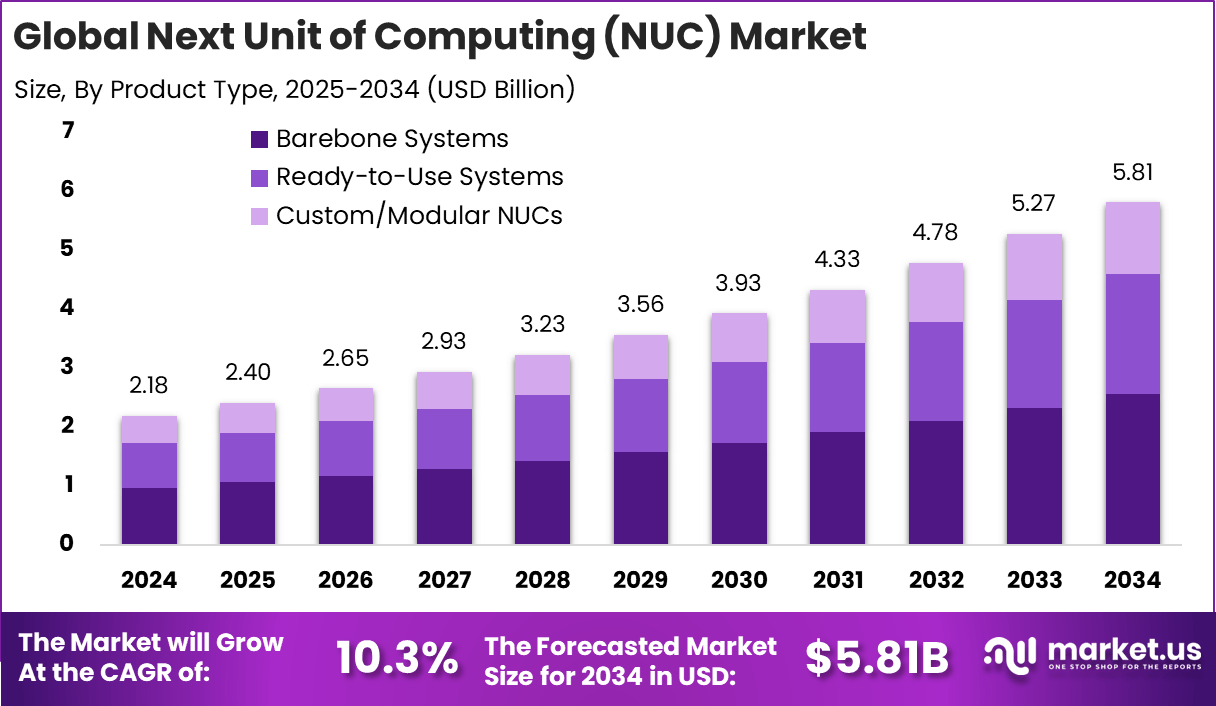

Global Next Unit of Computing (NUC) Market Size, Share Analysis Report By Product Type (Barebone Systems, Ready-to-Use Systems, Custom/Modular NUCs), By Application (Home & Personal Computing, Enterprise & Business Use, Industrial & Embedded Systems, Education & Government, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151864

