Global Modular Trailer Market By Trailer Type (Multi-Axle, Telescopic and Extendable, Lowboy Trailer), By Axles (2 Axles, More than 2 Axles), By End-Use Industry (Construction and Infrastructure, Mining, Wind and Energy, Heavy Engineering, Electrical and Off Shore, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 74371

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

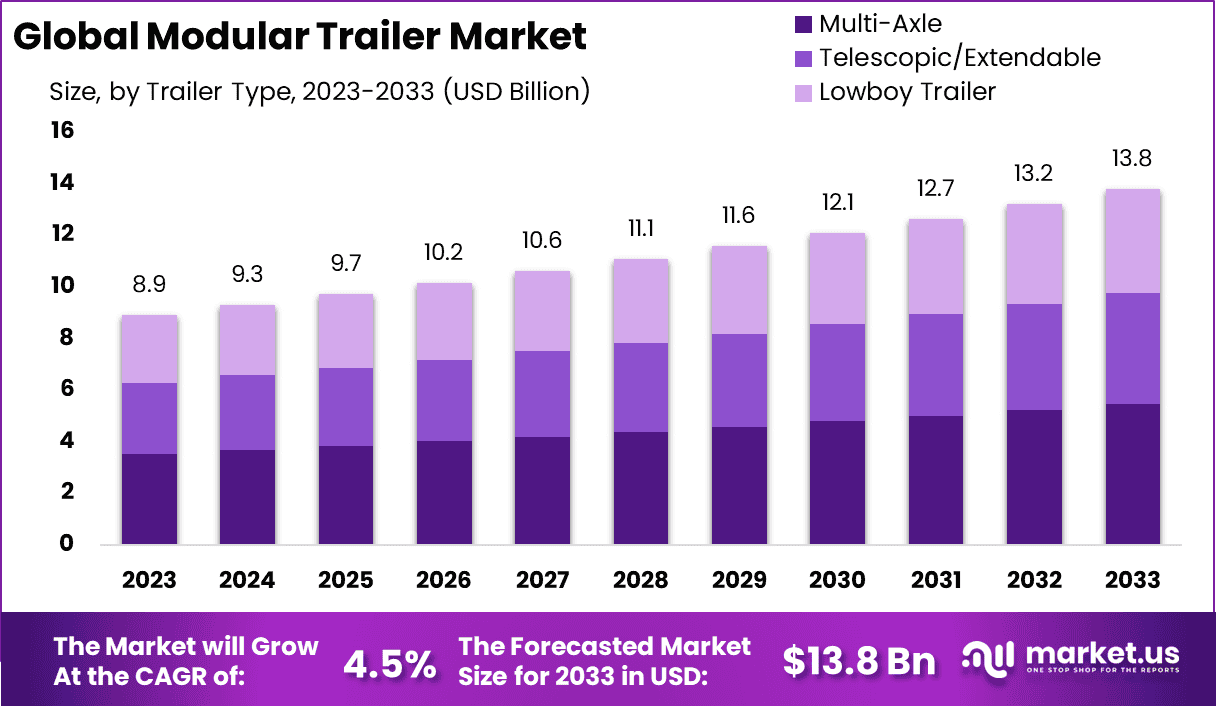

The Global Modular Trailer Market size is expected to be worth around USD 13.8 Billion by 2033, From USD 8.9 Billion by 2023, growing at a CAGR of 4.50% during the forecast period from 2024 to 2033.

The Modular Trailer Market encompasses a specialized sector dedicated to the design, manufacturing, and distribution of modular trailers. These trailers are engineered for the efficient transportation of oversized, heavy, or unconventional loads that standard trailers cannot accommodate. Integral to sectors such as construction, heavy industry, and logistics, modular trailers offer customizable configurations, enhancing load flexibility and operational efficiency.

The market’s growth is propelled by increasing infrastructure projects, industrial activities, and the need for logistical flexibility. For decision-makers, including Product Managers, understanding the dynamics of the Modular Trailer Market is crucial for strategic planning, investment decisions, and operational optimization in related industries.

The Modular Trailer Market is experiencing significant momentum, propelled by the escalating demand for efficient and flexible transportation solutions within the logistics and cargo sectors. The integration of modular trailers into the fleet strategies of transportation and logistics companies is being increasingly recognized as an essential component for enhancing operational efficiency and adaptability in response to fluctuating freight volumes and weights. This shift towards modular solutions can be attributed, in part, to their capability to accommodate diverse cargo types and sizes, thereby optimizing load configurations and minimizing transportation costs.

