Global Micro-Mobility Market Size, Share, Growth Analysis By Vehicle Type (Electric Scooters, Electric Bikes, Kick Scooters, E-Skateboards, Electric Mopeds), By Service Type (Shared Services, Owned Services), By End-User (Commuters, Tourists, Delivery Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138570

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

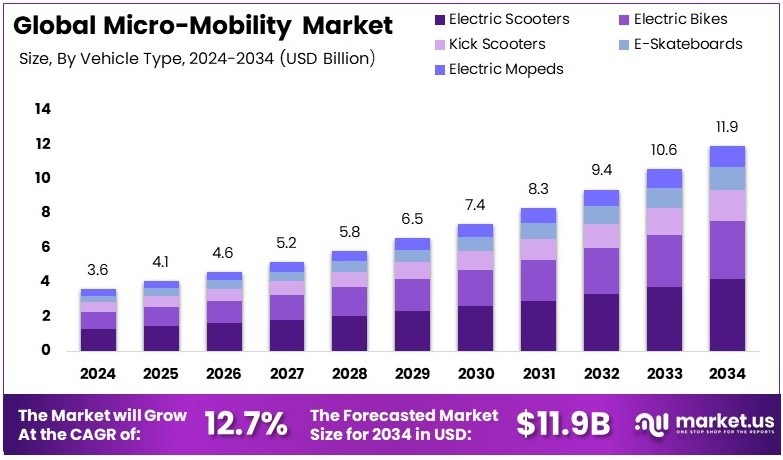

The Global Micro-Mobility Market size is estimated to reach USD 11.9 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 12.7% during 2025–2034.

Micro-mobility refers to small, lightweight vehicles like e-scooters, bicycles, and e-bikes used for short trips. These vehicles are often shared or rented and provide an efficient, eco-friendly solution for urban transportation and last-mile connectivity.

The micro-mobility market covers the production, distribution, and operation of small electric or manual vehicles. It serves city residents, tourists, and businesses looking for affordable and sustainable travel options for short distances.

According to the Bureau of Transportation Statistics (BTS), as of June 30, 2024, the U.S. has 60 dockless bikeshare and 194 e-scooter systems operational outside of restricted areas like college or employer campuses. This number indicates a decrease from previous years, suggesting a phase of market consolidation. Despite this contraction, these micro-mobility solutions remain vital for enhancing urban transit options, providing convenient and accessible transportation for short urban trips.

The consolidation in micro-mobility systems signifies a maturing market, where competition leads to the survival of the most efficient and well-integrated services. The need for sustainable, convenient and smart transportation options continues to grow, particularly in densely populated urban areas.

According to the World Bank, about 56% of the global population now lives in urban areas, a number expected to rise to nearly 70% by 2050. These urban centers, which generate more than 80% of the world’s GDP, are under increasing pressure to provide efficient transportation solutions that can reduce both congestion and environmental impact.

In response, governments are investing heavily in infrastructure to support this transition. For example, Reuters reports that the Indian government’s upcoming federal budget plans to allocate between 2.9 to 3 trillion rupees for railway modernization. This significant investment aims to expand and modernize the existing 68,000 km railway network and introduce 400 high-speed Vande Bharat trains by March 2027, enhancing urban mobility and reducing traffic congestion in rapidly growing cities.

Key Takeaways

- Micro-Mobility Market was valued at USD 3.6 Billion in 2024, and is expected to reach USD 11.9 Billion by 2034, with a CAGR of 12.7%.

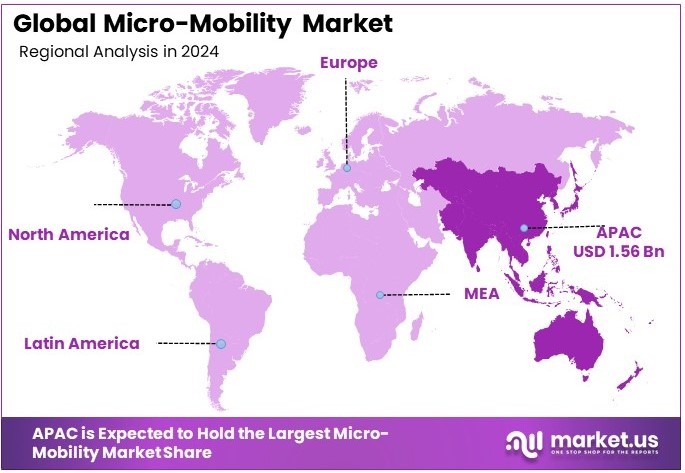

- In 2024, Asia Pacific holds the dominant region with 43.2% and USD 1.56 Billion, driving market expansion.

