Global Multifactor Authentication (MFA) Market Size, Share and Analysis Report Analysis By Offering Type (Hardware, Software, Services), By Authentication Model (Two-Factor (2FA), Multifactor (3F and 4F), Adaptive / Risk-Based MFA, Password-less (WebAuthn, Passkeys), By Deployment Mode (On-premises, Cloud), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Access Channel (VPN and Remote Login, Web and SaaS Applications, Mobile Workforce), By End-user Industry (Banking and Financial Institutions, Cryptocurrency and Web3 Exchanges, Technology (SaaS, IT Services, DevOps), Government (Federal, State, Local, Integrators), Healthcare and Pharmaceutical, Retail and E-commerce, Energy, Utilities and Manufacturing, Education, Immigration and Public Services, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 11892

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- MFA Adoption and Impact Statistics

- By Offering Type

- By Authentication Model

- By Deployment Mode

- By Enterprise Size

- By Access Channel

- By End-User Industry

- By Region

- Investment Opportunities

- Business Benefits

- Buyer Decision Criteria

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

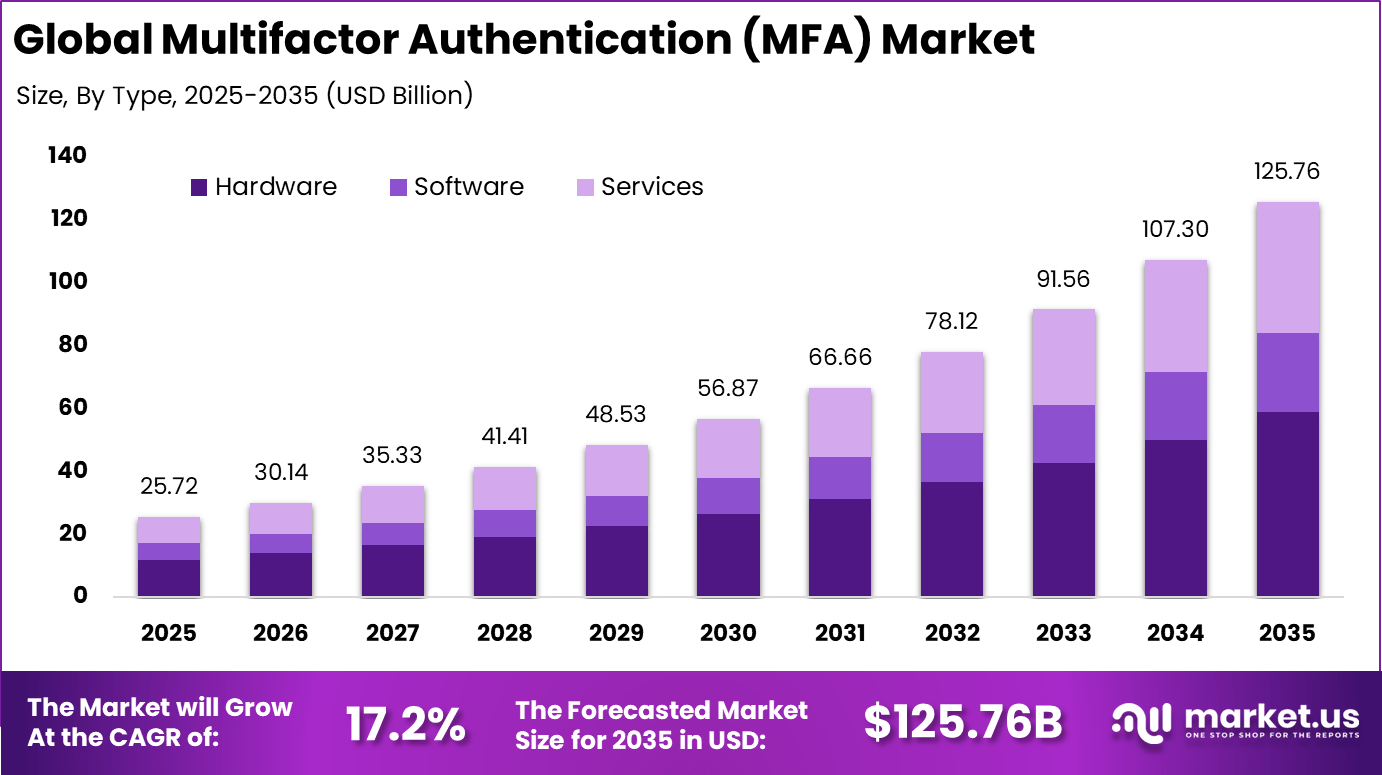

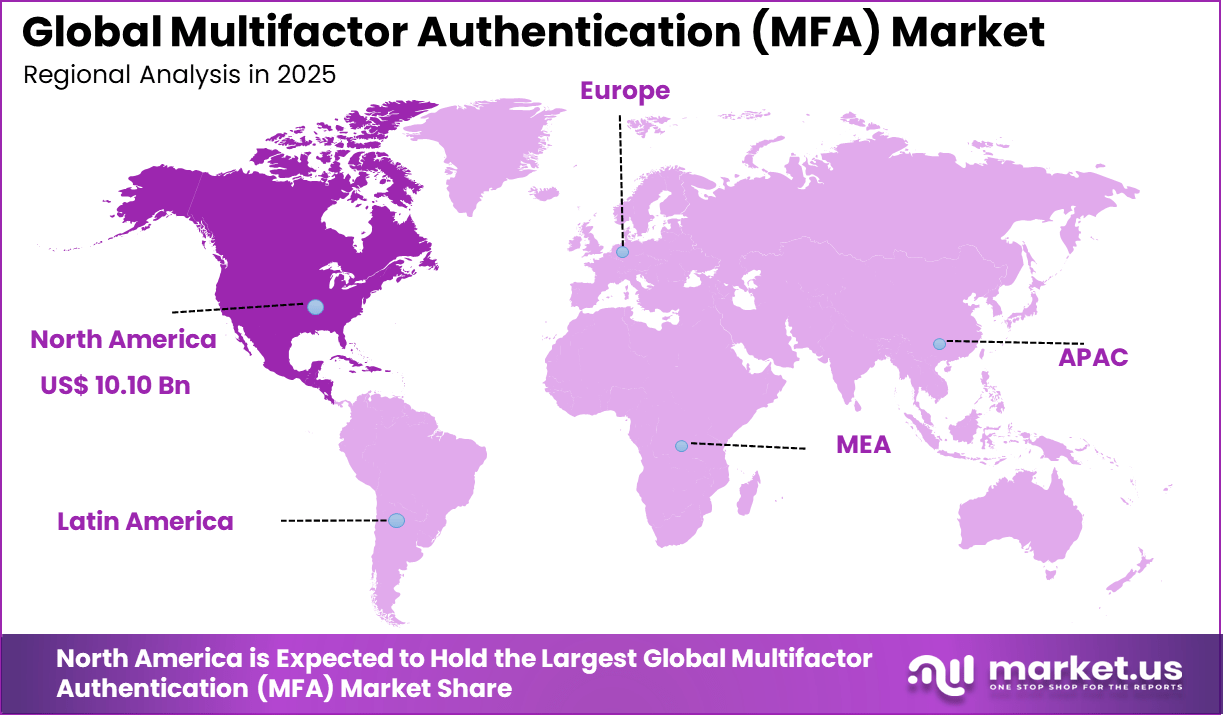

The Global Multifactor Authentication (MFA) Market represents a compelling cybersecurity investment opportunity, expanding from USD 25.72 billion in 2025 to nearly USD 125.76 billion by 2035, growing at a CAGR of 17.2%. North America’s dominant market position, capturing more than 39.3% share and USD 10.10 billion in revenue, underscores strong regional leadership in identity and access management solutions and sustained revenue visibility for investors.

The Multifactor Authentication market focuses on security solutions that require users to verify their identity using two or more authentication factors before gaining access to systems, applications, or data. These factors typically include something the user knows, something the user has, or something the user is, such as biometrics. MFA is designed to reduce the risk of unauthorized access caused by stolen passwords or compromised credentials.

