Nerve Conduit Market By Product Type (Synthetic Materials and Natural Biomaterials), By Application (Hospitals & Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153330

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

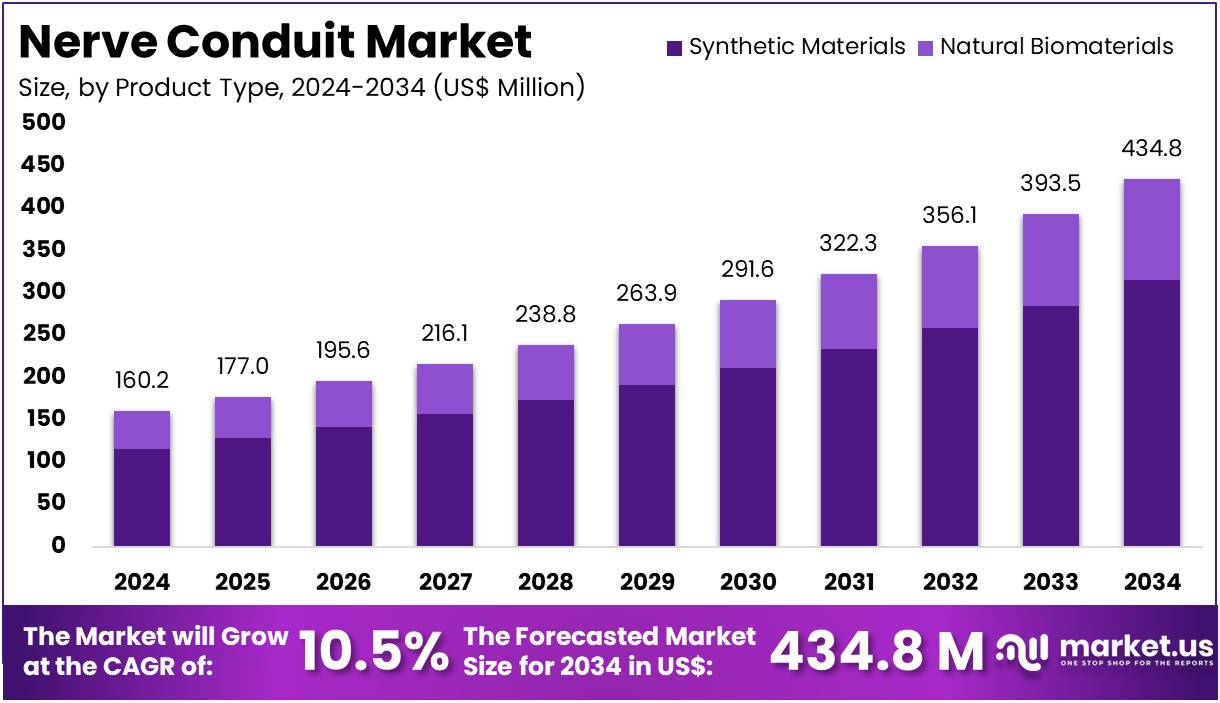

The Nerve Conduit Market Size is expected to be worth around US$ 434.8 million by 2034 from US$ 160.2 million in 2024, growing at a CAGR of 10.5% during the forecast period 2025 to 2034.

Rising demand for effective treatments for peripheral nerve injuries is driving the growth of the nerve conduit market. Nerve conduits, which act as scaffolds to promote nerve regeneration, are becoming increasingly important in treating conditions such as nerve trauma, congenital defects, and complications from surgeries. These medical devices provide a biocompatible environment that facilitates the regrowth of nerve fibers, offering a potential solution to the challenges posed by nerve damage.

Growing awareness of nerve injuries and their impact on quality of life is fueling the need for advanced treatments that improve recovery rates and reduce the long-term consequences of nerve damage. The increasing focus on regenerative medicine and the development of biomaterial technologies also presents significant opportunities in the market.

In January 2023, researchers from the University of Oxford and MedUni Vienna developed an innovative nerve conduit using two distinct types of natural silk sourced from silkworms and orb-web spiders. Their study revealed that these conduits effectively repair severed nerves, demonstrating promising results in nerve regeneration. This development underscores a trend toward using natural, biodegradable materials to create nerve conduits with enhanced biological compatibility and mechanical properties.

