Global Neurovascular Catheters Market By Type-(Microcatheters, Balloon Catheters, Access Catheters, Embolization Catheters, Others) By Application-(Embolic Stroke, Brain Aneurysms, Arteriovenous Malformations, Others) By End Use-(Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: July 2024

- Report ID: 12012

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

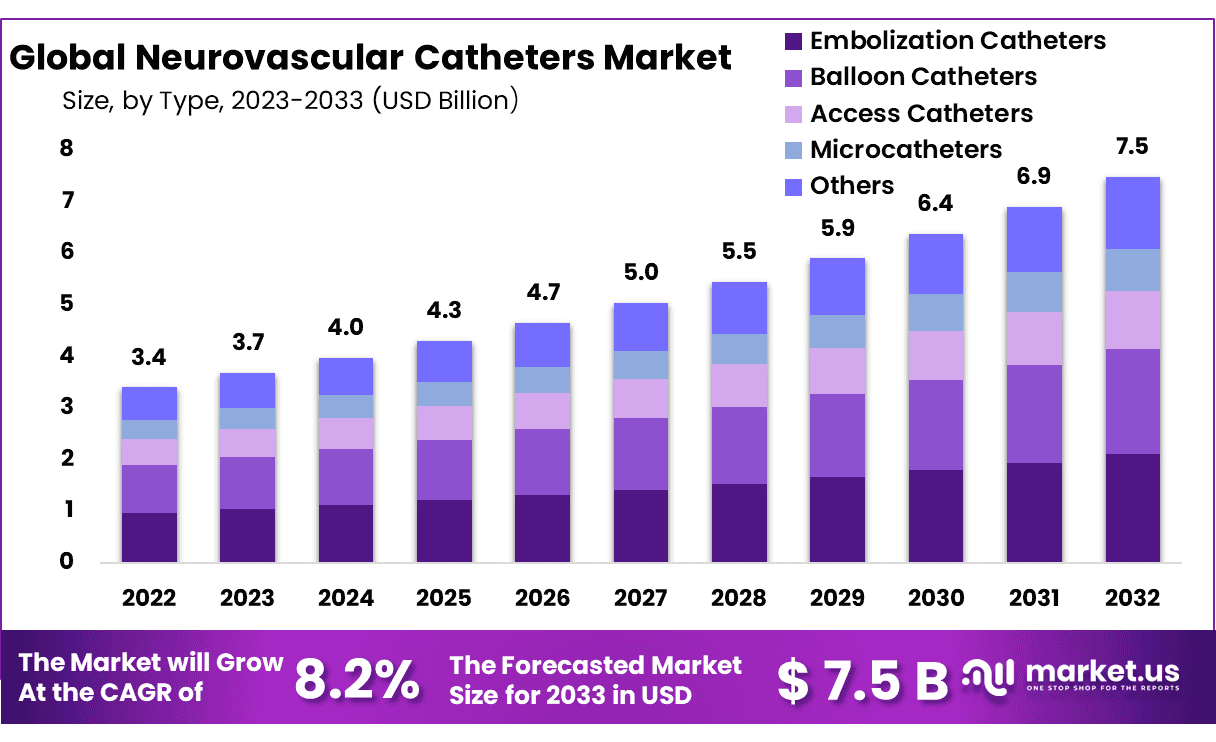

The Global Neurovascular Catheters Market size is expected to be worth around USD 7.5 Billion by 2033 from USD 3.4 Billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

Neurovascular catheters play an integral part in neurovascular surgeries conducted within the brain and intracranial spaces, and their design must ensure it does not damage or perforate sensitive neurovascular organs. Their applications span various functions such as providing access to neurovascular organs or aiding delivery of embolic coils or thrombectomy devices; their usage will likely drive demand over the forecast period.

FDA regulations classify neurovascular catheters as Class II (870.1330). According to FDA regulations, neurovascular catheters are used to remove blood clots from cerebral neuro vasculature using mechanical methods such as suction, laser, or ultrasound.

