Global N-type Semiconductor Material Market Size, Share Analysis Report By Doping Material (Phosphorus-doped, Arsenic-doped, Others), By Application (Consumer Electronics, Automotive, Industrial, Telecommunication, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138537

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

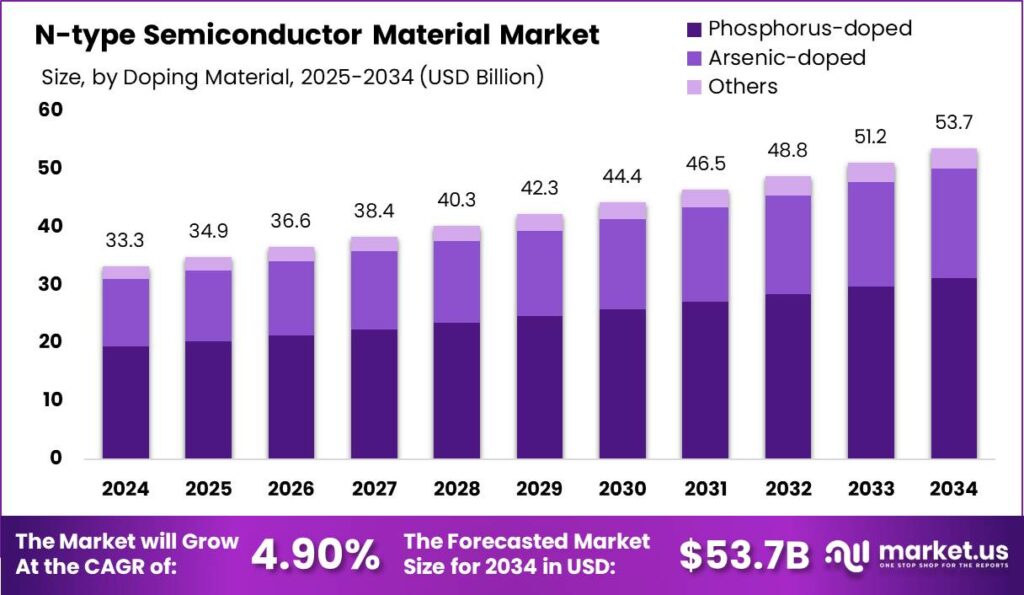

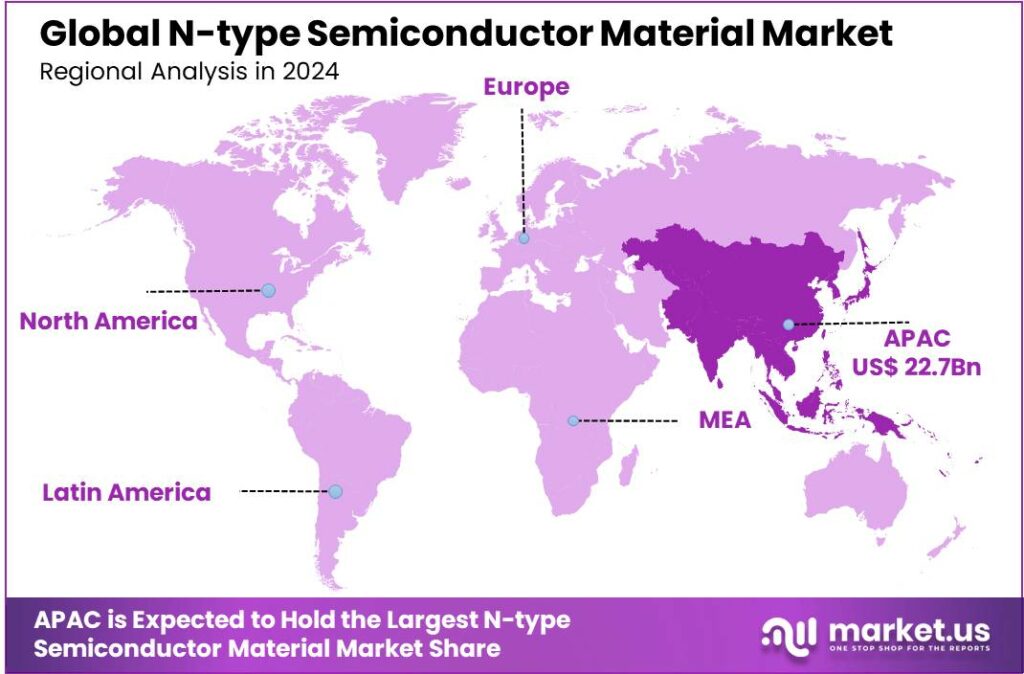

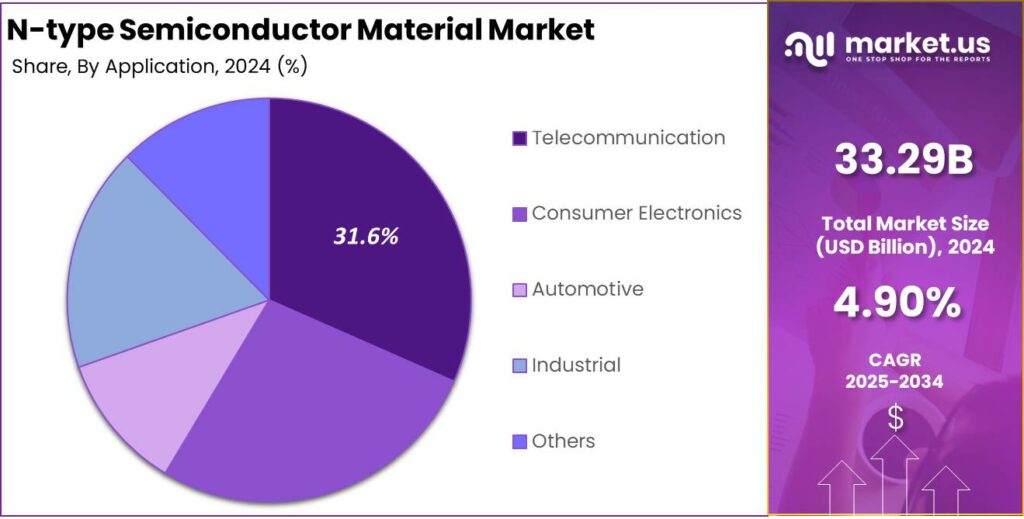

The Global N-type Semiconductor Material Market size is expected to be worth around USD 53.7 Billion By 2034, from USD 33.29 Billion in 2024, growing at a CAGR of 4.90% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region led the N-type semiconductor material market, capturing a 68.3% share and generating USD 22.7 billion in revenue.

An N-type semiconductor material is a type of semiconductor characterized by the presence of extra electrons that contribute to its electrical conductivity.This material is created by doping an intrinsic semiconductor, like silicon or germanium, with an element that has more valence electrons, such as phosphorus or arsenic.

In N-type semiconductors, the majority carriers are typically doped with elements that have more valence electrons than the semiconductor material itself, such as phosphorus in silicon, which introduces extra electrons into the system. These free electrons are the majority charge carriers and contribute to electrical conduction.

The N-type semiconductor material market is driven by the growth of the electronics industry, as these materials are vital for devices like transistors, diodes, and integrated circuits. Additionally, the increasing demand for renewable energy solutions, particularly in the production of photovoltaic cells for solar panels, further fuels market expansion.

Advancements in technology and higher R&D investments are driving the semiconductor market by enhancing device efficiency and capabilities. The trend toward miniaturization and the rising need for high-performance materials to support IoT and AI technologies are also key growth factors.

N-type semiconductor materials are popular due to their superior electrical properties and versatility in various applications. Their efficient conductivity and control over electron flow make them valuable in both established and emerging tech markets, with ongoing innovations further boosting their demand.

Market opportunities for N-type semiconductors are growing with the rise of electric vehicles, IoT devices, and 5G networks, all of which rely on efficient semiconductor materials. Ongoing R&D also opens doors for more advanced N-type materials, potentially transforming power management and energy efficiency across various technologies.

