Global Mobile Business Intelligence (BI) Market Size, Share, Growth Analysis By Solution (Software [Mobile BI Platforms, Data Visualization Tools, Dashboard and Reporting Apps], Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Business Function (Sales, Marketing, Finance, IT, Operations and Supply-chain, Human Resource (HR), Others), By End-user Industry (BFSI, IT & Telecommunications,, Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Manufacturing, Other End-user Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161683

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Key Takeaways

- AI Industry Adoption

- Analysts’ Viewpoint

- Role of Generative AI

- US Market Size

- Investment and Business Benefits

- By Solution

- By Deployment

- By Organization Size

- By Business Function

- By End-user Industry

- Emerging trends

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunity

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

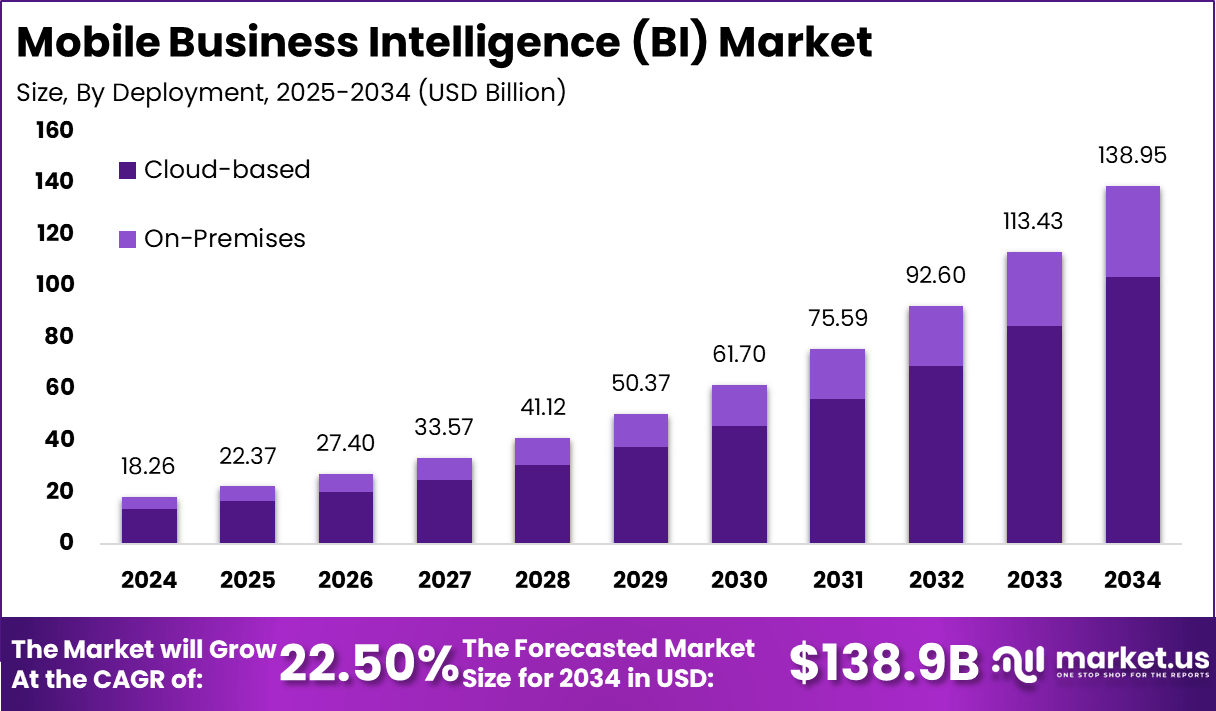

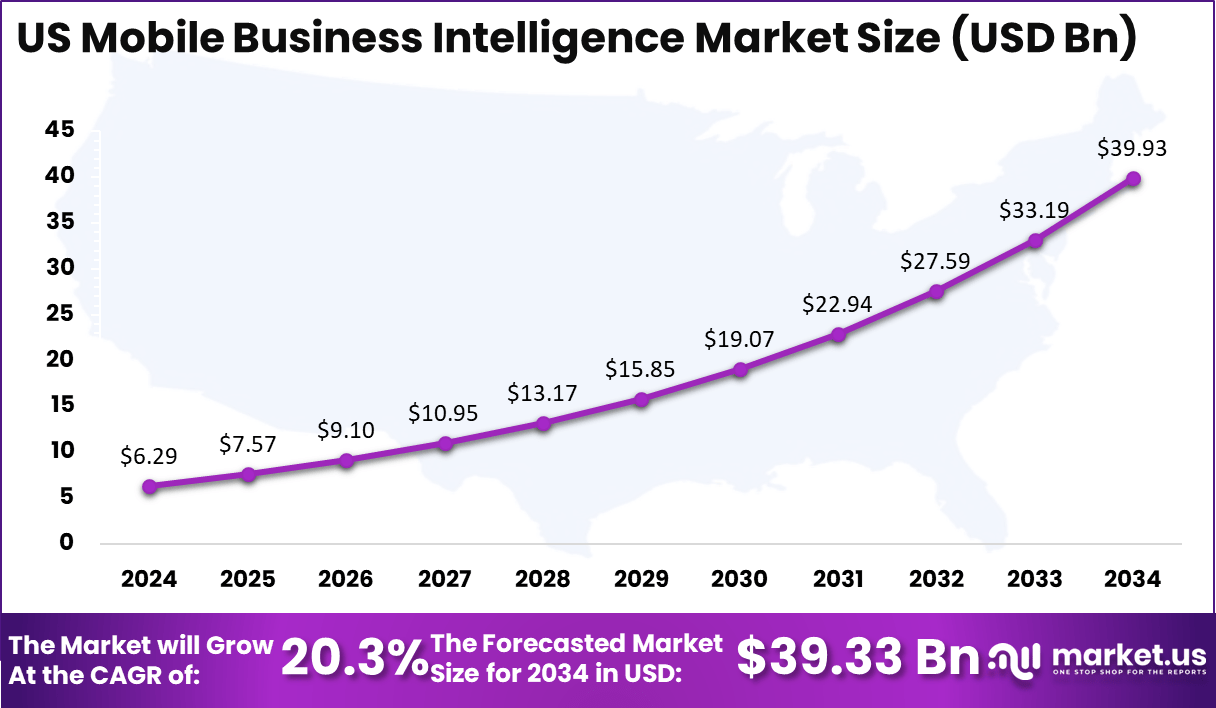

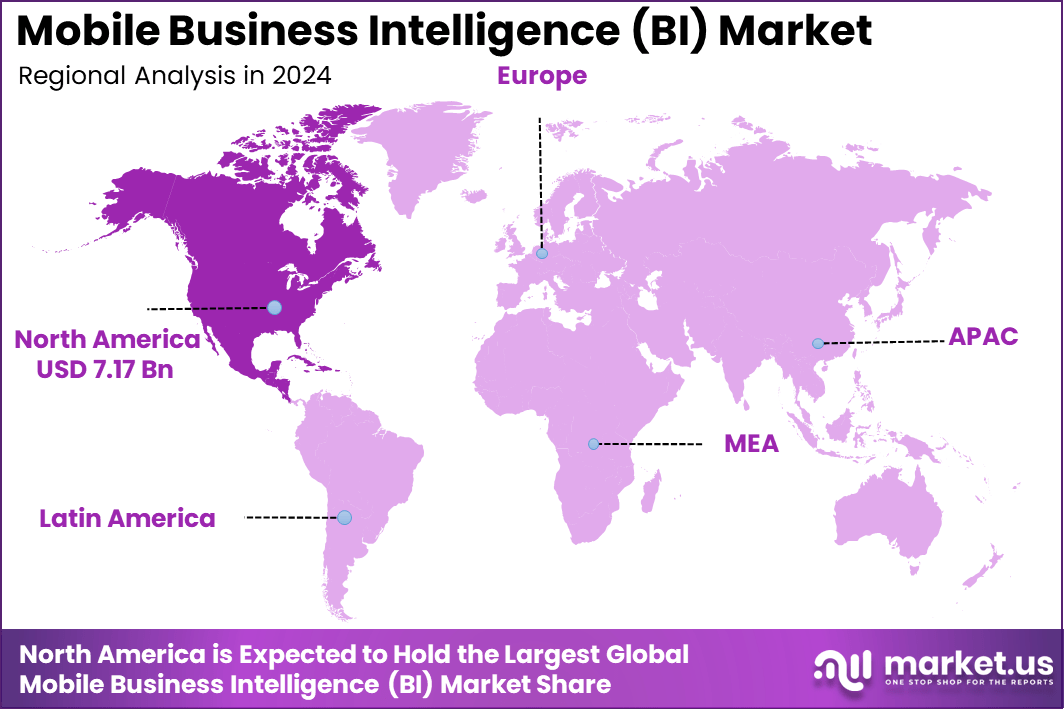

The Global Mobile Business Intelligence (BI) Market was valued at USD 18.26 billion in 2024 and is projected to grow significantly, reaching approximately USD 138.9 billion by 2034, registering a CAGR of 22.5% over the forecast period. In 2024, North America dominated the global landscape, accounting for about 39.3% of the total market share with a market value of USD 7.17 billion. Within the region, the United States stood out as the major contributor, generating USD 6.29 billion in 2024 and is anticipated to grow robustly to USD 39.93 billion by 2034, expanding at a CAGR of 20.3% throughout the forecast timeline.

