Global Nanosized Alumina Market By Type (Alpha Alumina, Beta Alumina, and Gamma Alumina) By End-Use Industry (Automotive, Oil & Gas, Energy, Electronics) By Distribution Channel (B2B, Online Platforms, and Suppliers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 105902

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

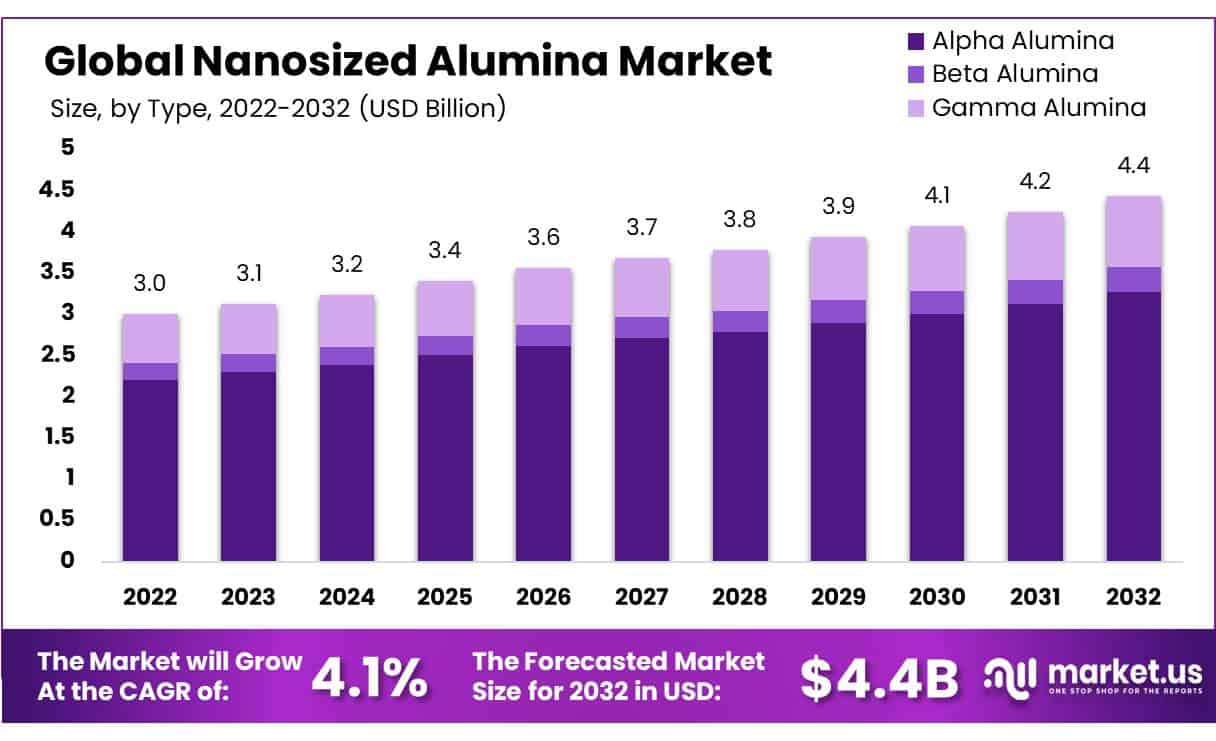

In 2022, the Global Nanosized Alumina Market was valued at USD 3.0 Billion, and is expected to reach USD 4.4 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 4.1%.

Nanosized alumina is a form of aluminum oxide (Al2O3) that has been meticulously engineered and processed to possess extremely small particle sizes at the nanometer scale. This results in alumina particles with dimensions typically ranging from 1 to 100 nanometers in diameter.

The reduction in particle size grants nanosized alumina unique properties and characteristics that are distinct from its larger-sized counterparts. Nanosized alumina exhibits enhanced surface area, reactivity, and mechanical properties compared to conventional alumina particles.

These attributes arise from the increased surface-to-volume ratio, which enables nanosized alumina to interact more profoundly with its surroundings.