Market expansion for N-type semiconductor materials is expected to continue as new technological frontiers are explored. As the global push towards more sustainable technologies grows, the role of N-type semiconductors in enhancing performance and reducing energy consumption becomes even more significant, ensuring their relevance and necessity in the tech-driven future.

Key Takeaways

- The Global N-type Semiconductor Material Market is expected to reach a value of approximately USD 53.7 Billion by 2034, growing from USD 33.29 Billion in 2024, at a compound annual growth rate (CAGR) of 4.90% during the forecast period from 2025 to 2034.

- In 2024, the Asia-Pacific region held a dominant position in the N-type semiconductor material market, with a 68.3% market share, generating USD 22.7 billion in revenue.

- The Phosphorus-doped segment was the leading segment in the N-type semiconductor material market in 2024, capturing 58.3% of the market share.

- The Telecommunication segment also held a significant position in the N-type semiconductor material market in 2024, commanding 31.6% of the market share.

Regional Analysis

In 2024, Asia-Pacific held a dominant market position in the n-type semiconductor material market, capturing more than a 68.3% share with USD 22.7 billion in revenue. This leadership is largely attributed to the substantial manufacturing base and rapid technological advancements in countries like China, South Korea, and Taiwan.

The growth in Asia-Pacific is further propelled by government initiatives aimed at boosting the semiconductor industry as part of broader national strategic plans. For example, China’s “Made in China 2025” initiative and South Korea’s investments in R&D and semiconductor manufacturing infrastructure are pivotal in supporting the region’s dominance.

Additionally, the region benefits from a competitive labor market and a strong educational focus on engineering and technology, which continuously supplies skilled labor to the semiconductor industry. This not only sustains growth but also drives innovation, leading to the development of advanced n-type semiconductor materials that cater to the evolving needs of high-tech sectors.

The Asia-Pacific region is expected to maintain its lead due to ongoing technological upgrades, increasing domestic consumption of electronic products, and strategic alliances among local companies. These factors collectively enhance the region’s capacity to adapt to dynamic market conditions, thereby securing its position at the forefront of the n-type semiconductor materials market.

Doping Material Analysis

In 2024, the Phosphorus-doped segment held a dominant market position in the N-type semiconductor material market, capturing more than a 58.3% share. This segment’s leadership is primarily attributed to phosphorus’s ability to efficiently donate electrons, enhancing the electrical conductivity of silicon-based semiconductors.

Phosphorus-doped N-type semiconductors are ideal for high-speed and high-power applications due to their high electron mobility and low electron scattering. These properties make them crucial for advanced technologies in automotive electronics and renewable energy systems, where efficiency and durability are key.

Moreover, the processing of Phosphorus-doped semiconductors is well-established and cost-effective, making it a preferred choice for manufacturers aiming to optimize production costs while maintaining high quality. The widespread adoption of these materials by leading semiconductor manufacturers further reinforces the segment’s strong market presence.

Ongoing advancements in semiconductor technology are driving the demand for Phosphorus-doped semiconductors due to their robust performance. R&D efforts are focused on improving their efficiency to meet the evolving needs of sophisticated electronics and IoT devices, supporting the continued growth and market dominance of this segment.

Application Analysis

In 2024, the Telecommunication segment held a dominant position in the N-type semiconductor material market, capturing more than a 31.6% share. This leading stance is primarily due to the burgeoning demand for high-speed and reliable communication networks across the globe.

As telecommunications infrastructure evolves with the rise of 5G networks and expanding IoT connectivity, the demand for advanced semiconductors capable of handling higher frequencies and reducing power consumption has grown. N-type semiconductors, known for their efficiency and durability, are well-suited to meet these challenges, making them crucial for the sector.

The Telecommunication segment holds a significant share due to advancements in mobile devices and wireless communication systems, which demand components that perform under high frequency and power while ensuring energy efficiency. N-type semiconductor materials, with their superior electron mobility, are perfect for applications like amplifiers and RF switches, essential for telecommunication devices.

The increasing demand for fast, reliable connectivity driven by remote work, online education, and digital healthcare is accelerating the need for stronger telecommunication networks.These vital for infrastructure, enable high-volume data transmission with minimal energy loss, making them key to supporting modern services and reinforcing market leadership in the sector.

