Near-Patient Molecular Solutions Market By Product Type (Infectious diseases testing kits, Urinalysis testing kits, Tumor/cancer markers, Pregnancy and fertility, Hematology testing kits, Glucose monitoring kits, Drugs-of-abuse testing kits, Coagulation monitoring kits, Cardiometabolic monitoring kits, and Others), By Technology (PCR-based, Microarray-based, Hybridization-based, and Genetic sequencing based), By End-user (Hospitals, Research Laboratories, Homecare, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162285

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

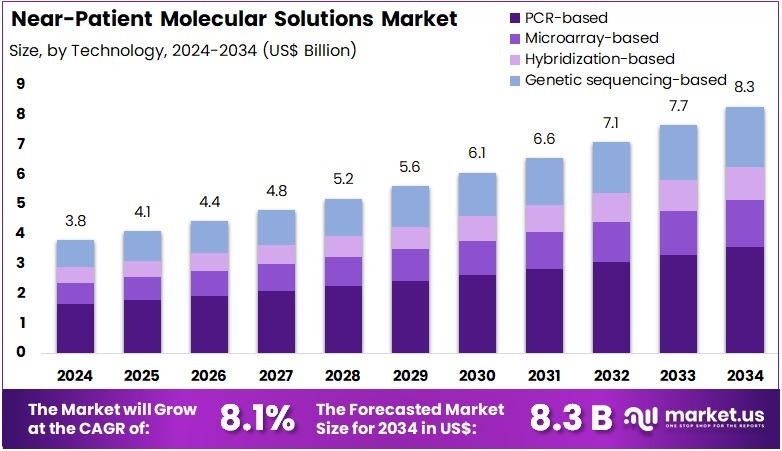

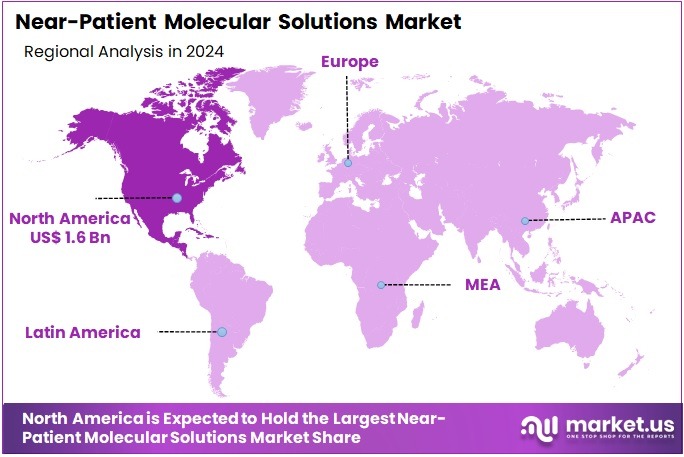

The Near-Patient Molecular Solutions Market Size is expected to be worth around US$ 8.3 billion by 2034 from US$ 3.8 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.1% share and holds US$ 1.6 Billion market value for the year.

Rising prevalence of infectious diseases drives the Near-Patient Molecular Solutions market as healthcare providers demand swift, on-site diagnostics to enable immediate interventions. Clinicians increasingly apply these solutions for respiratory pathogen identification, detecting influenza and RSV in emergency departments to guide antiviral prescriptions promptly. This driver escalates with the need for multiplex testing in oncology, where portable devices analyze tumor biomarkers for rapid therapy selection in outpatient clinics.

Hospitals utilize near-patient molecular tools for gastrointestinal infection screening, confirming Clostridium difficile in stool samples to isolate patients swiftly. In February 2024, Bio-Rad Laboratories received US FDA Emergency Use Authorization for its COVID-19 flu multiplex test, allowing simultaneous detection in near-patient settings during outbreaks. According to the WHO, tuberculosis caused 1.25 million deaths in 2023, with 10.8 million new cases estimated, highlighting the critical role of accessible molecular diagnostics across infectious and chronic applications.

