Global Multi-Agent System Market Size, Share, Industry Analysis Report By Deployment Mode (Cloud, On-premises), By End-use Industry (Manufacturing, Supply-chain and Logistics, Healthcare and Life-Sciences, BFSI, Others), By Application (Workflow and Process Orchestration, Multi-robot Coordination, Decision-support and Planning, Simulation and Digital-twin Modelling, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163476

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

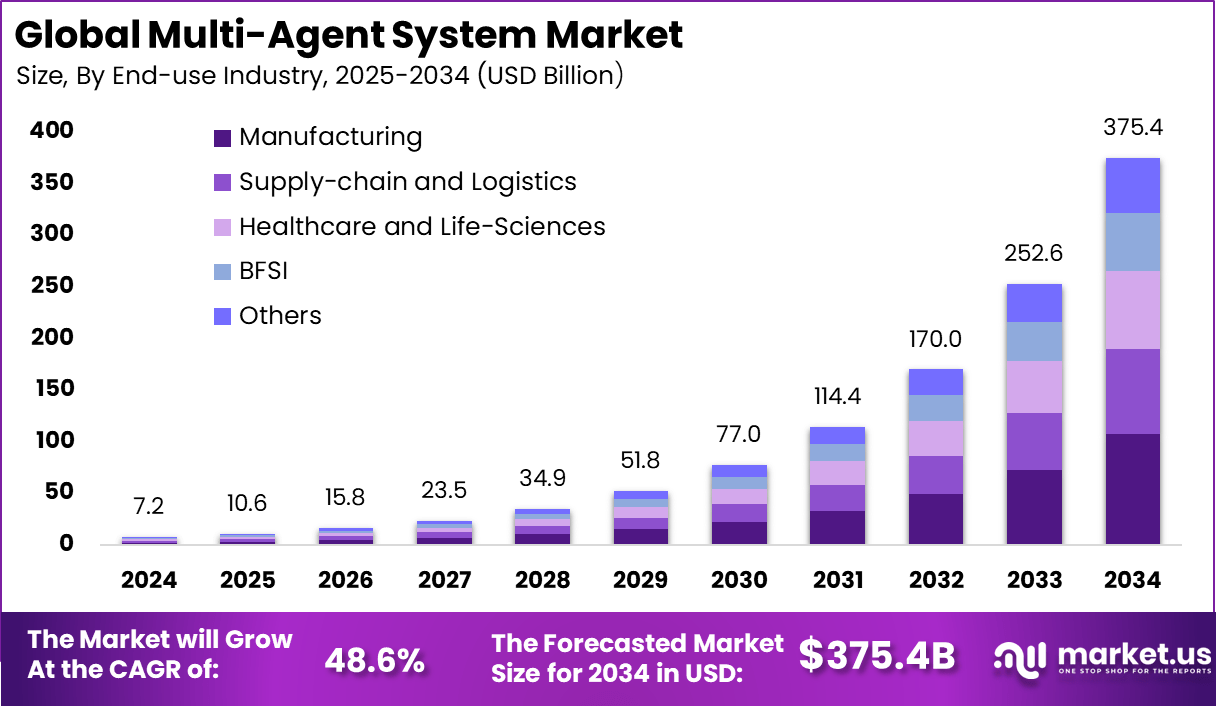

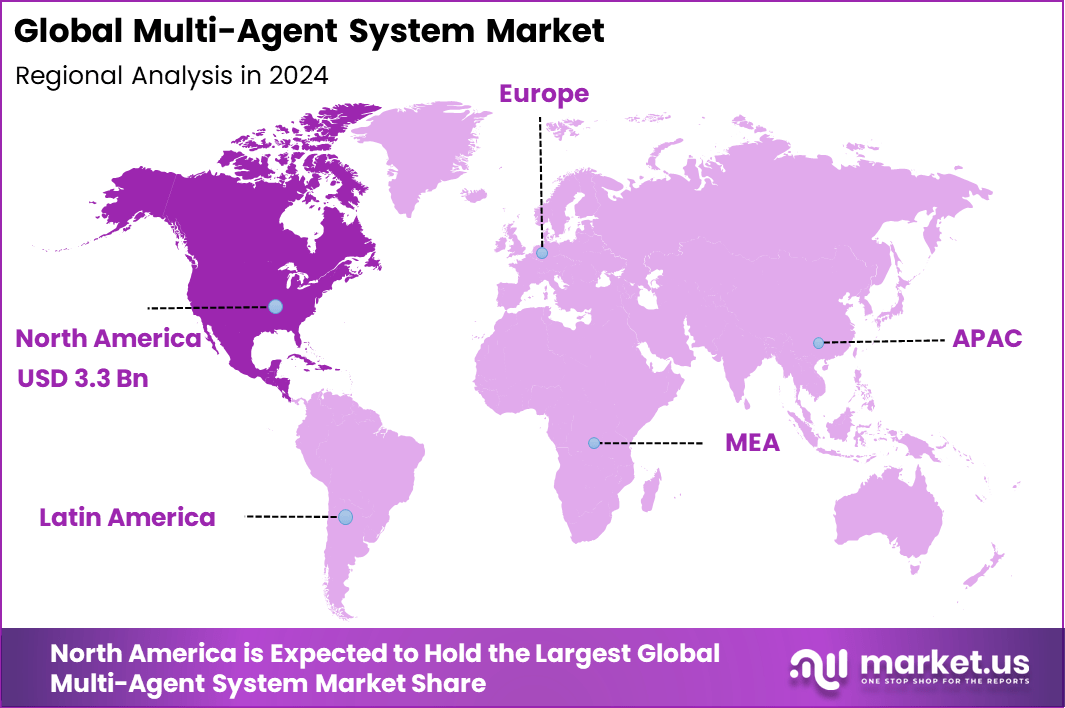

The Global Multi-Agent System Market generated USD 7.2 billion in 2024 and is predicted to register growth from USD 10.6 billion in 2025 to about USD 375.4 billion by 2034, recording a CAGR of 48.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 46.7% share, holding USD 3.3 Billion revenue.

The Multi-Agent System (MAS) market is driven by the increasing need for automation and decentralized decision-making, especially in complex environments. Key factors pushing the market include the rise of distributed AI, autonomous systems, and intelligent automation across industries like manufacturing, logistics, finance, and smart infrastructure. These systems enable enhanced operational efficiency and improved decision-making by allowing multiple AI agents to collaborate and share information seamlessly.

Demand for multi-agent systems is rising due to their ability to handle dynamic tasks in real-time. Businesses are adopting MAS to automate repetitive workloads, respond swiftly to market changes, and optimize processes. Technologies that boost this demand include cloud-native MAS deployments, edge computing integrations, and advances in AI reasoning capabilities that support autonomous decision-making without human intervention.

The adoption of Multi-Agent Systems (MAS) is increasing due to their scalability, flexibility, and fault tolerance. Companies are turning to these systems to automate domain-specific processes, minimize human error, and improve efficiency. The growing integration of MAS with enterprise tools such as CRM and ERP, along with emerging low-code development frameworks, is driving new investment opportunities in intelligent automation.

MAS solutions significantly reduce operational costs by automating complex, repetitive tasks. Their ability to run specialized agents in parallel enhances productivity and ensures smoother operations across departments. By aggregating data from multiple sources, MAS improves the quality of business decisions through faster and more accurate insights.

The scalable nature of MAS allows organizations to expand automation capabilities as needed, supporting a wide range of applications across industries such as finance, logistics, manufacturing, and healthcare. This adaptability positions MAS as a vital component of the next generation of enterprise automation systems.

Quick Market Facts

- Cloud deployment dominated with 72.1%, driven by its scalability, faster data processing, and ease of integration across distributed AI systems.

- The Manufacturing industry led end-use adoption with 28.7%, reflecting growing use of multi-agent coordination in robotics, automation, and predictive maintenance.