Key Market Segments

By Doping Material

- Phosphorus-doped

- Arsenic-doped

- Others

By Application

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Advanced Electronics

The surge in advanced electronic devices like smartphones, tablets, and wearables is a major factor boosting the n-type semiconductor market. Consumers today seek faster, more efficient, and feature-rich gadgets. To meet these expectations, manufacturers rely on n-type semiconductors for their superior conductivity and performance.

Moreover, the rapid expansion of electric vehicles (EVs) and renewable energy technologies has created a surge in demand for high-efficiency power semiconductors, which rely on advanced n-type materials for optimal performance. This trend further accelerates innovation in the semiconductor industry, fostering the development of new materials and processes to meet the growing needs of these sectors.

Restraint

Supply Chain Disruptions

The semiconductor industry often faces challenges due to supply chain disruptions. Factors like geopolitical tensions, natural disasters, and global pandemics can hinder the production and distribution of essential materials. For instance, the shortage of rare earth elements, crucial for semiconductor manufacturing, has led to price volatility and limited availability.

In addition, geopolitical tensions and trade restrictions can further complicate the global supply chain for semiconductors, creating uncertainty and volatility in prices and availability. Companies must diversify their supply sources and invest in risk mitigation strategies to safeguard against these disruptions and ensure long-term stability in the market.

Opportunity

Expansion in Renewable Energy and Electric Vehicles

The shift towards renewable energy sources and the rise of electric vehicles (EVs) present significant growth opportunities for n-type semiconductors. In renewable energy, these semiconductors are used in solar cells and wind turbines to improve energy conversion efficiency.

Similarly, in the EV market, n-type semiconductors play a critical role in battery management systems and power electronics, supporting the transition to cleaner transportation solutions. As the world focuses more on sustainability, the demand for efficient semiconductor materials in these applications is expected to grow substantially.

Challenge

High Production Costs

Developing advanced n-type semiconductors involves significant investment in research, development, and sophisticated manufacturing processes. As devices become more complex and miniaturized, the cost of production increases.

Furthermore, the rapid pace of technological advancement in semiconductor manufacturing requires significant investment in research and development. Smaller companies may struggle to allocate resources effectively to stay at the forefront of innovation while maintaining financial stability. Collaborations, partnerships, or tapping into government incentives for innovation could be vital strategies to overcome these financial challenges and foster growth.

Emerging Trends

One of the emerging trends in the field of N-type semiconductors is the exploration of new materials beyond traditional silicon. Materials like gallium nitride (GaN) and silicon carbide (SiC) are gaining attention due to their superior properties.

Another trend is the miniaturization of semiconductor components. As the demand for smaller and more powerful electronic devices grows, researchers are focusing on developing N-type semiconductors that can function effectively at nanoscale dimensions.

The rise of AI and IoT is driving advancements in N-type semiconductors, which are being optimized for faster data processing and improved energy efficiency to meet the high-speed demands of these technologies.

In the renewable energy sector, N-type semiconductors are making significant strides. They are used in the development of high-efficiency solar cells, contributing to more effective conversion of sunlight into electricity. This not only enhances the performance of solar panels but also supports global efforts towards sustainable energy solutions.

Business Benefits

For companies involved in electronics manufacturing, adopting these advanced materials can lead to the production of devices that are more efficient, durable, and capable of higher performance. This can result in a competitive edge in the market, as consumers increasingly seek out high-performing and reliable electronic products.

The use of materials like GaN and SiC in power electronics can lead to significant energy savings. For businesses, this means the development of products that consume less power, generate less heat, and have longer lifespans. These attributes are highly attractive to consumers and can open up new market opportunities.

Companies that incorporate these materials into their products can not only contribute to environmental conservation but also appeal to environmentally conscious consumers, thereby enhancing their brand image and market appeal.

Key Player Analysis

In N-type Semiconductor Material Market , there are several companies leading the way in the production and development of N-type semiconductors.

SUMCO Corporation is a major global supplier of semiconductor silicon wafers, including N-type materials. Known for its advanced manufacturing capabilities, SUMCO delivers high-quality wafers that are used in a variety of semiconductor applications.

