Global Modern Card Issuing Platforms Market Size, Share, Growth Analysis By Component (Software, [Card Management Software, Digital Issuance Solutions, API & SDKs, Others], Services [Implementation & Integration, Consulting & Advisory, Support & Maintenance, Managed Services]), By Deployment (Cloud-based, On-premise), By Card Type (Physical Cards, Virtual Cards, Tokenized Cards), By Organization Size (Large Enterprises, SMEs), By End-User (Banks & Financial Institutions, FinTechs & Neobanks, Corporations, Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167763

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Technology

- AI Industry Adoption

- Emerging Trends

- US Market Size

- By Component

- By Deployment

- By Card Type

- By Organization Size

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The Modern Card Issuing Platforms Market is expanding rapidly as financial institutions, fintech companies, and digital-first businesses adopt next-generation systems for issuing, managing, and personalizing physical and virtual payment cards. These platforms enable real-time card creation, programmable payment controls, seamless API integrations, automated compliance, and enhanced fraud prevention—capabilities essential for today’s fast-evolving digital payments environment.

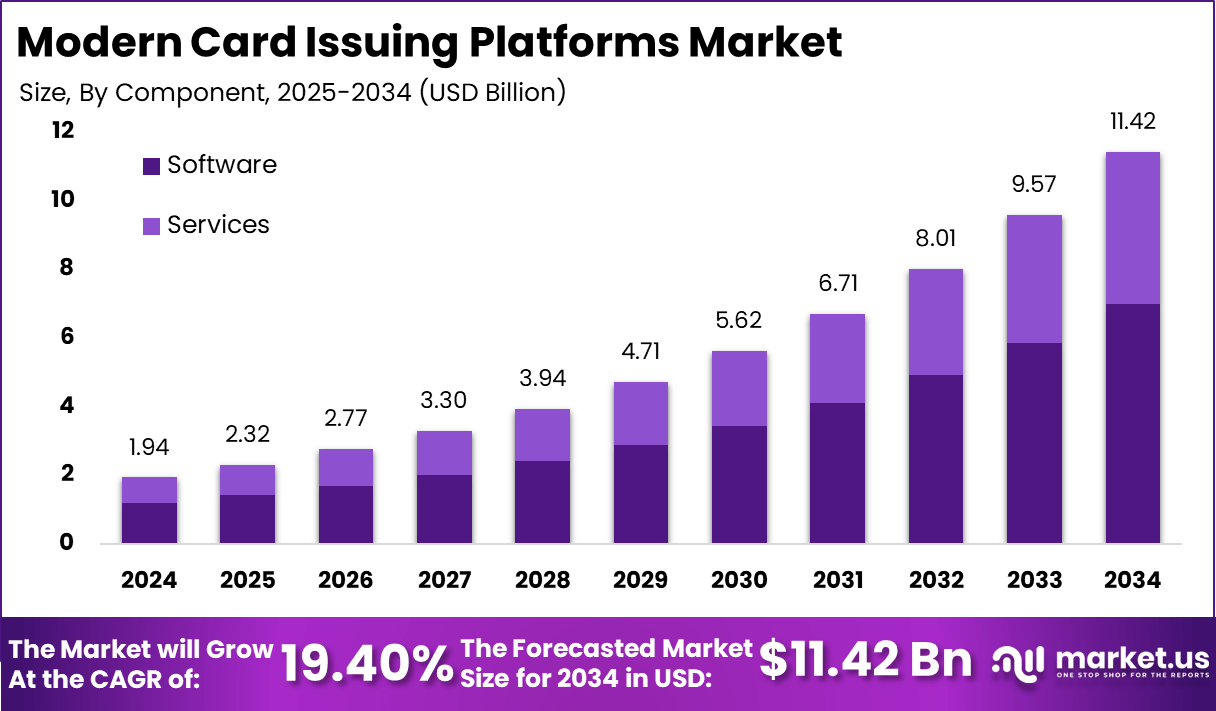

With a market value of USD 1.94 billion in 2024, the sector continues accelerating as embedded finance, digital wallets, and neobanking ecosystems rely on flexible card infrastructure to support diverse use cases, including corporate expense management, consumer debit and credit issuance, gig economy payouts, and instant digital onboarding. The market is projected to reach USD 11.42 billion by 2034, growing at a robust CAGR of 19.40%.

