Global Nutraceutical Packaging Market Size, Share, Growth Analysis By Material (Plastic, Paper & Paperboard, Metal, Glass, Others), By Product Type (Blisters, Bottles & Jars, Bags & Pouches, Sachets & Stick Packs, Boxes & Cartons, Caps & Closures, Others), By Application (Dietary Supplements, Functional Foods, Herbal Products, Functional Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155367

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

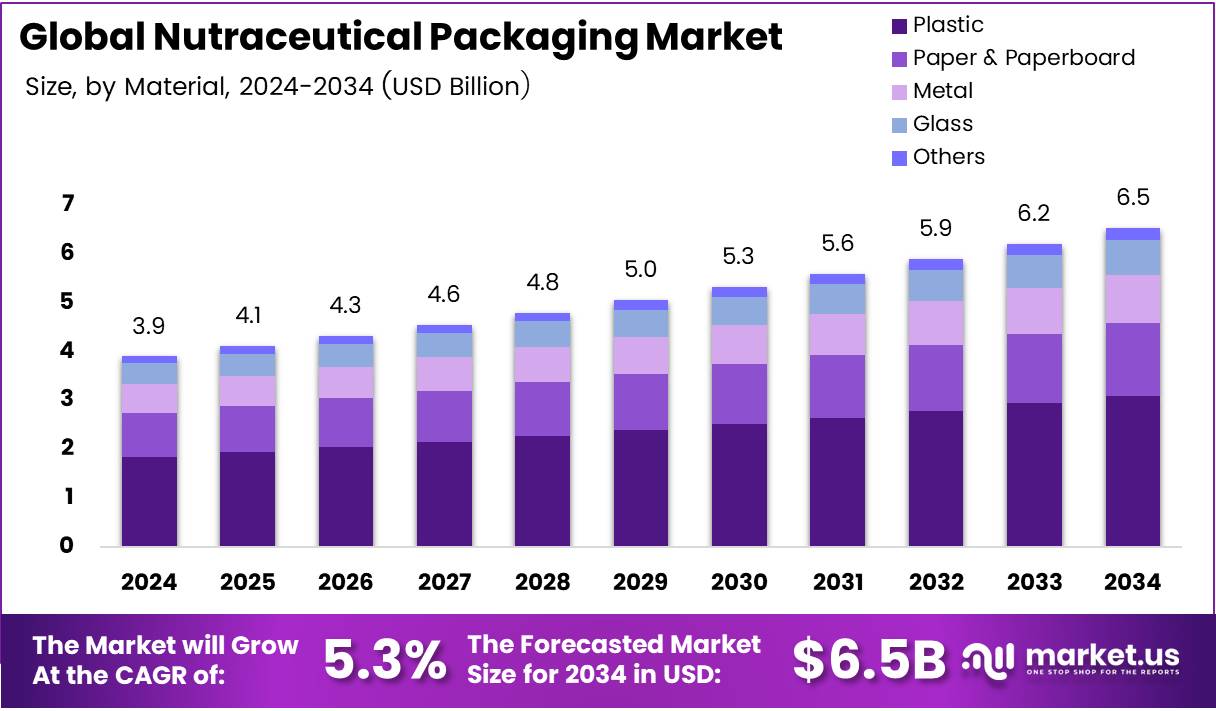

The Global Nutraceutical Packaging Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The nutraceutical packaging market plays a pivotal role in ensuring the safety, efficacy, and appeal of nutraceutical products. This market involves packaging solutions tailored for dietary supplements, functional foods, and beverages, providing not only protection but also enhancing consumer trust. As the demand for these products grows, packaging innovations have become crucial.

The global nutraceutical packaging market has experienced steady growth due to rising health awareness and increased consumer interest in preventive healthcare. With a growing focus on wellness, consumers are more inclined to invest in products that promise health benefits, fueling the demand for specialized packaging solutions that preserve quality and ensure convenience.

One of the key drivers of this market is the growing preference for sustainable and eco-friendly packaging. Consumers are becoming more environmentally conscious, pushing manufacturers to adopt biodegradable and recyclable materials. As a result, the packaging sector is embracing innovation, offering sustainable packaging options that align with market demands for reducing carbon footprints and environmental impact.