Growing adoption of portable diagnostic platforms unlocks substantial opportunities in the Near-Patient Molecular Solutions market. Innovators develop battery-operated devices for sexual health screening, enabling chlamydia and gonorrhea detection in primary care to facilitate discreet, same-day treatment. Research institutions leverage these solutions for antimicrobial resistance monitoring, sequencing bacterial genes at the bedside to tailor antibiotic choices in surgical wards.

Opportunities also emerge in maternal health, where near-patient tests assess fetal DNA for chromosomal anomalies during prenatal visits. In January 2024, MatMaCorp gained US FDA Emergency Use Authorization for its 2SF RNA test for COVID-19, providing portable detection for remote locations.

Recent trends in the Near-Patient Molecular Solutions market emphasize strategic partnerships and multiplex capabilities to streamline pathogen detection. Developers integrate isothermal amplification for field-deployable tests, supporting vector-borne disease surveillance like dengue in travel clinics. Trends also include AI-assisted result interpretation for neurology applications, analyzing cerebrospinal fluid for meningitis markers at the point of care. In June 2024, Bio-Rad Laboratories partnered with Seegene Company to co-develop multiplex molecular diagnostics, enhancing simultaneous pathogen detection in clinical settings.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.8 billion, with a CAGR of 8.1%, and is expected to reach US$ 8.3 billion by the year 2034.

- The product type segment is divided into infectious diseases testing kits, urinalysis testing kits, tumor/cancer markers, pregnancy and fertility, hematology testing kits, glucose monitoring kits, drugs-of-abuse testing kits, coagulation monitoring kits, cardiometabolic monitoring kits, and others, with infectious diseases testing kits taking the lead in 2023 with a market share of 28.4%.

- Considering technology, the market is divided into PCR-based, microarray-based, hybridization-based, and genetic sequencing based. Among these, PCR-based held a significant share of 43.2%.

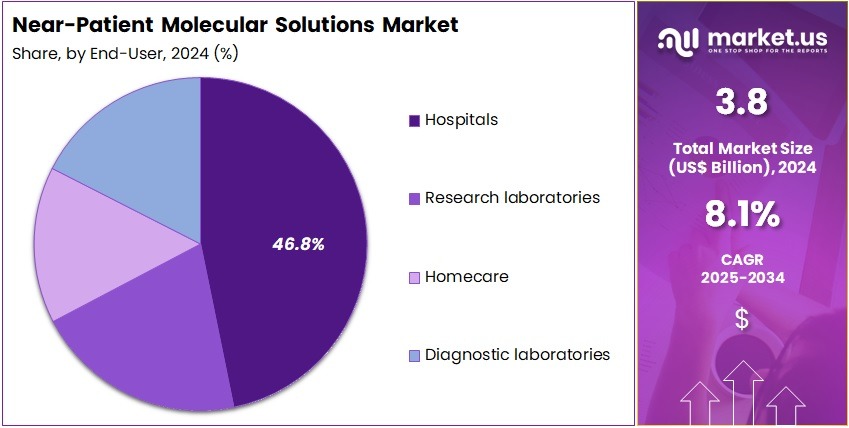

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, research laboratories, homecare, and diagnostic laboratories. The Hospitals sector stands out as the dominant player, holding the largest revenue share of 46.8% in the market.

- North America led the market by securing a market share of 41.1% in 2023.

Product Type Analysis

Infectious diseases testing kits account for 28.4% of the market and are expected to continue growing due to the rising global incidence of infectious diseases and the increasing need for rapid diagnostics. These kits are vital in the detection of a wide range of infections, from viral to bacterial, and are increasingly used in point-of-care settings, such as hospitals, clinics, and homecare environments.

The growing burden of infectious diseases, including respiratory infections, sexually transmitted diseases, and emerging diseases, is likely to drive the demand for reliable and quick diagnostic solutions. Additionally, the COVID-19 pandemic highlighted the need for fast, accurate testing for infectious diseases, fueling innovation and market expansion in this segment.