The Mobile Business Intelligence (BI) Market refers to the use of mobile devices such as smartphones and tablets to access, analyze, and manage business data in real time. It enables organizations to make data-driven decisions anytime and anywhere, improving efficiency and responsiveness. Mobile BI combines analytics, dashboards, and reporting tools through cloud-based platforms, allowing seamless data visualization and sharing. Its adoption is rising across industries like healthcare, retail, finance, and manufacturing due to the growing need for instant insights and agile business operations. Advancements in AI, 5G connectivity, and data security are further enhancing the capabilities of mobile BI solutions.

Cloud-based BI platforms are gaining traction due to their scalability, cost-efficiency, and easy accessibility. Additionally, the rising emphasis on data-driven strategies, improved internet connectivity, and the proliferation of mobile devices are expected to continue propelling the growth of the global mobile business intelligence market.

In 2025, the Mobile Business Intelligence (BI) landscape is experiencing significant growth and transformation, primarily due to the increasing demand for real-time data access on mobile devices and robust advancements in AI. The market has been growing at approximately a 22% annual rate, fueled by widespread adoption across sectors such as banking, healthcare, and retail.

Industry consolidation is on the rise, with the number of mergers and acquisitions among mid-size cloud BI providers increasing by 18% over the previous year, reflecting a strategic push toward hybrid cloud and mobile analytics solutions. A notable development includes Tableau (under Salesforce) acquiring a natural-language query (NLQ) startup, enhancing the capabilities of real-time BI on mobile dashboards.

Venture funding for BI and data intelligence startups exceeded $2.6 billion, with mobile-focused analytics companies like Sigma Computing and Klipfolio securing substantial investments to develop predictive, AI-powered mobile dashboards. New product launches have kept pace; Microsoft Power BI Mobile 2025 introduced an “Edge Insights” feature that leverages 5G and edge computing to deliver near-instant analytics for frontline staff, while Qlik launched Sense Mobile AI, whose natural language features boosted adoption among finance teams by 34% in the second quarter of 2025.

AI-driven assistants are now part of more than 70% of new BI deployments, reducing average data query times by almost 40% for enterprises adopting edge analytics. Partnerships have also shaped the sector, with SAP joining forces with Google Cloud to embed real-time mobile analytics into cloud platforms for retailers and telecom firms in Asia-Pacific, reporting a 30% rise in mobile BI adoption among logistics and retail clients through analytics-as-a-service models.

Investment in mobile BI security jumped by 26% this year, with organizations increasingly adopting encrypted storage and multifactor authentication to support BYOD (bring your own device) strategies. Regionally, Asia-Pacific remains the fastest-growing market, expanding at a 23% compound annual growth rate owing to rising smartphone use and large-scale digital government initiatives in countries like India, China, and Indonesia.

Embedded BI capabilities have gained traction as well, with 48% of new business apps in 2025 incorporating interactive mobile dashboards, most notably in manufacturing and fintech. Finally, localization efforts in chip supply for BI devices have led governments in India and the U.S. to invest more than $500 million to support domestic development, boosting mobile BI adoption and reducing reliance on overseas hardware vendors.

Top Key Takeaways

- The Mobile Business Intelligence (BI) Market generated USD 18.26 billion in 2024, highlighting strong demand for real-time analytics and mobile-based decision-making tools.

- A projected CAGR of 22.5% through 2034 reflects rapid enterprise digitalization and the growing adoption of cloud-based BI platforms.

- The market is anticipated to reach USD 138.9 billion by 2034, driven by an expanding mobile workforce and AI-integrated analytics solutions.

- North America accounted for around 39.3% of the global share in 2024, valued at USD 7.17 billion, underscoring early adoption and robust enterprise mobility infrastructure.

