Global Micro Electric Vehicle Market Size, Share, Growth Analysis By Type (Quadricycle, Golf Carts), By Battery Type (Lithium-ion Battery, Lead Acid Battery), By Vehicle Application (Commercial Use, Public Utilities, Personal Use), By Region and Companies

- Published date: May 2025

- Report ID: 148077

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

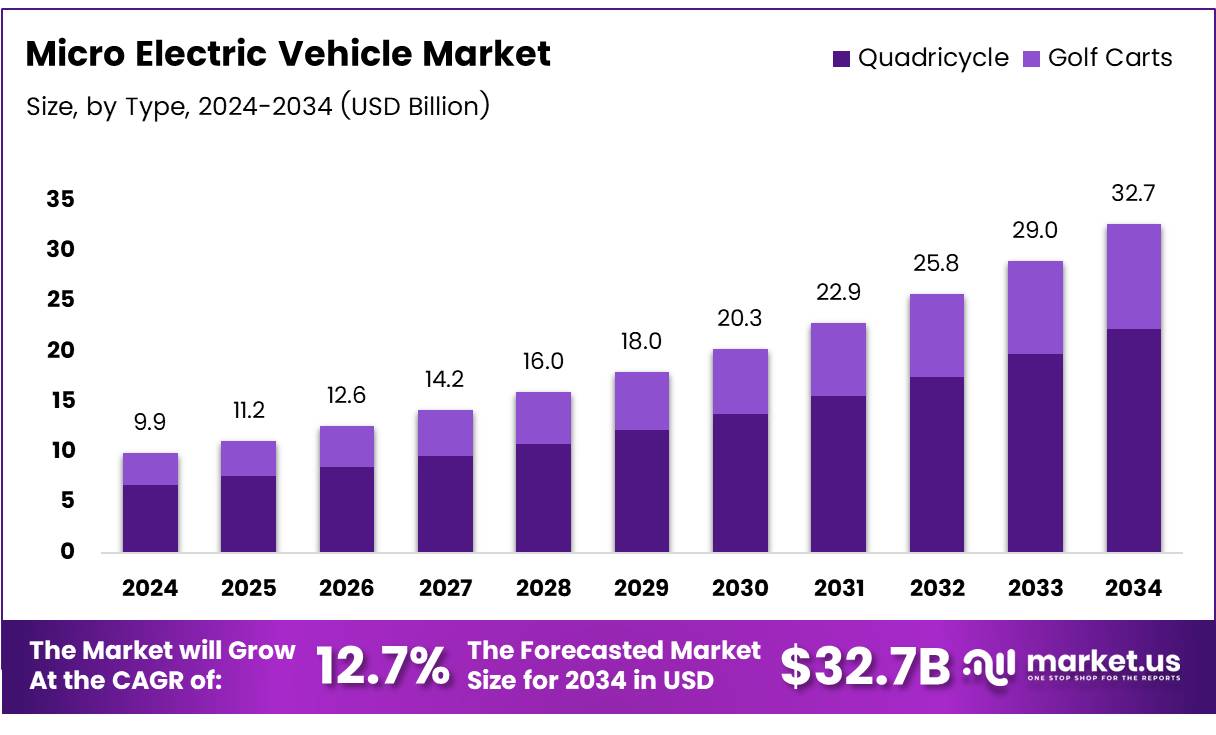

The Global Micro Electric Vehicle Market size is expected to be worth around USD 32.7 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

The Micro Electric Vehicle (MEV) market refers to compact, lightweight electric vehicles designed for short urban commutes, typically characterized by reduced size and speed compared to traditional electric cars. These vehicles cater to the growing demand for sustainable, efficient transportation solutions in congested urban environments. Micro electric vehicles, also known as quadricycles, are gaining popularity due to their low environmental impact, cost-effectiveness, and ease of use in traffic-heavy cities.

