Global Nordic Cross-Laminated Timber (CLT) And Lumber Processing Market Size, Share, And Enhanced Productivity By Product Type (Cross-Laminated Timber (CLT), Processed Lumber), By Application (Construction, Furniture and Interior Design, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175207

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

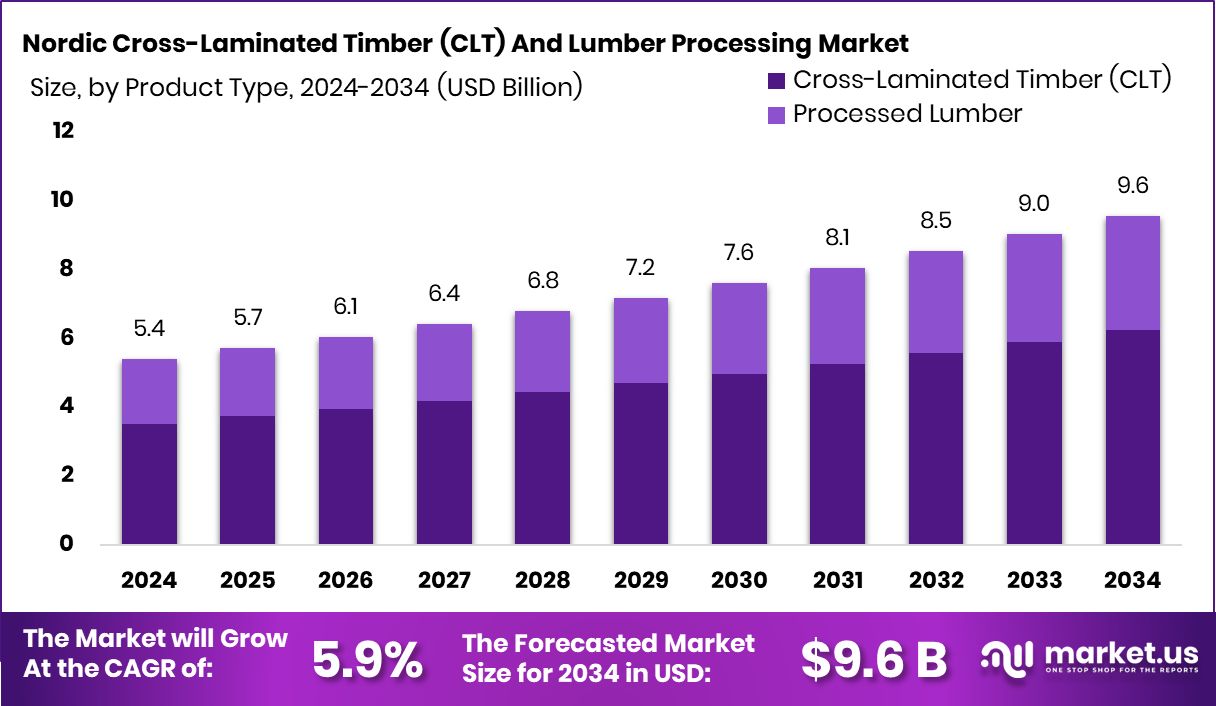

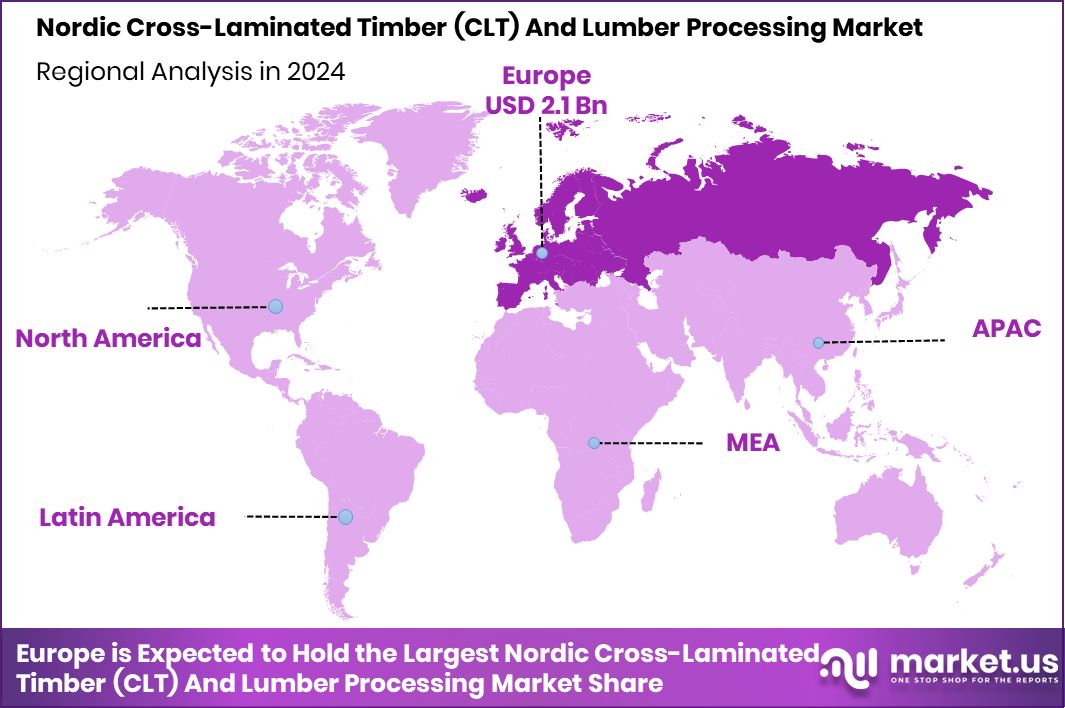

The Global Nordic Cross-Laminated Timber (CLT) And Lumber Processing Market is expected to be worth around USD 9.6 billion by 2034, up from USD 5.4 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Europe USD 2.1 Bn maintained steady demand as sustainable construction expanded across the region.

Nordic Cross-Laminated Timber (CLT) is an engineered wood material made by layering boards in alternating directions and pressing them into strong, stable structural panels. Lumber processing in the Nordic region supports this by converting sustainably sourced timber into graded boards used for CLT and other building materials. Together, they form a system where advanced timber engineering meets efficient sawmill operations. This combination allows builders to use low-carbon, lightweight, and high-performance wood solutions across housing, commercial projects, and public infrastructure.

The Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market represents the entire value chain—from sustainable forestry and sawmilling to CLT panel manufacturing and delivery to construction sites. This market grows as more developers seek faster installation, lower emissions, and high-strength-to-weight structural alternatives. Demand is reinforced by new funding and construction-tech investments that improve project efficiency. For example, Construction FinTech Billd raised $7.3 million, BRKZ secured $30 million in debt financing, and Mango landed $3 million, all supporting smoother cash flow and faster procurement in construction.

Growth factors for this market include rising interest in sustainable construction, government emphasis on carbon-neutral buildings, and improved digital-design adoption. The surge in construction-technology investment, such as Polyuse raising ¥2.7 billion for 3D-printing systems and Contineu securing $1.2 million for AI-powered site intelligence, supports greater efficiency in timber-based workflows. As projects become more automated and predictable, mass-timber adoption continues to rise across residential, office, and public building segments.

Demand continues to strengthen as developers push for faster building cycles and reduced onsite labor. Robotics investment also contributes to this trend—such as Gravis Robotics raising €19 million for its robotic excavator platform—showing broader movement toward mechanized construction. These technologies complement the prefabricated nature of CLT, making it easier to adopt in urban and remote areas where skilled labor is limited. The parallel rise of data-center construction, reaching $61 billion in deals in 2025, also increases the need for rapid-build materials, indirectly creating new opportunities for engineered timber suppliers.