- The U.S. dominated regional growth with USD 6.29 billion in 2024 and is expected to reach USD 39.93 billion by 2034, expanding at a 20.3% CAGR.

- Increasing reliance on smartphones and tablets for business operations is reshaping analytics accessibility and driving on-the-go decision-making.

- Consistent investment in advanced BI applications and AI-powered insights indicates sustained market momentum across industries.

- Software solutions hold about 62.8%, emphasizing their critical role in enabling data visualization, analytics, and interactive reporting within mobile BI systems.

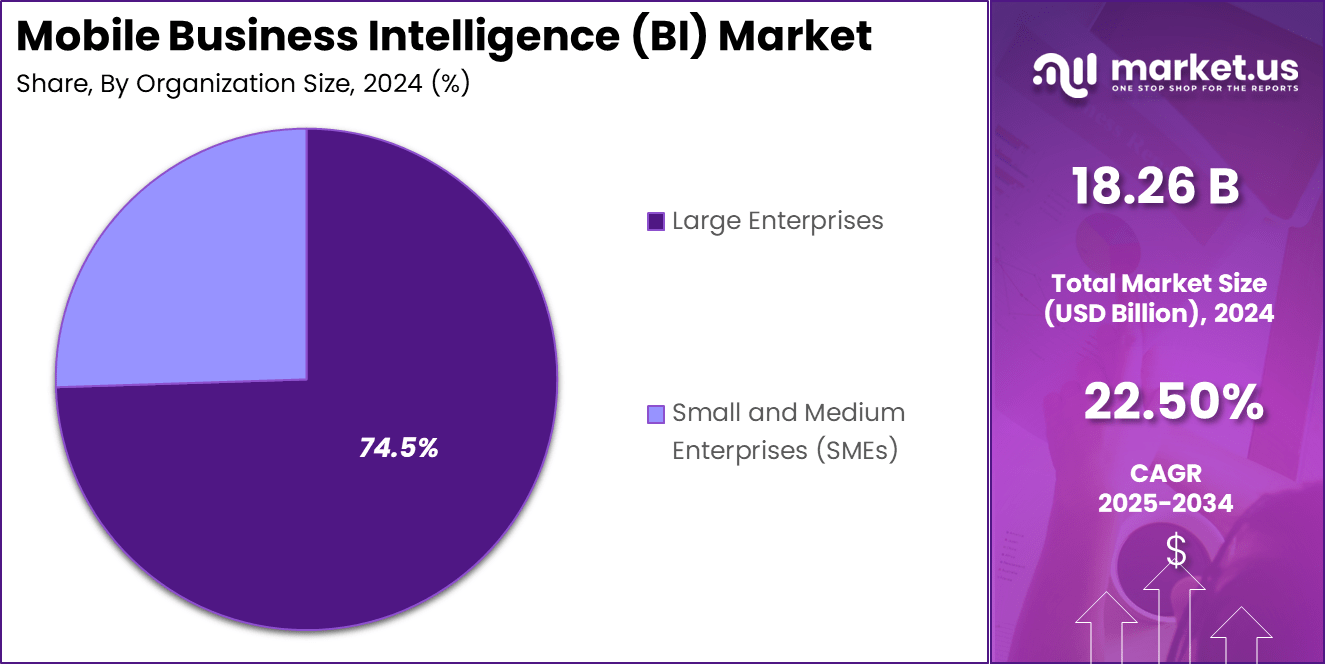

- Cloud-based deployment accounts for nearly 74.5%, reflecting the preference for scalable, cost-efficient, and easily accessible platforms supporting remote operations.

- Large enterprises represent approximately 73.6% of the market share, driven by extensive data generation, global operations, and the need for real-time performance monitoring.

- Sales functions contribute around 25.7%, highlighting their reliance on mobile BI for tracking leads, revenue performance, and customer engagement metrics.

- The BFSI sector captures nearly 23.4%, supported by strong demand for mobile analytics in fraud detection, customer management, and financial decision-making.

AI Industry Adoption

The adoption of Mobile Business Intelligence (BI) is accelerating across industries as organizations prioritize real-time data access and decision-making on the go. Sectors such as banking, retail, healthcare, manufacturing, and IT are integrating mobile BI tools to enhance productivity, monitor operations, and support strategic planning. The ability to visualize key metrics, sales performance, and customer insights directly through smartphones and tablets is transforming how businesses operate.