Government investment and regulations also play a significant role in the nutraceutical packaging market. Regulatory bodies across various regions are increasingly emphasizing the importance of safe and compliant packaging for nutraceutical products. These regulations ensure that packaging meets safety standards while effectively protecting products from contamination, providing a secure and trustworthy option for consumers.

In addition, advancements in packaging technology, such as tamper-evident seals, antimicrobial coatings, and advanced sealing techniques, are fueling market growth. These innovations help extend the shelf life of products, ensuring freshness while improving consumer confidence in product safety and quality. The demand for these advanced features is expected to rise as more consumers seek reliable and secure packaging solutions.

According to a survey by Consumer Reports, 68% of consumers tend to place their trust in nutraceutical products boasting appealing packaging. This statistic underscores the importance of visually appealing and functional packaging in driving consumer preference and purchase decisions in the nutraceutical market. Companies that leverage attractive packaging options stand to gain a competitive edge.

Furthermore, as governments around the world focus on promoting healthy lifestyles, investments in the nutraceutical industry are increasing. These investments are also influencing packaging trends, with manufacturers adapting to meet new regulatory guidelines. This combination of market demand, government support, and technological innovation is propelling the nutraceutical packaging market forward, creating lucrative opportunities for both new and established players.

Key Takeaways

- The Global Nutraceutical Packaging Market is projected to reach USD 6.5 Billion by 2034, growing at a CAGR of 5.3% from USD 3.9 Billion in 2024.

- In 2024, Plastic held 47.3% of the By Material Analysis segment in the Nutraceutical Packaging Market.

- Bottles & Jars led the By Product Type Analysis segment with a 34.9% market share in 2024.

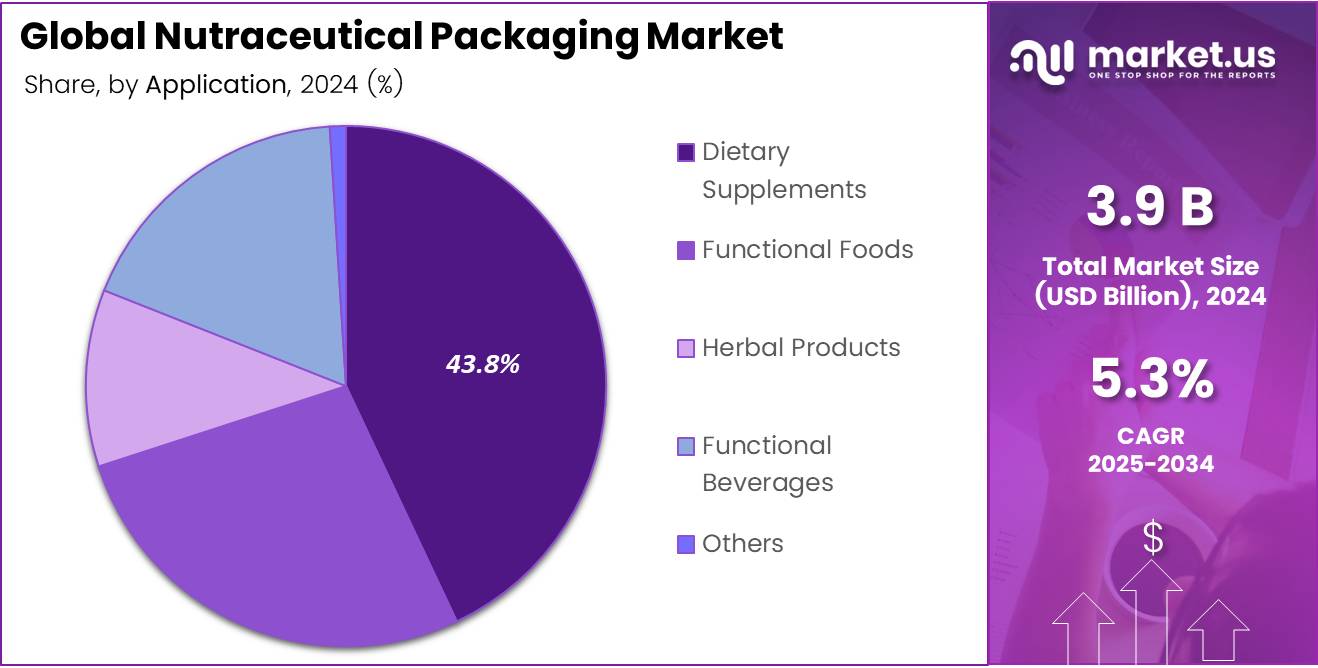

- Dietary Supplements accounted for 43.8% of the By Application Analysis segment in 2024.