The market is also benefiting from advances in 3D printing technology, which allows for the creation of personalized nerve conduits tailored to individual patient needs. With growing applications in trauma care, reconstructive surgeries, and even neurodegenerative disease treatments, the nerve conduit market presents substantial growth opportunities. These advancements offer hope for improved patient outcomes, making nerve conduit technology a critical area of focus for both medical device manufacturers and researchers.

Key Takeaways

- In 2024, the market for nerve conduit generated a revenue of US$ 160.2 million, with a CAGR of 10.5%, and is expected to reach US$ 434.8 million by the year 2034.

- The product type segment is divided into synthetic materials and natural biomaterials, with synthetic materials taking the lead in 2023 with a market share of 72.5%.

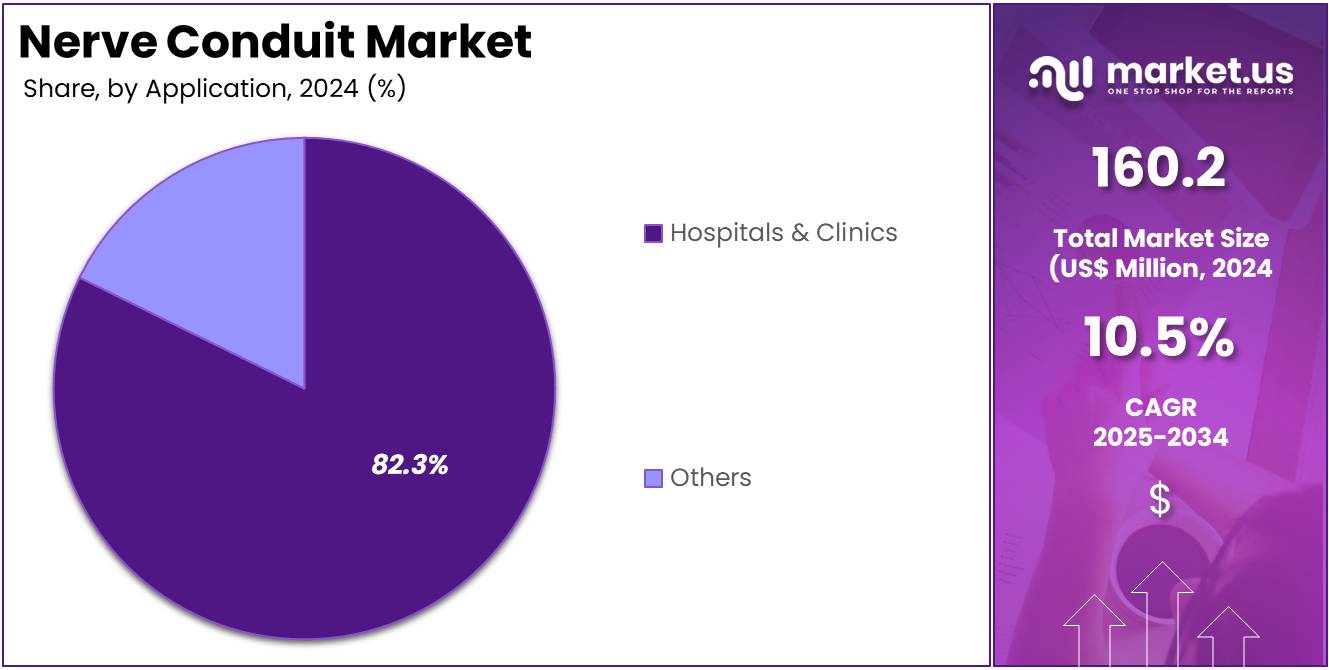

- Considering application, the market is divided into hospitals & clinics and others. Among these, hospitals & clinics held a significant share of 82.3%.

- North America led the market by securing a market share of 40.6% in 2023.

Product Type Analysis

Synthetic materials dominate the nerve conduit market, holding a significant share of 72.5%. This growth is expected to continue as synthetic nerve conduits offer several advantages, including flexibility in manufacturing, cost-effectiveness, and customization.

Synthetic materials, such as biodegradable polymers, have become a preferred choice for nerve regeneration due to their ability to provide support and promote nerve growth while also being absorbed by the body over time, reducing the need for surgical removal. As nerve injury treatments become more advanced, the demand for synthetic nerve conduits is anticipated to grow due to their ability to mimic natural nerve tissue and improve functional recovery.