- In 2024, Electric Scooters dominate the vehicle type segment with 48.6% due to their popularity in urban areas.

- In 2024, Shared Services lead the service type segment with 62.3% owing to cost-effective transportation solutions.

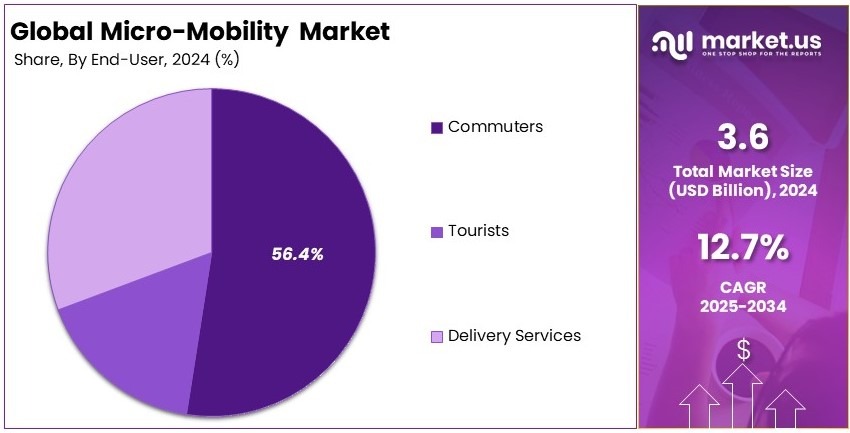

- In 2024, Commuters are the primary end-users with 56.4% because of daily travel needs.

- In 2024, Electric Bikes account for 30.4% of the vehicle type, offering sustainable mobility options.

Vehicle Type Analysis

Electric Scooters dominate with 48.6% due to their widespread adoption in urban areas.

Electric scooters have emerged as the dominant vehicle type in the Micro-Mobility Market, accounting for 48.6% of the market share. This is mainly because they are widely used in urban settings where traffic congestion and environmental concerns make them an appealing alternative to traditional cars.

Electric scooters are compact, affordable, and provide a quick way to navigate through crowded city streets. They are increasingly seen as a solution to “last-mile” transportation, offering a fast and eco-friendly way to travel short distances, particularly in metropolitan areas. Cities are also integrating electric scooters into their public transportation networks to provide commuters with a convenient option for completing their journeys.

Other vehicles such as electric bikes, kick scooters, e-skateboards, and electric mopeds contribute to the market but occupy smaller shares. Electric bikes are also gaining popularity, particularly in places where users may need to travel longer distances or prefer a more comfortable ride.

While they hold a smaller share compared to scooters, electric bikes have seen growth in commuter segments, especially for those who need to carry goods or navigate longer routes. Kick scooters, while often more affordable, are still primarily used by younger individuals or for casual short-distance trips.

E-skateboards, on the other hand, are more niche but continue to attract enthusiasts who enjoy their portability and agility. Electric mopeds are expected to grow but are currently overshadowed by the demand for electric scooters and bikes, as they generally have higher costs and require more complex maintenance.

Service Type Analysis

Shared Services dominate with 62.3% due to the rise of scooter-sharing programs.

Shared services represent the largest service type in the Micro-Mobility Market, holding a significant 62.3% share. This dominance is primarily driven by the growing popularity of scooter-sharing programs, which have become a common feature in cities worldwide.

