Global Next-Generation Digital Cockpit Market By Equipment Type (Digital Instrument Cluster, Driving Monitoring System, Head-Up Display(HUD), Advanced Head Unit, and Other Equipment Types), By Display ( LCD, TFT-LCD, OLED), By Vehicle Type ( Passenger Vehicles, Commercial vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 102255

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

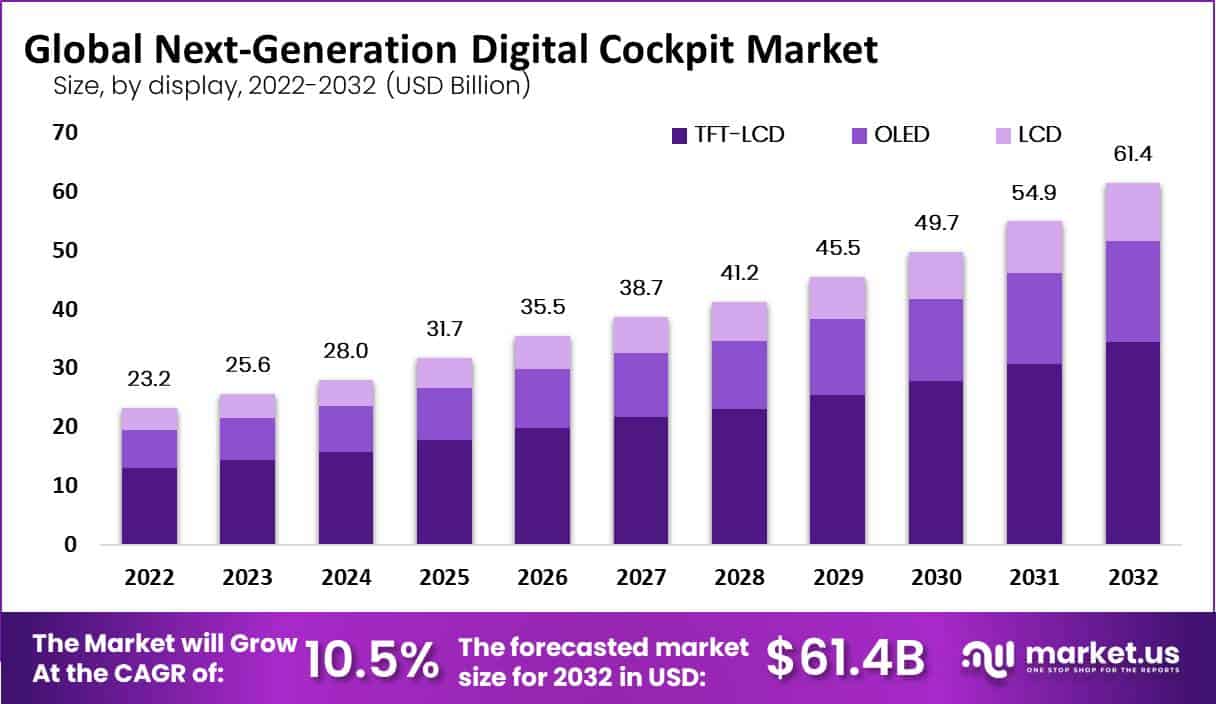

The Global Next-Generation Digital Cockpit Market size is expected to be worth around USD 61.4 Billion by 2032, From USD 25.6 Billion by 2023, growing at a CAGR of 10.5% during the forecast period from 2023 to 2032.

The Next-Generation Digital Cockpit Market encompasses advanced integrated automotive dashboard systems that combine digital instruments, multimedia functions, and navigational tools to enhance driver interaction and experience.

This market involves the convergence of various technologies, including display panels, infotainment systems, advanced driver assistance systems (ADAS), and connectivity modules, orchestrated through a unified user interface.

This innovation aims to provide a more intuitive and immersive driving experience, integrating control and feedback mechanisms seamlessly with the vehicle’s other systems.

The growth of the Next-Generation Digital Cockpit Market is primarily driven by the increasing demand for enhanced user experiences and improved driver assistance features in vehicles.

Factors such as advancements in technology, the integration of IoT in automotive design, and rising consumer expectations for connectivity features and personalized driving environments play pivotal roles.

