Global Nutrition Apps Market By Type (Nutrition Tracking App, Activity Tracking App, Social Platform Apps, Others), By Platform (iOS, Android), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123006

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

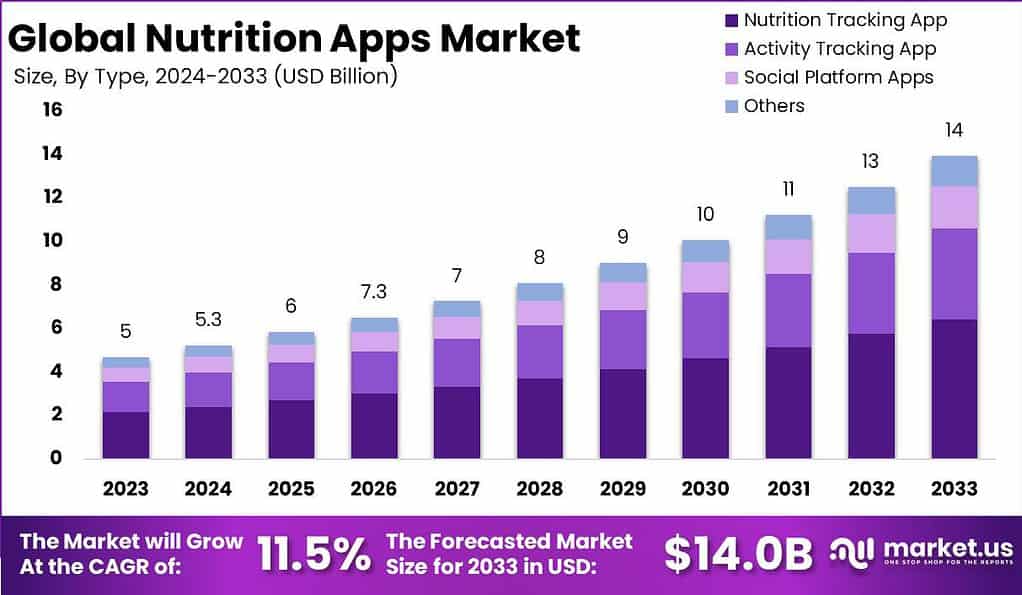

The Global Nutrition Apps Market size is expected to be worth around USD 14.0 Billion By 2033, from USD 5.0 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

Nutrition apps serve as digital tools that assist individuals in managing their dietary habits to foster better health. They offer a range of functionalities such as meal tracking, nutritional analysis, personalized diet recommendations, and progress monitoring. Users can log their daily food intake, receive insights into their nutritional deficiencies or excesses, and get tailored meal suggestions to meet specific health objectives, such as weight loss, muscle gain, or managing health conditions like diabetes.

The Nutrition Apps Market is experiencing robust growth, driven by increasing health awareness and the widespread use of smartphones globally. These applications offer features such as calorie tracking, personalized meal planning, and nutrition facts, which cater to the rising demand for convenient solutions to maintain a healthy lifestyle. This market is also fueled by the integration of advanced technologies like AI and machine learning, enhancing the user experience through customized dietary suggestions and behavior change coaching.

The market is driven by several growth factors. Firstly, the rising prevalence of chronic diseases, such as obesity and diabetes, has created a greater awareness of the importance of healthy eating habits. Individuals are turning to nutrition apps to monitor their calorie intake, track macronutrients, and manage their weight effectively. Additionally, the growing trend of personalized nutrition and the desire for customized meal plans tailored to specific dietary requirements or goals drive the demand for nutrition apps.

Moreover, the widespread use of smartphones and the increasing penetration of internet connectivity have significantly contributed to the growth of the nutrition apps market. Mobile apps provide a convenient and accessible platform for users to track their nutrition on-the-go and receive real-time feedback and recommendations. The integration of features like barcode scanning, food databases, and AI-powered algorithms further enhances the usability and effectiveness of these apps.

According to GSMA’s annual State of Mobile Internet Connectivity Report 2023, a staggering 4.3 billion individuals, accounting for approximately 54% of the global population, owned a smartphone as of 2023. This impressive figure highlights the widespread ownership and usage of smartphones as a key driver for the nutrition apps market.

