Global Next Generation Computing Market Size, Share, Statistics Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Type (Quantum Computing, High Performance Computing, Edge Computing, Cloud Computing, Other Types), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136093

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Type Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

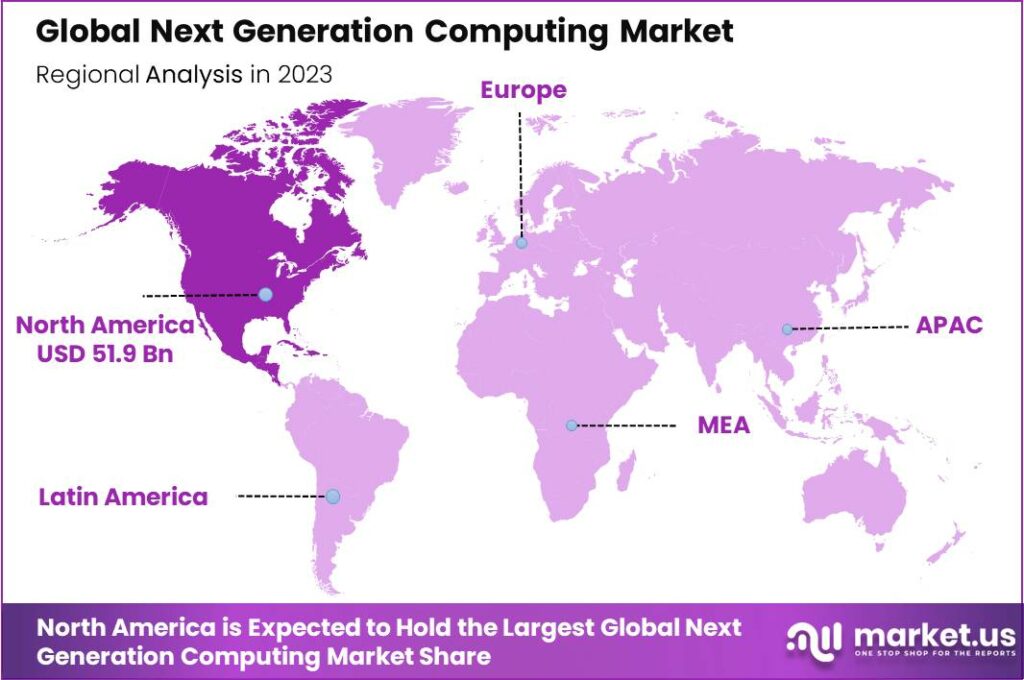

The Global Next Generation Computing Market size is expected to be worth around USD 738.2 Billion By 2033, from USD 135.2 Billion in 2023, growing at a CAGR of 18.50% during the forecast period from 2024 to 2033. In 2023, North America captured over 38.4% of the market share in the Next Generation Computing market, generating USD 51.9 billion in revenues, thus holding a dominant position.

Next Generation Computing refers to the latest advancements in computer technology that significantly enhance processing power, speed, and efficiency. This sector is characterized by the integration of cutting-edge technologies such as quantum computing, AI, machine learning, and cloud computing. These innovations are poised to transform various industries by enabling more complex and efficient data processing capabilities.

The growth of the Next Generation Computing market is largely driven by the continuous need for higher computing power and more efficient data processing across industries. Increased investment in research and development by key market players and a surge in demand for advanced technologies such as quantum and cloud computing further fuel this growth.

The rise of data-intensive applications in sectors such as healthcare, automotive, and telecommunications also necessitates the development of more sophisticated computing solutions. Market demand for Next Generation Computing is robust, propelled by the increasing adoption of AI and machine learning across various sectors. Enterprises are leveraging these technologies to gain insights from big data, enhance decision-making, and improve operational efficiencies.

The healthcare sector, in particular, is seeing a significant uptake in next-generation computing for drug discovery, patient diagnostics, and personalized medicine, driving further expansion of the market. The Next Generation Computing market presents numerous opportunities, particularly in cloud computing and services that offer flexibility, scalability, and cost efficiency.