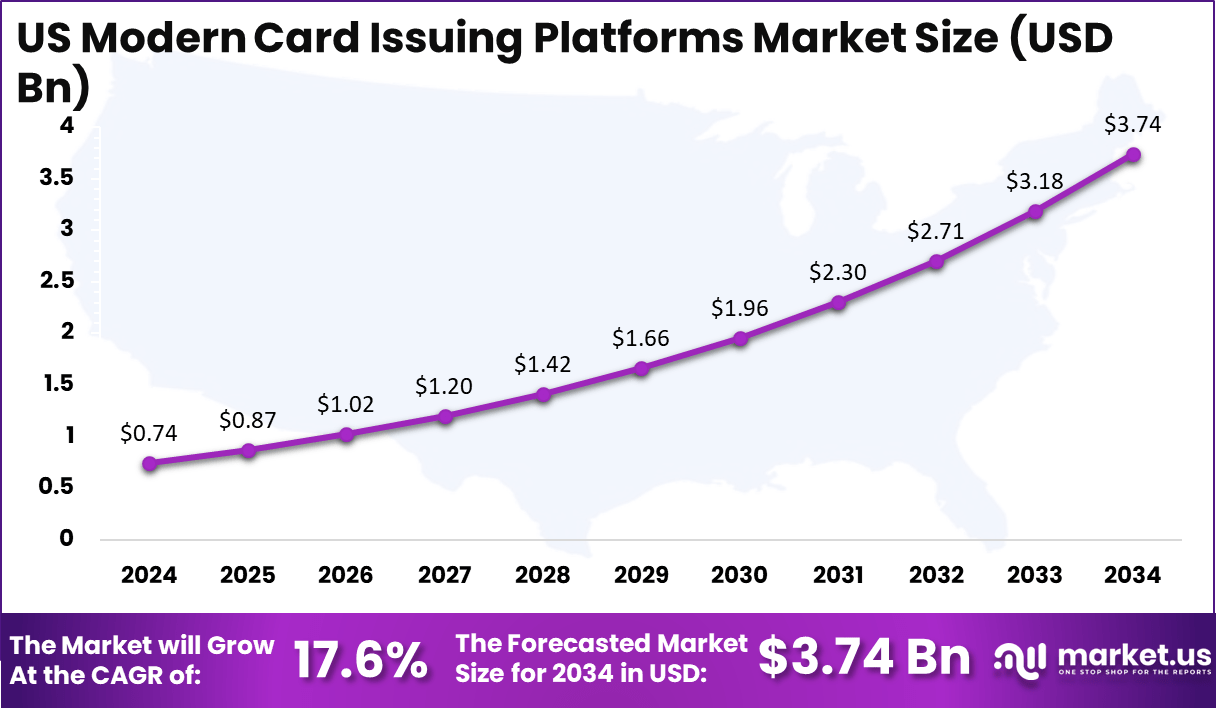

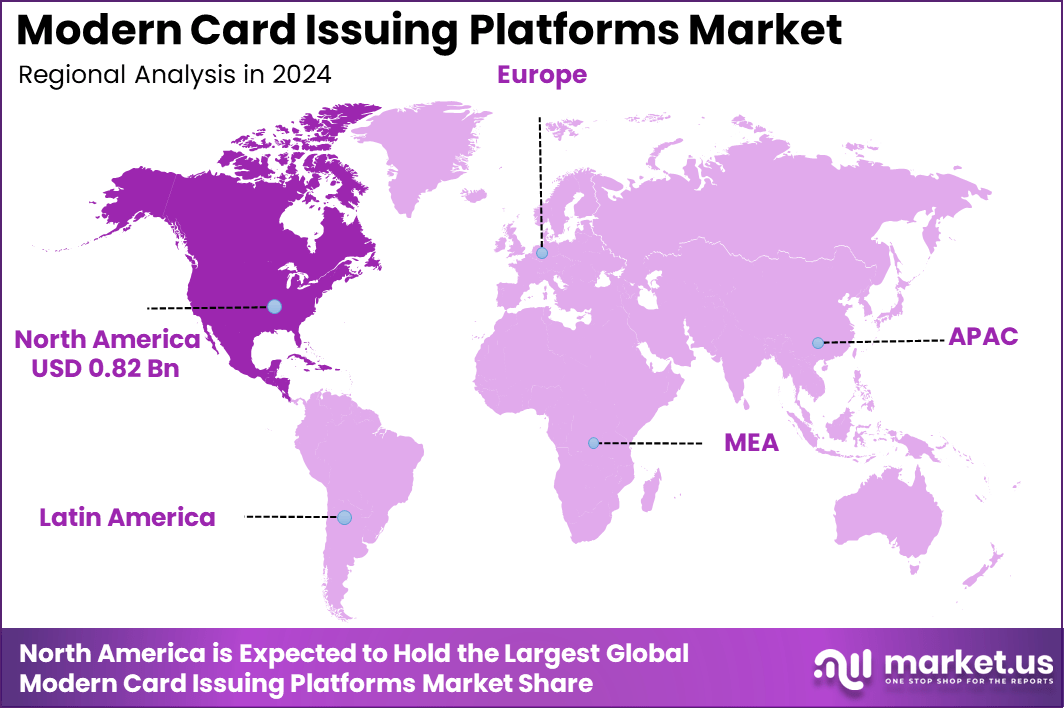

North America remains the leading region with 42.6% market share and a valuation of USD 0.82 billion in 2024, driven by advanced fintech adoption, high digital payment penetration, and strong innovation from API-first card issuance platforms. The US accounts for USD 0.74 billion in 2024 and is expected to reach USD 3.74 billion by 2034, supported by a CAGR of 17.6%. Its regulatory openness, mature digital banking ecosystem, and rapid shift toward virtual card solutions continue to fuel strong long-term growth.

Modern card issuing platforms are transforming the global payments ecosystem by enabling businesses to create, manage, and customize physical and virtual cards with unprecedented speed and flexibility. These platforms replace legacy issuing infrastructure with API-driven, cloud-native systems that support real-time card provisioning, programmable spending controls, dynamic authentication, and instant transaction monitoring.

As digital banking, fintech services, and embedded finance accelerate worldwide, organizations increasingly rely on modern issuing capabilities to deliver seamless payment experiences across consumer, commercial, and gig-economy use cases. The shift toward virtual cards, contactless payments, and digital wallets further strengthens demand, as enterprises adopt issuing platforms to enable secure, tokenized, and customizable payment solutions.

These systems also integrate advanced fraud detection, automated KYC/AML workflows, and regulatory compliance, making them essential for highly regulated financial environments. Industries such as e-commerce, travel, lending, and expense management increasingly depend on modern card infrastructure to support instant payouts, flexible credit models, and global transaction scalability.

In 2025, key movements in the modern card issuing platform space include the upcoming merger of Euronet Worldwide, Inc. with CoreCard Corporation, expected to close late in the year. This deal, valued at approximately $248 million, aims to combine CoreCard’s API-first issuing technology with Euronet’s real-time payment infrastructure to offer banks and fintechs a highly customizable and scalable global card issuing solution. CoreCard’s existing clients include fintech innovators and notable banks like Goldman Sachs, showcasing the strategic importance of this acquisition.