It is widely used across enterprises, governments, and digital service providers to strengthen identity security. As digital services and remote access expand, MFA has become a foundational component of modern cybersecurity frameworks. Organizations increasingly rely on MFA to secure cloud platforms, enterprise applications, and sensitive data environments. The technology is applied across on premises, cloud based, and hybrid IT infrastructures.

One of the main driving factors for the MFA market is the sharp increase in cyberattacks targeting user credentials. Password based authentication alone is no longer sufficient against phishing, credential stuffing, and account takeover incidents. MFA adds an additional security layer that significantly reduces the likelihood of successful unauthorized access. This security improvement has made MFA a standard requirement in many organizations.

For instance, in October 2025, Microsoft began enforcing MFA for all Azure resource management actions starting October 1, part of its Secure Future Initiative to shield against unauthorized access. The mandate covers admins and hybrid environments, cutting automated attacks by 99.2% and pushing zero-trust adoption.

Key Takeaway

- By offering type, hardware solutions led with 46.8%, driven by demand for physical security tokens, smart cards, and biometric devices.

- By authentication model, two factor authentication (2FA) accounted for 41.3%, reflecting its wide adoption as a balance between security and ease of use.

- By deployment mode, on premises solutions held 60.2%, showing strong preference for locally managed systems to maintain control over sensitive access data.

- By enterprise size, large enterprises dominated with 72.5%, supported by higher cybersecurity budgets and complex access management needs.