The global Micro Electric Vehicle market is poised for significant growth. According to Vanfleetworld, average congestion levels have risen by 9% year-on-year, reaching 20.4% in 2024, signaling an increasing demand for compact and efficient modes of transport.

Additionally, as driving speeds decline, with average speeds dropping from 37.3 mph in 2023 to 36.7 mph in 2024, urban commuters are seeking more efficient alternatives like MEVs to navigate traffic more effectively. This shift presents a major opportunity for the micro electric vehicle market to cater to the growing demand for urban mobility solutions.

Government support plays a crucial role in the development and adoption of micro electric vehicles. Various countries are introducing favorable regulations and incentives to promote electric mobility, including tax breaks, subsidies, and funding for EV infrastructure.

Governments are also tightening regulations around emissions and vehicle efficiency, further accelerating the demand for environmentally friendly alternatives like MEVs. For example, countries in Europe are actively promoting green transportation options, and the increasing investment in EV infrastructure will significantly boost the adoption of MEVs in urban areas.

Micro electric vehicles, particularly electric mini-vehicles or quadricycles, represented less than 0.2% of electric car sales globally in 2023, with approximately 25,000 units sold, according to VML. However, in Europe, this figure was slightly higher, accounting for 0.8% of electric vehicle sales.

This segment, though still in its nascent stage, is expected to grow as consumer preferences shift towards affordable, energy-efficient, and compact transportation options. With urban congestion on the rise, the market for these vehicles will continue to expand, driven by both consumer demand and supportive regulatory frameworks.

Key Takeaways

- Global Micro Electric Vehicle Market projected to reach USD 32.7 Billion by 2034 from USD 9.9 Billion in 2024, growing at a CAGR of 12.7%.

- Quadricycle segment dominated the market By Type in 2024, with a 60.2% share.