Marqeta reported strong performance in Q3 2025, with a 33% growth in total processing volume and 27% growth in gross profit, indicating expanding usage and financial health for one of the sector’s leading platforms. Marqeta also completed its acquisition of TransactPay, enhancing its BIN sponsorship and card issuance capabilities, further expanding its service portfolio.

Among new product launches, Thales released its D1 cloud-native issuing platform that enables real-time, scalable issuance of virtual and physical cards with features like tokenization, automated compliance, and modular use case deployment. Mastercard introduced its Product Express platform in 2025, targeting fintechs with fast, scalable card issuance via API, helping reduce deployment time significantly while supporting mobile wallet integration and transparent management.

Additional innovations include India’s first native biometric card payments by Cashfree, enabling payments in just 2 seconds using face or fingerprint authentication combined with device tokenization, significantly enhancing the speed and security of card transactions.

Additionally, the rise of subscription businesses, marketplace platforms, and real-time commerce drives the need for dynamic, programmable payments that traditional card issuing systems cannot support. As digital financial experiences mature, modern card issuing platforms are becoming foundational to innovation, customer convenience, and the future of global payments.

Key Takeaways

- The Modern Card Issuing Platforms Market was valued at USD 1.94 billion in 2024.

- The market is projected to grow at a CAGR of 19.40% through the forecast period.

- The global market value is expected to reach USD 11.42 billion by 2034.

- North America accounted for 42.6% market share in 2024 with a USD 0.82 billion valuation.

- The US recorded USD 0.74 Billion in 2024 and is projected to reach USD 3.74 billion by 2034 at a CAGR of 17.6%.

- By Component, Software dominated the market with a 61.3% share.