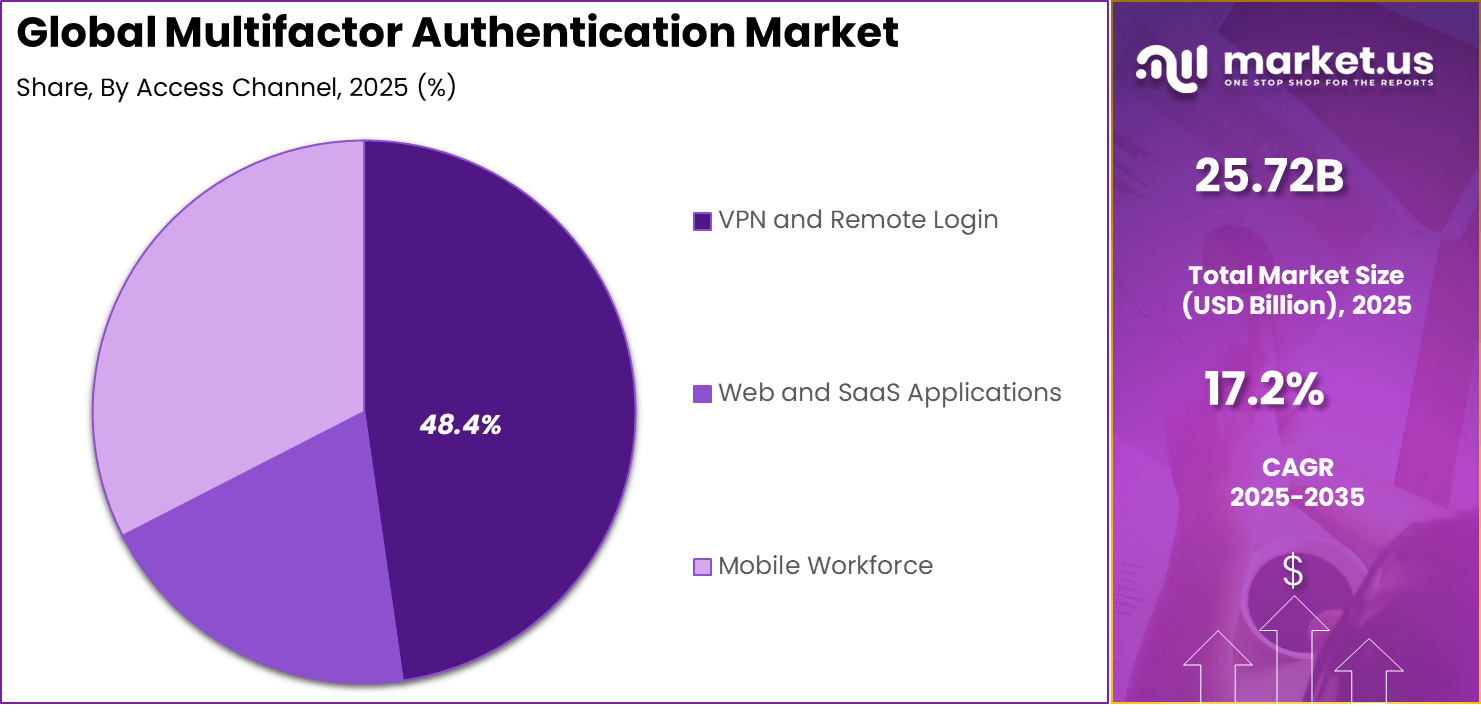

- By access channel, VPN and remote login accounted for 48.4%, driven by the rise in remote work and secure access requirements.

- By end user industry, banking and financial institutions captured 36.4%, reflecting strict regulatory requirements and high exposure to cyber threats.

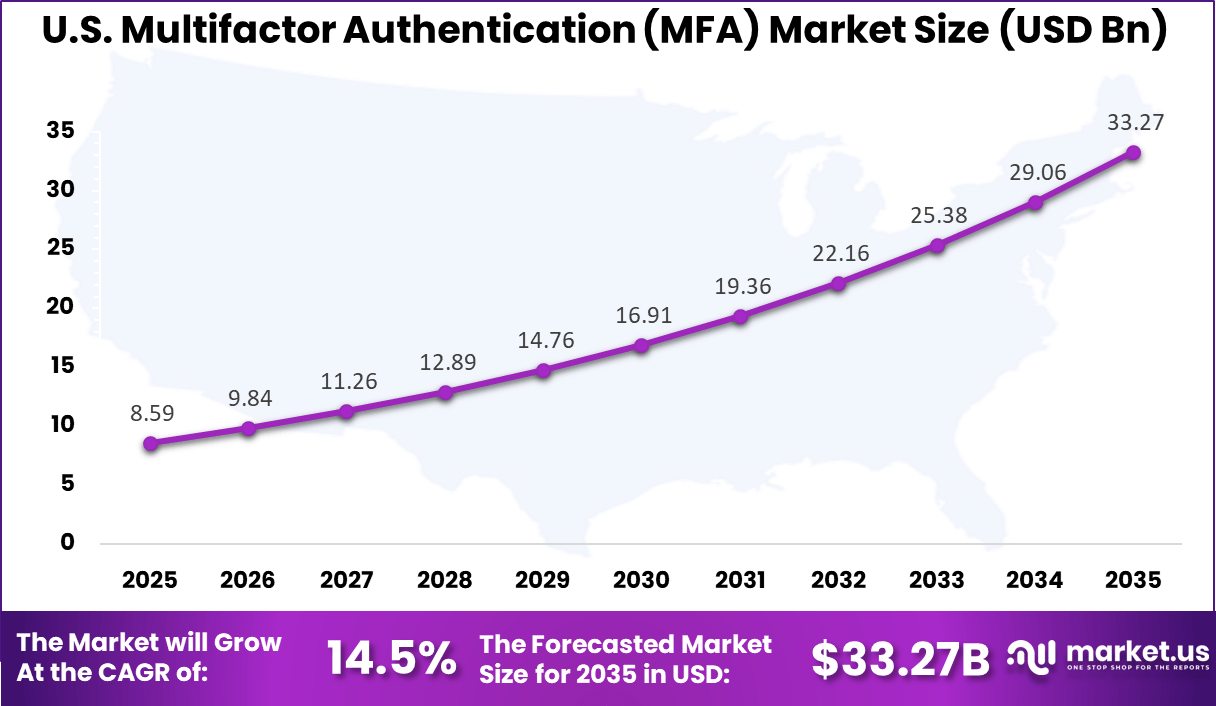

- North America held 39.3% of the global market, with the US valued at USD 8.59 billion and growing at a 14.5% CAGR, supported by strong cybersecurity adoption and regulatory focus.

