Global Motorcycle Advanced Rider Assistance System Market Size, Share, Growth Analysis By Product Type (Adaptive Cruise Control System, Motorcycle Stability Control System, Forward Collision Warning System, Blind Spot Detection System, Others), By Sensor (Radar, LiDAR, Image, Ultrasonic, Infrared), By Component (Sensors, Electronic Control Unit (ECU), Gear Assistors, Others), By Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176926

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

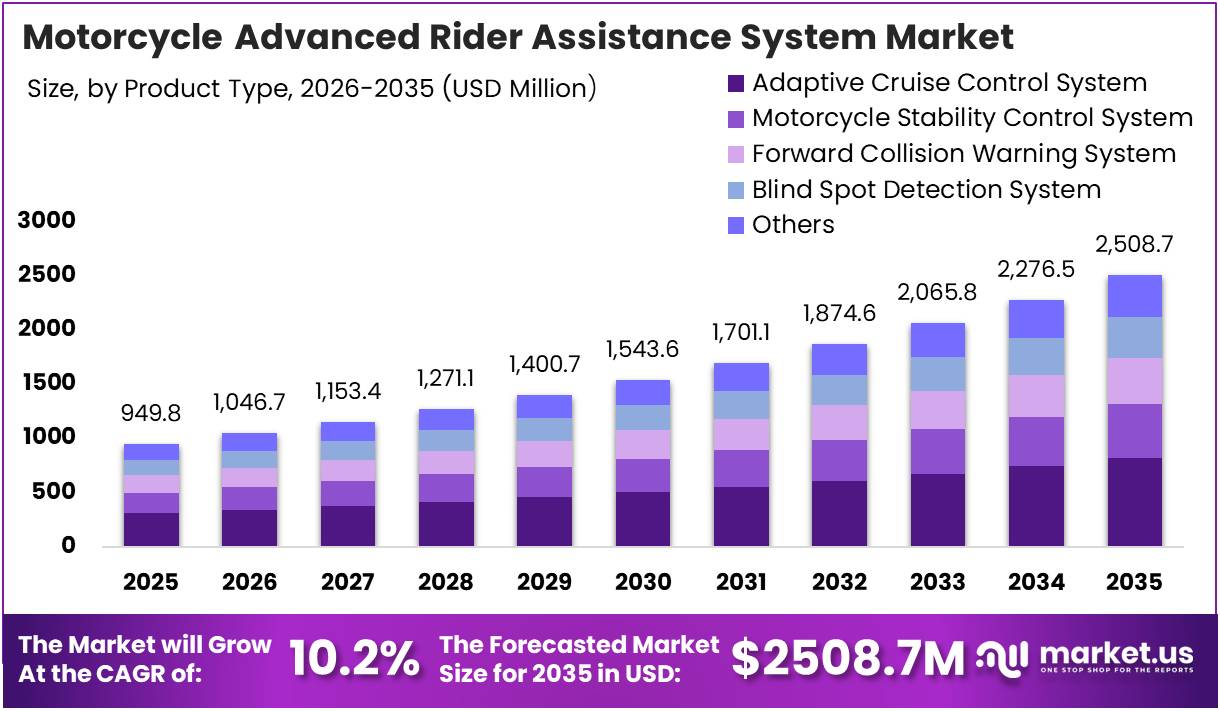

The Global Motorcycle Advanced Rider Assistance System Market size is expected to be worth around USD 2508.7 Million by 2035 from USD 949.8 Million in 2025, growing at a CAGR of 10.2% during the forecast period 2026 to 2035.

Motorcycle Advanced Rider Assistance Systems represent cutting-edge safety technologies designed specifically for two-wheelers. These systems integrate sophisticated sensors, electronic control units, and intelligent software to enhance rider safety and prevent accidents. Moreover, they provide real-time hazard detection and automated intervention capabilities.

The market encompasses various safety features including adaptive cruise control, collision warning systems, blind spot detection, and stability control. These technologies adapt automotive ADAS innovations to meet the unique dynamics and ergonomic requirements of motorcycles. Therefore, they address specific challenges associated with two-wheeler safety and performance.

Rising global motorcycle accident rates have become a primary catalyst for market expansion. Consequently, original equipment manufacturers are increasingly adopting collision avoidance technologies as standard safety features. Additionally, regulatory authorities worldwide are implementing stricter safety mandates for two-wheelers, further accelerating market growth.

