Global Natural Gas Generator Market By Power Rating (Medium Power Genset, High Power Genset and Low Power Genset) By Application (Standby, Peak Shaving and Prime/Continuous) By End-use (Commercial, Industrial and Residential) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Jan 2024

- Report ID: 51466

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

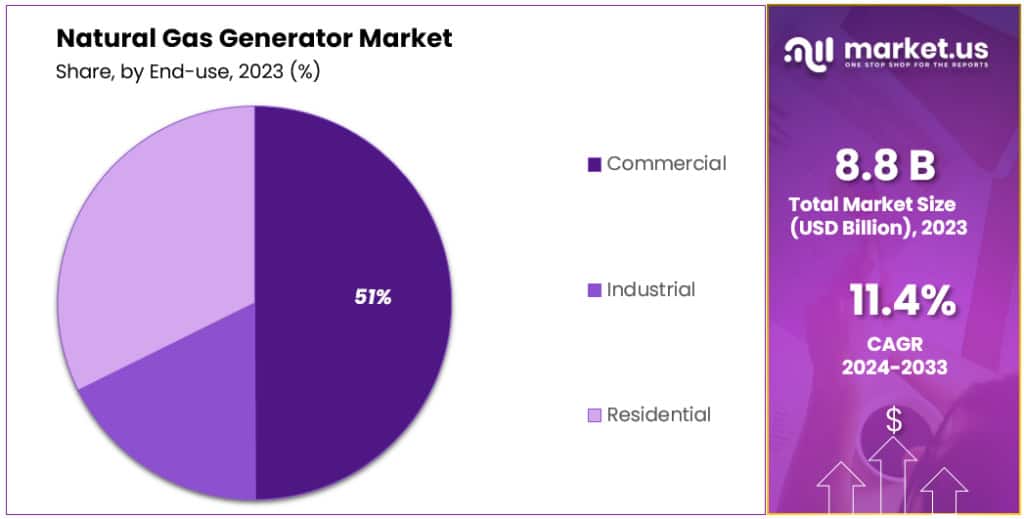

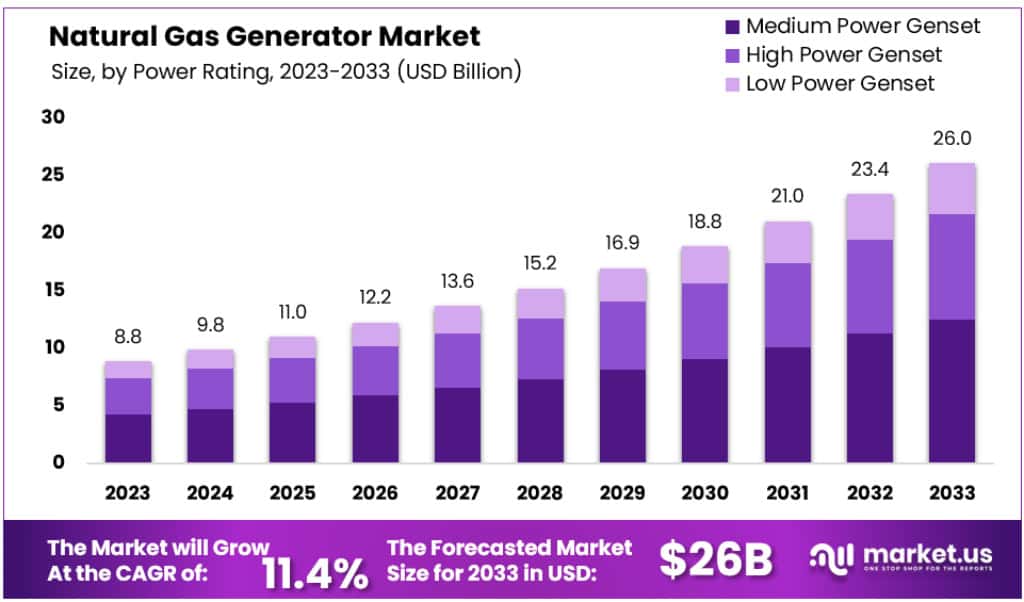

The Global Natural Gas Generator Market size is expected to be worth around USD 26 Billion by 2033, from USD 8.8 Billion in 2023, growing at a CAGR of 11.4% during the forecast period from 2024 to 2033.