MFA Adoption and Impact Statistics

- The technology sector leads MFA adoption, with 87% of organizations implementing multifactor authentication across user accounts.

- Software based MFA is the most common approach, used by 95% of MFA users through mobile apps, while hardware tokens and biometrics account for a small share.

- Large enterprises show the highest usage, with 87% of companies employing more than 10,000 employees using MFA as part of their security framework.

- MFA adoption declines sharply among smaller firms, with usage at 34% in medium sized businesses with 26 to 100 employees and 27% in firms with up to 25 employees.

- A strong usage gap exists between large enterprises and SMBs, where adoption falls from 87% in large organizations to around 34% or lower in smaller businesses.

- Regional differences are notable, as 89% of US based SMBs have implemented MFA, compared with only 35% of SMBs globally.

- Despite MFA use, 28% of users still face attack attempts such as SIM jacking, MFA fatigue, and adversary in the middle attacks, highlighting evolving threat methods.

- Basic password practices remain weak, with 62% of individuals writing down passwords in notebooks that are often kept in visible locations.

- MFA is highly effective, preventing more than 99.9% of account compromise attempts when properly implemented.

- User confidence is strong, as 86% of MFA users report feeling more secure about the safety of their accounts and data.

By Offering Type

Hardware accounts for 46.8%, highlighting its strong role in MFA deployments. Hardware tokens and devices provide an additional physical layer of security. These tools reduce reliance on passwords alone. Organizations use hardware to prevent unauthorized access. Reliability and tamper resistance remain important.

The demand for hardware-based MFA is driven by high-security requirements. Physical devices offer stronger assurance than software-only methods. Many enterprises prefer dedicated authentication tools. Hardware solutions operate independently of user devices. This sustains steady adoption of hardware offerings.

For Instance, in October 2025, HID Global signed a deal to buy IDmelon to boost its passwordless hardware tools. This move adds strong FIDO2 keys to access cards and mobiles, making hardware logins smoother for firms. It helps fight phishing with secure chips users carry, fitting the push for tough devices in key spots. HID plans a quick rollout to clients needing reliable tokens.

By Authentication Model

Two-factor authentication represents 41.3%, making it the most widely used model. 2FA combines two distinct verification methods. This approach improves security without excessive complexity. Users find it easier to adopt compared to multi-step models. Balance between security and usability is key.

Growth in 2FA adoption is driven by widespread cyber threats. Organizations seek effective yet simple security measures. 2FA reduces risk of credential misuse. Integration with existing systems is straightforward. This keeps 2FA widely implemented.

For instance, in January 2026, RSA Security reminded users to upgrade certificates for its 2FA agents by October 2025. The fix keeps OTP tokens and apps working safely on PAM and Apache setups. This step blocks old flaws that hackers target in the basic two-step checks. Firms using RSA hardware stay ahead with simple phone codes added to logins.

By Deployment Mode

On-premises deployment holds 60.2%, reflecting preference for local control of authentication systems. Enterprises manage sensitive identity data internally. On-premises setups support strict compliance needs. System customization aligns with internal policies. Predictable performance remains important.

Adoption of on-premises deployment is driven by regulatory constraints. Certain industries require full data control. Local deployment reduces dependency on external networks. IT teams maintain direct oversight. This sustains continued use of on-premises MFA systems.

For Instance, in May 2025, Duo Security (Cisco) launched Duo IAM with strong on-premises proxy support for legacy systems. It adds phishing-proof 2FA without cloud shifts, letting teams run MFA inside their nets. This fits big outfits, keeping control over servers. The tool cuts setup time for local hardware authenticators.

By Enterprise Size

Large enterprises account for 72.5%, making them the primary adopters of MFA solutions. These organizations manage large user bases. MFA supports access control across departments. Centralized identity management improves governance. Scale increases security exposure.

Adoption among large enterprises is driven by risk management needs. Data breaches can have significant impact. MFA strengthens access protection. Enterprise-wide policies improve consistency. This sustains strong enterprise-level demand.