Government initiatives promoting road safety and vehicle automation are creating favorable market conditions. Furthermore, premium and electric motorcycle segments are demonstrating higher adoption rates of advanced safety systems. However, technical complexity and cost considerations remain significant factors influencing market penetration across different motorcycle categories.

According to SAE Mobilus, ARAS prototypes with ultrasonic sensors reduced simulated rear-end collisions by 92% in tests, with average system response time measured at approximately 180 milliseconds. Additionally, research published in PubMed indicates that Automatic Emergency Braking showed impact speed reductions ranging from 2.5 km/h to 38.9 km/h, achieving avoidance rates up to 63%.

According to ResearchGate, Adaptive Cruise Control technology can prevent up to 53% of crashes under optimal settings, particularly when trigger distances and sensor calibration are properly configured. These statistics demonstrate the significant safety benefits and life-saving potential of motorcycle ARAS technologies in real-world riding scenarios.

Key Takeaways

- Global Motorcycle Advanced Rider Assistance System Market valued at USD 949.8 Million in 2025, projected to reach USD 2508.7 Million by 2035 at 10.2% CAGR.

- Adaptive Cruise Control System dominates product type segment with 32.6% market share in 2025.

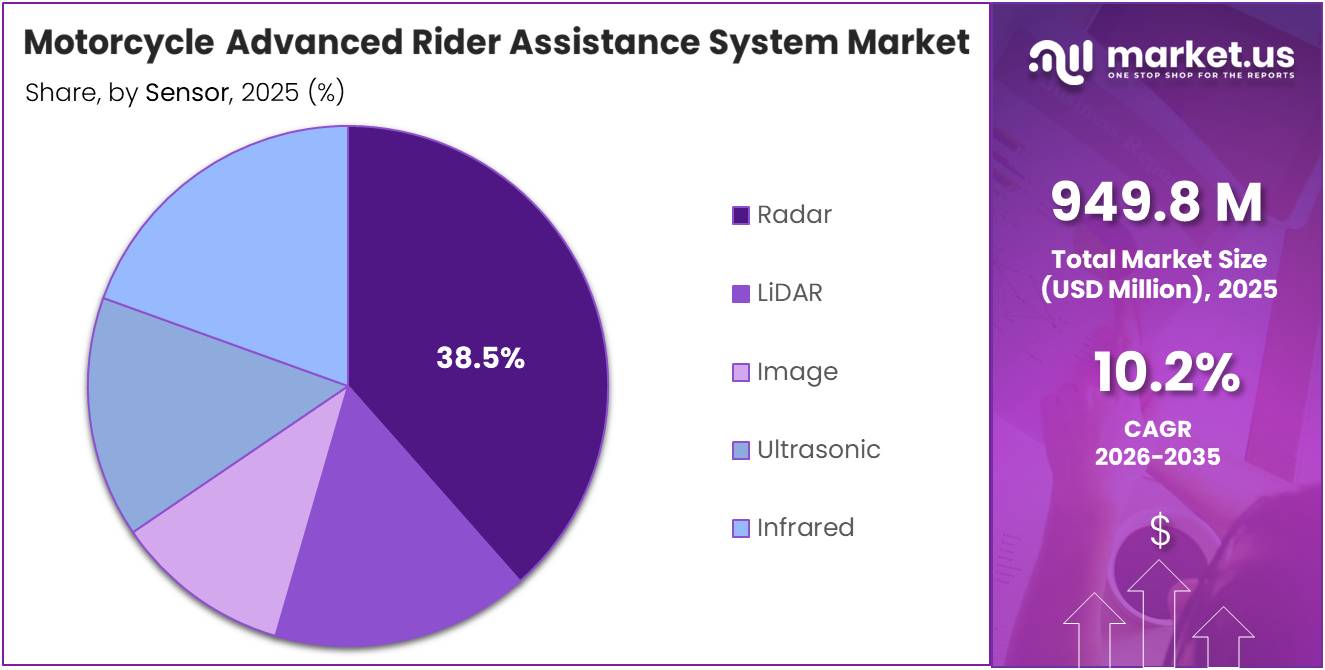

- Radar sensor segment leads with 38.5% share due to superior detection capabilities and weather resistance.

- Sensors component category holds 48.2% market share as foundational technology for ARAS functionality.

- OEM distribution channel commands 67.9% market share reflecting manufacturer integration strategies.