Cloud computing, 5G connectivity, and AI integration are further driving the scalability and intelligence of BI platforms. In the financial sector, mobile BI improves fraud detection and portfolio management, while in healthcare, it supports patient analytics and clinical performance tracking. Retailers leverage it for inventory management and personalized marketing, and manufacturing companies use it for production analytics and supply chain optimization.

According to IDC, over 60% of global enterprises are expected to adopt mobile-first BI strategies by 2026 to strengthen agility and competitive advantage. North America and Europe lead adoption, supported by strong enterprise mobility infrastructure and data-driven decision cultures. As mobile BI evolves with machine learning and predictive analytics, its role is expected to expand further, enabling organizations to unlock actionable insights anytime, anywhere, ensuring smarter, faster, and more informed business decisions.

Analysts’ Viewpoint

Analysts view the Mobile Business Intelligence (BI) Market as a transformative force reshaping enterprise decision-making, operational agility, and data democratization. Analysts emphasize that the increasing penetration of smartphones, cloud-based services, and 5G networks is fueling widespread adoption, particularly among large enterprises seeking real-time insights across dispersed teams.

The integration of artificial intelligence and machine learning is seen as a pivotal driver, enhancing predictive analytics and automation in mobile BI platforms. However, analysts also point out challenges such as data security, integration complexity, and the need for robust governance frameworks as mobile BI becomes more pervasive. The rise of bring-your-own-device (BYOD) policies and remote work trends further amplifies the relevance of mobile analytics.

North America continues to lead global adoption, while Asia-Pacific is emerging as a high-growth region driven by digital transformation initiatives. Analysts anticipate that ongoing innovation in natural language querying, embedded analytics, and self-service BI will make mobile BI more intuitive and accessible, solidifying its position as an indispensable tool for data-driven enterprises worldwide.

Role of Generative AI

Generative AI is playing a transformative role in the Mobile Business Intelligence (BI) Market by automating data analysis, report generation, and decision support. It enables users to generate insights through natural language queries, reducing dependence on technical expertise and enhancing accessibility for non-analysts.

By integrating with mobile BI platforms, generative AI can summarize complex datasets, forecast trends, and visualize key metrics instantly. This capability accelerates decision-making and enhances productivity for business leaders on the move. Generative AI also assists in creating dynamic dashboards that adapt to user behavior and contextual needs.

Combined with real-time data from cloud and mobile sources, it delivers personalized recommendations and scenario simulations, improving strategic agility. As enterprises increasingly adopt AI-driven analytics, generative AI is expected to redefine how mobile BI platforms deliver actionable insights, making business intelligence more conversational, predictive, and intuitive across industries and organizational functions.

US Market Size

The United States represents a major share of the global Mobile Business Intelligence (BI) Market, reflecting its advanced digital infrastructure and widespread adoption of mobile analytics tools. Valued at USD 6.29 billion in 2024, the U.S. market is projected to expand to USD 39.93 billion by 2034, growing at a CAGR of 20.3%. This growth is primarily driven by increasing enterprise mobility, demand for real-time decision-making, and the integration of AI and machine learning into BI platforms.

The country’s strong IT ecosystem, high smartphone penetration, and early adoption of 5G technology are fueling the deployment of mobile BI solutions across industries. Sectors such as banking, healthcare, retail, and manufacturing are rapidly incorporating mobile BI for operational efficiency, predictive analytics, and performance monitoring. Additionally, the presence of leading BI software providers and growing cloud adoption further position the U.S. as the global leader in mobile-driven business intelligence innovation and analytics transformation.

Investment and Business Benefits

Investments in the Mobile Business Intelligence (BI) Market are increasingly viewed as strategic enablers of data-driven transformation, offering significant business advantages. Organizations investing in mobile BI gain real-time access to performance metrics, sales trends, and customer insights, empowering faster and more informed decision-making. The integration of AI and machine learning enhances predictive analytics and automation, reducing operational inefficiencies and enabling proactive business strategies.

Companies adopting mobile BI benefit from improved collaboration, agile reporting, and cost savings through cloud deployment. Additionally, the ability to access dashboards and analytics via smartphones supports remote work and field operations, boosting productivity. As digital transformation accelerates globally, investment in mobile BI platforms offers both financial growth opportunities and long-term competitive advantages across diverse industries.

By Solution

Software accounts for around 62.8% of the Mobile Business Intelligence (BI) Market, indicating its critical role in empowering enterprises with real-time analytics and interactive dashboards. Within software, mobile BI platforms, data visualization tools, and dashboard applications dominate adoption due to their ability to streamline complex datasets into actionable insights accessible from smartphones and tablets.