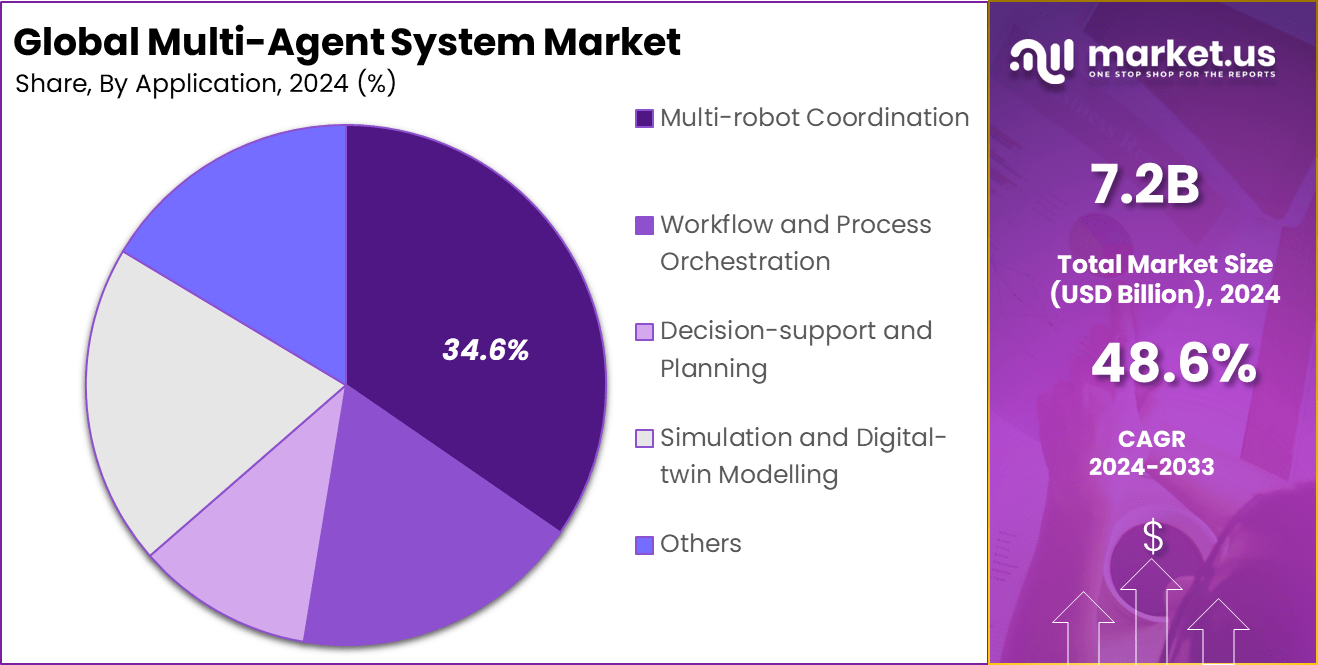

- Multi-robot Coordination applications captured 34.6%, supported by advancements in autonomous systems and collaborative industrial robotics.

- North America accounted for 46.7% of the global market, benefiting from strong research initiatives and widespread AI implementation across industries.

