Global Multiwall Bags Market Size, Share, Growth Analysis By Product (Paper Bags, Plastic Bags, Hybrid), By Layer (2-ply, 3-ply, Others), By Capacity (Up to 5kg, 6Kg to 10kg, 11Kg to 25Kg, Above 25Kg), By Application (Food & Beverages, Agriculture, Chemicals, Pharmaceuticals, Retail & Consumer Goods, Building Materials & Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157936

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

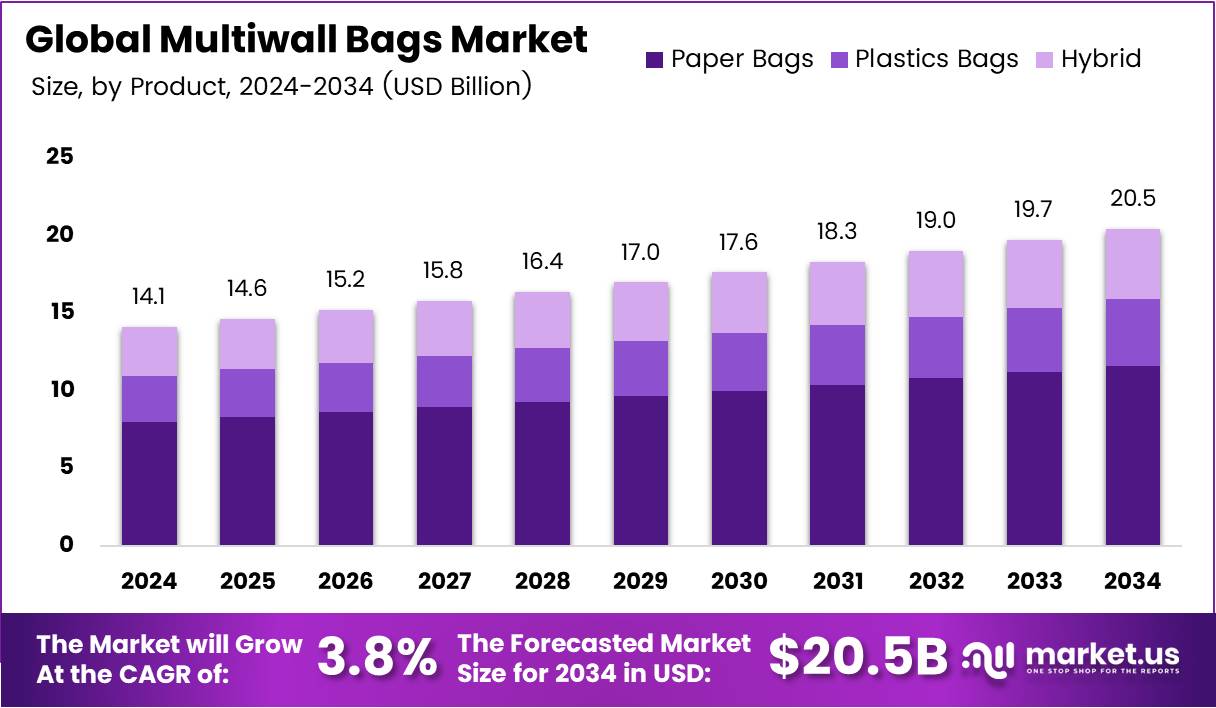

The Global Multiwall Bags Market size is expected to be worth around USD 20.5 Billion by 2034, from USD 14.1 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The multiwall bags market is integral to packaging across various industries, known for its robust and versatile design. These bags are primarily made from paper, although they may also feature polyethylene or other materials to enhance durability. Their applications span food, chemicals, cement, and other bulk products, providing a protective layer that ensures product integrity during transportation and storage.

Over the past few years, the market for multiwall bags has experienced notable growth, driven by the increasing demand for eco-friendly packaging solutions. As environmental concerns continue to rise, industries are shifting towards sustainable alternatives, with multiwall bags being a preferred choice due to their recyclability and biodegradability. This trend is expected to continue, especially with growing regulatory pressures on single-use plastics.