Additionally, the shift towards autonomous and electric vehicles acts as a catalyst, compelling automotive manufacturers to innovate their cockpit designs to align with future transportation technologies.

Demand in the Next-Generation Digital Cockpit Market is soaring, primarily due to consumer preferences shifting towards vehicles equipped with advanced safety features, connectivity, and immersive infotainment systems.

The rising sales of luxury and premium vehicles, particularly in developing markets, further bolster this demand, as these segments often pioneer the adoption of advanced digital cockpit systems.

Furthermore, regulatory pressures for enhanced vehicle safety standards continue to drive demand, as digital cockpits facilitate the integration of safety features such as real-time diagnostics and ADAS.

The market presents significant opportunities for both automotive manufacturers and technology providers. As vehicles evolve into connected mobile devices, the scope for integrating AI, augmented reality, and voice-assisted controls in digital cockpits is expanding.

There is also an emerging trend to use the cockpit as a platform for delivering personalized content and services, opening new revenue streams for content providers and software developers.

Additionally, partnerships between automotive and software companies are likely to increase, aiming to harness data analytics and machine learning to enhance the functionality and user experience offered by next-generation digital cockpits.

The Next-Generation Digital Cockpit market is undergoing rapid transformation, driven by advancements in AI, connectivity, and user-centric design. In 2023, over 25% of digital cockpits incorporated driver health monitoring, reflecting growing emphasis on safety and driver well-being.

Additionally, the adoption of AI-powered virtual assistants surged by 40% from 2022 to 2023, enhancing in-vehicle user experiences. Approximately 15% of digital cockpits integrated in-vehicle payment systems, while over 30% included external camera integration for a 360-degree view.

With infotainment systems projected to account for around 50% of cockpit functionalities, demand remains robust. By 2025, over 60% of new vehicles will feature digital cockpit technology, with over 70% of vehicles expected to offer connectivity features by 2024.

Implementation costs range from USD 1,000 to USD 3,000 per vehicle, contingent on feature complexity and technology integration. This evolving landscape underscores the shift toward more connected, intelligent, and user-focused vehicle environments.

The Next-Generation Digital Cockpit market is witnessing significant advancements, exemplified by strategic collaborations and technological breakthroughs. In 2023, smart and ECARX introduced their co-developed high-performance digital cockpit computing platform, powered by AMD technology, at CES in Las Vegas.

This platform will be featured in smart’s all-electric vehicles launching in 2024, marking the first in-vehicle computing platform developed by ECARX with AMD since their partnership announcement in August 2022.

Such collaborations emphasize the shift toward high-performance, immersive in-car experiences, positioning digital cockpit technology as a critical differentiator in the competitive electric vehicle market, driven by consumer demand for enhanced connectivity and user engagement.

Key Takeaways

- The Next-Generation Digital Cockpit Market is projected to grow from USD 25.6 billion in 2023 to USD 61.4 billion by 2032, with a CAGR of 10.5%, driven by increasing consumer demand for enhanced in-car experiences and technological advancements in connectivity.