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

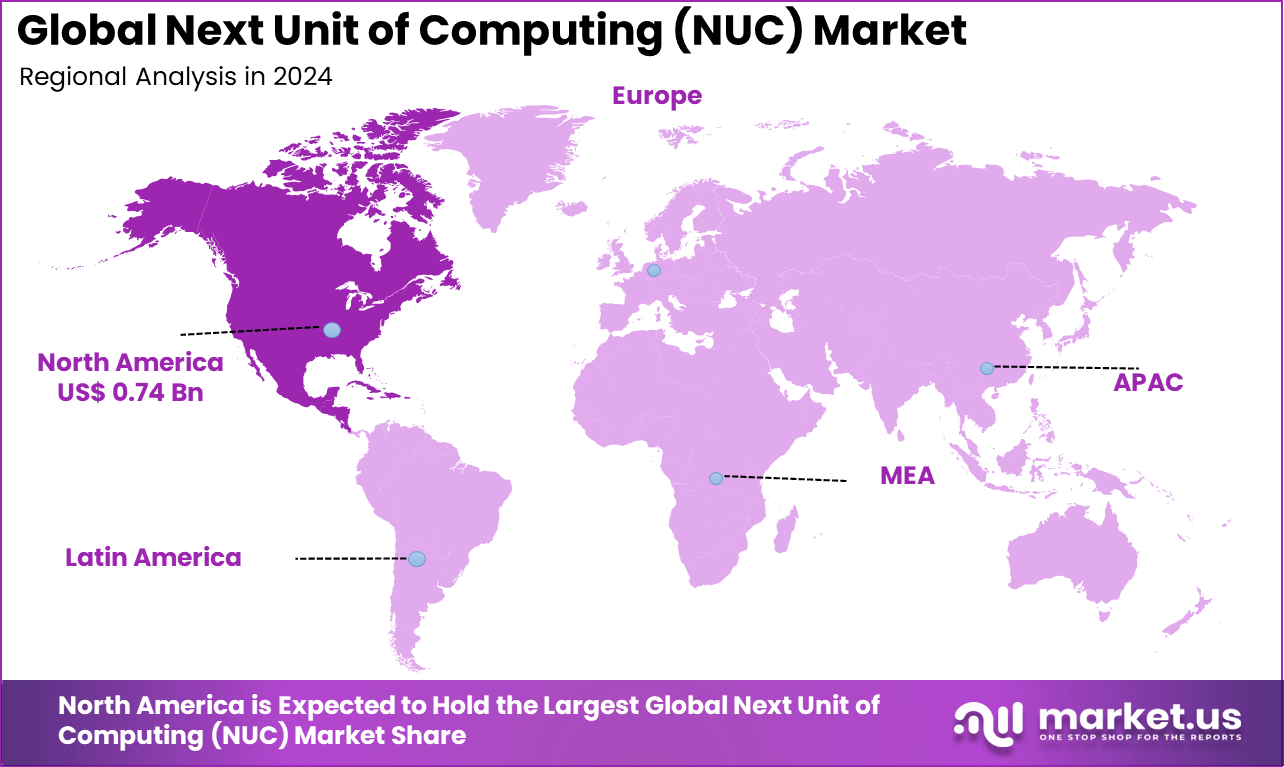

The Global Next Unit of Computing (NUC) Market size is expected to be worth around USD 5.81 billion by 2034, from USD 2.18 billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 0.74 billion in revenue.

The Next Unit of Computing (NUC) market can be described as a compact high‑performance mini‑PC segment, which has gained significance across various use cases, such as home entertainment setups, small business deployments, digital signage and edge infrastructure. The market is dominated by the leading bare‑bone and full‑host offerings, which are preferred for their small form factor, modularity and energy efficiency.

The top driving factors behind NUC adoption include rising demand for space‑saving yet powerful computing systems. The trend toward miniaturization and portability allows users to place these devices in constrained spaces such as living rooms, kiosks, or industrial environments. Energy efficiency also plays a key role; these systems consume notably less power than traditional desktops, making them appealing for businesses aiming to optimize operational costs.

Technological adoption within the NUC space is being propelled by developments in ARM‑based processors, AI acceleration, 5 G connectivity, and modular chassis designs. These trends are emerging as end‑users seek devices that can support targeted applications, such as on‑device AI inferencing, connected digital signage, and thin‑client deployments.

For instance, in September 2024, ASUS unveiled its latest lineup of AI-powered devices at the IFA 2024 trade show in Berlin, Germany. These new systems, branded as Copilot+ PCs, are equipped with Intel® Core™ Ultra processors (Series 2) and feature integrated Neural Processing Units (NPUs) capable of delivering up to 48 TOPS (Trillions of Operations Per Second), enabling advanced on-device AI capabilities.

Key reasons for adopting NUCs encompass cost efficiency from bare‑bone kits, reduced spatial footprint, lower total cost of ownership, and flexible connectivity. Their ability to be configured with different performance profiles on the fly makes them useful for scenarios ranging from remote education to server‑offloading tasks. Additionally, the inclusion of features like Thunderbolt, Wi‑Fi 6/7 and multiple display outputs increases their versatility.

Investment opportunities in the NUC market are centered around advanced processor integration (ARM, AI, low power), edge‑centric industrial designs, and modular/expandable platforms. Investors are likely to benefit by backing development of niche NUCs tailored for healthcare, retail analytics, or IoT gateways. The growth over recent years confirms that this mini‑PC category is maturing beyond hobbyist use, indicating a sound basis for further strategic investment.