Market growth is mainly driven by the increasing incidence of neurological conditions like stroke and brain aneurysms, sedentary lifestyles, increased awareness about neurological conditions, increased disposable incomes, and the launch of new products by market major players. Due to limited access to medical services, COVID-19 created a major disruption. This has led patients with other diseases to receive inadequate medical services. The pandemic has adversely affected neuro care clinics as well as neurosurgeons. Due to the lower transmission rate of the disease, many brain-related surgeries were delayed or canceled during this time.

Key Takeaways

- Market Size & Growth: Neurovascular Catheters Market size is expected to be worth around USD 7.5 Billion by 2033 from USD 3.4 Billion in 2023, growing at a CAGR of 8.2%Product Analysis: In terms of ‘Product Type’, the ‘Embolization Catheters’ segment dominated, with a market share of more than 28.1%, in 2023

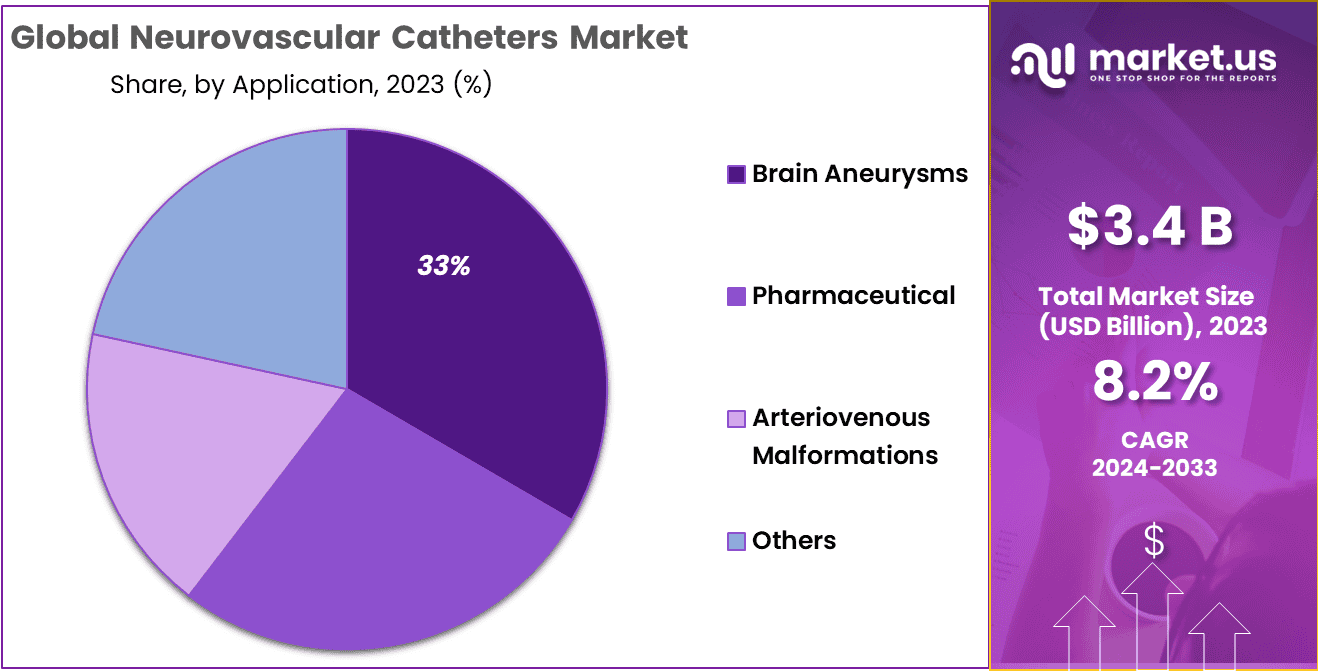

- Application Analysis: In terms of ‘Application’, the Brain Aneurysm market segment accounted 33.4% of revenue share in 2023.

