mHealth Market Analysis By Component (Wearables (BP Monitors, Glucose Meters, Pulse Oximeters, Sleep Apnea Monitors (PSG), Neurological Monitors, Activity Trackers/ Actigraphs), mHealth Apps (Medical Apps (Women's Health, Personal Health Record Apps, Medication Management Apps, Disease Management Apps, Diagnostic Apps, Remote Monitoring Apps, Others), Fitness Apps (Exercise & Fitness, Diet & Nutrition , Lifestyle & Stress)), By Service (Monitoring Services( Independent Aging Solutions, Chronic Disease Management & Post-acute Care Services), Diagnosis Services( Healthcare Systems Strengthening Services, Others)), By Participants (Mobile Operators, Device Vendors, Content Players, Healthcare Providers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 35818

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

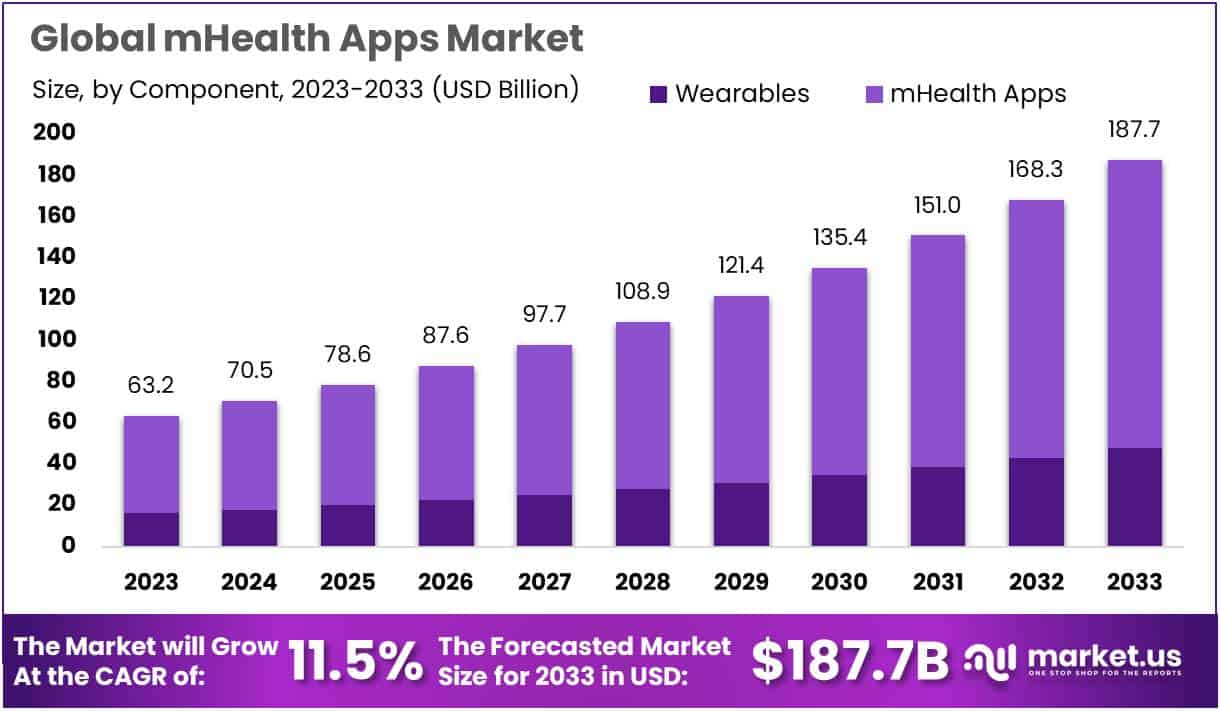

The Global mHealth Market size is expected to be worth around US$ 187.7 Billion by 2033, from US$ 63.2 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

MHealth, also known as mobile health, harnesses the power of mobile phones and wireless technology to enhance healthcare. Its primary use is to educate individuals about preventive health services, but it offers a broader range of applications. It aids in disease surveillance, treatment support, tracking epidemics, and managing chronic illnesses. MHealth is gaining popularity, especially in underserved regions with a high mobile phone user base. Nonprofits like the mHealth Alliance are advocating for its expansion in the developing world.

One of the significant advantages of mHealth is its convenience. It allows users to track and manage health data continuously without frequent doctor visits. With a vast selection of mobile health apps available, accessibility and personal health management have greatly improved. MHealth facilitates remote communication between patients and healthcare providers, promoting seamless care coordination. Some apps can even integrate with electronic health records, making health information easily accessible on mobile devices.

However, mHealth faces challenges, including potential privacy concerns, as not all apps adhere to strict data protection regulations. Additionally, some apps may provide inaccurate information, which can lead to false confidence in self-management, potentially discouraging users from seeking proper medical care. Careful consideration and scrutiny are necessary when using health apps.

Key Takeaways

- Market Growth: mHealth market is projected to grow at a CAGR of 11.5%, reaching US$ 187.7 billion by 2032 from US$ 63.2 billion in 2023.

