Global Neuro Immunoassay Market By Product Type (Reagents & Kits and Analysers), By Technology (ELISA, Western Blot, Rapid Tests, Radioimmunoassays (RIA), Polymerase Chain Reaction (PCR), and ELISPOT), By Application (Alzheimer’s Disease, Spinal Muscular Atrophy (SMA), Parkinson’s Disease, Huntington’s Disease, and Amyotrophic Lateral Sclerosis (ALS)), By End-user (Hospitals & Clinics, Pharmaceutical Companies, Biopharmaceutical Companies, Academic Organizations, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168950

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

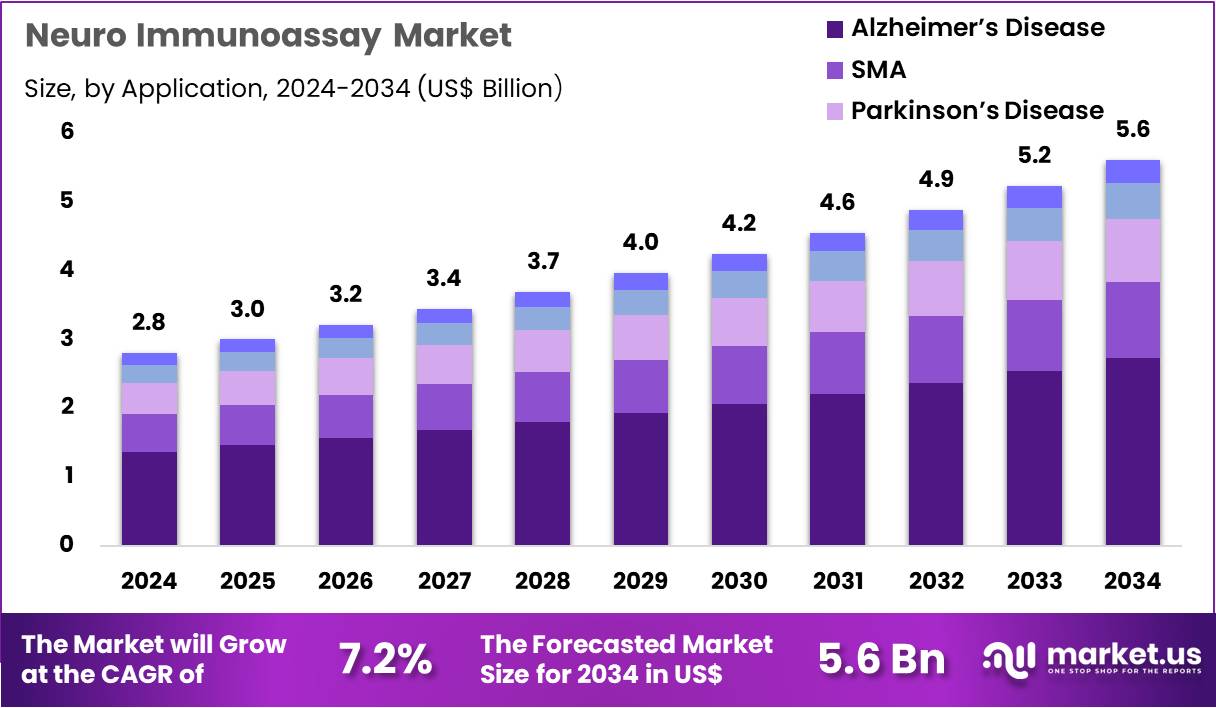

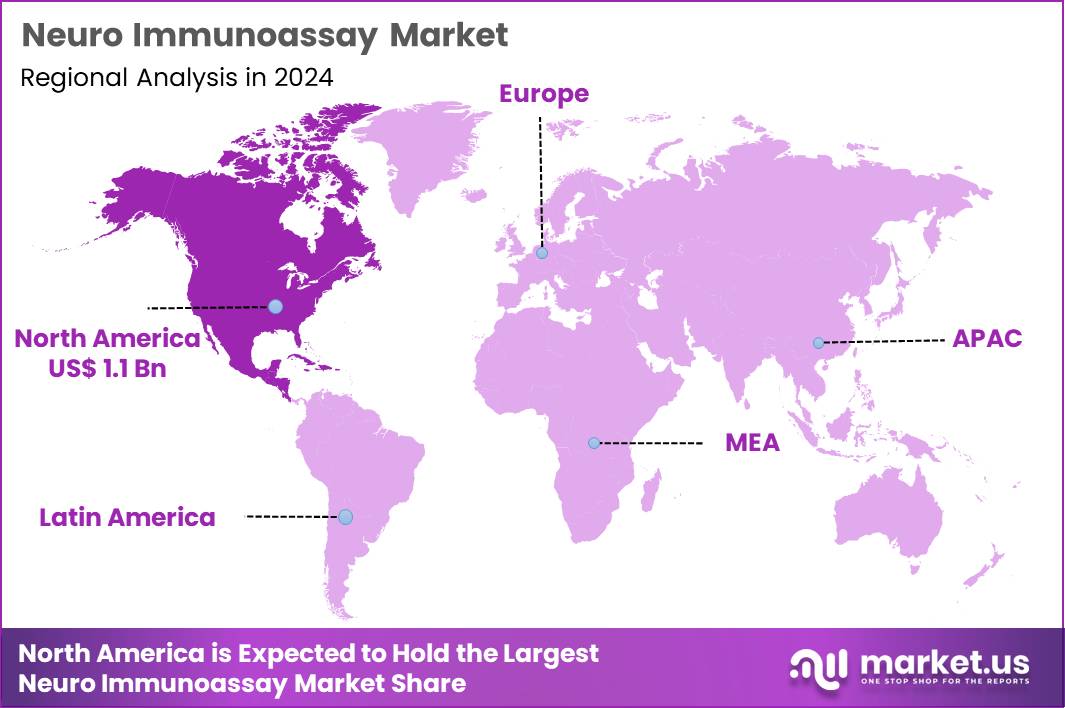

Global Neuro Immunoassay Market size is expected to be worth around US$ 5.6 Billion by 2034 from US$ 2.8 Billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 1.1 Billion.

Increasing recognition of neuroinflammatory pathways propels the Neuro Immunoassay market, as neurologists and psychiatrists seek objective biomarkers to guide diagnosis and therapeutic monitoring in complex brain disorders. Diagnostic manufacturers develop high-sensitivity chemiluminescent enzyme immunoassays that quantify minute protein concentrations from cerebrospinal fluid and serum samples.

These assays enable early Alzheimer’s disease detection through phosphorylated tau and amyloid-beta ratio measurements, multiple sclerosis progression tracking via neurofilament light chain levels, Parkinson’s disease differentiation with alpha-synuclein aggregation profiling, and traumatic brain injury severity grading using USS100B and GFAP markers. Advanced platforms create opportunities for longitudinal patient monitoring and clinical trial enrichment strategies.

Fujirebio released its Lumipulse® G sTREM2 assay on June 4, 2025, providing researchers with a precise tool to measure soluble TREM2 and deepen understanding of microglial activation in neurodegenerative processes. This launch directly expands the biomarker toolkit for investigating neuroinflammation and accelerates translational studies.

Growing demand for blood-based neurodegenerative screening accelerates the Neuro Immunoassay market, as healthcare systems prioritize minimally invasive tests to facilitate large-scale population studies and routine clinical assessments. Biotechnology firms engineer ultrasensitive digital ELISA platforms that detect femtogram-level analytes in plasma with laboratory-grade accuracy.

Applications encompass preclinical Alzheimer’s identification through plasma p-tau217 quantification, amyotrophic lateral sclerosis monitoring via neurofilament heavy chain trends, frontotemporal dementia subtyping with progranulin levels, and stroke outcome prediction using glial fibrillary acidic protein kinetics. Plasma-based assays open avenues for community screening programs and remote patient management via telemedicine integration. Pharmaceutical developers increasingly incorporate these immunoassays as companion diagnostics for emerging disease-modifying therapies.

