Global Multiple Unit Pellet Systems Market By Dosage Form (Capsules, Tablets, Sachets and Others), By Formulation (Extended Release Dosage Form, Delayed Release Orodispersible Dosage Form, Delayed Release Dosage Form and Other), By Drug Class (Proton Pump Inhibitors, Anti-Hypertensive, Antibiotics, Analgesics and Others), By Distribution Channel (Hospital Pharmacies, Drug Stores, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173700

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

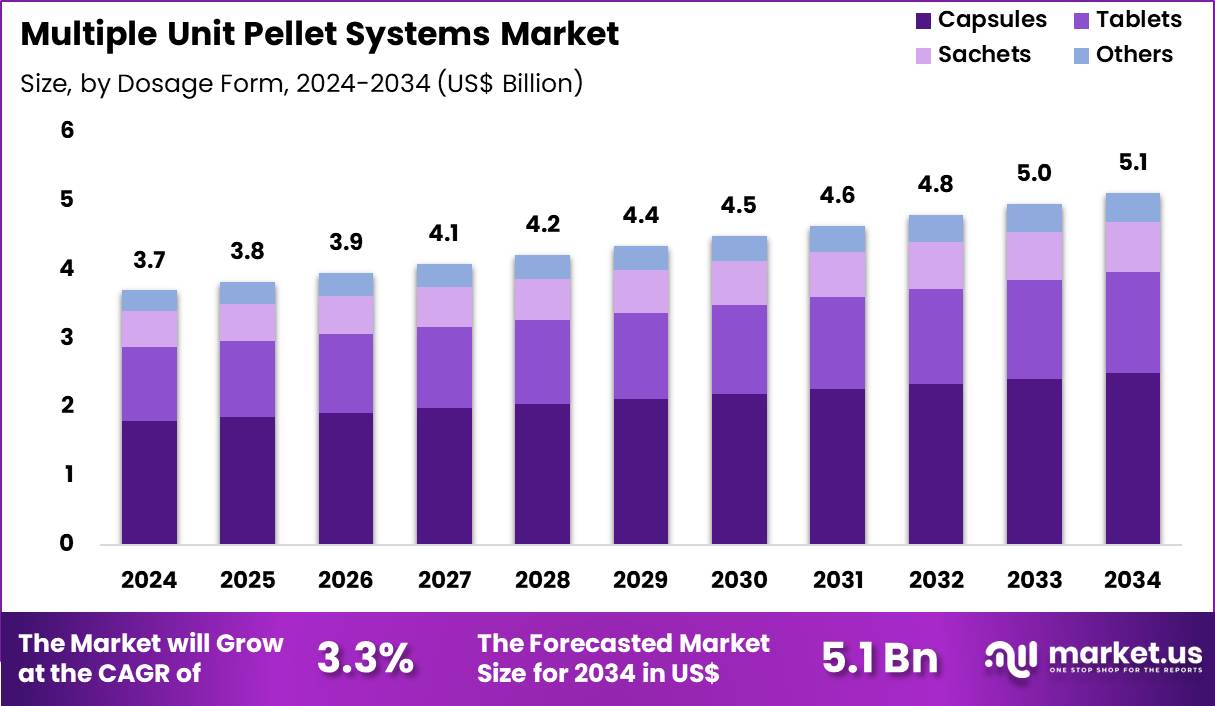

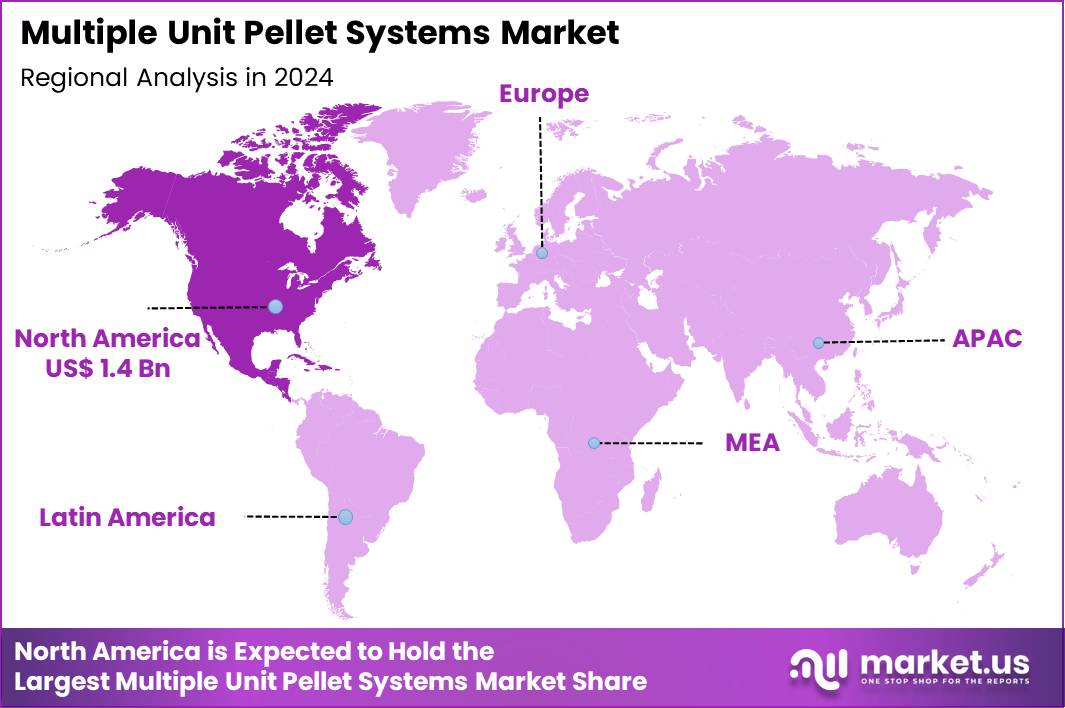

The Global Multiple Unit Pellet Systems Market size is expected to be worth around US$ 5.1 Billion by 2034 from US$ 3.7 Billion in 2024, growing at a CAGR of 3.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.9% share with a revenue of US$ 1.4 Billion.

Increasing demand for patient-centric modified-release formulations accelerates the adoption of Multiple Unit Pellet Systems that enable uniform drug distribution, predictable gastrointestinal transit, and reduced interpatient variability in plasma concentrations. Pharmaceutical developers increasingly incorporate MUPS technology into proton pump inhibitor tablets, allowing rapid disintegration into pellets that deliver sustained acid suppression for gastroesophageal reflux disease management.

These systems support cardiovascular therapies by compressing extended-release pellets containing beta-blockers, ensuring consistent blood pressure control throughout the day. Manufacturers utilize MUPS platforms to formulate non-steroidal