Key Takeaway

- The global NUC market is projected to grow from USD 2.18 billion in 2024 to USD 5.81 billion by 2034, recording a healthy CAGR of 10.3%. This rise is driven by the need for compact, energy-efficient computing systems across industries.

- In 2024, North America held a 34% share, generating about USD 0.74 billion in revenue. The region benefits from high digital adoption, remote work trends, and enterprise demand for space-saving devices.

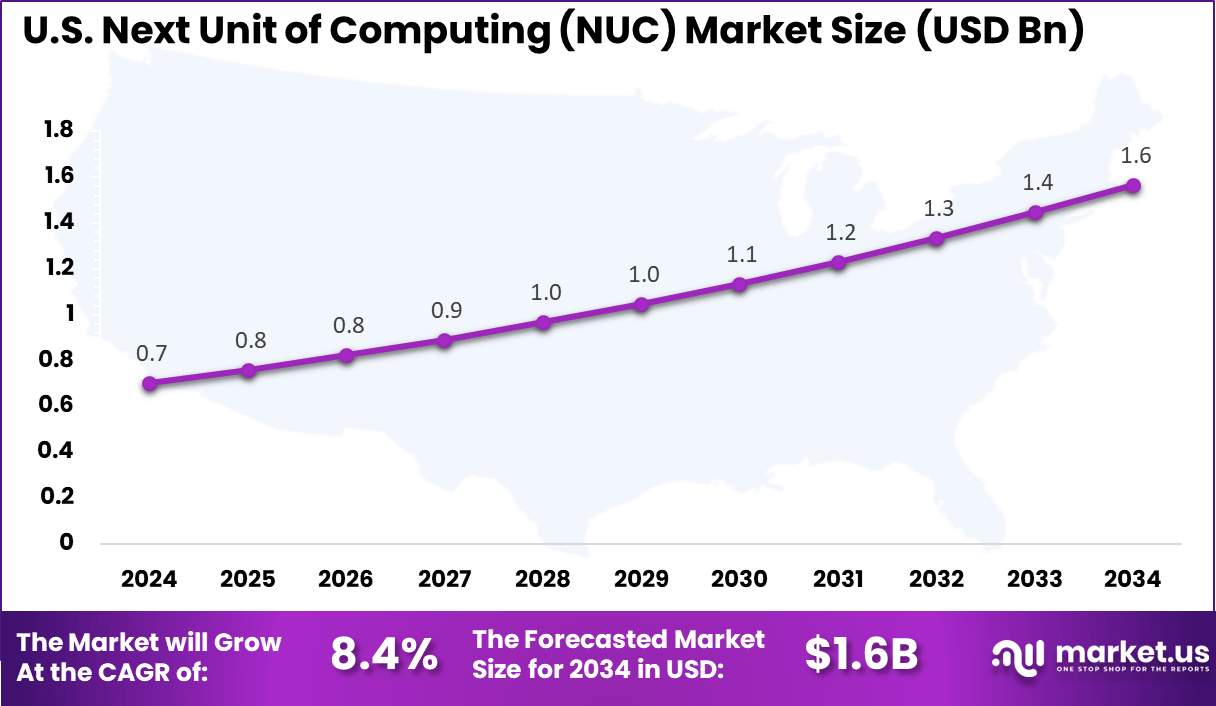

- The U.S. market alone was valued at USD 0.7 billion in 2024, and it is expected to expand at a CAGR of 8.4%. Ongoing investments in IT infrastructure and smart office setups support this growth.

- By product type, Barebone systems captured 44% of the market. Their modularity and affordability appeal to both system builders and OEMs seeking flexibility in design and upgrades.