Moreover, the ability to easily manipulate synthetic materials for different applications, such as enhancing the alignment of nerve cells or providing targeted drug delivery, is projected to drive further growth in this segment. The increasing focus on minimally invasive surgeries and the rising demand for nerve repair and regeneration in both traumatic injuries and neurological disorders will likely continue to boost the adoption of synthetic materials in nerve conduit solutions.

Application Analysis

Hospitals & clinics represent the largest application segment in the nerve conduit market, holding 82.3% of the market share. This growth is expected to be driven by the increasing number of surgeries performed to treat nerve injuries, especially in the context of trauma, degenerative diseases, and congenital nerve defects.

Hospitals and clinics are adopting nerve conduit technologies as they provide a reliable and effective means of repairing damaged nerves and restoring function. The increasing prevalence of nerve damage caused by conditions such as diabetes, carpal tunnel syndrome, and trauma is anticipated to drive the demand for nerve conduit solutions in healthcare settings.

Furthermore, the growing awareness of advanced nerve repair techniques and the rising number of skilled surgeons specializing in nerve reconstruction are projected to further expand the adoption of nerve conduits in hospitals and clinics. The ability of hospitals and clinics to integrate nerve conduit solutions into their surgical workflows, along with the increasing focus on improving patient outcomes, will likely contribute to the continued dominance of this segment in the nerve conduit market.

Key Market Segments

By Product Type

- Synthetic Materials

- Natural Biomaterials

By Application

- Hospitals & Clinics

- Others

Drivers

Increasing Incidence of Peripheral Nerve Injuries is Driving the Market

The rising global incidence of peripheral nerve injuries (PNIs), often resulting from trauma, accidents, and medical procedures, is a significant driver propelling the nerve conduit market. Peripheral nerves play a crucial role in motor and sensory functions, and their damage can lead to debilitating loss of function, pain, and reduced quality of life.

Traditional repair methods, such as autologous nerve grafting, involve harvesting a nerve from another part of the patient’s body, which can lead to complications at the donor site. Nerve conduits offer an alternative by providing a protective tunnel for regenerating nerve fibers to bridge gaps in damaged nerves, avoiding donor site morbidity.

A comprehensive 15-year observational study published in PLOS One in December 2024, analyzing data up to 2022, indicated an overall incidence of peripheral nerve injuries in Sweden of 12.9 cases per 100,000 individuals in 2022. This study also noted that men consistently experienced higher rates of injuries compared to women across all age groups.

Although this data is specific to Sweden, it reflects a persistent clinical challenge across developed nations, underscoring the consistent demand for effective nerve repair solutions. The high number of patients suffering from PNIs, combined with the limitations of autografts, consistently fuels the demand for innovative and less invasive nerve repair options, driving the growth of the nerve conduit market.

Restraints

Challenges in Nerve Regeneration and High Surgical Costs are Restraining the Market

Significant challenges inherent in the complex process of nerve regeneration and the high costs associated with specialized nerve repair surgeries are restraining the nerve conduit market. Complete functional recovery after a severe nerve injury remains difficult to achieve, even with advanced surgical techniques and biomaterials. The biological complexity of nerve regrowth, which involves multiple cellular and molecular processes, means that outcomes can be variable and often incomplete. This uncertainty in achieving full recovery can make both patients and healthcare providers cautious.

Furthermore, peripheral nerve repair surgeries, especially those involving complex reconstruction, are highly specialized and expensive procedures, encompassing surgical fees, hospital stays, and extensive post-operative rehabilitation. A February 2025 article in the Medical Clinical Policy Bulletins, discussing nerve grafting, highlighted the complexity and specific Current Procedural Terminology (CPT) codes associated with these intricate repairs, implying specialized skill and resource requirements.

While nerve conduits aim to improve outcomes, the overall high cost of the surgical intervention and the long rehabilitation period can limit accessibility, particularly in healthcare systems with budget constraints or for patients without comprehensive insurance coverage. These factors collectively slow the broader adoption of nerve conduits, especially in regions where healthcare expenditures are closely scrutinized.

Opportunities

Development of Advanced Bioactive Nerve Conduits is Creating Growth Opportunities

The ongoing development of advanced bioactive nerve conduits, which incorporate growth factors, stem cells, or electrical stimulation capabilities, is creating significant growth opportunities in the nerve conduit market. While earlier conduits were primarily passive guides, next-generation designs are engineered to actively promote nerve regeneration by mimicking the natural microenvironment of nerves.

