Global Mortuary Bags Market By Raw Material (Polyethylene, Polyvinyl Chloride (PVC) / PVC-based (or similar vinyl), Nylon, Polyester and Others), By Size (Adult bags, Child/Infant bags and Heavy Duty & Bariatric bags) By End-User (Hospitals and Medical facilities, Morgues, Funeral Homes and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169258

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

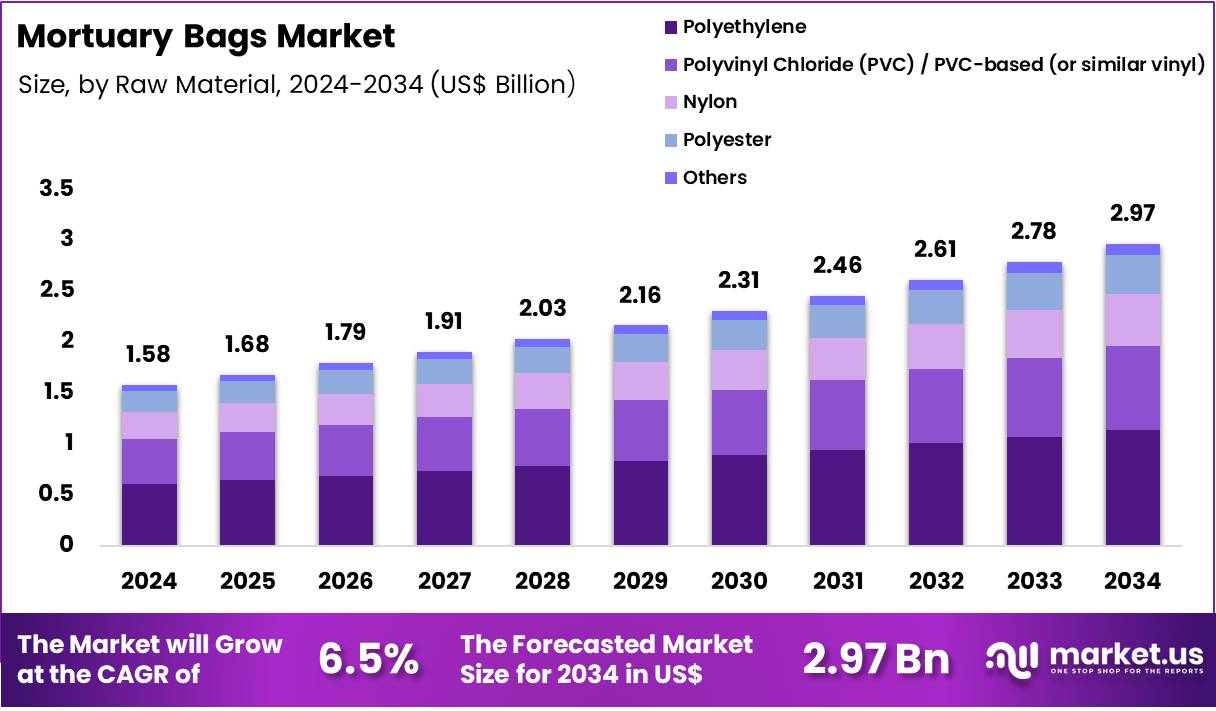

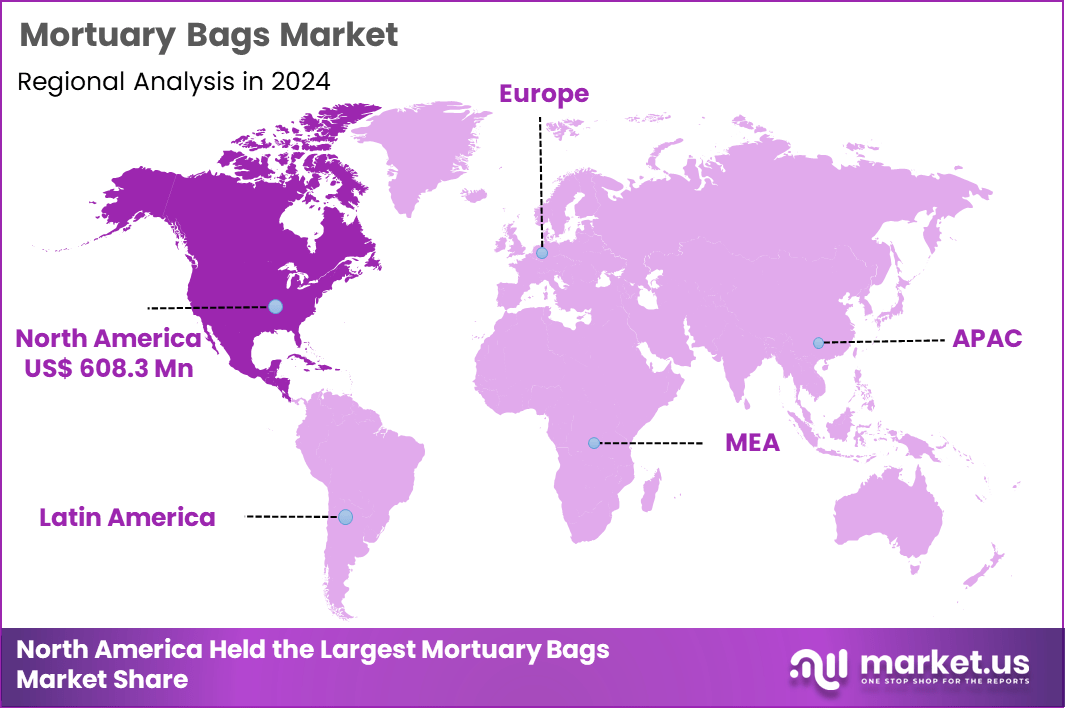

Global Mortuary Bags Market size is expected to be worth around US$ 2.97 Billion by 2034 from US$ 1.58 Billion in 2024, growing at a CAGR of 6.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 608.3 Million.

The Mortuary Bag Market represents a critical component of death management infrastructure across hospitals, morgues, emergency response units, and funeral facilities. Demand continues to rise due to increased attention to biohazard containment, public-health preparedness, and the need for durable, leak-proof body-handling solutions.

Mortuary bags serve essential functions in transport, storage, disease-control protocols, and disaster-response operations. Manufacturers are improving product durability, sealing integrity, and raw-material quality to meet evolving national and international health guidelines. Rising requirements for infection-control practices, emergency preparedness, and mass-casualty management contribute to consistent market expansion.

Polyethylene, PVC-based materials, nylon, and polyester remain the most widely used raw materials due to their strength, flexibility, and suitability for secure containment. Healthcare facilities, mortuaries, and funeral operators depend on heavy-duty and specialized bags designed for routine handling, bariatric support, forensic examination, and biohazard-sensitive management. Continuous improvements in zipper systems, load-bearing capacity, antimicrobial coatings, and biodegradable alternatives further support innovation in the sector.

Public health agencies, forensic departments, and disaster-response organizations increasingly emphasize standardized protocols for safe handling of deceased individuals, reinforcing demand for high-quality mortuary bags across global regions. In August 2020, Mopec, a major supplier of pathology, anatomy, mortuary, and necropsy equipment, introduced its Safe View body bag as part of its COVID-19 response efforts. This design incorporates a clear inner layer that enables families or personnel to view the deceased while significantly reducing the risk of exposure for those handling the remains.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.58 billion, with a CAGR of 6.5%, and is expected to reach US$ 2.97 billion by the year 2034.

- The Raw Material segment is divided into Polyethylene, Polyvinyl Chloride (PVC) / PVC-based (or similar vinyl), Nylon, Polyester, and Others, with Polyethylene taking the lead in 2024 with a market share of 38.5%