The future of natural gas is driven by economic growth, policies that reduce air pollution, and increased energy consumption. European countries have taken the initiative to reduce pollution by switching their coal-fired power plants to natural gas. To ensure reliable and uninterrupted natural gas supply, there are natural gas pipeline projects in North America as well as Europe. These projects amount to billions of dollars.

Power Rating Analysis

In 2023, the low-power genset segment held a dominant position in the natural gas generator market, capturing a significant share of over 48%. This segment is primarily driven by the residential and commercial sectors’ need for reliable power backup. Modern homes, equipped with various electrical appliances, necessitate a robust power supply. For instance, while a washing machine might require about ~2500 watts to start, its running power could be as low as ~750 watts. Consequently, many households opt for an 80 KW generator as a standby power source, highlighting the segment’s importance.

The medium power genset market, which stood as the second largest, is forecasted to grow at the highest CAGR during the projection period. This growth is fueled by increasing demand from emerging countries like Brazil, India, and China. Medium power gensets, typically around ~350 KW, are essential for powering heavy machinery and large equipment, marking their significance in industrial applications.

Furthermore, rapid industrialization in countries such as India, China, and Brazil is expected to boost the demand for both medium and high-power gensets. High power gensets, essential in large manufacturing facilities, power plants, and the marine industry, are crucial for ensuring continuous power supply. These generators are also vital in remote locations lacking grid connections.

The segment for generators with a capacity rating of ≤75 kVA is particularly significant in the telecommunication sector, commercial complexes, small-scale industries, and petrol stations. They serve as backup power in grid-connected areas and as the primary power source in off-grid regions. The rising demand for these generators in developing countries of Asia-Pacific and Africa, coupled with their affordability and portability, marks a significant trend. This is further supported by the global production of natural gas, which was approximately ~4044 billion cubic meters in 2022. The demand in developing countries is also driven by residential construction projects and governmental investments in tourism and agriculture.

Application Analysis

In 2023, the Standby application segment of the natural gas generator market held a dominant position, capturing an impressive share of 61.2%. This segment’s prominence is largely attributed to the critical need for emergency backup power across various sectors.

Standby generators are essential in situations where power outages can lead to significant losses or disruptions, such as in hospitals, data centers, and commercial establishments. The reliability and quick response of these gensets make them a preferred choice for emergency power backup.

End-use Analysis

Key Market Segments

By Power Rating

- Medium Power Genset

- High Power Genset

- Low Power Genset

By Application

- Standby

- Peak Shaving

- Prime/Continuous

By End-use

- Commercial

- Industrial

- Residential

Drivers

- Rising Demand for Uninterrupted Power: The growing industrial sectors and burgeoning population demand reliable, continuous power supply, especially in regions experiencing substantial economic growth. Information and communication technology sectors, requiring uninterrupted power for data centers, are notably driving this demand. The U.S., leading in natural gas production due to the shale gas revolution, along with emerging economies in the Asia Pacific, are significant contributors to this trend.

- Investment in Sustainable Energy: There’s a global shift towards eco-friendly energy sources. Initiatives aimed at sustainable energy development and reducing pollution severity are gaining momentum. This trend is likely to offer a profitable market for natural gas gensets, as they are considered a cleaner alternative to traditional fossil fuels.

Restraints

- Shift Toward Renewable Energy: The growing investment in renewable energy sources like solar, wind, and biogas is seen as a potential limit to the market. European countries, the U.S., China, and India are making substantial investments in renewable energy, which might reduce the reliance on natural gas generators.

- Natural Gas Infrastructure Vulnerability: The susceptibility of natural gas pipeline infrastructure to natural disasters like earthquakes and floods poses a significant restraint. Any disruption in the gas supply can critically impact the operation of natural gas gensets.

Opportunities

- Expansion in the Manufacturing Sector: The Asia Pacific region, with its expanding manufacturing sector due to agreements like the Regional Comprehensive Economic Partnership (RCEP), is driving the demand for power generation systems. This presents a significant opportunity for natural gas generator manufacturers, as these regions require reliable power for manufacturing processes.

