Global Multi-country Payroll (MCP) Solutions Market Size, Share, Statistics Analysis Report By Deployment Type (On-premise, Cloud-based), By End-use Industry (IT & Telecom, Financial Services, Retail & E-commerce, Healthcare, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141300

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

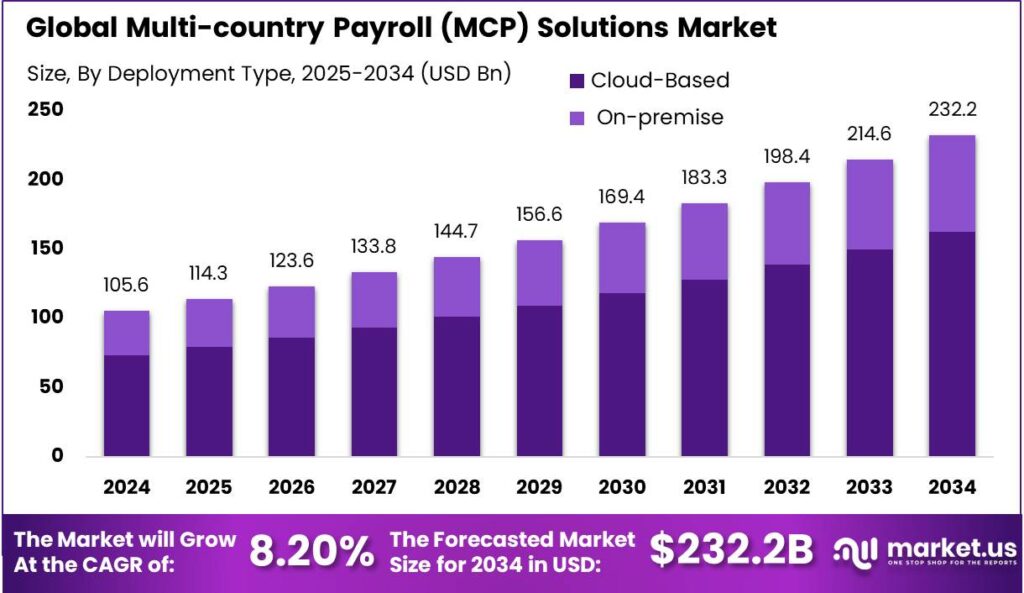

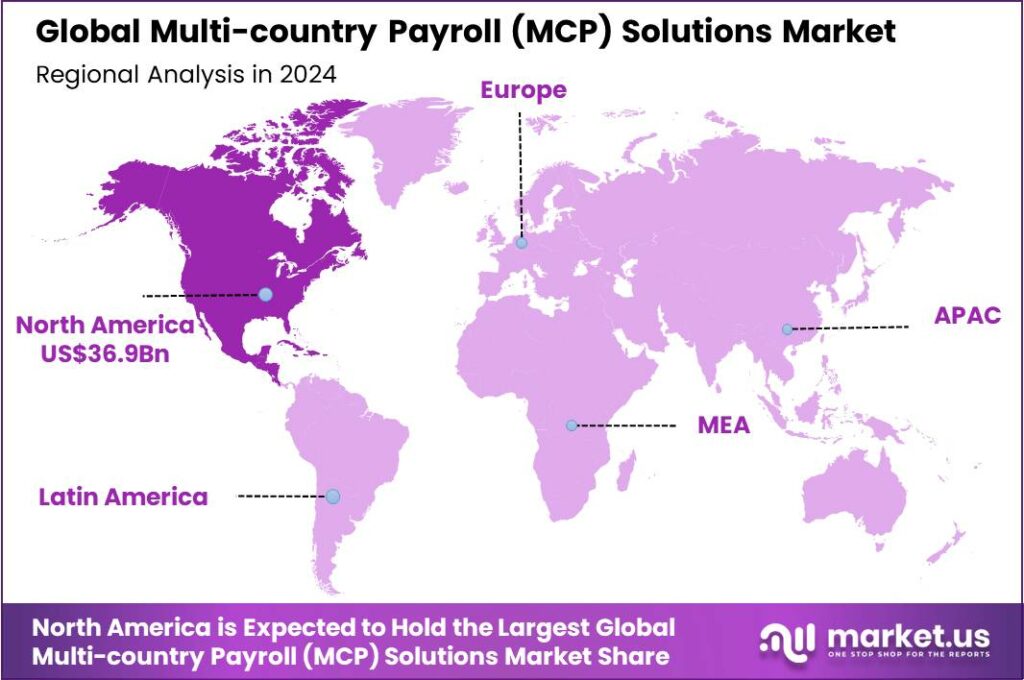

The Global Multi-country Payroll (MCP) Solutions Market size is expected to be worth around USD 232.2 Billion By 2034, from USD 105.6 Billion in 2024, growing at a CAGR of 8.20% during the forecast period from 2025 to 2034. In 2024, North America dominated the Multi-Country Payroll (MCP) Solutions Market, holding over 35% of the market share, with a revenue of approximately USD 36.9 billion.

Multi-country Payroll (MCP) solutions are comprehensive software systems designed to handle payroll processing across multiple countries, ensuring compliance with diverse local tax regulations, labor laws, and reporting requirements. These solutions simplify paying employees across regions, managing currencies, and meeting local legal requirements.

The MCP solutions market is growing rapidly due to factors like increasing globalization, with companies expanding into international markets and needing efficient payroll management across jurisdictions. The rise of remote and hybrid work models also drives demand for global payroll systems to manage payments and compliance for employees in diverse locations.

Technological advancements like cloud platforms and automation have simplified payroll management, ensuring accuracy. Concerns over data security and privacy, driven by regulations like GDPR, have increased demand for secure solutions. Additionally, businesses seeking to reduce costs and maintain efficiency often turn to outsourced or centralized MCP payroll solutions.

MCP solutions are gaining popularity for their ability to provide centralized control while ensuring local compliance. As globalization increases, mid-to-large enterprises with a global presence are adopting integrated payroll solutions. These solutions reduce administrative overhead and improve the employee experience by ensuring timely and accurate salary disbursements.

The MCP solutions market offers significant opportunities, especially in emerging markets and industries like technology, healthcare, and manufacturing with geographically dispersed workforces. The growing focus on data security and privacy regulations, like GDPR, opens doors for solutions that prioritize secure data handling and compliance.

The market for MCP solutions is expanding globally, particularly in regions like Asia-Pacific, Latin America, and Africa, due to rapid economic growth and the rise of multinational companies. The adoption of cloud-based technologies is making these solutions more accessible to smaller businesses and startups. Additionally, the demand for localized payroll solutions to meet regional and national requirements is further driving this global market expansion.

Key Takeaways

- The Global Multi-country Payroll (MCP) Solutions Market size is expected to be worth around USD 232.2 Billion by 2034, up from USD 105.6 Billion in 2024, growing at a CAGR of 8.20% during the forecast period from 2025 to 2034.

- In 2024, the Cloud-Based segment held a dominant market position, capturing more than 70% of the share in the Multi-country Payroll (MCP) Solutions market.