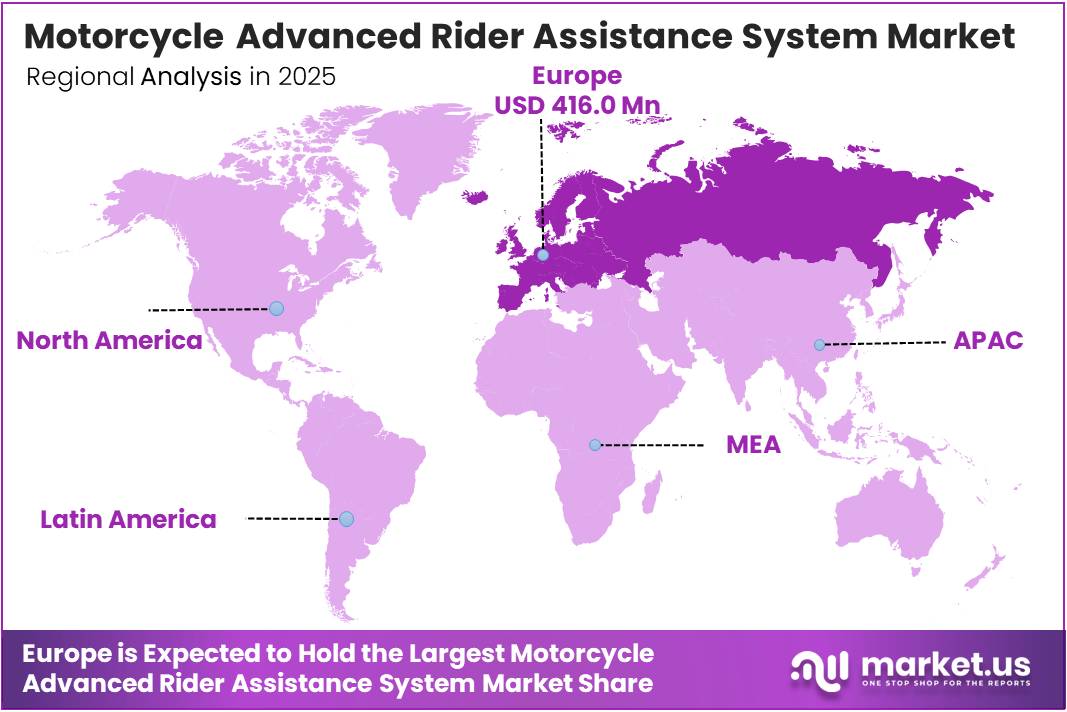

- Europe dominates regional market with 43.80% share valued at USD 416.0 Million in 2025.

Product Type Analysis

Adaptive Cruise Control System dominates with 32.6% due to enhanced rider comfort and automated speed management capabilities.

In 2025, Adaptive Cruise Control System held a dominant market position in the By Product Type segment of Motorcycle Advanced Rider Assistance System Market, with a 32.6% share. This technology automatically adjusts motorcycle speed based on traffic conditions, reducing rider fatigue during long journeys. Moreover, it enhances safety by maintaining optimal following distances.

Motorcycle Stability Control System provides critical intervention during challenging riding conditions including wet surfaces and sharp cornering maneuvers. This technology continuously monitors wheel speed, lean angle, and traction parameters to prevent slides and loss of control. Therefore, it significantly reduces accident risk in adverse weather conditions and emergency situations.

Forward Collision Warning System utilizes advanced sensors to detect potential frontal impact scenarios and alerts riders through visual or haptic warnings. Additionally, some systems integrate automatic emergency braking functionality to mitigate collision severity. Consequently, these features are becoming increasingly popular in premium motorcycle segments.

Blind Spot Detection System addresses a critical safety challenge by monitoring areas outside the rider’s direct line of sight using radar or ultrasonic sensors. The system provides real-time alerts when vehicles approach from adjacent lanes, particularly during lane-change maneuvers. Furthermore, it enhances urban riding safety where traffic density creates multiple blind spot scenarios.

Others category encompasses emerging ARAS technologies including lane departure warnings, rear collision alerts, and intelligent lighting systems. These supplementary features provide comprehensive safety coverage beyond primary collision avoidance functions. Additionally, innovations in artificial intelligence continue expanding the range of protective capabilities available to motorcycle riders.

Sensor Analysis

Radar dominates with 38.5% due to superior all-weather performance and long-range detection capabilities.

In 2025, Radar held a dominant market position in the By Sensor segment of Motorcycle Advanced Rider Assistance System Market, with a 38.5% share. Radar sensors excel in detecting objects at extended distances regardless of weather conditions including rain, fog, or darkness. Moreover, they provide reliable velocity measurements essential for adaptive cruise control and collision avoidance systems.

