Global Microinsurance Market Size, Share, Industry Analysis Report By Product Type (Digital Timers, Analog Timers), By End-User Application (Household, Industrial, Healthcare, Educational), By Sales Channel (Online Retail, Offline Retail), By Functionality (Basic Timers, Advanced Timers), By Price Range (Budget, Mid-Range, Premium), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct. 2025

- Report ID: 160273

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Statistics by Product and Distribution

- Analysts’ Viewpoints

- Role of Generative AI

- China Market Size

- By Model Type

- By Product Type

- By Distribution Channel

- By End Use

- Key Market Segment

- Emerging Trends

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Player Analysis

- Recent Development

- Report Scope

Report Overview

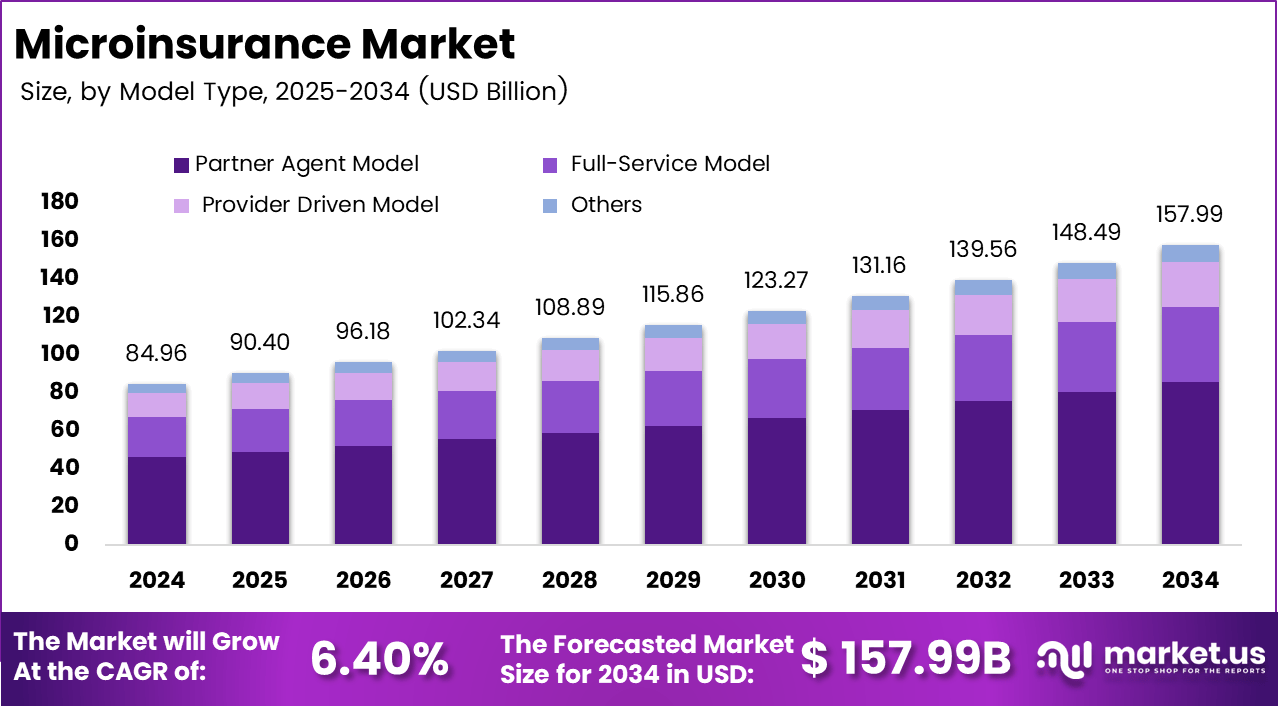

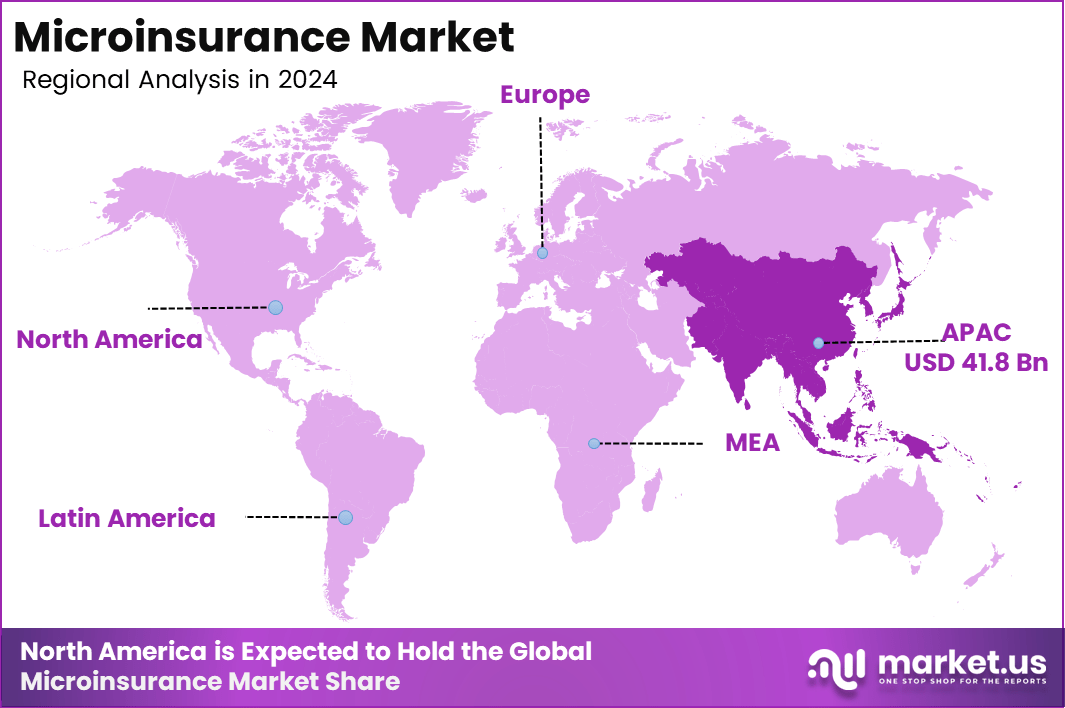

The Global Microinsurance Market size is projected to reach USD 157.99 Billion by 2034, growing from USD 84.96 Billion in 2024, at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, APAC is anticipated to hold a dominant market share, contributing to over 49.2% of the market revenue, which is estimated at USD 41.8 billion in the Asia-Pacific region.

The microinsurance market refers to insurance products designed specifically for low-income individuals, micro-entrepreneurs, informal workers and underserved populations. These products offer low-premium, low-coverage policies covering life, health, accidents, agriculture or property risks. The market operates through models adapted to the affordability and accessibility needs of target users rather than standard commercial insurance.

Top driving factors for the growth of microinsurance include rising financial inclusion efforts, increased mobile and internet penetration, and growing awareness of risk management in emerging economies. Governments and NGOs support microinsurance by promoting it as a way to protect low-income populations. Digitization through mobile apps and AI has boosted efficiency, with microinsurance coverage rising by about 70% in recent years due to better awareness and affordability.

Technologies like AI, blockchain, and automated claim processing are reducing costs and speeding up service delivery. For instance, AI-enabled crop damage assessments and blockchain-based transparent payouts are making microinsurance viable for smallholder farmers and other low-income groups. The demand is further fueled by partnerships between insurers and mobile operators, along with tailored insurance products that address local risk profiles.

Increasing adoption of technologies in microinsurance revolves around digital platforms such as mobile apps, AI for risk assessment and claims, blockchain for transparency, and data analytics to refine products. These technologies enable simplified onboarding, reduce paperwork, and help lower operational costs. The use of technology improves trust and transparency in insurance delivery, which is critical for populations that may have low trust in financial institutions.