Rising adoption of multiplex neuroinflammatory panels invigorates the Neuro Immunoassay market, as researchers combine cytokine, chemokine, and neuronal injury markers to generate comprehensive disease signatures. Instrument providers launch automated analyzers that process dozens of analytes simultaneously from microliter sample volumes.

These panels support autoimmune encephalitis diagnosis through neuronal antibody profiling, COVID-19 neurological complication assessment via cytokine storm detection, migraine chronification evaluation with CGRP pathway markers, and psychiatric disorder stratification using blood-brain barrier integrity indicators.

Multi-analyte approaches unlock opportunities for machine learning-driven pattern recognition and novel biomarker discovery. Academic-industry consortia actively validate these panels against gold-standard imaging and functional tests to establish clinical utility thresholds. This convergence positions neuro immunoassays as cornerstone tools in precision neurology and psychiatry.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.8 billion, with a CAGR of 7.2%, and is expected to reach US$ 5.6 billion by the year 2034.

- The product type segment is divided into reagents & kits and analysers, with reagents & kits taking the lead in 2024 with a market share of 59.4%.

- Considering technology, the market is divided into ELISA, western blot, rapid tests, RIA, PCR, and ELISPOT. Among these, ELISA held a significant share of 42.7%.

- Furthermore, concerning the application segment, the market is segregated into Alzheimer’s disease, SMA, Parkinson’s disease, Huntington’s disease, and ALS. The Alzheimer’s disease sector stands out as the dominant player, holding the largest revenue share of 48.6% in the market.

