Global Minimally Invasive Surgical Instruments Market By Product Type (Handheld Instruments, Inflation Devices, Surgical Scopes, Cutting Instruments, Guiding Devices, Electrosurgical & Electrocautery, Instruments and Other Instruments) By Application (Cardiac, Gastrointestinal, Orthopedic, Vascular, Gynecological, Urological, Thoracic, Cosmetic, Dental and Other Applications) By End-use (Hospitals & Clinics and Ambulatory Surgical Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 14207

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

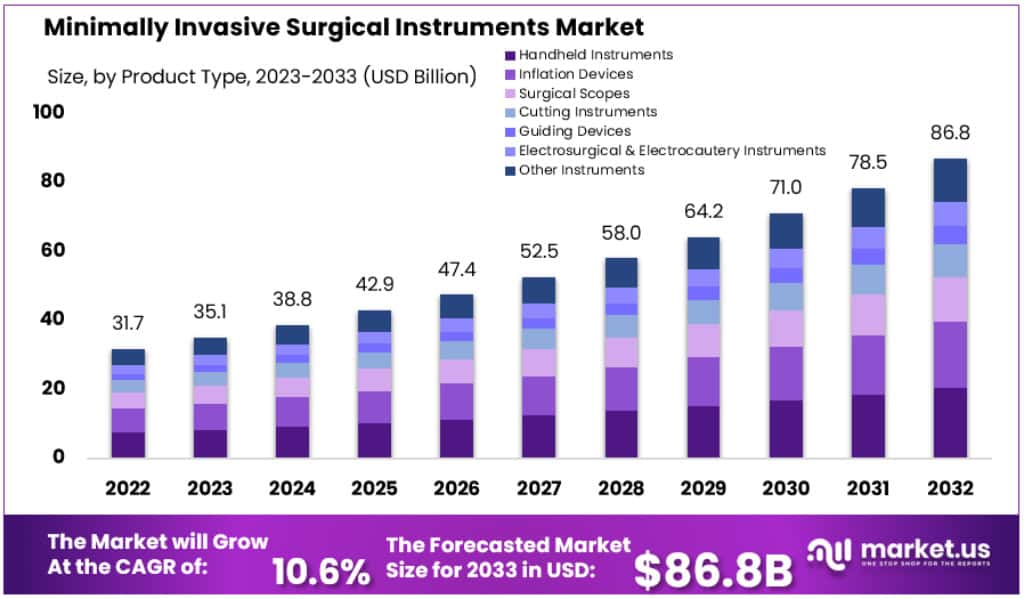

The Global Minimally Invasive Surgical Instruments Market size is expected to be worth around USD 86.8 Billion by 2032, from USD 35.1 Billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2024 to 2033.

Minimally Invasive Surgical Instruments (MISI) are devices used to perform minimally invasive surgery, which involves smaller incisions and shorter recovery times. These instruments access organs through small, keyhole incisions, such as laparoscopic, arthroscopic, and robotic-assisted procedures.

Surgical robotics has revolutionized minimally invasive surgery and is increasingly accepted by surgeons around the world. Minimally invasive surgery (MIS) costs are significantly lower than conventional open and in-patient surgeries. This results in significant value for both the patient and insurance companies. This trend will likely continue over the next few years.

The forecast period will see robust growth opportunities due to the increasing number of products being launched and product approvals from market players in order to gain a greater market share. In India, Abbott introduced a minimally invasive device to repair heart valves in 2020.

Key Takeaways

- Market Value: The market is valued at USD 35.1 Billion in 2023.

- Projected Market Valuation: It is anticipated to reach approximately USD 86.8 Billion by 2033.

- CAGR (2023-2033): The market is expected to grow at a CAGR of 10.6% during this period.

- Handheld Instruments Market Share: This segment holds a significant 23.6% share of the market.

- Orthopedic Applications Market Share: The orthopedic segment commands over 24.2% of the market.

- Hospitals’ Market Share: Hospitals are the leading end-users with over a 71.8% market share.