These tools enhance agility by enabling instant access to KPIs, sales metrics, and operational data, driving smarter business decisions. The demand for intuitive interfaces and AI-driven analytics capabilities continues to accelerate software adoption across industries. Meanwhile, the services segment—which includes professional and managed services—supports solution deployment, integration, and ongoing optimization.

Professional services cater to implementation, customization, and consulting, while managed services ensure continuous monitoring, updates, and support for seamless BI performance. As enterprises shift toward mobile-first strategies and cloud integration, the synergy between robust software tools and expert service offerings is expected to drive sustained market growth globally.

By Deployment

Cloud-based deployment holds nearly 74.5% of the Mobile Business Intelligence (BI) Market, reflecting a clear shift toward flexible, scalable, and cost-efficient analytics solutions. Organizations are increasingly adopting cloud-based BI platforms to enable remote accessibility, faster data processing, and real-time collaboration across teams.

The rise of hybrid work models and mobile-first operations has further accelerated the adoption of cloud BI, supported by advancements in data security, encryption, and AI-driven automation. Cloud solutions also simplify integration with other enterprise systems such as ERP and CRM, enhancing data synchronization and decision accuracy.

In contrast, on-premises deployment continues to serve industries with strict regulatory and data privacy requirements, such as banking, defense, and healthcare. These deployments offer greater control over data storage and system customization but require higher maintenance costs and infrastructure investment. Overall, the growing preference for cloud-based mobile BI highlights enterprises’ focus on agility, scalability, and continuous digital transformation across business functions.

By Organization Size

Large enterprises account for approximately 73.6% of the Mobile Business Intelligence (BI) Market, highlighting their dominant role in adopting advanced analytics and real-time data visualization tools. These organizations manage massive data volumes across global operations and rely on mobile BI solutions to enhance productivity, monitor performance, and streamline decision-making.

The integration of AI, cloud computing, and machine learning further strengthens BI applications within large corporations, enabling predictive insights and faster responses to market dynamics. High investment capacity and established digital infrastructures also support large-scale BI deployment and customization.

In contrast, small and medium enterprises (SMEs) are gradually increasing their adoption of mobile BI due to the growing affordability of cloud-based tools and subscription-based models. SMEs are leveraging these platforms to optimize operations, track business performance, and improve customer engagement without heavy infrastructure costs. As mobile BI becomes more accessible, both large enterprises and SMEs are expected to drive market expansion through data-centric business strategies.

By Business Function

Sales functions account for around 25.7% of the Mobile Business Intelligence (BI) Market, marking them as the leading business function in terms of BI adoption. Sales teams rely heavily on mobile BI tools to access real-time insights into customer behavior, lead conversion rates, and revenue performance while on the move.

Mobile dashboards enable sales professionals to make informed decisions instantly, enhancing productivity and customer engagement. Marketing departments follow closely, using mobile BI to analyze campaign performance and track ROI across multiple channels. Finance teams integrate BI to monitor cash flow, budgets, and financial health efficiently, while IT departments focus on managing system integrations and ensuring data security.

Operations and supply-chain functions utilize mobile BI for inventory optimization, logistics tracking, and performance benchmarking. Human resources (HR) uses mobile analytics to monitor employee performance and workforce trends. Overall, mobile BI empowers every department with instant access to actionable intelligence, supporting agile and data-driven business management.

By End-user Industry

The BFSI sector holds about 23.4% of the Mobile Business Intelligence (BI) Market, representing the largest end-user industry segment. The strong adoption in banking, financial services, and insurance stems from the growing need for real-time data analytics, fraud detection, and customer insight management. Mobile BI enables financial professionals to track transactions, assess portfolio performance, and make instant lending or investment decisions through secure, mobile-accessible dashboards.

IT and telecommunications companies follow closely, leveraging mobile BI for network performance monitoring and service optimization. Healthcare and life sciences sectors are using BI tools for patient analytics, clinical data tracking, and operational efficiency. Retail and e-commerce players adopt mobile BI to analyze consumer trends, manage inventory, and enhance personalized marketing.

Government and public sector agencies employ it for resource allocation, performance tracking, and transparency initiatives, while manufacturing firms utilize mobile BI for production monitoring and supply chain visibility. Collectively, these industries drive the expanding use of mobile BI for smarter, data-driven operations.