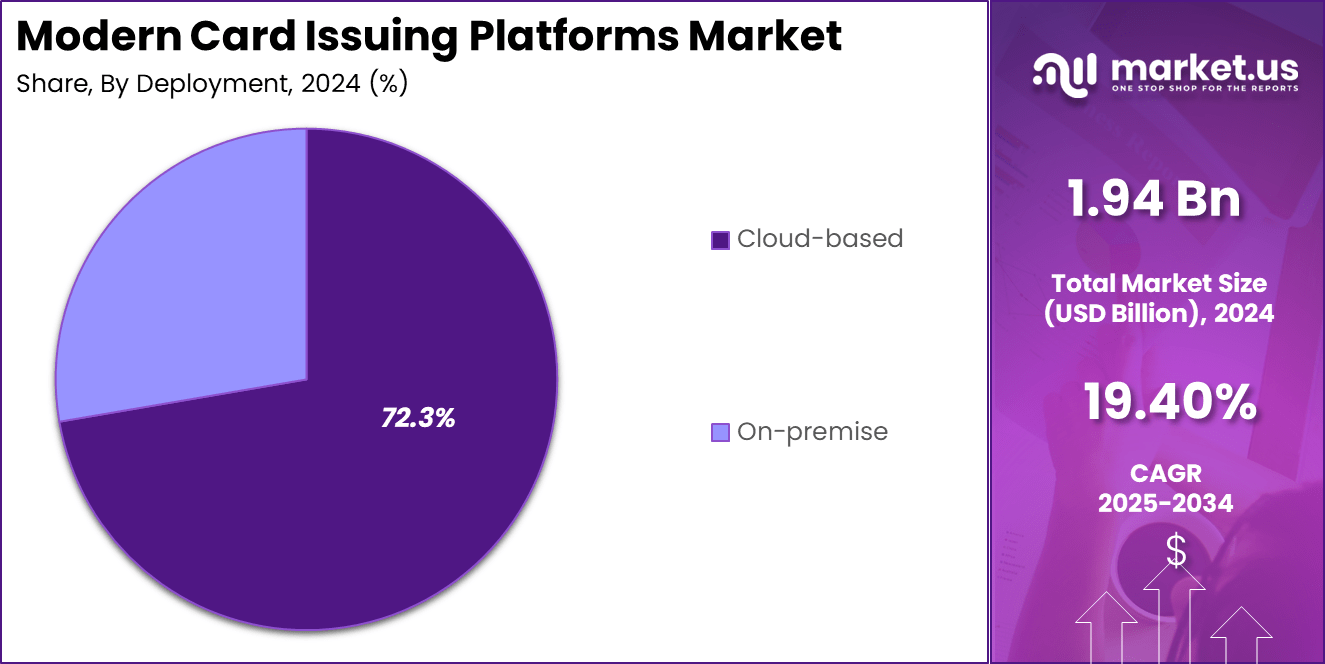

- By Deployment, Cloud-based platforms led adoption with a 72.3% share.

- By Card Type, Physical Cards represented 38.1% of the market.

- By Organization Size, Large Enterprises held the largest share at 73.4%.

- By End-User, Banks & Financial Institutions accounted for 36.8% market share.

Role of Technology

Technology plays a foundational role in modern card issuing platforms, enabling the speed, flexibility, and intelligence required to support today’s rapidly evolving payment ecosystems. Advanced API-driven architectures allow businesses to issue physical and virtual cards in real time, eliminating the delays associated with legacy banking systems.

Cloud computing enhances scalability, security, and cost efficiency, enabling platforms to handle millions of transactions seamlessly while maintaining high uptime and strong data protection standards. Tokenization, encryption, and biometric authentication strengthen security layers, reducing fraud risk and enabling safe digital payments across global channels.

Artificial intelligence and machine learning further transform card issuing by powering real-time fraud detection, anomaly monitoring, and automated risk scoring. These capabilities help businesses identify suspicious activity within milliseconds and prevent unauthorized transactions.

Embedded finance technologies enable non-financial companies to offer branded card solutions, expanding financial accessibility across retail, travel, logistics, gig work, and digital commerce sectors. Meanwhile, programmable payment controls allow organizations to customize spending rules, merchant categories, and transaction limits to suit specific use cases.

Technology also enhances regulatory compliance through automated KYC, AML screening, and continuous transaction auditing. Together, these innovations make modern card issuing platforms more efficient, secure, and adaptable—positioning them as critical infrastructure for the future of global digital payments.

AI Industry Adoption

AI adoption within the modern card issuing ecosystem is accelerating rapidly as financial institutions and fintech companies shift toward smarter, automated, and real-time payment infrastructures. Today, more than 70% of global fintech platforms embed AI into their card issuing workflows, enabling faster decision-making, enhanced fraud prevention, and personalized user experiences.

Machine learning models analyze millions of transaction patterns in seconds, allowing issuers to detect anomalies, flag suspicious behavior, and reduce fraud losses by up to 30%. AI-driven identity verification and automated KYC/AML checks also streamline onboarding, helping issuers cut customer verification times from days to minutes.