Supporting this trend, data from the American Trucking Associations highlight the trucking industry’s predominant role in the U.S. freight ecosystem. In 2022, the industry accounted for 80.7% of the nation’s freight bill, amassing a gross freight revenue of $940.8 billion. This underscores the trucking sector’s critical contribution to the economy, further evidenced by its facilitation of 61.9% and 83.5% of ground freight between the U.S. and its NAFTA partners, Canada and Mexico, respectively. The value of goods moved in North America underscores the scale and importance of efficient freight transportation solutions, with modular trailers playing a key role in this context.

Additionally, the sector’s employment growth, with a notable increase of 405,000 jobs from the previous year, reaching 8.4 million people employed in trucking-related positions, indicates robust industry health and a promising outlook for modular trailer integration. The predominance of small carriers, with 95.8% operating fewer than ten trucks, and 99.7% with fleets of 100 or fewer, highlights a significant market opportunity for modular trailer providers. These smaller fleets are likely to benefit from the flexibility and cost-efficiency modular trailers offer, presenting a compelling case for their adoption.

Key Takeaways

- Market Growth: The Global Modular Trailer Market size is expected to be worth around USD 13.8 Billion by 2033, From USD 8.9 Billion by 2023, growing at a CAGR of 4.50% during the forecast period from 2024 to 2033.

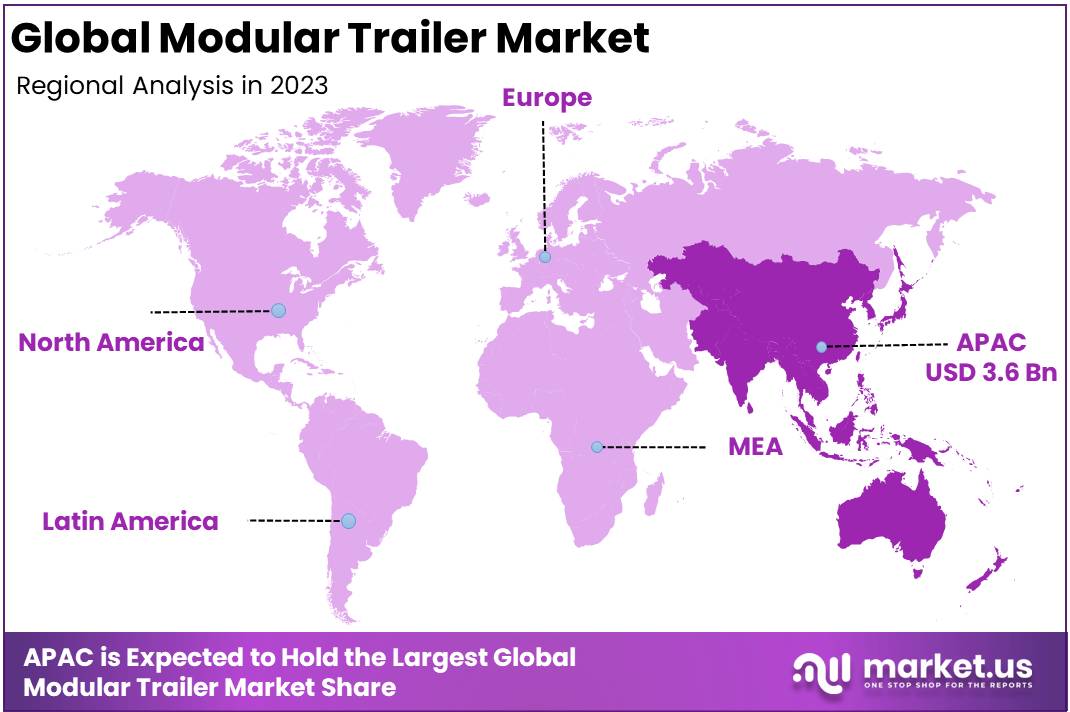

- Regional Dominance: Asia Pacific holds 40.1% of the global Modular Trailer Market share.

- Segmentation Insights:

- By Trailer Type: Multi-axle trailers dominate, holding a 39.5% market share significantly.