anti-inflammatory drugs with enteric-coated pellets, protecting the gastric mucosa while providing prolonged relief from chronic inflammatory conditions. These dosage forms facilitate combination therapies by layering pellets with different release profiles, optimizing pharmacokinetic synergy in metabolic disorder treatments.

In the quarter ending September 30, 2025, Dr. Reddy’s Laboratories reported revenue of approximately US$1.06 billion from its global generics section, which incorporates MUPS-based and other modified-release technologies. This performance contributed to total quarterly revenue of about US$1.2 billion, reflecting a 10% year-over-year increase and underscoring the growing role of differentiated generics in the company’s overall growth strategy.

Manufacturers pursue opportunities to develop orodispersible MUPS tablets that disintegrate rapidly in the mouth, expanding applications for pediatric and geriatric patients requiring modified-release antihistamines or antiemetics. Developers engineer high-drug-load pellets compressed into compact tablets, broadening utility in once-daily regimens for central nervous system disorders such as attention deficit hyperactivity disorder.

These innovations facilitate taste-masked formulations through polymer-coated pellets, improving compliance in chronic pain management with opioid analgesics. Opportunities emerge in creating fixed-dose combinations where MUPS technology separates incompatible actives, enabling controlled release of antihypertensives and diuretics in cardiovascular polypharmacy.