Companies like Lime, Bird, and Spin have launched successful platforms that allow users to rent electric scooters for short trips, eliminating the need for ownership. These services are particularly appealing to individuals who do not need a scooter on a daily basis but want access to one whenever necessary. Shared mobility services provide flexibility, cost-effectiveness, and convenience, making them a favored choice for many users, particularly those in densely populated urban areas.

The success of shared services is closely tied to the increasing trend toward “mobility as a service” (MaaS), where cities are embracing shared transportation options to reduce congestion and pollution. These platforms have quickly become a mainstream mode of transport in places like San Francisco, Paris, and Berlin, with millions of rides taken each year.

On the other hand, owned services, which represent the remaining 37.7% of the market, are growing, though not as rapidly. Many individuals are purchasing their own electric scooters, especially as prices for these vehicles continue to decrease.

While owning a scooter eliminates the need to pay per ride, it also requires maintenance and charging, which some people find inconvenient. The owned service model is still attractive for regular commuters who use their scooter daily and want the freedom of not relying on shared services.

End User Analysis

Commuters dominate with 56.4% due to the need for daily, convenient transportation.

Commuters are the largest end-user group in the Micro-Mobility Market, accounting for 56.4% of the market share. This is largely because electric scooters, bikes, and other forms of micro-mobility provide an ideal solution for daily commuting, particularly in cities where traffic congestion and limited parking make car use less desirable.

Commuters prefer electric scooters and bikes because they are fast, easy to use, and require minimal effort. Unlike public transport, micro-mobility vehicles do not rely on fixed routes or schedules, offering more freedom for users. Additionally, many commuters are increasingly choosing eco-friendly transport options as they become more aware of environmental issues.

Tourists represent another key end-user segment, though they account for a smaller share of the market at 24.2%. Tourists often use electric scooters and bikes for sightseeing, especially in cities where these vehicles are readily available for rent. These services allow tourists to explore destinations more easily than on foot and without the need for a car rental. While tourists contribute significantly to the revenue generated by micro-mobility services, their impact is seasonal and often limited to high-tourist areas.

Delivery services make up the smallest segment at 19.4%, but they are growing rapidly. Delivery companies are increasingly using electric bikes and scooters for last-mile deliveries, particularly in densely populated urban environments. These vehicles are perfect for making quick deliveries, avoiding traffic, and reducing the carbon footprint of delivery operations.

Key Market Segments

By Vehicle Type

- Electric Scooters

- Electric Bikes

- Kick Scooters

- E-Skateboards

- Electric Mopeds

By Service Type

- Shared Services

- Owned Services

By End-User

- Commuters

- Tourists

- Delivery Services

Driving Factors

Rising Demand for Sustainable and Convenient Urban Mobility

The Micro-Mobility Market is experiencing robust growth driven by the increasing demand for sustainable urban transportation solutions. As cities become more congested, commuters are seeking eco-friendly alternatives to traditional vehicles. Electric bikes and scooters offer zero-emission travel, appealing to environmentally conscious individuals who aim to reduce their carbon footprint.

Additionally, the expansion of urban infrastructure to support light mobility vehicles is significantly contributing to market growth. Cities are investing in dedicated bike lanes, scooter paths, and parking zones to accommodate the rising number of micro-mobility users.

The growth in popularity of first and last mile transportation is another key driver. Micro-mobility solutions bridge the gap between public transportation hubs and final destinations, providing a seamless and efficient travel experience.

Supportive government initiatives and funding for eco-friendly transit play a crucial role in propelling the Micro-Mobility Market forward. Governments are implementing policies that promote the use of electric bikes and scooters through subsidies, tax incentives, and grants. These financial incentives make micro-mobility options more affordable and accessible to a broader population.

Restraining Factors

Safety and Regulatory Challenges Limit Market Growth

Despite the promising growth, the Micro-Mobility Market faces several challenges that may restrain its expansion. Safety concerns due to inadequate riding paths and infrastructure remain a significant hurdle. In many cities, the lack of dedicated lanes for bikes and scooters increases the risk of accidents, deterring potential users from adopting micro-mobility solutions.

