North America Linear Low Density Polyethylene Market Size, Share Analysis Report By Product (Films, Liners, Bags and Pouches, Covers, Others), By Process (Injection Molding, Rotomolding, Extrusion), By Layer (Monolayer, Multilayer, 3 Layer, 5 Layer, Others), By End-use (Packaging, Building and Construction, Automotive, Electrical and Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159975

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

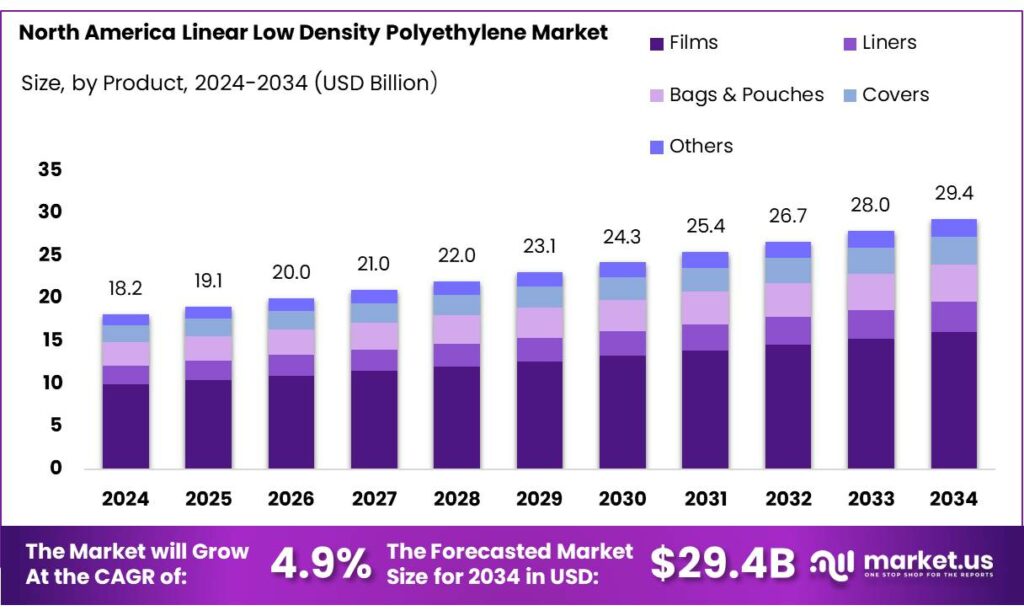

The North America Linear Low Density Polyethylene Market size is expected to be worth around USD 29.4 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Linear Low-Density Polyethylene (LLDPE) is a versatile thermoplastic polymer characterized by its linear molecular structure with short branches. Manufactured through the copolymerization of ethylene with higher alpha-olefins such as butene, hexene, or octene, LLDPE exhibits enhanced tensile strength, puncture resistance, and flexibility compared to traditional Low-Density Polyethylene (LDPE). This structural configuration allows LLDPE to serve a wide array of applications, including packaging films, agricultural films, and injection-molded products.

As of 2024, the installed capacity for LLDPE production in India stood at approximately 2.5 million tonnes per annum. Notable players in the Indian LLDPE market include GAIL (India) Limited, which operates a gas-based petrochemical complex in Pata, Uttar Pradesh, with a capacity of 810,000 tonnes per annum, and Hindustan Petroleum Corporation Limited (HPCL), which is set to commence two separate LLDPE/HDPE production projects, each with a capacity of 550,000 tonnes per annum.

This growth is attributed to the expanding packaging industry, increased agricultural activities, and the adoption of LLDPE in infrastructure projects. For instance, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), with an allocation of ₹50,000 crore over five years, is promoting micro-irrigation and watershed development, thereby boosting LLDPE adoption in agricultural applications.

Key players in the Indian LLDPE market include GAIL (India) Limited, which operates the Brahmaputra Cracker and Polymer Limited (BCPL) facility in Assam with a capacity of 220,000 tonnes per annum, and the ONGC Petro-additions Limited (OPaL) complex in Dahej, Gujarat, with a capacity of 1.06 million tonnes per annum. These facilities contribute significantly to meeting the domestic demand for LLDPE.