Opportunities ahead include expanding low-carbon building policies, scaling Nordic sawmills with automation, and integrating digital fabrication to reduce waste. The combination of rising construction-fintech funding, robotics, and AI-based site tools creates favorable conditions for CLT adoption. As financial, digital, and mechanical tools advance construction efficiency, the Nordic CLT and lumber processing ecosystem is positioned to expand into larger and more complex building applications.

Key Takeaways

- The Global Nordic Cross-Laminated Timber (CLT) And Lumber Processing Market is expected to be worth around USD 9.6 billion by 2034, up from USD 5.4 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Nordic CLT dominates with 65.3%, driven by sustainable building practices and advanced regional lumber processing technologies.

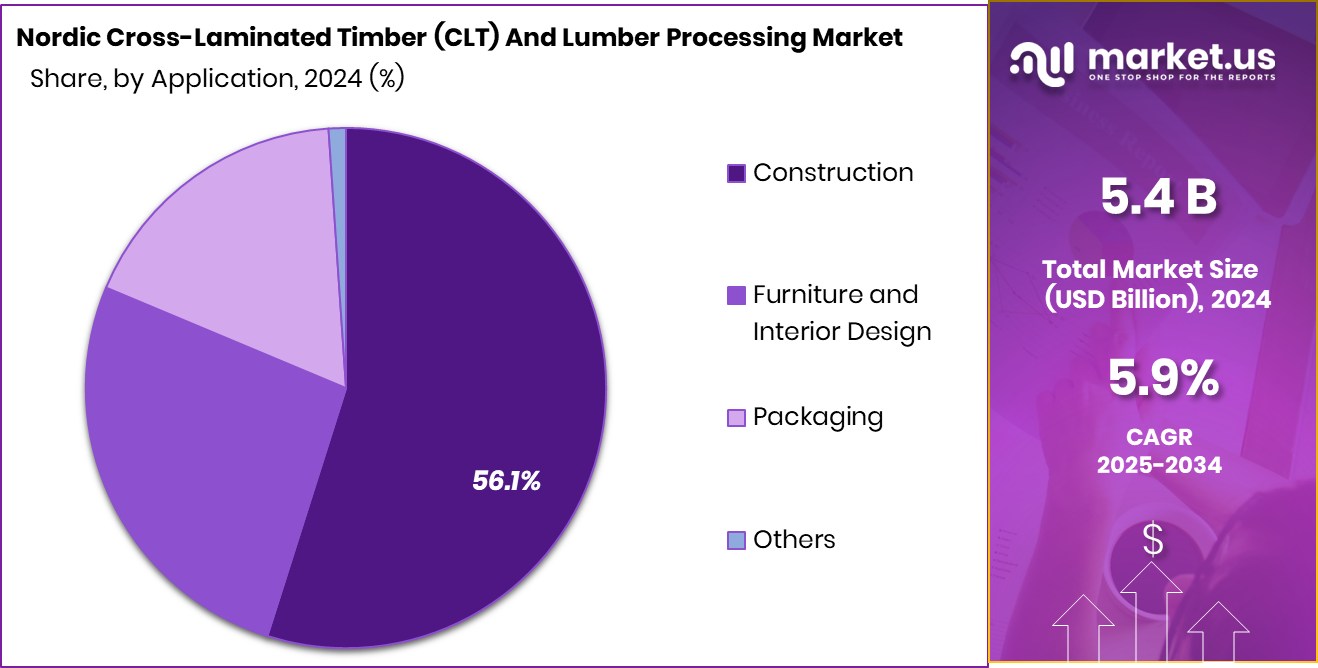

- Construction leads with 56.1%, as Nordic nations accelerate timber-based infrastructure and low-carbon development projects.

- Europe generated a strong market value of USD 2.1 Bn overall.

By Product Type Analysis

Nordic CLT leads the market with 65.3%, strengthening sustainable lumber processing.