The cloud model’s ability to provide powerful computing capabilities without the need for substantial upfront capital investment makes it especially attractive to small and medium-sized enterprises. Furthermore, governmental and corporate investments in ICT infrastructure globally support the broader adoption of these solutions, creating more growth opportunities in the market

The expansion of the next-generation computing market is evident across global regions, with particular emphasis on enhancing connectivity and computational power. The integration of 5G networks are also playing a crucial role in this expansion, providing the necessary infrastructure to support the growth and deployment of these advanced computing technologies.

This growth is unlocking new opportunities for businesses and consumers, offering advanced computing solutions once considered futuristic. Technological advancements in Next Generation Computing include developments in quantum computing, AI, and the expansion of cloud-based platforms. Quantum computing, for example, is set to revolutionize industries by processing information at speeds unachievable by traditional computers.

Key Takeaways

- The Global Next Generation Computing Market size is expected to reach approximately USD 738.2 Billion by 2033, up from USD 135.2 Billion in 2023, growing at a CAGR of 18.50% during the forecast period from 2024 to 2033.

- In 2023, the Hardware segment held a dominant market position in the Next Generation Computing market, capturing more than 47.9% of the market share.

- The On-Premise segment also held a leading market position in 2023, capturing over 65.1% of the market share.

- The Cloud Computing segment accounted for more than 29.5% of the market share in 2023, maintaining a strong position within the Next Generation Computing market.

- The Large Enterprises segment dominated the market in 2023, with a share of over 67.2%.

- The IT and Telecommunications segment held a significant position in the market in 2023, accounting for more than 25.3% of the share.

- In 2023, North America held a dominant market share of over 38.4%, generating USD 51.9 billion in revenues within the Next Generation Computing market.

Component Analysis

In 2023, the Hardware segment held a dominant market position in the Next Generation Computing market, capturing more than 47.9% of the market share.

The demand for advanced hardware capable of higher processing speeds and greater data capacity is driven by industries adopting complex applications like AI and big data analytics. This need has led to significant investments in developing and acquiring cutting-edge hardware solutions.

Hardware is integral to the deployment of emerging technologies like quantum computing and AI. These technologies require specialized processors and high-performance computing capabilities that are only possible with advanced hardware. The hardware segment benefits directly from the surge in these technologies, as they rely heavily on the underlying physical components to function effectively.

The expansion of the Internet of Things (IoT) and the proliferation of smart devices across various sectors require robust hardware to process and manage the increased data flow. From smart homes to industrial IoT applications, the demand for effective and efficient hardware continues to drive the market growth.

Deployment Mode Analysis

In 2023, the On-Premise segment held a dominant market position in the Next Generation Computing market, capturing more than a 65.1% share. This significant market share can be attributed to the enhanced control and security that on-premise solutions offer to organizations.

Many businesses, particularly those in sectors like finance, healthcare, and government, continue to prioritize on-premise systems due to their ability to provide stringent security measures and compliance with regulatory requirements. These factors are crucial for organizations that handle sensitive data, where security breaches can have severe consequences.

The preference for on-premise computing infrastructure also stems from its reliability and performance consistency. Organizations that require high-performance computing capabilities find that on-premise solutions can be more stable and offer faster data processing speeds because they do not rely on internet connectivity. This setup is essential for industries where real-time data processing and immediate results are critical, such as in manufacturing and telecommunications.

Type Analysis

In 2023, the Cloud Computing segment held a dominant market position within the Next Generation Computing market, capturing more than a 29.5% share. This prominence can be attributed to the widespread adoption of cloud services across various industries, including finance, healthcare, and retail, driven by the segment’s scalability, cost-efficiency, and enhanced collaborative capabilities.