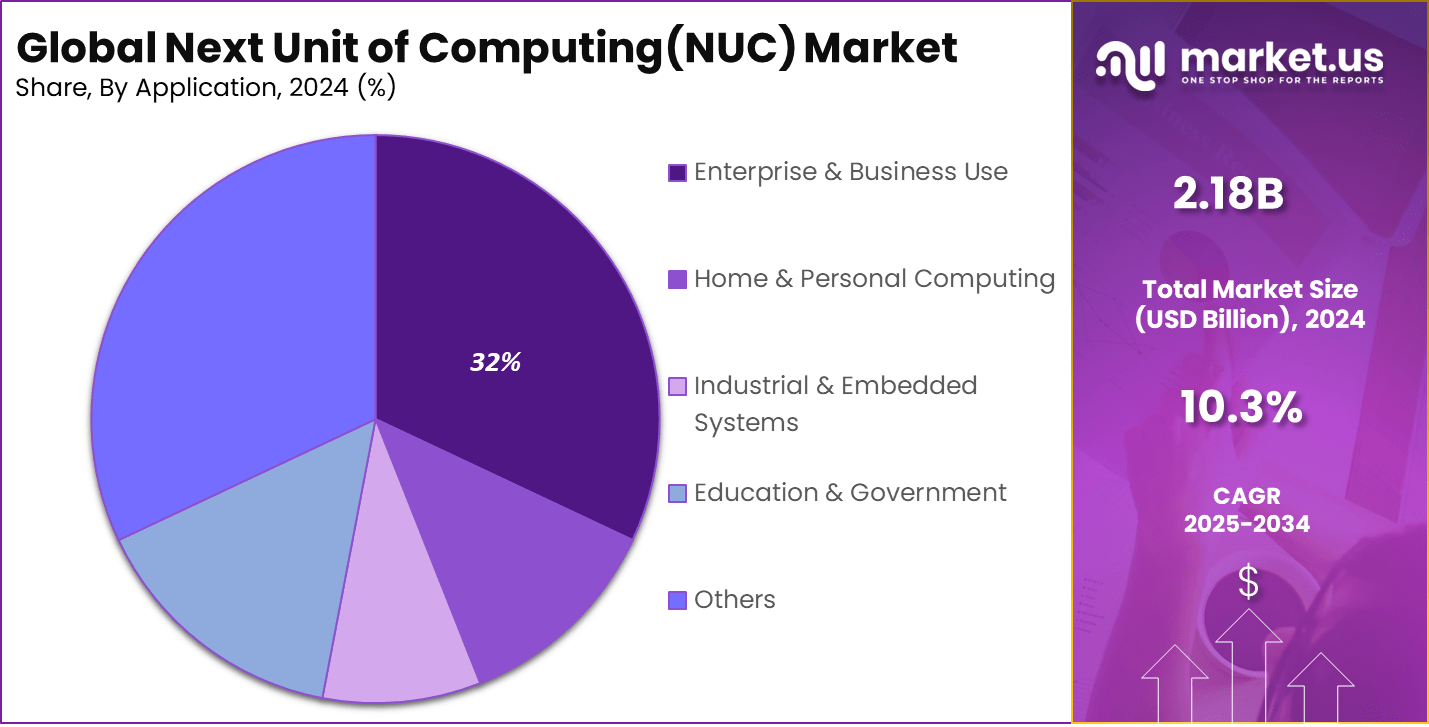

- In terms of application, Enterprise and business use held 32% share in 2024. Organizations are increasingly adopting NUCs for their compact size, reliability, and ease of integration into commercial IT environments.

U.S. NUC Market Size

The U.S. Next Unit of Computing (NUC) Market was valued at USD 0.7 Billion in 2024 and is anticipated to reach approximately USD 1.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.4% during the forecast period from 2025 to 2034.

For instance, in February 2025, ASUS launched the NUC 15 Pro, a compact mini PC powered by Intel’s Core Ultra 200 series processors. This system delivers up to 99 platform TOPS, supporting DDR5-6400 memory and featuring Intel Arc graphics and a dedicated NPU. It supports up to four 4K displays via HDMI 2.1 and Thunderbolt 4, making it ideal for high-productivity workflows.

In 2024, North America held a dominant market position in the Global Next Unit of Computing (NUC) Market, capturing more than a 34% share, holding USD 0.74 billion in revenue. The region’s strong embrace of technology, steady economic growth, widespread adoption of remote and hybrid work models, robust technology infrastructure, and the presence of major companies like Intel and Dell played a significant role in this dominance.

Moreover, the rising demand for compact, energy-efficient, and flexible computing solutions across industries such as business, manufacturing, and education has further strengthened North America’s position in the market.

For instance, in January 2025, Intel showcased advancements in its Next Unit of Computing (NUC) lineup at CES 2025, highlighting the integration of Intel Core Ultra 200-series processors and AI capabilities in mini-PCs. These developments underscore Intel’s commitment to enhancing edge computing solutions with compact, high-performance systems.

