Global Natural Astaxanthin Market By Type (Astaxanthin Powder, Astaxanthin Oleoresin), By Application (Food and Beverages, Nutraceuticals, Cosmetics, Animal Feed & Aquaculture, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: June 2023

- Report ID: 16180

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

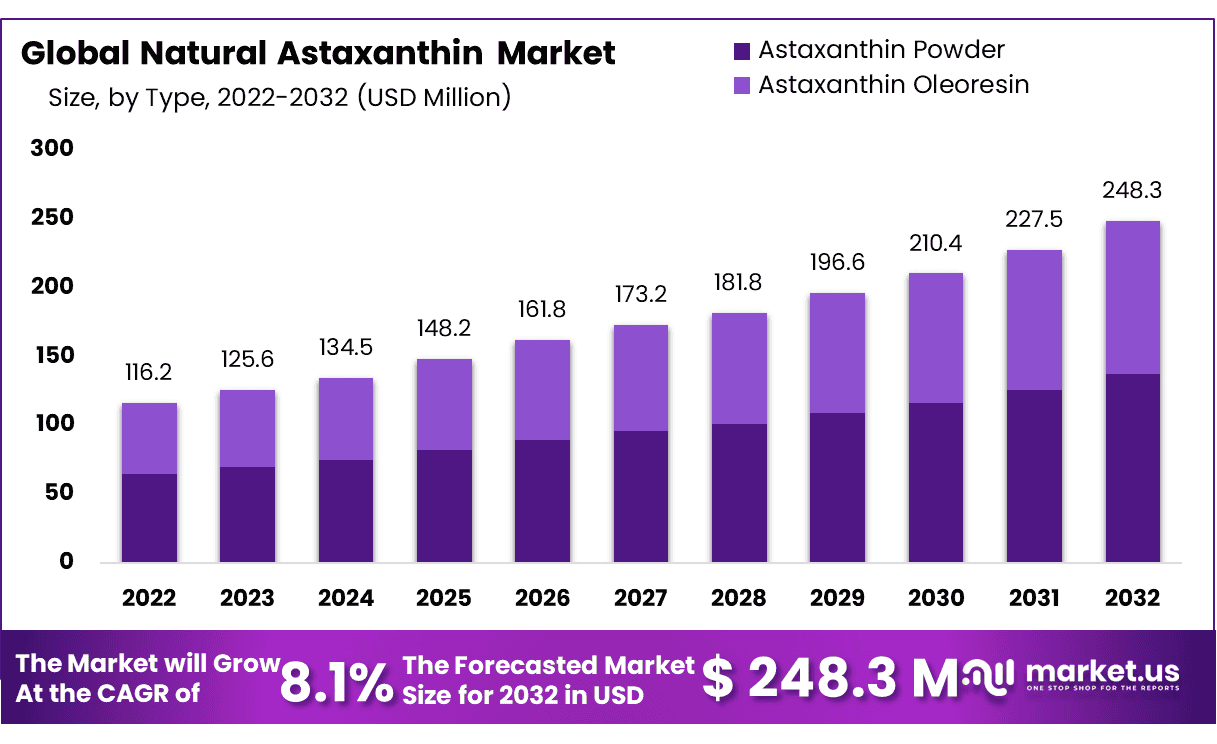

Global Natural Astaxanthin Market Was Valued at USD 125.6 Million in 2023 and Is Expected To Reach USD 248.3 Million by 2032, This Market Is Estimated To Register a CAGR Of 8.1%.

Natural astaxanthin is a red pigment. It belongs to the carotenoid class of chemicals. It is found naturally in certain types of algae and is responsible for the reddish color of salmon, lobster, and trout, as well as shrimp and many other seafood. Natural astaxanthin has been shown to be over 500 times more potent than vitamin E. Natural astaxanthin is also more effective than lycopene and way more potent than lutein. Astaxanthin may help treat conditions such as Male Infertility, Rheumatoid Arthritis, Parkinson’s Disease, Alzheimer’s Disease, Stroke, Age-Related Macular Degeneration, High Cholesterol, and Cancer.