- Increasing Energy Demand in Emerging Economies: Rapid industrialization and urbanization in countries like China, India, and nations within the ASEAN are propelling the demand for energy. Natural gas generators, offering a balance between environmental friendliness and efficiency, are positioned to meet this growing demand.

Challenges

- Environmental Concerns: The environmental impact of burning diesel, including the emission of nitrogen oxides, carbon monoxide, and particulate matter, is a growing concern. Strict environmental regulations across the globe are challenging the adoption of traditional diesel generators, thereby impacting the market for natural gas generators as well.

- High Initial Investment and Operating Costs: The significant initial investment and operating costs associated with natural gas gensets can be a barrier for many potential users, especially in cost-sensitive markets.

Trends

- Hybrid and Bi-fuel Generators: The development of hybrid and bi-fuel generators, which combine the benefits of gas and diesel, is a notable trend. These generators reduce emissions and operating costs, and are gaining traction in various sectors, including remote mining and isolated construction sites.

- Inverter Generators: The advent of inverter generators, providing pure AC power, is gaining popularity in the small-scale household sector. These generators are ideal for powering current-sensitive electronic appliances.

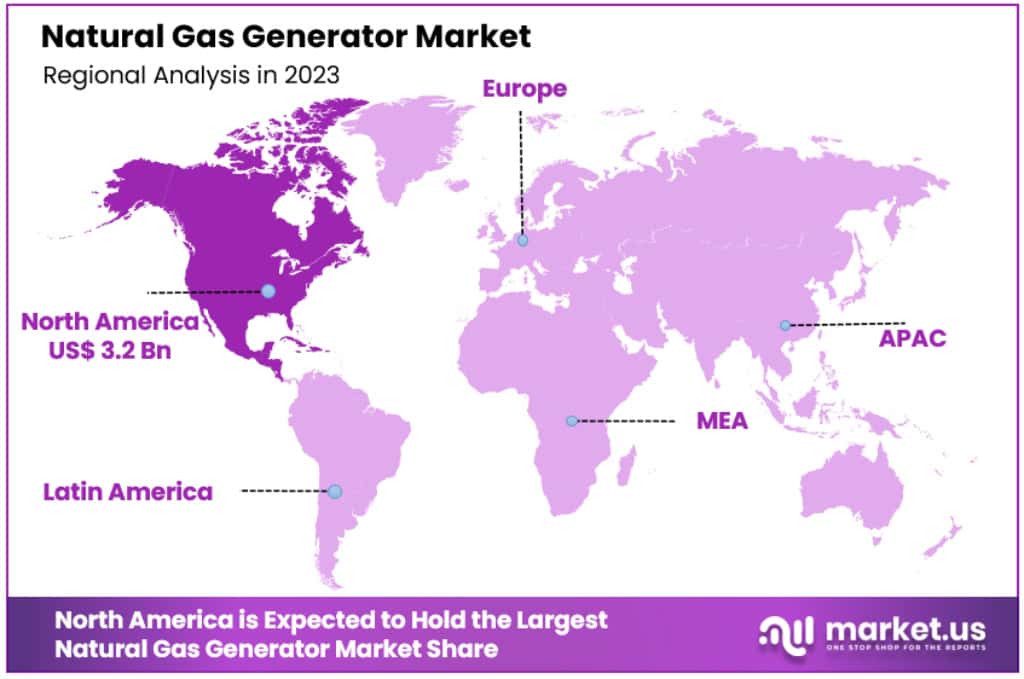

Regional Analysis

In 2023, North America dominates the natural gas generator market, holding a significant 43% share with a market value of USD 3.2 billion. This dominance is underpinned by several key factors, including the region’s extensive shale gas reserves, a well-established infrastructure for natural gas transportation, and the presence of major Original Equipment Manufacturers (OEMs) and Engineering, Procurement, and Construction (EPC) companies. The U.S., in particular, has seen a remarkable 25% increase in natural gas consumption over the past decade, largely driven by its abundant natural gas resources and a focused shift towards renewable energy.