- App Dominance: mHealth Apps held a substantial 74.4% market share in 2023, driving healthcare innovation.

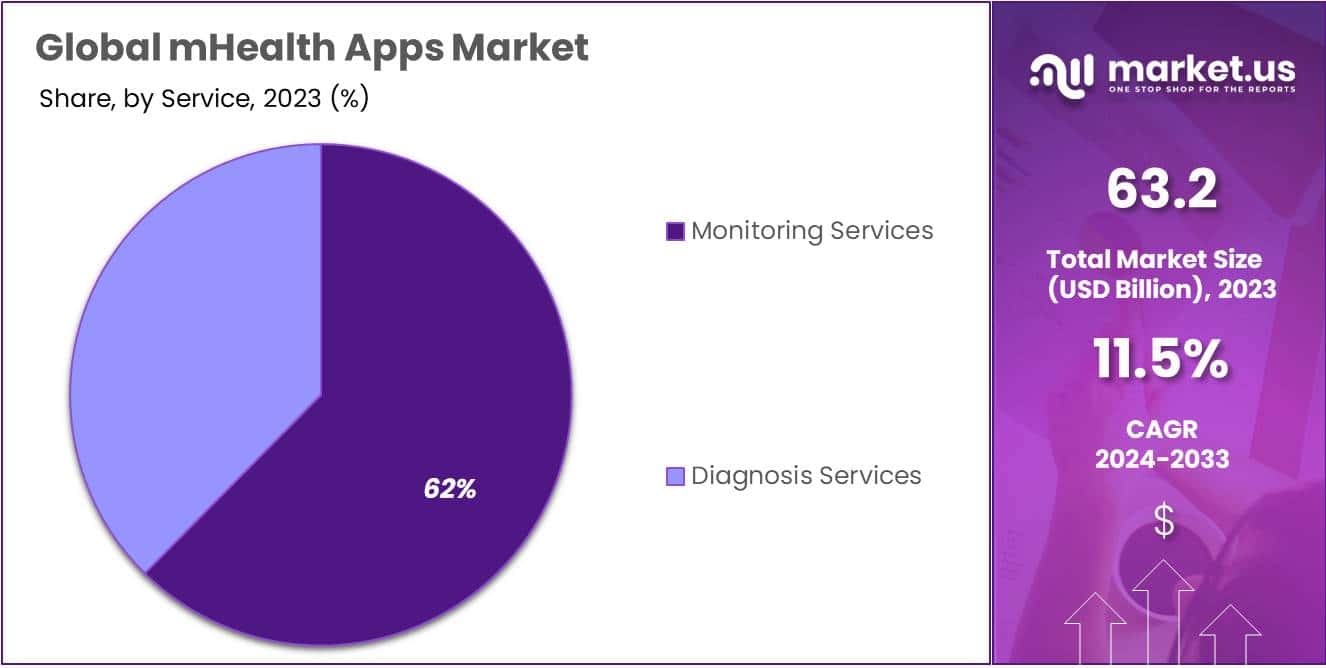

- Service Leadership: Monitoring services accounted for over 62.4% of the market share, offering real-time health tracking.

- Key Participants: Mobile Operators led with 47.2% market share, followed by Device Vendors, Content Players, and Healthcare Providers.

- Smartphone Proliferation: Widespread smartphone adoption contributed to mHealth growth, enhancing healthcare access.

- Data Security Concerns: Data security worries and regulatory compliance act as significant restraints to mHealth adoption.

