Global Network Automation Market Size, Share and Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Network Type (Physical Network Automation, Virtual Network Automation, Hybrid Network Automation), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Government & Education, Retail & E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171674

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Network Type Analysis

- End-User Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

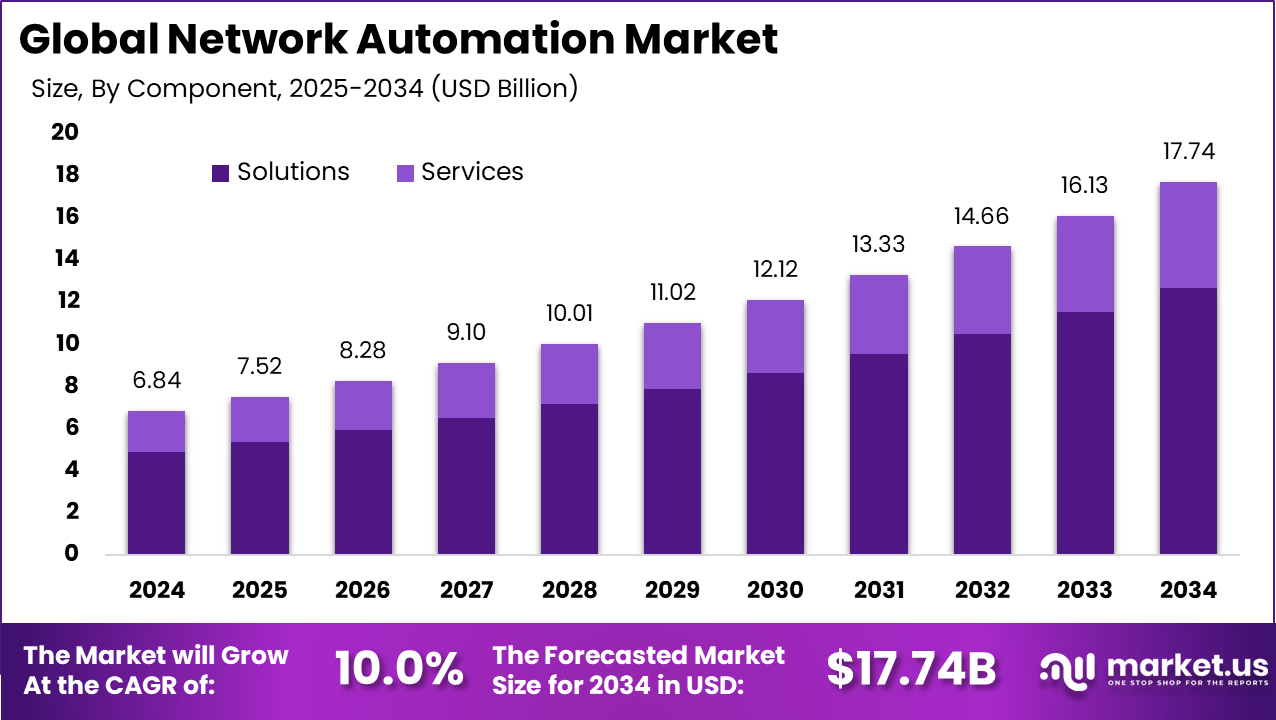

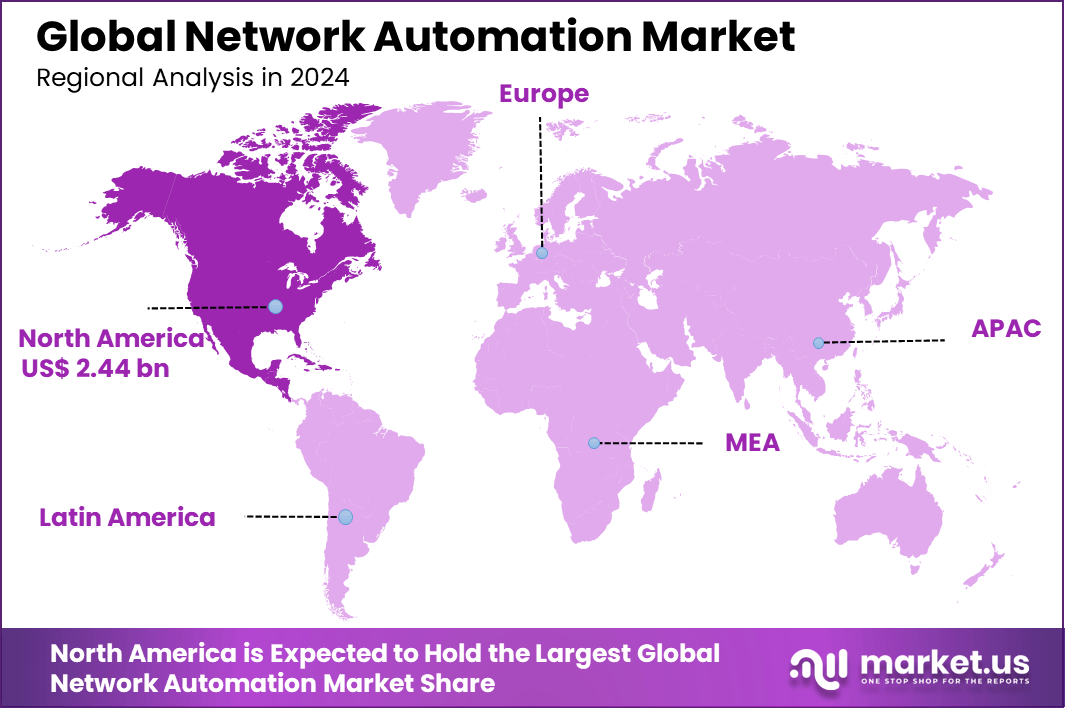

The Global Network Automation Market size is expected to be worth around USD 17.74 billion by 2034, from USD 6.84 billion in 2024, growing at a CAGR of 10.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.7% share, holding USD 2.44 billion in revenue.

The Network Automation Market encompasses software tools, platforms, and services that automate the configuration, management, provisioning, testing, deployment, and operation of physical and virtual network devices to improve efficiency and reduce human error. It includes solutions for intent-based networking, orchestration, analytics, and security across enterprise, service provider, and data center environments, supporting hybrid cloud, 5G, IoT, and edge computing infrastructures.

Demand for network automation stems from the challenges of managing increasingly complex networks with manual processes, which lead to errors, delays, and high operational costs. Enterprises and service providers seek automation to handle the scale of connected devices, 5G deployments, and multi-cloud environments where traditional methods fall short. Sectors like IT, telecommunications, manufacturing, and BFSI show strong interest as they prioritize uptime, compliance, and rapid service rollout.