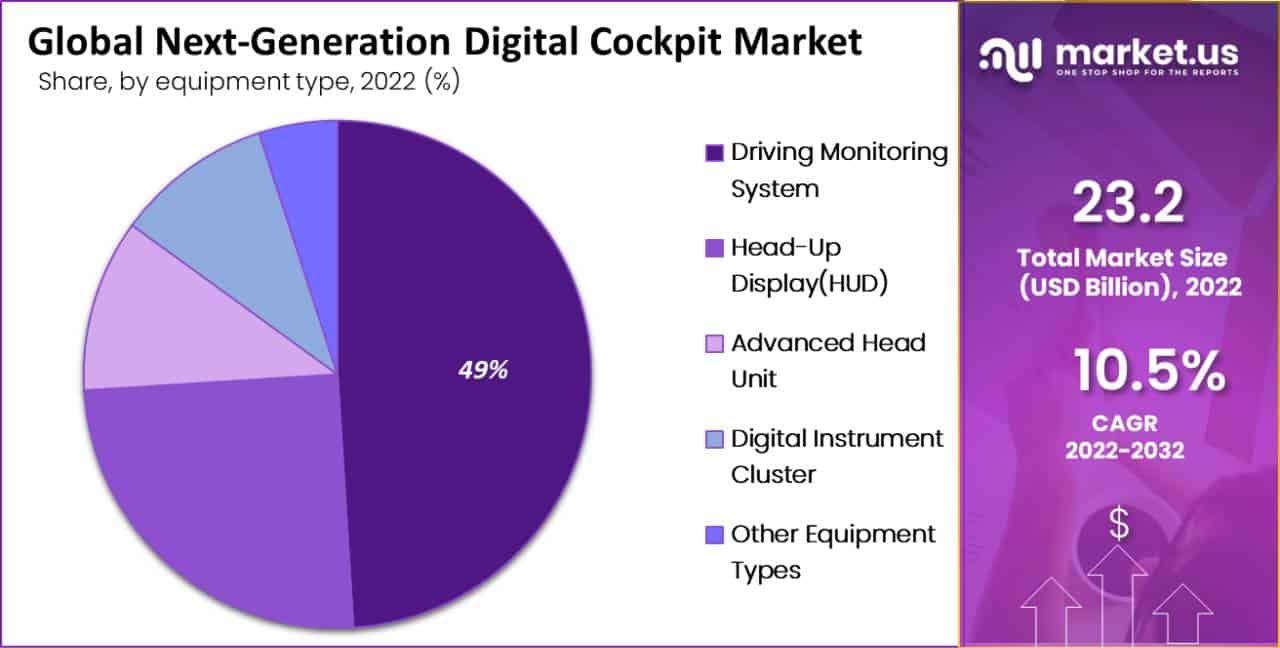

- The Driving Monitoring System led the equipment type segment in 2022, holding a 49% market share, driven by growing safety regulations and the shift towards autonomous driving.

- TFT-LCD displays dominated the display segment, capturing a 56% share in 2022, due to their cost-effectiveness and versatility across vehicle models.

- Passenger cars dominated the vehicle type segment with a 75% share in 2022, reflecting strong consumer demand for advanced digital interfaces and infotainment systems.

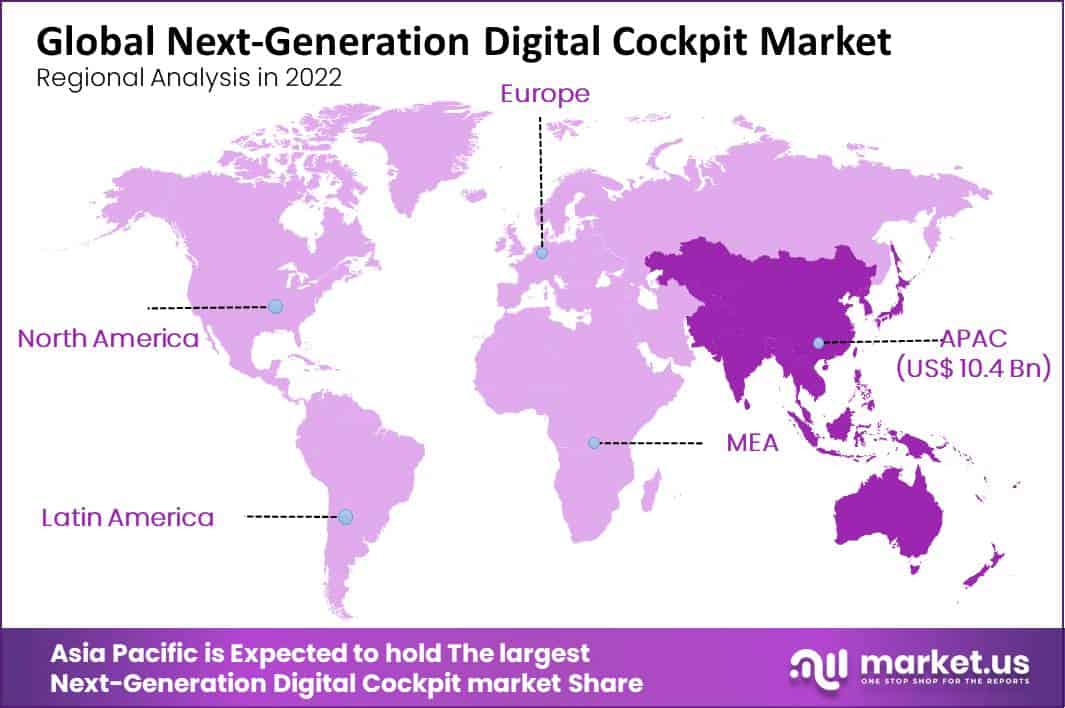

- In the digital cockpit market, Asia-Pacific held a dominant 45% market share in 2022, fueled by a strong automotive industry and rising demand for advanced vehicle technologies in China and India.