As healthcare systems strive for early detection and rapid intervention, the market for infectious diseases testing kits is expected to expand further. Advancements in diagnostic technology, such as more portable and cost-effective kits, are likely to increase adoption, making these solutions more accessible in low-resource settings. The expansion of telemedicine and mobile healthcare platforms will also drive demand for these testing kits in homecare and remote settings, further boosting market growth.

Technology Analysis

PCR-based technology dominates the testing technology segment with 43.2% share and is expected to continue leading due to its high sensitivity, accuracy, and ability to detect even trace amounts of DNA or RNA. PCR-based tests are crucial in the diagnosis of infectious diseases, including COVID-19, tuberculosis, and HIV, as well as in detecting genetic mutations and identifying pathogens.

The increasing demand for precise, rapid, and non-invasive diagnostic tools is likely to further drive the growth of PCR-based technologies in near-patient molecular solutions. As healthcare providers and laboratories seek more efficient ways to diagnose diseases quickly, the high throughput and scalability of PCR-based systems make them the preferred choice.

The growing emphasis on personalized medicine, where genetic information plays a critical role in treatment decisions, is expected to contribute to the growing adoption of PCR-based testing. Innovations in PCR technology, such as portable PCR devices for point-of-care testing and multiplex testing capabilities, are likely to expand their application in both clinical and homecare settings. Additionally, the decreasing cost of PCR-based tests, combined with increased global awareness of genetic diseases and infectious threats, will likely support the expansion of this segment.

End-User Analysis

Hospitals represent 46.8% of the end-user segment and are projected to continue dominating the market for near-patient molecular solutions due to their high patient volume and critical need for accurate, real-time diagnostic information. Hospitals rely heavily on molecular diagnostic tests, including PCR-based tests, to diagnose infectious diseases, monitor chronic conditions, and guide treatment decisions.

The increasing prevalence of chronic and infectious diseases, along with the growing need for early detection, is expected to drive continued adoption of molecular solutions in hospitals. Additionally, the rise in personalized medicine, where treatment is tailored based on genetic information, is likely to accelerate the demand for molecular testing in hospital settings.

Hospitals are increasingly integrating molecular diagnostics into their clinical workflows to improve patient care, reduce hospital stays, and enhance clinical outcomes. The introduction of more automated and user-friendly testing systems is expected to boost efficiency and make molecular diagnostics more accessible within hospital settings. As the healthcare industry continues to focus on improving patient safety and treatment efficacy, hospitals are expected to remain the leading end-users of near-patient molecular solutions, ensuring sustained growth in this segment.

Key Market Segments

By Product Type

- Infectious diseases testing kits

- Urinalysis testing kits

- Tumor/cancer markers

- Pregnancy and fertility

- Hematology testing kits

- Glucose monitoring kits

- Drugs-of-abuse testing kits

- Coagulation monitoring kits

- Cardiometabolic monitoring kits

- Others

By Technology

- PCR-based

- Microarray-based

- Hybridization-based

- Genetic sequencing based

By End-user

- Hospitals

- Research Laboratories

- Homecare

- Diagnostic Laboratories

Drivers

Escalating Incidence of Infectious Diseases is Driving the Market

The growing global burden of infectious diseases is driving the adoption of near-patient molecular solutions, which enable quick and accurate pathogen identification at the point of care. These solutions use nucleic acid amplification to detect viral and bacterial genetic material directly from patient samples, bypassing delays associated with centralized labs. This is especially critical during epidemics, where fast diagnostics can help inform isolation measures, manage antibiotics, and guide public health responses.

The demand for these tests is especially high for respiratory and gastrointestinal pathogens, as near-patient testing allows for immediate triage in emergency departments and clinics. With global travel and urbanization increasing the risk of outbreaks, healthcare systems are integrating these portable platforms for better surveillance and preparedness. Regulatory bodies are supporting these solutions due to their role in reducing disease spread, leading to investments in easy-to-use devices.