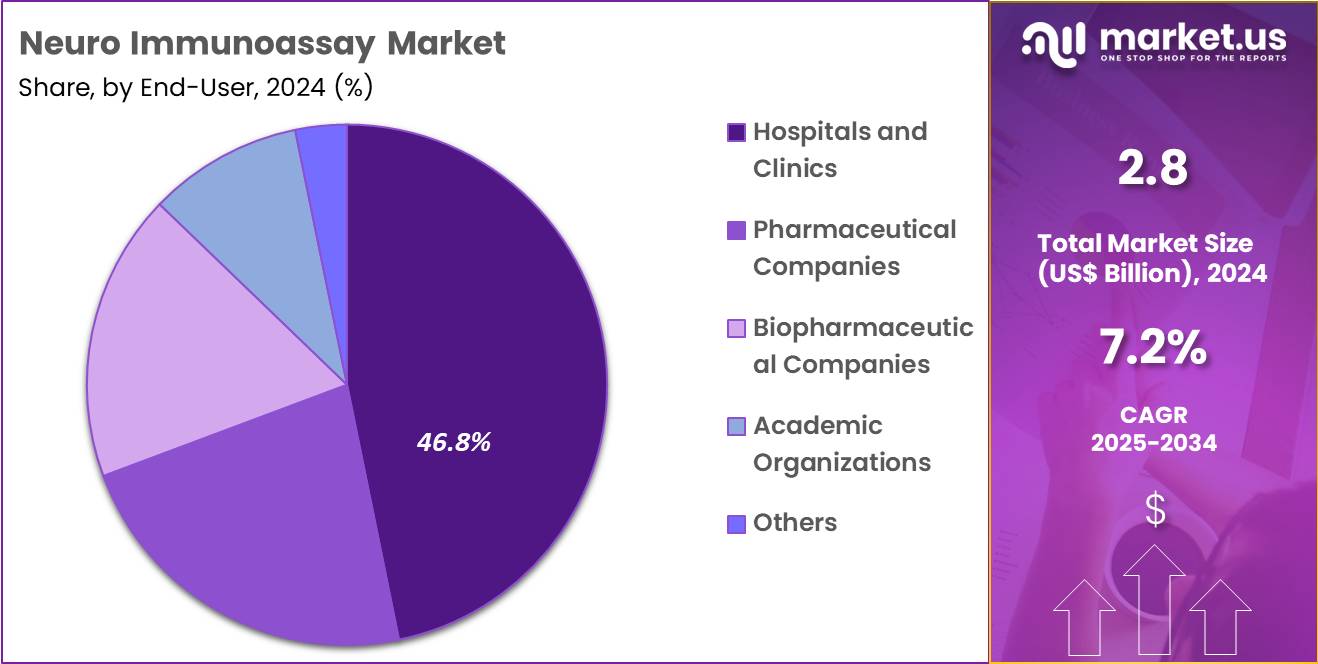

- The end-user segment is segregated into hospitals & clinics, pharmaceutical companies, biopharmaceutical companies, academic organizations, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 46.8%.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

Reagents and kits, holding 59.4%, are expected to dominate due to their essential role in neuro-immunoassay workflows across research, clinical diagnostics, and biomarker development. Neuroscience laboratories depend on high-sensitivity antibodies, detection reagents, and assay kits to quantify neuroinflammatory markers such as tau, beta-amyloid, neurofilaments, and cytokines. Rising prevalence of neurodegenerative disorders increases demand for reliable testing materials.

Pharmaceutical and biopharmaceutical companies intensify biomarker-driven drug development, expanding use of reagents in clinical-trial programs. Manufacturers develop multiplexed neuroassay kits that improve efficiency and reduce sample volume requirements. Hospitals and diagnostic labs adopt ready-to-use kits to accelerate testing turnaround.

Government and private funding support neurobiology research, increasing consumable purchases. Advancements in assay chemistry enhance accuracy, driving broader adoption. These drivers keep reagents and kits anticipated to remain the leading product type.

Technology Analysis

ELISA, holding 42.7%, is anticipated to dominate the technology segment due to its high sensitivity, straightforward workflow, and compatibility with large-scale neurobiomarker testing. Clinical laboratories depend on ELISA platforms to measure proteins associated with neuroinflammation and neuronal damage. Researchers use ELISA to validate biomarkers for Alzheimer’s disease, Parkinson’s disease, ALS, and other neurological conditions.

Pharmaceutical companies integrate ELISA into drug-development pipelines to track treatment response at the molecular level. Advancements in antibody specificity improve assay precision, driving increased usage. High throughput capability supports screening of multiple biomarkers from limited CSF or blood samples.

ELISA’s reproducibility strengthens confidence in longitudinal patient monitoring. Its adaptability to both manual and automated systems enhances operational flexibility. Growing interest in early neurodegenerative disease detection supports expanded ELISA adoption. These factors keep ELISA projected to remain the most influential technology in the neuro-immunoassay market.

Application Analysis

Alzheimer’s disease, holding 48.6%, is expected to dominate due to rising global prevalence and the urgent need for biomarkers that detect early cognitive decline. Neuro-immunoassays play a critical role in measuring beta-amyloid, tau, neurofilament light chain, and inflammatory cytokines, which support diagnosis and disease monitoring. Clinical researchers intensify studies on pathophysiology, increasing testing volumes.

Pharmaceutical companies expand Alzheimer’s drug pipelines, driving biomarker validation needs. Screening programs in aging populations emphasize early detection, increasing assay utilization. Imaging techniques often pair with immunoassays to strengthen diagnostic accuracy. Blood-based Alzheimer’s biomarkers gain traction, supporting broader testing accessibility.

Hospitals and specialty clinics integrate neurobiomarker panels into memory clinics and neurology units. Government and private organizations fund research into Alzheimer’s diagnostics, boosting market demand. These factors keep Alzheimer’s disease anticipated to remain the leading application.

End-User Analysis

Hospitals and clinics, holding 46.8%, are projected to dominate as they manage large patient populations suffering from neurodegenerative, autoimmune, and neuroinflammatory disorders. Clinicians depend on immunoassay results to support diagnosis, prognosis, and treatment planning. Hospitals expand neurology departments and memory-care programs, increasing testing volume. Rising awareness of early symptom recognition drives higher patient visits and biomarker testing.