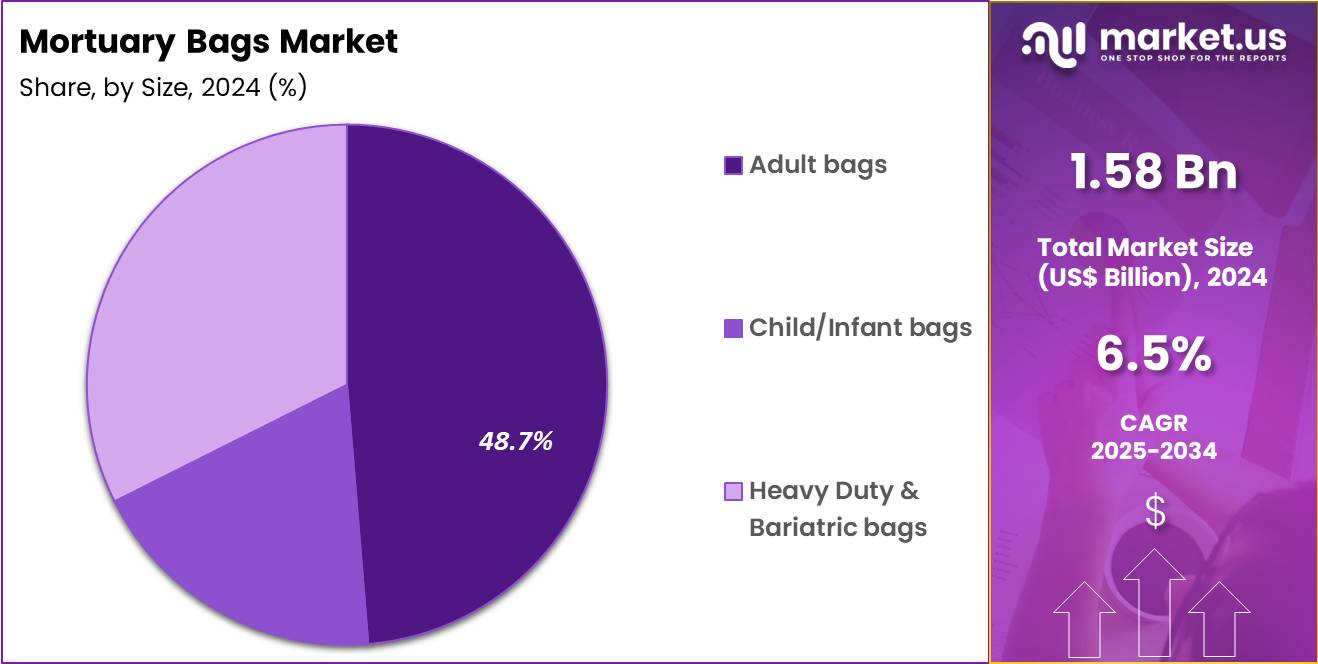

- The Size segment is divided into Adult bags, Child/Infant bags, and Heavy Duty & Bariatric bags, with Adult bags taking the lead in 2024 with a market share of 48.7%

- The End-User segment is divided into Hospitals and Medical facilities, Morgues, Funeral Homes, and Others, with Hospitals and Medical facilities taking the lead in 2024 with a market share of 38.8%

- North America led the market by securing a market share of 38.5% in 2024.

Raw Material Analysis

Polyethylene dominated mortuary bag usage with accounting for over 38.5% market share due to its robustness, moisture resistance, and affordability, making it ideal for routine transport and long-duration storage. It supports a wide range of hospital and emergency applications where reliability and ease of handling are essential.

PVC-based bags remain significant because they offer strong sealing properties and high tensile strength, making them suitable for biohazard-sensitive scenarios. Their impermeability and structural rigidity support use in pathology, forensic investigations, and infectious-disease management.

Nylon bags continue gaining attention in settings requiring higher durability and reusability. Their abrasion resistance and tear strength serve well in demanding operations, including military, emergency services, and field-level disaster management.

Polyester bags are preferred in applications requiring enhanced flexibility and smooth handling. Their lightweight nature, combined with dependable performance, makes them useful for funeral homes and mortuary units requiring easy maneuverability.

Other material categories include biodegradable and eco-friendly options responding to the growing demand for sustainable products. These variants appeal to regions with strict environmental guidelines and organizations seeking reduced ecological impact.

Size Analysis

Adult bags form the primary category in most medical and funeral operations which accounted for 48.7% market share in 2024, as hospitals and emergency departments require a constant supply for routine and critical cases. These bags are designed for high load-bearing capacity, reinforced stitching, and reliable zipper systems.

Child and infant bags are essential in pediatric hospitals, neonatal units, and forensic settings, where specialized sizing ensures dignity and safe containment. Increased awareness of standardized protocols for sensitive pediatric cases continues to strengthen demand.