In 2024, Cross-Laminated Timber (CLT) held a dominant position in the Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market with a 65.3% share, reflecting how quickly builders and processors are shifting toward engineered wood. CLT plants benefit from steady spruce and pine supply, strong sawmill integration, and higher value recovery compared with standard sawn timber.

Producers are investing in larger press lines, tighter moisture control, and automated grading to meet structural performance needs and shorten lead times. Demand is supported by low-carbon building targets, modular construction growth, and safer, more predictable onsite assembly. However, manufacturers still watch resin costs, energy prices, and logistics capacity, because these can pressure margins during peak building cycles and require careful contract pricing with buyers.

By Application Analysis

Construction dominates Nordic CLT and lumber processing market with 56.1% share.

In 2024, Construction led the Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market by application, accounting for 56.1% of demand as public and private projects prioritize timber-based solutions. Multi-storey housing, schools, and commercial retrofits are key adopters because CLT offers fast installation, strong fire-tested assemblies, and reduced site waste when paired with prefabrication.

For lumber processors, this construction focus increases the need for consistent strength classes, stable drying schedules, and precise planing to feed CLT and glulam lines without bottlenecks. Market growth depends on smoother permitting for mass timber, standardized design guidance, and reliable supply contracts that protect contractors from price swings. Over time, more renovation and hybrid wood-concrete builds should broaden volumes, especially in Nordic cities facing housing shortages.

Key Market Segments

By Product Type

- Cross-Laminated Timber (CLT)

- Processed Lumber

By Application

- Construction

- Furniture and Interior Design

- Packaging

- Others

Driving Factors

Rising Demand for Sustainable Wood Construction Solutions

The Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market is strongly driven by the shift toward sustainable and faster building methods. Developers increasingly prefer CLT because it reduces carbon emissions, speeds up installation, and supports modern architectural needs. This rising interest aligns with new activity in the wider interior and construction ecosystem, where companies are expanding with strong financial backing.

For example, Spacewood is eyeing Rs 300 crore funding from A91, which shows how interior and building-related firms are scaling to meet growing demand. Similarly, the founders of PharmEasy launched a new interior design startup that raised funding at a $120 million valuation, reflecting expanding interest in wood-based and design-focused construction solutions. These growth signals indirectly boost demand for CLT as part of modern building workflows.

Restraining Factors

Limited Awareness and Higher Initial Project Costs

A key restraint in the Nordic CLT and Lumber Processing Market is the higher upfront cost of mass-timber materials and the lack of awareness among smaller contractors. Many builders still rely on conventional materials because they are more familiar and widely available. The financial pressure becomes clearer when interior and construction-tech companies seek frequent capital injections just to stabilize operations.

For example, Pepperfry is set to raise INR 43 crore from existing investors, showing that cash flow gaps are common in design and building ecosystems. Likewise, Nirwana.AI raised funding at over an INR 100 crore valuation to improve interior design processes, but such advancements highlight how costly digital and material transitions can be. These financial realities often slow the shift toward CLT adoption.

Growth Opportunity

Expansion Through Tech-Enabled Interior and Building Design

A major opportunity for the Nordic CLT and lumber processing sector comes from the rapid digitization of interior design and building planning. As more design startups integrate 3D visualization and digital project tools, CLT becomes easier to specify, model, and adopt in projects of different scales. This direction is reinforced by new investments in the interior-tech space.

Flipspaces, for example, raised $4 million in its pre-Series B round, followed by another $4 million led by existing investors, showing strong momentum for tech-driven construction and design solutions. These advancements make it easier to demonstrate the performance, cost benefits, and sustainability of CLT to architects and clients, opening new opportunities for wider market penetration.

Latest Trends

Digital Interior Platforms Integrating Wood-Based Materials

A key trend shaping the Nordic CLT and Lumber Processing Market is the rise of digital interior design platforms that increasingly feature wood-based and modular solutions. These platforms simplify planning and allow customers to visualize CLT-based spaces more easily, boosting confidence in timber construction. Funding activity in this space highlights the trend’s strength—Flipspaces raised $2 million in another pre-Series B round, supporting further platform upgrades and design tools.

