Global Hemodynamic Monitoring Device Market By Type (Non-Invasive, Invasive, Minimally Invasive) By Product (Monitors, Disposables) By End-use (Hospitals, Catheterization Labs, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129329

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

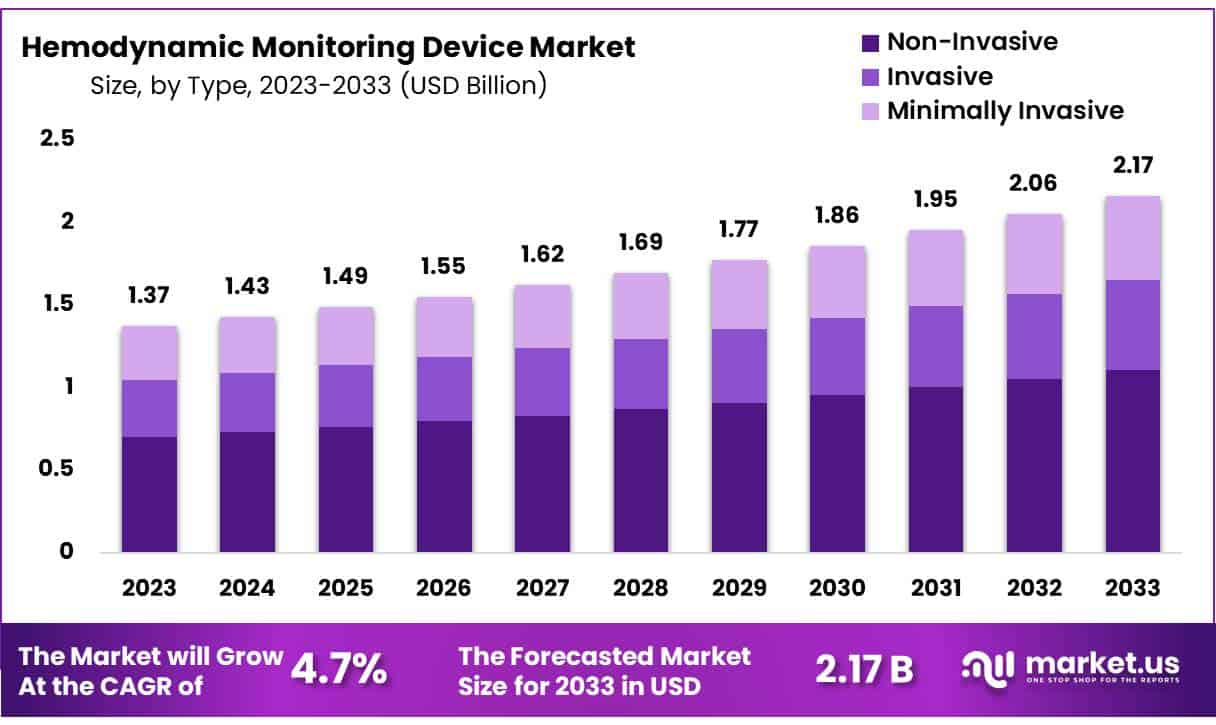

Global Hemodynamic Monitoring Device Market size is expected to be worth around USD 2.17 Billion by 2033 from USD 1.37 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Hemodynamic monitoring devices are essential tools used to assess cardiovascular health by measuring parameters such as blood pressure, cardiac output, and oxygen levels. These devices provide healthcare professionals with critical data for managing conditions like heart failure, sepsis, and post-operative care. Hemodynamic monitoring can be categorized into invasive methods, like pulmonary artery catheters, and non-invasive techniques, such as Doppler ultrasound and impedance cardiography.

Collaborations between institutions and companies are fostering advancements in hemodynamic monitoring solutions. For example, in July 2023, Temple University partnered with Retia Medical to utilize Argos’s advanced hemodynamic monitoring technology in clinical studies. This partnership aims to validate the benefits of new devices while integrating advanced technology to enhance patient outcomes.

The demand for these devices is driven by factors such as the increasing geriatric population, rising rates of cardiovascular diseases and diabetes, and innovations in non-invasive monitoring technologies. Globally, cardiovascular diseases cause approximately 17.9 million deaths each year, making them the leading cause of mortality. Additionally, the prevalence of diabetes continues to rise, with projections indicating 783 million cases by 2045.

The market for hemodynamic monitoring devices is expected to grow as a result of increasing patient safety awareness, improved quality of life expectations, and the need for better heart function monitoring, particularly in critical care settings.

Key Takeaways

- Market Size: Hemodynamic Monitoring Device Market size is expected to be worth around USD 2.17 Billion by 2033 from USD 1.37 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

- Type Analysis: Non-invasive devices lead the market, holding a dominant share of 51.27%.