The Cloud Computing segment’s leadership in the market is further reinforced by ongoing technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) technologies. These enhancements have improved the efficiency and capabilities of cloud services, making them more attractive to enterprises looking to innovate and improve their operational efficiencies.

The growth of the Cloud Computing segment has been fueled by significant investments from major tech companies, which are improving existing solutions and creating new services that integrate with emerging technologies like IoT and edge computing. This strategy aims to build comprehensive ecosystems that drive customer adoption of cloud computing in digital transformation efforts.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Next Generation Computing market, capturing more than a 67.2% share. This dominance is primarily due to the substantial financial resources available to large enterprises, enabling them to invest in cutting-edge computing technologies.

These organizations often lead in adopting new technologies that require significant upfront investment, such as advanced AI systems, quantum computing, and big data analytics platforms, which are integral components of next-generation computing.

Large enterprises typically have more complex operational needs that next-generation computing technologies can address. These include managing vast amounts of data, requiring high-speed processing and enhanced computing power that next-generation technologies provide.

Furthermore, large enterprises are often better positioned to attract skilled IT professionals capable of implementing and managing sophisticated next-generation computing systems. This talent advantage allows them to leverage these technologies effectively, maximizing their potential to transform business operations and drive growth.

Industry Vertical Analysis

In 2023, the IT and Telecommunications segment held a dominant market position within the Next Generation Computing market, capturing more than a 25.3% share. This leadership is largely due to the critical need for advanced computing technologies to manage the vast amounts of data generated by modern telecommunication networks and IT infrastructures.

The dominance of the IT and Telecommunications segment is also supported by the continuous innovation in network technologies, including network function virtualization (NFV) and software-defined networking (SDN). These technologies require robust computing power to optimize data traffic and resource management, which enhances the efficiency and reliability of network services.

Financial investment in this segment has surged as companies prioritize upgrading their infrastructure to support increasing data traffic and to improve the customer experience. Major players in IT and telecommunications are investing heavily in AI and machine learning platforms, which are integral to developing predictive maintenance, network optimization, and customer service solutions.

The IT and Telecommunications segment is expected to maintain its market lead, driven by accelerating digital transformation across industries. As businesses and consumers increasingly rely on digital communications and cloud services, demand for advanced computing capabilities in this sector will keep rising.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Type

- Quantum Computing

- High Performance Computing

- Edge Computing

- Cloud Computing

- Other Types

By Enterprise Size

- Small and Medium Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Manufacturing

- Retail

- Healthcare

- Other Industry Verticals

Driver

Advancements in Quantum Computing

Quantum computing offers a major leap in computational power, capable of solving complex problems beyond classical computers. This advancement is driven by qubits, which can exist in multiple states simultaneously, enabling unparalleled parallel processing.

Such capabilities are poised to revolutionize fields like cryptography, optimization, and complex simulations, providing solutions to challenges previously deemed intractable. The ongoing research and development in quantum technologies underscore a commitment to overcoming current technical limitations, with the aim of achieving practical and scalable quantum computing systems.

Restraint

Complexity of Integration

Implementing next-generation computing solutions, such as quantum computing and advanced parallel processing architectures, presents significant challenges due to their inherent complexity. These systems require sophisticated hardware and software, often involving intricate protocols and interfaces that differ from traditional computing models.

The integration of diverse components and subsystems, each with unique operational requirements, complicates the development process. Establishing seamless connectivity and interoperability among these elements demands substantial investments in time and resources. Moreover, the absence of standardized frameworks exacerbates compatibility issues, hindering widespread adoption.

Opportunity

Edge Computing and Mobile Integration

The rapid growth of Internet of Things (IoT) devices has led to an explosion in the amount of data generated, driving the need for real-time processing. Edge computing, which processes data closer to where it is generated rather than relying on centralized cloud servers, offers a solution to reduce latency and improve efficiency.