Product Type Analysis

In 2024, The Barebone Systems segment held a dominant market position, capturing a 44% share of the Global Next Unit of Computing (NUC) Market. This dominance is due to the increasing demand for customized solutions. Adaptability and affordability are both benefits of these systems, which enable users to choose specific components, such as memory, storage, or processors.

Both commercial and consumer demand for barebone systems are well-suited for applications such as gaming, business operations, and home entertainment. Their ability to improve and save money has made them highly sought-after by businesses, gamers, and tech enthusiasts, elevating their market share in many fields.

For Instance, in August 2024, Advansus Computer, a joint venture between Asustek Computer and Advantech, unveiled a compact wireless nano-ITX barebone system. This ultra-compact PC is designed for applications requiring minimal space without compromising on performance. The system features a nano-ITX motherboard with a low-power Intel processor, offering energy efficiency and sufficient computing power for tasks such as digital signage, edge computing, and industrial automation.

Application Analysis

In 2024, Enterprise & Business Use segment held a dominant market position, capturing more than a 32 % share. This prominence can be attributed to its alignment with the growing demand for compact, reliable computing solutions tailored for business workflows, office environments, and professional services.

NUCs in this category benefit from their modular and space-saving designs, enabling seamless deployment in conference rooms, remote offices, and corporate training setups. They also match enterprise needs for energy efficiency and manageability, offering IT departments centralized control with reduced operational costs.

This segment’s leadership reflects its strategic fit within digital transformation initiatives and hybrid work models adopted broadly in 2024. Enterprise preferences for NUCs are further rooted in their ability to support business-critical applications – such as virtual desktop infrastructure (VDI), data processing, and collaborative platforms – while maintaining a minimal footprint.

The innate flexibility in configuring memory, storage, and connectivity makes these units suitable for bespoke corporate requirements. In addition, regulatory and cybersecurity standards in enterprise environments favor compact yet secure devices, positioning NUCs as a compliant and high-performing alternative to traditional desktops.

Key Market Segments

By Product Type

- Barebone Systems

- Ready-to-Use Systems

- Custom/Modular NUCs

By Application

- Home & Personal Computing

- Enterprise & Business Use

- Industrial & Embedded Systems

- Education & Government

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Latest Trends

AI‑Embedded Edge Computing

The integration of AI capabilities into NUC platforms is rapidly becoming a central trend. With the advancement of machine learning and edge AI applications, NUCs are being re-engineered to support real-time inference at the network edge.

This trend is particularly noticeable in sectors like healthcare, retail analytics, and smart surveillance, where the need for compact yet intelligent systems is growing. For instance, new models are now equipped with neural compute engines or support for external AI accelerators, enabling faster processing without relying on centralized servers.

This shift toward AI-embedded edge computing reflects a broader movement from general-purpose mini PCs to more specialized, task-oriented systems. By offering AI readiness in a small form factor, NUCs are addressing latency, bandwidth, and privacy concerns in decentralized environments. Companies like ASUS are collaborating with Intel to launch AI toolkits for developers, further facilitating adoption.

Drivers

Growing Demand for Edge Computing

Edge computing is increasing the demand for Next Unit of Computing (NUC). These devices are well-suited for processing data closer to the source, enabling real-time data analysis and faster decision-making. The increasing popularity of edge computing, with its low delay and scalability in applications like IoT, industrial automation, and smart city projects, has led to NUCs becoming more popular.

For instance, in October 2025, ASUS’s new AI NUC range delivers compact versatility and cutting-edge performance, catering to the growing demand for edge computing solutions. These mini PCs are designed to handle AI workloads efficiently, making them ideal for applications requiring real-time data processing and decision-making at the edge.

Restraint

Performance Limitations

Next Unit of Computing (NUC) is capable of high performance in small amounts, but it may not be suitable for power-intensive applications such as gaming, 3D rendering, and computational tasks. The inadequacy of performance can limit their usage in fields like graphic design, animation, and scientific computing, which heavily rely on advanced processing power.

For instance, in May 2025, the NUC 15 Performance, equipped with an Intel Core Ultra 7 255HX processor and NVIDIA GeForce RTX 5060 GPU, is designed for tasks like 4K video editing and multitasking. However, its 8GB VRAM may not suffice for demanding applications such as high-end gaming, 3D rendering, and complex scientific simulations, which require more substantial graphical memory and processing power.