Key opportunities in the multiwall bags market lie in expanding end-use sectors, such as agriculture, construction, and pharmaceuticals. With growing demand for bulk packaging in these sectors, companies are poised to leverage multiwall bags for cost-effective, high-performance packaging solutions. Additionally, innovations in the design and customization of multiwall bags, such as moisture-resistant coatings and barrier properties, provide further growth potential in specialized markets.

Government investments and regulations also play a significant role in shaping the market landscape. In many regions, governments are incentivizing the use of sustainable materials, aligning with the global push for environmental sustainability. This has led to increased adoption of multiwall bags, as they meet the requirements of eco-conscious packaging standards. Industry regulations, such as those surrounding product safety and food-grade packaging, further support the market’s growth.

For example, according to Industry Weekly, multiwall bags have gained traction in sectors like food packaging due to their superior strength and ability to maintain freshness. Additionally, the expansion of manufacturing capacities, highlighted by recent acquisitions such as Namakor Holdings acquiring Metallomax Inc. in January 2025 and Hood Container’s acquisition of Sumter Packaging Corp. in January 2024, reflects growing consolidation in the industry. These strategic moves are expected to accelerate the market’s growth trajectory, enhancing production capabilities and expanding product offerings.

Key Takeaways

- The Global Multiwall Bags Market is projected to reach USD 20.5 Billion by 2034, growing from USD 14.1 Billion in 2024, at a CAGR of 3.8%.

- Paper Bags lead the market with a 56.8% share in the By Product Analysis segment in 2024.

- The 2-ply configuration dominates the By Layer Analysis segment with a 44.9% share in 2024.

- The 11Kg to 25Kg capacity segment holds a 38.1% share in 2024 in the By Capacity Analysis segment.

- The Food & Beverages sector represents 31.5% of the Multiwall Bags Market in 2024 in the By Application Analysis segment.

- The Asia Pacific region dominates the market with a 43.8% share, valued at USD 6.1 billion in 2024.

Product Analysis

Paper Bags dominate with 56.8% due to their eco-friendly nature and widespread consumer acceptance.

In 2024, Paper Bags held a dominant market position in By Product Analysis segment of Multiwall Bags Market, with a 56.8% share. This substantial market leadership reflects the growing environmental consciousness among consumers and businesses, driving demand for sustainable packaging solutions.

Paper-based multiwall bags have gained significant traction due to their biodegradable properties and recyclability. Industries are increasingly adopting paper bags to meet sustainability goals and comply with environmental regulations. The material offers excellent printability for branding purposes while maintaining structural integrity for various applications.

Plastic Bags represent the second-largest segment, though their market share remains considerably lower than paper alternatives. The shift away from plastic packaging in many regions has contributed to this positioning. However, plastic bags still maintain relevance in specific applications where moisture resistance and durability are critical factors.

Hybrid solutions combine the benefits of both materials, offering a compromise between environmental concerns and performance requirements. While this segment holds a smaller market share, it demonstrates innovation in packaging technology, catering to specialized applications that require both sustainability and enhanced protective properties.

Layer Analysis

2-ply dominates with 44.9% due to its optimal balance of strength and cost-effectiveness.

In 2024, 2-ply held a dominant market position in By Layer Analysis segment of Multiwall Bags Market, with a 44.9% share. This configuration provides an ideal compromise between material costs and functional performance, making it the preferred choice across various industries.

The 2-ply construction offers sufficient strength for most standard applications while keeping manufacturing costs reasonable. This balance appeals to businesses seeking cost-effective packaging solutions without compromising on quality. The dual-layer design provides adequate barrier properties for moisture and contamination protection.

3-ply bags constitute the second-largest segment, primarily serving applications requiring enhanced durability and protection. Industries handling heavier products or those requiring superior barrier properties often opt for this configuration. The additional layer provides extra security but comes at a higher cost.

The Others category encompasses specialized layer configurations designed for niche applications. These may include single-layer bags for lightweight products or multi-layer solutions exceeding three plies for extreme-duty applications. While representing a smaller market share, this segment demonstrates the industry’s ability to customize solutions for specific requirements.