Due to these heightened characteristics, nanosized alumina finds applications in diverse industries and fields. The rising utilization of nanosized alumina is fueling an increase in demand, driven by its versatile applications across various industries.

The unique properties of nanosized alumina, such as high surface area, exceptional mechanical strength, and improved chemical reactivity, have garnered significant attention. Industries are integrating it into catalysts, coatings, and advanced materials, enhancing performance without increasing bulk volume.

Key Takeaways

- Market Growth and Value: The Nanosized Alumina Market was valued at USD 3.0 Billion in 2022 and is projected to reach USD 4.4 Billion by 2032, indicating a Compound Annual Growth Rate (CAGR) of 4.1% between 2023 and 2032.

- Nanosized Alumina Defined: Nanosized alumina is a specialized form of aluminum oxide (Al2O3) engineered at the nanometer scale, with particle sizes typically ranging from 1 to 100 nanometers. Its reduced particle size grants it unique properties and enhanced characteristics.

- Unique Properties of Nanosized Alumina: Due to its small particle size, nanosized alumina exhibits attributes like increased surface area, higher reactivity, and improved mechanical properties compared to conventional alumina particles. These qualities are a result of the higher surface-to-volume ratio.

- Versatile Applications: Nanosized alumina is gaining popularity across various industries due to its exceptional properties. It is utilized in catalysts, coatings, and advanced materials, enhancing performance without adding bulk volume.

- Alpha Alumina Dominance: In 2022, Alpha Alumina held the largest market share in the nanosized alumina segment at 73.6%. It is favored for its mechanical strength, thermal stability, and electrical insulation properties, making it ideal for electronics, ceramics, and aerospace industries.

- Gamma Alumina Significance: Gamma Alumina was the second dominant segment with a 19.5% market share in 2022. It is known for its high surface area, exceptional catalytic activity, and adsorption capabilities, making it suitable for refining, petrochemical, and environmental applications.