Heavy-duty and bariatric bags serve a growing need across healthcare and emergency services as they provide additional strength, wider dimensions, and reinforced construction. These variants are essential for safe handling of larger bodies and are increasingly adopted by funeral service providers, military units, and disaster-response teams.

End-User Analysis

The end-user landscape is categorized into Hospitals and Medical Facilities, Morgues, Funeral Homes, and Others. Hospitals and medical facilities accounted for the largest share in 2024, representing 38.8% of total demand. Their reliance on mortuary bags is sustained by routine operational needs as well as emergency situations. The demand is driven by infection-control protocols, disease-management practices, and continuous patient-care activities. These facilities require a wide assortment of bag sizes, specifications, and material strengths to ensure safe handling, transport, and storage.

Morgues and mortuary institutions constitute the second major end-user group. Their operational focus on long-term preservation, forensic examination, and regulated storage results in strong preference for structurally durable, leak-proof, and cooling-system-compatible bag designs.

Funeral homes utilize mortuary bags to uphold hygiene and dignity during body preparation and handling. Requirements in this setting emphasize ease of handling, smooth internal surfaces, and materials that support respectful treatment.

The “Others” category includes military units, emergency response teams, disaster-management authorities, and law-enforcement agencies. These stakeholders require highly durable, tear-resistant, and biohazard-resistant bags suitable for field operations, mass-casualty management, and forensic transport under demanding conditions.

Key Market Segments

By Raw Material

- Polyethylene

- Polyvinyl Chloride (PVC) / PVC-based (or similar vinyl)

- Nylon

- Polyester

- Others

By Size

- Adult bags

- Child/Infant bags

- Heavy Duty & Bariatric bags

By End-User

- Hospitals and Medical facilities

- Morgues

- Funeral Homes

- Others

Drivers

Growing Focus on Infection Control, Public-Health Preparedness & Emergency Response

A major driver for the mortuary bag market is the increasing emphasis on infection-control standards and preparedness for public-health emergencies. During outbreaks such as COVID-19, Ebola, Nipah, H1N1, and other high-risk pathogens, safe handling of deceased individuals becomes a national priority. The World Health Organization (WHO) mandates the use of certified, leak-proof mortuary bags for infectious-disease fatalities, directly increasing demand.

For example, during the COVID-19 peak in 2020, over 6 million global deaths (WHO) resulted in large-scale procurement of body bags by hospitals and emergency agencies. Similarly, countries like India, the U.S., Brazil, and Italy issued emergency tenders for high-strength polyethylene and PVC bags to meet sudden surges.

Emergency preparedness frameworks also contribute significantly. FEMA (U.S.) maintains federal stockpiles of mortuary supplies for disaster scenarios, while India’s National Disaster Response Force (NDRF) stocks heavy-duty bags for flood, landslide, and accident responses. Climate-change-driven events such as hurricanes, heatwaves, and earthquakes have increased global disaster fatalities. According to UNDRR, weather-related disasters rose 83% between 2000 and 2020, heightening the need for mortuary management resources. Hospitals, forensic labs, and military units now standardize high-grade bags as part of their emergency protocols, sustaining consistent and long-term market demand.

Restraints

Material Costs, Environmental Concerns & Uneven Standardization

A key restraint for the mortuary bag market is the rising cost and regulatory pressure associated with raw materials such as polyethylene, PVC, nylon, and polyester. Since these polymers are tied to the petrochemical supply chain, global price fluctuations directly impact product manufacturing. For example, global polyethylene prices increased by 20–35% in 2021 (ICIS data) due to supply disruptions and crude oil volatility. Such increases burden hospitals, emergency agencies, and funeral homes especially in developing regions with tight budgets.

Environmental restrictions further complicate adoption. Many countries, including members of the European Union, Japan, and several U.S. states, have introduced strict regulations on single-use plastics and PVC-based materials due to disposal challenges and potential toxic emissions. This forces manufacturers to redesign products using alternative materials, raising production costs.

Another restraint is inconsistent standardization across global regions. While countries such as the U.S., UK, Canada, and Australia follow stringent protocols for body-handling materials, many low-income regions lack uniform specifications. This leads to quality variations, poor sealing performance, and safety concerns. For instance, during flood disasters in Southeast Asia, emergency teams frequently reported tears or leaks in low-quality bags, resulting in contamination risks. These challenges collectively slow adoption of high-grade mortuary bags in cost-sensitive markets.