Capacity Analysis

11Kg to 25Kg dominates with 38.1% due to its versatility across multiple industrial applications.

In 2024, 11Kg to 25Kg held a dominant market position in By Capacity Analysis segment of Multiwall Bags Market, with a 38.1% share. This capacity range strikes an optimal balance between handling convenience and operational efficiency, making it suitable for diverse industrial and commercial applications.

The mid-range capacity appeals to manufacturers and distributors as it offers manageable handling while maximizing storage efficiency. This weight range is ideal for products like cement, fertilizers, and food ingredients, where manual handling remains feasible while achieving reasonable packaging economics.

Smaller capacity segments (Up to 5kg and 6Kg to 10kg) serve specialized markets including retail packaging and consumer goods. These lighter bags facilitate easier handling and are preferred for products requiring portion control or consumer convenience.

The Above 25Kg segment caters to heavy-duty industrial applications where bulk packaging is prioritized over handling convenience. This category serves industries like construction materials and large-scale chemical processing, where mechanical handling systems are typically employed.

Each capacity segment addresses specific market needs, with the 11Kg to 25Kg range achieving market leadership through its universal applicability across various industries and handling systems.

Application Analysis

Food & Beverages dominates with 31.5% due to stringent quality requirements and growing packaged food consumption.

In 2024, Food & Beverages held a dominant market position in By Application Analysis segment of Multiwall Bags Market, with a 31.5% share. This sector’s prominence reflects the critical importance of safe, hygienic packaging in food supply chains and the continuous growth in processed food consumption globally.

The food industry demands high-quality packaging that ensures product safety, extends shelf life, and meets regulatory compliance standards. Multiwall bags provide excellent barrier properties against moisture, oxygen, and contaminants, making them ideal for flour, sugar, rice, and other bulk food products.

Agriculture represents a significant application segment, utilizing multiwall bags for seeds, fertilizers, and animal feed. The sector values durability and weather resistance for outdoor storage applications.

Chemicals and Pharmaceuticals require specialized packaging solutions with superior barrier properties and contamination prevention. These industries often demand customized bag specifications to handle specific product characteristics safely.

Building Materials & Construction uses multiwall bags for cement, sand, and other construction materials, where strength and tear resistance are paramount.

Retail & Consumer Goods and Others encompass diverse applications including pet food, gardening supplies, and various consumer products, demonstrating the versatility of multiwall bag solutions across different market segments.

Key Market Segments

By Product

- Paper Bags

- Plastic Bags

- Hybrid

By Layer

- 2-ply

- 3-ply

- Others

By Capacity

- Up to 5kg

- 6Kg to 10kg

- 11Kg to 25Kg

- Above 25Kg

By Application

- Food & Beverages

- Agriculture

- Chemicals

- Pharmaceuticals

- Retail & Consumer Goods

- Building Materials & Construction

- Others

Drivers

Growing Demand for Sustainable Packaging Solutions Drives Market Growth

The multiwall bags market is experiencing strong growth due to several key factors. Companies across industries are looking for eco-friendly packaging options that reduce their environmental impact. Multiwall bags offer a sustainable alternative to traditional packaging materials, making them increasingly popular among environmentally conscious businesses.

The e-commerce boom has created massive demand for reliable packaging solutions. Online retailers need bags that can protect products during shipping while maintaining cost efficiency. Multiwall bags provide excellent durability and protection, making them ideal for e-commerce applications. The retail sector also benefits from these bags’ versatility in storing and transporting various products.

Agriculture and food industries are major drivers of multiwall bag adoption. These sectors require packaging that keeps products fresh and protected from contamination.

Multiwall bags offer excellent barrier properties that prevent moisture and air from affecting food quality. Their strength makes them perfect for heavy agricultural products like grains, seeds, and fertilizers. This growing adoption in food packaging reflects the bags’ ability to meet strict safety and quality standards.

Restraints

Environmental Concerns Regarding Plastic Use Create Market Challenges

Despite their benefits, multiwall bags face several market restraints. Environmental concerns about plastic waste are growing worldwide. Consumers and governments are pushing for reduced plastic usage, which could limit demand for traditional multiwall bags. Many companies are being pressured to find completely plastic-free alternatives.