In addition, AI enhances credit risk modeling by evaluating non-traditional data sources—such as spending behavior, repayment habits, and real-time cash flow—enabling issuers to extend personalized credit limits and flexible repayment options. Virtual card issuance benefits heavily from AI through instant risk scoring and adaptive transaction controls, supporting secure use in e-commerce, subscription services, and corporate expense management.

AI-powered chatbots and support engines improve customer service efficiency, with many issuers reporting a 40% reduction in operational load through automated issue resolution. As embedded finance expands and digital payments accelerate, AI adoption is becoming essential for issuers seeking to stay competitive, reduce risk, optimize operations, and deliver seamless, intelligent card experiences.

Emerging Trends

Emerging trends in modern card issuing platforms reflect the rapid evolution of digital payments, embedded finance, and AI-driven transaction management. One of the most significant trends is the shift toward virtual-first card issuance, with virtual cards growing more than 25% year over year as businesses adopt them for secure online transactions, subscription controls, and instant corporate spending. Tokenization and biometric authentication continue gaining momentum, enabling safer, frictionless payments across mobile wallets and contactless environments.

Another major trend is the rise of programmable payments. Companies now use API-driven controls to set dynamic spending limits, merchant category restrictions, and real-time approval rules—capabilities that traditional issuing infrastructure could not support. Embedded finance is expanding rapidly, allowing non-financial businesses such as retailers, gig platforms, and logistics companies to launch branded payment cards without becoming licensed banks.

AI and machine learning are transforming transaction monitoring, with real-time fraud detection engines reducing false declines and improving approval rates. Predictive analytics is increasingly used to automate credit decisioning and optimize cardholder lifecycle management. Open banking integrations are also emerging, enabling issuers to complement card data with bank account insights for enhanced risk assessment.

US Market Size

The US modern card issuing platforms market is expanding rapidly as digital payments, fintech innovation, and embedded finance solutions reshape the country’s financial ecosystem. Valued at USD 0.74 billion in 2024, the US remains one of the most advanced markets globally due to its strong digital infrastructure, high consumer adoption of mobile banking, and the presence of leading fintech innovators.

The shift toward virtual cards, real-time payments, and API-driven financial services continues to drive strong demand for flexible, programmable issuing platforms. These platforms support instant card provisioning, dynamic spending controls, and seamless integration with digital wallets—features increasingly expected by both consumers and enterprises.

By 2034, the US market is projected to reach USD 3.74 billion, growing at a CAGR of 17.6%. This growth is supported by rising enterprise adoption of expense management systems, subscription payments, gig economy payouts, and corporate card programs that rely on automated issuance capabilities. The proliferation of digital-native banks, BNPL providers, and embedded finance offerings further boosts adoption as issuers seek scalable, cloud-based infrastructure.

Additionally, strong regulatory support for digital identity, rising fraud prevention needs, and rapid AI integration into card management workflows continue strengthening market momentum. As businesses and consumers shift toward secure, personalized, and instant payment experiences, the US solidifies its position as a global leader in modern card issuing technology.

By Component

The software segment leads the Modern Card Issuing Platforms Market with a 61.3% share, reflecting the growing reliance on programmable, cloud-native systems that enable instant issuance and seamless lifecycle management. Card management software forms the core of this segment, providing issuers with real-time control over activation, authorization, fraud monitoring, and spending rules.

These platforms support both physical and virtual cards, allowing businesses to customize card programs at scale. Digital issuance solutions continue gaining momentum as enterprises adopt virtual-first strategies to enable instant provisioning across mobile wallets, e-commerce, and subscription services.

API & SDK toolkits further strengthen the ecosystem by allowing fintechs, banks, and embedded finance providers to integrate card functionality directly into apps, platforms, and enterprise workflows, powering real-time payments, automated controls, and flexible user experiences. The “Others” category includes tokenization engines, authentication tools, and AI-driven fraud modules that enhance security and operational efficiency.

The services segment remains essential for smooth implementation and long-term success. Implementation and integration services ensure a seamless connection between issuing platforms, core banking systems, payment networks, and enterprise applications. Consulting and advisory services help organizations design compliant, optimized card programs aligned with regulatory and market needs.

Support and maintenance services provide ongoing updates, fraud rule tuning, and system performance monitoring. Managed services are increasingly adopted by enterprises seeking fully outsourced card operations, enabling faster deployment and reduced operational burden. Together, software and services create a comprehensive ecosystem driving the next generation of digital card issuing.

By Deployment

The cloud-based segment leads the Modern Card Issuing Platforms Market with a 72.3% share, reflecting the industry’s rapid shift toward agile, API-driven, and highly scalable infrastructure. Cloud deployment enables instant issuance of physical and virtual cards, real-time transaction monitoring, and rapid integration with core banking, payment gateways, and digital wallets.