Companies advance bioequivalent MUPS versions of established brands, providing cost-effective alternatives while maintaining therapeutic equivalence in respiratory and endocrine indications. Firms invest in flexible pellet coating technologies that allow customization of release kinetics, supporting precision dosing in hormone replacement therapies.

Industry leaders refine compression excipients and cushioning agents to protect functional pellet coatings during tableting, preserving release profiles in high-speed manufacturing of proton pump inhibitor and antidepressant MUPS tablets. Developers introduce multiparticulate systems with pH-independent coatings, ensuring consistent drug delivery across diverse gastrointestinal environments in anti-inflammatory and antiepileptic applications.

Market participants prioritize scalable extrusion-spheronization processes that enhance pellet uniformity, streamlining production for large-volume cardiovascular and gastrointestinal modified-release products. Innovators incorporate real-time process analytical technologies to monitor pellet integrity, elevating quality assurance in complex MUPS formulations.

Companies emphasize patient-friendly tablet sizes and swallowability, driving acceptance in long-term therapies for chronic conditions. Ongoing advancements focus on hybrid MUPS designs that integrate immediate- and sustained-release pellets, optimizing therapeutic outcomes across diverse therapeutic categories.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.7 Billion, with a CAGR of 3.3%, and is expected to reach US$ 5.1 Billion by the year 2034.

- The dosage form segment is divided into capsules, tablets, sachets and others, with capsules taking the lead in 2024 with a market share of 48.7%.

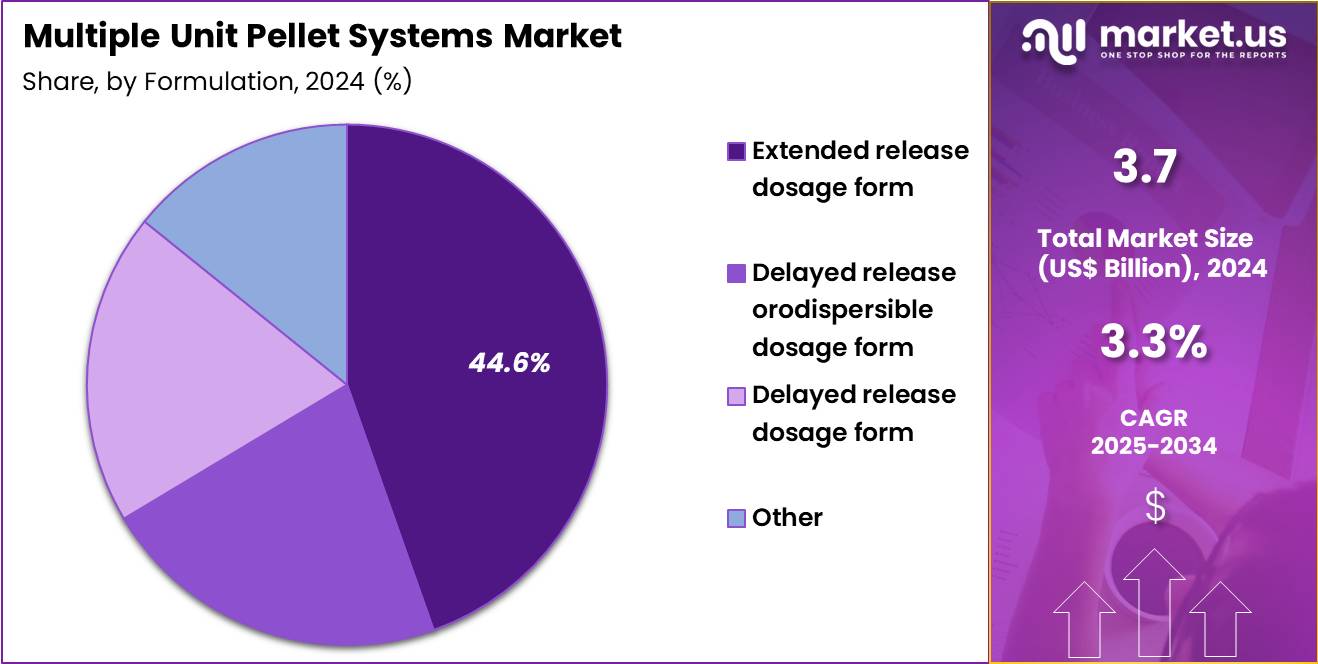

- Considering formulation, the market is divided into extended release dosage form, delayed release orodispersible dosage form, delayed release dosage form and other. Among these, extended release dosage form held a significant share of 44.6%.