Government regulations on packaging materials are becoming stricter globally. New laws require companies to use recyclable or biodegradable materials, which may not always include current multiwall bag options. These regulations create compliance costs and limit market opportunities for manufacturers who cannot adapt quickly.

Competition from alternative packaging solutions poses another challenge. Paper bags, biodegradable films, and reusable containers are gaining market share. These alternatives often appeal to environmentally conscious consumers who prioritize sustainability over other factors.

Companies offering innovative packaging solutions can capture market share from traditional multiwall bag manufacturers. The increasing availability of eco-friendly alternatives makes it harder for conventional multiwall bags to maintain their market position.

Growth Factors

Demand for Customized Multiwall Bags Creates New Growth Opportunities

The multiwall bags market presents several exciting growth opportunities. Custom packaging solutions are becoming increasingly important as businesses seek unique ways to differentiate their products. Companies want multiwall bags designed specifically for their applications, creating opportunities for manufacturers to offer specialized solutions.

Development of eco-friendly and biodegradable multiwall bags represents a major growth area. Manufacturers investing in sustainable materials can capture environmentally conscious customers while meeting regulatory requirements. These innovative products address environmental concerns while maintaining the performance benefits that make multiwall bags popular.

Strategic partnerships between manufacturers and end-users are creating new business models. Collaborative relationships allow bag producers to better understand customer needs and develop targeted solutions. These partnerships often lead to long-term contracts and stable revenue streams. Manufacturing companies can work directly with agricultural producers, food companies, and retailers to create customized packaging programs.

The rise of specialty applications also presents growth opportunities. Industries like pharmaceuticals, chemicals, and construction materials require specialized packaging with unique properties. Manufacturers who can develop multiwall bags for these niche markets often enjoy higher profit margins and less competition.

Emerging Trends

Shift Toward Lightweight and High-Performance Multiwall Bags Shapes Market Trends

Current market trends are reshaping the multiwall bags industry. The shift toward lightweight yet high-performance bags is driven by cost reduction needs and environmental concerns. Lighter bags reduce shipping costs while maintaining strength and durability. Advanced materials and manufacturing techniques enable this performance improvement.

Smart packaging features are being integrated into multiwall bags. These include sensors that monitor product freshness, temperature indicators, and tracking capabilities. Smart packaging helps companies improve supply chain management and reduce product waste. The technology appeals to modern consumers who value transparency and information about their products.

The construction industry is increasingly using multiwall bags for various applications. These bags store and transport cement, sand, and other building materials safely. Construction companies appreciate the bags’ durability and weather resistance. This expanding use case represents a significant growth area for manufacturers.

Hazardous material packaging is another trending application. Industries handling chemicals, pharmaceuticals, and dangerous goods need specialized containment solutions. Multiwall bags designed for hazardous materials must meet strict safety standards. This specialized market segment often commands premium pricing and offers stable demand from industrial customers.

Regional Analysis

Asia Pacific Dominates the Multiwall Bags Market with a Market Share of 43.8%, Valued at USD 6.1 Billion

The Asia Pacific region holds the dominant share of the Multiwall Bags Market, accounting for 43.8%, valued at USD 6.1 billion. This market leadership is primarily driven by the growing demand for industrial packaging and the rapid expansion of manufacturing sectors in countries like China and India. The region’s strong presence in construction, agriculture, and food packaging is expected to fuel continued growth in the coming years.

North America Multiwall Bags Market Trends

North America holds a significant share of the Multiwall Bags Market, supported by a steady demand from the food and beverage industry. The growing focus on sustainable packaging solutions in the U.S. and Canada is expected to drive market expansion. The region’s emphasis on eco-friendly products, coupled with advancements in packaging technologies, enhances its position in the market.

Europe Multiwall Bags Market Trends

Europe’s Multiwall Bags Market is driven by stringent regulations aimed at reducing plastic waste and increasing the use of recyclable packaging. The demand for paper-based packaging in industries such as food, chemicals, and construction is growing steadily. As sustainability becomes a priority, European manufacturers are innovating to meet eco-friendly standards, supporting long-term market growth.

