Middle East & Africa continues to capitalize on its vast natural resources, with significant projects underway in countries like Saudi Arabia, UAE, and Nigeria. The market in this region is propelled by large-scale investments in oil and natural gas production facilities and the modernization of aging infrastructure.

Latin America, with countries like Brazil and Mexico, is seeing a revival in its Oil and Gas EPC market due to recent regulatory reforms, which have made it more attractive to foreign investments. This region is expected to witness substantial growth due to new projects in both offshore and onshore sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Oil and Gas EPC Market is significantly shaped by the strategic initiatives and market presence of key players, each contributing distinct capabilities and expertise. This analysis provides an overview of several prominent companies influencing market dynamics.

Bechtel Corporation and Fluor Corporation are longstanding leaders in the industry, known for their extensive portfolios and capability to manage mega-projects across diverse geographies. Their robust project management skills and advanced technological integration set industry standards for operational excellence and efficiency.

TechnipFMC and McDermott International stand out for their specialization in offshore and subsea operations, benefiting from the increasing investments in deepwater projects. Their advanced solutions in floating production storage and offloading (FPSO) and subsea infrastructure are pivotal in exploiting remote reserves.

Saipem S.p.A. and Petrofac excel in their regional expertise, particularly in the challenging terrains of the Middle East and North Africa, where they leverage strong local partnerships and extensive knowledge of regulatory landscapes to secure and execute large-scale projects.

Wood plc and KBR, Inc. have expanded their market presence by increasingly integrating sustainability into their project execution, aligning with global shifts towards environmental responsibility and energy transition.

L&T and Aker Solutions are distinguished by their innovation in modular construction techniques, significantly reducing project timelines and costs, which is crucial in today’s economically sensitive oil market.

Hyundai Engineering & Construction Co., Ltd. and Samsung Engineering Co., Ltd. contribute through their high engineering standards and competitive project execution strategies, particularly in Asia, driving regional market dynamics.

Mott MacDonald, Jacobs Engineering Group Inc., and SNC-Lavalin Group Inc. focus on incorporating digital technologies and data-driven project management approaches, enhancing efficiency and predictability in project outcomes.

NPCC, Lamprell, and Worley leverage localized expertise and strategic global alliances to expand their service offerings beyond traditional EPC scopes, increasingly focusing on maintenance, operations, and decommissioning phases.

Together, these companies are not just participants but active drivers of growth and innovation in the Oil and Gas EPC Market, navigating complexities of technological, regulatory, and economic changes shaping the industry in 2023. Their combined efforts are set to maintain the market’s robustness despite the fluctuating global energy landscape.

Market Key Players

- Bechtel Corporation

- Fluor Corporation

- TechnipFMC

- McDermott International

- Saipem S.p.A.

- Petrofac

- Wood plc

- KBR, Inc.

- NPCC

- Lamprell

- SNC-Lavalin Group Inc.

- Worley

- L&T

- Aker Solutions

- Hyundai Engineering & Construction Co., Ltd.

- Samsung Engineering Co., Ltd.

- Mott MacDonald

- Jacobs Engineering Group Inc.

Recent Development

- In May 2024, AlSuwaiket Oil & Gas announced the construction of a multifunctional industrial facility at SPARK, Saudi Arabia, aiming for an operational start in Q2 2025, enhancing regional oil and energy services.

- In April 2024, Samsung Engineering & Construction secured a $9.6 trillion order for 37 projects in Saudi Arabia, leveraging modular construction and design automation technologies.

Report Scope

Report Features Description Market Value (2023) USD 51.7 Billion Forecast Revenue (2033) USD 100.8 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type(Engineering, Procurement, Construction, Fabrication), By Type(Upstream EPC, Midstream EPC, Downstream EPC), By Application(Onshore, Offshore), By End-Use(Exploration and Production, Refining and Petrochemicals, LNG and Gas Processing, Pipeline and Transportation, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bechtel Corporation, Fluor Corporation, TechnipFMC, McDermott International, Saipem S.p.A., Petrofac, Wood plc, KBR, Inc., NPCC, Lamprell, SNC-Lavalin Group Inc., Worley, L&T, Aker Solutions, Hyundai Engineering & Construction Co., Ltd., Samsung Engineering Co., Ltd., Mott MacDonald, Jacobs Engineering Group Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Oil and Gas EPC Market Size in 2023?The Global Oil and Gas EPC Market Size is USD 51.7 Billion in 2023.

What is the projected CAGR at which the Global Oil and Gas EPC Market is expected to grow at?The Global Oil and Gas EPC Market is expected to grow at a CAGR of 6.9% (2024-2033).

List the segments encompassed in this report on the Global Oil and Gas EPC Market?Market.US has segmented the Global Oil and Gas EPC Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Service Type(Engineering, Procurement, Construction, Fabrication), By Type(Upstream EPC, Midstream EPC, Downstream EPC), By Application(Onshore, Offshore), By End-Use(Exploration and Production, Refining and Petrochemicals, LNG and Gas Processing, Pipeline and Transportation, Other)

List the key industry players of the Global Oil and Gas EPC Market?Bechtel Corporation, Fluor Corporation, TechnipFMC, McDermott International, Saipem S.p.A., Petrofac, Wood plc, KBR, Inc., NPCC, Lamprell, SNC-Lavalin Group Inc., Worley, L&T, Aker Solutions, Hyundai Engineering & Construction Co., Ltd., Samsung Engineering Co., Ltd., Mott MacDonald, Jacobs Engineering Group Inc.

Name the key areas of business for Global Oil and Gas EPC Market?The US, Canada, Mexico are leading key areas of operation for Global Oil and Gas EPC Market.

- The Global Oil and Gas EPC Market is projected to grow from USD 51.7 billion in 2023 to USD 100.8 billion by 2033, with a CAGR of 6.9%.

-

-

- Bechtel Corporation

- Fluor Corporation

- TechnipFMC

- McDermott International

- Saipem S.p.A.

- Petrofac

- Wood plc

- KBR, Inc.

- NPCC

- Lamprell

- SNC-Lavalin Group Inc.

- Worley

- L&T

- Aker Solutions

- Hyundai Engineering & Construction Co., Ltd.

- Samsung Engineering Co., Ltd.

- Mott MacDonald

- Jacobs Engineering Group Inc.