Opportunities

Integration with AI and IoT

Next Unit of Computing (NUC) is becoming more integrated with artificial intelligence (AI) and the Internet of Things (IoT), creating new opportunities for many industries. Through the integration of AI capabilities and IoT connections, NUCs can serve as potent edge devices for applications in smart cities, which include industrial automation and autonomous systems, making them significant contributors to the evolving digital landscape.

For instance, in January 2025, Gigabyte Technology unveiled its latest lineup of BRIX Mini PCs at CES 2025, introducing three distinct series: Mainstream, Small Core, and Extreme. The Mainstream series is powered by Intel Core Ultra 200H processors featuring a Neural Processing Unit (NPU) for enhanced AI capabilities, while the Small Core series utilizes Intel Twin Lake processors, offering a compact design ideal for everyday applications.

Challenges

Intense Competition

The Next Unit of Computing (NUC) industry is a highly competitive sector, with major players such as Intel, Dell, Lenovo, HP, ASUS, and others constantly exploring new ways to gain market share. The intense competition can lead to price pressures that reduce profit margins for manufacturers. Also, with the speedy growth of technological innovation, companies must keep up with changes in new features and performance, which poses a challenge for NUC developers.

For instance, in January 2025, HP introduced new mini PC and all-in-one desktop models featuring Copilot Plus AI capabilities. The OmniStudio X all-in-one desktop is available in 31.5-inch and 27-inch variants, utilizing Intel’s latest Core Ultra 200V series processors. The larger model includes a 4K IPS panel with HDR support, while the smaller models offer 1080p and 4K options, with some models featuring touch capability.

Key Players Analysis

Intel Corporation continues to play a foundational role in the Next Unit of Computing (NUC) market. As the originator of the NUC concept, Intel has influenced design standards, processor configurations, and modularity trends across the ecosystem. Its leadership stems from consistent innovation in compact desktop processors and strong collaboration with ecosystem partners.

ASUS and Gigabyte Technology (BRIX series) have also emerged as key players by offering competitive designs tailored to gaming, office, and creator use. Their offerings combine performance, cooling efficiency, and customizable features for diverse consumer segments. HP Inc., Dell Technologies, and Lenovo Group have extended their mainstream computing portfolio into the NUC form factor to address business, education, and professional applications.

Their reputation for enterprise-grade security, global distribution networks, and service infrastructure enhances their adoption in institutional environments. These vendors are increasingly focusing on compact desktops for flexible workspace designs and remote deployment.

ZOTAC, ASRock Industrial, MinisForum, and Beelink are gaining attention for their agile innovation and performance-focused mini-PCs. ZOTAC’s NUC alternatives often target high-performance gaming and graphics-intensive tasks, while ASRock Industrial caters to embedded and industrial-grade deployments. MinisForum and Beelink are tapping into the consumer and prosumer market by offering compact yet powerful models with competitive pricing.

Top Key Players in the Market

- Intel Corporation

- ASUS

- Gigabyte Technology (BRIX series)

- HP Inc.

- Dell Technologies

- Lenovo Group

- ZOTAC

- ASRock Industrial

- MinisForum

- Beelink

- Others

Recent Developments

- May 2025, Gigabyte launched its BRIX Mainstream AI series, featuring Intel Core Ultra 7/5 CPUs with integrated Arc graphics and NPUs, delivering up to 96 TOPS of AI compute in compact designs

- In January 2024, ASUS assumed technical and warranty support for Intel NUC systems from NUC7 through NUC13, signifying a strategic brand handoff.

Report Scope

Report Features Description Market Value (2024) USD 2.18 Bn Forecast Revenue (2034) USD 5.81 Bn CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Barebone Systems, Ready-to-Use Systems, Custom/Modular NUCs), By Application (Home & Personal Computing, Enterprise & Business Use, Industrial & Embedded Systems, Education & Government, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, ASUS, Gigabyte Technology (BRIX series), HP Inc., Dell Technologies, Lenovo Group, ZOTAC, ASRock Industrial, MinisForum, Beelink, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Unit of Computing (NUC) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Next Unit of Computing (NUC) MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- ASUS

- Gigabyte Technology (BRIX series)

- HP Inc.

- Dell Technologies

- Lenovo Group

- ZOTAC

- ASRock Industrial

- MinisForum

- Beelink

- Others