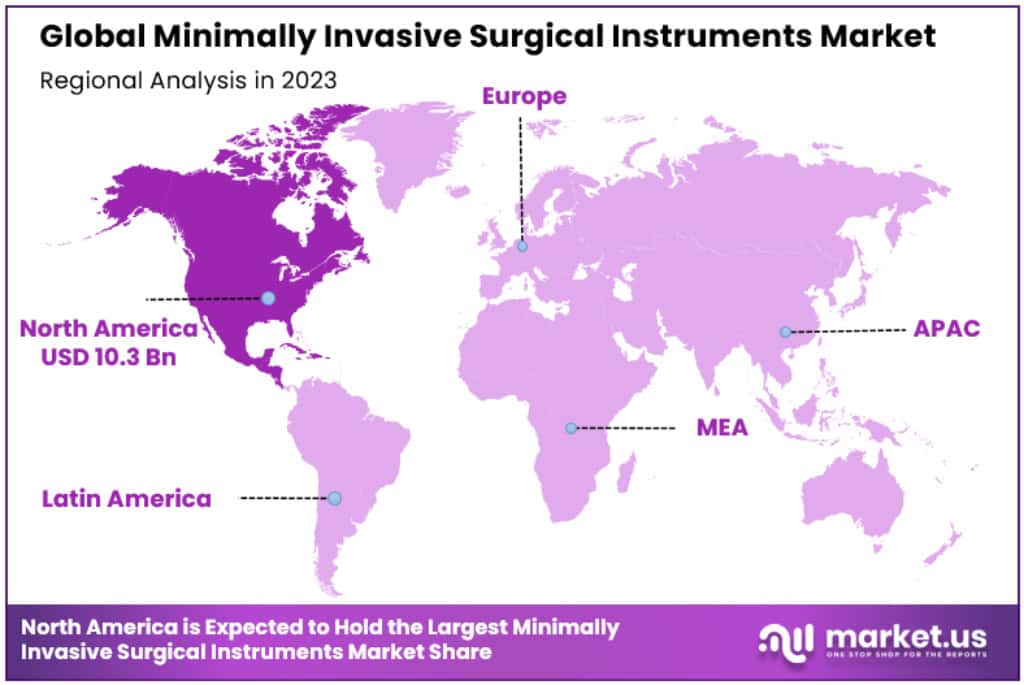

- North American Market Share: North America dominates the market with a 32.49% share, valued at USD 10.3 billion.

- Asia Pacific Growth Forecast: This region is projected to be the fastest-growing during the forecast period.

- Healthcare Spending in the US: The US has the highest per capita healthcare spending according to the OECD.

- Ambulatory Surgical Centers Growth: There is a notable increase in the adoption of minimally invasive surgical instruments in ASCs.

- Recent Developments: In August 2023, VISEON Inc. launched an AI-powered surgical navigation system.

- Market Players: Key players include Medtronic, Siemens Healthineers AG, Johnson & Johnson Services, and Abbott.

- Regulatory Hurdles: The market faces challenges due to stringent regulatory requirements and the need for extensive clinical data.

- Technological Advances: Continuous innovations in surgical tools present significant growth opportunities.

- Rise in Chronic Diseases: The increasing prevalence of chronic diseases is driving the demand for minimally invasive surgeries.

Product Type Analysis

In 2023, the Minimally Invasive Surgical Instruments Market saw significant growth across various segments. This analysis focuses on the major segments, providing insights into their market positions and contributions.

- Handheld Instruments: Capturing more than a 23.6% share, handheld instruments held a dominant market position. Their ease of use and versatility in various surgical procedures largely contributed to this segment’s growth. Advances in ergonomic design and material technology further propelled their adoption in diverse surgical settings.

- Inflation Devices: Inflation devices, essential for endoscopic and laparoscopic surgeries, experienced steady market growth. Their role in providing controlled inflation for better visibility and access during surgeries underlines their importance. Innovations in device precision and safety mechanisms are key drivers for this segment.

- Surgical Scopes: The surgical scopes segment, comprising endoscopes, laparoscopes, and other specialized scopes, has shown a significant upward trend. Their critical role in providing visual access to internal body parts during minimally invasive procedures positions them as indispensable tools in modern surgery.

- Cutting Instruments: This segment includes advanced scissors, blades, and other cutting devices. Their development, focusing on precision and minimal tissue damage, has made them integral to minimally invasive surgeries. Ongoing enhancements in material durability and sharpness are vital factors influencing their market demand.

- Guiding Devices: Guiding devices such as catheters and wires have become more prevalent due to their crucial role in navigating through narrow or difficult anatomical pathways. The focus on enhancing flexibility and control of these devices has led to their increased adoption.

- Electrosurgical & Electrocautery Instruments: These instruments are pivotal in coagulation and tissue dissection, marked by their high efficiency and reduced blood loss. Continuous technological advancements, such as improved heat control and precision, have bolstered their market position.