Key Takeaways

- The Partner Agent Model led with 54.2%, reflecting strong collaborations between insurers and local partners to expand coverage reach.

- Life Insurance products accounted for 35.5%, driven by growing demand for affordable protection and financial security among low-income groups.

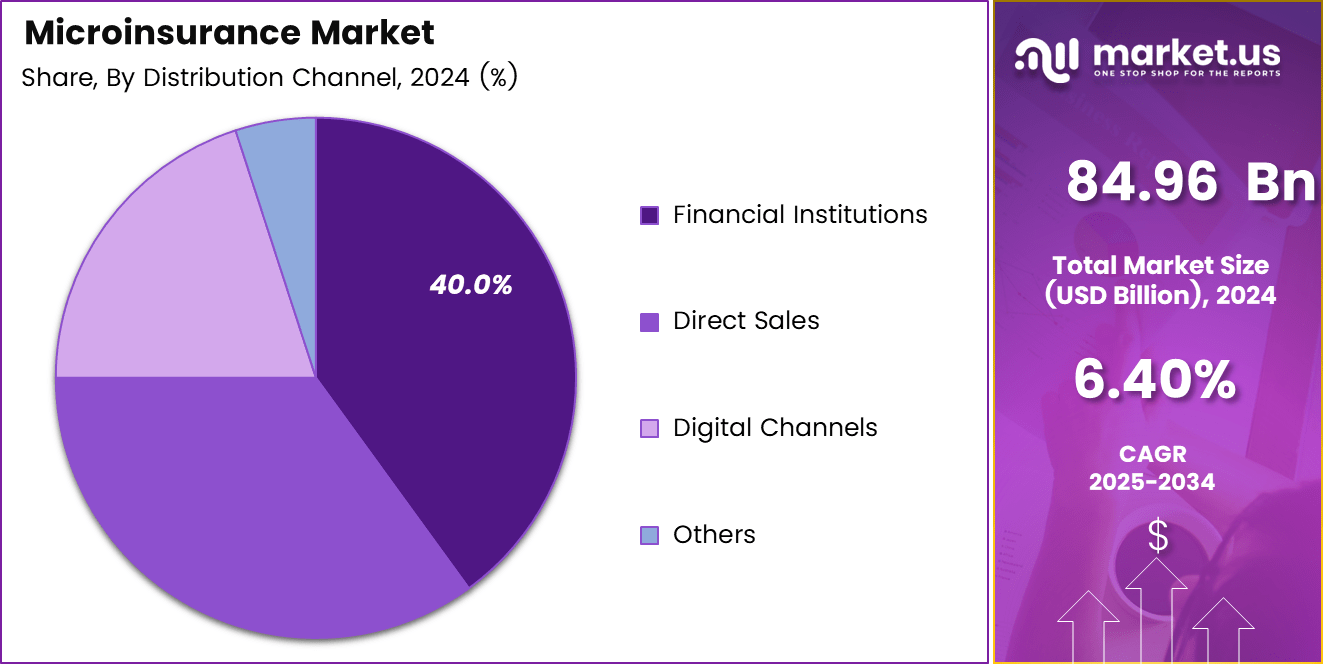

- Financial Institutions contributed 40% of total distribution, highlighting their role in building trust and ensuring accessibility through existing banking networks.

- Personal end-use dominated with 86.3%, showing that individual consumers remain the main target for microinsurance products.

- Asia-Pacific held 49.2% of the global market, supported by rising financial inclusion initiatives and expanding rural insurance programs.