- Growth Opportunity The emergence of autonomous and electric vehicles presents significant growth potential, driving demand for innovative digital cockpit designs and integrated AI-based features.

- Restraining Factor Cybersecurity concerns and the complexity of integrating advanced technologies pose challenges, potentially slowing down market adoption and raising costs for manufacturers.

By Equipment Type Analysis

Driving Monitoring System Dominates the Next-Generation Digital Cockpit Market with a 49% Share in 2022

In 2022, the Driving Monitoring System held a dominant market position in the Equipment Type segment of the Next-Generation Digital Cockpit Market, capturing more than a 49% share.

This dominance was driven by the growing emphasis on vehicle safety and regulations mandating driver monitoring systems in regions like Europe and North America. As the automotive industry advances toward autonomous driving, the role of driving monitoring systems has become increasingly pivotal, ensuring enhanced driver awareness and safety features.

Digital Instrument Cluster This segment accounted for a significant portion of the market share in 2022, representing approximately 21%. Digital instrument clusters have become a preferred choice among automakers due to their ability to provide customizable and intuitive displays, which enhance the user experience. The trend towards fully digital dashboards in premium and mid-range vehicles further boosted the demand for this equipment type.

Head-Up Display (HUD) Capturing around 13% of the market share, HUDs have gained traction in the Next-Generation Digital Cockpit Market, especially among premium vehicle manufacturers. The ability to project critical driving information directly onto the windshield enhances driver focus and reduces distractions.

The adoption of augmented reality (AR) technology in HUDs has further propelled their market growth, offering a competitive edge in advanced driver assistance systems (ADAS).

Advanced Head Unit This segment represented about 10% of the market share in 2022. Advanced head units have evolved from simple audio systems to comprehensive infotainment hubs, integrating navigation, connectivity, and multimedia features.

The increasing consumer preference for connected car experiences has driven the growth of this segment, especially in electric and luxury vehicles where a seamless interface between the driver and the vehicle’s digital ecosystem is essential.

Other Equipment Types The remaining 7% of the market share in 2022 was attributed to various other equipment types, including rear-seat entertainment systems and connectivity modules.

While these components may not hold as large a share individually, they contribute significantly to the overall appeal and functionality of next-generation digital cockpits, particularly in family and long-haul vehicles where in-car entertainment is a key selling point.

By Display Analysis

TFT-LCD Dominates the Next-Generation Digital Cockpit Market by Display Segment with a 56% Share in 2022

In 2022, TFT-LCD held a dominant market position in the display segment of the Next-Generation Digital Cockpit Market, capturing more than a 56% share. The widespread use of TFT-LCD displays is driven by their cost-effectiveness, reliability, and versatility in various vehicle models.

These displays are favored for their high resolution and readability under different lighting conditions, making them a popular choice for instrument clusters and infotainment systems.

The LCD segment accounted for approximately 28% of the market share in 2022. While less advanced than TFT-LCD and OLED technologies, standard LCDs continue to find application in lower-end vehicle models where cost considerations are paramount.

The segment remains steady due to its lower production costs and sufficient visual performance for basic digital cockpit needs.

Representing around 16% of the market share in 2022, OLED displays have started to gain traction, particularly in premium and luxury vehicles. OLED technology is known for offering superior contrast, deeper blacks, and flexibility in design, which appeals to automakers focusing on high-end aesthetics and advanced user experiences.

By Vehicle Type Analysis

Passenger Cars Dominate the Next-Generation Digital Cockpit Market by Vehicle Type with a 75% Share in 2022

In 2022, passenger cars held a dominant market position in the vehicle type segment of the Next-Generation Digital Cockpit Market, capturing more than a 75% share. The significant adoption of digital cockpit technologies in passenger cars is driven by rising consumer demand for enhanced in-car experiences, including advanced infotainment, connectivity, and safety features.