Natural Astaxanthin also has the potential to treat heart disease, diabetes, and stroke. It improves exercise performance and reduces muscle soreness and muscle damage after exercise. Astaxanthin also helps protect your skin from sunburn and wrinkles, increases skin elasticity, and other cosmetic benefits.

Key Takeaways

- The global Natural Astaxanthin Market was worth USD 125.6 million in 2023.

- The market size is projected to increase to USD 248.3 Million by 2032, with a CAGR of 8.1% from 2023 to 2032.

- Increasing demand and rising health awareness are major growth drivers.

- The COVID-19 pandemic had a positive impact on the Natural Astaxanthin Market.

- Astaxanthin Powder accounted for the majority of revenue in the type segment (53.5%).

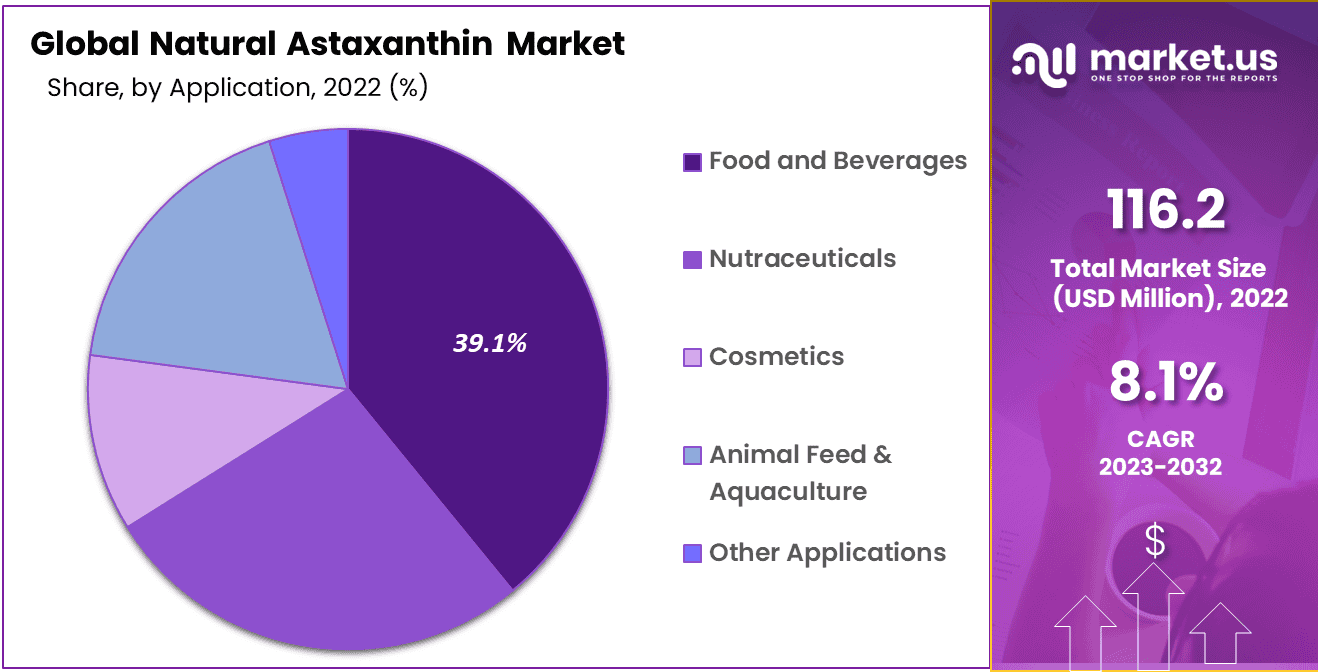

- Nutraceuticals dominated the application segment (39.1%).

- Rise in government initiatives offer growth opportunities for the market.

- Increasing demand from the food industry and medicine drives the natural astaxanthin market growth.