Key Takeaways

- North America Linear Low Density Polyethylene Market size is expected to be worth around USD 29.4 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 4.9%.

- Films held a dominant market position, capturing more than a 54.8% share.

- Extrusion held a dominant market position, capturing more than a 72.3% share.

- Multilayer held a dominant market position, capturing more than a 65.7% share.

- Packaging held a dominant market position, capturing more than a 57.2% share.

By Product Analysis

Films dominate North America LLDPE products with 54.8% share in 2024, driven by flexible-packaging demand.

In 2024, Films held a dominant market position, capturing more than a 54.8% share. This prominence can be attributed to the continued substitution of thicker LDPE films with thinner, higher-performance LLDPE grades across flexible packaging, stretch wrap, and agricultural films, where better tensile strength and puncture resistance are required. Demand from food and consumer-goods packaging was a primary driver, as converters prioritized material efficiency and downgauging to lower input costs while maintaining package performance.

At the same time, industrial applications such as pallet wrap and geomembranes supported steady off-take because LLDPE’s improved mechanical properties and processing flexibility reduced film weight and improved throughput for film producers. Supply dynamics reflected the concentration of production in integrated petrochemical hubs, where access to competitively priced ethylene feedstock enabled margin capture for local producers; this structure has incentivized investments in metallocene and bimodal LLDPE grades to address specific film performance needs. Regulatory and sustainability pressures have begun to shape product specifications: producers and converters were increasingly required to consider recyclability and post-consumer recycled (PCR) content, which influenced formulation and grade selection for film applications.

By Process Analysis

Extrusion dominates North America LLDPE processes with 72.3% share in 2024, led by packaging and film applications.

In 2024, Extrusion held a dominant market position, capturing more than a 72.3% share. This leading position was supported by the extensive use of extrusion in producing films, sheets, and molded products, where LLDPE’s flexibility, strength, and processability offered clear advantages. The packaging sector, particularly flexible packaging and stretch films, accounted for the bulk of this demand as converters sought materials capable of delivering thinner films with higher performance. Infrastructure and construction also contributed, with extrusion-based pipes, geomembranes, and protective sheets seeing steady adoption.

The ability of extrusion to handle large-scale, continuous production with high material efficiency made it the preferred process across industries. In North America, integrated petrochemical facilities ensured a stable supply of extrusion-grade LLDPE, enabling converters to meet rising demand from both consumer and industrial applications. By 2025, extrusion was expected to remain the dominant process, sustained by the shift toward downgauged films, investments in metallocene catalyst technology for improved extrusion performance, and the rising importance of recyclability in packaging films, which required extrusion processes capable of incorporating recycled content without compromising quality.

By Layer Analysis

Multilayer dominates North America LLDPE layers with 65.7% share in 2024, driven by packaging innovation and durability.

In 2024, Multilayer held a dominant market position, capturing more than a 65.7% share. The strong preference for multilayer structures was mainly due to their superior barrier properties, strength, and versatility in packaging applications. Food packaging, stretch films, and protective wraps increasingly relied on multilayer films to provide extended shelf life, enhanced durability, and reduced material use, all while maintaining cost efficiency. The adoption of multilayer technology also aligned with the industry’s efforts to achieve downgauging, allowing manufacturers to produce thinner yet stronger films that consume less resin without compromising performance.

North America’s robust packaging sector, coupled with the growing demand for sustainable and high-performance materials, ensured the steady expansion of multilayer applications. By 2025, multilayer films were expected to maintain their dominance, supported by ongoing innovations in resin formulations and processing technologies, particularly in incorporating recycled content into multilayer structures. This shift not only addressed regulatory and consumer pressures for sustainability but also enhanced the value proposition of LLDPE in advanced packaging and industrial protection markets.