By processing data closer to its source, edge computing reduces latency, enhances response times, and alleviates bandwidth constraints associated with centralized data centers. This approach is particularly beneficial in applications requiring immediate analysis and action, such as autonomous vehicles, industrial automation, and remote healthcare monitoring.

Challenge

Technical Hurdles and Ethical Considerations

The development and deployment of next-generation computing technologies are fraught with technical challenges, including issues of scalability, reliability, and interoperability. Ensuring these systems can operate seamlessly across various platforms and applications requires overcoming significant engineering obstacles.

Additionally, ethical considerations such as fairness, accountability, and transparency are paramount. The potential for unintended consequences, including biases in decision-making processes and the displacement of human labor, necessitates a careful and responsible approach to the advancement of these technologies.

Emerging Trends

Computing is evolving rapidly, introducing technologies that are reshaping our world. Artificial Intelligence (AI) stands at the forefront, enabling machines to perform tasks that typically require human intelligence, such as understanding language and recognizing patterns. This advancement is transforming industries by automating processes and enhancing decision-making.

Quantum computing is another groundbreaking development. Unlike traditional computers, quantum computers process information in fundamentally new ways, potentially solving complex problems much faster. This capability could revolutionize fields like cryptography and complex system simulations.

Edge computing brings data processing closer to where it’s generated, reducing latency and improving efficiency. By handling data locally, devices can respond more quickly, which is crucial for applications like autonomous vehicles and real-time analytics.

Business Benefits

- Enhanced Problem-Solving: Technologies like quantum computing can tackle complex challenges that traditional computers struggle with, leading to innovative solutions across various industries.

- Improved Efficiency: Advanced computing systems integrate automation and intelligent algorithms to optimize workflows, reducing the need for manual intervention. By streamlining operations, these systems enable businesses to operate more smoothly, which not only increases productivity but also cuts down operational costs.

- Real-Time Data Processing: The rise of edge computing allows businesses to process data locally, near its source, rather than relying on distant cloud servers. This minimizes latency and accelerates decision-making, making it possible to respond instantly to changing conditions.

- Increased Security: Next-generation computing offers advanced security features, such as improved encryption and authentication protocols, helping businesses protect sensitive information more effectively.

- Scalability and Flexibility: Cloud-based next-gen computing solutions allow businesses to scale resources up or down based on demand, providing flexibility and supporting growth without significant infrastructure.

Regional Analysis

In 2023, North America held a dominant market position in the Next Generation Computing market, capturing more than a 38.4% share, with revenues amounting to USD 51.9 billion. This leading position can be largely attributed to the region’s robust technological infrastructure and the presence of key industry players that drive innovation and development in next-generation computing technologies such as quantum computing, AI, and edge computing.

The region’s commitment to research and development is another crucial factor underpinning its leadership in the market. Significant investments in R&D by both public and private sectors facilitate continuous improvements in computing technologies, ensuring that North America often sets global standards for the next-generation computing industry.

Moreover, North America’s regulatory environment is conducive to the growth of the next-generation computing market. Policies and initiatives aimed at boosting technological advancements, coupled with support for intellectual property rights, create a favorable business climate for companies operating in this space.

The high adoption rate of advanced technologies across various sectors such as healthcare, automotive, and finance in North America further fuels demand for next-generation computing solutions. This widespread adoption is driven by the need to handle large data volumes and perform complex computations quickly and accurately, a requirement that next-generation computing technologies are well-equipped to meet.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the landscape of next-generation computing, Amazon Web Services, Inc. (AWS) stands out as a leading player. AWS has pioneered numerous advancements in cloud computing, offering scalable and efficient solutions that are integral to next-generation technologies. Their services support everything from machine learning to quantum computing, making them essential for companies advancing tech development.

IBM Corporation has long been synonymous with innovation in the computing industry, and its foray into next-generation technologies is no exception. IBM is at the forefront of developing quantum computing systems and artificial intelligence, aiming to transform industries ranging from finance to healthcare.