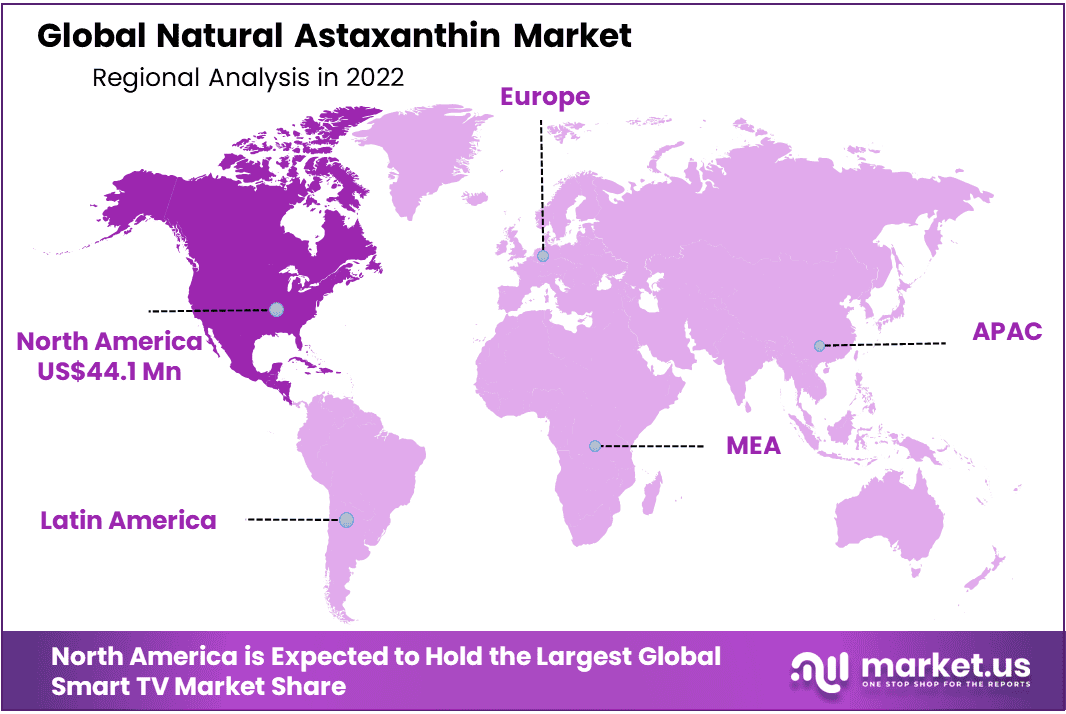

- North America dominated the market (38% revenue share) followed by Asia Pacific.

- Some of the key players are Cyanotech Corporation, BGG, Fuji Chemical Industry Co., Ltd., Parry Nutraceuticals Ltd., and others.

Type Analysis

Astaxanthin Powder is Dominating the Natural Astaxanthin Market

Based on type the market is divided into Astaxanthin Powder and Astaxanthin Oleoresin. Among them, Astaxanthin Powder dominated the market with a 53.5% market share. The most preferred form of astaxanthin is astaxanthin powder because of its solubility; it can easily mix with solvent, water, or alcohol. It is also available in capsule and oil forms.

In addition, there is a high demand for astaxanthin oleoresin. Oleoresin astaxanthin can be obtained from a variety of plants such as hibiscus and Larsenia polymorphphylla. This makes oleoresin astaxanthin unique amongst all other antioxidants available in the market currently. It also has the ability to get rid of reactive oxygen species, protect cells from oxidative damage, and boost the immune system. It is also known for its anti-inflammatory properties, which can help ease pain and inflammation associated with conditions such as arthritis or rheumatism.

Application Analysis

Nutraceuticals hold the largest market share.

Based on applications, the market is further divided into Food and Beverages, Nutraceuticals, Cosmetics, Animal Feed & aquaculture, and other applications. Among these applications, nutraceuticals is dominating the market with a market share of 39.1% due to the increasing demand for astaxanthin natural nutritional products and its superior antioxidant properties compared to other food supplements. Additionally, sedentary lifestyle, aging population, and a deficiency of essential nutrients are driving the growth of nutraceuticals. Moreover, the demand for nutraceuticals has increased post the COVID-19 pandemic.

The animal feed & aquaculture segment was expected to experience the most rapid growth during the forecast period. The aquaculture industry is growing at a faster pace, so there is an increasing demand for natural astaxanthin. Additionally, it is also used to improve the quality of seafood.

