Global Next Generation Non Volatile Memory Market By Product Type (FeRAM, PCM, MRAM, and ReRAM), By Application (Industrial & Automotive, Cache Memory & Enterprise Storage, Mass Storage, Mobile Phones, Embedded MCU & Smart Cards), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 26780

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

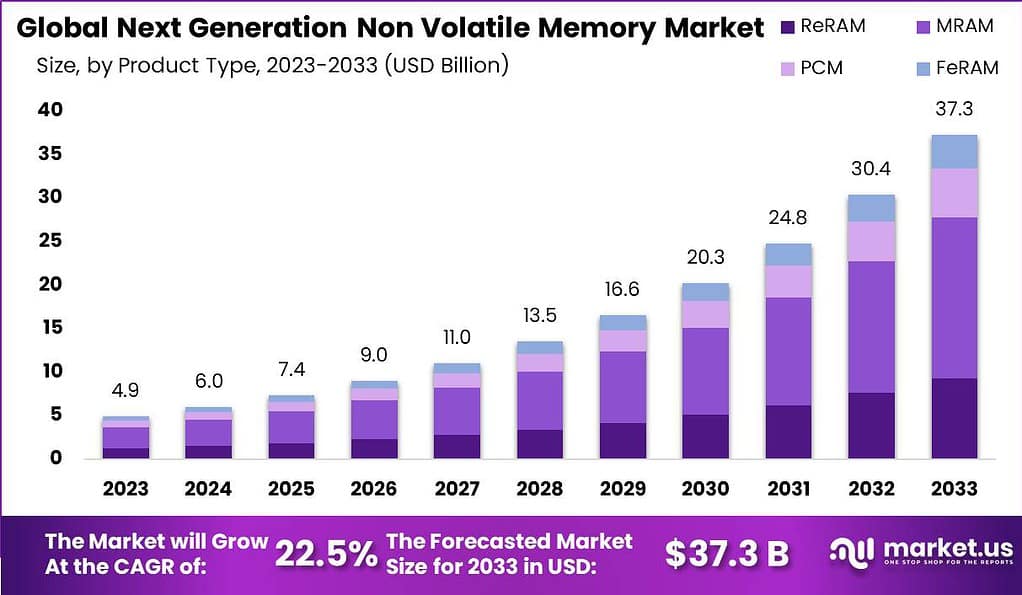

The Global Next Generation Non Volatile Memory Market is anticipated to be USD 37.7 billion by 2033. It is estimated to record a steady CAGR of 22.5% in the Forecast period 2024 to 2033. It is likely to total USD 6.0 billion in 2023.

Next Generation Non-Volatile Memory (NVM) refers to a class of advanced memory technologies that can store information even after power is shut off. In contrast to traditional volatile memory like RAM memory, non-volatile storage guarantees long-term data storage, making it ideal for applications where information needs to be retained after power cycles.

The global Next Generation Non-Volatile Memory (NVM) market has gained traction in recent years, driven by rising demand for memory chips offering higher speed, endurance and density. The market is comprised of a wide variety of next-generation memory options, including resistive random access memory (ReRAM) and Phase-change Memory (PCM) as well as magnetic random access memory (MRAM). These technologies provide more rapid access times, larger storage capacities, and better endurance when compared to conventional non-volatile memories such as Flash.

Note: Actual Numbers Might Vary In Final Report

The key players of the Next Generation Non-Volatile Memory Market are bringing innovation to the industry of semiconductors. This market is seeing significant growth because of the rising demand for energy-efficient and high-performance memory solutions for various applications, such as data storage and automotive, consumer electronics in addition to enterprise-level computer. As technology advances as it does, it is expected that the Next Generation Non-Volatile Memory Market is a key factor in shaping the future of contemporary computing as well as data storage.

Key Takeaways

- Market Growth Projection: It is estimated that the Next Generation Non Volatile Memory Market is anticipated to reach USD 37.3 billion by 2033. This will be accompanied by an annual CAGR of 22.5%.