Furthermore, the BankMyCell.com report indicates that 57.14% or 2 billion global smartphone users have access to the internet. This accessibility to internet services opens up new opportunities for nutrition apps to reach and engage with a large user base. With internet connectivity, individuals can easily download and utilize nutrition apps, empowering them to monitor their dietary habits, access nutritional information, and make informed choices about their food intake.

However, the nutrition apps market also presents challenges. One major challenge is ensuring the accuracy and reliability of the nutritional information provided by these apps. The quality and comprehensiveness of food databases, as well as the algorithms used for nutrient analysis, need to be reliable and up-to-date to ensure accurate tracking and recommendations. Additionally, the ability to capture user data and provide personalized recommendations without compromising user privacy and data security is crucial.

For new entrants, there are opportunities to tap into the growing market for nutrition apps. Developing innovative features, such as AI-powered meal planning, personalized coaching, or integration with wearable devices, can differentiate new apps in a crowded market. Collaboration with nutritionists, dietitians, or healthcare professionals can also add credibility and trust to new entrants’ offerings.

Key Takeaways

- The Global Nutrition Apps Market size is expected to be worth around USD 14.0 Billion by 2033, growing from USD 5.0 Billion in 2023. This represents a robust compound annual growth rate (CAGR) of 11.5% during the forecast period from 2024 to 2033.

- In 2023, the Nutrition Tracking App segment held a dominant position in the nutrition apps market, capturing more than a 46% share. This segment’s prominence is driven by the increasing demand for personalized dietary guidance and the convenience of tracking food intake through digital means.

- The iOS segment also exhibited a strong performance in 2023, securing a dominant market position with more than a 55% share. The preference for iOS devices among users is attributed to the seamless integration of apps within the Apple ecosystem, along with the high penetration rate of iOS devices in key markets.

- North America maintained a leading position in the nutrition apps market in 2023, capturing more than a 40% share with revenues reaching approximately USD 2.0 billion. This leadership can be attributed to high smartphone penetration, increased health awareness, and substantial investments in digital health technologies within the region.

Type Analysis

In 2023, the Nutrition Tracking App segment held a dominant position in the nutrition apps market, capturing more than a 46% share. This segment leads primarily due to the increasing consumer focus on health and diet management, where individuals actively seek tools that offer detailed insight into their daily nutritional intake.

Nutrition tracking apps cater to this need by enabling users to log their meals, monitor their calorie and nutrient intake, and track their progress toward specific dietary goals. The popularity of these apps is further supported by their ability to provide personalized feedback and dietary suggestions based on user input, making them indispensable for those looking to improve their dietary habits systematically.

Furthermore, the rise in chronic dietary-related health conditions, such as obesity and diabetes, has propelled the demand for nutrition tracking apps. These applications assist users in making informed food choices by breaking down the nutritional content of meals, which is crucial for disease prevention and management.

Their integration with other health apps and devices, such as fitness trackers that monitor physical activity, enhances their utility, making them more attractive to health-conscious consumers. This integration helps users see a more comprehensive view of their health, encouraging continued use and reliance on these apps for daily health management.

As the market for nutrition apps evolves, the Nutrition Tracking App segment continues to innovate, incorporating advanced features like AI-driven meal planning and virtual consultations with nutrition experts. These enhancements not only improve user engagement but also increase the accuracy and personalization of dietary advice, further solidifying the segment’s leadership in the market.

Platform Analysis

In 2023, the iOS segment held a dominant market position in the nutrition apps market, capturing more than a 55% share. This leadership can be attributed to the high penetration of iOS devices among health-conscious consumers, particularly in developed markets where Apple’s products maintain a strong presence.

iOS users are generally perceived as having higher disposable incomes, making them more likely to invest in health and wellness apps, including premium versions of nutrition apps that offer more features and personalized services. The seamless integration of these apps with Apple’s health ecosystem, which includes the Health app and various wearable devices like the Apple Watch, further enhances user experience, encouraging more iOS users to adopt nutrition apps.