- By Axles: More than 2 axles trailers lead with 55.6% market preference.

- By End-Use Industry: Construction, and infrastructure sectors drive 35.4% demand for modular trailers.

- Growth Opportunities: The integration of smart technologies and adherence to stricter safety regulations are driving innovation and efficiency in the global Modular Trailer Market, promising enhanced operational safety and market growth.

Driving Factors

Expanding Wind Energy Industry: Catalyst for Modular Trailer Market Expansion

The growth of the modular trailer market can be attributed significantly to the expanding wind energy industry. As nations globally accelerate their shift towards renewable energy sources, the demand for wind turbines has surged. This increase necessitates the transportation of large and heavy turbine components, such as blades and towers, which are often suited for modular trailers designed for heavy and oversized loads.

Modular trailers, with their versatility and capability to handle substantial weights, become indispensable in the logistics of wind farm constructions. This symbiotic relationship propels the modular trailer market forward, as the expansion of wind energy projects directly translates to an increased demand for specialized transportation solutions.

Growing Construction and Mining Industries: Driving Modular Trailer Demand

The construction and mining sectors are pivotal in propelling the modular trailer market’s growth. These industries require the frequent movement of heavy machinery, equipment, and materials, often in challenging terrains and remote locations. Modular trailers, known for their strength, flexibility, and adaptability, are perfectly suited to meet these demands.

As these industries continue to grow, fueled by urbanization and industrial development, the demand for modular trailers correspondingly rises. The construction of infrastructure projects, such as bridges and highways, and the expansion of mining activities, particularly in emerging economies, further amplify this demand, showcasing a direct correlation between industry growth and the need for modular trailers.

Increasing Demand for Self-Propelled Modular Trailers: Enhancing Market Prospects

The surge in demand for self-propelled modular trailers (SPMTs) significantly contributes to the modular trailer market’s growth. SPMTs offer unparalleled advantages, including maneuverability in confined spaces and the ability to transport extremely heavy loads, making them highly sought after for complex logistical operations in industries such as oil and gas, heavy engineering, and maritime.

This increasing preference for SPMTs stems from their efficiency and the reduction of operational risks, thereby enhancing safety and productivity in project executions. As industries continue to undertake more ambitious and intricate projects, the demand for SPMTs escalates, underscoring their pivotal role in the market’s expansion. This trend reflects a broader shift towards more innovative and specialized modular transportation solutions, driving market growth.

Restraining Factors

High Maintenance Costs of Hea vy-Duty Trailers: A Financial Challenge

The modular trailer market faces a significant growth restraint due to the high maintenance costs associated with heavy-duty trailers. These specialized vehicles, designed to transport large and heavy loads, require frequent upkeep to ensure safety, reliability, and efficiency. Maintenance encompasses regular inspections, repairs, and replacements of critical components, which can be costly.

This financial burden can deter potential new entrants and limit the expansion capabilities of existing fleet operators, particularly small to medium-sized enterprises that might not have the capital for such investments. Consequently, the high maintenance costs can slow down the market growth as they impact the total cost of ownership and, subsequently, the purchasing decisions of businesses.

Rise in Environmental Concerns Regarding Refrigerated Trailers: Impacting Market Dynamics

Environmental concerns related to refrigerated modular trailers represent a growing challenge for the market. These trailers, essential for transporting temperature-sensitive goods, rely on refrigeration systems that often use hydrofluorocarbons (HFCs) as refrigerants. HFCs are potent greenhouse gases, contributing to global warming. As awareness of environmental issues increases, regulatory pressures tighten, and companies seek more sustainable operations, the demand for traditional refrigerated trailers could see a downturn.

This shift compels manufacturers to invest in greener technologies, potentially increasing costs and affecting market growth in the short term. However, this restraint also opens avenues for innovation, encouraging the development of more eco-friendly refrigeration solutions that could, in the long run, foster market expansion by aligning with global sustainability goals.

By Trailer Type Analysis

Multi-axle trailers dominate 39.5% of the market, supporting heavy loads across diverse industries.

In 2023, the Modular Trailer Market was segmented into several categories based on trailer type, with Multi-Axle, Telescopic/Extendable, and Lowboy Trailer being the primary segments. Among these, Multi-Axle trailers held a dominant market position in the Trailer Type segment, capturing more than a 39.5% share. This segment’s preeminence can be attributed to the versatility and efficiency offered by Multi-Axle trailers in heavy-duty transportation, catering to a broad spectrum of industries including construction, mining, and heavy machinery manufacturing.