Automakers are increasingly integrating digital displays and smart interfaces in passenger vehicles to meet customer expectations for convenience and luxury.

Commercial Vehicles: The commercial vehicle segment accounted for approximately 25% of the market share in 2022. Although smaller in comparison, this segment is experiencing growth as logistics companies and fleet operators increasingly adopt digital cockpit solutions to improve driver safety and vehicle management.

The emphasis on real-time data analytics and navigation aids is particularly relevant in commercial applications, contributing to the steady adoption of advanced cockpit technologies in this segment.

The Next-Generation Digital Cockpit Market is primarily driven by the passenger car segment, reflecting a strong demand for enhanced user experience and advanced digital interfaces. Meanwhile, the commercial vehicle segment offers growth opportunities as the industry recognizes the value of integrating digital systems for operational efficiency.

Key Market Segments

By Equipment Type

- Digital Instrument Cluster

- Driving Monitoring System

- Head-Up Display(HUD)

- Advanced Head Unit

- Other Equipment Types

By Display

- LCD

- TFT-LCD

- OLED

By Vehicle Type

- Passenger Vehicles

- Commercial vehicles

Driver

Technological Advancements in Connectivity and Interface Systems

The primary driver for the growth of the Next-Generation Digital Cockpit Market is the rapid advancement in connectivity and interface technologies. As automotive manufacturers strive to meet the increasing consumer demand for a seamless digital experience, the integration of high-speed internet connectivity and sophisticated user interface designs becomes critical.

These technologies enable the incorporation of real-time traffic updates, cloud-based services, and multimedia streaming, all accessible via touchscreens and voice commands.

This surge in connectivity solutions directly correlates with heightened consumer expectations for functionality and comfort, driving vehicle sales with advanced digital cockpits.

The adoption of 5G technology is particularly transformative, providing the bandwidth necessary to support enhanced features like augmented reality (AR) navigation systems, which offer real-time overlays of route mapping and hazard detection.

This technological leap not only enhances the user experience but also significantly boosts the market as manufacturers update older models to compete in this digitally driven environment.

Restraint

Cybersecurity Concerns and Technological Complexity

One of the main restraints in the Next-Generation Digital Cockpit Market is the growing concern over cybersecurity. As digital cockpits become more interconnected with the Internet of Things (IoT) and other vehicle systems, the risk of cyber-attacks increases. These concerns are not unfounded, as any breach could compromise driver privacy or, worse, vehicle safety.

Additionally, the complexity of implementing advanced digital technologies poses a significant challenge. The integration of various components—such as ADAS, infotainment systems, and connectivity modules requires high-level expertise and substantial investment in research and development.

This complexity can slow down product development cycles and increase manufacturing costs, potentially deterring automotive manufacturers from adopting sophisticated digital cockpit technologies.

Opportunity

Emergence of Autonomous and Electric Vehicles

The rise of autonomous and electric vehicles presents a vast opportunity for the expansion of the Next-Generation Digital Cockpit Market. These vehicle types are predicated on advanced technologies that require extensive digital input and output systems to operate safely and efficiently.

Digital cockpits in these contexts do more than provide information; they are integral to the vehicle’s operation, processing vast amounts of data to support automated driving systems.

As more automotive companies enter the electric and autonomous vehicle market, the demand for innovative cockpit designs is expected to skyrocket. This trend is encouraging investments in next-generation cockpit components that can handle more complex functionalities, such as AI voice assistance systems and gesture control features.

Such innovations not only enhance driver and passenger experience but also position manufacturers as leaders in a highly competitive market, thereby driving further growth.

Trends

Integration of AI and Machine Learning

A significant trend in the Next-Generation Digital Cockpit Market is the integration of artificial intelligence (AI) and machine learning. These technologies are being leveraged to enhance the adaptability and personalization of the cockpit environment.

AI algorithms can learn from user behavior to adjust settings such as seat position, climate control, and infotainment system preferences, providing a highly personalized driving experience.