- Furthermore, concerning the drug class segment, the market is segregated into proton pump inhibitors, anti-hypertensive, antibiotics, analgesics and others. The proton pump inhibitors sector stands out as the dominant player, holding the largest revenue share of 41.9% in the market.

- The distribution channel segment is segregated into hospital pharmacies, drug stores, retail pharmacies and online pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 46.3%.

- North America led the market by securing a market share of 36.9% in 2024.

Dosage Form Analysis

Capsules accounted for 48.7% of growth within the dosage form category and represent the primary delivery format in the Multiple Unit Pellet Systems market. Pharmaceutical manufacturers prefer capsules due to their compatibility with pellet filling technologies. Capsules support uniform distribution of pellets, improving dose accuracy. Patient preference for easy swallowing strengthens capsule adoption.

Capsules enable combination of multiple pellet populations within a single dose. This flexibility supports complex release profiles. Stability of pellets remains higher in capsule shells compared to compressed formats. Capsules reduce mechanical stress on coated pellets during manufacturing. Brand owners leverage capsules for product differentiation.

Modified release products increasingly adopt capsule-based MUPS designs. Capsules simplify scale-up and commercial production processes. High-speed encapsulation supports cost-efficient manufacturing. Pediatric and geriatric compliance improves with capsule formats. Capsules allow rapid reformulation of existing drugs into MUPS. Regulatory familiarity accelerates approval timelines.

Reduced risk of dose dumping improves safety perception. Capsule-based products integrate well with extended release strategies. Hospitals and clinicians recognize capsules as reliable dosage forms. Prescription trends favor capsule-based therapies in chronic care. The segment is projected to maintain dominance due to manufacturing and patient advantages.

Formulation Analysis

Extended release dosage form captured 44.6% of growth within the formulation category and leads the Multiple Unit Pellet Systems market. Chronic disease management drives demand for sustained drug release profiles. Extended release pellets maintain consistent plasma drug concentrations. Reduced dosing frequency improves patient adherence. Healthcare providers prefer extended release formulations for long-term therapies. MUPS technology enables precise control over drug release kinetics.

Reduced peak-to-trough fluctuations enhance therapeutic outcomes. Extended release products lower incidence of side effects. Pharmaceutical companies prioritize lifecycle management through extended release conversions. Patent extension strategies support investment in this formulation. Pelleted systems allow blending of immediate and extended release components.

Improved safety profiles strengthen clinician confidence. Extended release dosage forms align with once-daily dosing trends. Patient convenience supports market uptake. Controlled release improves disease symptom management. Extended release pellets demonstrate robust in vivo performance. Regulatory guidance supports predictable release mechanisms.

Hospitals favor extended release products for stable patient management. The segment is anticipated to grow with chronic condition prevalence. Overall dominance reflects adherence benefits and clinical effectiveness.

Drug Class Analysis

Proton pump inhibitors represented 41.9% of growth within the drug class category and dominate the Multiple Unit Pellet Systems market. High prevalence of acid-related disorders drives sustained demand. PPIs require protection from gastric acid degradation. MUPS technology supports enteric-coated pellet delivery. Improved bioavailability enhances therapeutic performance of PPIs. Chronic gastroesophageal reflux disease management increases usage volumes.

Clinicians prefer pellet-based PPIs for consistent acid suppression. Reduced dosing variability supports symptom control. Extended release and delayed release profiles improve night-time acid management. Aging populations increase PPI consumption rates. Hospital prescribing patterns favor advanced PPI formulations. Combination therapies integrate well within pellet systems.

Improved patient adherence strengthens long-term demand. Manufacturers invest in pelletized PPIs for differentiation. Stability advantages support extended shelf life. Reduced adverse gastrointestinal effects reinforce clinical acceptance. Generic manufacturers adopt MUPS for competitive positioning. Reimbursement frameworks support widespread PPI use. The segment is projected to remain dominant due to disease prevalence. Growth reflects clinical necessity and formulation compatibility.