Emerging trends

Emerging trends in the Mobile Business Intelligence (BI) Market are centered around AI integration, cloud analytics, and user-centric design. The convergence of artificial intelligence and machine learning with mobile BI platforms is enabling predictive and prescriptive analytics, allowing users to anticipate business outcomes in real time. Natural language processing (NLP) is making BI tools more conversational, empowering users to query data using simple voice or text commands.

The adoption of cloud-based and hybrid BI models continues to rise, offering scalability, flexibility, and cost efficiency. Another key trend is the growing use of embedded analytics within mobile applications, providing insights directly in workflow environments. The rise of 5G connectivity enhances data transmission speed and supports real-time visualization. Furthermore, mobile BI is evolving toward personalized, role-based dashboards tailored to user behavior, driving higher engagement and adoption across industries focused on agility, automation, and data-driven competitiveness.

Key Market Segments

By Solution

-

- Software

- Mobile BI Platforms

- Data Visualization Tools

- Dashboard and Reporting Apps

- Services

- Professional Services

- Managed Services

- Software

By Deployment

-

- Cloud-based

- On-Premises

By Organization Size

-

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Business Function

-

- Sales

- Marketing

- Finance

- IT

- Operations and Supply Chain

- Human Resource (HR)

- Others

By End-user Industry

-

- BFSI

- IT & Telecommunications

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Manufacturing

- Other End-user Verticals

Regional Analysis

In 2024, North America dominated the Mobile Business Intelligence (BI) market with a 39.3% share, translating to approximately regional revenue. This strong foothold reflects mature digital infrastructures, high enterprise mobility adoption, and the presence of major BI solution providers across the U.S. and Canada.

Within North America, the United States remains the engine of growth, accounting for 2024, or nearly 88% of the region’s total. Projections suggest the U.S. market will expand by 2034, with a robust CAGR, reflecting high demand for mobile analytics, predictive modeling, and real-time decisioning across sectors.

Canada and Mexico contribute the residual share of North America’s market, benefiting from the spill-over adoption of cloud and mobile BI trends. Growth in the region is further supported by strong enterprise spending, high smartphone penetration, and accelerated digital transformation initiatives across industries like finance, healthcare, retail, and manufacturing. As leading BI vendors and cloud platforms are headquartered in North America, the region is expected to maintain its leadership position, even as Asia Pacific and Europe ramp up adoption.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The growth of the Mobile Business Intelligence (BI) Market is primarily driven by the increasing adoption of smartphones, cloud computing, and data-driven decision-making. Enterprises are prioritizing mobile BI tools to enable real-time analytics, improve productivity, and enhance operational visibility. The integration of AI and machine learning into mobile BI applications is enabling predictive analytics and automation, transforming how organizations extract insights from data. Additionally, the expansion of 5G networks and growing remote work trends are boosting demand for mobile-accessible dashboards and analytics solutions that ensure agility and responsiveness across global operations.

Restraint Factors

Despite strong growth, the market faces restraints such as data security concerns, integration complexities, and high implementation costs. Many organizations struggle with safeguarding sensitive data transmitted via mobile networks and ensuring compliance with stringent data protection regulations. Limited technical expertise and the complexity of integrating BI tools with legacy systems also hinder adoption, particularly among small and medium enterprises.

Growth Opportunity

Significant opportunities lie in the rapid digitalization of emerging economies and the increasing shift toward cloud-based BI platforms. The demand for AI-driven, self-service mobile analytics and real-time data visualization offers vast growth potential across sectors such as BFSI, healthcare, and retail. Expanding 5G infrastructure and low-code BI tools further open avenues for scalable and user-friendly BI adoption.

Challenging Factors

The key challenges include maintaining data consistency across multiple devices, ensuring seamless synchronization, and managing large-scale unstructured data. Interoperability between various BI systems and mobile operating environments also remains a hurdle. Furthermore, user adoption challenges, stemming from inadequate training and resistance to change in traditional enterprises, continue to impact the effective deployment of mobile BI solutions globally.

Competitive Analysis

The Mobile Business Intelligence (BI) Market is highly competitive, dominated by global technology leaders such as IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, SAS Institute Inc., and MicroStrategy Incorporated. These companies hold significant market share due to their extensive product portfolios, strong cloud ecosystems, and global customer base.