According to the Centers for Disease Control and Prevention, 4.7 million emergency department visits were linked to infectious diseases in 2022, underscoring the need for rapid molecular testing. Manufacturers are also focusing on multiplex assays, which can detect multiple pathogens at once, to optimize resource use in busy healthcare facilities.

Early detection helps reduce secondary infections and hospital stays, providing significant cost savings in the long run. Partnerships between public health organizations and device developers are further promoting deployment in high-risk areas, boosting the market and continuously improving test sensitivity and accuracy.

Restraints

Stringent Regulatory Hurdles for Laboratory-Developed Tests is Restraining the Market

Strict regulations on laboratory-developed tests are posing challenges for the near-patient molecular solutions market, making it harder to validate and commercialize these technologies. These tests are often customized for specific targets, and the need for comprehensive clinical data and performance testing means longer approval times and higher development costs.

Smaller labs and emerging providers, who rely on quick adaptation, are especially impacted, potentially slowing innovation in areas like oncology and rare infections. This increased regulatory scrutiny creates uncertainty, which in turn reduces venture capital investments and complicates partnerships necessary for scaling production.

Additionally, the lack of consistent regulations across different regions further complicates global market access for multinational companies. In 2022, the FDA processed approximately 18,800 submissions for medical device clearances, highlighting the agency’s workload and potential delays.

These delays affect the availability of next-generation point-of-care solutions, forcing healthcare providers to deal with compliance costs like staff retraining and audits. This, in turn, leads to fewer specialized tests, as developers focus on high-volume products instead of niche assays. Efforts to streamline regulatory pathways are ongoing, but implementation lags behind market demands, restricting market growth, particularly in resource-limited regions where flexibility is key.

Opportunities

Shift Toward Decentralized Healthcare Models is Creating Growth Opportunities

The shift toward decentralized healthcare is opening up significant opportunities for near-patient molecular solutions, allowing testing to take place in clinics, pharmacies, and even homes, reducing the reliance on centralized labs. This trend aligns with the growing focus on value-based care, which aims to improve healthcare efficiency by minimizing transport logistics and speeding up result turnaround.

Portable molecular devices, integrated with digital health systems, allow for real-time data sharing, helping manage both chronic and acute conditions. There is a growing demand in underserved areas, where mobile testing units can bridge the gap in disease screening and oncology monitoring. Government-backed telehealth programs are further accelerating adoption, leading to investments in durable, low-maintenance devices.

Partnerships between pharmaceutical companies and diagnostics providers are emerging, with diagnostics being bundled with therapeutics to enhance patient adherence. This trend is driving significant growth in outpatient settings. Innovations in sample-to-answer workflows are reducing errors, making these solutions accessible to non-specialists.

As the aging population puts strain on traditional healthcare infrastructures, decentralized solutions offer scalable, modular designs. Strategic acquisitions are also consolidating supply chains, ensuring reliable deployment in remote areas. Overall, this transition not only diversifies revenue streams but also strengthens the role of these solutions in building resilient healthcare systems.

Impact of Macroeconomic / Geopolitical Factors

Persistent inflation and tighter credit markets are creating challenges for innovators in the bedside Rising inflation and tight capital access are pressuring developers in the Near-Patient Molecular Solutions market, pushing them to delay advanced cartridge designs while securing stocks of key reagents against price swings.

U.S.-China trade barriers and Mediterranean shipping delays are disrupting supplies of extraction kits, lengthening validation timelines and raising certification costs for global rollouts. To tackle this, developers are partnering with Ontario suppliers, strengthening assay reliability and fast-tracking CMS reimbursements for local setups.

Growing viral outbreak concerns are channeling BARDA funds into rapid diagnostic panels, boosting urgent care adoption. U.S. tariffs of 25% on imported pharmaceuticals and medical devices, effective February 18, 2025, are increasing costs for Asian-sourced thermocyclers, squeezing margins for clinic kits and slowing international tech partnerships. In response, developers are leveraging BIL grants to build Utah production hubs, introducing efficient amplification methods and enhancing low-resource expertise..