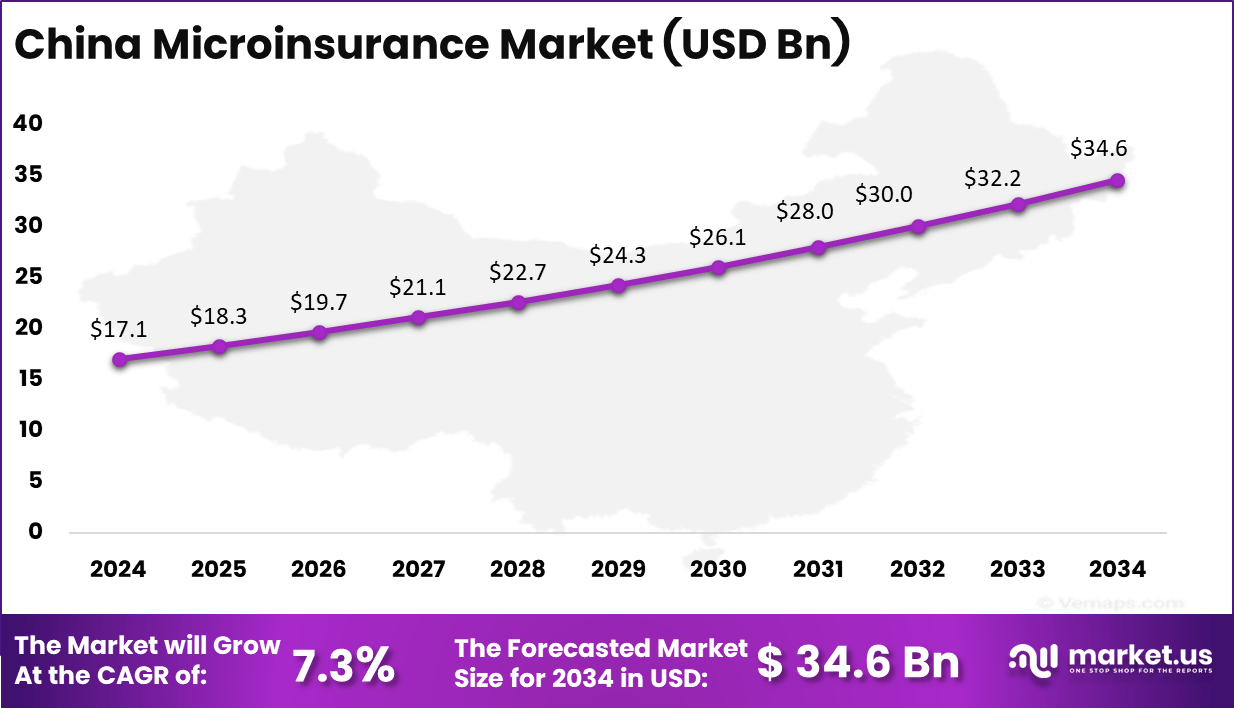

- China recorded USD 17.1 Billion in market value with a steady 7.3% CAGR, driven by digital distribution models and government-backed microinsurance frameworks.

Statistics by Product and Distribution

Life and Accident Insurance

Life and accident microinsurance held the leading position in 2024, accounting for 52% of total market revenue. For low-income households, life coverage remains a priority as it provides financial security to families in the event of death. This product category continues to serve as the foundation of microinsurance portfolios worldwide.

Health Insurance

Health microinsurance is positioned for notable growth, driven by the ongoing rise in global healthcare costs and the increasing demand for affordable healthcare access. For underserved populations, this segment represents a critical mechanism for protecting households against financial shocks from illness and hospitalization.

Distribution Channels

In 2024, agents and brokers generated the majority of sales, contributing 62% of overall distribution. Traditional channels remain vital due to personal trust and guidance offered by intermediaries. However, digital channels are expanding rapidly. Digital payments are projected to be the fastest-growing method, with an estimated 8.6% CAGR between 2025 and 2034, reflecting the shift toward financial inclusion and mobile-based accessibility.

Analysts’ Viewpoints

Investment opportunities in microinsurance are expanding as the market continues to grow with the backing of governments and private players. The sector attracts investments from multinational insurers and intermediaries focusing on scalable, profitable microinsurance models.