- Other Instruments: This broad category includes various specialized instruments like clamps, graspers, and retractors. Their tailored designs for specific surgical needs have made them essential in the minimally invasive surgical toolkit.

Each segment within the Minimally Invasive Surgical Instruments Market plays a unique and crucial role. Their collective growth is reflective of the increasing preference for minimally invasive surgical techniques, driven by advancements in medical technology and a growing emphasis on patient safety and recovery time reduction.

Application Analysis

In 2023, the Minimally Invasive Surgical Instruments Market witnessed considerable growth across various applications. This segment-wise analysis offers insights into their market standings and contributions.

- Orthopedics: Commanding more than a 24.2% share, the orthopedic segment held a dominant market position. This growth is attributed to the increasing demand for minimally invasive procedures in joint replacements and spine surgeries, driven by an aging population and rising sports injuries.

- Cardiac: The cardiac segment experienced robust growth due to advancements in minimally invasive cardiac surgeries, like valve replacements and bypass surgeries. The focus on reducing recovery time and complications has escalated its market appeal.

- Gastrointestinal: This segment, integral for procedures like endoscopies and colonoscopies, saw significant growth. The rising prevalence of gastrointestinal disorders and the shift towards early detection and minimally invasive treatments contributed to its market expansion.

- Vascular: Vascular surgery witnessed a steady market increase, driven by the growing incidence of vascular diseases and the adoption of less invasive methods for procedures like angioplasty and stenting.

- Gynecological: In gynecology, minimally invasive techniques for procedures like hysterectomies and fibroid removals have gained traction. This shift aims at reducing hospital stays and enhancing recovery, thereby fueling market growth.

- Urological: The urological segment, focusing on treatments for urinary tract and kidney disorders, has benefited from the adoption of minimally invasive techniques, emphasizing patient comfort and reduced recovery time.

- Thoracic: Minimally invasive methods in thoracic surgeries, especially for lung and esophageal conditions, have seen an uptick. This is due to their effectiveness in reducing postoperative pain and complications.

- Cosmetic: The cosmetic surgery segment has embraced minimally invasive techniques, focusing on aesthetic enhancements with shorter recovery periods. This approach has broadened its market appeal.

- Dental: Dental surgeries using minimally invasive instruments have gained popularity, particularly in implantology and periodontal treatments. The focus on patient comfort and precision drives this segment’s growth.

- Other Applications: This category includes various specialized applications like neurosurgery and ENT surgeries. Their growth is propelled by the continuous development of specialized instruments tailored for specific surgical needs.

Each application within the Minimally Invasive Surgical Instruments Market plays a pivotal role in its overall growth. The market’s expansion is reflective of the increasing preference for minimally invasive techniques across various medical specialties, driven by technological advancements and a heightened focus on patient outcomes and recovery.

End-Use Analysis

In 2023, the Minimally Invasive Surgical Instruments Market experienced significant developments across different end-use segments. Here’s an analysis of these segments, highlighting their market positions and contributions.

- Hospitals: Holding a dominant position with over a 71.8% share, hospitals were the primary end-users of minimally invasive surgical instruments. This high market share can be attributed to the comprehensive range of surgeries performed in hospitals, coupled with their advanced infrastructure and capacity to invest in cutting-edge surgical technologies. The availability of diverse specialties under one roof also plays a key role in their market dominance.

- Clinics: Clinics, especially those specializing in specific surgical procedures, have shown steady growth in the adoption of minimally invasive surgical instruments. Although their market share is smaller compared to hospitals, their significance is rising due to the growing preference for outpatient surgeries, which offer cost-effectiveness and convenience. Clinics are increasingly investing in specialized minimally invasive tools to enhance their service offerings.

- Ambulatory Surgical Centers (ASCs): ASCs have witnessed notable growth in the market. Their focus on providing day surgeries, which are less invasive and require shorter recovery times, aligns well with the advantages of minimally invasive surgical instruments. ASCs cater to a growing segment of patients seeking quick, efficient, and cost-effective surgical procedures, thus, driving their market growth.

Each end-use segment within the Minimally Invasive Surgical Instruments Market plays a crucial role, with hospitals leading due to their extensive capabilities and patient volume. However, the growing trends towards outpatient surgeries and specialized care are bolstering the importance of clinics and ASCs in Minimally Invasive Surgical Instruments market. The overall market growth reflects an increasing shift towards minimally invasive procedures, underpinned by advancements in medical technology and patient-centric approaches.