Key Market Segments

By Type

- Astaxanthin Powder

- Astaxanthin Oleoresin

By Application

- Food and Beverages

- Nutraceuticals

- Cosmetics

- Animal Feed & Aquaculture

- Other Applications

Drivers

Increasing demand for nutraceuticals

The increasing demand for nutraceuticals will drive the growth of the natural astaxanthin market over the forecast period. Astaxanthin is used in various nutraceutical products due to its health benefits, such as anti-inflammatory and antioxidant properties. As the focus of developing economies shifts towards preventive healthcare, the need for nutraceuticals rises. Antioxidants are a key component of preventive healthcare, and their demand is also increasing, thus contributing to the surge of nutraceuticals.

Rising health awareness among consumers

The increasing health awareness among consumers is raising the demand for natural astaxanthin as it is considered a natural and organic product. Astaxanthin has been found to have effects on the vision, immune system, cardiovascular health, and metabolic function, therefore, people find it very helpful. Additionally, it has shown anticancer, anti-inflammatory, antidiabetic, and antitumor properties.

Restraints

Limited availability

The limited availability of natural astaxanthin is a restraint for the market. The production of natural astaxanthin is limited due to the high cost of production, which results in limited availability of the product. It depends on raw material availability, astaxanthin yield, and purity and extraction methodology.

Opportunity

Government initiatives

The aquaculture sector is experiencing a surge in growth as a result of the various initiatives undertaken by government around the world. For instance, in order to enhance and diversify the aquaculture sector, under the ongoing Pradhan Mantri Matsya Sampada Yojana (PMMSY), the Department has taken initiatives to support and expand the inland fishery and the aquaculture industry. The aim of this initiative is to diversifying the species, introducing new species and identifying the critical shortages in quality brood.

Trends

Demand from the food industry is on the rise

There has been a steady increase in the use of natural astaxanthin food additive due to its health benefits, such as anti-inflammatory properties, immunosuppressive properties, and the prevention of brain and cardiovascular diseases. Addtionally, the trend towards natural and organic products has made the natural astaxanthin segment more popular than synthetic astaxanthin. Hence, the demand for natural astaxanthin is rising.

Regional Analysis

North America Accounted for Significant Share of the Global Natural Astaxanthin Market

North America held the largest market share, with 38% in natural astaxanthin market in 2022. North America has an increasing prevalence of nutritional deficiencies and skin-related diseases. The natural astaxanthin market is driven by rise in investment in biotechnology and the pharmaceutical industry in North America. Also, there is an increase in the percentage of health-conscious people, who are driving the growth opportunities in the market. For instance, as per a Summit on Biotechnology and Biomanufacturing on September 14, 2022, The Department of Health & Human Services will allocate US$40 million to enhance biomanufacturing capabilities for active pharmaceutical ingredients.

Asia Pacific is the fastest-growing region in the natural astaxanthin market. This is because countries like China, Japan, and India are increasingly investing in aquaculture industry. For instance, the Indian government initiated to improve and expand the aquaculture sector, under the ongoing Pradhan Mantri Matsya Sampada Yojana (PMMSY).

Key Regions

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Strong Focus on Product Portfolio Expansion through various Strategies maintains the Dominance of Industry Leaders.

New product launches, mergers and acquisitions, and partnerships are some of the key initiatives undertaken by leading players. For instance, in October 2022, Astaxanthin gummies containing vitamin C were developed by Solabia-Algatech. These gummies do not contain any preservatives or artificial colors, and each gummy contains 4mg of a complex of astaxanthins derived from the alga. Some of the dominant players in the market are AlgaTechnologies Ltd., Cyanotech Corporation, Parry Nutraceuticals Ltd., and other key players.

Market Key Players

The following are some of the major players in the industry

- Cyanotech Corporation

- BGG

- Fuji Chemical Industry Co., Ltd.

- Parry Nutraceuticals Ltd.

- AlgaTechnologies Ltd.

- Jingzhou Natural Astaxanthin Inc

- Yunnan Alphy Biotech Co., Ltd.

- Archer-Daniels-Midland Company (ADM)

- Piveg, Inc.

- Asta Supreme

- Other Key Players

Recent Development

- Cyanotech Corporation (March 2024): Cyanotech Corporation announced the acquisition of a new production facility in Hawaii to expand its natural astaxanthin production capacity. This strategic move aims to enhance their market presence and meet the growing global demand for natural astaxanthin.