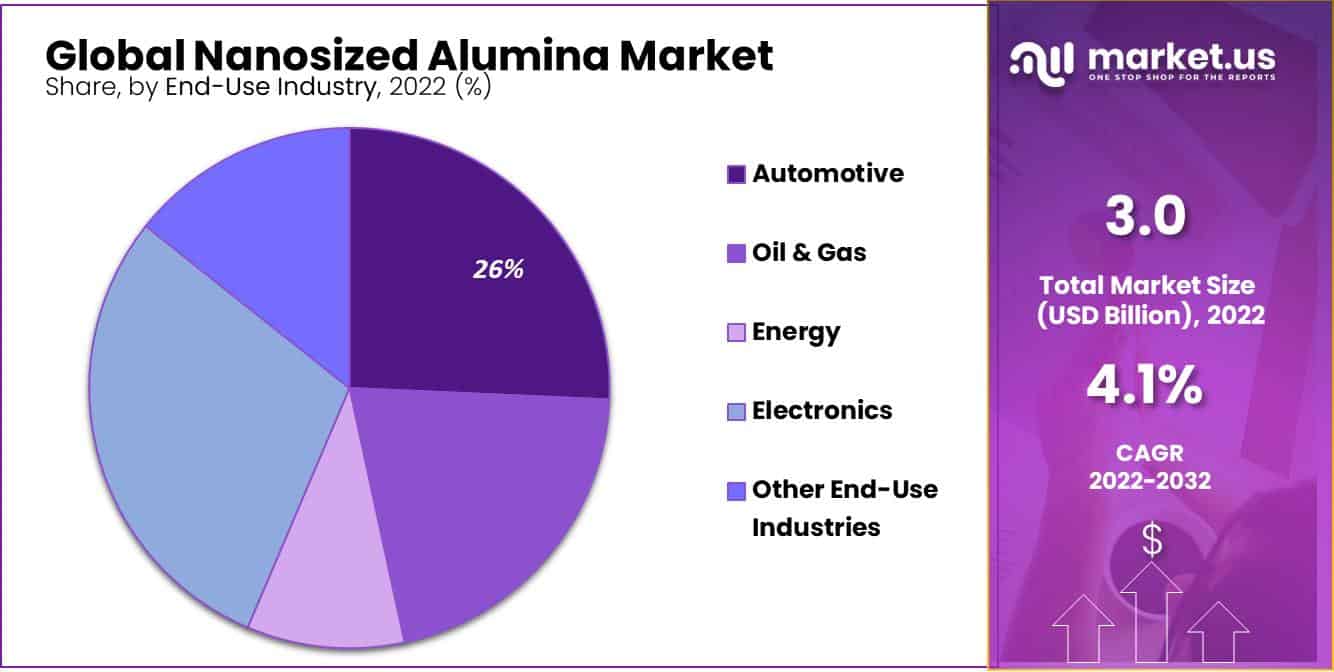

- Electronics Leading End-Use Industry: In 2022, electronics held the largest market share at 29.3% among end-use industries. The need for precision in electronic manufacturing and the demand for miniaturized devices drive the use of nanosized alumina in this sector.

- Automotive on the Rise: The automotive sector is the fastest-growing segment in the nanosized alumina market, with a market share of 25.7% in 2022. Its lightweight, robust properties are sought after for improving fuel efficiency and reducing emissions in vehicles.

- B2B Distribution Channel Prevalence: In 2022, the B2B distribution channel was the most lucrative with a market share of 68.8%. Nanosized alumina’s technical nature aligns well with B2B interactions, offering tailored consultations, bulk negotiations, and post-sales support.

- Future Trends: Trends to watch include sustainable synthesis techniques for environmentally conscious production and the potential of nanosized alumina in medical applications and sustainable catalysts. These align with the global push towards eco-friendly practices.

- Challenges and Opportunities: The nanosized alumina market faces regulatory challenges and environmental concerns due to the use of nanomaterials. However, it presents opportunities in medical and pharmaceutical applications and as a sustainable catalyst.