For Instance, in September 2025, Thales Group tied deeper with Microsoft for large firm MFA on Entra ID. It brings FIDO hardware and cert-based 2FA to thousands of users across devices. Big enterprises gain phishing resistance for global teams without password woes. Thales calls it a zero-trust win for complex setups.

By Access Channel

VPN and remote login channels account for 48.4%, making them the leading access points. Remote access increases exposure to threats. MFA adds protection to off-site connections. Secure access supports workforce mobility. Reliability remains critical.

Growth in this segment is driven by remote work trends. Employees access systems from various locations. MFA reduces unauthorized VPN access. Integration with remote systems is essential. This keeps MFA central to remote security strategies.

For Instance, in April 2025, ManageEngine added MFA to VPNs in ADSelfService Plus for remote workers. Biometrics and tokens now guard net entry, blocking stolen logins from home access. This protects internal files as VPN use spikes. The update works fast on AD systems without big changes.

By End-User Industry

Banking and financial institutions represent 36.4%, making them the leading end-user industry. These institutions handle sensitive financial data. MFA supports transaction security and user verification. Regulatory compliance drives adoption. Trust and security remain priorities.

Adoption in banking is driven by rising digital services. Online banking increases exposure to fraud. MFA reduces identity-based risks. Secure authentication builds customer confidence. This sustains steady adoption in financial institutions.

For Instance, in January 2025, Entrust rolled out AI facial biometrics for banking MFA in IDaaS. It checks users against phone-stored data for high-value logins like transfers. Banks cut deepfake fraud with passwordless steps. The tool fits rules needing strong proofs without cloud data risks.

By Region

North America accounts for 39.3%, supported by strong cybersecurity adoption. Enterprises invest in identity and access management solutions. Regulatory frameworks encourage stronger authentication. Technology maturity supports deployment. The region remains influential.

In North America, MFA adoption is supported by strong cybersecurity awareness and widespread digital service usage. Organizations across industries actively deploy MFA to protect cloud platforms and enterprise applications. Regulatory expectations around data protection also reinforce adoption. These factors contribute to steady and mature use of MFA solutions.

For instance, in February 2025, GoTrustID Inc. expanded its Idem Key deployment across over 100 U.S. school districts for passwordless MFA. The solution enables secure Microsoft 365 access without personal phones, supporting Entra ID and phishing-resistant authentication. This adoption highlights North American leadership in user-friendly, education-focused MFA technologies.

Asia Pacific shows increasing adoption driven by rapid digital transformation and growing online user populations. Organizations in this region are strengthening identity security to protect expanding digital ecosystems. Europe demonstrates consistent adoption with emphasis on privacy and data protection standards. Other regions are gradually increasing deployment as digital infrastructure matures.

The United States reached USD 8.59 Billion with a CAGR of 14.5%, reflecting steady market growth. Expansion is driven by digital transformation initiatives. Organizations prioritize access security. MFA adoption continues to rise. Market momentum remains stable.

For instance, in May 2025, Cisco Duo Security launched Duo IAM with end-to-end phishing-resistant MFA capabilities to counter AI-powered threats. The solution provides comprehensive identity security without hardware keys, featuring enhanced authentication methods that maintain user convenience. This development underscores U.S. dominance in innovative, scalable MFA solutions critical for enterprise security.

Investment Opportunities

Investment opportunities in the MFA market are emerging from the need to secure cloud first and remote access environments. Organizations are investing in identity centric security architectures that prioritize authentication and access control. MFA solutions that integrate easily with cloud platforms and enterprise applications present strong opportunity areas. These investments aim to reduce breach risk and improve access governance.

Another opportunity lies in adaptive and risk based authentication models. MFA systems that adjust authentication requirements based on user behavior or access context offer improved security and user experience. This approach reduces friction for low risk access while strengthening controls for high risk scenarios. Such capabilities create differentiation and long term value.

Business Benefits

MFA delivers significant business benefits by reducing the likelihood of security breaches caused by stolen credentials. Strong authentication lowers the risk of unauthorized access to sensitive systems and data. This protection helps organizations avoid financial losses and operational disruption. Improved security posture also strengthens stakeholder confidence.