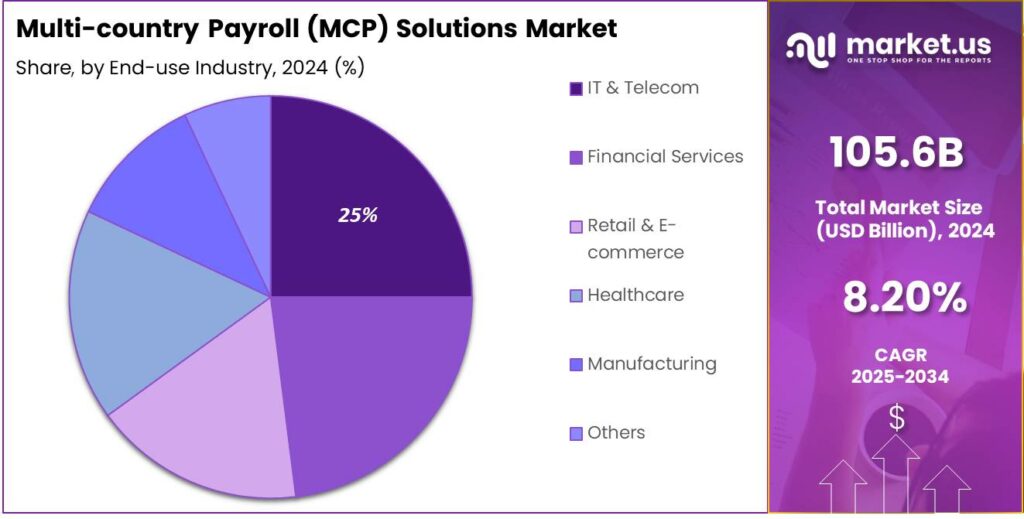

- In 2024, the IT & Telecom segment also held a dominant market position in the Multi-Country Payroll (MCP) solutions market, capturing more than a 25% share.

- In 2024, North America held a dominant market position in the Multi-Country Payroll (MCP) Solutions Market, capturing over 35% of the total market share, with a revenue of approximately USD 36.9 billion.

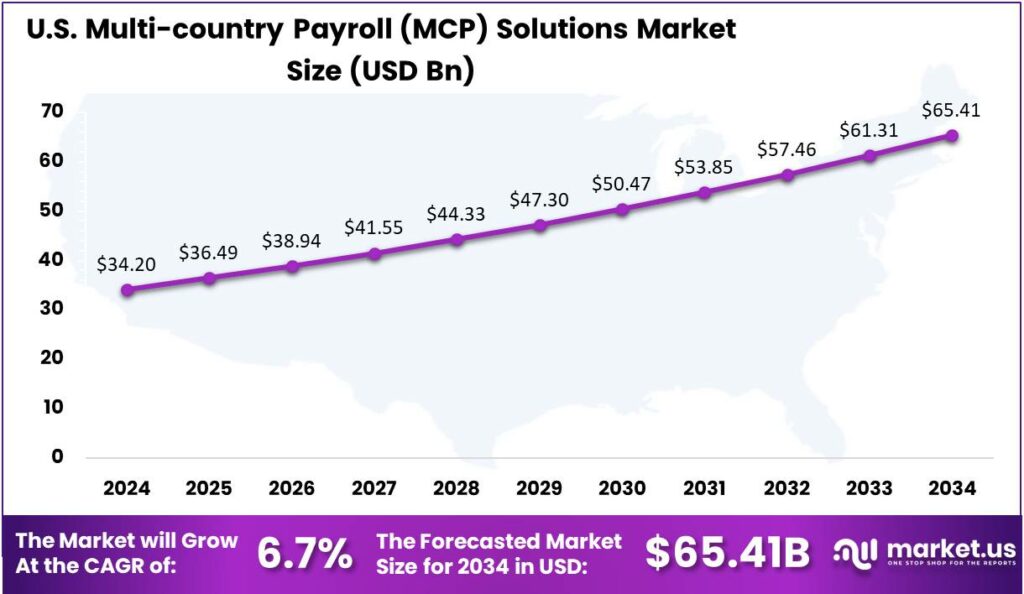

- The U.S. Multi-Country Payroll (MCP) Solutions Market is projected to reach USD 34.2 billion by 2024, driven by globalization, multinational expansion, and the need for efficient payroll management. The market is expected to grow at a CAGR of 6.7%.

U.S. Market Size

The U.S. Multi-Country Payroll (MCP) Solutions Market is projected to reach a valuation of $34.2 billion by 2024, driven by increasing globalization, the expansion of multinational enterprises, and the growing need for efficient payroll management across multiple jurisdictions. The market is projected to grow at a CAGR of 6.7%, driven by strong demand for streamlined payroll solutions that ensure compliance with local tax regulations and labor laws across countries.

As companies continue to expand their global footprint, the need for comprehensive payroll solutions that can operate across diverse legal and tax environments becomes essential. MCP solutions provide businesses with the ability to simplify payroll processes, reduce compliance risks, and optimize operational efficiency.