- End-Use Analysis: In 2023, the ‘Hospitals’ segment was dominant and accounted for a revenue share greater than 56.7%.

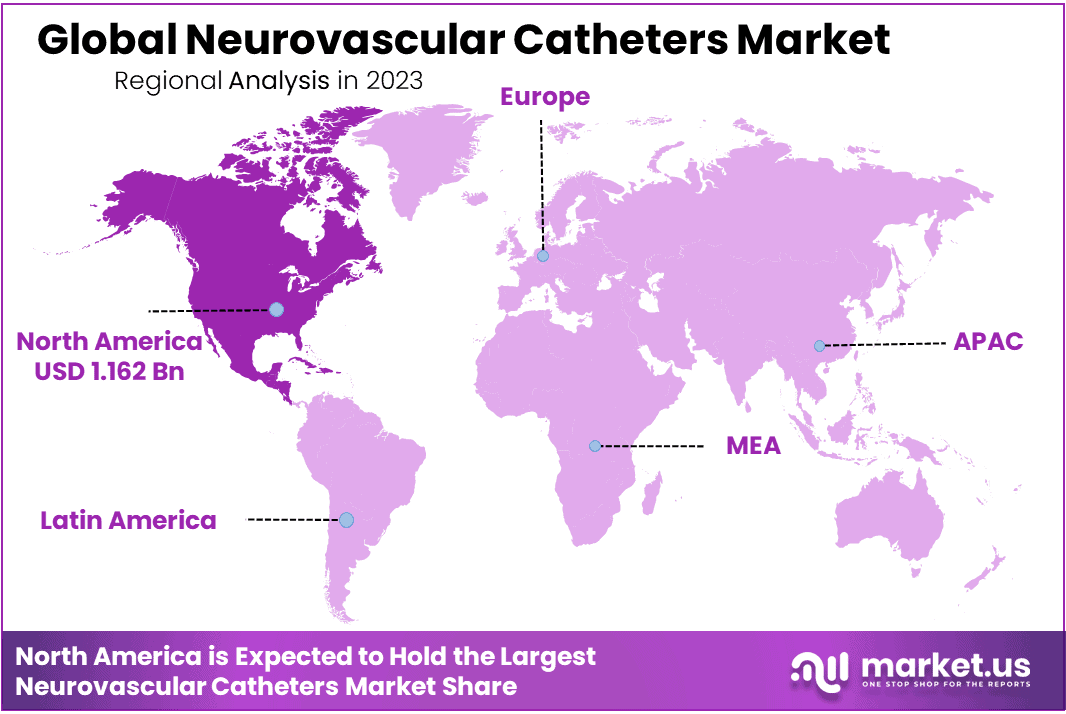

- Regional Analysis: North America was the dominant regional market, accounting for more than 34.2% of market share and USD 1.162 Billion revenues in 2023

- Recent Trends: Neurovascular catheters market is experiencing continuous technological advancement, as companies introduce innovative catheter designs, advanced materials and improved coatings to stay competitive in this competitive marketplace.

- Future Prognosis: The market for neurovascular catheters is expected to experience steady expansion, driven by growing demand for minimally invasive neurovascular interventions and an aging.

Product Type Analysis

In terms of ‘Product Type’, the ‘Embolization Catheters’ segment dominated, with a market share of more than 28.1%, in 2023. The ‘Microcatheters’ segment is expected to grow at a 8.6% revenue-based CAGR over the forecast period. The market for neurovascular catheters can be divided into microcatheters and balloon catheters as well as access catheters and embolization devices.

Microcatheters will be driven by the increasing use of neurosurgical procedures, as well as the introduction of highly-technical microcatheters by key market players such as Medtronic, Stryker, and Terumo Corporation. Microcatheters are also useful for navigation in small veins. This allows surgeons to reach tumors or clots in these small veins which are difficult to access with other neurovascular catheters. This is driving up the demand for neurovascular microcatheters.