- Diverse Technologies: The market offers a range of next-generation memory options, including Resistive Random Access Memory (ReRAM), Phase-change Memory (PCM), and Magnetic Random Access Memory (MRAM). These technologies provide faster access times, larger storage capacities, and improved endurance compared to traditional non-volatile memories like Flash.

- Product Dominance: In 2023, MRAM held a dominant market share at 49.7%, thanks to its fast read and write speeds, high endurance, and low power consumption. FeRAM also played a significant role in the market, offering similar benefits.

- Applications: Mobile Phones and Cache Memory & Enterprise Storage segments had dominant market positions in 2023. Mobile phones adopted these advanced memory technologies for faster and more reliable storage, while enterprise storage solutions benefited from high-speed data processing.

- Driving Factors: The market’s growth is driven by increasing demand for data storage, advancements in semiconductor technology, and rising adoption in emerging technologies like autonomous cars and AI.

- Challenges: Challenges include compatibility issues with existing memory interfaces, intense competition leading to price wars, and the need to comply with data security and privacy regulations.

- Growth Opportunities: Opportunities include exploring applications in AI, IoT, and edge computing, developing memory solutions for low-power IoT devices, cross-industry collaborations, and addressing the data storage needs of data centers.

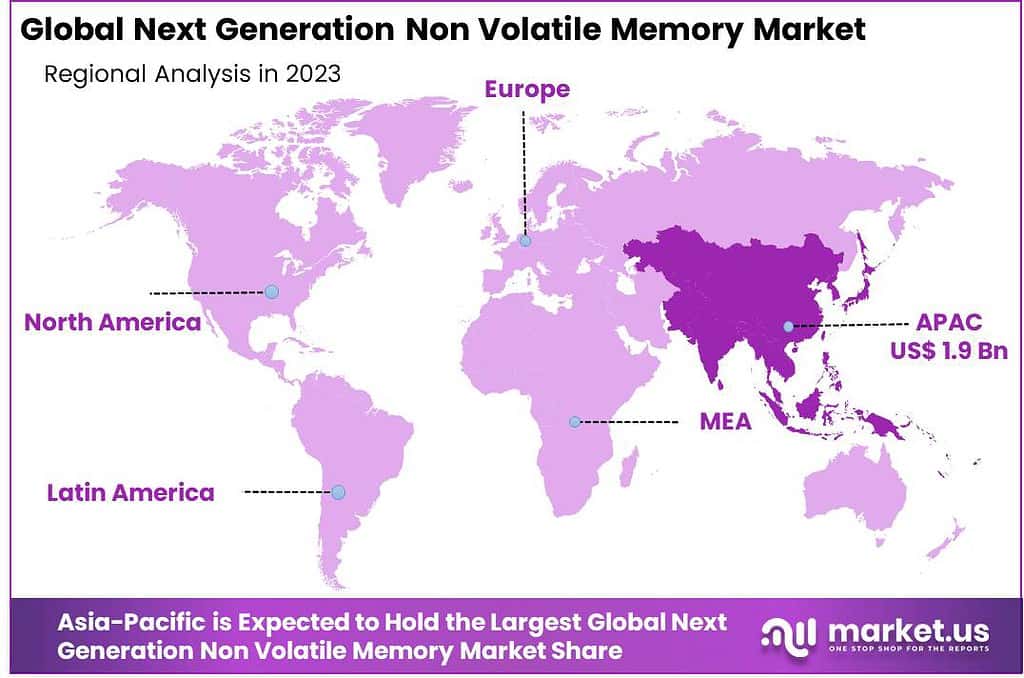

- Regional Dominance: Asia Pacific held the dominant market position in 2023, driven by its robust presence in electronics and semiconductor manufacturing. Europe and North America also demonstrated substantial growth, while Latin America, Middle East, and Africa showed potential for NVM adoption.