The increasing reliance on cloud-based payroll platforms and the adoption of artificial intelligence (AI) and machine learning (ML) for automated payroll calculations and compliance checks are expected to further contribute to market growth. Additionally, the rise of remote workforces and international partnerships has heightened the demand for innovative payroll systems capable of handling complex multi-currency and multi-jurisdictional requirements.

In 2024, North America held a dominant market position in the Multi-Country Payroll (MCP) Solutions Market, capturing over 35% of the total market share, with a revenue of approximately USD 36.9 billion. The region’s leading position is due to its strong tech infrastructure, widespread cloud adoption, and the presence of multinational corporations needing efficient payroll systems.

North America, particularly the United States, is home to a diverse and expansive corporate landscape, with numerous companies managing a global workforce. The increasing need for seamless payroll management that can comply with varying tax laws and labor regulations across different countries has driven significant demand for MCP solutions in the region.

The growth of the MCP solutions market in North America is also fueled by the rapid digitization of businesses and the strong emphasis on compliance, efficiency, and cost reduction. Companies are adopting AI and ML-powered automated payroll systems to streamline processes, improve accuracy, and ensure compliance with evolving regulations.

Moreover, the presence of leading MCP solution providers, such as ADP, Ceridian, and Workday, has bolstered North America’s market share. These companies have established a strong foothold in the region by offering comprehensive, end-to-end payroll services, including tax calculation, benefits management, and employee self-service portals.

Deployment Type Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing more than 70% of the share in the Multi-country Payroll (MCP) Solutions market. This significant market share can be attributed to the growing demand for scalable, flexible, and cost-effective payroll solutions.

Cloud-based platforms integrate easily with other enterprise systems, offering real-time payroll data access for efficient workforce management. They also reduce the need for on-premise infrastructure, lowering capital expenditures and maintenance costs, making them ideal for businesses of all sizes.

The increasing trend of remote work and the rise of globalized teams has also contributed to the rapid adoption of cloud-based MCP solutions. These platforms allow businesses to easily manage payroll across multiple countries, ensuring compliance with local tax laws and regulations. Additionally, cloud solutions provide greater scalability, which is essential for companies looking to expand their operations globally.

The dominance of the cloud-based segment is driven by easy software updates and continuous improvements from cloud providers. Businesses receive regular updates without manual installations or downtime, ensuring compliance with current regulations and tax laws. Automation reduces administrative errors and enhances payroll accuracy.

End-Use Industry Analysis

In 2024, the IT & Telecom segment held a dominant market position in the Multi-Country Payroll (MCP) solutions market, capturing more than a 25% share. This sector’s leadership can be attributed to its globalized nature and the highly dispersed workforce, where companies operate across multiple countries and time zones.

IT & Telecom firms have complex payroll requirements, given the diverse regulations, tax policies, and labor laws that vary from region to region. This sector often involves large-scale organizations with employees working remotely or in different jurisdictions, creating a need for efficient and compliant payroll solutions to ensure accurate and timely salary processing.

The rapid growth of the IT & Telecom sector has increased demand for scalable payroll systems capable of managing international payroll. As the industry innovates, the need for systems that integrate with HR technologies like talent management and benefits platforms has risen. The sector’s reliance on technology and automation drives the adoption of modern MCP platforms.

The global nature of the IT & Telecom workforce, with remote and contract workers, adds complexity to payroll, requiring solutions that handle multi-currency transactions, tax codes, and legal obligations. The rise of digital payment systems and cloud-based payroll solutions supports this growth, enabling businesses to manage payroll globally.

Key Market Segments

By Deployment Type

- On-premise

- Cloud-based

By End-use Industry

- IT & Telecom

- Financial Services

- Retail & E-commerce

- Healthcare

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Globalization and Workforce Mobility

One of the key drivers for Multi-Country Payroll (MCP) solutions is the need to streamline payroll management across different regions. With multinational companies hiring employees in various countries, each with its own regulatory requirements and tax laws, businesses are under pressure to ensure compliance while minimizing administrative overhead.