Moreover, developers often prioritize the iOS platform for launching new applications due to its streamlined development environment and higher monetization potential compared to Android. This early and often exclusive access to innovative features attracts a tech-savvy user base keen on utilizing cutting-edge tools for health management.

The consistent user interface and stringent app store regulations on iOS also ensure a higher standard of app quality and security, factors highly valued by users concerned with data privacy, particularly in health-related apps. The continued dominance of the iOS segment is supported by aggressive marketing strategies from Apple, emphasizing health and fitness as core components of the iOS experience.

Coupled with a strong brand loyalty observed among Apple users, these factors drive higher engagement rates with nutrition apps on iOS platforms, cementing its leading position in the market. As digital health technologies advance and integrate more deeply with personal devices, the iOS segment is poised to maintain its market leadership, benefiting from Apple’s robust ecosystem and ongoing innovations in app functionalities.

Key Market Segments

By Type

- Nutrition Tracking App

- Activity Tracking App

- Social Platform Apps

- Others

By Platform

- iOS

- Android

Driver

Increased Health Awareness and Digitalization

One significant driver propelling the growth of the nutrition apps market is the heightened awareness of health and wellness, combined with the rapid digitalization across various sectors. More people are prioritizing their health and fitness, turning to nutrition apps to gain insights and control over their dietary habits. These apps offer convenient and efficient means to monitor and manage nutrition, aligning well with the busy lifestyles of modern consumers.

This trend is especially prevalent in regions with high smartphone penetration and internet connectivity, where downloading and interacting with health-related apps is becoming a daily routine for many. The continued integration of advanced technologies like AI and machine learning in these apps enhances their appeal by providing personalized diet and health advice to users, further driving market growth.

Restraint

High Costs and Limited Services

A major restraint in the nutrition apps market is the relatively high cost of premium app features compared to the free versions, which could discourage widespread adoption. While these apps offer valuable services, they sometimes fall short of providing the comprehensive, personalized guidance available from professional nutritionists or physical health centers.

This perceived limitation can lead users to seek more traditional or alternative health and fitness services. Moreover, the cost factor is compounded by security concerns, with increasing threats like data breaches and privacy issues, making potential users hesitant about providing personal health information to app platforms.

Opportunity

Integration with Wearable Technology

The market for nutrition apps has a significant opportunity in the integration with wearable technology. As the adoption of smartwatches and fitness trackers grows, these devices can work seamlessly with nutrition apps, providing users with real-time data on their health metrics such as calorie consumption, physical activity, and even sleep patterns.

This integration enables a more holistic view of health and wellness, appealing to a tech-savvy demographic that values comprehensive health monitoring. Such capabilities not only enhance user engagement but also improve the app’s functionality, making it indispensable as a daily health management tool.

Challenge

User Engagement and Retention

Maintaining user engagement and retention presents a significant challenge for nutrition apps. Despite the initial interest, many users download health-related apps and abandon them after a few uses. This trend can be attributed to various factors, including the perceived complexity of the app, the effort required to input detailed dietary information regularly, and the lack of immediate and visible benefits that can discourage continued use.

To overcome this challenge, app developers need to enhance the user experience by making apps more intuitive and easier to use. Additionally, incorporating engaging elements such as gamification, personalized feedback, and interactive features can help sustain user interest and promote long-term commitment to using the app.

Growth Factors

- Increasing Health Consciousness: Growing global awareness about health and wellness significantly drives the demand for nutrition apps.

- Technological Enhancements: Advances in technology improve app functionalities, making them more appealing to users by offering personalized experiences.

- Higher Smartphone Penetration: The widespread availability of smartphones provides a larger platform for app developers, increasing app accessibility.

- Integration with Wearables: Syncing apps with wearable devices enhances the functionality of nutrition apps, providing comprehensive health tracking.

- COVID-19 Impact: The pandemic has heightened health awareness and increased the use of apps for maintaining wellness at home.

Emerging Trends

- Expanding User Engagement: Apps are integrating more interactive and community-based features to increase user engagement.

- Use of AI for Customization: Artificial intelligence is being used to tailor nutritional advice and meal planning to individual user needs.

- Increased Gamification: Incorporating game-like elements in apps to motivate users to achieve their health goals.