Its elastic computing power allows platforms to process millions of authorization requests with low latency, making it ideal for fintechs, neobanks, and enterprises operating at scale. Cloud systems also support faster rollout of new card products, automated updates, and advanced security measures such as tokenization and AI-powered fraud detection.

Businesses benefit from reduced infrastructure costs, shorter implementation cycles, and the flexibility to innovate quickly across multiple geographies. As digital banking, embedded finance, and contactless payments continue expanding, cloud-based issuing remains the preferred deployment model.

On-premise deployment continues to hold relevance among organizations with strict data-sovereignty, regulatory, or security requirements, including large banks, government-linked institutions, and enterprises managing highly sensitive customer information. On-premise platforms offer deeper customization, direct control over infrastructure, and the ability to integrate with legacy systems that may not be cloud-compatible.

However, they require higher upfront investment, dedicated IT resources, and longer implementation times. While adoption remains steady in highly regulated environments, the overall market momentum favors cloud-based deployment due to its speed, flexibility, and support for modern digital payment ecosystems.

By Card Type

Physical cards account for 38.1% of the Modern Card Issuing Platforms Market, reflecting their continued relevance across global commerce despite the rapid rise of digital and virtual alternatives. Physical cards remain essential for in-store payments, ATM access, corporate expense programs, travel spending, and consumer debit and credit usage.

Modern issuing platforms enhance physical card capabilities through real-time activation, programmable spending controls, instant PIN generation, and dynamic fraud monitoring. The ability to customize design, add security layers such as EMV chips, and support contactless payments ensures ongoing demand, especially in regions where cashless adoption is still emerging.

Virtual cards are expanding rapidly as businesses prioritize secure online transactions, subscription payments, and instant issuance. They are widely adopted by enterprises for travel and expense management, vendor payments, and controlled B2B transactions due to their ability to limit usage, set merchant restrictions, and reduce fraud risk. Virtual cards also integrate seamlessly with digital wallets, enabling secure mobile payments across platforms.

Tokenized cards represent a fast-growing segment as mobile wallets, wearables, and contactless ecosystems scale globally. Tokenization replaces sensitive card numbers with encrypted tokens, reducing fraud risk and enabling secure omnichannel transactions. Tokenized cards support seamless cross-channel experiences, making them a critical component of modern digital payment infrastructures.

By Organization Size

Large enterprises hold a commanding 73.4% share of the Modern Card Issuing Platforms Market, driven by their need for high-performance, scalable, and deeply integrated payment infrastructure. These organizations manage large customer bases, high transaction volumes, and complex financial workflows across multiple geographies, making advanced issuing platforms essential.

Large enterprises rely on modern card systems for instant issuance, global authorization routing, programmable controls, and real-time fraud detection. Industries such as banking, fintech, travel, logistics, e-commerce, and corporate services increasingly adopt API-driven issuing to power employee expense programs, consumer debit and credit products, payout systems, and marketplace settlements.

The ability to integrate seamlessly with core banking, ERP, CRM, and digital wallet ecosystems gives large enterprises strong operational advantages. Regulatory compliance, AML/KYC automation, and AI-driven risk scoring further strengthen their reliance on enterprise-grade issuing platforms.

SMEs are also expanding their adoption as digital payments and embedded finance become mainstream. Smaller businesses use modern issuing platforms to simplify payouts, manage corporate spending, and provide virtual cards for vendors or field teams. Cloud-based issuing and low-code integration make adoption more accessible by reducing upfront infrastructure costs.

SMEs benefit from instant virtual card creation, spend controls, and simplified reconciliation. Although adoption grows steadily, SMEs contribute a smaller share due to budget constraints and lower transaction complexity. Over time, digital-first business models and wider access to fintech APIs are expected to accelerate SME penetration.

By End-User

Banks and financial institutions lead the Modern Card Issuing Platforms Market with a 36.8% share, driven by their large customer bases, regulatory requirements, and need for secure, scalable payment infrastructure. These institutions depend on modern issuing platforms to support debit, credit, and prepaid card programs while enabling real-time controls, instant issuance, and advanced fraud protection.

Banks also leverage API-driven systems to modernize legacy infrastructures, accelerate digital onboarding, and integrate seamlessly with mobile banking apps and digital wallets. Enhanced compliance features—including automated KYC, AML monitoring, and transaction-level auditing—further reinforce adoption across traditional financial institutions upgrading their digital capabilities.