MCP solutions help in automating payroll processing, ensuring timely payments, and managing varying tax regulations, thus reducing the risk of non-compliance. These solutions also enhance data accuracy and reduce the risk of human errors, which are common in manual payroll processing. By utilizing centralized platforms, businesses can ensure that payroll is processed consistently across all regions, reducing the potential for costly errors and improving operational efficiency.

Restraint

Compliance Challenges and Regulatory Complexity

Despite the benefits of MCP solutions, companies often face significant challenges in navigating the complex web of local tax regulations, labor laws, and compliance requirements. Each country has distinct payroll regulations, tax rates, and reporting standards, which require businesses to constantly stay updated with the latest changes. The constant evolution of these regulations makes it difficult for businesses to maintain compliance across all jurisdictions.

Additionally, these complexities may require businesses to invest in specialized legal and HR teams for each region, adding to operational costs. In many cases, even automated solutions struggle to keep up with the speed of regulatory changes in diverse countries. While MCP solutions provide some level of automation, managing such complexity often requires deep expertise, which can limit the scalability and cost-effectiveness of these solutions.

Opportunity

Technological Advancements and Automation

One of the major opportunities for Multi-Country Payroll (MCP) solutions lies in the continuous advancements in technology, particularly in the areas of automation, artificial intelligence, and cloud computing. Automation can streamline payroll by reducing manual tasks like calculating wages, taxes, and benefits. Cloud-based systems offer real-time updates and scalability, enabling businesses to manage payroll across multiple countries without extra infrastructure costs.

Furthermore, the rise of artificial intelligence and machine learning technologies is allowing MCP platforms to predict trends, assess risks, and enhance data accuracy. For example, AI can be used to identify potential compliance issues before they arise or help optimize tax calculations based on the latest changes in regulations. These advancements in technology offer businesses a cost-effective way to handle complex payroll tasks while improving overall efficiency.

Challenge

Data Privacy and Security Concerns

Data privacy and security remain one of the biggest challenges when it comes to implementing Multi-Country Payroll (MCP) solutions. Payroll data contains sensitive information like salaries, tax details, and bank accounts, making it vulnerable to cyber-attacks. Companies must ensure their payroll systems comply with data protection regulations, such as the GDPR in the EU, to meet privacy laws in all operating jurisdictions.

Managing data security becomes even more challenging for businesses with employees in countries that have differing standards for data protection. A breach of payroll data can result in severe financial and reputational damage, as well as legal ramifications. To mitigate these risks, companies must invest in robust cybersecurity measures, including encryption, secure access controls, and regular audits. Additionally, businesses need to continuously monitor for potential vulnerabilities in their systems to prevent data breaches.

Emerging Trends

One of the key emerging trends is the integration of cloud-based payroll systems. These systems allow organizations to manage payroll across multiple countries more efficiently, eliminating the need for manual data entry and reducing the risk of human error.

A growing trend is the adoption of AI and machine learning in payroll management. AI automates routine tasks like calculations and compliance checks, ensuring smooth processes. It can also predict payroll anomalies, helping businesses identify and address issues before they escalate.

The demand for employee self-service portals is on the rise. Employees expect to access their payroll information easily and securely, which can improve transparency and trust within an organization. Self-service portals also reduce the administrative burden on HR departments, as employees can update their personal information, download payslips, and manage benefits independently.

Business Benefits

One of the primary advantages is the streamlining of payroll processes. By using a unified system to manage payroll across multiple countries, businesses can eliminate the need for different systems, which saves time and reduces complexity. This leads to a more efficient payroll operation and allows HR departments to focus on strategic tasks rather than administrative ones.

Another key benefit of MCP solutions is cost reduction. Outsourcing payroll or using an integrated solution lowers operational costs by eliminating the need for separate teams or systems in each country. Automation and self-service portals further contribute to savings by reducing manual tasks and enabling employees to manage certain payroll functions independently.