At the same time, Houseome, which generated Rs 2.1 crore in just 18 months, shows how rapidly digital interior services are expanding. As these platforms grow, they encourage more adoption of sustainable materials like CLT, reinforcing a trend toward digital-first, wood-centric building approaches.

Regional Analysis

Europe led the Nordic CLT and Lumber Processing Market with 39.5% share.

In 2024, Europe dominated the Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market, holding 39.5% of the regional share with a market value of USD 2.1 Bn, driven by strong adoption of mass-timber buildings, strict carbon-reduction policies, and widespread use of engineered wood in commercial and residential projects.

North America continued to expand as favorable building code updates and interest in mid-rise and high-rise timber structures supported consistent growth, especially in urban development zones. Asia Pacific showed rising potential with increased construction activity and growing awareness of sustainable materials, although its adoption still trails Europe’s mature timber ecosystem.

The Middle East & Africa region demonstrated gradual uptake, supported by selective sustainable building initiatives but limited by regional climatic and structural preferences. Latin America maintained steady but smaller-scale adoption, influenced by local construction patterns and early-stage integration of CLT technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Stora Enso continued to strengthen its position in the Nordic Cross-Laminated Timber (CLT) and Lumber Processing Market by leveraging its long-standing expertise in engineered wood solutions. The company focused on expanding CLT production efficiency, improving digital design integration, and optimizing sawmill operations to support rising demand for sustainable building materials across Europe. Stora Enso’s strong regional footprint and consistent innovation in prefabricated timber components helped it remain a preferred supplier for large construction projects and urban development initiatives.

SPLITCON maintained steady momentum in 2024 with its specialization in high-quality CLT panels and advanced lumber processing capabilities. The company’s operations benefited from reliable Nordic timber resources and its emphasis on precision manufacturing, enabling it to meet structural performance requirements for diverse applications. SPLITCON’s strategic focus on scaling production capacity and enhancing its value chain integration positioned the firm as a competitive mid-tier player capable of supporting both domestic and cross-border construction needs.

SÖDRA continued to play a critical role in the Nordic timber ecosystem by combining sustainable forest management with advanced lumber and CLT manufacturing. In 2024, the company emphasized circular practices, strong member-based forestry operations, and efficient processing systems. SÖDRA’s commitment to sustainable growth and engineered wood innovation enabled it to support increasing demand from low-carbon construction markets.

Top Key Players in the Market

- Stora Enso

- SPLITCON

- SÖDRA

- CROSSLAM KUHMO

- PÖLKKY OY

- MOELVEN

- UPM Timber

- Nordic CLT

Recent Developments

- In July 2025, Pölkky Oy’s new state-of-the-art sawmill at its Kajaani site was completed and put into operation. This facility more than doubled its annual sawn timber production from 200,000 m³ to 450,000 m³, strengthening output for lumber and CLT feeds. The sawmill uses highly automated technology, improving efficiency and supporting sustainable timber processing across Nordic markets.

- In May 2024, Moelven Valåsen completed and began running a new advanced saw line at its Valåsen sawmill. This modern line replaces older equipment and increases efficiency in producing sawn timber used for CLT and other wood products. The installation of this line is part of a broader modernization to improve output and technology across Moelven’s timber operations.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Billion Forecast Revenue (2034) USD 9.6 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cross-Laminated Timber (CLT), Processed Lumber), By Application (Construction, Furniture and Interior Design, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Stora Enso, SPLITCON, SÖDRA, CROSSLAM KUHMO, PÖLKKY OY, MOELVEN, UPM Timber, Nordic CLT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nordic Cross-Laminated Timber (CLT) And Lumber Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Nordic Cross-Laminated Timber (CLT) And Lumber Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Stora Enso

- SPLITCON

- SÖDRA

- CROSSLAM KUHMO

- PÖLKKY OY

- MOELVEN

- UPM Timber

- Nordic CLT