This demand is further fueled by the rise of remote work, data center expansion, and the need for real-time visibility into network performance. Organizations aim to minimize downtime and mean time to repair through proactive monitoring and self-healing capabilities. As bandwidth requirements grow with IoT and streaming services, automation becomes essential for scalable and secure network operations.

Adoption is accelerating through cloud-based and hybrid deployment models that offer flexibility and quick integration with existing infrastructure. Intent-based networking and AI-driven tools are gaining traction for translating high-level business policies into automated network configurations. Major vendors provide platforms that support zero-touch provisioning and orchestration across wired, wireless, and SDN environments.

Open standards and APIs enable seamless interoperability, encouraging wider use in enterprises transitioning to software-defined networks. Training and managed services help overcome skill gaps, allowing mid-sized firms to adopt automation without full in-house expertise. Pilot projects in 5G and edge computing demonstrate tangible results, spurring broader implementation across industries.

Key Takeaway

- In 2024, solutions dominated the network automation market with a 71.5% share, reflecting strong demand for end-to-end automation platforms that simplify network configuration, monitoring, and operations.

- Cloud-based deployment led with a 64.8% share, as organizations favored scalable and centrally managed automation tools to support dynamic network environments.

- Large enterprises accounted for 76.3% of adoption, driven by complex network infrastructures and the need to reduce manual intervention.

- Physical network automation captured 52.7%, highlighting continued focus on automating routers, switches, and on-premise network assets.