MCP solutions also ensure improved compliance with local regulations, which is essential in avoiding costly fines and reputational damage. With automated compliance checks and updates for country-specific regulations, businesses can be confident that they are meeting legal obligations.

Key Player Analysis

ADP is one of the largest and most well-known providers of payroll and human capital management (HCM) solutions globally. With decades of experience, ADP offers a comprehensive suite of services that cover payroll, tax compliance, and HR management in multiple countries.

Paychex is another major player in the MCP space, known for offering payroll solutions tailored to small and medium-sized businesses (SMBs). While Paychex is widely recognized in the U.S., it also provides payroll services for businesses operating in multiple countries. The platform is user-friendly and offers features like tax management, compliance assistance, and employee benefits integration.

UKG, formerly known as Ultimate Software and Kronos, is a strong competitor in the global payroll market. The company provides cloud-based HCM solutions that combine workforce management, payroll, and talent management for businesses of all sizes. UKG’s Multi-country Payroll solutions stand out due to their seamless integration with its other HR products and its ability to manage payroll across a broad range of countries.

Top Key Players in the Market

- ADP

- Paychex

- UKG

- Alight Solutions

- Ramco Systems

- Paycom Software

- CloudPay

- Neeyamo

- SAP

- SD Worx

- TMF Group

- Humanica

- Payslip

- Other Key Players

Top Opportunities Awaiting for Players

The Multi-Country Payroll (MCP) Solutions market presents several promising opportunities for industry players.

- Growing Demand for Streamlined Global Payroll Systems: As businesses expand across borders, the demand for integrated payroll solutions that simplify compliance, reporting, and tax management grows. Solutions that provide real-time data and ensure regulatory adherence are in high demand.

- Advancements in Automation and AI: Automation technologies and artificial intelligence are revolutionizing payroll processes. Players in the MCP space can leverage AI to offer enhanced payroll accuracy, reduce human error, and speed up processing times, all of which are highly attractive to multinational enterprises.

- Cloud-Based Payroll Solutions: The rise in cloud computing is creating new growth avenues. Cloud-based MCP solutions enable businesses to manage payroll across multiple countries in a centralized system. This scalability and accessibility make cloud solutions particularly attractive to small and medium enterprises (SMEs) looking for cost-effective global payroll management.

- Regulatory Complexity and Compliance Management: The increasing complexity of labor laws and tax regulations across various regions offers an opportunity for payroll providers to develop solutions that ensure businesses stay compliant with local laws. This is especially critical as non-compliance can lead to heavy fines.

- Focus on Employee Experience and Data Security: As companies focus more on enhancing employee satisfaction, there is an opportunity for MCP providers to offer solutions that improve pay transparency, ensure timely payments, and provide secure access to payroll data. These features contribute to better employee trust and retention.

Recent Developments

- In August 2024, CloudPay, a leader in global payroll and payment solutions, has secured $120 million in funding, led by Blue Owl Capital and supported by existing shareholders. This investment enhances CloudPay’s financial strength and opens doors for future growth.

- In February 2025, CloudPay, a global payroll and payments leader, has been recognized as a technology innovator by QKS Group. Its UKG One View solution simplifies complex HR and payroll environments, ensuring compliance, accuracy, and on-time processing across all regions.

Report Scope

Report Features Description Market Value (2024) USD 105.6 Bn Forecast Revenue (2034) USD 232.2 Bn CAGR (2025-2034) 8.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Type (On-premise, Cloud-based), By End-use Industry (IT & Telecom, Financial Services, Retail & E-commerce, Healthcare, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADP, Paychex, UKG, Alight Solutions, Ramco Systems, Paycom Software, CloudPay, Neeyamo, SAP, SD Worx, TMF Group, Humanica, Payslip, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multi-country Payroll (MCP) Solutions MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Multi-country Payroll (MCP) Solutions MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADP

- Paychex

- UKG

- Alight Solutions

- Ramco Systems

- Paycom Software

- CloudPay

- Neeyamo

- SAP

- SD Worx

- TMF Group

- Humanica

- Payslip

- Other Key Players