Investment in insurtech innovations supporting mobile delivery, AI, and blockchain is particularly promising. Emerging economies in Asia, Africa, and Latin America offer high potential due to large underserved markets and supportive regulatory environments that encourage inclusive insurance strategies.

Business benefits of microinsurance include tapping into a large, underserved customer base, enhancing corporate social responsibility, and contributing to financial inclusion goals. Insurers can diversify revenue streams and increase brand loyalty by offering affordable, relevant products to low-income groups. Flexible, low-cost insurance builds financial resilience in communities, reducing economic vulnerability.

Role of Generative AI

Microinsurance is rapidly evolving, and generative AI is playing a significant role in shaping its future. About 89% of insurers planned to invest in generative AI in 2025, with many dedicating budgets specifically for this technology. This investment is transforming microinsurance by enabling more personalized customer experiences, automating risk assessments, and speeding up claims processes.

AI-driven automation can enhance efficiency by up to 30%, enabling insurers to reach underserved groups at lower costs. Generative AI supports the creation of customized insurance products and improves accessibility for low-income customers, while AI chatbots and personalized communication have raised customer satisfaction by 81%.

Claims fraud detection and risk modeling have become more refined due to AI’s predictive capabilities, enhancing overall risk management for microinsurance providers. With nearly 70% of insurance professionals using generative AI weekly, the technology is becoming embedded in how microinsurance adapts to complex risks and diverse customer segments.

China Market Size

China, accounting for 17.1 billion in market value and growing at a 7.3% CAGR, demonstrates strong momentum through digital innovation. Its regulatory reforms prioritize insurance literacy and technology-driven micro policies. Rural protection schemes and digital distribution platforms continue to expand outreach, creating a strong foundation for sustainable market development.

The Microinsurance Market Regional Analysis for 2024 reveals a dynamic landscape with distinct regional contributions. The APAC region leads with a substantial market value of USD 41.8 billion, reflecting its significant share and growth potential, likely fueled by a large population and increasing insurance adoption. North America is expected to hold the global microinsurance market share, indicating its pivotal and possibly leading role, though specific financial figures are not detailed.

Europe maintains a moderate presence, contributing notably but falling short of APAC and North America’s dominance. The Middle East and Africa (MEA) and Latin America represent emerging markets with growing potential, as microinsurance accessibility continues to expand. North America’s projected leadership underscores its critical position, while APAC’s high valuation highlights its current market strength.

By Model Type

In 2024, The Partner Agent Model captures a 54.2% share of the microinsurance market, marking it as the most preferred model across emerging economies. It allows insurers to collaborate with trusted intermediaries such as local cooperatives, NGOs, or microfinance institutions. These partnerships help extend insurance accessibility to lower-income groups who often lack exposure to formal financial channels.

This model integrates personal connection, local trust, and community familiarity, making it ideal for rural and semi-urban coverage settings. Its strength lies in striking a balance between efficiency and affordability. Partner agents can educate customers directly, enabling better awareness and claim transparency.

The relatively low distribution cost adds to its scalability, as insurers minimize overhead while maximizing coverage. Continuous training and digital engagement tools for agents are now improving communication, ensuring consistency and clarity in customer interaction.

By Product Type

In 2024, Life insurance represents about 35.5% of the total microinsurance offerings. The demand arises from individuals seeking financial stability during unforeseen life events, especially in regions without formal social security systems. The simplicity of micro life policies – often with limited paperwork and quick claim disbursal – makes them more approachable for first-time buyers.

Financial inclusion programs and savings-linked insurance products have further reinforced this demand. At a community level, micro life insurance complements health and agricultural risk covers, forming a holistic protection net.

The steady expansion of mobile platforms enables quick premium payments and policy renewals. As awareness grows, insurers are focusing on transparent terms and better claim communication. This ensures families view micro life insurance as a long-term financial safeguard, rather than a short-term expense.