Another key benefit is improved compliance and access governance. MFA supports consistent enforcement of identity verification policies across systems. Centralized authentication management simplifies oversight and reporting. These benefits contribute to stronger operational control and risk management.

Buyer Decision Criteria

Buyers evaluating MFA solutions prioritize security effectiveness and ease of deployment. Compatibility with existing systems and cloud platforms is a key consideration. User experience is also critical to ensure adoption across diverse user groups. Buyers seek solutions that balance protection with usability.

Cost efficiency and scalability influence purchasing decisions as well. Organizations assess long term operational costs and support requirements. Reliability and vendor support are important for sustained performance. Buyers prefer MFA solutions that offer flexibility and long term value.

Driver Analysis

The multifactor authentication market is being driven by the increasing priority that organisations place on securing access to systems, data, and digital services. Cyber threats such as credential theft, phishing, and ransomware continue to evolve in sophistication, making single-factor password protection inadequate.

Multifactor authentication adds layers of verification by requiring two or more forms of credential evidence, such as something the user knows, something the user has, or something the user is. This capability improves access control, strengthens identity verification for remote and mobile access, and supports compliance with security mandates and regulatory standards across industries.

Restraint Analysis

A key restraint in the multifactor authentication market is the challenge of balancing security with user convenience and adoption. While additional authentication steps increase protection, they can also introduce friction in user workflows if poorly implemented or overly burdensome.

Organisations must design MFA experiences that minimise disruption and avoid negative impacts on productivity or customer satisfaction. If users perceive authentication processes as inconvenient or time consuming, resistance or work-around behaviour may arise, reducing effectiveness and slowing broader deployment.

Opportunity Analysis

Opportunities in the multifactor authentication market are linked to the expansion of adaptive and risk-based authentication models that adjust verification requirements based on contextual signals. These models consider factors such as device reputation, user behaviour patterns, location, and real-time risk indicators to determine the appropriate level of authentication challenge.

This approach can improve security while preserving usability by applying stronger checks only when risk thresholds are met. Integration of MFA with broader identity and access management frameworks, zero-trust architectures, and secure remote access solutions also expands demand as organisations pursue cohesive, end-to-end security strategies.

Challenge Analysis

A central challenge confronting this market involves integration with legacy systems and diverse application environments. Many enterprises operate hybrid environments that include on-premise applications, cloud services, custom platforms, and third-party systems.

Ensuring that MFA solutions work seamlessly across these varied ecosystems without creating gaps or incompatibilities requires careful planning, configuration, and often custom integration work. Coordination between security, IT operations, and application owners is essential to prevent access issues and maintain continuous business operations.

Emerging Trends

Emerging trends in the multifactor authentication landscape include increasing adoption of biometric authentication factors such as fingerprint, facial recognition, and behavioural biometrics that use unique user characteristics for verification.

Another trend is the rise of passwordless authentication, where users authenticate using secure tokens, device-based cryptographic keys, or biometrics instead of traditional passwords. Risk-adaptive authentication techniques that tailor verification steps based on real-time threat signals are also gaining traction, improving security without imposing uniform friction on all users.

Growth Factors

Growth in the multifactor authentication market is supported by heightened regulatory focus on data protection and privacy obligations that require strong access controls and authentication practices. Industries such as financial services, healthcare, and government often face stringent compliance frameworks that mandate MFA for certain access scenarios.

Increasing adoption of cloud services, remote work models, and mobile access further intensifies the need for robust authentication mechanisms. Advances in authentication technologies, broader support across platforms, and improved user-centric design contribute to the feasibility and appeal of MFA solutions for organisations aiming to enhance security posture without compromising user experience.