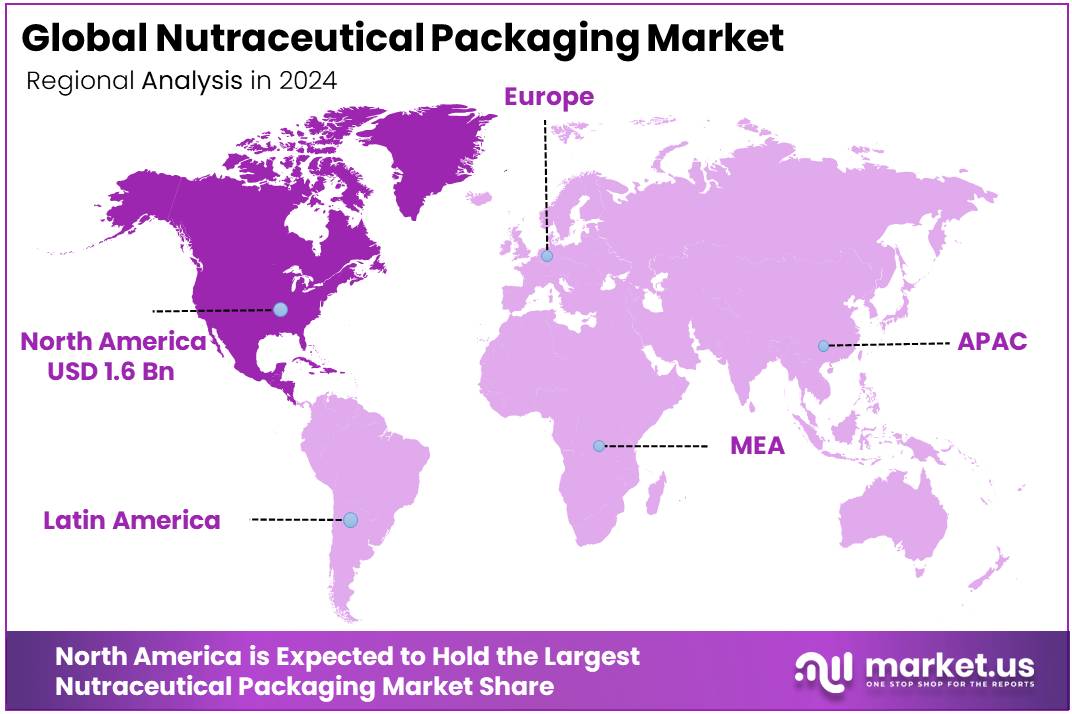

- North America dominates the market with a 42.8% share, valued at USD 1.6 Billion in 2024.

Material Analysis

Plastic dominates with 47.3% share, driven by its versatility and cost-effectiveness in packaging.

In 2024, Plastic maintained a dominant position in the Nutraceutical Packaging Markets By Material Analysis segment, capturing a substantial 47.3% share. Its widespread usage across the industry is attributed to its durability, lightweight nature, and ability to preserve product integrity. These attributes make plastic a preferred material in nutraceutical packaging, especially for items requiring secure and moisture-resistant packaging solutions.

Paper & Paperboard followed as a significant material type with a notable presence in the market. This eco-friendly alternative is becoming increasingly popular due to its recyclable properties, offering a sustainable packaging solution.

Metal and Glass materials also play essential roles, offering premium packaging for specific high-end products. Metals are particularly valued for their strength and ability to protect against external contaminants, while glass provides a premium, high-quality perception.

The Others category, which includes composite materials, continues to show growth, contributing to the diversification of packaging options in the nutraceutical sector.