The U.S. market’s growth is further bolstered by the need for reliable power supplies in the face of frequent natural disasters like hurricanes and thunderstorms, which disrupt established electricity networks. Significant investments in data centers, such as Vantage’s USD 713 million expansion in Canada, highlight the increasing reliance on natural gas generators for steady power supply.

The introduction of new models like Cummins Inc.’s 175kW and 200kW natural gas standby generator sets in February 2023 exemplifies the ongoing innovation and adaptation within the market. The stringent air emission norms in the U.S., combined with the environmental advantages of natural gas over diesel, are expected to further escalate the demand for gas generators.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Inorganic and organic growth strategies are being used by key players in the industry to increase their service portfolios and gain market share. The U.S. Environmental Protection Agency (EPA) awarded Kohler Co. Inc. the Green Power Leadership Award. This voluntary program, run by U.S. EPA, aims to improve the use of green energy across the U.S. Kohler Co. Inc. purchased 425,000,000 units of renewable energy annually under this program to offset its electricity use in the U.S. and Canada. The company also acquired Selmec. It was involved in the design and manufacture of diesel generators from 10 kW through 2,750 kW and natural-gas generators from 30 kW upwards.

Market Key Players

- Caterpillar Inc.

- Cummins Inc.

- Generac Power System

- General Electric

- Kohler Co., Inc.

- Mahindra Powerol

- MTU-onsite Energy GMBH

- Yanmar Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Coopercorp Generators

- Other Companies

Recent Developments

- January 2023: Caterpillar announced a strategic investment in Lithos Energy Inc., focusing on advancing the development and production of battery packs. This move signals Caterpillar’s commitment to diversifying its energy solution offerings, particularly in renewable energy storage.

- January 2023: Generac Industrial Power expanded its range with the introduction of innovative transfer switches. This development is aligned with the growing need for more sophisticated and reliable power transfer solutions in industrial settings.

- January 2023: General Electric (GE) secured a significant contract with the Polish Export Credit Agency, reflecting its continued expansion and influence in the European market.

- February 2023: Cummins Inc. introduced 175kW and 200kW natural gas standby generator sets for North American customers. These sets, part of Cummins’s Destination Zero strategy, emphasize the company’s dedication to zero-emission technology and underline its leadership in offering industry-leading power density and performance.

- July 2022: Sterling Generators entered a strategic partnership with Moteurs Baudouin, a French diesel and gas engine manufacturer. This collaboration is set to leverage Baudouin’s expertise in high-quality engine production and Sterling Generators’ proficiency in fuel-efficient power solutions.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Billion Forecast Revenue (2033) USD 26 Billion CAGR (2024-2033) 11.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Rating (Medium Power Genset, High Power Genset and Low Power Genset) By Application (Standby, Peak Shaving and Prime/Continuous) By End-use (Commercial, Industrial and Residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Caterpillar Inc., Cummins Inc., Generac Power System, General Electric, Kohler Co., Inc., Mahindra Powerol, MTU-onsite Energy GMBH, Yanmar Co., Ltd., Mitsubishi Heavy Industries, Ltd., Coopercorp Generators and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Natural Gas Generator Market in 2023?The Natural Gas Generator Market size was USD 8.8 Billion in 2023.

What is the projected CAGR at which the Natural Gas Generator Market is expected to grow at?The Natural Gas Generator Market is expected to grow at a CAGR of 11.4% (2024-2033).

List the key industry players of the Natural Gas Generator Market?Caterpillar Inc., Cummins Inc., Generac Power System, General Electric, Kohler Co., Inc., Mahindra Powerol, MTU-onsite Energy GMBH, Yanmar Co., Ltd., Mitsubishi Heavy Industries, Ltd., Coopercorp Generators and Other Key Players are engaged in the Natural Gas Generator market.

Natural Gas Generator MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Natural Gas Generator MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar Inc.

- Cummins Inc.

- Generac Power System

- General Electric

- Kohler Co., Inc.

- Mahindra Powerol

- MTU-onsite Energy GMBH

- Yanmar Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Coopercorp Generators

- Other Companies