Кеу Маrkеt Ѕеgmеntѕ

Product Type

- Handheld Instruments

- Inflation Devices

- Surgical Scopes

- Cutting Instruments

- Guiding Devices

- Electrosurgical & Electrocautery Instruments

- Other Instruments

Application

- Cardiac

- Gastrointestinal

- Orthopedic

- Vascular

- Gynecological

- Urological

- Thoracic

- Cosmetic

- Dental

- Other Applications

End-use

- Hospitals & Clinics

- Ambulatory Surgical Centers

Drivers

- Benefits Over Traditional Surgery: Minimally invasive surgeries (MIS) are preferred over traditional open surgeries due to less trauma, quicker recovery, reduced scarring, and shorter hospital stays. These advantages increase the demand for MIS instruments.

- Chronic Diseases Increase: The rise in chronic diseases like heart conditions, cancer, and orthopedic issues boosts the need for less invasive surgeries, driving the market for specialized MIS instruments.

Opportunities

- Technological Advances: Continuous innovations in surgical tools, like smaller devices, improved imaging, and robotic systems, open up opportunities for new product development and market growth.

- Collaboration and Market Expansion: Increasing partnerships and acquisitions among market players, along with the entry of new companies, are expected to expand the market further.

Restraints

- High Costs and Supply Chain Issues: The expensive nature of MIS instruments and supply chain disruptions pose challenges to market growth. Additionally, limited technology access in developing regions and insufficient infrastructure can hinder market expansion.

- Regulatory Hurdles: Delays in FDA approvals and the need for more clinical data increase investment requirements and slow down the market growth.

Trends

- Increased Use in Various Surgeries: MIS is becoming more effective in a wide range of surgeries, including those for breast and abdominal cancers, and neurological procedures. Its rapid healing makes it often preferred over open surgery.

- Virtual Reality Enhancements: The use of Virtual Reality in operating rooms improves the visualization and handling of tissues, leading to more precise surgeries.

- Growth in Ambulatory Surgical Centers: The rise of Ambulatory Surgical Centers, especially in the US, and their adoption of advanced robotics for complex cases create significant market opportunities.

- Product Launches by Market Leaders: Major players like Medtronic and Abbott are releasing new, robotic-assisted products, pushing forward the market’s technological boundaries.

Regional Analysis

North America

In 2023, North America holds a commanding presence in the Minimally Invasive Surgical Instruments Market, accounting for a 32.49% share with a valuation of USD 10.3 billion. This dominance is attributed to advanced healthcare infrastructure, widespread adoption of technologically advanced surgical procedures, and a high prevalence of chronic diseases in the region. The Organization for Economic Cooperation and Development (OECD) reported that per capita healthcare spending in the United States is higher than in any other country in the world. Patients in the U.S. can choose their treatment methods and providers. This will likely have a positive effect on North America’s MIS market. The Asia Pacific, on the other hand, is expected to grow fastest between 2023 and 2032.

Asia Pacific

The Asia Pacific region is projected to be the fastest-growing market during the forecast period. Factors driving this growth include:

- Rising Chronic Diseases: An increase in chronic health conditions necessitates more surgical interventions, boosting demand for minimally invasive procedures.

- Healthcare Infrastructure Expansion: The growing number of hospitals and medical professionals in the region enhances healthcare access and quality.

- Improved Affordability: Economic growth in the region is making advanced healthcare more accessible to a broader population.

- Large Patient Base: The vast patient pool undergoing surgical treatments, particularly in populous countries like China and India, drives the demand for minimally invasive surgical instruments.

- Medical Tourism: Asia Pacific is becoming a preferred destination for medical tourism, owing to its cost-effectiveness and quality healthcare services.

- Government Support: Favorable government policies and initiatives are encouraging advancements in healthcare sectors across the region.

- Adaptive Regulatory Policies: Compared to developed countries, the regulatory framework in the Asia Pacific is more flexible and conducive to business, attracting global market players to invest and expand in this region.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Minimally Invasive Surgical Instruments Market is marked by the presence of several notable players, contributing to a competitive and fragmented market landscape. These players are actively engaging in collaborations, strategic partnerships, and mergers & acquisitions, enhancing their market positions and expanding their global footprint.

- Medtronic: A leading player, known for strategic moves like its acquisition of Titan Spine in June 2019, strengthening its global standing in spine surgery solutions. Medtronic also collaborates with organizations like Vizient and BiointelliSense, focusing on expanding its product portfolio and enhancing patient monitoring technologies.