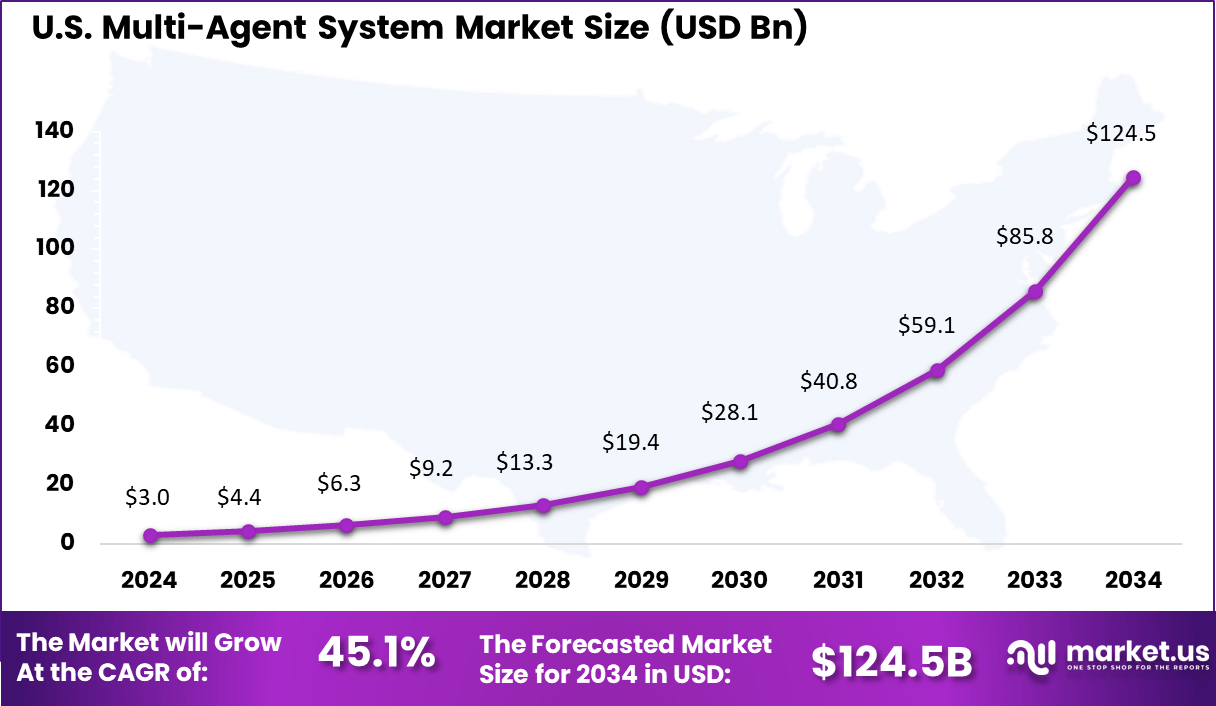

- The US market reached USD 3.01 Billion in 2024, expanding at an exceptional 45.1% CAGR, driven by rapid adoption of intelligent automation, autonomous robotics, and decentralized AI frameworks.

Role of Generative AI

Generative AI plays a crucial role in multi-agent systems by enabling these systems to perform complex and collaborative tasks that single agents cannot manage alone. In 2025, statistics show that about 25% of organizations using generative AI plan to implement autonomous AI agents as part of their operational workflows.

This approach allows specialized agents within the system to handle different parts of a task, improving both efficiency and accuracy. For instance, multi-agent collaboration helps break down and distribute the workload into smaller, manageable subtasks, leading to better decision-making and faster problem solving.

According to PwC’s 2025 survey, 88% of company decision-makers increased their AI budgets, with 35% reporting improved performance due to these agentic AI systems. This underlines generative AI’s expanding impact in driving practical applications and business outcomes.

US Market Size

The United States alone accounts for approximately USD 3.01 billion, expanding at a strong 45.1% CAGR. Growth is driven by heavy investments in AI-integrated robotics, coordinated drone systems, and real-time simulation platforms.

The country’s focus on autonomous mobility, digital manufacturing, and mission planning technologies is reinforcing its dominance in multi-agent system deployment. These trends reflect how North America continues to set the benchmarks for integrating artificial intelligence into practical, high-value, and scalable use cases across industries.

In 2024, North America holds about 46.7% of the global market, supported by mature AI research, strong robotics infrastructure, and fast-growing industrial automation initiatives. The region benefits from the presence of high-performance computing resources and well-developed cloud ecosystems that help scale multi-agent deployments efficiently. The manufacturing and defense sectors have been at the forefront of experimenting with collaborative autonomous systems that use distributed agent control.

By Deployment Mode

In 2024, Cloud deployment dominates the multi-agent system market with a share of 72.1%, showing a clear shift toward flexible and scalable computing environments. Organizations prefer cloud systems because they simplify the integration of distributed agents and support real-time decision-making across dynamic operations.

The rising volume of data from interconnected machines and IoT devices further strengthens the case for cloud-based frameworks, especially in sectors like logistics, smart cities, and energy management. The cloud model also allows developers to experiment with adaptive and reinforcement learning techniques at reduced infrastructure costs.

With growing adoption of digital twins and remote industrial control, the demand for cloud platforms capable of managing thousands of interacting agents continues to grow. Vendors are focusing on improving latency control and edge-cloud synchronization, ensuring that decision processes remain accurate even in high-speed, data-heavy applications.

By End-use Industry

In 2024, The manufacturing sector leads with 28.7% of the total market share. Multi-agent systems play a critical role in coordinating autonomous production lines, predictive maintenance, and resource allocation within smart factories.

As factories embrace Industry 4.0 standards, intelligent agents provide the decentralized decision-making needed to adapt to real-time changes in demand, supply, or equipment status. These systems help improve throughput, reduce downtime, and enhance operational visibility. Manufacturers are increasingly embedding agents in robotics, material handling, and logistics operations to create more agile production networks.