Application Analysis

With respect to ‘Application’, the ‘Brain Aneurysm’ market segment accounted 33.4% of revenue share in 2023. This is due to factors like the increasing incidence of brain aneurysms, new product launches by market players, as well as increasing awareness concerning brain aneurysm treatment. The treatment of many diseases and conditions such as brain aneurysms, embolic strokes, and arteriovenous malformations, among others, can be carried out using neurovascular catheters.

The highest revenue-based CAGR, 11.9%, is expected to be registered by the ‘Others’ segment over the forecast period. There are several key factors that contribute to this segment’s growth, including an increasing number of patients with atherosclerosis and intracranial arterial stenosis, increasing initiatives by governments, and a spike in R&D investments.

End-Use Analysis

In 2023, the ‘Hospitals’ segment was dominant and accounted for a revenue share greater than 56.7%. This segment is driven by government funding, advanced products, and skilled neurosurgeons. The segment is also driven by the increasing number of hospitals around the world, and improvements in healthcare infrastructure across developing nations.

The highest revenue-based CAGR for the ‘Ambulatory Surgical Centers segment is expected to be 16.7% over the forecast period. The segment growth is being driven by the provision of same-day surgical treatments, including preventive and diagnostic procedures, shorter wait times at an ambulatory surgical center, personalized care, and supportive government initiatives.

Kеу Маrkеt Ѕеgmеntѕ

Type

- Microcatheters

- Balloon Catheters

- Access Catheters

- Embolization Catheters

- Others

Application

- Embolic Stroke

- Brain Aneurysms

- Arteriovenous Malformations

- Others

End Use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

Driver

Utilizing Advanced Neurovascular Access (ANA)

Advanced Neurovascular Access (ANA), an innovative stroke thrombectomy tool, has become one of the primary drivers in the neurovascular catheters market. The device features a self-expanding funnel component designed to restrict local blood flow while aligning with the width of the affected artery; this approach minimizes adverse effects due to clot breakup. Once deployed, the ANA device facilitates distal aspiration when used with a stent retriever (SR), transferring the clot securely into its tube for extraction. Market growth should continue with the implementation of advanced medical devices; hence adoption will continue over time.

Trend

Technological Advancements and the Rise in Neurovascular Disease Incidence

The neurovascular catheters market has experienced an explosion of technological advancements. Advancements in catheter design, materials, and functionality have focused on increasing precision, safety, and efficacy for neurovascular interventions. With strokes and aneurysms on the rise – as well as lifestyle factors and improved diagnostic capabilities driving demand – neurovascular catheters have become an indispensable resource.

Restraint

Inadequate Professional Know-How

An important challenge facing the global neurovascular catheters market is its dearth of skilled professionals. Due to the intricate nature of neurovascular catheters, their usage and maintenance require specific skill; lacking such individuals could result in complications, procedural errors, and diminished patient outcomes as well as ongoing monitoring with precise adjustments necessary for optimal device performance – making their absence an obvious barrier in this industry. As a result, their scarcity acts as a significant restraint.

Opportunities

Neurovascular Surgeries for AI/ML Integration

Endovascular neurosurgery offers transformative potential to neurovascular care through the integration of robotics and artificial intelligence (AI). AI’s use can interpret data and model human behavior, revolutionizing decision-making during surgeries. Machine learning models commonly employed in healthcare detect patterns in datasets to detect associations; artificial intelligence combined with machine learning may enhance the capabilities of neurovascular catheters allowing more effective use. It is anticipated that such advancements will bring numerous opportunities to market growth.

Regional Analysis

North America was the dominant regional market, accounting for more than 34.2% of market share and USD 1.162 Billion revenues in 2023. This is due to the increasing incidence of neurological diseases, favorable reimbursement policies, and growing awareness among individuals.