Key Market Segments

By Offering Type

- Hardware

- Tokens (USB, Smart-card, Smartkey)

- Biometric Devices (Fingerprint, Palm-vein, Facial)

- Other Devices (Wearables, Smartcards-NFC)

- Software

- Authenticator Solutions (TOTP, Push, U2F)

- Mobile Apps (Native, SDK)

- Services

- Managed Services

- Professional Services

By Authentication Model

- Two-Factor (2FA)

- Multifactor (3F and 4F)

- Adaptive / Risk-Based MFA

- Password-less (WebAuthn, Passkeys)

By Deployment Mode

- On-premises

- Cloud

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Access Channel

- VPN and Remote Login

- Web and SaaS Applications

- Mobile Workforce

By End-user Industry

- Banking and Financial Institutions

- Cryptocurrency and Web3 Exchanges

- Technology (SaaS, IT Services, DevOps)

- Government (Federal, State, Local, Integrators)

- Healthcare and Pharmaceutical

- Retail and E-commerce

- Energy, Utilities and Manufacturing

- Education, Immigration and Public Services

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in December 2025, Giesecke+Devrient acquired Bank-Verlag’s Payment & Banking Services business, bolstering its secure payment and identity solutions portfolio. This move strengthens G+D’s position in financial services MFA and digital identity, serving banks and fintechs with enhanced security tech amid rising cyber threats. The acquisition aligns with G+D’s strategy to expand in Europe and beyond.

Top Key Players in the Market

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security (Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC (Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine (Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp. (Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp. (Broadcom Inc.)

- Technologies

- Secret Double Octopus

- Trusona Inc.

- Others

Recent Developments

- In May 2025, Cisco’s Duo Security unveiled Duo Identity and Access Management (IAM), building on its trusted MFA with phishing-resistant features like passwordless authentication and proximity verification. Designed to combat AI-era identity attacks, it offers comprehensive IAM without hardware keys, protecting 100,000+ users globally while keeping the user experience smooth.

- In July 2025, RSA released MFA Agent for Windows 2.4, adding support for passwordless primary authentication in Active Directory and Microsoft Entra ID environments. This update helps organizations transition to stronger MFA amid regulatory pressures and rising bypass attempts.

Report Scope

Report Features Description Market Value (2025) USD 25.7 Bn Forecast Revenue (2035) USD 125.7 Bn CAGR(2026-2035) 17.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering Type (Hardware, Software, Services), By Authentication Model (Two-Factor (2FA), Multifactor (3F and 4F), Adaptive / Risk-Based MFA, Password-less (WebAuthn, Passkeys), By Deployment Mode (On-premises, Cloud), By Enterprise Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Access Channel (VPN and Remote Login, Web and SaaS Applications, Mobile Workforce), By End-user Industry (Banking and Financial Institutions, Cryptocurrency and Web3 Exchanges, Technology (SaaS, IT Services, DevOps), Government (Federal, State, Local, Integrators), Healthcare and Pharmaceutical, Retail and E-commerce, Energy, Utilities and Manufacturing, Education, Immigration and Public Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Giesecke+Devrient GmbH, Thetis, GoTrustID Inc., Thales Group, Duo Security (Cisco Systems Inc.), RSA Security LLC, Okta Inc., Google LLC (Alphabet Inc.), Ping Identity Corp., ManageEngine (Zoho Corp.), Microsoft Corp., TeleSign Corp. (Proximus Group), HID Global Corp., OneSpan Inc., CyberArk Software Ltd., ForgeRock Inc., Entrust Corp., SecureAuth Corp., Symantec Corp. (Broadcom Inc.), Technologies, Secret Double Octopus, Trusona Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multifactor Authentication (MFA) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Multifactor Authentication (MFA) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Giesecke+Devrient GmbH

- Thetis

- GoTrustID Inc.

- Thales Group

- Duo Security (Cisco Systems Inc.)

- RSA Security LLC

- Okta Inc.

- Google LLC (Alphabet Inc.)

- Ping Identity Corp.

- ManageEngine (Zoho Corp.)

- Microsoft Corp.

- TeleSign Corp. (Proximus Group)

- HID Global Corp.

- OneSpan Inc.

- CyberArk Software Ltd.

- ForgeRock Inc.

- Entrust Corp.

- SecureAuth Corp.

- Symantec Corp. (Broadcom Inc.)

- Technologies

- Secret Double Octopus

- Trusona Inc.

- Others