Latest Trends

Advancements in Microfluidic and Isothermal Amplification Technologies is a Recent Trend

Innovations in microfluidic and isothermal amplification technologies are revolutionizing near-patient molecular diagnostics, offering compact, low-reagent platforms that make high-quality testing more accessible. Microfluidic chips automate sample processing on disposable cartridges, combining lysis, amplification, and detection into a single, efficient step without bulky equipment.

Isothermal amplification methods, which don’t require thermal cycling, use enzymes like recombinase polymerase for room-temperature reactions, making them ideal for field use in challenging environments. These technologies enhance the ability to test for multiple biomarkers from small samples, making them highly effective for rapid diagnostics. The trend is supported by mobile apps that allow clinicians to interpret results easily, fostering greater engagement with patients.

Regulatory bodies are increasingly endorsing these technologies, speeding up clinical validation. Applications like antimicrobial resistance profiling and viral load quantification are expanding, guiding better stewardship practices. The future of these technologies includes battery-powered versions for even more portability. This progress not only improves diagnostic equity but also sparks new developments in interdisciplinary engineering, pushing the boundaries of what’s possible in near-patient diagnostics.

Regional Analysis

North America is leading the Near-Patient Molecular Solutions Market

In 2024, North America secured a 41.1% share of the global near-patient molecular solutions market, propelled by federal imperatives to decentralize diagnostic capabilities following persistent respiratory pathogen threats, which spurred deployment of cartridge-based systems for rapid nucleic acid amplification in outpatient clinics. Clinicians increasingly utilized these tools for on-site respiratory syncytial virus and influenza differentiation, enabling immediate antiviral initiations that curtailed transmission in pediatric and geriatric populations.

The FDA’s breakthrough designations expedited validations for multiplex assays, fostering integration with electronic records for seamless result dissemination in urgent care networks. Institutional partnerships with diagnostic developers advanced microfluidic platforms, enhancing sensitivity for low-viral-load samples in immunocompromised cohorts.

Heightened reimbursement alignments under Medicare Part B incentivized adoption in rural health centers, addressing geographic barriers to centralized labs. These integrations exemplified the region’s strategic pivot toward agile, frontline molecular diagnostics. The FDA authorized 84 novel devices in 2022, including several point-of-care molecular platforms for infectious disease detection.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health ministries in Asia Pacific project the near-patient molecular solutions sector to thrive during the forecast period, as national strategies emphasize point-of-care platforms to bolster outbreak responses in densely interconnected economies. Regulators in Thailand and Vietnam direct investments toward portable amplification kits, equipping border posts with tools for real-time dengue serotyping amid vector surges.

Diagnostic collaborators engage state laboratories to adapt isothermal assays, anticipating accelerated identifications of melioidosis in endemic agricultural zones. Administrative leaders in Malaysia and the Philippines pioneer solar-compatible readers, positioning field units to process tuberculosis samples without grid dependencies.

Governments estimate embedding these systems into mobile clinics, mitigating delays in hepatitis surveillance for migrant workers. Regional technicians refine lyophilized reagents, aligning with continental networks to track chikungunya variants in trade corridors. These enhancements forge a resilient vanguard for localized pathogen control. The CDC’s Advanced Molecular Detection program received $175 million in fiscal year 2024, supporting genomic surveillance initiatives adaptable to near-patient applications in international collaborations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the near-patient molecular diagnostics sector drive growth by launching compact PCR platforms that deliver pathogen detection in under 20 minutes, addressing urgent needs in outpatient settings. They establish partnerships with urgent care chains to integrate testing into point-of-care workflows, enhancing accessibility for rapid diagnosis.