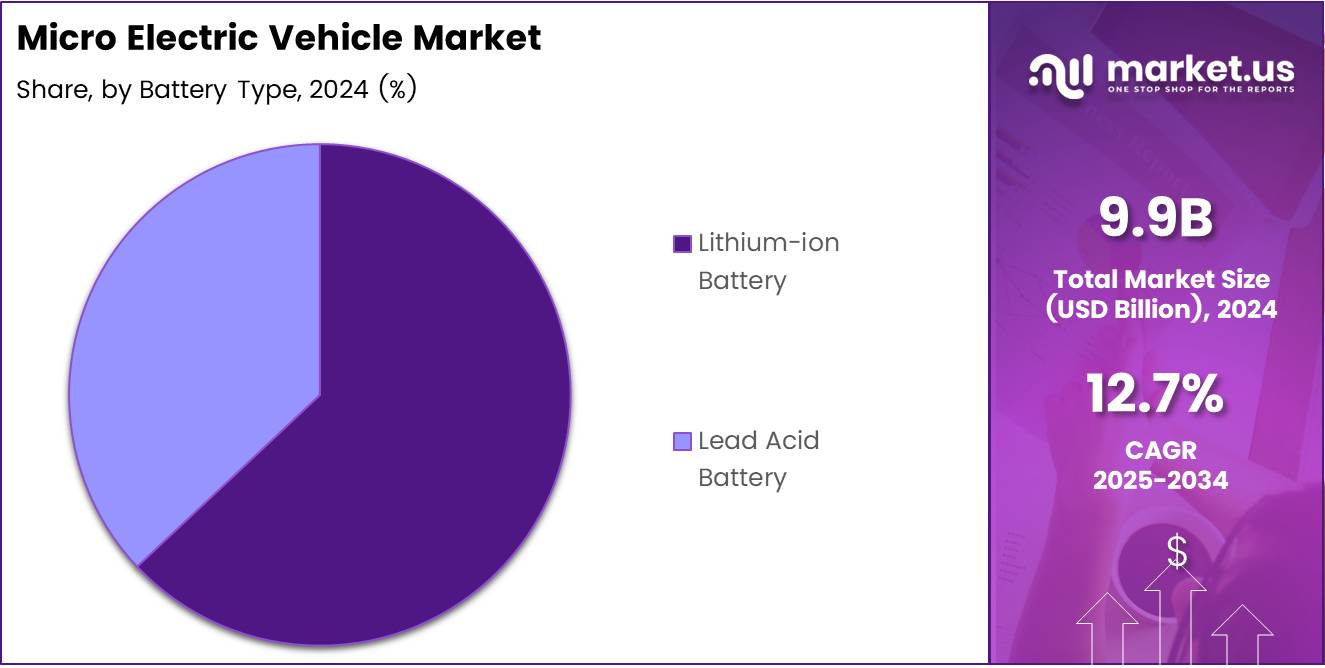

- Lithium-ion Battery held the leading position By Battery Type in 2024.

- Commercial Use dominated the Vehicle Application segment in 2024.

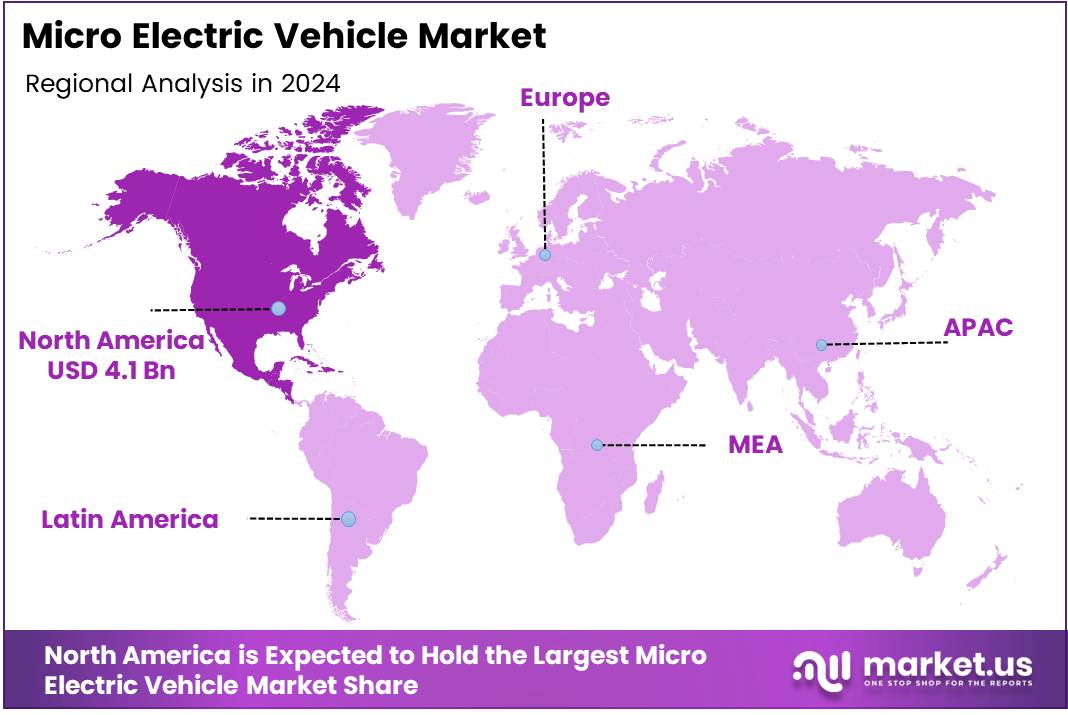

- North America led the global market with 40.7% share, valued at USD 4.1 Billion in 2024.

Type Analysis

Quadricycles lead the market with 60.2% share due to compact design and urban suitability

In 2024, Quadricycle held a dominant market position in the By Type Analysis segment of the Micro Electric Vehicle Market, with a 60.2% share.