The Telescopic/Extendable segment also showcased a significant market presence, designed specifically to accommodate long and heavy loads that standard trailers cannot transport effectively. This segment’s growth is driven by the increasing demand for renewable energy equipment transportation, such as wind turbine blades, which require specialized trailers for safe and efficient conveyance.

Lowboy Trailers, known for their low ground clearance, are pivotal in transporting tall equipment or machinery that might otherwise exceed height restrictions on roads or under bridges. This segment benefits from robust demand in the heavy equipment and construction sectors, facilitating the transport of bulldozers, cranes, and other tall equipment.

The Modular Trailer Market’s dynamics are influenced by factors such as technological advancements in trailer manufacturing, stringent road safety regulations, and the growing emphasis on renewable energy projects. These factors collectively bolster the demand for specialized trailers, driving innovation and growth across all segments. As the market continues to evolve, the adoption of advanced materials and design improvements in trailer manufacturing is expected to further enhance operational efficiency and safety, contributing to the sustained growth of the Modular Trailer Market.

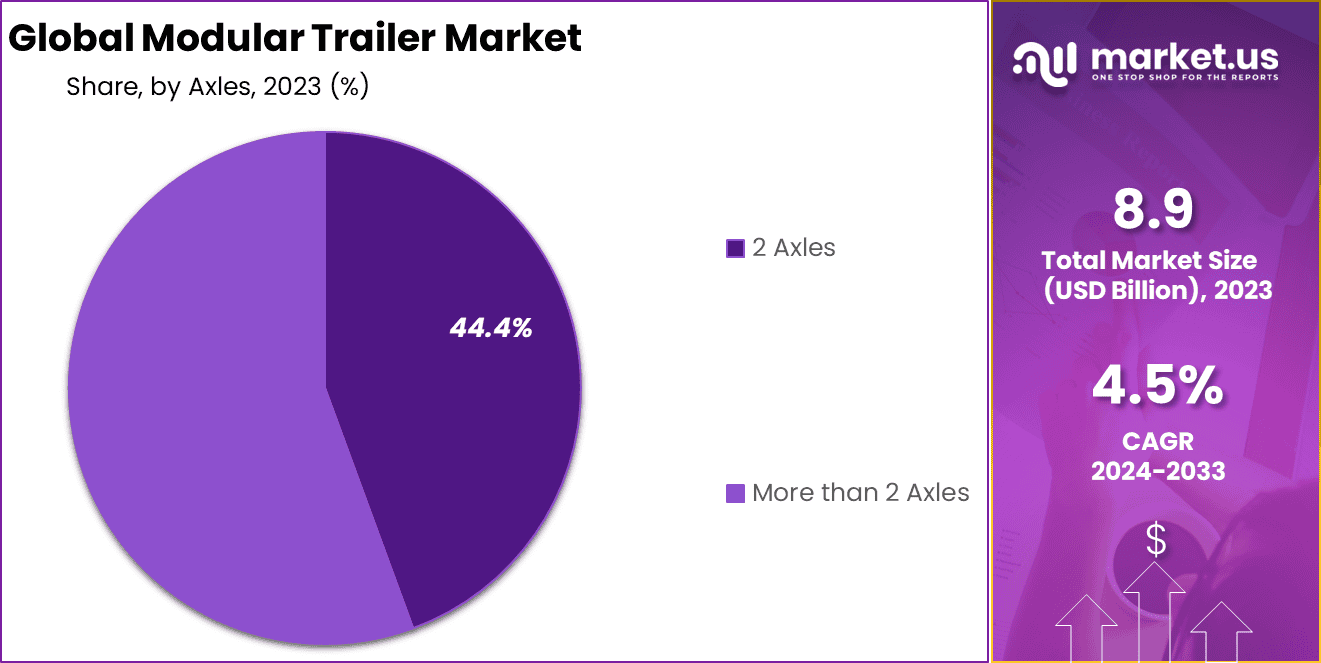

By Axles Analysis

Trailers with more than 2 axles constitute 55.6%, enhancing stability and load capacity.