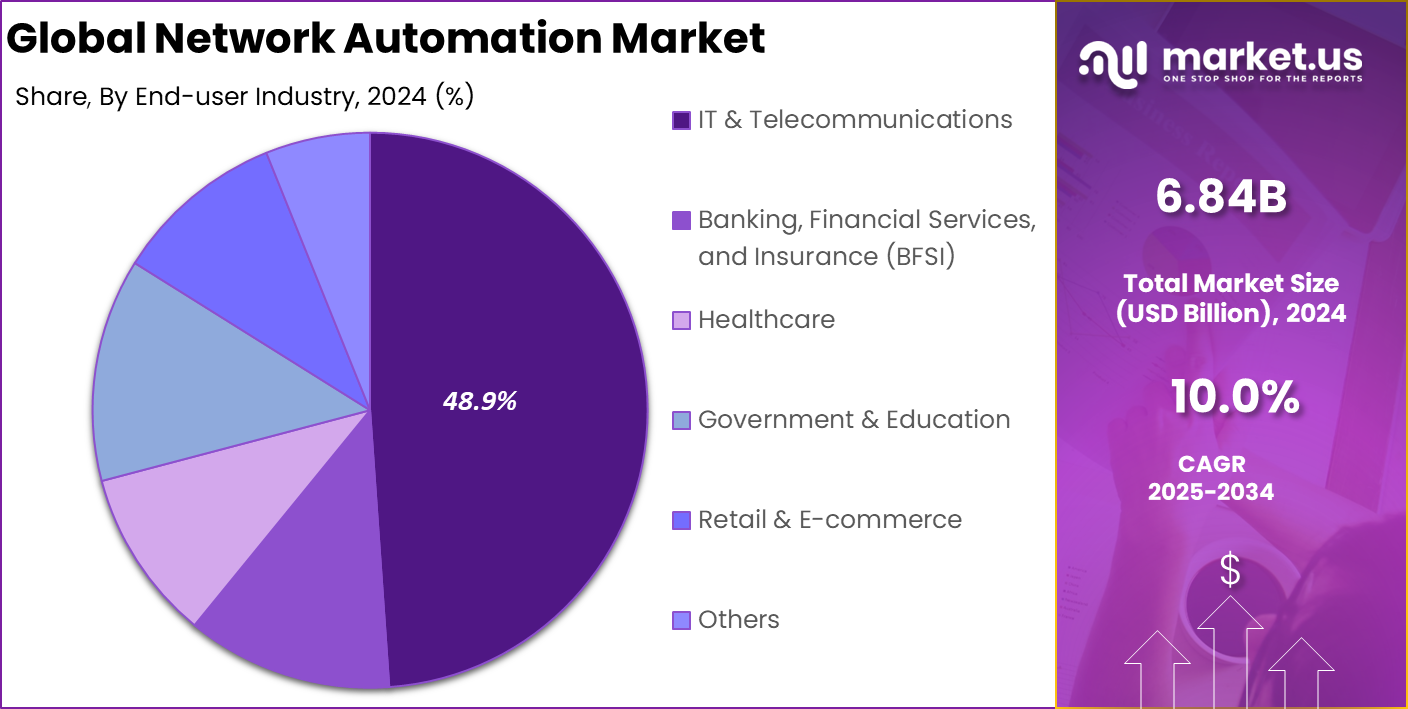

- The IT and telecommunications sector held 48.9%, supported by high network traffic, service reliability requirements, and continuous infrastructure expansion.