Opportunities

Rise of Biodegradable Solutions, Innovation in Heavy-Duty Bags & Government Preparedness

One of the strongest opportunities in the mortuary bag market lies in the development of biodegradable and eco-friendly body bags made from plant-based polymers, starch blends, and compostable materials. As more governments enforce sustainable procurement policies, demand for these alternatives grows rapidly. For instance, several European municipalities now require eco-compliant bags for public funeral services to reduce landfill load. In India and Southeast Asia, biodegradable mortuary bags gained traction after plastic-waste rules strengthened post-2022.

The growing need for reinforced heavy-duty and bariatric bags also presents a substantial opportunity. With global obesity rates rising—650+ million adults classified as obese (WHO)—hospitals and funeral services require wider, stronger, puncture-resistant bags capable of supporting higher weight. Military forces, disaster-response teams, and forensic units increasingly procure heavy-duty bags equipped with multiple handles, double zippers, and anti-leak linings.

Government initiatives further expand opportunities. Countries such as the U.S., India, Japan, and the UAE now maintain larger stockpiles of disaster-response supplies, including body-handling equipment. The U.S. Strategic National Stockpile (SNS) routinely replenishes mortuary supplies, while India’s NDMA mandates standardized body-handling materials for flood and pandemic responses.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence hospital budgets, procurement cycles, and investment in death-management infrastructure. During economic slowdowns, healthcare spending prioritizes essential supplies, supporting continued adoption of mortuary bags. Supply-chain disruptions, geopolitical tensions, and fluctuations in polymer raw-material availability can impact manufacturing timelines and pricing. Cross-border regulations for hazardous-material transport may also affect global distribution and inventory levels.

Public-health policies shaped by geopolitical events often dictate preparedness standards, influencing how institutions stockpile and utilize mortuary bags. Emergency response agencies frequently update procurement strategies to address uncertainties stemming from pandemics, territorial conflicts, or climate-related disasters.

Latest Trends

Shift Toward Eco-Friendly Materials, Advanced Sealing Systems & Customizable Identification

A key trend in the mortuary bag market is the transition toward eco-friendly, sustainable materials, driven by global environmental regulations and public-sector sustainability commitments. Countries in Europe, the UK, Canada, and Australia are prioritizing biodegradable alternatives due to increasing scrutiny of PVC and polyethylene waste. This has led to the emergence of compostable, plant-derived polymer bags with comparable strength to traditional materials.

Another important trend is the improvement of advanced sealing technologies. Modern mortuary bags include heat-sealed seams, double-track zippers, tamper-proof linings, and leak-resistant coatings. These enhancements emerged after WHO and CDC guidelines emphasized the importance of containment during infectious outbreaks. For example, during the Ebola crisis in West Africa, double-envelope bags with high-integrity sealing became standard practice.

Customization is also rising. Funeral homes and hospitals now request color-coded, transparent-window, or barcode-enabled bags to improve tracking, identification, and chain-of-custody workflows. Forensic units increasingly use bags compatible with imaging systems or bags designed with odor-control technology for extended storage.

Global disaster frequency is also influencing trends. With climate-related disasters increasing—7,348 major events recorded between 2000–2020 (UNDRR) countries are adopting more rugged, field-ready mortuary bags capable of handling extreme conditions. This continues to push innovation toward higher durability and multifunctional design.

Regional Analysis

North America is leading the Mortuary Bags Market

North America stands as the largest region in the Mortuary Bags Market with 38.5% market share due to its advanced healthcare infrastructure, strict public-health regulations, and high disaster-preparedness standards. The U.S. maintains one of the world’s most organized emergency response systems, with agencies such as FEMA, the Strategic National Stockpile (SNS), and state-level disaster units routinely procuring mortuary bags as part of readiness protocols.