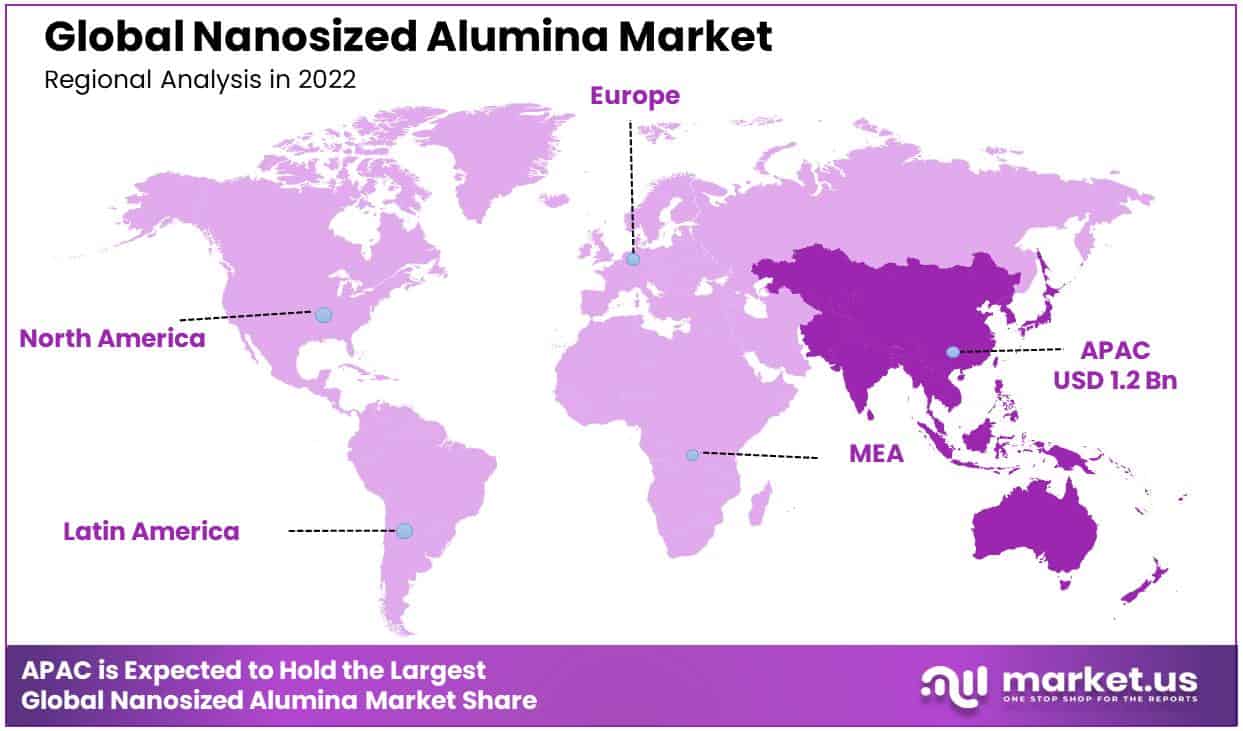

- Regional Dominance: APAC (Asia-Pacific) held the leading position in the global market in 2022 with a market share of 42.9%. Europe followed as the second dominant region with a market share of 24.7%. APAC’s robust industrial infrastructure and Europe’s focus on sustainable solutions contribute to their dominance.

- Key Market Players: Major players in the nanosized alumina market include Merck KGaA, Sumitomo Chemical Co. Ltd., Baikowski SA, Evonik Industries AG, Alcoa Corporation, and others. These players employ strategies such as research and development, partnerships, and sustainability initiatives to stay competitive.

Market Scope

Type Analysis

The Alpha Alumina Segment Held the Largest Market Share in 2022 Due to its Exceptional Mechanical Strength, Superior Thermal Stability, and Electrical Insulation.

Based on type, the global nanosized alumina market is segmented into Alpha Alumina, Beta Alumina, and Gamma Alumina. Among these types, the Alpha Alumina segment was the most lucrative in the global nanosized alumina market, with a market share of 73.6% in 2022.

The dominance can be attributed to its mechanical strength, thermal stability, and electrical insulation capabilities. This makes it highly desirable for various electronics, ceramics, and aerospace industries. Its superior hardness and wear resistance also contribute to its prevalence in abrasive and cutting tools.

Furthermore, the controlled synthesis of alpha alumina nanoparticles has become more efficient, allowing for precise particle size and morphology tailoring, thus enhancing its suitability for diverse applications. Its stability at high temperatures and in harsh environments further solidifies its position as a preferred choice for demanding applications.

Gamma Alumina has emerged as the second dominant segment in the global nanosized alumina market, with a market share of 19.5% in 2022. Its distinct characteristics, such as high surface area, exceptional catalytic activity, and enhanced adsorption capabilities, have garnered significant attention from various industries.

Gamma alumina’s increased surface area in catalyst manufacturing allows for greater active site exposure, improving catalytic performance and efficiency. This advantage has led to its extensive use in refining, petrochemical, and environmental sectors. Moreover, gamma alumina’s high adsorption capacity plays a pivotal role in gas and water purification processes, making it a preferred choice for filtration and treatment systems.

End-Use Industry Analysis

The Electronics Segment Held the Largest Market Share in 2022 Due to Its Indispensable Role in Precision Manufacturing Processes and Optimal Performance in Miniaturized Electronic Devices.

Based on the end-use industry, the global nanosized alumina market is segmented into Automotive, Oil and gas, Energy, Electronics, and Other End-Use Industries. Among these end-use industries, electronics was the most lucrative in the global nanosized alumina market, with a market share of 29.3% in 2022.

The relentless pursuit of miniaturization in electronic devices has propelled the demand for nanosized alumina. As electronic components shrink, the need for materials that can maintain optimal performance at smaller scales becomes paramount. Nanosized alumina, with its exceptional electrical properties, perfectly aligns with these requirements.