By End-use Analysis

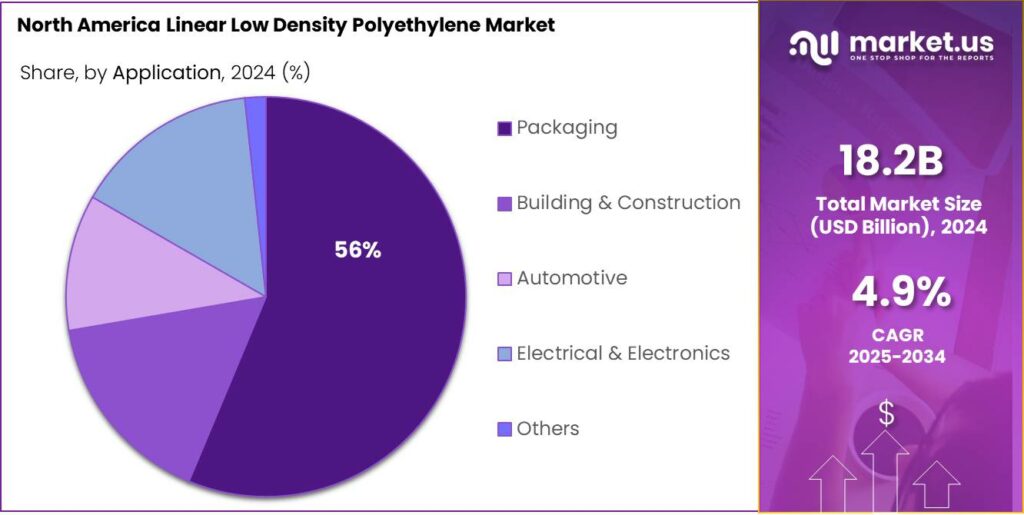

Packaging dominates North America LLDPE end-use with 57.2% share in 2024, fueled by flexible film demand.

In 2024, Packaging held a dominant market position, capturing more than a 57.2% share. This leadership was driven by the rising consumption of LLDPE in flexible packaging formats such as stretch films, pouches, bags, and protective wraps, which benefited from the polymer’s high tensile strength, puncture resistance, and ease of downgauging. The food and beverage sector represented a major share of this demand, as multilayer and thin-gauge films provided extended shelf life, lightweighting, and cost savings. Industrial packaging applications, including pallet wraps and heavy-duty sacks, further reinforced the importance of LLDPE in safeguarding goods during storage and transport.

North America’s strong retail and e-commerce ecosystem amplified the demand for flexible packaging solutions, with converters increasingly turning to LLDPE for its balance of performance and cost efficiency. By 2025, packaging was expected to retain its dominance, supported by advancements in film technology, regulatory momentum toward recyclable packaging solutions, and rising incorporation of recycled LLDPE into packaging formats. These trends positioned packaging as the central growth engine for LLDPE in the region’s evolving plastics landscape.

Key Market Segments

By Product

- Films

- Liners

- Bags & Pouches

- Covers

- Others

By Process

- Injection Molding

- Rotomolding

- Extrusion

By Layer

- Monolayer

- Multilayer

- 3 Layer

- 5 Layer

- Others

By End-use

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Others

Emerging Trends

Adoption of Smart Food Packaging

A significant trend shaping the North American Linear Low-Density Polyethylene (LLDPE) market is the increasing adoption of smart food packaging solutions. This innovation integrates technology into packaging materials to enhance food safety, quality, and consumer engagement. Smart packaging includes features like temperature indicators, freshness sensors, and QR codes that provide consumers with real-time information about the product’s condition and origin.

In the United States, the Food and Drug Administration (FDA) has been actively involved in regulating food contact substances to ensure consumer safety. The FDA requires that any food contact substance, including packaging materials, undergo a rigorous safety assessment before being marketed. This regulatory framework supports the development and adoption of new packaging technologies, including smart packaging solutions.

- Government initiatives also play a crucial role in promoting sustainable packaging practices. For instance, the U.S. Food and Drug Administration (FDA) regulates food contact substances to ensure safety and encourage the use of materials that do not pose health risks. In 2024, the FDA responded to concerns about phthalates in food packaging by affirming its 2022 Final Rule to remove 25 plasticizers from various food contact applications. This regulatory action supports the industry’s shift towards safer and more sustainable packaging materials.

The integration of smart features into LLDPE packaging not only enhances the consumer experience but also offers manufacturers the opportunity to differentiate their products in a competitive market. As the demand for smart packaging continues to rise, LLDPE’s versatility and adaptability make it an ideal material for these innovations. The ongoing advancements in smart food packaging are expected to further propel the growth of the LLDPE market in North America.