Integration of automated immunoassay analysers improves test turnaround time and accuracy. Multidisciplinary care teams rely on neuro-immunoassay panels for comprehensive patient evaluation. Hospitals participate in clinical trials, increasing biomarker testing demand.

Growing prevalence of age-related neurological diseases strengthens reliance on immunoassays. Investment in specialized neurodiagnostic infrastructure expands assay adoption. These factors keep hospitals and clinics anticipated to remain the dominant end-user segment in the neuro-immunoassay market.

Key Market Segments

By Product Type

- Reagents & Kits

- Analysers

By Technology

- ELISA

- Western Blot

- Rapid Tests

- Radioimmunoassays (RIA)

- Polymerase Chain Reaction (PCR)

- ELISPOT

By Application

- Alzheimer’s Disease

- Spinal Muscular Atrophy (SMA)

- Parkinson’s Disease

- Huntington’s Disease

- Amyotrophic Lateral Sclerosis (ALS)

By End-user

- Hospitals & Clinics

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Academic Organizations

- Others

Drivers

Increasing Prevalence of Neurodegenerative Diseases is Driving the Market

The rising prevalence of neurodegenerative diseases, particularly Alzheimer’s, has established a compelling driver for the neuro immunoassay market, as these assays detect key biomarkers like amyloid-beta and tau proteins in cerebrospinal fluid or blood. This epidemiological shift, driven by aging populations, necessitates sensitive immunoassays for early diagnosis and progression monitoring to enable timely interventions.

Healthcare providers are increasingly relying on these tools to differentiate Alzheimer’s from other dementias, improving patient stratification for disease-modifying therapies. Diagnostic laboratories are expanding their immunoassay portfolios to include multiplex formats for comprehensive biomarker panels. Regulatory agencies support the validation of these assays as part of national dementia plans, ensuring their integration into clinical guidelines.

Collaborative research consortia facilitate large-scale studies, generating evidence for broader reimbursement coverage. The economic implications of delayed diagnosis, including long-term care costs, justify substantial investments in accessible immunoassay technologies.

Professional organizations advocate for routine screening with neuro immunoassays, embedding them in primary care workflows for at-risk individuals. This driver accelerates innovation in point-of-care devices, reducing dependency on invasive lumbar punctures. Educational initiatives for clinicians highlight the assays’ prognostic accuracy, fostering greater adoption across neurology practices.

Restraints

Regulatory and Validation Challenges are Restraining the Market

Stringent regulatory requirements and validation hurdles for neuro immunoassays continue to impose significant restraints, prolonging development timelines and elevating compliance costs for manufacturers. Agencies demand extensive analytical and clinical performance data, including inter-laboratory reproducibility, which burdens smaller innovators with resource-intensive studies. This barrier leads to delayed market entry, confining new assays to academic settings rather than widespread clinical use.

Laboratories face uncertainties in adopting unvalidated products, preferring established markers despite their limitations in sensitivity. The restraint exacerbates disparities in access, as high validation expenses translate to premium pricing in global markets. Policy harmonization efforts across regions remain fragmented, complicating multinational approvals and supply chains.

Manufacturers must navigate evolving standards for biomarker specificity, diverting funds from R&D to documentation. These challenges perpetuate reliance on CSF-based tests, hindering the shift to less invasive blood assays. International collaborations aim to streamline processes, but progress is incremental amid competing priorities. Addressing this necessitates simplified pathways for fit-for-purpose validations tailored to neuro diagnostics.

Opportunities

Advancements in Blood-Based Neuro Biomarkers are Creating Growth Opportunities

The evolution of blood-based neuro immunoassays for biomarkers like phosphorylated tau represents a major growth opportunity, offering non-invasive alternatives to cerebrospinal fluid testing for Alzheimer’s detection. These advancements enable earlier screening in primary care, expanding the addressable patient population beyond specialized neurology centers. Opportunities emerge in partnering with pharmaceutical companies to develop companion diagnostics for anti-amyloid therapies, ensuring assay alignment with drug approvals.