In 2023, the Modular Trailer Market was categorized distinctly based on the axle configuration, primarily segmented into 2 Axles and More than 2 Axles. Within this classification, the “More than 2 Axles” segment held a dominant market position in the By Axles segment, capturing more than a 55.6% share. This segment’s significant market share is primarily due to the enhanced load-bearing capacity and stability provided by trailers with more than 2 axles, making them indispensable for transporting heavy and oversized loads across various industries such as construction, mining, and heavy machinery.

On the other hand, the 2 Axles segment, while occupying a smaller portion of the market, plays a critical role in applications requiring maneuverability and efficiency for medium-weight loads. Trailers with 2 axles are favored for their lower maintenance costs and higher fuel efficiency, catering to a niche market that demands cost-effectiveness without compromising on performance.

The dominance of the “More than 2 Axles” segment is further underpinned by the increasing complexity of projects requiring the transportation of exceptionally heavy and voluminous cargo. Such projects necessitate robust and reliable transportation solutions, driving the demand for modular trailers equipped with multiple axles. Additionally, regulatory standards and safety considerations regarding load distribution and road wear contribute to the preference for trailers with more than 2 axles, as they distribute weight more evenly and reduce the likelihood of road damage.

As the Modular Trailer Market continues to expand, the evolution of transportation regulations, coupled with technological advancements in trailer design and manufacturing, is anticipated to influence the distribution of market shares between these segments. The ongoing demand for efficient and versatile transportation solutions across various sectors signifies a promising growth trajectory for the “More than 2 Axles” segment, reinforcing its pivotal role in the Modular Trailer Market.

By End-Use Industry Analysis

Construction and infrastructure sectors lead, using 35.4% of modular trailers for project efficiency.

In 2023, the Modular Trailer Market was segmented by End-Use Industry into Construction & Infrastructure, Mining, Wind & Energy, Heavy Engineering, Electrical & Off Shore, and Others. Among these, Construction & Infrastructure held a dominant market position, capturing more than a 35.4% share. This prominence within the Modular Trailer Market can be attributed to the extensive deployment of modular trailers in the transportation of heavy construction machinery and materials, which are critical to infrastructure development projects worldwide. The construction and infrastructure segment’s demand for modular trailers is driven by the global push for infrastructural advancement, including roads, bridges, and residential and commercial buildings.

Following closely, the Mining sector also leverages modular trailers extensively for transporting heavy mining equipment and machinery. This sector’s demand is propelled by the need for efficient and safe transportation solutions that can navigate rough terrain and remote locations.

The Wind & Energy segment, vital for transporting large and heavy components such as turbine blades and towers, underscores the increasing investment in renewable energy projects globally. Similarly, Heavy Engineering industries require modular trailers for the movement of large industrial components and machinery, further diversifying the market’s scope.

The Electrical & Off Shore segment, though smaller, represents a specialized market niche, focusing on the transport of oversized electrical components and offshore drilling equipment. The Others category encompasses various industries with sporadic but specific demands for modular trailers, highlighting the versatility and broad applicability of these transport solutions.

The dominance of the Construction & Infrastructure segment in the Modular Trailer Market underscores the critical role of modular trailers in supporting the infrastructural development essential for economic growth. As the market evolves, the diversification of end-use industries presents a dynamic landscape for the modular trailer industry, driven by technological advancements and global economic and energy trends.

Key Market Segments

By Trailer Type

- Multi-Axle

- Telescopic/Extendable

- Lowboy Trailer

By Axles

- 2 Axles

- More than 2 Axles

By End-Use Industry

- Construction & Infrastructure

- Mining

- Wind & Energy

- Heavy Engineering

- Electrical & Off Shore

- Others

Growth Opportunities

Implementation of Smart Technologies for Real-Time Tracking and Load Management

The integration of smart technologies within the global Modular Trailer Market is poised to revolutionize the way heavy loads are managed and transported. In 2023, the adoption of IoT devices, GPS tracking, and advanced load management systems offers unprecedented visibility and control over logistics operations.

This digital transformation not only enhances operational efficiency but also significantly reduces the risk of accidents by providing real-time data on vehicle performance and load stability. As industries continue to demand higher precision in transportation logistics, the modular trailer providers that leverage these smart technologies are expected to capture significant market share, setting a new standard in the industry.