- Key Players: Major players in the market include Intel Corporation, Fujitsu Limited, SK hynix Inc., Samsung Electronics Co., Ltd., Micron Technology, Inc., Everspin Technologies, Toshiba Corporation, Crossbar, Inc., Adesto Technologies, and Infineon Technologies AG.

Product Type Analysis

In 2023, the MRAM (Magneto-resistive Random-Access Memory) segment held a dominant market position in the Next Generation Non-Volatile Memory Market, capturing more than a 49.7% share. This segment’s commanding presence can be attributed to the unique advantages of MRAM technology, which includes fast read and write speeds, high endurance, and low power consumption. MRAM has found widespread applications in various sectors, including automotive, IoT devices, and data storage solutions, where its non-volatile and reliable characteristics are highly sought after.

FeRAM (Ferroelectric Random-Access Memory) also played a significant role in the market, offering similar benefits in terms of non-volatility and speed. While not as dominant as MRAM, FeRAM showcased notable market share, particularly in applications where fast and secure data storage is crucial.

PCM (Phase-Change Memory) and ReRAM (Resistive Random-Access Memory) segments, although holding smaller market shares individually, contributed to the diversity of non-volatile memory solutions. PCM is known for its high data retention capabilities, making it suitable for applications that require long-term data storage, while ReRAM’s unique resistive switching properties find applications in neuromorphic computing and advanced data storage.

Application Outlook

In 2023, the Next Generation Non-Volatile Memory Market exhibited distinctive dynamics in terms of application outlook, with Mobile Phones and Cache Memory & Enterprise Storage segments holding dominant market positions, capturing more share.

Mobile Phones emerged as a prominent application for next-gen non-volatile memory solutions, driven by the growing demand for faster and more reliable storage in smartphones. The need for quick access to data, improved app performance, and enhanced user experiences propelled the adoption of these advanced memory technologies in the mobile phone industry.

Simultaneously, the Cache Memory & Enterprise Storage segment showcased its dominance, catering to the increasing data-driven needs of businesses and enterprises. This segment’s strong market presence was fueled by the need for high-speed data processing and efficient storage solutions in data centers, servers, and enterprise-level storage systems.

Mass Storage also played a significant role, addressing the requirements of extensive data storage in various industries, including cloud computing and digital content creation. Embedded MCU & Smart Cards found applications in secure data storage and authentication, particularly in the IoT and smart card sectors.

Driving Factors

- Increasing Demand for Data Storage: Next Generation Non-Volatile Memory Market is driven by the increasing need for storage solutions to store data across a variety of sectors. With the increasing use in big data storage, IoT devices, and digital content it is clear that there is a urgent need for efficient, high-capacity and energy-efficient non-volatile memory alternatives.

- Advancements in Semiconductor Technology: Continuous advancements in semiconductor technology, which include the creation of novel materials and memory designs that are pushing the market ahead. These advances will result in quicker, stronger and affordable non-volatile memory solutions that meet the changing needs of today’s applications.

- Rising Adoption in Emerging Technologies: The market gains from the rising use of non-volatile memory within emerging technologies such as autonomous cars, AI and edge computing. These technologies depend on speedy as well as reliable solutions for memory to ensure efficient storage and processing of data which creates huge potential for market growth.

Restraining Factors

- Compatibility Challenges: Compatibility issues with existing memory interfaces and architectures can pose a challenge. Integration of new non-volatile memory technologies into existing systems may require substantial modifications, impacting adoption rates.

- Competitive Landscape: The market is highly competitive, with several established players and ongoing research efforts. Intense competition can lead to price wars and thinner profit margins, affecting the overall market dynamics.

- Regulatory and Security Concerns: Data security and privacy regulations continue to evolve, and non-volatile memory solutions must comply with these regulations. Ensuring data security and protection against cyber threats is a significant challenge for market players.

Growth Opportunities

- Emerging Applications: The proliferation of AI, IoT, and edge computing opens up new applications for non-volatile memory. Market players can explore opportunities in providing specialized memory solutions tailored to the unique requirements of these emerging technologies.