FinTechs and neobanks represent one of the fastest-growing user groups as digital-only players rely heavily on programmable, cloud-native issuing technology to power virtual cards, on-demand payouts, and innovative lending or budgeting tools. Corporations increasingly adopt modern issuing platforms for employee expense management, procurement controls, vendor payments, and treasury operations, benefitting from instant virtual card creation and real-time spending visibility.

Retailers use modern issuing systems to build loyalty-driven financial products, private-label cards, and reward-linked payment experiences. The Others category includes travel platforms, gig-economy marketplaces, logistics providers, and wellness ecosystems that rely on instant payouts and secure digital transaction flows. Together, these end-users reflect broad market adoption across both financial and non-financial sectors.

Key Market Segments

By Component

- Software

- Card Management Software

- Digital Issuance Solutions

- API & SDKs

- Others

- Services

- Implementation & Integration

- Consulting & Advisory

- Support & Maintenance

- Managed Services

By Deployment

- Cloud-based

- On-premise

By Card Type

- Physical Cards

- Virtual Cards

- Tokenized Cards

By Organization Size

- Large Enterprises

- SMEs

By End-User

- Banks & Financial Institutions

- FinTechs & Neobanks

- Corporations

- Retailers

- Others

Regional Analysis

North America leads the Modern Card Issuing Platforms Market with a 42.6% share and a valuation of USD 0.82 billion in 2024, reflecting the region’s strong foundation in digital payments, fintech innovation, and API-driven financial services.

The widespread adoption of mobile banking, contactless payments, and digital wallets has accelerated demand for modern issuing infrastructure capable of supporting instant virtual card creation, programmable spending controls, and real-time authorization decisions. The region is home to several leading card networks, fintech platforms, and cloud service providers, creating a technology-rich environment where new issuing capabilities can scale rapidly.

The US, in particular, drives regional dominance through its robust embedded finance ecosystem, growing neobank penetration, and increasing use of virtual cards across corporate payments, subscription management, and digital commerce.

North American enterprises prioritize security, prompting strong adoption of tokenization, advanced fraud analytics, and AI-based risk scoring tools integrated into issuing platforms. Additionally, regulatory clarity around digital identity, privacy, and financial compliance supports the rollout of programmable payment solutions.

As businesses across retail, logistics, travel, gig economy, and B2B payments accelerate digitization, demand for flexible card issuing platforms continues rising. North America remains at the forefront of innovation, shaping global trends in virtual-first card products, expense automation, and instant payouts.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The Modern Card Issuing Platforms Market is driven by rapid digital payment adoption, rising demand for virtual cards, and the acceleration of embedded finance. With over 70% of US consumers using digital wallets and contactless payment usage rising more than 30% in the past year, businesses require agile issuing systems to support real-time transactions.

API-driven infrastructure enables instant card provisioning, programmable controls, and seamless integration with banking and fintech ecosystems, making it essential for digital-first services. The rise of gig-economy payouts, subscription commerce, and corporate expense automation further strengthens demand, as enterprises increasingly require instant virtual cards and automated spending governance.

AI-powered fraud detection—now reducing risk by up to 40% – and automated KYC/AML workflows also drive adoption among regulated institutions. Overall, growing expectations for instant, secure, and personalized financial experiences continue to propel market momentum.

Restraint Factors

Despite strong growth, the market faces notable restraints. High integration complexity remains a major barrier, as nearly 45% of banks still operate on legacy core systems that are difficult to connect with modern issuing APIs. Compliance requirements such as KYC, AML, and PCI-DSS add operational burdens, especially for smaller enterprises lacking dedicated compliance teams.

Security concerns also persist, with cyberattacks on financial systems rising more than 20% annually, prompting businesses to strengthen infrastructure before adopting new issuing solutions. Upfront implementation costs and the need for skilled developers further slow deployment among SMEs.

Additionally, some regions face slower adoption of digital wallets and contactless transactions, limiting demand for advanced card capabilities. Interoperability challenges with global payment networks and inconsistent regulatory frameworks across countries also hinder cross-border program expansion, delaying full-scale implementation.

Growth Opportunities

The market presents substantial growth opportunities as virtual-first financial services expand globally. Virtual card usage is growing more than 25% annually, opening new avenues across e-commerce, subscription services, travel, and enterprise spending. Embedded finance is another high-potential area, enabling retailers, logistics companies, gig platforms, and SaaS providers to launch branded payment cards without becoming traditional banks.

The rise of real-time payments and open banking APIs enhances opportunities for programmable card controls and automated financial workflows. Corporate digital transformation further drives demand, with over 60% of enterprises prioritizing spend management modernization – creating a strong need for API-based issuing infrastructure.