Regulatory and legal challenges across different jurisdictions also pose obstacles to market growth. Each city or region may have its own set of rules regarding the operation, parking, and usage of micro-mobility vehicles. Navigating these varied regulations can be complex and resource-intensive for service providers, limiting their ability to expand uniformly.

High initial setup and operational costs for service providers further restrict market expansion. Establishing a fleet of electric bikes and scooters involves substantial investment in purchasing vehicles, setting up charging stations, and maintaining the fleet.

Competition from traditional public transportation and new mobility services also restrains the growth of the Micro-Mobility Market. Established public transit systems like buses and trains, as well as emerging services like ride-sharing and car rentals, offer alternative transportation options that can compete with micro-mobility solutions.

Growth Opportunities

Technological Innovations and Strategic Partnerships Offer Growth Avenues

The Micro-Mobility Market is ripe with opportunities driven by technological advancements and strategic collaborations. Integration of IoT and connectivity solutions for fleet management is a significant growth opportunity. IoT-enabled devices allow for real-time tracking of vehicles, efficient fleet management, and data collection on usage patterns.

Partnerships with urban developers to enhance infrastructure compatibility present another promising avenue. Collaborating with city planners and construction firms ensures that micro-mobility vehicles are seamlessly integrated into new and existing urban landscapes.

The development of innovative business models, such as vehicle subscription services, offers enhanced customer retention and revenue streams. Subscription-based models allow users to pay a monthly or annual fee for unlimited access to bikes and scooters, providing convenience and cost savings.

Expansion into smaller towns and residential communities is another significant opportunity. While urban areas are the primary markets for micro-mobility, smaller towns and suburban regions present untapped potential. These areas often lack efficient public transportation options, making micro-mobility a practical solution for local commuters.

Emerging Trends

Technological Advancements and Sustainable Practices Are Latest Trending Factors

Several emerging trends are shaping the future of the Micro-Mobility Market, driving its evolution and adoption. The surge in the use of e-bikes and electric scooters among all age groups is a notable trend. These electric-powered vehicles offer ease of use, longer ranges, and lower environmental impact, making them appealing to a diverse demographic.

Deployment of AI and machine learning for traffic management and route optimization is another cutting-edge trend. These technologies analyze traffic patterns, predict demand, and optimize routes for micro-mobility vehicles, enhancing efficiency and reducing wait times for users. AI-driven solutions also help in maintaining the fleet by predicting maintenance needs and minimizing downtime, ensuring a reliable service for customers.

Increasing corporate social responsibility (CSR) initiatives towards green mobility are also influencing the market. Companies are recognizing the importance of sustainable practices and are investing in micro-mobility solutions as part of their CSR strategies. By promoting the use of eco-friendly transportation options, businesses contribute to environmental conservation and enhance their brand image.

Customization and personalization of micro-mobility devices cater to individual preferences and enhance user satisfaction. Offering options to customize bikes and scooters with different colors, accessories, and performance features allows users to express their personal style and meet their specific needs.

Regional Analysis

Asia Pacific Dominates with 43.2% Market Share

Asia Pacific leads the Micro-Mobility Market, holding a dominant 43.2% share valued at USD 1.56 billion. This leadership is driven by the region’s rapid urbanization, high population density, and increasing demand for cost-effective transportation. Countries like China, India, and Japan are at the forefront, adopting micro-mobility solutions to address traffic congestion and reduce pollution.

Key factors include Asia Pacific’s growing focus on sustainable urban transport. Government initiatives promoting eco-friendly mobility and the expansion of shared services like bike and scooter rentals have boosted market growth. For example, China’s extensive network of bike-sharing platforms, including Mobike and Ofo, has revolutionized short-distance travel. Similarly, India’s focus on electric two-wheelers has encouraged the adoption of affordable and efficient micro-mobility options.

The region’s market dynamics reflect the challenges and opportunities of its dense urban landscapes. Micro-mobility solutions are ideal for navigating crowded cities where traditional vehicles face limitations. Moreover, the affordability of shared services has made these options accessible to a wide demographic, including students, workers, and tourists. Technological advancements, such as app-based rentals and integrated payment systems, have further enhanced the convenience of these services.