- Growth in Subscription Models: More apps are moving towards subscription-based models for revenue generation.

- Focus on Mental Health Integration: Emerging trends show a holistic health approach where apps also address mental health alongside nutrition.

Top 5 Nutrition Apps

- MyFitnessPal: MyFitnessPal is widely recognized for its extensive food database and user-friendly interface, making it a top choice for both beginners and seasoned users. It allows you to track food intake, exercise, weight, and water consumption all in one app. The premium version offers a more detailed breakdown of macronutrients and other nutritional metrics, helping users achieve their specific health goals. MyFitnessPal also integrates with various fitness trackers and apps, enhancing its utility for comprehensive health monitoring.

- Noom: Noom combines psychology with nutrition to help users build healthier habits. It offers personalized health plans, daily lessons, and a large database of scannable barcodes for food items. Noom’s unique approach focuses on behavior change and long-term weight management. The app is designed to help users understand their eating habits and make sustainable lifestyle changes, with features that include meal logging, exercise tracking, and water intake monitoring.

- Lifesum: Lifesum provides a comprehensive approach to health and wellness, focusing on calorie tracking, exercise planning, and sleep scheduling. It offers a variety of diet plans and healthy recipes, making it easier for users to maintain balanced and sustainable food habits. The app also includes hydration management and community support features, which enhance user engagement and motivation.

- Fooducate: Fooducate goes beyond calorie counting by analyzing the quality of the calories consumed. It provides personalized nutrition grades for foods based on their nutritional content, helping users make healthier choices. The app offers a wealth of articles and tips on nutrition and exercise, making it an excellent educational resource. Additionally, Fooducate has a community support feature and a barcode scanner for quick food logging.

- Carb Manager: Ideal for those following a keto diet, Carb Manager tracks net carbs, ketones, and glycemic load, among other metrics. It includes a large database of keto-friendly foods and recipes, making it easier to stick to a ketogenic lifestyle. The app also connects with popular fitness trackers and provides detailed reports on dietary progress, helping users achieve their health goals more effectively.

Regional Analysis

In 2023, North America held a dominant position in the nutrition apps market, capturing more than a 40% share with revenues reaching approximately USD 2.0 billion. This leadership is largely attributed to the region’s high penetration of smartphones and internet connectivity, which facilitates easy access to health and wellness apps.

Additionally, there is a significant emphasis on health and fitness across the demographic spectrum in North America, from young adults to the elderly, driving the demand for nutrition tracking and dietary management solutions. Moreover, the prevalence of lifestyle-related health issues such as obesity and diabetes in countries like the United States and Canada has heightened awareness and fostered the adoption of digital health tools, including nutrition apps.

The integration of these apps with other health monitoring devices and platforms, prevalent in this tech-forward region, also contributes to their widespread use. Companies in North America often lead in technological advancements, including the development and application of AI and machine learning in mobile apps, which enhances the personalized user experience and functionality of nutrition apps.

Europe, following North America, shows robust growth in the nutrition apps market, driven by increased health awareness and governmental support for health initiatives. The European market benefits from widespread public health campaigns promoting nutritional awareness and the adoption of healthier lifestyles, which encourage the use of dietary and fitness apps.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Nutrition Apps Market features a diverse array of key players, each contributing unique innovations and features to cater to a wide range of consumer needs. Among the prominent names, Adidas stands out, leveraging its brand strength and extensive reach to integrate nutrition tracking into its broader fitness and wellness platforms. MyNetDiary Inc. and FatSecret offer comprehensive dietary tracking tools that emphasize ease of use and integration with other health metrics.

FitNow Inc. and Eat This Much Inc. specialize in personalized meal planning and tracking, helping users adhere to specific dietary goals through customized meal suggestions. Under Armour Inc., through its suite of apps, combines athletic apparel with digital health, offering users a holistic approach to fitness and nutrition. Azumio Inc. and Lifesum AB distinguish themselves with apps that use data analytics to provide feedback and health insights based on dietary inputs and lifestyle choices.