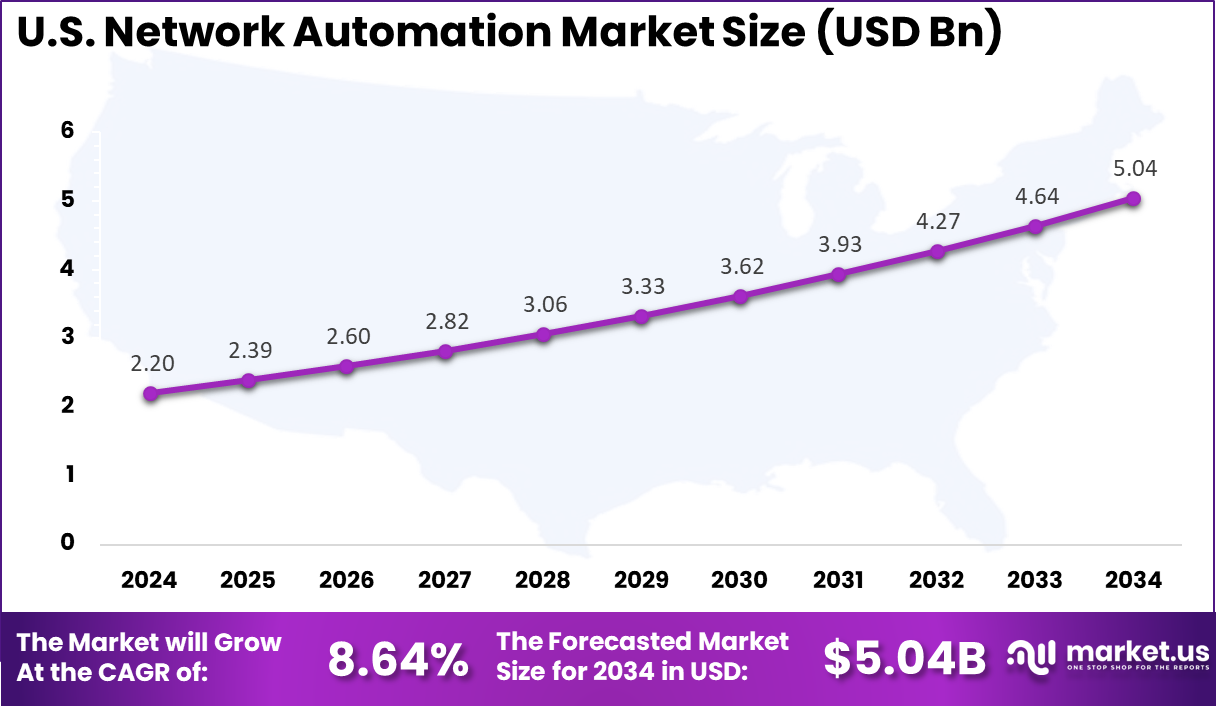

- The U.S. network automation market reached USD 2.20 billion in 2024 and is expanding at an 8.64% CAGR, driven by efficiency gains and network scalability needs.

- North America captured over 35.7% share globally, supported by early adoption of automation technologies and mature network infrastructure.

Quick Market Facts

Adoption and Implementation Trends

- By 2026, nearly 30% of enterprises are expected to automate more than half of their network operations, compared with less than 10% adoption in 2023.

- Manual execution remains widespread, with up to 95% of network changes still handled by hand in some organizations, resulting in operating costs two to three times higher than automated alternatives.

- Large enterprises show higher maturity, with over 80% having deployed some level of network automation, while adoption among small and mid-sized firms remains below 50%.

- Only 18% of IT professionals currently rate their network automation programs as fully successful, pointing to gaps in strategy execution and integration.

Key Drivers and Benefits

- Operational efficiency is the primary driver, cited by 33.9% of organizations as the main benefit of network automation investment.

- Automation reduces configuration and security errors, which are involved in nearly 90% of failures when manual processes dominate.

- By 2026, about 50% of enterprises are expected to apply AI capabilities to automate ongoing network maintenance and performance monitoring.

- Well-executed IP network automation can enable cost avoidance of up to 65% through lower labor requirements and reduced service disruptions.

Critical Barriers

- Skills shortages remain a major constraint, with 26.8% of organizations identifying lack of automation expertise as a key challenge, potentially slowing near-term growth by 2.8%.

- Integration complexity persists, as 25% of IT teams report difficulties connecting automation tools with multi-vendor or legacy infrastructure.

- Budget constraints strongly influence outcomes, with fully funded projects achieving around 80% success rates, while partially funded initiatives face significantly higher failure risks.

U.S. Market Size

The market for Network Automation within the U.S. is growing tremendously and is currently valued at USD 2.20 billion, the market has a projected CAGR of 8.64%. The market is growing due to rising demand for efficient network management amid surging data traffic from cloud apps, 5G rollout, and IoT devices.