Drivers

Surge in E-commerce and Packaged Food Demand

One of the primary drivers propelling the growth of Linear Low-Density Polyethylene (LLDPE) in North America is the significant rise in e-commerce and the escalating demand for packaged foods. As consumer preferences shift towards online shopping and ready-to-eat meals, the need for efficient, durable, and cost-effective packaging solutions has intensified. LLDPE, with its superior flexibility, puncture resistance, and moisture barrier properties, has become the material of choice for various packaging applications, including stretch films, shrink wraps, and protective bags.

In the United States, the retail e-commerce sales amounted to approximately USD 277.6 billion in the second quarter of 2023, reflecting a robust expansion compared to previous periods. This surge in online shopping has directly influenced packaging requirements, with companies seeking materials that ensure product safety during transit and enhance shelf appeal. LLDPE’s lightweight nature and resilience make it ideal for packaging goods ranging from electronics to groceries, thereby supporting the growth of the LLDPE market.

Simultaneously, the packaged food industry in North America has witnessed substantial growth. Factors such as busy lifestyles, increased consumer preference for convenience, and advancements in food preservation technologies have contributed to this trend. LLDPE plays a crucial role in extending the shelf life of food products by providing an effective barrier against moisture, oxygen, and contaminants. Its application in food packaging not only preserves product quality but also caters to the growing consumer demand for hygienic and tamper-evident packaging solutions.

In response to these market dynamics, manufacturers are focusing on innovation and sustainability. The development of recycled LDPE (rLDPE) materials is gaining momentum, aligning with consumer preferences for eco-friendly packaging options. Companies are investing in advanced recycling technologies and exploring bio-based feedstocks to produce LLDPE with reduced environmental impact. This shift towards sustainable practices not only meets regulatory requirements but also caters to the growing consumer consciousness regarding environmental issues.

Restraints

Stringent Environmental Regulations and Recycling Challenges

The Linear Low-Density Polyethylene (LLDPE) industry in North America faces significant challenges due to escalating environmental regulations and limitations in recycling infrastructure. While LLDPE is favored for its versatility and performance in packaging applications, its environmental impact has attracted heightened scrutiny from both regulatory bodies and environmental organizations.

- In the United States, the Environmental Protection Agency (EPA) has reported that containers and packaging constitute approximately 28% of municipal solid waste (MSW), with plastic packaging alone accounting for 14.5 million tons in 2018. Despite efforts to improve recycling rates, only about 13.6% of plastic containers and packaging were recycled in the same year. This low recycling rate is attributed to various factors, including contamination, lack of consumer awareness, and inadequate recycling facilities.

To address these concerns, several states have implemented or are considering Extended Producer Responsibility (EPR) laws. For instance, New Jersey’s proposed legislation mandates that all packaging materials be recyclable or compostable by 2034 and aims to reduce single-use packaging by 25% by 2032. The bill also proposes a $120 million fund sourced from fees on manufacturers to enhance recycling efforts.

Moreover, the U.S. Food and Drug Administration (FDA) has been under pressure to regulate the use of harmful chemicals in food-contact plastics. In 2025, environmental groups filed a lawsuit against the FDA for its refusal to ban phthalates in plastic food packaging, despite evidence linking these chemicals to health risks such as birth defects and reduced IQ in children.

These regulatory developments pose challenges for LLDPE manufacturers, who must navigate the complex landscape of compliance and adapt to evolving standards. The increasing demand for sustainable packaging solutions further intensifies the pressure on the industry to innovate and invest in environmentally friendly alternatives.

Opportunity

Expansion of Flexible Food Packaging in North America

The North American Linear Low-Density Polyethylene (LLDPE) market is experiencing significant growth, driven by the increasing demand for sustainable packaging solutions in the food industry. As consumer preferences shift towards environmentally friendly products, food manufacturers are adopting packaging materials that are recyclable, compostable, and made from renewable resources. LLDPE, known for its flexibility, durability, and low environmental impact, is emerging as a preferred choice for packaging applications.