During COVID-19, North America witnessed significant surges in hospital fatalities, prompting large-scale purchases of heavy-duty, leak-proof bags across New York, California, and Texas. The region also faces increasing climate-related disasters such as hurricanes, wildfires, and winter storms which often result in mass-fatality management needs. UNDRR data shows a consistent rise in weather-related emergencies across the U.S. and Canada, reinforcing the requirement for reliable body-handling equipment. Strong forensic infrastructure, large hospital networks, military preparedness programs, and established funeral industries collectively make North America the dominant market for mortuary bags.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific represents the fastest-growing region in the Mortuary Bags Market, driven by expanding healthcare capacity, rapid urbanization, and heightened public-health awareness following recent disease outbreaks. Countries such as India, China, Indonesia, and the Philippines frequently experience natural disasters floods, cyclones, earthquakes that require robust mortuary management solutions.

According to UNDRR, Asia accounts for the majority of global disaster-linked fatalities, creating continuous demand for durable and cost-effective mortuary bags. The region’s large population base and rising burden of infectious diseases—such as dengue, Nipah virus, avian influenza, and COVID-19 also push hospitals and morgues to maintain greater stock levels. Governments are strengthening emergency-response frameworks, with agencies like India’s NDRF and Japan’s Disaster Management Bureau incorporating standardized body-handling supplies into national preparedness kits.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Smart Choice Funeral Supplies, Classic Plastics, Mopec, Auden Funeral Supplies Ltd., Deluxe Scientific Surgico Pvt. Ltd., EIHF Isofroid, Ceabis, Flexmort, Span Surgical Co., Peerless Plastics Mortuary, Extra Packaging, Tianjin Guyufan Biological Technology, and other key players.

Smart Choice Funeral Supplies offers a broad range of mortuary and funeral-home products, including body bags, mortuary garments and prep-room supplies, positioning itself as a full-service provider for funeral and mortuary needs.

Classic Plastics specializes in custom flexible-plastic fabrication producing cadaver bags, mortuary garments, and related supplies using materials such as vinyl, PVC, olefins, reinforced poly materials and bioplastics. Their bags come in multiple sizes (standard to jumbo), leak-resistant and cremation-ready, and support both hospital/morgue and funeral-home requirements.

Mopec is recognized as a high-quality mortuary and pathology-product supplier globally. The company emphasizes rigorous mortuary standards, offering durable body bags and pathology-ready containment solutions, catering to hospitals, morgues and forensic units needing reliable, compliant mortuary bags.

Top Key Players

- Smart Choice Funeral Supplies

- lassic Plastics

- Mopec

- Auden Funeral Supplies Ltd.

- Deluxe Scientific Surgico Pvt. Ltd.

- EIHF Isofroid

- Ceabis

- Flexmort

- Span Surgical Co.

- Peerless Plastics Mortuary

- Extra Packaging

- Tianjin Guyufan Biological Technology

- Other key players

Recent Developments

- In August 2020, Mopec, a prominent supplier of pathology, anatomy, mortuary, and necropsy products, launched the Safe View body bag as part of its response to the COVID-19 pandemic. The bag incorporates a transparent inner layer that enables safe viewing of remains while reducing exposure risks for healthcare and mortuary personnel. This introduction underscored the critical need for effective protective solutions to safeguard workers handling the deceased during health emergencies.

Report Scope

Report Features Description Market Value (2024) US$ 1.58 Billion Forecast Revenue (2034) US$ 2.97 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Polyethylene, Polyvinyl Chloride (PVC) / PVC-based (or similar vinyl), Nylon, Polyester and Others), By Size (Adult bags, Child/Infant bags and Heavy Duty & Bariatric bags) By End-User (Hospitals and Medical facilities, Morgues, Funeral Homes and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smart Choice Funeral Supplies, Classic Plastics, Mopec, Auden Funeral Supplies Ltd., Deluxe Scientific Surgico Pvt. Ltd., EIHF Isofroid, Ceabis, Flexmort, Span Surgical Co., Peerless Plastics Mortuary, Extra Packaging, Tianjin Guyufan Biological Technology, and other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smart Choice Funeral Supplies

- lassic Plastics

- Mopec

- Auden Funeral Supplies Ltd.

- Deluxe Scientific Surgico Pvt. Ltd.

- EIHF Isofroid

- Ceabis

- Flexmort

- Span Surgical Co.

- Peerless Plastics Mortuary

- Extra Packaging

- Tianjin Guyufan Biological Technology

- Other key players