Overall, Plastics dominance at 47.3% continues to drive the market, but other materials are expected to steadily increase their share due to sustainability trends and technological advancements.

Product Type Analysis

Bottles & Jars dominate with 34.9% share, owing to their widespread use and effectiveness in preserving product integrity.

In 2024, Bottles & Jars held the largest market share in the Nutraceutical Packaging Markets By Product Type Analysis segment, accounting for 34.9% of the market. This product type is favored for its ability to provide airtight packaging, preserving the quality of nutraceuticals for extended periods. Their versatility in both liquid and solid nutraceutical packaging contributes to their widespread use.

Blisters also accounted for a significant portion of the market, with their compact and efficient design offering advantages for single-dose packaging, especially for dietary supplements and functional products.

Bags & Pouches and Sachets & Stick Packs continue to gain traction due to their convenience, cost-effectiveness, and suitability for smaller, on-the-go portions.

Boxes & Cartons, along with Caps & Closures, are integral to ensuring secure packaging and maintaining product safety during transportation.

The Others category, including specialized packaging formats, is gradually expanding due to unique packaging solutions designed for niche nutraceutical products.

Overall, Bottles & Jars retain their leadership with a 34.9% market share, but diverse packaging types continue to meet evolving consumer preferences.

Application Analysis

Dietary Supplements lead with 43.8% share, driven by rising consumer demand for health-conscious products.

In 2024, Dietary Supplements dominated the Nutraceutical Packaging Markets By Application Analysis segment, securing a significant 43.8% market share. The growth in this segment is driven by the increasing consumer focus on health, wellness, and preventive care. Nutritional supplements, ranging from vitamins to minerals, are experiencing higher demand, fueling the need for specialized packaging to ensure product integrity and longevity.

Functional Foods and Herbal Products are also vital segments, driven by the surge in natural health solutions. These categories are seeing steady growth as consumers seek out food and drink products that provide functional health benefits beyond basic nutrition.

Functional Beverages have gained momentum, offering liquid solutions with added nutrients aimed at boosting overall well-being. As consumers turn to convenient, on-the-go health options, this segment is poised for further expansion.

The Others segment, encompassing various niche nutraceutical applications, continues to show incremental growth as the market diversifies.

Dietary Supplements remain at the forefront, with a commanding 43.8% share, reflecting the ongoing shift toward personalized health and wellness solutions.

Key Market Segments

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Product Type

- Blisters

- Bottles & Jars

- Bags & Pouches

- Sachets & Stick Packs

- Boxes & Cartons

- Caps & Closures

- Others

By Application

- Dietary Supplements

- Functional Foods

- Herbal Products

- Functional Beverages

- Others

Drivers

Increased Health Consciousness Drives Nutraceutical Packaging Market Growth

The growing awareness around personal health and wellness has led to a surge in demand for nutraceuticals. As more consumers turn to supplements and functional foods, the need for efficient, appealing packaging solutions increases. Packaging plays a key role in preserving product integrity and improving shelf appeal.

Advancements in packaging materials and technologies are also contributing to this growth. Innovations such as tamper-evident seals, moisture-resistant barriers, and sustainable materials are helping to enhance the safety and effectiveness of nutraceuticals. These advancements not only maintain product quality but also offer greater convenience and user-friendly features.

The rise of e-commerce and online sales channels further fuels the demand for nutraceutical packaging. With an increasing number of consumers purchasing products online, there is a heightened need for packaging that protects products during transit and attracts attention in the crowded digital marketplace. As online shopping continues to expand, packaging becomes essential for differentiating products.

Consumer preferences are also shifting towards eco-friendly and sustainable packaging. Many customers are now more conscious of the environmental impact of the products they buy. This demand for sustainable materials such as biodegradable plastics and recycled content is reshaping packaging solutions. Brands that invest in eco-friendly packaging are often rewarded with customer loyalty and a positive brand image.

Restraints

Regulatory Challenges in Nutraceutical Packaging Restrain Market Growth

One of the key challenges in the nutraceutical packaging market is regulatory hurdles. Packaging regulations vary across regions, creating complexities for manufacturers. Companies must comply with strict standards on labeling, safety, and material usage, which can increase production costs and lead to delays.