These innovative conduits can release neurotrophic factors, provide electrical cues, or serve as scaffolds for cell delivery, enhancing axonal regrowth and myelination. This functional enhancement promises superior outcomes compared to passive conduits or autografts. A March 2025 review in Advanced Technology in Neuroscience highlighted recent advances in biomaterial design for nerve guidance conduits, discussing natural polymers like chitosan and collagen, along with synthetic counterparts, emphasizing multi-channel and aligned fiber designs for effective topographical cues.

Furthermore, a groundbreaking development was reported in January 2025 by researchers at the University of Bath, who created a new electrically active, transplantable biomaterial that can help regrow cells in the brain and spinal cord, offering potential for bespoke ‘scaffolds’ for neural stem cell delivery. These advancements improve the efficacy and therapeutic potential of nerve conduits, making them a more attractive option for complex nerve injuries. This push towards biologically active and functionalized implants is poised to capture a larger share of nerve repair procedures, driving substantial market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and overall healthcare research and development (R&D) spending, significantly influence the nerve conduit market by affecting manufacturing costs and innovation. Inflation can increase the cost of raw materials, specialized biomaterials, and skilled labor required for producing nerve conduits, potentially leading to higher product prices. However, the consistent and substantial global investment in healthcare R&D, particularly in regenerative medicine, mitigates some of these pressures.

While specific global R&D spending figures for the nerve conduit segment are not often isolated, overall pharmaceutical R&D spending remained robust. According to unreleased data from Evaluate Pharma cited in a BioSpace article in May 2025, pharmaceutical R&D spending globally climbed 1.5% in 2024, reaching nearly US$288 billion, following an 11.5% increase from 2022 to 2023. This continued commitment to R&D, despite macroeconomic headwinds, fosters innovation in biomaterials and manufacturing processes crucial for nerve conduits.

Furthermore, geopolitical stability generally supports global supply chains, ensuring a steady flow of materials and components. The drive for advanced medical solutions to address unmet clinical needs in nerve regeneration continues to attract investment, thereby sustaining market growth even amidst economic fluctuations.

Evolving US trade policies, including the implementation of tariffs on imported medical devices and components, are shaping the nerve conduit market by influencing supply chain costs and manufacturing strategies. Nerve conduits often utilize specialized biomaterials or components that may be sourced globally. Tariffs on these imports can increase the manufacturing costs for companies operating or selling in the US, potentially leading to higher prices for nerve conduits or impacting the profitability of manufacturers.

A May 2025 article by AAMC highlighted that the US imported over US$75 billion in medical devices and supplies in 2024, emphasizing the industry’s reliance on global supply chains and the potential impact of tariff policies. While the article did not specifically isolate nerve conduits, it underscored that medical devices in general are not exempt from tariffs, unlike some pharmaceutical products. These policies also encourage domestic manufacturing and diversification of supply chains to reduce reliance on specific regions, potentially leading to increased investment in US-based production facilities.

Despite the potential for increased costs due to tariffs, the imperative to provide innovative solutions for nerve repair, coupled with the drive for resilient and secure supply chains, encourages continued investment and strategic adaptation within the market.

Trends

Increased Focus on Minimally Invasive Nerve Repair Techniques is a Recent Trend

A key trend shaping the nerve conduit market in 2024 and extending into 2025 is the growing emphasis on developing and adopting minimally invasive surgical techniques for nerve repair. Traditional methods of nerve repair typically involve extensive surgical dissection, resulting in larger incisions, increased tissue damage, and longer recovery times.

In contrast, minimally invasive techniques, often supported by microsurgical tools or endoscopic procedures, aim to reduce surgical trauma, decrease patient discomfort, and speed up post-operative recovery. Although nerve conduits are implants, their use alongside these less invasive approaches enhances the overall appeal of the treatment for both surgeons and patients. Across various medical specialties, including neurosurgery and orthopedics, the trend is shifting toward less invasive procedures, driven by patient preferences for shorter hospital stays and quicker returns to daily activities.

A comprehensive review published in PubMed Central in May 2025 emphasized how techniques like keyhole craniotomy, endoscopic skull base surgery, and percutaneous spinal procedures have improved the management of cranial and spinal conditions by reducing tissue disruption and blood loss. The review also noted that the integration of artificial intelligence (AI) and robotic technologies is improving precision in these complex surgeries, highlighting a clear movement toward less invasive methods enhanced by advanced technology. This broader shift in surgical practices creates a favorable environment for the increased adoption and innovation of nerve conduits that complement minimally invasive techniques.