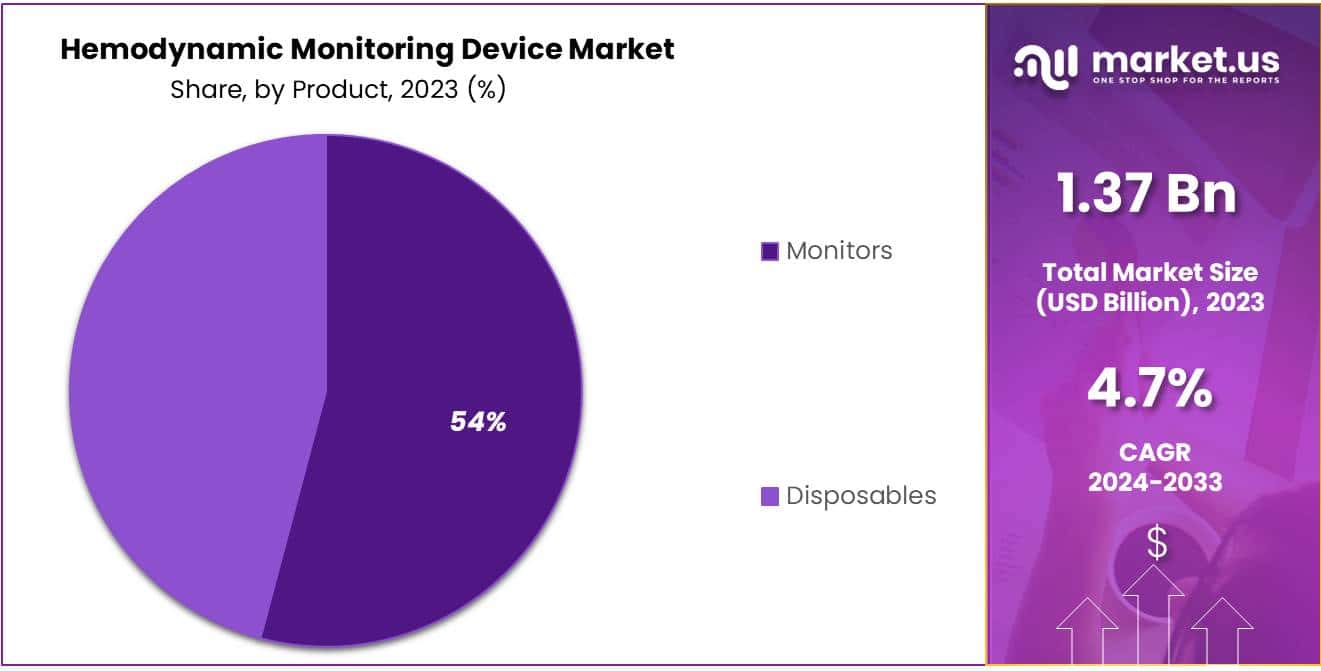

- Product Analysis: In 2023, monitors account for 54.13% of the market share in 2023.

- End-Use Analysis: In 2023, hospitals lead the market with a 41.38% share in 2023.