Latin America Multiwall Bags Market Trends

Latin America’s Multiwall Bags Market is showing significant growth, with countries like Brazil and Mexico driving demand for industrial packaging solutions. Increased agricultural production in the region, coupled with the growth of the e-commerce sector, is expected to boost the demand for multiwall bags. However, challenges related to economic fluctuations in the region could affect growth in the short term.

Middle East and Africa Multiwall Bags Market Trends

The Middle East and Africa region is experiencing moderate growth in the Multiwall Bags Market, primarily fueled by the increasing demand for packaging solutions in the construction and agriculture sectors. While economic diversification in countries like the UAE and Saudi Arabia presents opportunities, the market remains somewhat restrained by limited manufacturing capabilities in certain regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Multiwall Bags Company Insights

The global multiwall bags market in 2024 is characterized by a dynamic landscape, with key players driving innovation and sustainability.

Mondi Group continues to lead with its commitment to sustainable packaging solutions. The company has introduced innovations like FlexiBag Reinforced, a recyclable and cost-effective packaging solution, reinforcing its position in the market.

WestRock Company, now part of Smurfit WestRock following its merger with Smurfit Kappa, brings a wealth of experience in corrugated packaging. This merger has expanded its global reach and product offerings, positioning it as a formidable player in the multiwall bags sector.

Smurfit Kappa Group, as part of Smurfit WestRock, continues to be a significant force in the packaging industry. The company’s extensive network and focus on sustainable packaging solutions contribute to its strong presence in the multiwall bags market.

Bag Supply Company, Inc., specializes in providing a wide range of bulk bag solutions. With a focus on quality and customer satisfaction, the company caters to various industries requiring durable and reliable packaging options.

These companies exemplify the diverse approaches and innovations shaping the multiwall bags market in 2024, each contributing uniquely to the industry’s growth and evolution.

Top Key Players in the Market

- Mondi Group

- WestRock Company

- Smurfit Kappa Group

- Bag Supply Company, Inc.

- ABX

- Hood Packaging Corporation

- El Dorado Packaging, Inc.

- Lincon Polymers Pvt. Ltd.

- ProAmpac Holdings Inc.

- Global-Pak, Inc.

- NNZ Group

Recent Developments

- In June 2024, MASTERGRAIN announced the acquisition of Fibercraft Door Company, expanding its presence in the specialty paper products sector. This strategic move is expected to enhance MASTERGRAIN’s product portfolio and strengthen its competitive edge in the global market.

- In March 2024, ProAmpac agreed to acquire Gelpac, a move aimed at expanding ProAmpac’s capabilities in flexible packaging. The acquisition will allow ProAmpac to leverage Gelpac’s expertise in sustainable packaging solutions to meet growing demand.

- In March 2025, Cordovan Capital acquired Ireland’s only paper sack producer, a significant step to diversify its portfolio and strengthen its position in the European packaging market. This acquisition is expected to boost Cordovan’s market share in the paper-based packaging segment.

Report Scope

Report Features Description Market Value (2024) USD 14.1 Billion Forecast Revenue (2034) USD 20.5 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Paper Bags, Plastic Bags, Hybrid), By Layer (2-ply, 3-ply, Others), By Capacity (Up to 5kg, 6Kg to 10kg, 11Kg to 25Kg, Above 25Kg), By Application (Food & Beverages, Agriculture, Chemicals, Pharmaceuticals, Retail & Consumer Goods, Building Materials & Construction, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mondi Group, WestRock Company, Smurfit Kappa Group, Bag Supply Company, Inc., ABX, Hood Packaging Corporation, El Dorado Packaging, Inc., Lincon Polymers Pvt. Ltd., ProAmpac Holdings Inc., Global-Pak, Inc., NNZ Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mondi Group

- WestRock Company

- Smurfit Kappa Group

- Bag Supply Company, Inc.

- ABX

- Hood Packaging Corporation

- El Dorado Packaging, Inc.

- Lincon Polymers Pvt. Ltd.

- ProAmpac Holdings Inc.

- Global-Pak, Inc.

- NNZ Group