By Distribution Channel

Financial institutions hold around 40% of the distribution base in microinsurance. Their established credibility and broad customer relationships enable seamless product integration. Banks, credit cooperatives, and microfinance networks provide both the reach and infrastructure to deliver insurance products efficiently. By bundling microinsurance with other financial offerings, institutions help lower acquisition costs and improve service consistency.

Partnerships between insurers and banks have strengthened since digital platforms increased ease of access and payment. These institutions also help with underwriting data through their credit history records, improving risk management accuracy. As a result, policy lapses decrease and long-term trust grows. The institutional approach now acts as a bridge between insurers and the underserved, ensuring practical coverage at low administrative cost.

By End Use

The personal segment, with an 86.3% market share, emphasizes the growing recognition of financial protection among individuals. For many low-income earners, microinsurance represents the first step toward formal risk coverage. Demand is particularly strong among agricultural workers, daily wage laborers, and self-employed individuals who face inconsistent incomes. These users seek affordable protection against health crises or income loss.

In rural markets, awareness campaigns and social benefit programs have deepened trust in personal microinsurance. Technology-driven channels – such as mobile-based policy issuance – are reshaping how individuals access coverage instantly. The combination of low-cost digital solutions and human assistance through local partners strengthens customer confidence. As adoption rises, the personal line continues to fuel industry-wide inclusion goals.

Key Market Segment

By Model Type

- Partner Agent Model

- Full-Service Model

- Provider Driven Model

- Others

By Product Type

- Life Insurance

- Health Insurance

- Property Insurance

- Agriculture (Crop & Livestock) Insurance

- Others

By Distribution Channel

- Direct Sales

- Financial Institutions

- Digital Channels

- Others

By End-Use

- Business

- Personal

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Emerging Trends

- Digital Transformation: AI, machine learning, and blockchain streamline underwriting, claims, and fraud detection, boosting Digital Channels’ growth.

- Embedded Insurance: Insurance integrated into platforms like e-commerce or ride-sharing apps enhances accessibility.

- Personalization: Big data tailors policies, especially for Personal insurance 86.3% market share, meeting individual needs.

- Climate-Driven Products: Agriculture Insurance rises with climate risks, with parametric models gaining traction.

- Telematics and IoT: Usage-based insurance grows in auto and health, using real-time device data for pricing.

- Cyber Insurance Surge: Increased demand for cyber coverage within Others due to rising digital threats.

- Financial Institution Dominance: Financial Institutions’ 40% share drives growth via bundled insurance products.

Top 5 Use Cases

- Life Insurance for Financial Security: Life Insurance 35.5% market share provides payouts to beneficiaries, ensuring financial stability for families, especially in the Personal segment 86.3%.

- Health Insurance for Medical Coverage: Covers hospital stays and preventive care, addressing rising healthcare costs for individuals.

- Property Insurance for Asset Protection: Safeguards homes and belongings against risks like fire or theft, critical for personal consumers.

- Agriculture Insurance for Climate Risks: Protects farmers from crop and livestock losses due to extreme weather, increasingly vital with climate change.

- Cyber Insurance for Digital Threats: Offers coverage against data breaches and cyberattacks, growing within the Others category for businesses and individuals.

Driver Analysis

Growing Demand from Low-Income Populations

The microinsurance market is fundamentally driven by the increasing demand for affordable insurance solutions among low-income populations, especially in emerging economies. These communities often face financial vulnerability due to limited access to traditional insurance products.

Microinsurance offers a reasonably priced risk protection option that caters to their needs, supported by mobile platforms and government initiatives. This demand is further boosted by financial inclusion programs aiming to bring underserved groups into the formal insurance landscape.

Additionally, technological advances such as mobile apps and AI-based risk assessment have improved policy accessibility and distribution, making it easier for low-income individuals to obtain insurance coverage. This democratization of insurance enhances resilience for populations that are prone to economic shocks, natural disasters, and health emergencies.