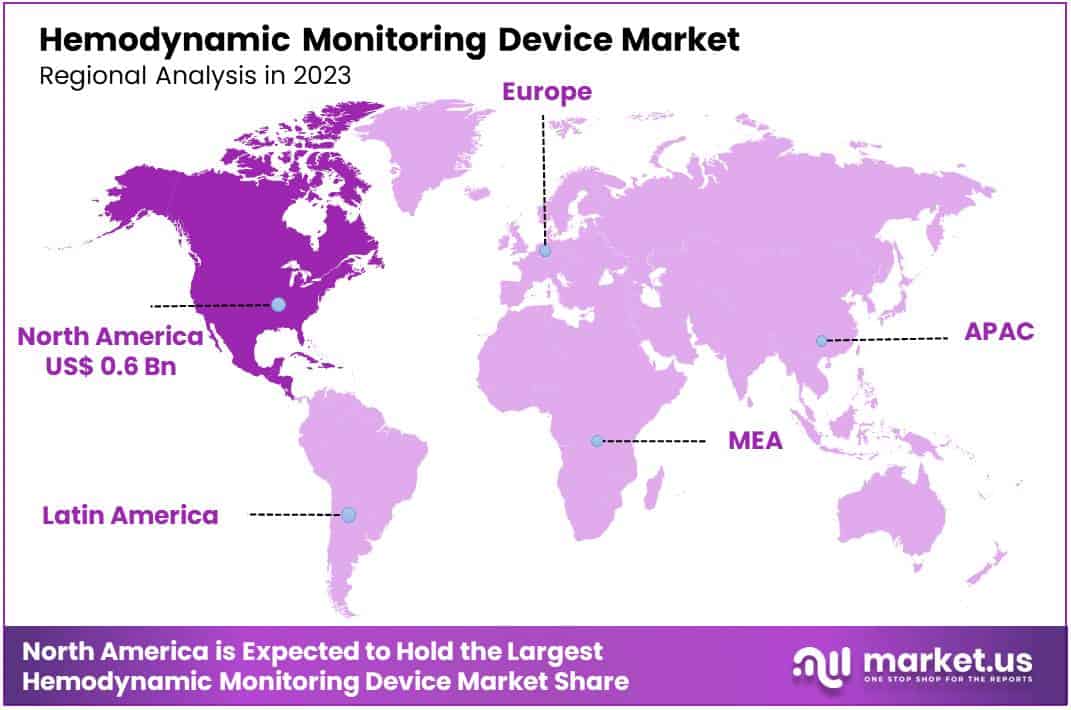

- Regional Analysis: In 2023, North America captured a dominant 40.5% share of the global Hemodynamic Monitoring Device Market.

- Technological Advancements: Innovations like AI and machine learning in real-time monitoring systems are driving market expansion by improving accuracy in patient care.

- Rising Incidence of Cardiovascular Diseases: The increasing global burden of cardiovascular conditions and aging populations contribute to the rising demand for these devices in hospitals and outpatient settings.

- Non-Invasive Monitoring Preference: There is a growing preference for non-invasive monitoring solutions, reducing risks associated with traditional invasive methods and improving patient safety.

Type Analysis

The Hemodynamic Monitoring Device Market is categorized into three primary types: non-invasive, invasive, and minimally invasive devices, each offering unique benefits and applications in clinical settings. Non-invasive devices lead the market, holding a dominant share of 51.27%. These devices are highly favored for their safety, ease of use, and ability to monitor cardiovascular health without surgical intervention, making them ideal for routine assessments and broad patient applications.

Invasive devices, though utilized less frequently than non-invasive alternatives, provide direct and precise measurements by being inserted into the blood vessels or heart. These are essential in critical care settings where detailed data is crucial for managing severe cases.

Minimally invasive devices serve as a middle ground, offering detailed insights with less risk and discomfort compared to fully invasive methods. Advancements in technology continue to enhance their accuracy and reduce their invasiveness, making them increasingly popular in clinical use.

The segmentation of the Hemodynamic Monitoring Device Market reflects a growing preference for technologies that minimize patient risk while providing accurate and reliable data, with non-invasive devices currently leading the expansion due to their broad applicability and safety profile.

Product Analysis

The Hemodynamic Monitoring Device Market is segmented into two primary product categories: monitors and disposables. In 2023, monitors account for 54.13% of the market share. These devices are essential for real-time tracking of vital parameters such as blood pressure, cardiac output, and oxygen saturation. Monitors are used extensively in critical care units and operating rooms, where continuous observation of cardiovascular health is crucial for patient management.

Disposables, which include single-use items like sensors and catheters, are also a vital segment of this market. They play a key role in ensuring safe and sterile procedures, particularly in invasive and minimally invasive monitoring systems.

This product segmentation highlights the market’s focus on improving patient outcomes with advanced monitoring technologies. The dominance of monitors reflects the growing demand for accurate, real-time data in various healthcare settings. Disposables, while smaller in share, remain critical for maintaining the safety and efficiency of hemodynamic monitoring practices across hospitals and clinics globally.

End-use Analysis

The Hemodynamic Monitoring Device Market is segmented by end-use, primarily into hospitals and catheterization labs. In 2023, hospitals lead the market with a 41.38% share. This is due to the high volume of patients requiring critical care, surgeries, and post-operative monitoring. Hemodynamic monitoring devices are essential in hospitals for assessing cardiovascular health, particularly in intensive care units and operating rooms where real-time monitoring is vital for patient management and recovery.

Catheterization labs (Cath Labs) also play a significant role in this market. These labs focus on diagnosing and treating cardiovascular diseases through procedures like angioplasty and stent placement. Hemodynamic monitoring devices are crucial in Cath Labs for accurately measuring cardiac output, blood pressure, and other critical parameters during invasive procedures, ensuring improved outcomes.

The demand for precise, continuous monitoring in hospitals and Cath Labs drives the market, with hospitals leading due to their larger patient base and range of critical care services. This segmentation reflects the growing need for advanced monitoring tools in complex healthcare environments.

Key Market Segments

By Type

- Non-Invasive

- Invasive

- Minimally Invasive

By Product

- Monitors

- Disposables

By End-use

- Hospitals

- Catheterization Labs

- Others

Driver

A key driver of the Hemodynamic Monitoring Device Market is the rising incidence of cardiovascular diseases and chronic conditions like diabetes. Cardiovascular diseases account for approximately 17.9 million deaths annually, and diabetes affects millions worldwide, with projections reaching 783 million by 2045.