LiDAR technology offers exceptional three-dimensional mapping capabilities and precise distance measurements for enhanced environmental perception. These sensors create detailed point cloud representations of surrounding objects, enabling sophisticated object classification and tracking. However, cost considerations currently limit widespread adoption in mainstream motorcycle applications.

Image sensors leverage camera-based technology to provide visual recognition of lane markings, traffic signs, and potential hazards. Additionally, they enable advanced features like pedestrian detection and traffic light recognition through machine learning algorithms. Therefore, they complement other sensor types in comprehensive ARAS implementations.

Ultrasonic sensors specialize in short-range detection applications including parking assistance and low-speed maneuvering scenarios. These cost-effective sensors provide reliable proximity measurements for close-range obstacle detection in urban environments. Moreover, their compact size and affordability make them ideal for entry-level ARAS implementations.

Infrared sensors enhance night-time visibility and thermal imaging capabilities for all-weather riding safety across diverse lighting conditions. These sensors detect heat signatures from vehicles, pedestrians, and animals that might be invisible to conventional cameras. Furthermore, infrared technology provides critical safety benefits during low-visibility scenarios including nighttime and adverse weather conditions.

Component Analysis

Sensors dominate with 48.2% as foundational hardware enabling environmental perception and data collection.

In 2025, Sensors held a dominant market position in the By Component segment of Motorcycle Advanced Rider Assistance System Market, with a 48.2% share. These components include radar, cameras, ultrasonic, and LiDAR technologies that capture real-time environmental data. Moreover, sensor fusion techniques combine multiple sensor inputs to create comprehensive situational awareness for safety systems.

Electronic Control Unit (ECU) serves as the computational brain of ARAS, processing sensor data and executing safety algorithms in real-time. These sophisticated microprocessors analyze vast amounts of information within milliseconds to determine appropriate intervention strategies. Consequently, ECU performance directly influences system response times and overall safety effectiveness.

Gear Assistors enhance rider experience by enabling smooth gear transitions and optimizing power delivery during acceleration and deceleration. These components work in conjunction with other ARAS features to maintain vehicle stability during shifting operations. Additionally, they contribute to improved fuel efficiency and reduced mechanical stress on transmission components.

Others category encompasses various supporting components including actuators, display interfaces, and communication modules that enable complete ARAS functionality. These elements facilitate human-machine interaction and system integration with broader vehicle architectures. Furthermore, they support connectivity features essential for future V2X communication capabilities.

Distribution Channel Analysis

Original Equipment Manufacturer (OEM) dominates with 67.9% reflecting manufacturer preference for factory-integrated safety systems.

In 2025, Original Equipment Manufacturer (OEM) held a dominant market position in the By Distribution Channel segment of Motorcycle Advanced Rider Assistance System Market, with a 67.9% share. OEM integration ensures optimal calibration, warranty coverage, and seamless vehicle system compatibility from initial production. Moreover, manufacturers leverage ARAS as key differentiators in premium and mid-range motorcycle segments.

Aftermarket distribution channels serve existing motorcycle owners seeking to upgrade their vehicles with advanced safety technologies. These solutions cater to riders wanting enhanced protection without purchasing new motorcycles. However, aftermarket installations face challenges including compatibility verification, professional installation requirements, and potential warranty implications. Therefore, this segment appeals primarily to safety-conscious enthusiasts and commercial fleet operators.

Key Market Segments

By Product Type

- Adaptive Cruise Control System

- Motorcycle Stability Control System

- Forward Collision Warning System

- Blind Spot Detection System

- Others

By Sensor

- Radar

- LiDAR

- Image

- Ultrasonic

- Infrared

By Component

- Sensors

- Electronic Control Unit (ECU)

- Gear Assistors

- Others

By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Drivers

Rising Safety Concerns and Regulatory Mandates Drive Rapid ARAS Market Adoption

Rising global motorcycle accident rates are driving original equipment manufacturers to accelerate adoption of collision avoidance technologies across their product portfolios. Consequently, safety features once reserved for premium models are increasingly becoming standard equipment. Moreover, consumer awareness regarding two-wheeler safety is creating market demand for advanced protective systems.

Increasing regulatory pressure for mandatory safety features in two-wheelers is reshaping industry standards worldwide. Governments across developed and emerging markets are implementing stricter homologation requirements that mandate specific ARAS functionalities. Therefore, manufacturers must invest in safety technologies to maintain market access and regulatory compliance.