This approach reduces dependency on centralized control, promoting faster adaptation to disruptions or rescheduling needs. Continuous investment in automation and the expansion of digital industrial ecosystems have positioned multi-agent coordination as a cornerstone of next-generation manufacturing efficiency.

By Application

In 2024, Multi-robot coordination represents 34.6% of the application base, reflecting growing use in warehouse automation, defense robotics, and collaborative manufacturing. Multi-agent frameworks enable fleets of robots to share situational awareness, divide tasks efficiently, and operate safely in shared environments. This capability is essential for high-precision assembly lines, large-scale inspection tasks, and autonomous logistics operations.

Advances in swarm intelligence and reinforcement learning have made multi-robot systems more adaptive and reliable. Developers are focusing on algorithms that minimize communication overhead while improving task distribution accuracy. As industries deploy more autonomous mobile robots, the ability to coordinate multiple intelligent units in real time has become a crucial differentiator for both industrial and research applications.

Emerging Trends

One emerging trend in multi-agent systems is the rise of intelligent orchestration, where agent managers go beyond simple routing and actively coordinate workflows in real time. About 33% of enterprise software platforms will feature this agentic AI capability within the next few years.

Another trend is the integration of LLMs with multi-agent systems, which enables dynamic collaboration between agents specialized in planning, execution, and error correction. Multi-agent systems are also increasingly deployed in edge computing environments where costs have dropped, enabling on-device agents to operate more efficiently.

Growth Factors

The primary growth factors include the increasing complexity of enterprise operations and the limitations of single-agent AI models to handle multi-step and multi-variable tasks effectively. Multi-agent systems offer significant advantages like distributed intelligence, which eliminates single points of failure and improves resilience.

Recent research reveals that adoption in North America holds roughly 38% market share, driven by robust digital transformation and automation needs. The rise of agentic low-code development tools is also democratizing access to these systems, helping companies customize AI solutions for their specific needs without heavy technical overhead.

Key Market Segments

By Deployment Mode

- Cloud

- On-premises

By End-use Industry

- Manufacturing

- Supply-chain and Logistics

- Healthcare and Life-Sciences

- BFSI

- Others

By Application

- Multi-robot Coordination

- Workflow and Process Orchestration

- Decision-support and Planning

- Simulation and Digital-twin Modelling

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing demand for distributed intelligence and automation

The increasing complexity of business operations and digital ecosystems has created a strong demand for systems capable of distributing decision making across multiple autonomous agents rather than relying on centralized control. The concept of a multi agent system enables many independent agents to work collaboratively or competitively in a shared environment and thus tackle large scale, dynamic problems.

As organisations pursue operational agility, resilience and real time responsiveness, MAS are being adopted to enhance process efficiency, enable parallel task execution, and respond to fluctuations in data and environment. For example, enterprises report productivity gains in scenarios where agents automate repetitive tasks and coordinate actions.

Restraint Analysis

Complexity of system design and coordination

The deployment of multi agent systems is restrained by the inherent complexity of designing, coordinating and maintaining interactions among autonomous agents. Each agent must communicate, adapt and align with broader system goals, which raises issues of task allocation, context alignment and memory management across the agents.

In particular, the challenge of ensuring that agent behaviours remain consistent, coordinated and robust when scaled presents a barrier to large scale industrial adoption. The cost, effort and risk of unintended interactions or system instability slow down widespread implementation despite the potential benefits.

Opportunity Analysis

Expansion into new sectors and advanced capabilities

Significant opportunities exist for multi agent systems to be applied in new industry sectors and use cases such as smart cities, autonomous vehicles, healthcare systems and complex supply chains. Their ability to manage inter dependent tasks and dynamically allocate resources positions MAS as an enabler of next generation infrastructure and services.

Additionally, advances in technologies such as generative AI, edge computing and real time analytics further extend the capabilities of MAS, making them more adaptive, scalable and effective. Organisations that invest early can capture value in system integration, service innovation and competitive differentiation.

Challenge Analysis

Governance, interoperability and trust issues

A major challenge for the MAS market is the need to establish governance, interoperability and trust frameworks that manage how autonomous agents operate, communicate and make decisions in dynamic environments. As agents become more capable and autonomous, questions arise around control, accountability, security and alignment of objectives.