Quadricycles have gained popularity owing to their compact design, energy efficiency, and suitability for dense urban areas. They offer a balance between convenience and cost, making them attractive for short-distance commuting and shared mobility solutions. This segment benefits significantly from urbanization trends and rising demand for eco-friendly transport in congested cities.

Golf carts, while still relevant in specialized environments like resorts, golf courses, and gated communities, remain a niche offering in the broader micro electric vehicle ecosystem. Their limited utility and speed constrain their adoption for general mobility. However, they continue to maintain a steady demand in recreational and utility-based applications.

The dominance of quadricycles in this segment is also driven by increased regulatory support and consumer preference for affordable and compact electric transport. The adaptability of quadricycles for both personal and light commercial use further enhances their appeal in developed and emerging economies.

Battery Type Analysis

Lithium-ion Batteries dominate due to superior energy density and long lifecycle benefits

In 2024, Lithium-ion Battery held a dominant market position in the By Battery Type Analysis segment of the Micro Electric Vehicle Market.

Lithium-ion batteries are the preferred choice for micro electric vehicles due to their high energy density, lightweight nature, and longer lifespan. These attributes contribute significantly to improving vehicle range and performance, aligning with the increasing demand for efficient and sustainable urban transport solutions.

Manufacturers continue to adopt lithium-ion technology as it offers faster charging capabilities and lower maintenance requirements compared to alternatives. This trend is especially prominent in urban fleets and personal micro-mobility solutions.

Lead acid batteries, while more cost-effective, are generally heavier and offer shorter life cycles. As a result, their market presence is slowly declining, particularly in premium or high-usage micro electric vehicles. However, they remain in use for low-cost applications and markets where upfront affordability outweighs long-term performance.

Vehicle Application

Commercial Use leads due to widespread utility and operational cost benefits

In 2024, Commercial Use held a dominant market position in the By Vehicle Application Analysis segment of the Micro Electric Vehicle Market.

Commercial use of micro electric vehicles has surged due to growing demand for last-mile delivery, fleet operations, and intra-facility transport in industrial zones and campuses. Their low operating cost, compact form, and reduced emissions make them ideal for frequent short trips, especially in urban environments.

Businesses increasingly prioritize sustainability and cost-efficiency, pushing micro EVs into roles traditionally filled by gas-powered small vehicles. The rise in e-commerce and logistics industries has further bolstered this trend, making commercial adoption of micro EVs a key growth driver.

Public utilities, including municipal transport and maintenance services, are also adopting micro electric vehicles for tasks like patrolling, waste collection, and maintenance, though the scale remains smaller compared to commercial sectors.

Personal use lags slightly behind due to varying regulatory frameworks, limited awareness in some regions, and competition from other micro-mobility solutions such as e-scooters and bikes. Nonetheless, as cities develop EV-friendly infrastructure, personal adoption is expected to grow steadily.

Key Market Segments

By Type

- Quadricycle

- Golf Carts

By Battery Type

- Lithium-ion Battery

- Lead Acid Battery

By Vehicle Application

- Commercial Use

- Public Utilities

- Personal Use

Drivers

Urbanization and Traffic Congestion Fuel Demand for Micro Electric Vehicles

The increasing population in cities is making roads more crowded, which boosts the need for smaller, more maneuverable vehicles. Micro electric vehicles (micro EVs) are ideal for navigating congested urban environments.

These compact vehicles require less space for parking and help reduce overall traffic flow. As more people move to cities, especially in developing countries, the demand for efficient transport alternatives like micro EVs continues to grow. Their size and ease of handling make them attractive for short commutes and daily errands in dense urban settings.

Governments worldwide are offering various benefits to encourage the use of electric micro-mobility solutions. These include tax rebates, financial incentives, and favorable regulations that make micro EVs more affordable. By promoting cleaner transportation options, policymakers aim to reduce emissions and traffic-related issues. These supportive policies are encouraging both manufacturers and consumers to invest in micro EVs, making the market more vibrant.