Furthermore, the ascendancy of high-definition displays, intricate semiconductor architectures, and advanced packaging techniques necessitates materials that can facilitate precision manufacturing. Nanosized alumina, with its fine particle size and uniform dispersion characteristics, emerges as an indispensable element in chemical mechanical polishing (CMP) and lithography processes. Its adeptness in planarization and as a barrier layer accentuates its relevance in enabling the production of cutting-edge electronics with superior performance metrics.

Followed by electronics, the automotive segment has emerged as the fastest-growing segment in the global nanosized alumina market, with a market share of 25.7% in 2022. The drive towards lightweight materials in the automotive industry has boosted the utilization of nanosized alumina.

Manufacturers are constantly seeking innovative ways to reduce the weight of vehicles, thereby improving fuel efficiency and reducing emissions. Nanosized alumina’s impressive strength-to-weight ratio offers a compelling solution for creating lightweight yet robust parts. Additionally, nanosized alumina’s exceptional electrical insulating properties make it an ideal candidate for applications in electric and hybrid vehicles.

Moreover, the versatility of nanosized alumina allows for its incorporation into various automotive systems. Nanosized alumina’s potential applications are virtually limitless, from engine components to catalytic converters, from brake systems to sensors. This adaptability has contributed significantly to its prevalence within the automotive sector.

Distribution Channel Analysis

The B2B Segment Held the Largest Market Share in 2022 Due to the Benefit of Tailored Consultations, Bulk Negotiations, and Post-Sale Support.

The global nanosized alumina market is segmented based on distribution channels into B2B, Online Platforms, and Suppliers. Among these distribution channels, the B2B segment was the most lucrative in the global nanosized alumina market, with a market share of 68.8% in 2022. The nature of nanosized alumina itself aligns harmoniously with the B2B framework.

Given this product’s specialized and technical nature, the target audience predominantly consists of industrial entities seeking to integrate it within intricate manufacturing processes. The B2B framework inherently caters to this scenario, providing a platform that facilitates tailored discussions, negotiates bulk quantities, and engages in nuanced consultations that cater to the precise requirements of buyers.

Furthermore, the complexity of the nanosized alumina market necessitates a certain level of expertise during the procurement process. B2B interactions inherently offer the prospect for suppliers to elucidate technical intricacies, provide consultative guidance, and furnish post-sale support. These components are integral to building enduring partnerships within the industry, further fortifying the dominance of the B2B channel.

Followed by B2B, the suppliers segment has emerged as the fastest-growing segment in the global nanosized alumina market, with a market share of 21.3% in 2022. Suppliers often establish long-standing relationships with buyers built on trust, consistency, and quality assurance. As suppliers consistently deliver high-quality products, they gain a competitive edge, fostering customer loyalty and enhancing their dominant position within the market.

The geographical dispersion of suppliers also contributes to their prominence. Suppliers can cater to a wider range of customers by strategically positioning themselves across different regions, thereby capturing a larger market share. This broad coverage allows them to tap into emerging markets and respond effectively to shifting demands.

Key Market Segments

Based on the Type

- Alpha Alumina

- Beta Alumina

- Gamma Alumina

Based on the End-Use Industry

- Automotive

- Oil & Gas

- Energy

- Electronics

- Other End-Use Industries

Based on the Distribution Channel

- B2B

- Online Platforms

- Suppliers

Drivers

Growing Demand for Advanced Materials

The global nanosized alumina market is propelled by a compelling driver – the surging demand for advanced materials across industries. Electronics and healthcare industries are increasingly seeking materials with enhanced properties and performance. Nanosized alumina, due to its unique characteristics at the nanoscale, offers remarkable strength, superior thermal and chemical stability, and improved conductivity.

As industries seek to create innovative products and solutions, utilizing nanosized alumina becomes integral in achieving these objectives. This demand-driven trend serves as a significant driver, fostering the expansion of the nanosized alumina market on a global scale.

Technological Advancements and Research

Technological advancements in materials science have developed sophisticated methods for synthesizing and manipulating nanosized alumina particles. These innovations enable precise control over particle size, morphology, and surface properties. As a result, industries can harness these tailored properties for enhanced performance in applications such as catalysis, electronics, and ceramics.