The ability of AI to process and react to environmental and contextual data also helps improve safety features, such as predictive collision avoidance and driver alertness monitoring.

As these AI-driven features become more sophisticated, they not only improve safety and comfort but also significantly influence consumer buying decisions. The market is thus seeing a shift towards vehicles that can offer these advanced, AI-enabled digital cockpits, driving growth through technological innovation and enhanced consumer satisfaction.

Regional Analysis

Asia-Pacific Leads Next-Generation Digital Cockpit Market with 45% Share

The Asia-Pacific region emerged as the dominant market for next-generation digital cockpit solutions, holding a significant 45% share in 2022. This dominance is driven by the region’s extensive automotive industry, rapid technological advancements, and a strong consumer base.

Valued at approximately USD 10.4 billion, the market in Asia-Pacific is supported by robust demand in countries like China and India. China, with a demand for around 320 million passenger cars in 2022, is a critical market, contributing to the adoption of advanced automotive technologies, including digital cockpits.

Meanwhile, India, boasting the third-largest road network globally and a passenger car base of 295.8 million units, also plays a pivotal role in the region’s growth trajectory. This confluence of large automotive markets, coupled with increasing investments in digital and autonomous vehicle technologies, makes Asia-Pacific a key player in the global landscape of next-generation digital cockpits.

North America is a significant market for next-generation digital cockpit solutions, characterized by high consumer expectations for advanced automotive technologies and substantial investments in connected vehicles.

The region benefits from a well-established automotive sector, particularly in the United States, where the demand for luxury and electric vehicles drives the integration of digital cockpits.

Key market players are leveraging technological innovations such as voice recognition, AI integration, and seamless connectivity to enhance in-vehicle experiences. The presence of leading automotive OEMs, along with favorable regulatory frameworks for autonomous and semi-autonomous driving, further boosts the adoption of digital cockpit solutions in this region.

Europe represents a mature market for next-generation digital cockpit technologies, driven by stringent safety regulations, a focus on reducing emissions, and a robust demand for electric vehicles (EVs). The region’s automotive industry is heavily invested in enhancing in-car user experience, integrating advanced display systems, and fostering seamless connectivity.

Germany, as a major automotive hub, plays a central role, with its manufacturers leading the adoption of digital cockpit solutions. Additionally, the presence of tech-savvy consumers across countries like France, the UK, and Scandinavia supports demand for innovative automotive technologies.

The emphasis on autonomous driving and the European Union’s push towards smart mobility are likely to sustain growth in this market segment. The Middle East & Africa region is gradually adopting next-generation digital cockpit technologies, driven by a growing luxury vehicle market and increasing consumer interest in advanced automotive technologies.

The UAE and Saudi Arabia, in particular, are emerging as key markets within this region due to their high disposable incomes and a preference for premium vehicles equipped with the latest in-car technology.

The region’s investment in smart cities and infrastructure is creating opportunities for connected and autonomous vehicle technology, indirectly supporting the adoption of digital cockpits.

However, market growth in this region is tempered by varying economic conditions across different countries, which can impact the pace of technology adoption.

In Latin America, the market for next-generation digital cockpit solutions is in a developing phase, with growth being driven by an expanding middle class and rising demand for connected cars in markets such as Brazil and Mexico.

The adoption of digital cockpit technologies is further encouraged by a shift towards electric vehicles (EVs) and hybrid models in response to global trends towards reducing carbon emissions.

Brazil, as the largest automotive market in the region, plays a key role, with local manufacturers increasingly incorporating digital interfaces and connectivity solutions into their offerings.

While the region faces challenges such as economic volatility and infrastructure constraints, the long-term outlook remains positive due to the gradual modernization of the automotive sector.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the landscape of the global Next-Generation Digital Cockpit Market is significantly shaped by the contributions and innovations of several key players, each bringing unique strengths and strategic focuses to the forefront.

Continental AG and Robert Bosch GmbH are at the vanguard, leveraging their extensive expertise in automotive electronics to integrate sophisticated ADAS features into digital cockpits. Their focus on creating user-friendly interfaces and enhancing vehicle connectivity demonstrates a commitment to evolving consumer demands in high-tech automotive solutions.