Rapid integration of sensor fusion technologies including radar, camera, and inertial measurement units is enhancing ARAS capabilities significantly. These multi-sensor approaches provide redundancy and improved accuracy compared to single-sensor systems. Additionally, advances in artificial intelligence enable more sophisticated hazard recognition and intervention algorithms for comprehensive rider protection.

Restraints

Technical Complexity and Environmental Challenges Limit Market Penetration

Technical complexity of adapting ADAS features to two-wheeler dynamics and ergonomics presents significant engineering challenges for manufacturers. Motorcycles exhibit unique characteristics including lean angles, compact dimensions, and exposed rider positioning that complicate sensor placement and system calibration. Moreover, computational requirements must balance performance with weight and power consumption constraints.

Reliability challenges of advanced sensors under harsh riding and weather conditions affect system dependability and consumer confidence. Sensors must withstand vibration, temperature extremes, moisture, and physical impacts common in motorcycle operation. Additionally, false positive warnings or system failures during critical moments could paradoxically increase accident risk rather than preventing it.

Cost implications of integrating sophisticated ARAS technologies remain prohibitive for entry-level and budget motorcycle segments. Furthermore, limited consumer willingness to pay premium prices for safety features restricts market expansion beyond luxury categories. Therefore, achieving cost-effective solutions through economies of scale and technological optimization remains essential for mass-market adoption.

Growth Factors

Emerging Segments and Strategic Partnerships Accelerate Market Expansion

Expansion of ARAS adoption in electric and premium motorcycle segments is creating new growth opportunities for technology providers and manufacturers. Electric motorcycles often incorporate advanced electronics and software platforms that facilitate ARAS integration more readily than conventional vehicles. Moreover, premium segment buyers demonstrate higher willingness to invest in cutting-edge safety technologies.

OEM partnerships with technology providers for cost-optimized ARAS platforms are enabling broader market penetration across motorcycle categories. Collaborative development programs distribute research costs and accelerate time-to-market for innovative safety solutions. Consequently, these partnerships leverage automotive ADAS expertise while addressing motorcycle-specific requirements through specialized engineering.

Untapped demand for advanced safety systems in emerging urban mobility markets represents significant long-term growth potential. Rapidly growing motorcycle populations in Asia-Pacific and Latin American cities create substantial addressable markets. Additionally, increasing urbanization and traffic density in these regions heighten awareness of safety needs, driving consumer interest in protective technologies.

Emerging Trends

Connected Technologies and Software Innovation Transform ARAS Capabilities

Shift toward radar-based and camera-based ARAS solutions for real-time hazard detection is redefining industry technology preferences. These sensor modalities offer superior object classification capabilities and cost-effectiveness compared to earlier generation systems. Moreover, continuous improvements in signal processing algorithms enhance detection accuracy while reducing false alarm rates.

Integration of ARAS with connected vehicle and V2X communication technologies enables collaborative safety features that extend beyond individual motorcycle capabilities. Vehicle-to-vehicle communication and vehicle-to-infrastructure communication allows anticipatory hazard warnings based on information from surrounding traffic participants. Therefore, connected ARAS systems can alert riders to dangers beyond direct sensor range.

Growing focus on software-defined safety features and over-the-air updates provides manufacturers with continuous improvement capabilities throughout vehicle lifecycle. This approach enables feature enhancements, bug fixes, and performance optimizations without requiring physical hardware modifications. Additionally, software-centric architectures support subscription-based business models and ongoing customer engagement beyond initial purchase.

Regional Analysis

Europe Dominates the Motorcycle Advanced Rider Assistance System Market with a Market Share of 43.80%, Valued at USD 416.0 Million

In 2025, Europe held a dominant market position with a 43.80% share, valued at USD 416.0 Million, driven by stringent safety regulations and advanced automotive technology infrastructure. European manufacturers lead in ARAS development and implementation across premium motorcycle segments. Moreover, strong regulatory frameworks mandate comprehensive safety features, accelerating market adoption rates.

North America Motorcycle Advanced Rider Assistance System Market Trends

North America demonstrates robust growth driven by increasing consumer safety awareness and premium motorcycle market expansion. The region benefits from established technology ecosystems and high disposable incomes supporting advanced safety feature adoption. Additionally, growing recreational riding culture creates demand for enhanced protection systems among enthusiast segments.