Enterprises seek tools to cut manual errors, speed up configurations, and ensure uptime in complex hybrid setups. Tech hubs drive early adoption, while AI integration boosts predictive maintenance and scalability. Strong investments in digital infrastructure further fuel this steady expansion.

For instance, in October 2025, IBM Corporation launched Network Intelligence with agentic AI, combining analytical AI for massive data processing and reasoning AI for automated root cause analysis, enabling scalable network automation and self-healing operations across hybrid environments.

In 2024, North America held a dominant market position in the Global Network Automation Market, capturing more than a 35.7% share, holding USD 2.44 billion in revenue. This dominance is due to advanced tech infrastructure and high adoption of cloud and AI-driven tools in key sectors like IT and telecom.

Enterprises here manage massive data flows from 5G and IoT with automation to reduce errors and downtime. Strong R&D investments and skilled talent pools speed up deployments, while regulatory pushes for secure networks boost demand further.

For instance, in July 2025, Extreme Networks released general availability of Extreme Platform ONE, an AI-infused platform reducing manual work by up to 90% and resolution times by 98% through unified network and security management for multi-vendor environments.

Component Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 71.5% share of the Global Network Automation Market. These tools focus on configuration management, SD-WAN orchestration, and intent-based systems that simplify complex network tasks. Teams rely on them to reduce manual errors and speed up deployments in fast-paced environments. The shift comes from rising data volumes that demand quick, reliable changes without constant oversight.

Businesses find that these solutions integrate well with legacy setups, making adoption straightforward. This leadership persists because solutions handle provisioning, monitoring, and troubleshooting efficiently. They support hybrid networks where physical and virtual elements coexist. Operators report fewer outages and faster service rollouts after implementation. Data from recent analyses highlights how these tools cut operational costs by automating repetitive jobs.

For Instance, in April 2025, NetBrain launched updates to its no-code automation platform with Kubernetes support and cloud-native features. The additions enable end-to-end path analysis for hybrid environments. Teams can now map topologies and run assessments quickly in test environments. It targets solution tools for proactive network control.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 64.8% share of the Global Network Automation Market. They provide elastic scaling for fluctuating traffic and eliminate heavy upfront hardware investments. Small and mid-sized teams appreciate the quick setup and pay-as-you-go models that align with budget needs. Remote access enhances collaboration across global operations. Security features like encryption and compliance tools make them suitable for sensitive data flows.

The appeal grows from seamless integration with multi-cloud strategies and DevOps practices. Cloud options enable real-time updates without downtime, vital for continuous service delivery. Maintenance shifts to providers, freeing internal staff for innovation. Trends show rising use in edge computing, where low latency matters. This mode fits the move toward distributed networks that support IoT and 5G demands.

For instance, in December 2025, Juniper integrated its Mist platform deeper into HPE’s cloud offerings post-acquisition. The combo delivers AI-driven wireless management with real-time scalability for cloud deployments. It cuts setup times and boosts performance in multi-cloud setups. Operators gain remote access without hardware limits.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 76.3% share of the Global Network Automation Market. They manage sprawling infrastructures across regions, needing tools for centralized control and real-time visibility. Automation helps optimize resource allocation and predict issues before they disrupt services. These firms lead adoption due to high stakes in uptime and compliance. Investments focus on tools that scale with growth and handle peak loads effectively.

Their dominance stems from complex ecosystems involving multiple vendors and protocols. Automation streamlines policy enforcement and change management at scale. Reports indicate faster ROI through reduced labor and error rates. Smaller players follow suit but lag in customization depth. Large entities drive innovation by testing advanced features first.

For Instance, in September 2025, Cisco advanced its enterprise-grade automation suite for large-scale infrastructures. Updates focus on secure provisioning across global operations. Large firms use it to centralize control and predict outages. The platform handles peak loads with minimal downtime.

Network Type Analysis

In 2024, the Physical Network Automation segment held a dominant market position, capturing a 52.7% share of the Global Network Automation Market. It targets wired infrastructures where cabling and device configs demand precision to avoid bottlenecks. Tools automate discovery, firmware updates, and fault isolation in data centers. This segment thrives on reliability needs in industries like manufacturing and finance. Operators value it for bridging old hardware with new software layers.