Another strong advantage of micro EVs is their low operating and maintenance costs. Unlike traditional fuel vehicles, micro EVs use electricity, which is cheaper than gasoline or diesel. They also have fewer moving parts, reducing the need for regular repairs and servicing.

Restraints

Limited Range and Battery Life Constrain Market Growth

One of the major challenges for micro electric vehicles is their limited driving range. Most micro EVs can only travel short distances before needing a recharge, which is a problem for users who need to cover more ground. This range limitation restricts their use mainly to city travel and short commutes, reducing their appeal for broader transportation needs. Until battery technology improves, this will continue to be a key barrier to mass adoption.

Another significant restraint is the lack of adequate charging infrastructure. In many areas, especially in semi-urban or newly developing regions, public charging stations are hard to find. This creates inconvenience for users who might run out of charge during a trip. The fear of not finding a charging point makes many potential buyers hesitant to switch from traditional vehicles to micro EVs. To unlock the full potential of this market, large-scale investments in charging networks are crucial.

Growth Factors

Fleet Electrification by Delivery Services Opens New Growth Channels

Micro EVs are gaining popularity among logistics and delivery companies focused on sustainable last-mile delivery. These small, efficient vehicles are perfect for navigating tight city roads while reducing carbon footprints.

Companies see them as a cost-effective way to meet their green goals and reduce fuel expenses. As e-commerce continues to grow, the need for quick, eco-friendly delivery solutions is driving investment in micro EV fleets. This shift is expected to significantly boost market demand.

The integration of IoT and smart features in micro EVs is creating fresh opportunities for innovation. Advanced technologies like GPS tracking, app-based control, and real-time diagnostics improve both convenience and safety. These smart features attract tech-savvy users who want more control over their vehicles. As the digital transformation of transportation grows, manufacturers that offer smart-enabled micro EVs are likely to see rising demand.

There is also growing interest in micro EVs in smaller towns and cities. Urbanization in Tier-II and Tier-III cities is creating a need for affordable, compact transportation. These areas, often overlooked by traditional car makers, represent untapped market segments. As infrastructure improves in these regions, micro EV adoption is expected to accelerate, providing manufacturers with new growth opportunities.

Emerging Trends

Rise of Subscription-Based Micro EV Services Boosts Market Adoption

Subscription-based models are changing the way people access micro EVs. Instead of buying a vehicle outright, many users prefer monthly rental or pay-per-use plans. This flexible approach reduces the financial burden and makes micro EVs accessible to a wider audience, including students and urban professionals. Startups and mobility providers are leveraging this trend to grow their customer base and increase usage in busy cities.

Design customization and visual appeal are becoming key factors in attracting younger buyers. Consumers today want vehicles that reflect their personality and style. Micro EV manufacturers are responding with colorful, sleek designs and personalization options. This trend is especially strong among Gen Z and millennials, who value aesthetics as much as functionality. Offering unique design features helps brands differentiate themselves in a crowded market.

Shared mobility platforms are also driving demand for micro EVs. Urban areas are seeing a rise in shared fleets of electric bikes, scooters, and compact cars. These services offer convenience without the long-term commitment of ownership. As city dwellers prioritize sustainability and flexibility, shared micro-mobility becomes an attractive solution. This trend is expected to support steady growth in the micro EV segment.

Regional Analysis

North America Dominates the Micro Electric Vehicle Market with a Market Share of 40.7%, Valued at USD 4.1 Billion

North America leads the global micro electric vehicle market, accounting for 40.7% of the total market share, valued at USD 4.1 billion. The region’s growth is driven by strong consumer demand for sustainable mobility solutions, government incentives for electric vehicles, and a robust charging infrastructure. Urban populations and tech-savvy consumers continue to influence adoption rates positively.

Regional Mentions:

Europe follows as a significant contributor to the market, supported by stringent emission regulations and increased focus on reducing urban congestion. Countries in Western Europe are especially proactive in EV integration, leveraging smart mobility initiatives and public-private partnerships to drive micro EV usage.