Moreover, interoperability among heterogeneous agents, legacy systems and external environments remains a technical obstacle. Smooth integration requires standard protocols, clear data sharing mechanisms and robust monitoring. Without clear frameworks, enterprises may hesitate to adopt MAS at scale due to concerns over risk, unpredictability and regulatory compliance.

Competitive Analysis

The Multi-Agent System Market is led by prominent AI and automation firms such as OpenAI LLC, UiPath Inc., C3.ai Inc., and Instadeep Ltd. These companies develop platforms where multiple autonomous agents collaborate, coordinate, and adapt dynamically within complex environments. Their solutions are utilized in logistics, manufacturing, supply chain optimization, and enterprise automation, facilitating scalable, intelligent workflows that mirror human teamwork and decision-making.

Specialized robotics and multi-agent technology providers including GreyOrange Inc., Fetch.ai Foundation Pte Ltd., Locus Robotics Corp., and Manus AI contribute by embedding agent-based systems into physical automation environments. Their systems enable warehouses, factories, and distribution centers to deploy fleets of robots and intelligent agents that communicate, optimize tasks, and react in real time. This increases efficiency, throughput, and operational flexibility in fast-moving industries.

Emerging and research-driven players such as Mindsmiths d.o.o., CrewAI Inc., Swarms AI Inc., HASH.ai Ltd., Algovera DAO Ltd., Emergence AI Inc., AgentVerse Technologies Ltd., Temporal Technologies Inc., Onomatic LLC, Blue Yonder Group Inc., and other major participants offer domain-specific multi-agent frameworks and simulation tools. Their innovations help enterprises design, test, and deploy complex agent networks for applications in smart cities, digital twins, traffic management, and autonomous coordination-intensive scenarios.

Top Key Players in the Market

- OpenAI LLC

- UiPath Inc.

- GreyOrange Inc.

- C3.ai Inc.

- Fetch.ai Foundation Pte Ltd.

- Mindsmiths d.o.o.

- CrewAI Inc.

- Swarms AI Inc.

- HASH.ai Ltd.

- Algovera DAO Ltd.

- Emergence AI Inc.

- AgentVerse Technologies Ltd.

- Temporal Technologies Inc.

- Instadeep Ltd.

- Locus Robotics Corp.

- Blue Yonder Group Inc.

- Manus AI

- Onomatic LLC

- Others

Recent Developments

- October 2025, OpenAI LLC launched AgentKit, a comprehensive toolkit designed to streamline the building and deployment of AI agents. This platform includes a visual Agent Builder and ChatKit for embedding chat interfaces, significantly lowering barriers for developers to create multi-agent workflows at scale.

- October 2025, UiPath Inc. expanded its agentic automation platform with new offerings aimed at accelerating AI transformation across enterprises. The enhancements include pre-built solutions for complex business processes, a low-code environment for agent building, and orchestration tools to simplify deploying multi-agent systems.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 375.4 Bn CAGR(2025-2034) 48.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud, On-premises), By End-use Industry (Manufacturing, Supply-chain and Logistics, Healthcare and Life-Sciences, BFSI, Others), By Application (Workflow and Process Orchestration, Multi-robot Coordination, Decision-support and Planning, Simulation and Digital-twin Modelling, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OpenAI LLC, UiPath Inc., GreyOrange Inc., C3.ai Inc., Fetch.ai Foundation Pte Ltd., Mindsmiths d.o.o., CrewAI Inc., Swarms AI Inc., HASH.ai Ltd., Algovera DAO Ltd., Emergence AI Inc., AgentVerse Technologies Ltd., Temporal Technologies Inc., Instadeep Ltd., Locus Robotics Corp., Blue Yonder Group Inc., Manus AI, Onomatic LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- OpenAI LLC

- UiPath Inc.

- GreyOrange Inc.

- C3.ai Inc.

- Fetch.ai Foundation Pte Ltd.

- Mindsmiths d.o.o.

- CrewAI Inc.

- Swarms AI Inc.

- HASH.ai Ltd.

- Algovera DAO Ltd.

- Emergence AI Inc.

- AgentVerse Technologies Ltd.

- Temporal Technologies Inc.

- Instadeep Ltd.

- Locus Robotics Corp.

- Blue Yonder Group Inc.

- Manus AI

- Onomatic LLC

- Others