Cisco Systems, Inc. is another major entity in the realm of next-generation computing, particularly known for its contributions to networking and cybersecurity. Cisco’s approach to next-gen computing includes advanced networking solutions that support the vast data flows required by modern computing frameworks, including AI and machine learning operations.

Top Key Players in the Market

- Amazon Web Services, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- NVIDIA Corporation

- Intel Corporation

- Google LLC

- Microsoft Corporation

- D-Wave Quantum Inc.

- Qualcomm Technologies, Inc.

- Hewlett Packard Enterprise (HPE)

- Other Key Players

Top Opportunities Awaiting for Players

The next-generation computing market presents numerous opportunities for players, driven by several key growth areas.

- Edge and Mobile Computing Expansion: As industries adapt to the Internet of Things (IoT), the demand for edge and mobile computing solutions is surging. This growth is fueled by the need for real-time analytics and the ability to handle massive data sets with minimal latency, presenting substantial opportunities for market participants to expand their offerings in sectors like manufacturing, healthcare, and transportation.

- Artificial Intelligence (AI) Integration: The growing use of AI across sectors drives demand for advanced computing technologies like quantum and neuromorphic computing. These technologies support AI’s need for substantial computational resources, enhancing decision-making, automation, and creating new opportunities for computing solution providers.

- Quantum Computing Advancements: Quantum computing, particularly cloud-based quantum services provided by major companies like IBM and Google, is rapidly emerging as a game-changer. This technology allows complex computations at unprecedented speeds, offering growth opportunities for technology firms as they provide new quantum computing capabilities to a broader market.

- Increased Cloud Adoption: Cloud computing remains a critical area with high growth potential, driven by the flexibility it offers businesses to scale resources. This segment is expected to continue its dominance, with more organizations leveraging cloud platforms for cost-effective and scalable computing solutions.

- Technological Innovations in Healthcare and IT: In sectors such as healthcare and IT, next-generation computing technologies like edge computing are revolutionizing operations. For healthcare, this means more efficient telehealth services and robotic surgeries, while IT benefits from enhanced data management and network solutions, further driving sector-specific market growth.

Recent Developments

- In November 2023, AWS and NVIDIA have announced a strategic collaboration to provide new supercomputing infrastructure, software, and services for generative AI. This partnership includes the launch of Amazon EC2 instances powered by NVIDIA’s next-generation Grace Hopper Superchip and the creation of Project Ceiba.

- In February 2024, Cisco joined the Linux Foundation’s Post-Quantum Cryptography Alliance, collaborating with other tech leaders to address cryptographic security challenges posed by quantum computing.

- In June 2024, HPE announced a partnership with NVIDIA to offer products that enable companies to adopt generative AI systems in secure private clouds, leveraging HPE’s supercomputing expertise to provide customizable AI solutions for large corporate clients.

- In December 2024, Google introduced ‘Willow,’ a quantum computing chip capable of solving complex tasks in mere minutes, a feat that would take classical supercomputers an unimaginably long time. This advancement underscores Google’s significant progress in quantum computing.

Report Scope

Report Features Description Market Value (2023) USD 135.2 Bn Forecast Revenue (2033) USD 738.2 Bn CAGR (2024-2033) 18.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Deployment Mode (Cloud-Based, On-Premise), By Type (Quantum Computing, High Performance Computing, Edge Computing, Cloud Computing, Other Types), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Other Industry Verticals), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services, Inc., IBM Corporation, Cisco Systems, Inc., NVIDIA Corporation, Intel Corporation, Google LLC, Microsoft Corporation, D-Wave Quantum Inc., Qualcomm Technologies, Inc., Hewlett Packard Enterprise (HPE), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Generation Computing MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Next Generation Computing MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- NVIDIA Corporation

- Intel Corporation

- Google LLC

- Microsoft Corporation

- D-Wave Quantum Inc.

- Qualcomm Technologies, Inc.

- Hewlett Packard Enterprise (HPE)

- Other Key Players