Distribution Channel Analysis

Hospital pharmacies accounted for 46.3% of growth within the distribution channel category and lead the Multiple Unit Pellet Systems market. Hospitals manage complex chronic disease treatments requiring advanced formulations. Physicians initiate extended release and specialty therapies within hospital settings. Hospital pharmacies ensure controlled dispensing and patient counseling. MUPS-based medications align with inpatient and outpatient care transitions.

Hospitals maintain strong procurement capabilities for specialized formulations. Clinical pharmacists support therapy optimization using modified release products. Higher patient trust strengthens hospital dispensing volumes. Hospital formularies prioritize safety and adherence-enhancing medications. Monitoring capabilities support extended release therapies. Hospitals manage high volumes of gastrointestinal and cardiovascular patients.

Complex dosing regimens favor supervised initiation in hospitals. Institutional guidelines support standardized use of advanced dosage forms. Teaching hospitals promote adoption through clinical protocols. Bulk purchasing supports consistent supply availability. Hospitals handle patients with polypharmacy needs effectively. Integration with electronic prescribing improves utilization.

Hospital pharmacies drive early adoption of novel MUPS products. The segment is anticipated to retain leadership due to clinical control. Overall dominance reflects infrastructure strength and prescribing authority.

Key Market Segments

By Dosage Form

- Capsules

- Tablets

- Sachets

- Others

By Formulation

- Extended Release Dosage Form

- Delayed Release Orodispersible Dosage Form

- Delayed Release Dosage Form

- Other

By Drug Class

- Proton Pump Inhibitors

- Anti-Hypertensive

- Antibiotics

- Analgesics

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing demand for advanced dosage form solutions is driving the market

The multiple unit pellet systems market is driven by the increasing demand for advanced dosage form solutions, which enable controlled release and improved bioavailability in pharmaceutical formulations. Healthcare providers benefit from these systems in delivering consistent drug levels for chronic conditions, enhancing patient compliance and therapeutic outcomes. Regulatory bodies support the adoption of pellet systems through guidelines that emphasize innovation in drug delivery technologies.

Pharmaceutical companies invest in pelletization to meet the needs of complex therapies, sustaining market momentum. Clinical applications in oral solid dosages rely on multiple unit pellets for reduced variability and dose dumping risks. Global trends in personalized medicine amplify the role of pellet systems in customized formulations. Academic research validates the efficacy of pellets in extended-release products, driving industry adoption.

Patient care improves with systems that minimize gastrointestinal irritation through dispersed release. Economic factors, including the cost-efficiency of scalable pellet production, further propel market growth. Lonza’s Dosage Form Solutions segment benefited from solid growth in 2024, contributing to the Capsules & Health Ingredients division’s performance amid overall market challenges.

Restraints

Customer destocking in pharma capsules is restraining the market

The multiple unit pellet systems market is restrained by customer destocking in pharma capsules, which reduces inventory levels and impacts sales volumes for pellet-based products. Manufacturers face decreased orders as clients adjust stock to align with demand fluctuations, leading to underutilization of production capacity. Regulatory compliance for pellet formulations adds complexity when destocking disrupts supply planning.

Pharmaceutical firms prioritize cost control, exacerbating destocking trends in pellet segments. Clinical supply chains experience delays, affecting the availability of pellet systems for therapeutic applications. Global economic uncertainties contribute to cautious purchasing behaviors among customers. Academic analyses of supply dynamics highlight the ripple effects on pellet market stability.

Patient safety indirectly suffers from potential shortages in pellet-delivered medications. Ethical considerations in manufacturing emphasize sustainable practices amid destocking pressures. Lonza’s Capsules & Health Ingredients division reported a -6.6% constant exchange rate sales decline in 2024 due to soft demand from customer destocking in pharma capsules.