The shortage of skilled labor in packaging design and development is another significant restraint. Packaging design requires specialized knowledge in materials, sustainability, and consumer preferences. The current talent gap limits the ability of many companies to develop innovative, cost-effective packaging solutions, which affects their competitive edge.

Supply chain disruptions and raw material shortages also impact the nutraceutical packaging market. The availability of essential raw materials, such as plastics and sustainable packaging materials, has been disrupted due to global supply chain issues. This creates uncertainty for manufacturers and may lead to price hikes and production delays.

Growth Factors

Expansion of Functional Food and Beverage Sector Drives Growth Opportunities

The rapid expansion of the functional food and beverage sector presents significant growth opportunities for the nutraceutical packaging market. As more consumers opt for products that provide health benefits beyond basic nutrition, packaging must meet the increasing demand for functional, convenient solutions that enhance the product’s appeal and usability.

Increasing investments in smart packaging technologies are also driving growth in the nutraceutical packaging market. With the rise of connected packaging solutions, such as QR codes and NFC technology, companies can provide enhanced consumer experiences and valuable product information. These technologies also enable better tracking, monitoring, and authentication of products.

The growing popularity of personalized nutraceutical products presents another opportunity. Consumers are increasingly seeking customized supplements tailored to their specific health needs, which requires innovative, adaptable packaging solutions. Personalized packaging offers a unique selling point and allows companies to target niche markets.

Rising demand for travel-size and convenient packaging formats is a trend that is boosting market growth. With the increasing popularity of on-the-go products, packaging needs to be portable, easy to use, and offer single-serve options. This shift aligns with consumer preferences for convenience and functionality in nutraceutical packaging.

Emerging Trends

Shift Towards Minimalistic and Aesthetic Packaging Designs as a Trending Factor

A noticeable trend in the nutraceutical packaging market is the shift towards minimalistic and aesthetic designs. Consumers are gravitating towards clean, modern packaging that is both functional and visually appealing. This design approach focuses on simplicity and elegance, aligning with the preferences of health-conscious buyers.

Another significant trend is the integration of digital technology in packaging. QR codes, NFC tags, and other smart features are becoming commonplace in packaging, providing consumers with instant access to product information, health benefits, and even promotional offers. This integration not only enhances user experience but also adds a layer of interactivity.

Rising popularity of biodegradable and recyclable packaging is another trend that is gaining momentum. As environmental concerns grow, consumers are increasingly seeking out products with packaging that can be easily recycled or is made from sustainable materials. This shift is encouraging manufacturers to adopt eco-friendly packaging solutions to meet consumer demand.

Lastly, the development of packaging designed for targeted delivery of active ingredients is a growing trend. With an increased focus on product efficacy, packaging is being designed to optimize the release and absorption of nutrients. This innovative approach not only enhances the product’s effectiveness but also appeals to consumers seeking scientifically-backed health solutions.

Regional Analysis

North America Dominates the Nutraceutical Packaging Market with a Market Share of 42.8%, Valued at USD 1.6 Billion

North America holds the largest share in the Nutraceutical Packaging Market, accounting for 42.8% of the market, valued at USD 1.6 Billion. This region’s dominance can be attributed to the rising health consciousness and growing demand for nutraceutical products. Additionally, the presence of key market players and a well-established healthcare infrastructure further fuel the market growth. The demand for advanced and sustainable packaging solutions is also contributing to the region’s significant market share.

Europe Nutraceutical Packaging Market Trends

Europe is the second-largest market for nutraceutical packaging, benefiting from increasing health awareness and regulatory support for eco-friendly packaging solutions. The region is seeing significant growth in demand for packaging materials that offer enhanced protection and sustainability, especially as consumers increasingly opt for natural and organic nutraceutical products. The market in Europe is expected to expand as the demand for both functional foods and supplements rises.

Asia Pacific Nutraceutical Packaging Market Trends

The Asia Pacific region is experiencing rapid growth in the nutraceutical packaging market, driven by rising disposable incomes, urbanization, and a growing aging population. This has led to a higher demand for nutritional supplements and health-oriented products, fostering the need for innovative packaging solutions. Countries like China and India are significant contributors to this growth, where the demand for nutraceutical packaging is accelerating due to increasing awareness about health and wellness.