Despite virtual gains, physical automation remains essential for backbone stability. It cuts deployment times from days to hours while enhancing security postures. Integration with overlays like SDN adds flexibility without a full rip-and-replace. Recent insights show it supports high-bandwidth apps reliably. Focus stays on tools that evolve with hybrid realities.

For Instance, in December 2025, Hewlett Packard Enterprise (HPE) introduced the QFX5250 switch for physical AI data center backbones. Built on Broadcom silicon, it handles ultra-high Ethernet speeds reliably. Enterprises automate firmware and fault isolation on wired layers. It bridges legacy hardware to modern demands.

End-User Industry Analysis

In 2024, The IT & Telecommunications segment held a dominant market position, capturing a 48.9% share of the Global Network Automation Market. They face relentless traffic from streaming, cloud apps, and mobile users, pushing automation for config consistency and rapid scaling. Tools handle orchestration across core, edge, and access layers. This reduces human errors in high-stakes environments where seconds count. Adoption accelerates service velocity and customer satisfaction.

These industries pioneer use cases like zero-touch provisioning and AI-driven optimization. Networks here evolve fastest with 5G and fiber rollouts. Automation ensures resilience against cyber threats and failures. Data confirms quicker fault recovery and better spectrum use. They set benchmarks for others entering the space.

For Instance, in December 2025, Nokia expanded agentic AI for telecom operations in its Digital Operations Center. Automation covers service assurance and network slicing for 5G. IT telecom users gain zero-touch provisioning and threat resilience. It speeds up fiber rollouts and spectrum efficiency.

Emerging Trends

Shift Toward Intent-Based and Policy-Driven Automation

A key trend in the network automation market is the adoption of intent-based networking. Instead of manually configuring each network device, administrators define high-level business objectives. Automation systems then translate these objectives into device-level configurations and enforce them across the network. This approach reduces complexity and shortens the time required to implement changes.

Another emerging trend is the integration of automation with real-time analytics. Network systems now generate large volumes of operational data, and analytics tools help interpret this information. When combined with automation, analytics can trigger corrective actions or scaling adjustments without human intervention. These capabilities make network operations more adaptive to changing conditions and demand patterns.

Growth Factors

Increase in Digital Services and Multi-Cloud Deployments

A major growth factor is the expansion of digital services and multi-cloud deployments. Businesses use services from multiple cloud providers and maintain hybrid environments that combine on-premise infrastructure with public cloud resources. Network automation helps manage configurations and connectivity across diverse environments. This reduces operational workload and supports consistent access to resources.

Another growth factor is the rise of complex application architectures. Modern applications often involve microservices, distributed databases, and continuous delivery pipelines. Network automation supports these architectures by ensuring consistent connectivity, improved scalability, and reduced human error. As application complexity grows, the need for automated network operations becomes more pronounced.

Key Market Segments

By Component

- Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Network Type

- Physical Network Automation

- Virtual Network Automation

- Hybrid Network Automation

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government & Education

- Retail & E-commerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Need for Operational Efficiency and Reduced Human Error

A key driver of the network automation market is the need for greater operational efficiency. Manual network management is time-consuming and prone to configuration errors that can cause service disruptions. Automation systems execute predefined tasks quickly and accurately, reducing the likelihood of mistakes. This improves network reliability and reduces time spent on repetitive tasks.

Another driver is the demand for standardized network configurations. Inconsistent device settings across an enterprise can create vulnerabilities or performance issues. Automation supports standardized deployment by applying identical policies across locations and devices. This improves security posture and ensures predictable network behavior.

Restraint Analysis

Complex Integration With Legacy Systems

A major restraint is the challenge of integrating automation tools with legacy network systems. Many organizations operate older hardware or software that lacks modern APIs or automation support. Connecting these devices to automated workflows requires custom adapters or middleware, increasing implementation complexity. This slows deployment and reduces the immediate value of automation investments.

Another restraint is the need for skilled personnel. Although automation reduces manual configuration burdens, it requires staff with expertise in automation frameworks, scripting languages, and network policies. Organizations with limited technical resources may face challenges in designing, implementing, and maintaining automated workflows.