Regulatory incentives for breakthrough designations expedite validations, facilitating rapid commercialization of sensitive plasma assays. This shift supports population-level studies, generating data for guideline updates and reimbursement expansions. Economic projections indicate cost efficiencies from reduced procedural risks, appealing to value-based payers. Global consortia accelerate cross-ethnic validations, addressing variability in biomarker expression. These developments diversify revenue through integrated kits combining multiple neuro markers for differential diagnosis.

Emerging applications in Parkinson’s and frontotemporal dementia further broaden utility, tailoring panels to specific pathologies. Sustained funding will drive miniaturization for point-of-care deployment in underserved regions. As of the end of fiscal year 2024, the National Institutes of Health was funding 495 clinical trials for Alzheimer’s and related dementias, many incorporating blood-based biomarker assays.

Impact of Macroeconomic / Geopolitical Factors

Economic uncertainties and elevated R&D expenses deter pharmaceutical firms from expanding neuro immunoassay portfolios, leading developers to defer launches in emerging economies. Robust government grants for brain health initiatives and climbing incidences of Alzheimer’s disease, however, inspire companies to innovate multiplex assays, capturing opportunities in aging societies.

Geopolitical clashes in East Asian trade hubs obstruct enzyme deliveries from dominant suppliers, forcing manufacturers to endure extended downtimes and higher sourcing fees. These clashes, in contrast, propel firms toward Middle Eastern and Latin American alliances that diversify inputs and streamline global distribution.

U.S. tariffs at 25% on Chinese-sourced immunoassay reagents, maintained under Section 301 through 2025, drive up material costs for domestic labs and complicate competitive pricing for exporters. Enterprises mitigate this effectively by investing in U.S. synthesis capabilities and securing exclusion approvals that restore margin health. Altogether, these pressures cultivate vigilant forecasting and partnership depth across the industry.

Latest Trends

FDA Clearance for pTau217 Plasma Assay is a Recent Trend

The U.S. Food and Drug Administration’s clearance of plasma-based pTau217 immunoassays has crystallized as a pivotal trend in 2024, revolutionizing Alzheimer’s diagnostics through high-specificity blood testing for amyloid pathology. This development allows detection of tau hyperphosphorylation with over 90% accuracy, obviating the need for invasive procedures in routine screening.

The trend emphasizes integration with automated platforms, enabling scalable results within hours for primary care integration. Developers are refining thresholds for age-adjusted interpretations, mitigating confounders like renal function. Regulatory endorsements validate the assay’s role in trial enrichment, accelerating drug development pipelines.

Adoption in memory clinics surges, where pTau217 informs amyloid PET confirmation and therapy eligibility. This evolution intersects with digital dashboards for longitudinal tracking, supporting remote monitoring in community settings. Competitive advancements include multiplex formats incorporating neurofilament light for combined neurodegeneration assessment.

Broader implications encompass applications in mild cognitive impairment cohorts, adapting the assay for prognostic stratification. The trend fosters global alignments, harmonizing cutoffs for international validations. In 2024, the U.S. Food and Drug Administration cleared the Lumipulse G pTau 217/β-Amyloid 1-42 Plasma Ratio assay to aid in identifying patients with amyloid pathology associated with Alzheimer’s disease.

Regional Analysis

North America is leading the Neuro Immunoassay Market

North America accounted for 39.6% of the overall market in 2024, and the region experienced strong growth as hospitals and neurology centers increased demand for biomarker-based diagnostics to assess neuroinflammation, neurodegeneration, and autoimmune neurological disorders. Clinicians expanded use of protein-specific immunoassays to support early identification of conditions such as multiple sclerosis and Alzheimer’s disease.

Laboratories upgraded automated analyzers to handle rising cerebrospinal fluid and serum biomarker volumes linked to expanding neurological screening programs. Growth accelerated as precision-medicine initiatives emphasized quantitative markers like neurofilament light chain and GFAP to guide treatment planning.