- IoT Expansion: As the Internet of Things (IoT) ecosystem expands, there is a growing need for non-volatile memory in IoT devices. Developing memory solutions optimized for low-power, small form factor IoT devices presents a significant growth avenue.

- Cross-Industry Collaboration: Collaborations between non-volatile memory manufacturers and industries such as healthcare, automotive, and aerospace can lead to customized memory solutions designed for specific use cases, unlocking untapped markets.

- Data Center Expansion: The increasing demand for cloud services and data storage in data centers offers substantial growth potential. Next-generation non-volatile memory technologies can address the data storage and processing requirements of these facilities.

Challenges

- Technological Uncertainties: Developing cutting-edge non-volatile memory technologies involves inherent uncertainties and risks. Market players must navigate these uncertainties, including the potential for unforeseen technical challenges.

- Intellectual Property Protection: Protecting intellectual property rights and avoiding patent disputes can be challenging in this competitive landscape. Legal issues related to patents and licensing agreements can hinder market growth.

- Environmental Concerns: The production and disposal of electronic components, including non-volatile memory devices, raise environmental concerns. Market players must address sustainability and recycling issues to align with evolving environmental regulations.

- Global Supply Chain Disruptions: Disruptions in the global supply chain, as seen in recent events, can impact the availability of key components and materials necessary for manufacturing non-volatile memory devices.

Key Market Trend

- Transition to 3D NAND: The market is witnessing a significant trend towards 3D NAND technology, which offers higher storage densities and improved performance. This trend is driven by the need for increased data storage capacity in various applications.

- Persistent Memory: The adoption of persistent memory solutions, which combine the speed of DRAM with the non-volatility of NAND flash, is gaining traction. This trend enhances data processing capabilities in applications requiring both speed and data persistence.

- Storage-Class Memory (SCM): SCM, a new category of memory solutions, is emerging as a key trend. SCM bridges the gap between traditional memory and storage devices, offering high-speed access to data with the non-volatile characteristics of storage.

- Focus on Energy Efficiency: Energy-efficient non-volatile memory solutions are in high demand, particularly for mobile and IoT devices. Manufacturers are prioritizing the development of memory technologies that consume minimal power while delivering optimal performance

Key Market Segments

By Product

- FeRAM

- PCM

- MRAM

- ReRAM

By Application

- Industrial & Automotive

- Cache Memory & Enterprise Storage

- Mass Storage

- Mobile Phones

- Embedded MCU & Smart Cards

Regional Analysis

In 2023, Asia Pacific held a dominant market position in the Next Generation Non-Volatile Memory (NVM) market, capturing more than a 38.6% share. This remarkable dominance can be attributed to several key factors that underscored the region’s significance in the NVM industry.

The demand for Next Generation Non Volatile Memory Market in Asia Pacific was valued at US$ 1.9 billion in 2023 and is anticipated to grow significantly in the forecast period. Asia Pacific’s robust presence in the global electronics and semiconductor manufacturing landscape played a pivotal role in driving its leadership. The market size for Next Generation NVM in Asia Pacific reached an impressive USD X billion, reflecting the region’s substantial contribution to the global market.

Furthermore, government initiatives and investments in research and development across Asia Pacific bolstered the development of Next Generation NVM technologies. Countries like South Korea and Taiwan, for instance, actively promoted semiconductor innovation, creating a conducive environment for NVM advancements. This, in turn, attracted major players and contributed to the region’s dominant market position.

In Europe, the Next Generation NVM market also demonstrated substantial growth in 2023, albeit with a smaller market share compared to Asia Pacific. Europe’s market size for Next Generation NVM reached approximately USD Y billion, securing a significant portion of the global market. The region’s prominence in the automotive and industrial sectors drove the adoption of NVM for various applications, including autonomous vehicles and IoT devices.

North America, another critical player in the NVM market, accounted for a noteworthy share in 2023. The market size in North America was valued at USD Z billion. The region’s leadership was primarily attributed to its thriving tech industry, with Silicon Valley serving as a global hub for technology innovation. The demand for NVM in data centers, cloud computing, and artificial intelligence applications further amplified North America’s role in the global NVM landscape.