Restraint Analysis

Low Awareness and Financial Literacy

Despite the growing demand, one significant restraint to microinsurance market growth is the widespread lack of awareness and financial literacy among target populations. Many potential customers do not fully understand the benefits and workings of insurance products, leading to reluctance or mistrust in purchasing microinsurance. This knowledge gap limits market penetration and hinders widespread adoption.

Designing microinsurance products that both meet diverse local needs and remain operationally efficient is complex. Highly customized products increase costs and complicate underwriting, while overly standardized approaches risk irrelevance to specific communities. Additionally, insufficient data on customer behaviors and risk patterns restricts the industry’s ability to tailor products effectively, creating barriers to achieving scalable growth.

Opportunity Analysis

Technological Innovation in Distribution and Claims

Microinsurance presents a significant opportunity through the integration of new technologies in distribution and claims management. Digital platforms, especially mobile money systems, have revolutionized how policies are purchased and claims are settled, reducing friction and increasing convenience for customers. Mobile-based claims submission accelerates processing times and expands reach to remote or rural areas.

Furthermore, innovations like blockchain for transparency, AI for fraud detection, and data analytics for precise risk assessment make microinsurance more efficient and trustworthy. These technological improvements lower operational costs and enhance customer experience, enabling insurers to scale services while maintaining affordability.

Challenge Analysis

Regulatory Complexity and Infrastructure Gaps

A key challenge in the microinsurance sector is navigating the complex regulatory landscape while building the necessary infrastructure to support growth. Regulatory requirements vary widely across regions and sometimes create hurdles in product approval, customer onboarding, and claims settlement.

Ensuring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations can be particularly burdensome for microinsurance providers targeting low-income populations. Moreover, infrastructure limitations, such as insufficient digital connectivity and low smartphone penetration in certain areas, restrict access to digital insurance platforms.

Without robust infrastructure, many prospective users remain unreachable, and scaling operations becomes difficult. Overcoming these regulatory and infrastructural challenges is essential for unlocking the full potential of microinsurance, especially in developing markets where financial inclusion remains a priority.

SWOT Analysis

Strengths

- Leading Market Segments: Life Insurance (35.5%) and Personal Insurance (86.3%) drive demand for financial protection.

- Reliable Distribution: Financial Institutions hold a 40% share, using trusted bank networks to reach customers.

- Strong Premium Growth: Global premiums grew significantly in 2024, with life insurance showing robust increases.

- High Customer Retention: Established channels maintain strong loyalty, with most customers staying despite cost rises.

- Varied Product Range: Offers life, health, property, and agriculture insurance, meeting diverse consumer needs.

Weaknesses

- Rising Policy Costs: Higher medical and repair expenses make coverage less affordable for many families.

- Limited Reach in Some Markets: Rural or underserved areas have low insurance uptake, slowing growth.

- Retention Struggles: High prices in risky regions cause some customers to switch or drop policies.

- Slow Claims Processes: Complicated claims handling frustrates clients, weakening trust in brands.

- Digital Adoption Gaps: Some insurers struggle to fully use online tools, falling behind competitors.

Opportunities

- Growing Digital Platforms: Online apps attract younger buyers, boosting sales in digital channels.

- Insurance in Everyday Apps: Adding coverage to shopping or ride-sharing platforms appeals to convenience seekers.

- Tailored Policy Options: Data-driven custom plans could improve profits and customer satisfaction.

- Climate-Focused Coverage: Agriculture insurance grows as weather risks increase, especially for new models.

- Cyber Protection Demand: Rising digital risks fuel need for cyber insurance in niche markets.

Threats

- Extreme Weather Losses: Frequent storms and wildfires create massive claim costs, straining budgets.

- Tighter Regulations: New rules on data and sustainability add compliance challenges for insurers.

- Economic Pressures: Inflation reduces consumer budgets for insurance, slowing market growth.