The CDC reported 6.9 million Alzheimer’s disease cases among Americans aged 65 and older in 2023, and this rising burden directly pushed healthcare systems to adopt advanced neuro-biomarker testing. Academic centers broadened translational neuroscience research, increasing the need for high-sensitivity assay platforms. These combined developments reinforced significant regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to register sustained growth during the forecast period as healthcare providers scale diagnostic capacity for neurological disorders across aging populations. Hospitals invest in high-throughput immunoassay platforms to improve early detection of neurodegenerative diseases and autoimmune encephalitis. Governments strengthen national programs for dementia surveillance, increasing the demand for biomarker-based testing.

Clinical laboratories integrate multiplex assays to support broader neurological evaluations. Growth accelerates as private diagnostic chains expand specialized neurology test menus across India, Japan, South Korea, and Australia. The Japan Ministry of Health, Labour and Welfare reported 4.7 million dementia cases in 2023, and this rising prevalence underscores the need for earlier, biomarker-driven assessment.

Research institutions deepen neurobiology studies, requiring consistent access to validated immunoassay reagents. These factors collectively position Asia Pacific for strong forward-looking diagnostic growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms in the neuro-immunodiagnostics field expand their offerings by developing assays that detect a wide range of biomarkers associated with neurodegenerative and neuroinflammatory conditions, thereby increasing their clinical utility across neurology and psychiatry specialists. They strengthen lab adoption by investing in multiplex immunoassay platforms that deliver high sensitivity and throughput while reducing turnaround time for cerebrospinal fluid and blood-based tests.

They extend their global reach through partnerships with hospitals, reference labs, and regional distributors in markets where awareness of neurological disorders rises steadily. They enhance credibility by funding clinical validation studies and publishing performance data that support diagnostic accuracy and regulatory compliance. They integrate data analytics and reporting modules to help clinicians interpret complex biomarker patterns more efficiently, boosting demand among neurology centres.

One of the major players, Quanterix Corporation, develops ultrasensitive digital-immunoassay platforms and reagents for neurological biomarker detection, leverages its advanced technology suite and global distribution channels to support growth in neuro-diagnostics, and positions itself as a preferred partner for laboratories and healthcare providers seeking cutting-edge neuro-immuno testing solutions.

Top Key Players

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd.

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Bio‑Rad Laboratories, Inc.

- Beckman Coulter, Inc.

Recent Developments

- On July 23, 2025, Roche obtained CE Mark approval for its Elecsys® pTau181 assay. This blood-based test measures phosphorylated Tau 181 and is intended to help exclude Alzheimer’s-related changes, offering a less invasive alternative to traditional confirmatory procedures.

- In September 2025, Beckman Coulter Diagnostics introduced a fully automated BD-Tau immunoassay for research use. The blood-based test is now available on the DxI 9000 Immunoassay Analyzer and is designed to support growing scientific efforts focused on tau-related neurodegenerative diseases.

Report Scope

Report Features Description Market Value (2024) US$ 2.8 Billion Forecast Revenue (2034) US$ 5.6 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Kits and Analysers), By Technology (ELISA, Western Blot, Rapid Tests, Radioimmunoassays (RIA), Polymerase Chain Reaction (PCR), and ELISPOT), By Application (Alzheimer’s Disease, Spinal Muscular Atrophy (SMA), Parkinson’s Disease, Huntington’s Disease, and Amyotrophic Lateral Sclerosis (ALS)), By End-user (Hospitals & Clinics, Pharmaceutical Companies, Biopharmaceutical Companies, Academic Organizations, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, F. Hoffmann‑La Roche Ltd., Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, DiaSorin S.p.A., Bio‑Rad Laboratories, Beckman Coulter, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- F. Hoffmann‑La Roche Ltd.

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Bio‑Rad Laboratories, Inc.

- Beckman Coulter, Inc.