Shin-Etsu Chemical Co., Ltd. stands out as one of the leading manufacturers of N-type semiconductor materials. With a long history of technological expertise, Shin-Etsu Chemical specializes in silicon wafer production, including materials optimized for N-type semiconductors.

Global Wafers Co., Ltd. is another key player in the N-type semiconductor materials sector. As one of the largest silicon wafer producers globally, the company focuses on providing high-quality N-type wafers that meet the demanding needs of the semiconductor industry. Global Wafers places a strong emphasis on technological advancements and sustainability, ensuring that its products not only meet market demands but also contribute to environmentally-friendly solutions.

Top Key Players in the Market

- SUMCO Corporation

- Shin-Etsu Chemical Co., Ltd.

- Global Wafers Co., Ltd.

- Siltronic AG

- Wafer Works Corporation

- Okmetic

- Sicom Technologies, Inc.

- Soitec

- Tokyo Electron Limited (TEL)

- Other Major Players

Top Opportunities Awaiting for Players

- Artificial Intelligence (AI) Advancements: The demand for semiconductors that can handle AI applications is growing rapidly. Companies are focusing on developing advanced chips capable of processing information at high speeds, necessary for AI’s data-intensive applications. This trend is not only boosting the semiconductor market but also encouraging innovation in high-bandwidth memory and AI-optimized chip architectures.

- Expansion in Cloud Infrastructure: As more data is stored and processed in the cloud, the need for efficient semiconductor chips is increasing. This expansion is pushing the boundaries of semiconductor design and manufacturing, with companies like Texas Instruments leading in developing robust supply chains that can support the growing demand for cloud infrastructure.

- Growth in Automotive Applications: The rise of electric vehicles (EVs) and autonomous driving technology is creating a burgeoning demand for semiconductors in the automotive sector. Semiconductor players need to produce chips that meet the high safety and performance standards required in this industry, thus opening new markets for specialized semiconductor solutions.

- Technological Innovations and Supply Chain Resilience: Innovation in semiconductor materials and chip architecture continues to be a strong driver for the industry. Companies are increasingly focusing on developing more energy-efficient and powerful chips, while also improving supply chain resilience to better manage future market dynamics and challenges.

- Sustainability and Eco-Friendly Materials: With rising awareness of environmental issues, semiconductor manufacturers are prioritizing the development of materials that are both high-performing and eco-friendly. This shift not only helps in addressing environmental concerns but also opens up new business opportunities in sectors that value sustainability.

Recent Developments

- In January 2024, Shin-Etsu Chemical announced plans to invest approximately $545 million (83 billion yen) in a new factory in Gunma Prefecture, Japan. This facility will focus on producing lithography materials essential for chip production, aiming to strengthen Japan’s semiconductor supply chain and meet rising demand.

- In October 2024, A research team has made strides in developing a new n-type thermoelectric semiconductor based on bismuth telluride (Bi-Te). This material incorporates antimony (Sb) as a doping agent instead of the traditionally used selenium (Se). The innovation lies in artificially inducing atomic-scale defects during fabrication, which enhances electrical conductivity while reducing thermal conductivity.

Report Scope

Report Features Description Market Value (2024) USD 33.29 Bn Forecast Revenue (2034) USD 53.7 Bn CAGR (2025-2034) 4.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Doping Material (Phosphorus-doped, Arsenic-doped, Others), By Application (Consumer Electronics, Automotive, Industrial, Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SUMCO Corporation, Shin-Etsu Chemical Co., Ltd., Global Wafers Co., Ltd., Siltronic AG, Wafer Works Corporation, Okmetic, Sicom Technologies, Inc., Soitec, Tokyo Electron Limited (TEL), Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  N-type Semiconductor Material MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

N-type Semiconductor Material MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SUMCO Corporation

- Shin-Etsu Chemical Co., Ltd.

- Global Wafers Co., Ltd.

- Siltronic AG

- Wafer Works Corporation

- Okmetic

- Sicom Technologies, Inc.

- Soitec

- Tokyo Electron Limited (TEL)

- Other Major Players