Emerging markets in the Asia Pacific, Latin America, and Africa also present significant opportunities due to rising smartphone penetration and mass adoption of mobile payments. Additionally, AI-driven risk analytics and tokenized payment ecosystems offer new revenue streams for issuers seeking faster, more secure, and personalized payment experiences.

Trending Factors

Several major trends are shaping the future of modern card issuing. Virtual cards continue to surge, replacing traditional corporate and e-commerce transactions, with adoption increasing more than 30% year over year. Tokenization and biometric authentication are becoming standard as security-focused payment methods expand across mobile wallets and wearables.

AI-driven fraud detection, risk scoring, and behavioral monitoring are transforming real-time decisioning, helping issuers reduce false declines and improve approval rates. Programmable payments—enabled through APIs—allow businesses to set dynamic limits, merchant restrictions, and automated rules, making card programs more flexible and customizable.

Embedded finance is rapidly growing, enabling non-financial companies to issue cards as part of their core services. Sustainability trends are pushing issuers toward eco-friendly physical cards and digital-only card programs. The adoption of low-code and composable issuing architectures is also rising, giving businesses faster deployment cycles and the ability to innovate at scale across global markets.

Competitive Analysis

The competitive landscape of the Modern Card Issuing Platforms Market is intensifying as fintechs, traditional payment processors, and cloud-native technology providers race to deliver faster, more flexible, and programmable card infrastructure.

Leading players differentiate themselves through API-first architectures that support instant issuance, dynamic spending controls, tokenization, and embedded finance integrations. Competition is especially strong among platforms offering multi-product issuing—spanning physical cards, virtual cards, and tokenized payment credentials—to meet the needs of banks, neobanks, and digital-first enterprises.

AI-driven capabilities are becoming a critical differentiator. Providers that offer real-time fraud detection, automated risk scoring, and intelligent transaction routing gain a competitive edge, particularly as fraud attempts continue rising by double-digit percentages. Cloud-native scalability also shapes competition, with platforms capable of handling millions of transactions per second positioning themselves as enterprise-grade solutions.

Partnership ecosystems play a major role in competitive strength. Issuers that integrate seamlessly with global payment networks, core banking systems, identity verification providers, and digital wallet platforms are more attractive to enterprises seeking a unified payment stack. Compliance readiness—covering PCI-DSS, KYC/AML automation, and regional regulatory alignment—has become a deciding factor for financial institutions evaluating vendors.

Top Key Players in the Market

- Marqeta

- Stripe

- Galileo (SoFi)

- FIS

- Fiserv

- Global Payments

- Adyen

- Railsr

- Solaris

- Treezor

- Plaid

- Lithic

- Visa

- Mastercard

- Discover

- Others

Recent Developments

- November 21, 2025: Marqeta launched its Adaptive Authorization Engine, enabling issuers to apply real-time, AI-driven decision rules to every transaction. Early pilot programs across fintech clients reported a 28% reduction in false declines and improved approval rates for legitimate card activity.

- November 15, 2025: Stripe introduced its Universal Issuing API, allowing businesses to generate physical, virtual, and tokenized cards through a single programmable layer. The update enhances compatibility with major mobile wallets and reduces integration time for developers by nearly 35%.

- November 10, 2025: FIS unveiled its Cloud Issuer Hub, a modular issuing platform optimized for neobanks and digital lenders. The system supports instant virtual card provisioning, multi-currency settlement, and biometric authentication, achieving sub-second authorization speeds in regional testing.

Report Scope

Report Features Description Market Value (2024) USD 1.94 Billion Forecast Revenue (2034) USD 11.42 Billion CAGR(2025-2034) 19.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software, [Card Management Software, Digital Issuance Solutions, API & SDKs, Others], Services [Implementation & Integration, Consulting & Advisory, Support & Maintenance, Managed Services]), By Deployment (Cloud-based, On-premise), By Card Type (Physical Cards, Virtual Cards, Tokenized Cards), By Organization Size (Large Enterprises, SMEs), By End-User (Banks & Financial Institutions, FinTechs & Neobanks, Corporations, Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marqeta, Stripe, Galileo (SoFi), FIS, Fiserv, Global Payments, Adyen, Railsr, Solaris, Treezor, Plaid, Lithic, Visa, Mastercard, Discover, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Modern Card Issuing Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Modern Card Issuing Platforms MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Marqeta

- Stripe

- Galileo (SoFi)

- FIS

- Fiserv

- Global Payments

- Adyen

- Railsr

- Solaris

- Treezor

- Plaid

- Lithic

- Visa

- Mastercard

- Discover

- Others