Regional Mentions:

- North America: North America holds a strong position in the market, driven by high disposable incomes and tech-driven innovations. Cities like Los Angeles and New York have embraced e-scooters and bike-sharing programs to reduce traffic congestion.

- Europe: Europe is a key player, focusing on sustainability and green mobility. Countries like France and the Netherlands lead the market with widespread adoption of shared micro-mobility services.

- Middle East & Africa: The region is growing steadily as smart city projects and tourism fuel demand for micro-mobility. Cities like Dubai are investing in electric scooters and bikes to enhance urban mobility.

- Latin America: Latin America is emerging in the market, with countries like Mexico and Brazil adopting bike-sharing programs. Efforts to modernize transportation and address pollution are driving growth in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Micro-Mobility Market is dominated by Bird, Lime, Spin, and Tier Mobility, which lead through innovation, extensive operations, and customer-focused services. These companies are reshaping urban transportation by offering eco-friendly and efficient mobility solutions.

Bird, a pioneer in e-scooter sharing, has established a strong presence in global markets. The company’s focus on sustainability and technology-driven fleet management sets it apart. Bird’s partnerships with cities ensure compliance with local regulations, making its services reliable and widely accessible.

Lime operates one of the largest networks of shared bikes and scooters worldwide. Its seamless app-based service and commitment to sustainability have gained it a loyal user base. Lime’s strategic expansions and investments in electric bikes make it a key player in urban micro-mobility.

Spin, backed by Ford, leverages advanced safety features and smart mobility technology to offer user-friendly micro-mobility solutions. Spin’s focus on integrating with public transportation systems and prioritizing safety has strengthened its position in competitive markets.

Tier Mobility emphasizes sustainability and innovation, leading in Europe’s micro-mobility sector. The company’s eco-friendly approach, such as introducing recyclable batteries, aligns with global trends toward greener transportation. Tier Mobility’s expansion into various cities and partnerships with local governments ensure its strong market presence.

These companies continuously innovate by integrating IoT and AI into their services, enhancing fleet management and user convenience. Their strategies focus on addressing urban challenges such as congestion and pollution, making them leaders in the growing micro-mobility market. As demand for shared and electric mobility solutions rises, these key players are expected to drive further growth and innovation in the industry.

Major Companies in the Market

- Bird

- Lime

- Spin

- Tier Mobility

- Voi Technology

- Helbiz

- Bolt

- Uber Technologies Inc.

- Lyft Inc.

- DiDi Bike

- Beam Mobility

- Circ

- Yulu Bikes

- Wind Mobility

- Scoot Networks

Recent Developments

- Lime: On July 2024, Lime reported nearly 156 million global trips in 2023, reflecting significant growth in its micromobility services. To further boost accessibility, Lime introduced two new models: the LimeBike, featuring pedal assistance and a throttle, and the LimeGlider, a sit-down scooter without pedals. These models aim to appeal to a broader range of riders, including women and older individuals, and were piloted in Atlanta and Zurich, with full production expected by 2025.

- Segway: On January 2025, Segway unveiled several new products at CES 2025, including two e-bikes, the Xyber and Xafari, and the GT3 Pro scooter, which can reach speeds of up to 49.7 mph. These new offerings demonstrate Segway’s commitment to advancing the micro-mobility space with enhanced performance and innovative designs.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 11.9 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Electric Scooters, Electric Bikes, Kick Scooters, E-Skateboards, Electric Mopeds), By Service Type (Shared Services, Owned Services), By End-User (Commuters, Tourists, Delivery Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bird, Lime, Spin, Tier Mobility, Voi Technology, Helbiz, Bolt, Uber Technologies Inc., Lyft Inc., DiDi Bike, Beam Mobility, Circ, Yulu Bikes, Wind Mobility, Scoot Networks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bird

- Lime

- Spin

- Tier Mobility

- Voi Technology

- Helbiz

- Bolt

- Uber Technologies Inc.

- Lyft Inc.

- DiDi Bike

- Beam Mobility

- Circ

- Yulu Bikes

- Wind Mobility

- Scoot Networks