In response to consumer preferences for sustainability, many companies are adopting recycled LLDPE (rLLDPE) in their packaging solutions. This shift not only reduces environmental impact but also aligns with regulatory pressures and consumer expectations for eco-friendly products. For instance, major retailers like Aldi are redesigning their packaging to use lighter, recyclable, or compostable materials, aiming to make all of their private-label product packaging reusable, recyclable, or compostable by 2025.

A notable example is Aldi’s initiative to redesign over 90% of its private-label products’ packaging to make them more recognizable and aligned with sustainability goals. The company aims to use lighter, recyclable, or compostable materials, contributing to its broader sustainability objectives. Such initiatives reflect a growing industry-wide commitment to adopting sustainable packaging solutions.

Government regulations are also influencing the shift towards sustainable packaging. The U.S. Food and Drug Administration (FDA) regulates the safety of substances that come into contact with food, including packaging materials. Manufacturers are increasingly required to ensure that their packaging materials meet safety standards and are free from harmful chemicals. This regulatory environment encourages the development and adoption of safer, more sustainable packaging options.

Regional Insights

- North America

- US

- Canada

Key Players Analysis

INEOS MOLDS PVT. LTD is a notable player in the LLDPE market, with a focus on high-quality polymers and molding solutions. The company specializes in manufacturing polyethylene-based products used in various sectors, including packaging and agriculture. Known for its technological expertise, INEOS MOLDS emphasizes sustainable production and innovation. Its strong commitment to research and development, along with its strategic collaborations, allows the company to maintain a competitive edge in the North American LLDPE market.

Dow is a key player in the North American LLDPE market, known for its extensive portfolio of polyethylene products. The company produces high-performance LLDPE used in packaging, agricultural films, and industrial applications. Dow’s advanced technology and commitment to sustainability have made it a leader in polyethylene production. Through constant innovation and a focus on reducing environmental impact, Dow continues to strengthen its position in the LLDPE market while meeting the growing demand for sustainable packaging solutions.

LyondellBasell Industries Holdings B.V. is a global leader in the LLDPE market, producing a wide range of polyethylene products. The company is known for its innovative polymer solutions that cater to packaging, consumer goods, and industrial applications. LyondellBasell’s emphasis on sustainability and its ability to adapt to changing market dynamics position it as a key player in the LLDPE sector. With cutting-edge production technologies, LyondellBasell continues to drive growth and maintain leadership in the North American polyethylene market.

Top Key Players Outlook

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS MOLDS PVT. LTD

- Dow

- LyondellBasell Industries Holdings B.V.

- Westlake Corporation

- Chevron Phillips Chemical Company LLC.

- Arkema

- Borealis AG

- LOTTE Chemical Corporation

Recent Industry Developments

In 2024 ExxonMobil, produced approximately 11.2 million metric tonnes of polyethylene globally, including LLDPE, contributing to its substantial presence in the market.

In 2024, Dow’s polyethylene production capacity included approximately 1.1 billion pounds slated for shutdown by the end of 2025. A significant development occurred in June 2025 when Dow commenced operations at a new 600,000 metric tons per year LLDPE/HDPE unit at its Freeport, Texas facility.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Bn Forecast Revenue (2034) USD 29.4 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Films, Liners, Bags and Pouches, Covers, Others), By Process (Injection Molding, Rotomolding, Extrusion), By Layer (Monolayer, Multilayer, 3 Layer, 5 Layer, Others), By End-use (Packaging, Building and Construction, Automotive, Electrical and Electronics, Others) Regional Analysis North America – The US & Canada Competitive Landscape Exxon Mobil Corporation, Formosa Plastics Corporation, INEOS MOLDS PVT. LTD, Dow, LyondellBasell Industries Holdings B.V., Westlake Corporation, Chevron Phillips Chemical Company LLC., Arkema, Borealis AG, LOTTE Chemical Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  North America Linear Low Density Polyethylene MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

North America Linear Low Density Polyethylene MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS MOLDS PVT. LTD

- Dow

- LyondellBasell Industries Holdings B.V.

- Westlake Corporation

- Chevron Phillips Chemical Company LLC.

- Arkema

- Borealis AG

- LOTTE Chemical Corporation