Denso Corporation and Hyundai Mobis play crucial roles, particularly in the Asia-Pacific region, by advancing display technologies and modular solutions that offer scalability across different vehicle models. Their innovations are crucial in driving the adoption of digital cockpits in emerging markets where cost-effectiveness paired with advanced technology is paramount.

Visteon Corporation and Faurecia SE are noteworthy for their emphasis on aesthetic and functional integration, offering sleek, customizable user interfaces that enhance the overall user experience. Visteon’s cockpit domain controller platforms and Faurecia’s focus on intuitive user interfaces represent significant advancements in cockpit technology.

Garmin Ltd. and Pioneer Corporation distinguish themselves with enhancements in multimedia and navigation systems, integrating real-time data processing to deliver enhanced navigational aids and entertainment options, crucial for the consumer satisfaction index.

HARMAN International excels in integrating sophisticated audio and infotainment systems, enriching the in-cabin experience and setting high industry standards for multimedia functionalities.

Panasonic Corporation leverages its cross-sector expertise to fuse consumer electronics innovations with automotive demands, leading to highly integrated and intelligent systems that support driver and passenger needs seamlessly.

Aptiv PLC and DXC Technology Company are pivotal in integrating next-generation software solutions with hardware, focusing on cybersecurity and data analytics to enhance the safety and personalization of digital cockpits.

These key players are not only enhancing their competitive edge but also collectively driving the market forward through technological innovation, strategic partnerships, and a deep understanding of evolving automotive trends.

Each company’s specific focus areas contribute to a more integrated, intuitive, and immersive digital cockpit environment, pushing the boundaries of what these systems can achieve.

Top Key Players in the Market

- Continental AG

- Denso Corporation

- Faurecia SE

- Garmin Ltd.

- HARMAN International

- Hyundai Mobis

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

- Robert Bosch GmbH

- Aptiv PLC

- DXC Technology Company

- Other Key Players

Recent Developments

- In 2023, in Las Vegas, ECARX and smart introduced their new high-performance digital cockpit platform at CES 2023. This innovative platform, developed in collaboration, uses advanced AMD technology to enhance the in-car digital experience.

- In 2023, BlackBerry Limited and PATEO, a leading provider of Internet of Vehicles (IoV) technology from China, announced that Dongfeng Motor has chosen their BlackBerry IVY™-powered digital cockpit for its next-generation electric VOYAH H97 model. This decision came after a successful proof of concept (POC) test.

- In 2023, Analog Devices, Inc .and Hon Hai Technology Group, better known as Foxconn (TWSE: 2317), signed a Memorandum of Understanding (MoU). This partnership aims to develop advanced digital car cockpits and a high-performance battery management system (BMS). The agreement was formalized by ADI’s CEO, Vincent Roche, and Foxconn’s CEO, Young Liu.

- In 2023, ECARX Holdings, Inc. hosted its first investor day, where it revealed a range of new technologies designed to improve the driving experience. Key announcements included Super Brain, an integrated central computing system, and Makalu, a cutting-edge cockpit platform featuring real-time 3D rendering and enhanced safety features. ECARX also shared news of its partnership with Epic Games to develop 3D immersive in-vehicle digital cockpits and infotainment systems.

Report Scope

Report Features Description Market Value (2023) US$ 25.6 Bn Forecast Revenue (2032) US$ 61.4 Bn CAGR (2023-2032) 10.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Equipment Type- Digital Instrument Cluster, Driving Monitoring System, Head-Up Display(HUD), Advanced Head Unit, and Other Equipment Types: By Display- LCD, TFT-LCD, and OLED: By Vehicle Type-Passenger Cars, and Commercial Vehicles Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Continental AG, Denso Corporation, Faurecia SE, Garmin Ltd., HARMAN International, Hyundai Mobis, Panasonic Corporation, Pioneer Corporation, Visteon Corporation, Robert Bosch GmbH, Aptiv PLC, DXC Technology Company, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next-Generation Digital Cockpit MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Next-Generation Digital Cockpit MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental AG

- Denso Corporation

- Faurecia SE

- Garmin Ltd.

- HARMAN International

- Hyundai Mobis

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

- Robert Bosch GmbH

- Aptiv PLC

- DXC Technology Company

- Other Key Players