Asia Pacific Motorcycle Advanced Rider Assistance System Market Trends

Asia Pacific represents the largest motorcycle market globally, offering tremendous long-term growth potential for ARAS technologies. However, price sensitivity and market fragmentation currently limit widespread adoption beyond premium segments. Consequently, manufacturers are developing cost-optimized solutions targeting high-volume commuter motorcycle categories.

Latin America Motorcycle Advanced Rider Assistance System Market Trends

Latin America exhibits emerging demand for motorcycle safety technologies driven by urbanization and increasing accident awareness. Economic constraints limit market penetration, but premium segment growth is creating initial adoption opportunities. Furthermore, regulatory developments in major markets like Brazil may accelerate future ARAS requirements.

Middle East & Africa Motorcycle Advanced Rider Assistance System Market Trends

Middle East and Africa show nascent but growing interest in motorcycle ARAS technologies, particularly within premium segments and commercial applications. Market development is influenced by infrastructure investments and evolving safety standards. Moreover, increasing motorcycle usage for delivery services creates demand for fleet safety solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Robert Bosch GmbH leads the motorcycle ARAS market through comprehensive safety technology portfolios and extensive automotive electronics expertise. The company pioneered radar-based motorcycle safety systems and maintains strong partnerships with major motorcycle manufacturers globally. Moreover, Bosch’s integrated sensor and ECU solutions enable complete ARAS implementations. Their recent production agreements with premium brands demonstrate market leadership and technological advancement.

Continental AG leverages its global automotive safety systems experience to develop specialized motorcycle ARAS solutions. The company offers comprehensive sensor technologies, electronic control units, and integrated safety platforms tailored for two-wheeler applications. Additionally, Continental invests heavily in research and development to address unique motorcycle dynamics challenges. Their focus on cost optimization enables broader market penetration.

ZF Friedrichshafen AG brings advanced chassis control and safety system expertise to the motorcycle ARAS market. The company develops integrated solutions combining sensors, actuators, and intelligent control algorithms for enhanced rider protection. Furthermore, ZF’s acquisition strategy and technology partnerships strengthen its position in emerging safety segments. Their systems integration capabilities provide competitive advantages.

Denso Corporation applies decades of automotive electronics experience to motorcycle safety system development, particularly in sensor technology and electronic control units. The company maintains strong relationships with Japanese motorcycle manufacturers and expanding global presence. Moreover, Denso’s expertise in miniaturization and reliability engineering addresses motorcycle-specific packaging constraints. Their focus on quality and durability supports premium market positioning.

Key players

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Mitsubishi Electric Corporation

- BMW Motorrad

- Ducati Motor Holding

- Honda Motor Co.

- Yamaha Motor Co.

- Kawasaki Heavy Industries

Recent Developments

- January 2026 – Valeo and Hero MotoCorp announced a strategic partnership to develop Advanced Rider Assistance Systems specifically designed for two-wheelers, targeting mass-market motorcycle segments. This collaboration aims to bring affordable ARAS technologies to emerging markets through joint engineering and manufacturing initiatives.

- January 2026 – Irish firm Luna Systems successfully raised €1.5 Million in funding to advance AI-powered rider assistance technologies for cyclists and motorcyclists. The investment will accelerate development of machine learning algorithms for enhanced hazard detection and real-time safety interventions.

- September 2025 – Bosch announced its new radar-based Advanced Rider Assistance Systems will enter production on KTM motorcycles, featuring multiple safety functions including adaptive cruise control and collision warnings. This deployment marks significant progress in mainstream ARAS adoption across performance motorcycle segments.

Report Scope

Report Features Description Market Value (2025) USD 949.8 Million Forecast Revenue (2035) USD 2508.7 Million CAGR (2026-2035) 10.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Adaptive Cruise Control System, Motorcycle Stability Control System, Forward Collision Warning System, Blind Spot Detection System, Others), By Sensor (Radar, LiDAR, Image, Ultrasonic, Infrared), By Component (Sensors, Electronic Control Unit (ECU), Gear Assistors, Others), By Distribution Channel (Original Equipment Manufacturer (OEM), Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Mitsubishi Electric Corporation, BMW Motorrad, Ducati Motor Holding, Honda Motor Co., Yamaha Motor Co., Kawasaki Heavy Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Motorcycle Advanced Rider Assistance System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Motorcycle Advanced Rider Assistance System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Mitsubishi Electric Corporation

- BMW Motorrad

- Ducati Motor Holding

- Honda Motor Co.

- Yamaha Motor Co.

- Kawasaki Heavy Industries