Regulatory Changes Requiring Safer and More Efficient Transport of Heavy Loads

The year 2023 marks a pivotal point for the Modular Trailer Market in terms of compliance with evolving regulatory standards aimed at enhancing road safety and efficiency. Governments worldwide are tightening regulations on the transportation of heavy loads, necessitating the adoption of advanced modular trailers that meet these stringent requirements. These regulatory changes present both a challenge and an opportunity for market players.

Companies that proactively adapt their offerings to comply with new safety standards can differentiate themselves and gain a competitive advantage. Furthermore, these regulations are likely to stimulate innovation in trailer design and construction, leading to safer, more efficient, and environmentally friendly transportation solutions. The market’s response to these regulatory shifts will be a critical factor in shaping its future growth trajectory.

Latest Trends

Increased Use of Lightweight Materials to Enhance Payload Capacity

In 2023, the global Modular Trailer Market has seen a notable shift towards the increased use of lightweight materials, such as high-strength steel and aluminum alloys, to construct trailers. This trend is driven by the dual objectives of enhancing payload capacity and improving fuel efficiency. By reducing the weight of the trailer itself, manufacturers are able to offer solutions that can carry heavier loads without compromising on safety or exceeding regulatory weight limits.

This innovation not only meets the evolving demands of industries reliant on heavy transport but also aligns with global sustainability goals by reducing carbon emissions through improved fuel efficiency. The adoption of lightweight materials is a strategic response to the competitive pressures and regulatory challenges facing the industry, positioning market leaders to capitalize on emerging opportunities.

Integration of Telematics and IoT for Advanced Tracking and Management

The integration of telematics and the Internet of Things (IoT) within the Modular Trailer Market signifies a transformative phase in the industry’s evolution. In 2023, these technologies will become integral for enabling advanced tracking, real-time data collection, and efficient fleet management. Through the use of GPS, sensors, and internet connectivity, modular trailer operators can monitor vehicle health, optimize routes, and ensure the safety of transported goods. This digital leap enhances operational transparency and facilitates proactive maintenance, thereby reducing downtime and operational costs.

The strategic implementation of telematics and IoT technologies not only elevates the service quality provided by trailer manufacturers and operators but also empowers clients with insights into their logistics chain. As this trend continues to gain momentum, it heralds a new era of efficiency and connectivity in heavy haulage and logistics, shaping the future of the Modular Trailer Market.

Regional Analysis

In 2023, the Asia Pacific region dominated the Modular Trailer Market, holding a 40.1% share.

The global Modular Trailer Market demonstrates significant variation across regions, influenced by industrial activity, infrastructure development, and regulatory frameworks. Dominating the market, Asia Pacific commands a substantial share of 40.1%, underpinned by rapid industrialization and infrastructure projects, particularly in China and India. This region benefits from a strong manufacturing base, escalating construction activities, and increasing investments in renewable energy projects.

North America, with its advanced technology landscape and robust regulatory environment, represents a key market. The region’s focus on safety and efficiency in heavy transport, coupled with significant investments in the construction and energy sectors, drives the demand for modular trailers equipped with advanced features.

Europe, known for its stringent regulations on road safety and emissions, showcases a steady demand for modular trailers. The region’s push towards renewable energy and large-scale infrastructure projects contributes to market growth, with a particular emphasis on innovation and sustainability.

The Middle East & Africa region is witnessing growth driven by infrastructure development and mining activities. Countries such as Saudi Arabia and South Africa are leveraging modular trailers for construction and energy projects, indicating potential market expansion.

Latin America, though smaller in comparison, is on a growth trajectory fueled by infrastructural developments and mining. The region’s increasing focus on modernizing its transportation and logistics infrastructure presents opportunities for modular trailer providers.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global modular trailer market of 2023, several key players have demonstrated significant contributions and have played pivotal roles in shaping the industry’s dynamics. Among these, the Faymonville Group, Goldhofer AG, and Nicolas Industrie S.A.S have emerged as industry leaders, showcasing robust innovations and comprehensive solutions tailored for heavy transport needs across diverse sectors. Faymonville Group’s expansive product range, emphasizing customization and flexibility, has positioned it as a versatile solution provider catering to varied market demands. Goldhofer AG has continued to excel in delivering high-quality, durable trailers, reinforcing its reputation for reliability and excellence in engineering. Nicolas Industrie S.A.S, with its focus on advanced technology and design, has catered to the evolving requirements of heavy transport, underscoring its commitment to innovation.