Microsoft’s Power BI, SAP Analytics Cloud, and Oracle Analytics are widely used for their seamless integration with enterprise systems, scalability, and advanced mobile features. Emerging players such as Tableau (Salesforce), Qlik, Domo, and ThoughtSpot are intensifying competition by focusing on user-friendly interfaces, AI-driven analytics, and real-time mobile accessibility. The competitive landscape is characterized by rapid innovation in AI, natural language processing, and embedded analytics, which enhance user interaction and self-service capabilities.

Cloud-based architecture and low-code BI platforms are becoming key differentiators as enterprises demand flexible, scalable, and mobile-first analytics solutions. However, pricing pressures, integration complexity, and high competition among vendors continue to challenge market positioning. Strategic partnerships, acquisitions, and product diversification remain crucial strategies for maintaining leadership in this rapidly evolving market.

Top Key Players in the Market

- Microsoft (Power BI)

- Salesforce (Tableau)

- Qlik (Qlik Sense)

- Strategy (formerly MicroStrategy)

- SAP (SAP Analytics Cloud)

- IBM (Cognos Analytics)

- Domo Inc.

- Sisense Inc.

- Oracle Corporation (Oracle Analytics Cloud)

- TIBCO Software (Spotfire)

- Yellowfin BI (now part of Idera)

- ThoughtSpot Inc.

- Google LLC (Looker)

- Phocas Software

- Zoho Corporation

- Board International

- Dundas Data Visualization

- TARGIT A/S

- e-Zest Solutions Ltd.

- Information Builders Inc.

- Others

Major Developments

- September 2025: Microsoft Enhances Power BI with Advanced Mobile and AI Features

Microsoft introduced new updates to its Power BI platform in September 2025, focusing on enhanced mobile usability and AI-driven analytics. The release includes an upgraded Copilot experience, improved natural language search, and NFC tag reading support in Power BI Mobile. These advancements strengthen Power BI’s mobile ecosystem, enabling users to access real-time insights and automated reports seamlessly across devices.

- August 2025: SAP Launches BusinessObjects BI 2025 Edition

SAP unveiled the BusinessObjects BI 2025 Edition, featuring upgraded dashboards, advanced visualization tools, and tighter integration with SAP’s enterprise systems. The new version enhances real-time analytics for mobile users and supports a unified experience across devices. This development reinforces SAP’s commitment to delivering scalable, cloud-aligned business intelligence solutions.

- July 2025: Mosaic Expands AI-Powered Mobile BI Capabilities

Mosaic released an updated version of its BI platform in July 2025, integrating advanced AI for automated dashboard creation and cross-platform data analysis. The update streamlines workflow automation, enabling businesses to generate insights faster and reduce manual reporting time. The upgrade marks a key step toward embedding generative AI into mobile BI applications for enhanced user productivity.

Report Scope

Report Features Description Market Value (2024) USD 18.26 Billion Forecast Revenue (2034) USD 138.9 Billion CAGR(2025-2034) 22.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Solution (Software [Mobile BI Platforms, Data Visualization Tools, Dashboard and Reporting Apps], Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Business Function (Sales, Marketing, Finance, IT, Operations and Supply-chain, Human Resource (HR), Others), By End-user Industry (BFSI, IT & Telecommunications,, Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Manufacturing, Other End-user Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft (Power BI), Salesforce (Tableau), Qlik (Qlik Sense), Strategy (formerly MicroStrategy), SAP (SAP Analytics Cloud), IBM (Cognos Analytics), Domo Inc., Sisense Inc., Oracle Corporation (Oracle Analytics Cloud), TIBCO Software (Spotfire), Yellowfin BI (now part of Idera), ThoughtSpot Inc., Google LLC (Looker), Phocas Software, Zoho Corporation, Board International, Dundas Data Visualization, TARGIT A/S, e-Zest Solutions Ltd., Information Builders Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Mobile Business Intelligence (BI) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Business Intelligence (BI) MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft (Power BI)

- Salesforce (Tableau)

- Qlik (Qlik Sense)

- Strategy (formerly MicroStrategy)

- SAP (SAP Analytics Cloud)

- IBM (Cognos Analytics)

- Domo Inc.

- Sisense Inc.

- Oracle Corporation (Oracle Analytics Cloud)

- TIBCO Software (Spotfire)

- Yellowfin BI (now part of Idera)

- ThoughtSpot Inc.

- Google LLC (Looker)

- Phocas Software

- Zoho Corporation

- Board International

- Dundas Data Visualization

- TARGIT A/S

- e-Zest Solutions Ltd.

- Information Builders Inc.

- Others