Asia Pacific is witnessing rapid growth due to the rising urban population and government initiatives promoting electric mobility. Countries such as China and India are investing heavily in EV infrastructure and manufacturing, making the region a fast-emerging hub for micro electric vehicles.

The Middle East & Africa region shows steady development, primarily driven by the UAE and South Africa, where smart city initiatives and renewable energy integration are fostering EV adoption. However, infrastructural and economic challenges remain a limiting factor in broader market expansion.

Latin America presents gradual growth potential, with countries like Brazil and Mexico starting to adopt EV-friendly policies. While infrastructure development is still at an early stage, increasing environmental awareness and urban mobility issues are prompting interest in micro electric vehicles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global micro electric vehicle market continues to evolve rapidly, with several key players shaping its trajectory through innovation, strategic positioning, and market expansion.

Yamaha Motor remains a significant player, leveraging its legacy in compact mobility solutions to advance its electric vehicle offerings. The company’s focus on integrating performance and sustainability makes its micro EV lineup appealing in both urban and recreational segments.

Club Car, traditionally known for golf carts and light-duty vehicles, is adapting well to the urban mobility shift. With recent expansions into compact electric transportation, it is positioning itself as a reliable option for last-mile solutions and gated communities.

GEM (Waev Inc.) continues to stand out in the low-speed vehicle market, emphasizing safety, utility, and urban design. Its vehicles cater well to city-based applications such as campus commuting and light cargo transport, helping it maintain a strong foothold in North America.

Micro Mobility System AG (Microlino) offers a unique blend of retro design and modern electric technology, capturing attention across Europe. Its compact, stylish vehicles are especially well-suited to dense urban environments, where space efficiency and zero emissions are paramount.

Together, these companies are responding to increasing regulatory pressure, sustainability goals, and consumer demand for compact, efficient transportation. Their diverse strategies—from leveraging established platforms to introducing design-driven urban vehicles—underscore a dynamic and highly competitive landscape in the micro electric vehicle sector. As infrastructure improves and city policies evolve, these key players are likely to remain at the forefront of this mobility revolution.

Top Key Players in the Market

- Yamaha Motor

- Club Car

- GEM (Waev Inc.)

- Micro Mobility System AG (Microlino)

- ICON Electric Vehicles

- Citroen

- Nissan Motor

- Toyota Motor Corporation

- Eli Electric Vehicles

- Polaris

Recent Developments

- In Mar 2025, Rivian spinout Also launched with $105 million in funding, aiming to develop compact electric vehicles tailored for urban environments. The startup plans to target last-mile delivery and personal urban mobility markets.

- In Nov 2024, Bajaj Finance secured a $400 million loan from the International Finance Corporation (IFC) to accelerate electric vehicle adoption in India. The funding will support consumer financing for two- and three-wheeler EV purchases.

- In Jan 2025, Swobbee and its consortium partners were awarded $3.7 million in federal funding to develop micromobility infrastructure. The initiative focuses on deploying standardized parking and battery charging hubs in urban areas.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 32.7 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Quadricycle, Golf Carts), By Battery Type (Lithium-ion Battery, Lead Acid Battery), By Vehicle Application (Commercial Use, Public Utilities, Personal Use) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Yamaha Motor, Club Car, GEM (Waev Inc.), Micro Mobility System AG (Microlino), ICON Electric Vehicles, Citroen, Nissan Motor, Toyota Motor Corporation, Eli Electric Vehicles, Polaris Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Micro Electric Vehicle MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Micro Electric Vehicle MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Yamaha Motor

- Club Car

- GEM (Waev Inc.)

- Micro Mobility System AG (Microlino)

- ICON Electric Vehicles

- Citroen

- Nissan Motor

- Toyota Motor Corporation

- Eli Electric Vehicles

- Polaris