Fitbit Inc. integrates its well-established wearable technology with nutrition tracking capabilities, offering users a seamless way to monitor their health metrics alongside their food intake. MyFitnessPal Inc. remains one of the most popular apps in the market, known for its extensive food database and robust community support, which encourages accountability and shared learning. Noom Inc. uses a psychological approach to weight loss and nutrition, focusing on behavioral changes to achieve long-term health results.

Top Key Players in the Market

- MyNetDiary Inc.

- FatSecret

- FitNow Inc.

- Eat This Much Inc.

- Under Armour Inc.

- Azumio Inc.

- Lifesum AB

- Fitbit Inc.

- MyFitnessPal Inc.

- Noom Inc.

- Other Key Players

Recent Developments

- Under Armour Inc. continued to enhance its MyFitnessPal app with new integrations and features. In early 2024, the company introduced a partnership with several food delivery services to provide users with healthier meal options directly from the app.

- MyFitnessPal Inc. introduced a significant update in early 2024, focusing on improving user interface and experience. The update includes new meal recommendations based on user preferences and dietary goals, enhancing the app’s personalization capabilities

- Azumio Inc. expanded its app’s capabilities in 2023 by incorporating new fitness tracking features that complement its nutrition tracking functionalities. This holistic approach aims to provide users with a comprehensive health management tool.

- Lifesum AB launched an innovative update in late 2023 that includes a feature for tracking micronutrients, addressing a common user request. This update has positioned Lifesum as a leading app in providing detailed nutritional analysis.

- In October 2023, Noom launched Noom Med, a clinical obesity management solution that offers access to healthcare professionals and medications. This new service was unveiled at HLTH 2023 in Las Vegas and aims to provide comprehensive support for users with significant weight management needs.

- In 2023, MyNetDiary introduced new AI-driven features to its popular nutrition tracking app. These updates included enhanced food recognition capabilities and more personalized dietary advice based on user data. The app’s global user base grew significantly, reaching over 20 million members. This growth was supported by continuous improvements in user interface and integration with wearable devices.

Report Scope

Report Features Description Market Value (2023) USD 5 Bn Forecast Revenue (2033) USD 14 Bn CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Nutrition Tracking App, Activity Tracking App, Social Platform Apps, Others), By Platform (iOS, Android) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adidas, MyNetDiary Inc., FatSecret, FitNow Inc., Eat This Much Inc., Under Armour Inc., Azumio Inc., Lifesum AB, Fitbit Inc., MyFitnessPal Inc., Noom Inc., Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are nutrition apps?Nutrition apps are mobile or web-based applications designed to help users manage their dietary habits, track food intake, monitor nutrition levels, and achieve health goals such as weight loss, muscle gain, or managing specific health conditions.

How big is Nutrition Apps Market?The Global Nutrition Apps Market size is expected to be worth around USD 14.0 Billion By 2033, from USD 5.0 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Nutrition Apps Market?Key factors include increasing health awareness, the rise in smartphone usage, growing adoption of fitness and health tracking, advancements in app technology, and a higher demand for personalized nutrition plans.

What are the current trends and advancements in the Nutrition Apps Market?Current trends include integration with wearable devices, the use of AI for personalized nutrition advice, the growth of subscription-based models, the incorporation of social features, and the rise of apps offering holistic wellness solutions.

What are the major challenges in the Nutrition Apps Market?Major challenges include concerns over data privacy, the need for continuous app updates and maintenance, the high competition leading to market saturation, and ensuring the accuracy of nutritional information.

What are the major opportunities in the Nutrition Apps Market?Major opportunities include expanding into emerging markets, integrating more advanced AI features, partnerships with healthcare providers, developing more comprehensive health tracking, and leveraging user data for more personalized experiences.

Who are the leading players in the Nutrition Apps Market?Adidas, MyNetDiary Inc., FatSecret, FitNow Inc., Eat This Much Inc., Under Armour Inc., Azumio Inc., Lifesum AB, Fitbit Inc., MyFitnessPal Inc., Noom Inc., Other Key Players,

-

-

- MyNetDiary Inc.

- FatSecret

- FitNow Inc.

- Eat This Much Inc.

- Under Armour Inc.

- Azumio Inc.

- Lifesum AB

- Fitbit Inc.

- MyFitnessPal Inc.

- Noom Inc.

- Other Key Players