Companies invest in single-use cartridge innovations, combining viral and bacterial panels to support comprehensive treatment decisions. Executives acquire niche sequencing firms to enhance assay specificity, ensuring reliable results across diverse patient cohorts. They expand into South Asia and sub-Saharan Africa, aligning with public health initiatives to secure government tenders. Additionally, they offer cloud-integrated analytics subscriptions, strengthening provider trust and generating consistent revenue streams.

bioMérieux SA, founded in 1963 and headquartered in Marcy l’Étoile, France, specializes in molecular diagnostics, delivering rapid testing solutions for infectious diseases globally. Its BIOFIRE platform provides automated, multiplex PCR testing, identifying multiple pathogens in one sample for timely clinical decisions. bioMérieux channels significant R&D into user-friendly designs and connectivity for decentralized care settings.

CEO Marc Y. Lorin leads operations across 150 countries, focusing on sustainable innovation. The company collaborates with health organizations to tailor solutions for regional disease patterns. bioMérieux reinforces its leadership by blending precision diagnostics with scalable deployment strategies.

Top Key Players in the Near-Patient Molecular Solutions Market

- Thermo Fisher Scientific

- Siemens Healthineers

- Roche Diagnostics

- QIAGEN N.V.

- PerkinElmer

- Illumina, Inc.

- Cepheid (a Danaher company)

- Bio-Rad Laboratories

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

Recent Developments

- In June 2025: Cepheid, a subsidiary of Danaher, announced that Health Canada had issued a medical device license for its Xpert HIV-1 Viral Load XC test. This development enhances Cepheid’s position in the Near-Patient Molecular Solutions market by offering a fast, reliable method for assessing HIV viral load levels, thereby enabling clinicians to make quicker, more informed decisions for patient management and treatment.

- In January 2025: F. Hoffmann-La Roche Ltd. received FDA 510(k) clearance and a Clinical Laboratory Improvement Amendments (CLIA) waiver for its cobas liat sexually transmitted infection (STI) multiplex assay panels. This approval strengthens Roche’s role in the Near-Patient Molecular Solutions market by offering an easy-to-use, point-of-care diagnostic tool that can simultaneously detect multiple STIs, improving rapid diagnosis and treatment.

- In September 2024: QIAGEN N.V. expanded its partnership with Bio-Manguinhos/Fiocruz to provide advanced PCR-based molecular screening for malaria, HIV, hepatitis B, and hepatitis C as part of Brazil’s blood donation program. This collaboration drives the Near-Patient Molecular Solutions market by enhancing diagnostic capabilities in high-demand, resource-limited settings and improving the safety of blood donations.

- In June 2024: bioMérieux received US FDA Special 510(k) clearance and CLIA waiver for its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini. This milestone allows bioMérieux to further penetrate the Near-Patient Molecular Solutions market by providing a portable, rapid diagnostic tool for respiratory infections, increasing accessibility and accelerating treatment decisions in clinical and point-of-care settings.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 billion Forecast Revenue (2034) US$ 8.3 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infectious diseases testing kits, Urinalysis testing kits, Tumor/cancer markers, Pregnancy and fertility, Hematology testing kits, Glucose monitoring kits, Drugs-of-abuse testing kits, Coagulation monitoring kits, Cardiometabolic monitoring kits, and Others), By Technology (PCR-based, Microarray-based, Hybridization-based, and Genetic sequencing based), By End-user (Hospitals, Research Laboratories, Homecare, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Siemens Healthineers, Roche Diagnostics, QIAGEN N.V., PerkinElmer, Illumina, Inc., Cepheid (a Danaher company), Bio-Rad Laboratories, Becton, Dickinson and Company (BD), Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Near-Patient Molecular Solutions MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Near-Patient Molecular Solutions MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Siemens Healthineers

- Roche Diagnostics

- QIAGEN N.V.

- PerkinElmer

- Illumina, Inc.

- Cepheid (a Danaher company)

- Bio-Rad Laboratories

- Becton, Dickinson and Company (BD)

- Abbott Laboratories