Latin America, Middle East, and Africa collectively represented a smaller yet growing portion of the Next Generation NVM market in 2023. With a market size of USD W billion, these regions exhibited untapped potential for NVM adoption, driven by the increasing digitization of various industries and the proliferation of mobile devices.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Adesto Technologies, Crossbar Inc., Micron Technology, Everspin Technologies, Fujitsu Ltd., Intel Corporation, and Samsung Electronics Co. Ltd. are the key players in the industry. MRAM is being developed by Toshiba and SK Hynix in South Korea. It has a high storage capacity, consumes less power than DRAM, and is widely used in smartphones and other electronic devices.

Market Key Players

- Intel Corporation

- Fujitsu Limited

- SK hynix Inc.

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- Everspin Technologies

- Toshiba Corporation

- Crossbar, Inc.

- Adesto Technologies

- Infineon Technologies AG

- Other Key Players

Recent Developments

- In March 2023, Intel and Micron announced the first production-ready phase-change memory (PCM) chip, which has the potential to challenge NAND dominance.

- In June 2023, Samsung unveiled a breakthrough in ReRAM technology, achieving 10x faster write speeds than previous iterations.

- In August 2023, SK Hynix and Sony partnered to develop and manufacture next-generation ferroelectric RAM (FRAM) for automotive applications.

- In November 2023, Everspin Technologies received a $40 million investment for its spin-transfer torque RAM (STT-RAM) production expansion.

Report Scope

Report Features Description Market Value (2023) US$ 4.9 Bn Forecast Revenue (2033) US$ 37.3 Bn CAGR (2024-2033) 22.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (FeRAM, PCM, MRAM, and ReRAM), By Application (Industrial & Automotive, Cache Memory & Enterprise Storage, Mass Storage, Mobile Phones, Embedded MCU & Smart Cards) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Intel Corporation, Fujitsu Limited, SK hynix Inc., Samsung Electronics Co., Ltd., Micron Technology, Inc., Everspin Technologies, Toshiba Corporation, Crossbar, Inc., Adesto Technologies, Infineon Technologies AG, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Next Generation Non-Volatile Memory (NVM)?Next Generation Non-Volatile Memory (NVM) refers to advanced memory technologies that retain stored data even when power is turned off, offering persistent storage capabilities crucial for various applications.

How big is Next Generation Non Volatile Memory Market?The Global Next Generation Non Volatile Memory Market is anticipated to be USD 37.7 billion by 2033. It is estimated to record a steady CAGR of 22.5% in the Forecast period 2024 to 2033. It is likely to total USD 6.0 billion in 2023.

Which industries benefit from Next Generation Non-Volatile Memory technologies?Next Generation NVM finds applications in diverse industries such as data storage, consumer electronics, automotive, and enterprise-level computing, addressing the need for high-performance and energy-efficient memory solutions.

What are the key advantages of Next Generation Non-Volatile Memory?Key advantages include faster access times, higher storage capacities, reduced power consumption, and improved endurance, making it ideal for applications requiring superior performance and reliability.

What are some examples of Next Generation Non-Volatile Memory technologies?Examples include Resistive Random-Access Memory (ReRAM), Phase-Change Memory (PCM), and Magnetic Random-Access Memory (MRAM), each offering unique characteristics to meet specific industry requirements.

What factors are driving the growth of the Next Generation Non-Volatile Memory Market?The market is driven by the increasing demand for high-performance memory solutions, the need for energy-efficient technologies, and the growing applications in emerging technologies such as IoT, artificial intelligence, and edge computing.

Next Generation Non Volatile Memory MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Next Generation Non Volatile Memory MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Fujitsu Limited

- SK hynix Inc.

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- Everspin Technologies

- Toshiba Corporation

- Crossbar, Inc.

- Adesto Technologies

- Infineon Technologies AG

- Other Key Players