Regional Analysis

North America is leading the Nerve Conduit Market

North America led the market with the largest revenue share of 40.6%, driven by the rising incidence of peripheral nerve injuries, advancements in surgical techniques, and a growing focus on enhancing patient outcomes in nerve repair. Peripheral nerve injuries, which often occur due to trauma, accidents, or surgical complications, commonly require intervention to restore function and relieve pain.

The increasing frequency of motor vehicle accidents, which accounted for 46% of peripheral nerve injuries according to a National Library of Medicine article published in August 2023, is a major factor fueling the demand for effective repair solutions. Additionally, the rise in sports participation and workplace accidents has contributed to a higher occurrence of these injuries. The market’s growth is further supported by ongoing innovations in biomaterials and surgical methods aimed at promoting nerve regeneration.

Companies specializing in nerve repair products, such as AxoGen, have shown strong financial performance. For instance, AxoGen reported preliminary unaudited revenue of approximately US $187.3 million for 2024, reflecting a 4.5% increase from the previous year, with its Tissue Technologies segment, which includes peripheral nerve repair, playing a key role in this growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s large and rapidly aging population, the increasing prevalence of chronic diseases such as diabetes that can lead to nerve damage, and improving healthcare infrastructure. As per a Mayo Clinic article updated in October 2023, diabetic neuropathy affects up to half of people with diabetes, highlighting a significant patient population for nerve repair solutions.

Governments across Asia Pacific are investing in healthcare development and promoting access to advanced medical treatments. For example, the Government of Malaysia allocated RM45.3 billion (approximately US$9.6 billion) to healthcare in 2025, reflecting a 105.1% increase from 2024. As healthcare professionals in the region gain greater access to specialized training and advanced medical technologies, the demand for sophisticated nerve repair options, such as nerve conduits, is expected to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the nerve conduit market implement several strategies to drive growth and enhance patient outcomes. They focus on developing bioresorbable and synthetic conduits that promote nerve regeneration and minimize complications. Companies invest in research and development to create advanced materials and structures that mimic natural nerve environments, improving healing processes.

Strategic partnerships with healthcare providers and research institutions facilitate clinical trials and expand product applications across various medical fields. Additionally, these companies emphasize global expansion, targeting regions with increasing incidences of nerve injuries and advancing healthcare infrastructure. They also engage in educational initiatives to raise awareness among clinicians about the benefits and proper use of nerve conduits.

One key player, Axogen Inc., is a leading company specializing in surgical solutions for peripheral nerve repair. The company offers a comprehensive portfolio of products, including Avance Nerve Graft and Axoguard Nerve Protector, designed to support nerve regeneration. Axogen has established a strong presence in the market through extensive clinical research, a robust distribution network, and partnerships with healthcare providers. The company’s commitment to innovation and education has positioned it as a significant contributor to advancements in nerve repair technologies.

Top Key Players in the Nerve Conduit Market

- Toyobo Co. Ltd

- Stryker

- Regenity

- Newrotex

- Neuraptive Therapeutics, Inc

- Kerimedical

- Integra LifeSciences Holding Corporation

- Axogen, Inc

Recent Developments

- In September 2024, Neuraptive Therapeutics, Inc. announced that its product, NTX-001, had been granted Breakthrough Therapy Designation by the FDA. This designation follows positive results from the Phase 2 NEUROFUSE study and extensive consultations with the FDA, positioning NTX-001 as a potential game-changer in the treatment of peripheral nerve injuries.

- In September 2024, Axogen, Inc., a global leader in surgical solutions for peripheral nerve injuries, revealed the successful completion of its Biologics License Application (BLA) for the Avance Nerve Graft. This groundbreaking product has received approval from the US Food and Drug Administration (FDA).

Report Scope

Report Features Description Market Value (2024) US$ 160.2 million Forecast Revenue (2034) US$ 434.8 million CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Synthetic Materials and Natural Biomaterials), By Application (Hospitals & Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Toyobo Co. Ltd, Stryker, Regenity, Newrotex, Neuraptive Therapeutics, Inc, Kerimedical, Integra LifeSciences Holding Corporation, Axogen, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Toyobo Co. Ltd

- Stryker

- Regenity

- Newrotex

- Neuraptive Therapeutics, Inc

- Kerimedical

- Integra LifeSciences Holding Corporation

- Axogen, Inc