Scheuerle Fahrzeugfabrik GmbH and Cometto S.p.A. have remained at the forefront of technological advancements, contributing significantly to the modular trailer market through their cutting-edge designs and engineering prowess. Their contributions have not only enhanced operational efficiencies but have also set new standards for safety and functionality in the industry.

KAMAG Transporttechnik GmbH & Co. KG and Nooteboom Trailers B.V. have been instrumental in driving forward the industry with their focus on sustainability and efficiency. Their innovative approach to designing more environmentally friendly and cost-effective solutions has catered to the growing demand for sustainable practices within the logistics and transportation sector.

Kässbohrer Fahrzeugwerke GmbH, Tratec-Indus, and Scheuerle, a TII Group Brand, have continued to expand their market presence by offering highly specialized trailers that cater to specific industry needs, such as those in construction and mining. This specialization has allowed them to carve unique niches within the market.

Doll Fahrzeugbau AG and Mammoet Holding B.V. have distinguished themselves through their strategic focus on global expansion and the ability to offer customized, comprehensive solutions on a global scale. Their efforts in extending their geographic reach and adapting to local markets have been key factors in their success.

Market Key Players

- Faymonville Group

- Goldhofer AG

- Nicolas Industrie S.A.S

- Scheuerle Fahrzeugfabrik GmbH

- Cometto S.p.A.

- KAMAG Transporttechnik GmbH & Co. KG

- Nooteboom Trailers B.V.

- Kässbohrer Fahrzeugwerke GmbH

- Tratec-Indus

- Scheuerle, a TII Group Brand

- Doll Fahrzeugbau AG

- Mammoet Holding B.V.

Recent Development

- In February 2024, Little Caesars launched its PODs program, offering modular units for quicker store openings. The initiative aims to accelerate expansion with smaller spaces. The first POD opened in Keokuk, Iowa, showing promising franchisee interest.

- In December 2023, Despite longstanding hopes for a revolution in construction through industrialization, recent advancements in off-site building methods have faced challenges. Ventures like Katerra faltered, while FactoryOS thrived in producing modular homes.

- In November 2023, HVIA announced finalists for its 2023 Production Innovation award. O’Phee Trailers’ ‘London’ container trailer, Lucidity Australia’s fuel tanker probe, Base Air Global’s pressure-control system, Carmate Electronics’ Mata7S TPMS, and PT Blueboys’ coupling connection covers are among them.

Report Scope

Report Features Description Market Value (2023) USD 8.9 Billion Forecast Revenue (2033) USD 13.8 Billion CAGR (2024-2033) 4.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Trailer Type(Multi-Axle, Telescopic/Extendable, Lowboy Trailer), By Axles(2 Axles, More than 2 Axles), By End-Use Industry(Construction & Infrastructure, Mining, Wind & Energy, Heavy Engineering, Electrical & Off Shore, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Faymonville Group, Goldhofer AG, Nicolas Industrie S.A.S, Scheuerle Fahrzeugfabrik GmbH, Cometto S.p.A., KAMAG Transporttechnik GmbH & Co. KG, Nooteboom Trailers B.V., Kässbohrer Fahrzeugwerke GmbH, Tratec-Indus, Scheuerle, a TII Group Brand, Doll Fahrzeugbau AG, Mammoet Holding B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Modular Trailer Market Size in the Year 2023?The Global Modular Trailer Market size was USD 8.9 Billion by 2023, growing at a CAGR of 4.50%.

What is the Modular Trailer Market Estimated CAGR During the Forecast Period?The Global Modular Trailer Market size is expected to grow at a CAGR of 4.50% during the forecast period from 2024 to 2033.

What is the Modular Trailer Market Estimated Size During the Forecast Period?The Global Modular Trailer Market size is expected to be worth around USD 13.8 Billion during the forecast period from 2024 to 2033.

-

-

- Faymonville Group

- Goldhofer AG

- Nicolas Industrie S.A.S

- Scheuerle Fahrzeugfabrik GmbH

- Cometto S.p.A.

- KAMAG Transporttechnik GmbH & Co. KG

- Nooteboom Trailers B.V.

- Kässbohrer Fahrzeugwerke GmbH

- Tratec-Indus

- Scheuerle, a TII Group Brand

- Doll Fahrzeugbau AG

- Mammoet Holding B.V.