The Asia Pacific is expected to experience the fastest revenue growth of 9.5%, between 2023 and 2033. This region has significant growth potential due to increasing awareness of and access to neurovascular catheters. This region is also home to an increasing number of neurological diseases like stroke and brain aneurysms, which is slated to help boost regional market growth prospects.

The volume of neurosurgical procedures increasing among countries that are highly affected, including the U.S. and Russia. These countries are the most affected in terms of reported deaths and confirmed cases. The American College of Surgeons (ACS), in response to the rapid rise in COVID-19-related cases in the United States, issued a recommendation in March 2020 to cancel, postpone or curtail elective procedures. The ACS was followed by the Center for Medicare and Medicaid Services and the American Hospital Association, who also issued similar recommendations to reduce the spread of the coronavirus

Key Regions and Countries

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Market leaders are focused on innovative medical devices, growth strategies, and technological advancements. Stryker, Medtronic and Penumbra, Inc. dominate the neurovascular catheters market due to their comprehensive portfolios and extensive distribution networks worldwide. Notably, Stryker secured premarket approval from US FDA for their AXS catalyst distal access catheter, further solidifying their position within neurovascular procedures. Market leaders are actively making strategic acquisitions to broaden their offerings with advanced neurointervention catheters.

Маrkеt Kеу Рlауеrѕ

- Medtronic

- Stryker

- Terumo Corporation

- Integer Holdings Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Acandis GmbH

- Spiegelberg GmbH & Co. KG

Recent Developments

- Medtronic: In March 2024, Medtronic announced the acquisition of a neurovascular catheter startup, enhancing their portfolio in minimally invasive neurosurgery solutions. This acquisition aims to integrate advanced technologies, improving patient outcomes and expanding Medtronic’s market share in neurovascular therapies.

- Stryker: In June 2024, Stryker launched the latest version of their neurovascular catheter, the Stryker FlowStar 2.0. This new product features enhanced flexibility and precision, targeting improved patient outcomes in endovascular treatments for stroke and aneurysm management.

- Terumo Corporation: In May 2024, Terumo Corporation completed the merger with a leading neurovascular catheter manufacturer. This strategic move is expected to strengthen Terumo’s position in the global neurovascular market, expanding its product offerings and research capabilities.

- Integer Holdings Corporation: In April 2024, Integer Holdings Corporation introduced a new line of neurovascular catheters designed for complex neuro-interventional procedures. The new products offer advanced navigation capabilities, aiming to reduce procedure time and improve clinical outcomes.

- Penumbra, Inc.: In February 2024, Penumbra, Inc. acquired a pioneering firm specializing in neurovascular catheter technology. This acquisition is expected to accelerate innovation and enhance Penumbra’s product development pipeline, addressing unmet needs in neurovascular care.

- Johnson & Johnson Services, Inc.: In January 2024, Johnson & Johnson Services, Inc. announced the launch of their cutting-edge neurovascular catheter system, designed to offer superior control and safety during neuro-interventional procedures. This launch aligns with their commitment to advancing neurovascular health through innovative medical solutions.

Report Scope

Report Features Description Market Value (2023) USD 3.4 Billion Forecast Revenue (2033) USD 7.5 Billion CAGR (2024-2033) 8.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Microcatheters, Balloon Catheters, Access Catheters, Embolization Catheters, Others);By Application-(Embolic Stroke, Brain Aneurysms, Arteriovenous Malformations, Others);By End Use-(Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Centers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Medtronic, Stryker, Terumo Corporation, Integer Holdings Corporation, Penumbra, Inc., Johnson & Johnson Services, Inc., Integra LifeSciences Corporation, Acandis GmbH, Spiegelberg GmbH & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Neurovascular Catheters MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Neurovascular Catheters MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Stryker

- Terumo Corporation

- Integer Holdings Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Acandis GmbH

- Spiegelberg GmbH & Co. KG