Middle East and Africa Nutraceutical Packaging Market Trends

The Middle East and Africa region is gradually expanding in the nutraceutical packaging market, with a notable increase in health-conscious consumers. This growth is primarily driven by the rise in lifestyle diseases and a growing preference for preventive healthcare. Although the market is still in the nascent stages compared to other regions, demand for nutraceuticals is rising, prompting an increase in the need for innovative and sustainable packaging solutions.

Latin America Nutraceutical Packaging Market Trends

In Latin America, the nutraceutical packaging market is experiencing steady growth, driven by the rising popularity of functional foods and health supplements. The region is showing a growing preference for packaging that is not only functional but also sustainable and cost-effective. As the region’s middle class expands, there is an increasing demand for packaging solutions that align with modern consumer preferences for healthier lifestyles and eco-friendly products.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Nutraceutical Packaging Company Insights

The global Nutraceutical Packaging Market in 2024 is shaped by the strategies and innovations of several key players.

Amcor continues to dominate the market with its broad portfolio of sustainable packaging solutions tailored to the nutraceutical industry. The company’s focus on eco-friendly materials and advancements in packaging technology reinforces its leadership position.

Gerresheimer AG remains a strong player by offering high-quality, specialized packaging solutions. Its expertise in the pharmaceutical and healthcare sectors translates well into nutraceuticals, where it provides innovative packaging designs that meet both consumer and regulatory requirements.

Constantia Flexibles is recognized for its flexible packaging solutions, which offer customization options that enhance the shelf appeal of nutraceutical products. By focusing on sustainability and reducing environmental impact, the company has gained a competitive edge, especially in eco-conscious markets.

Comar Packaging stands out with its extensive range of packaging formats designed for the nutraceutical sector. Known for its strong emphasis on product protection and tamper-evident solutions, Comar ensures product integrity throughout its lifecycle, which is crucial in maintaining consumer trust and product efficacy.

These companies continue to shape the market through innovation, sustainability, and a focus on consumer-friendly packaging solutions. Their diverse offerings cater to the growing demand for nutraceutical products, driven by increased health consciousness globally.

Top Key Players in the Market

- Amcor

- Gerresheimer AG

- Constantia Flexibles

- Comar Packaging

- Glenroy Inc.

- ProAmpac

- TricorBraun

- Sanner Group

- Glenroy, Inc.

- Jones Healthcare Group

- Brook + Whittle

Recent Developments

- In January 2025, SGT Group acquired Axium Packaging, a strategic move aimed at unlocking new growth and innovation opportunities in packaging solutions. This acquisition positions SGT Group to strengthen its market presence and broaden its product offerings in the packaging industry.

- In December 2024, TricorBraun acquired Vertiv Containers, enhancing its capabilities in the packaging market. This acquisition supports TricorBraun’s efforts to expand its product portfolio and improve customer service through innovative packaging solutions.

- In June 2024, Green Bay Packaging Inc. expanded its operations with the acquisition of SMC Packaging Group. This acquisition will allow Green Bay Packaging to further diversify its product line and boost its production capacity to meet growing demand in the packaging sector.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Paper & Paperboard, Metal, Glass, Others), By Product Type (Blisters, Bottles & Jars, Bags & Pouches, Sachets & Stick Packs, Boxes & Cartons, Caps & Closures, Others), By Application (Dietary Supplements, Functional Foods, Herbal Products, Functional Beverages, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor, Gerresheimer AG, Constantia Flexibles, Comar Packaging, Glenroy Inc., ProAmpac, TricorBraun, Sanner Group, Glenroy, Inc., Jones Healthcare Group, Brook + Whittle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nutraceutical Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Nutraceutical Packaging MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor

- Gerresheimer AG

- Constantia Flexibles

- Comar Packaging

- Glenroy Inc.

- ProAmpac

- TricorBraun

- Sanner Group

- Glenroy, Inc.

- Jones Healthcare Group

- Brook + Whittle