- Digital Competition: Tech-driven startups offer faster, cheaper options, challenging traditional firms.

- Higher Reinsurance Costs: Rising rates in risky areas cut into insurer profits, limiting expansion.

Key Player Analysis

The Microinsurance Market is led by global insurance and financial giants such as Allianz SE, AXA SA, Zurich Insurance Group, and American International Group (AIG). These companies offer microinsurance products that provide affordable risk coverage for low-income individuals and small enterprises, particularly in developing economies.

Regional leaders such as Bajaj Allianz Life Insurance, SBI Life Insurance, ICICI Prudential Life Insurance, Ping An Insurance, MAPFRE SA, Manulife Financial, Prudential plc, and Sun Life Financial are expanding microinsurance offerings in Asia-Pacific and Latin America. Their focus on rural outreach, health coverage, and agricultural protection schemes supports financial inclusion and strengthens resilience among underserved populations.

Specialized and mission-driven providers such as Blue Marble Microinsurance, BIMA (Milvik), MicroEnsure (Turaco), Britam Holdings, Pioneer Life (Philippines), Banco do Nordeste do Brasil, and CLIMBS Life & General Insurance Co-op, along with other key players, are leveraging mobile platforms, community networks, and AI-based risk assessment tools to enhance accessibility.

Top key players

- Allianz SE

- AXA SA

- Zurich Insurance Group

- American International Group (AIG)

- Hollard Insurance Company

- Bajaj Allianz Life Insurance

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Ping An Insurance

- MAPFRE SA

- Manulife Financial

- Prudential plc

- Sun Life Financial

- Blue Marble Microinsurance

- BIMA (Milvik)

- MicroEnsure (Turaco)

- Britam Holdings

- Pioneer Life (Philippines)

- Banco do Nordeste do Brasil

- CLIMBS Life & General Insurance Co-op

- Others

Recent Development

- In January 2024, MicroEnsure launched its agricultural insurance product, ‘Kisan Shield,’ in collaboration with local cooperatives across India. The initiative provides protection against crop failure and livestock mortality, targeting coverage for over one million farmers by 2026.

- In March 2024, AXA XL entered a strategic partnership with the World Food Programme (WFP) to deliver microinsurance to smallholder farmers in Africa. This collaboration aims to safeguard farmers from weather-related risks and income loss, with a goal of reaching 500,000 farmers within three years.

Report Scope

Report Features Description Market Value (2024) USD 84.96 Bn Forecast Revenue (2034) USD 157.9 Bn CAGR(2025-2034) 6.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Model Type (Partner Agent Model, Full-Service Model, Provider Driven Model, Others), By Product Type (Life Insurance, Health Insurance, Property Insurance, Agriculture (Crop & Livestock) Insurance, Others), By Distribution Channel (Direct Sales, Financial Institutions, Digital Channels, Others), By End-Use (Business, Personal) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA SA, Zurich Insurance Group, American International Group (AIG), Hollard Insurance Company, Bajaj Allianz Life Insurance, SBI Life Insurance, ICICI Prudential Life Insurance, Ping An Insurance, MAPFRE SA, Manulife Financial, Prudential plc, Sun Life Financial, Blue Marble Microinsurance, BIMA (Milvik), MicroEnsure (Turaco), Britam Holdings, Pioneer Life (Philippines), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Allianz SE

- AXA SA

- Zurich Insurance Group

- American International Group (AIG)

- Hollard Insurance Company

- Bajaj Allianz Life Insurance

- SBI Life Insurance

- ICICI Prudential Life Insurance

- Ping An Insurance

- MAPFRE SA

- Manulife Financial

- Prudential plc

- Sun Life Financial

- Blue Marble Microinsurance

- BIMA (Milvik)

- MicroEnsure (Turaco)

- Britam Holdings

- Pioneer Life (Philippines)

- Banco do Nordeste do Brasil

- CLIMBS Life & General Insurance Co-op

- Others