- BGG (February 2024): BGG launched a new high-potency natural astaxanthin supplement, AstaxMax, in February 2024. This product is designed to provide enhanced antioxidant support, targeting the health and wellness market, and is derived from sustainably sourced microalgae.

- Fuji Chemical Industry Co., Ltd.(January 2024): Fuji Chemical Industry Co., Ltd. completed a merger with a leading biotechnology firm in January 2024 to strengthen its research and development capabilities in natural astaxanthin and expand its product portfolio in the global market.

- Parry Nutraceuticals Ltd.(April 2024): Parry Nutraceuticals Ltd. introduced an innovative astaxanthin-infused beverage, AstaxBrew, in April 2024. This launch targets health-conscious consumers, offering a convenient way to incorporate natural astaxanthin into daily diets.

- AlgaTechnologies Ltd.(May 2024): AlgaTechnologies Ltd. acquired a cutting-edge algae cultivation facility in Spain in May 2024. This acquisition is part of their strategy to increase production efficiency and ensure a steady supply of high-quality natural astaxanthin.

- Jingzhou Natural Astaxanthin Inc.(March 2024): Jingzhou Natural Astaxanthin Inc. merged with a prominent marine biotechnology company in March 2024. This merger aims to leverage combined expertise and resources to enhance the development and commercialization of natural astaxanthin products.

Report Scope

Report Features Description Market Value (2023) USD 116.2 Mn Forecast Revenue (2032) USD 248.3 Mn CAGR (2023-2032) 8.1% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Astaxanthin Powder, Astaxanthin Oleoresin), By Application (Food and Beverages, Nutraceuticals, Cosmetics, Animal Feed & aquaculture, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherland, Rest of Europe; APAC– China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Cyanotech Corporation, BGG, Fuji Chemical Industry Co., Ltd., Parry Nutraceuticals Ltd., AlgaTechnologies Ltd., Jingzhou Natural Astaxanthin Inc, Yunnan Alphy Biotech Co., Ltd., Archer-Daniels-Midland Company (ADM), Piveg, Inc., Asta Supreme, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Natural Astaxanthin Market?The Natural Astaxanthin Market refers to the industry that produces and sells astaxanthin, a potent antioxidant derived from microalgae and seafood, known for its health benefits.

How big is the Natural Astaxanthin Market?The global Natural Astaxanthin Market size was estimated at USD 125.6 Million in 2023 and is expected to reach USD 248.3 Million in 2032.

What is the Natural Astaxanthin Market growth?The global Natural Astaxanthin Market is expected to grow at a compound annual growth rate of 8.1%. From 2023 To 2032

Who are the key companies/players in the Natural Astaxanthin Market?Some of the key players in the Natural Astaxanthin Markets are Cyanotech Corporation, BGG, Fuji Chemical Industry Co., Ltd., Parry Nutraceuticals Ltd., AlgaTechnologies Ltd., Jingzhou Natural Astaxanthin Inc, Yunnan Alphy Biotech Co., Ltd., Archer-Daniels-Midland Company (ADM), Piveg, Inc., Asta Supreme, Other Key Players

What are the primary sources of natural astaxanthin?Natural astaxanthin is mainly sourced from microalgae and certain marine organisms like shrimp, krill, and salmon.

What are the health benefits of natural astaxanthin?Natural astaxanthin is associated with benefits like antioxidant protection, anti-inflammatory properties, and support for eye, skin, and joint health.

What factors drive the growth of the Natural Astaxanthin Market?Growing awareness of health benefits, increasing demand for natural ingredients, and expanding applications in dietary supplements and cosmetics are driving market growth.

Natural Astaxanthin MarketPublished date: June 2023add_shopping_cartBuy Now get_appDownload Sample

Natural Astaxanthin MarketPublished date: June 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Cyanotech Corporation

- BGG

- Fuji Chemical Industry Co., Ltd.

- Parry Nutraceuticals Ltd.

- AlgaTechnologies Ltd.

- Jingzhou Natural Astaxanthin Inc

- Yunnan Alphy Biotech Co., Ltd.

- Archer-Daniels-Midland Company (ADM)

- Piveg, Inc.

- Asta Supreme

- Other Key Players