The aging population, prone to these conditions, further drives demand for monitoring devices. Hospitals and healthcare providers are increasingly adopting advanced monitoring systems to improve patient care, particularly in critical care environments where accurate real-time data is essential.

Trend

A significant trend in the Hemodynamic Monitoring Device Market is the shift toward non-invasive and minimally invasive monitoring technologies. Non-invasive devices now dominate the market due to their safety and ease of use. Technologies like Doppler ultrasound and impedance cardiography provide accurate real-time data without invasive procedures, reducing risk and discomfort for patients.

This trend reflects the growing demand for safer, more efficient solutions in both critical and routine healthcare settings, as providers aim to improve patient outcomes while minimizing complications.

Restraint

The high cost of advanced hemodynamic monitoring devices presents a major restraint for the market, particularly in developing regions. Equipment like advanced monitors and invasive catheters require substantial investment, making them less accessible to smaller healthcare facilities.

Additionally, the need for trained professionals to operate these devices adds to operational costs, limiting the adoption of these systems in resource-constrained settings. This financial burden can slow market growth, particularly in countries with limited healthcare budgets.

Opportunity

The Hemodynamic Monitoring Device Market offers significant opportunities through the integration of artificial intelligence (AI) and machine learning (ML). These technologies can enhance predictive analysis and automate data processing, helping healthcare professionals detect critical conditions early.

Additionally, the growing integration of monitoring systems with electronic health records (EHR) and telemedicine platforms presents new opportunities, especially in remote and home healthcare settings. These advancements can improve patient management, offering real-time monitoring and better outcomes in diverse care environments.

Regional Analysis

In 2023, North America captured a dominant 40.5% share of the global Hemodynamic Monitoring Device Market. This leadership is driven by the region’s advanced healthcare infrastructure, widespread adoption of innovative technologies, and high rates of cardiovascular diseases. With a growing geriatric population, the demand for precise, real-time cardiovascular monitoring has surged.

Additionally, North America’s strong focus on research and development, coupled with increased healthcare spending, has fueled the growth of non-invasive and minimally invasive hemodynamic monitoring solutions. These factors position the region as a key driver in the global market, ensuring continuous growth and innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Hemodynamic Monitoring Device Market is characterized by the presence of key players driving technological innovation and market expansion. These companies focus on developing advanced non-invasive and minimally invasive monitoring solutions, catering to the rising demand for safer and more efficient cardiovascular monitoring tools. Strategic partnerships, mergers, and acquisitions are common among market leaders to strengthen their product portfolios and expand global reach.

Additionally, these companies invest heavily in research and development to introduce cutting-edge technologies that enhance real-time monitoring accuracy. By prioritizing patient safety, these key players are influencing market trends and shaping the future of cardiovascular healthcare.

Market Key Players

- Baxter

- Edwards Lifesciences Corporation

- GE HealthCare

- ICU Medical, Inc.

- Koninklijke Philips N.V.

- OSYPKA MEDICAL

- Deltex Medical, SC

- Masimo

- Schwarzer Cardiotek

- Getinge

Recent Developments

- Edwards Lifesciences – New Product Launch (March 2024) In March 2024, Edwards Lifesciences launched the Acumen IQ sensor, a machine learning-powered hemodynamic monitoring device. It provides real-time insights into fluid levels and cardiovascular function during surgeries, helping clinicians make precise decisions. The device integrates with hospital monitoring systems for continuous patient tracking and improving patient outcomes.

- ICU Medical – New Product Launch (May 2024): ICU Medical launched the OmniFlow Hemodynamic Monitoring System in May 2024, offering real-time, non-invasive monitoring of cardiac output and vascular resistance. Designed for use in intensive care units, it provides accurate cardiovascular data without invasive procedures, improving patient safety during high-risk surgeries.

Report Scope

Report Features Description Market Value (2023) USD 1.37 Billion Forecast Revenue (2033) USD 2.17 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Invasive, Invasive, Minimally Invasive) By Product (Monitors, Disposables) By End-use (Hospitals, Catheterization Labs, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Baxter, Edwards Lifesciences Corporation, GE HealthCare, ICU Medical, Inc., Koninklijke Philips N.V., OSYPKA MEDICAL, Deltex Medical, SC, Masimo, Schwarzer Cardiotek, Getinge Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hemodynamic Monitoring Device MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Hemodynamic Monitoring Device MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Baxter

- Edwards Lifesciences Corporation

- GE HealthCare

- ICU Medical, Inc.

- Koninklijke Philips N.V.

- OSYPKA MEDICAL

- Deltex Medical, SC

- Masimo

- Schwarzer Cardiotek

- Getinge