Opportunities

Growth in dosage form solutions is creating growth opportunities

The multiple unit pellet systems market offers growth opportunities through the expansion in dosage form solutions, which enable customized pellet formulations for diverse pharmaceutical and nutraceutical applications. Developers can innovate pellet systems to support extended-release profiles, addressing unmet needs in chronic disease management. Regulatory frameworks encourage the development of advanced pellet technologies for improved stability and bioavailability.

Healthcare systems benefit from pellet solutions that enhance drug delivery in oral therapies. Pharmaceutical partnerships focus on integrating pellets into robotic manufacturing for efficiency. Clinical research explores pellet applications in targeted delivery for gastrointestinal conditions. Global adoption in emerging markets aligns with infrastructure development for solid dosage forms.

Academic collaborations refine pellet software for optimized production processes. Patient therapies gain from pellet solutions enabling sustained release with reduced side effects. Lonza’s Dosage Form Solutions benefited from solid growth in 2024, providing avenues for pellet system diversification.

Impact of Macroeconomic / Geopolitical Factors

Global economic surges allocate ample resources to pharmaceutical innovations, energizing the multiple unit pellet systems market through amplified R&D in extended-release formulations. Organizations harness low unemployment environments to recruit specialized talent, which accelerates development cycles for pellet-based therapies targeting chronic ailments.

In contrast, accelerating worldwide inflation magnifies costs for excipients and equipment, straining operational budgets for smaller-scale manufacturers. Sharpened diplomatic rifts in primary commodity regions obstruct polymer transports, slowing down assembly lines for affected conglomerates. Entrepreneurs offset these vulnerabilities by implementing agile procurement frameworks, which expands access to alternative inputs and reinforces strategic alliances.

Today’s US tariffs, enforcing 100% duties on imported branded pharmaceuticals since October 2025, exacerbate overheads for entities sourcing patented pellet tech abroad. Indigenous firms utilize this policy to intensify facility expansions, which cultivates expertise hubs and boosts economic contributions at home. Transformative progress in nanoscale coatings reliably empowers the arena, guaranteeing heightened performance and expansive opportunities ahead.

Latest Trends

Introduction of proprietary capsule manufacturing technology is a recent trend

In 2024, the multiple unit pellet systems market has exhibited a prominent trend toward the introduction of proprietary capsule manufacturing technology, which enhances production efficiency and supports advanced pellet encapsulation. Manufacturers implement these technologies to achieve superior capsule integrity, facilitating the integration of multiple unit pellets.

Healthcare sectors adopt the trend to meet demands for high-performance pellet systems in nutraceutical delivery. Regulatory evaluations accommodate innovations that demonstrate improved stability for pellet applications. Clinical implementations benefit from technologies reducing variability in pellet release profiles. Academic studies assess the impact of new manufacturing on pellet performance across formulations.

Global supply chains integrate these technologies to streamline pellet production processes. Patient therapies gain from enhanced reliability in pellet-based capsules. Ethical protocols ensure the technologies align with sustainability goals in pellet manufacturing. Lonza reported the early positive impact of the newly-introduced superior proprietary D90 capsule manufacturing technology in 2024, contributing to productivity initiatives.

Regional Analysis

North America is leading the Multiple Unit Pellet Systems Market

In 2024, North America held a 36.9% share of the global Multiple Unit Pellet Systems market, advanced by the escalating need for sustained-release drug delivery mechanisms that improve patient compliance in managing chronic ailments such as hypertension and gastrointestinal disorders, where multi-particulate pellets allow for uniform distribution and minimized gastric irritation. Pharmaceutical developers prioritized these systems to reformulate off-patent molecules with enhanced pharmacokinetic profiles, capitalizing on regulatory incentives for complex generics that extend therapeutic windows.

Heightened focus on pediatric and geriatric formulations drove adoption of taste-masked pellets, addressing swallowing difficulties amid demographic aging. Clinical protocols integrated pellet-based combinations for polypharmacy reduction, supported by evidence-based practices in ambulatory care. Biotech collaborations refined extrusion-spheronization techniques for high-potency actives, ensuring content uniformity in small-batch productions.