The discreet nature of nanomaterials makes them harder to detect, keeping competition from easily reverse-engineering products. This factor has spurred growth in the global nanosized alumina market as companies seek to leverage these advancements for improved product offerings and competitive advantages.

Restraints

Regulatory Challenges and Environmental Concerns

The global nanosized alumina market encounters a significant restraint in the form of regulatory challenges and mounting environmental concerns. Utilizing nanomaterials, including nanosized alumina, raises questions about potential health risks and environmental impacts. Stringent regulations surrounding nanoparticle production, handling, and disposal add complexity to market dynamics.

Concerns regarding nanoparticle toxicity, bioaccumulation, and long-term environmental effects necessitate comprehensive assessments and regulatory frameworks. Uncertainties hinder market growth in navigating these regulations and addressing public apprehensions about the safety of nanoscale materials.

High Production Costs and Scalability

The high production costs and challenges related to scalability present a notable restraint in the global nanosized alumina market. Manufacturing nanosized alumina with precise particle size, morphology, and purity control requires specialized equipment, skilled labor, and advanced technologies.

These factors contribute to elevated production costs, limiting the affordability and accessibility of nanosized alumina products. Additionally, the scalability of nanomaterial production processes poses challenges as maintaining consistent quality and quantity becomes more complex at larger scales. These cost and scalability issues impede the market’s growth potential, particularly in industries where cost-effectiveness is critical.

Opportunity

Applications in Medical & Pharmaceuticals

Utilizing nanosized alumina in medical and pharmaceutical applications represents a promising avenue for market growth. Its biocompatibility, surface modification potential, and drug delivery capabilities open doors for targeted therapies and medical device breakthroughs.

The nanoscale dimensions enable precise interactions at cellular levels, fostering advancements in diagnostics and treatment. This opportunity is further fueled by the increasing need for personalized medicine and minimally invasive procedures.

As research continues to unveil the potential of nanosized alumina in healthcare, collaborations between materials scientists and medical professionals could drive significant advancements in this sector.

Nanosized Alumina in Sustainable Catalysts

Another promising avenue within the global nanosized alumina market is its application in sustainable catalysts. As industries seek greener and more efficient processes, nanosized alumina emerges as catalyst support with immense potential. By finely tuning its surface characteristics and porosity, nanosized alumina can offer enhanced catalytic activity, selectivity, and stability for various chemical reactions, including hydrogenation, oxidation, and emission control.

This opportunity aligns with the global push towards eco-friendly manufacturing practices and cleaner energy sources. Integrating nanosized alumina as catalyst support can enable the development of environmentally friendly processes while optimizing resource utilization. Seizing this opportunity holds the promise of advancing catalysis science and contributing to a more sustainable future.

Trends

Sustainable Synthesis Techniques and Green Nanosized Alumina Production

Another noteworthy trend shaping the global nanosized alumina market is the increasing focus on sustainable synthesis techniques and environmentally conscious production methods. This trend, termed “Green Nanosized Alumina Production,” highlights the industry’s growing commitment to reducing its environmental footprint.

Manufacturers are exploring novel routes for synthesizing nanosized alumina that minimize energy consumption, waste generation, and the use of hazardous chemicals. These efforts align with global sustainability goals and regulatory requirements, fostering the adoption of greener practices in nanosized alumina production. This trend addresses environmental concerns and positions nanosized alumina as a responsible choice for industries aiming to uphold sustainable practices.

COVID-19 Impact Analysis

The global nanosized alumina market experienced a noticeable impact due to the COVID-19 pandemic. The pandemic disrupted supply chains and led to reduced production capacities across industries. Demand for nanosized alumina in sectors such as electronics and automotive slowed down as economic uncertainties prevailed. Travel restrictions and lockdowns affected international trade, affecting the availability of raw materials for alumina production.