- Siemens Healthineers AG & GE Healthcare: These companies are recognized for their advancements in medical imaging and diagnostics, vital for minimally invasive surgeries.

- Johnson & Johnson Services: Through its subsidiaries like Ethicon, Inc. and Depuy Synthes, Johnson & Johnson has made significant contributions to the market, including the introduction of the ECHELON+Stapler in March 2021.

- Abbott: A key player in the market, Abbott offers innovative solutions like the IonicRF Generator for pain management, along with other minimally invasive devices.

Маrkеt Кеу Рlауеrѕ

- Medtronic

- Siemens

- Healthineer AG

- HOYA Corporation

- Ethicon, Inc. (Johnson & Johnson)

- Depuy Synthes

- GE Healthcare

- B. Braun Melsungen AG

- Abbott Laboratories

- Intutive Surgical, Inc.

- Nuvasive, Inc.

- Zimmer Biomet

- Other Key Players

Recent Development

- August 2023: VISEON Inc. announced the launch of its new AI-powered surgical navigation system for minimally invasive spine surgery.

- September 2022: Medtronic expanded its MI Spine Surgery Ecosystem with the next generation of spinal technologies, becoming the only organization to provide combined data (i.e., the combination of biologics, spinal implants, robotics, navigation, and AI-powered data) to surgeons worldwide.

- November 2021: Johnson & Johnson unveiled its new Robot-Assisted Surgical System for providing more control and flexibility in the minimally invasive surgery processes.

- October 2021: Stryker Corporation launched the Niagra Lateral Access System, expanding its lateral spine portfolio.

- September 2021: Medtronic acquired Titan Spine, a medical device company that specializes in minimally invasive spine surgery.

- March 2021: Johnson & Johnson announced the launch of ECHELON+ Stapler, a new minimally invasive stapling device for colorectal surgery.

Report Scope

Report Features Description Market Value (2023) USD 35.1 Billion Forecast Revenue (2033) USD 86.8 Billion CAGR (2023-2032) 10.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Handheld Instruments, Inflation Devices, Surgical Scopes, Cutting Instruments, Guiding Devices, Electrosurgical & Electrocautery, Instruments and Other Instruments) By Application (Cardiac, Gastrointestinal, Orthopedic, Vascular, Gynecological, Urological, Thoracic, Cosmetic, Dental and Other Applications) By End-use (Hospitals & Clinics and Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Siemens, Healthineer AG, HOYA Corporation, Ethicon, Inc. (Johnson & Johnson), Depuy Synthes, GE Healthcare, B. Braun Melsungen AG, Abbott Laboratories, Intutive Surgical, Inc., Nuvasive, Inc., Zimmer Biomet and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the minimally invasive surgical instruments market in 2023?The Minimally invasive surgical instruments market size is USD 35.1 Billion in 2023.

Q: What is the projected CAGR at which the Minimally invasive surgical instrument market is expected to grow at?The Minimally invasive surgical instrument market is expected to grow at a CAGR of 10.6% during the forecast period from 2023 to 2033.

Q: List the segments encompassed in this report on the Minimally invasive surgical instruments market?Market.US has segmented the Minimally invasive surgical instrument market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type (Handheld Instruments, Inflation Devices, Surgical Scopes, Cutting Instruments, Guiding Devices, Electrosurgical & Electrocautery, Instruments and Other Instruments) By Application (Cardiac, Gastrointestinal, Orthopedic, Vascular, Gynecological, Urological, Thoracic, Cosmetic, Dental and Other Applications) By End-use (Hospitals & Clinics and Ambulatory Surgical Centers)

Q: List the key industry players of the Minimally invasive surgical instruments market?Medtronic, Siemens, Healthineer AG, HOYA Corporation, Ethicon, Inc. (Johnson & Johnson), Depuy Synthes, GE Healthcare, B. Braun Melsungen AG, Abbott Laboratories, Intutive Surgical, Inc., Nuvasive, Inc., Zimmer Biomet and Other Key Players, and Other Key Players engaged in the Minimally Invasive Surgical Instrument market.

Minimally Invasive Surgical Instruments MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Minimally Invasive Surgical Instruments MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Siemens

- Healthineer AG

- HOYA Corporation

- Ethicon, Inc. (Johnson & Johnson)

- Depuy Synthes

- GE Healthcare

- B. Braun Melsungen AG

- Abbott Laboratories

- Intutive Surgical, Inc.

- Nuvasive, Inc.

- Zimmer Biomet

- Other Key Players