Opportunity Analysis

Expansion of AI-Assisted and Self-Healing Networks

There is strong opportunity in the development of AI-assisted automation. Artificial intelligence can analyze network patterns to anticipate performance issues or security threats. When paired with automation tools, AI can support self-healing networks that correct performance degradation or threats without human intervention. These capabilities support more resilient operations.

Another opportunity arises from analytics-enabled prescriptive actions. Analytics tools provide insights into bottlenecks, resource usage, and traffic patterns. When automation workflows use these insights to prescribe corrective steps, network performance improves. Vendors offering integrated analytics and automation can appeal to organizations seeking more proactive operations.

Challenge Analysis

Security Risks and Policy Governance

A major challenge in the network automation market is managing security risks associated with automated changes. Automated systems must be governed by strict policies that prevent unauthorized actions. Poorly designed automation workflows could introduce security gaps or allow unintended configuration changes. Ensuring strong policy governance is essential to maintain network integrity.

Another challenge involves managing multi-vendor environments. Many enterprises operate networks with devices from different manufacturers. Each device may have distinct configuration syntax and management interfaces. Automation systems must support interoperability across vendors, which increases development and maintenance efforts.

Key Players Analysis

Cisco Systems, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise, VMware, Inc., and IBM Corporation lead the network automation market with platforms that automate configuration, provisioning, and lifecycle management of complex networks. Their solutions help enterprises reduce manual errors, improve uptime, and manage hybrid and multi cloud environments.

Nokia Corporation, Extreme Networks, Inc., Arista Networks, Inc., SolarWinds Worldwide, LLC, and NetBrain Technologies, Inc. strengthen the market with network visibility, performance automation, and troubleshooting intelligence. Their tools support real time network insights and faster fault resolution. These providers emphasize scalability, analytics driven automation, and operational efficiency for large enterprise and service provider networks.

Forward Networks, Inc., Itential, Inc., SaltStack, and Apstra expand the landscape with vendor agnostic automation and intent based networking software. Their platforms enable faster deployment and consistent policy enforcement across heterogeneous environments. These players focus on flexibility, API driven workflows, and cloud readiness. Rising network complexity and demand for agile operations continue to drive adoption of network automation solutions.

Top Key Players in the Market

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise (HPE) Aruba Networking

- VMware, Inc.

- IBM Corporation

- Nokia Corporation

- Extreme Networks, Inc.

- Arista Networks, Inc.

- SolarWinds Worldwide, LLC

- NetBrain Technologies, Inc.

- Forward Networks, Inc.

- Itential, Inc.

- SaltStack

- Apstra

- Others

Recent Developments

- In December 2025, Hewlett Packard Enterprise (HPE) rolled out major AI-native updates to its networking portfolio, including HPE Aruba Networking Central On-Premises 3.0 with unified AIOps across Aruba and Juniper Mist platforms. This delivers self-driving operations and a consistent experience for hybrid environments, cutting trouble tickets and truck rolls while supporting AI workloads from edge to cloud.

- In August 2025, Cisco acquired Aura Asset Intelligence, enhancing its network observability with AI-driven asset and risk management integrated into Splunk. This move strengthens secure enterprise networking for AI era demands, helping customers automate compliance and visibility across complex infrastructures.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 17.7 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs), By Network Type (Physical Network Automation, Virtual Network Automation, Hybrid Network Automation), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare, Government & Education, Retail & E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise (HPE), Aruba Networking, VMware, Inc., IBM Corporation, Nokia Corporation, Extreme Networks, Inc., Arista Networks, Inc., SolarWinds Worldwide, LLC, NetBrain Technologies, Inc., Forward Networks, Inc., Itential, Inc., SaltStack, Apstra, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise (HPE) Aruba Networking

- VMware, Inc.

- IBM Corporation

- Nokia Corporation

- Extreme Networks, Inc.

- Arista Networks, Inc.

- SolarWinds Worldwide, LLC

- NetBrain Technologies, Inc.

- Forward Networks, Inc.

- Itential, Inc.

- SaltStack

- Apstra

- Others