Supply infrastructure adaptations guaranteed excipient compatibility with pellet coatings, aligning with quality-by-design principles. Collaborative pharmacovigilance tracked long-term efficacy, fostering innovation in oncology supportive care. In 2024, CDER approved 50 new drugs never before approved or marketed in the U.S.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry observers foresee marked proliferation of multiple unit pellet technologies in Asia Pacific during the forecast period, propelled by intensifying chronic disease management imperatives and investments in local pharmaceutical capabilities. Developers harness pellet systems to create affordable sustained-release generics, optimizing release kinetics for tropical stability in high-humidity zones.

Health ministries subsidize production facilities with spheronization equipment, equipping them to address surging demands for antihypertensive combinations in urbanizing populations. Biotech firms customize multi-layered coatings with pH-dependent polymers, tailoring them to dietary patterns that influence gastrointestinal transit.

Regional alliances validate bioequivalence through comparative dissolution studies, enabling export expansions compliant with global formularies. Pharmaceutical entities adapt extrusion processes for herbal integrations, bridging traditional remedies with modern delivery for arthritis relief. Policy drives promote training on pellet formulation, empowering smaller enterprises in emerging markets. Noncommunicable diseases account for over 81% of deaths in the upper-middle-income Asia-Pacific countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Multiple Unit Pellet Systems market drive growth by engineering multiparticulate dosage designs that deliver precise release control, dose flexibility, and improved gastrointestinal tolerability across chronic therapies. Companies expand uptake by offering formulation services that customize pellet size, coating thickness, and release kinetics to differentiate brands and extend product lifecycles.

Commercial strategies prioritize partnerships with originators and generics manufacturers to co-develop scalable solutions that de-risk development and accelerate regulatory approval. Innovation efforts concentrate on solvent-free coatings, high-load pellets, and robust encapsulation or tableting compatibility to improve manufacturing efficiency.

Market expansion targets regions with strong demand for patient-centric oral delivery and growing generic substitution. Evonik operates as a leading participant by leveraging its polymers expertise, application-driven formulation know-how, and global production network to enable reliable, compliant, and customizable pellet-based oral drug products.

Top Key Players

- Pfizer Inc.

- AstraZeneca PLC

- GlaxoSmithKline PLC

- Novartis AG

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Galderma SA

- Perrigo Company Plc

- Cipla Ltd.

- Astellas Pharma Inc.

Recent Developments

- In 2024, AstraZeneca continued to build on its long-standing leadership in MUPS technology, anchored by products such as Nexium (esomeprazole). The company reported total revenue of US$54.073 billion for the full year, reflecting a 21% increase at constant exchange rates. In the first nine months of 2025, revenue expanded further to US$43.236 billion, supported by sustained demand across its core therapeutic portfolios, reinforcing the commercial relevance of advanced oral drug delivery platforms.

- In the second quarter of fiscal year 2026, ending September 30, 2025, Lupin recorded US sales of US$315 million, representing a 47.3% increase compared to the same period in 2024. By late 2025, the company ranked as the third-largest generic pharmaceutical player in the US by prescription volume, supported by a broad portfolio of 147 generic products that includes complex and modified-release formulations.

Report Scope

Report Features Description Market Value (2024) US$ 3.7 Billion Forecast Revenue (2034) US$ 5.1 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Dosage Form (Capsules, Tablets, Sachets and Others), By Formulation (Extended Release Dosage Form, Delayed Release Orodispersible Dosage Form, Delayed Release Dosage Form and Other), By Drug Class (Proton Pump Inhibitors, Anti-Hypertensive, Antibiotics, Analgesics and Others), By Distribution Channel (Hospital Pharmacies, Drug Stores, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc., AstraZeneca PLC, GlaxoSmithKline PLC, Novartis AG, Johnson & Johnson Services, Inc., Merck KGaA, Galderma SA, Perrigo Company Plc, Cipla Ltd., Astellas Pharma Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multiple Unit Pellet Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Multiple Unit Pellet Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- AstraZeneca PLC

- GlaxoSmithKline PLC

- Novartis AG

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Galderma SA

- Perrigo Company Plc

- Cipla Ltd.

- Astellas Pharma Inc.