Remote work setups slowed down research and development activities, which in turn impacted the introduction of new applications. However, the healthcare sector saw increased demand for alumina-based materials used in medical equipment. The market is expected to recover gradually as economies stabilize and industries regain momentum post-pandemic. Strategic adaptations and technological innovations will likely play a pivotal role in shaping the nanosized alumina market’s resurgence.

Regional Analysis

APAC is the Dominant Region in the Global Nanosized Alumina Market in 2022 Due to its Robust Industrial Infrastructure, Favorable Policies, and Strong Academic-Industry Collaborations.

In 2022, APAC held the leading position in the global market, with a significant market share of 42.9%. With a burgeoning industrial landscape, APAC countries have capitalized on the advantages offered by nanosized alumina in various applications, including electronics, coatings, ceramics, and catalysis.

The region’s robust manufacturing capabilities and a focus on technological innovation have enabled it to cater to domestic and international demand for nanosized alumina-based products. Additionally, favorable government policies and investments in research and development have fostered a conducive environment for expanding nanotechnology-related industries in APAC. The availability of skilled labor and strong collaborations between academia and industry further contribute to the region’s dominance.

Europe has emerged as the second dominant segment in the global nanosized alumina market, with a market share of 24.7% in 2022. Europe’s emphasis on sustainable and eco-friendly solutions aligns well with the utilization of nanosized alumina, which offers enhanced properties and functionalities while minimizing environmental impact.

The region’s commitment to stringent quality standards and regulations has fostered a reputation for producing high-quality nanomaterials, attracting domestic and international demand. Geopolitically, Europe’s position as a hub for trade and commerce has positioned it favorably for both sourcing raw materials and exporting finished products, bolstering its influence on the global nanosized alumina market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key global nanosized alumina market players include Merck KGaA, Sumitomo Chemical Co. Ltd., Baikowski SA, Evonik Industries AG, Alcoa Corporation, and more. Key player’s strategies encompass diverse dimensions such as research and development investments, strategic collaborations, product diversification, market expansion, and innovative marketing tactics.

Some key players also focus on enhancing product quality through cutting-edge research, while others form partnerships to access new markets and customer segments. Additionally, differentiation through customization and unique product offerings has been observed, aiding market penetration. Moreover, a few players have emphasized sustainability initiatives to align with evolving market preferences.

Market Key Players

- Merck KGaA

- Sumitomo Chemical Co. Ltd.

- Baikowski SA

- Evonik Industries AG

- Alcoa Corporation

- American Elements

- Meliorum Technologies Inc.

- Otto Chemie Pvt. Ltd.

- SkySpring Nanomaterials Inc.

- Other Key Players

Report Scope

Report Features Description Market Value (2022) US$ 3.0 Bn Forecast Revenue (2032) US$ 4.4 Bn CAGR (2023-2032) 4.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Alpha Alumina, Beta Alumina, and Gamma Alumina) By End-Use Industry (Oil & Gas, Energy, Electronics, and Other End-Use Industries) By Distribution Channel (B2B, Online Platforms, and Suppliers) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Merck KGaA, Sumitomo Chemical Co. Ltd., Baikowski SA, Evonik Industries AG, Alcoa Corporation, American Elements, Meliorum Technologies Inc., SkySpring Nanomaterials Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of Nanosized Alumina Market?Global Nanosized Alumina Market was valued at USD 3.0 Billion, and is expected to reach USD 4.4 Billion in 2032 Between 2023 and 2032

What is the Nanosized Alumina Market growth?The global Nanosized Alumina Market is expected to grow at a compound annual growth rate of 4.1%.

What is nanosized alumina, and how is it different from regular alumina?Nanosized alumina refers to aluminum oxide particles that are extremely small, typically at the nanometer scale. They have unique properties and applications compared to regular alumina, such as enhanced surface area and improved reactivity.

-

-

- Merck KGaA

- Sumitomo Chemical Co. Ltd.

- Baikowski SA

- Evonik Industries AG

- Alcoa Corporation

- American Elements

- Meliorum Technologies Inc.

- Otto Chemie Pvt. Ltd.

- SkySpring Nanomaterials Inc.

- Other Key Players