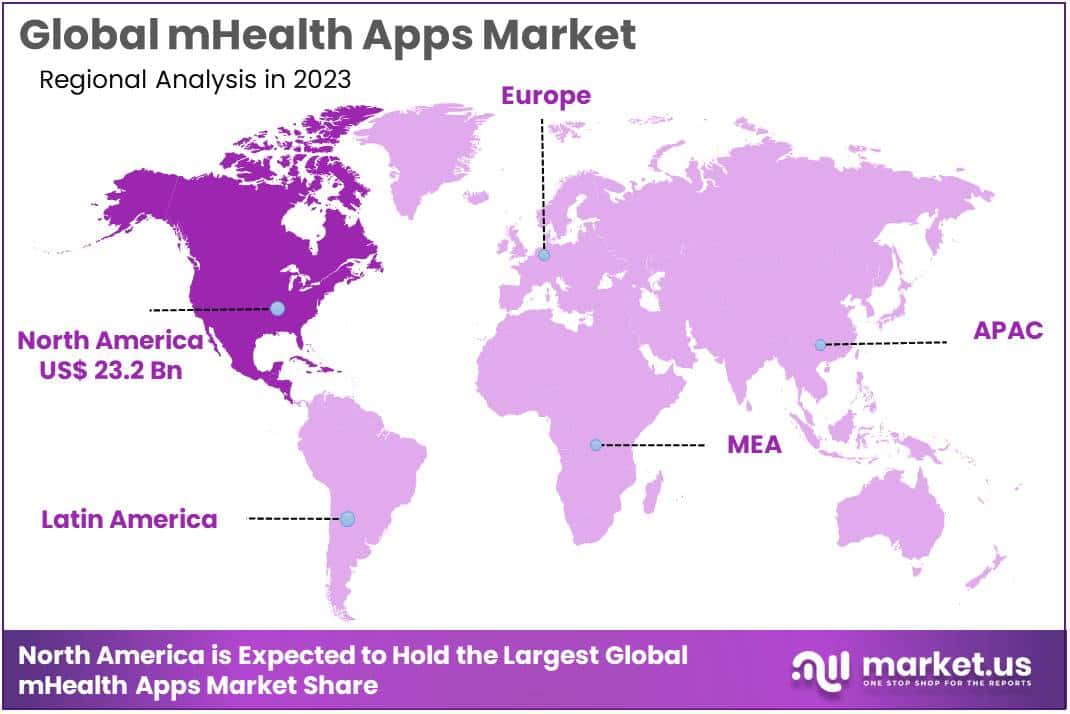

- Regional Dominance: North America dominated the market with a 36.8% revenue share in 2023.

- Key Players: Major players include AT&T, Telefonica S.A., Google Inc., Apple Inc., and others.

Component Analysis

In 2023, mHealth Apps emerged as the frontrunners in the booming mHealth market, securing a commanding 74.4% market share. These versatile applications have revolutionized healthcare by providing users with a wide array of functionalities tailored to their specific needs.

Within the mHealth Apps segment, Medical Apps took center stage, empowering individuals to manage their health proactively. Women’s Health Apps catered to the unique needs of women, offering support for various aspects of reproductive and general health. Personal Health Record Apps streamlined healthcare management, allowing users to organize their medical information efficiently.

Medication Management Apps played a pivotal role in ensuring adherence to prescribed treatments, enhancing medication compliance rates significantly. Disease Management Apps provided comprehensive solutions for individuals dealing with specific health conditions, offering personalized guidance and support. Diagnostic Apps facilitated preliminary health assessments, empowering users to monitor their well-being conveniently.

Service Analysis

In 2023, The mHealth market witnessed a dominant market position held by monitoring services, which secured an impressive share of more than 62.4%. Monitoring services play a pivotal role in the mHealth landscape, offering essential features that empower patients and healthcare providers to keep track of vital health metrics in real-time.

Independent aging solutions are another critical facet of the mHealth market. These solutions provide senior citizens with the tools they need to maintain their independence while staying connected to healthcare services. In 2023, independent aging solutions showed promising growth, indicating an increasing demand for services tailored to the elderly population.

Chronic disease management and post-acute care services are integral components of the mHealth market. They help patients effectively manage long-term health conditions and provide support after hospital discharges. These services exhibited substantial market presence in 2023, reflecting the growing awareness and adoption of mHealth solutions for improving patient outcomes.

Diagnosis services in the mHealth sector are designed to enhance accessibility and convenience in healthcare diagnostics. Their prominence in 2023 underscores the value of on-the-go diagnostics, enabling timely disease identification and management.

Participants Analysis

In 2023, the mHealth market showcased a dynamic landscape, with key participants playing pivotal roles in shaping its trajectory. Mobile Operators emerged as frontrunners, commanding a significant market share of 47.2%. Their robust infrastructure and widespread network coverage empowered seamless mHealth services, enabling easy access for users across the globe.

Device Vendors, another crucial segment, showcased innovation and diversity in product offerings. Catering to varied user needs, they contributed to the market’s growth by providing cutting-edge devices tailored for mHealth applications. Their user-friendly designs and advanced functionalities resonated well with consumers, further fueling market expansion.

Content Players played a vital role by providing engaging and informative content on mHealth platforms. Their contributions ranged from informative articles and videos to interactive applications, enriching user experience and enhancing health awareness. By delivering relevant and engaging content, they facilitated a deeper understanding of healthcare solutions, promoting healthier lifestyles among users.

Healthcare Providers, the cornerstone of the mHealth ecosystem, offered personalized and remote healthcare services. Leveraging technology, they facilitated virtual consultations, remote monitoring, and timely interventions. Their expertise coupled with digital platforms ensured accessible healthcare solutions, bridging the gap between healthcare seekers and providers. By embracing mHealth solutions, healthcare providers enhanced patient outcomes and streamlined healthcare delivery.

This collaborative effort among Mobile Operators, Device Vendors, Content Players, and Healthcare Providers not only drove market growth but also paved the way for a healthier and connected future. As these key participants continued to innovate and collaborate, the mHealth market witnessed sustained expansion, offering promising prospects for improved healthcare accessibility and outcomes globally.

Key Market Segments

Component

- Wearables

- BP Monitors

- Glucose Meters

- Pulse Oximeters

- Sleep Apnea Monitors (PSG)

- Neurological Monitors

- Activity Trackers/ Actigraphs

- mHealth Apps

- Medical Apps

- Women’s Health

- Personal Health Record Apps

- Medication Management Apps

- Disease Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others

- Fitness Apps

- Exercise & Fitness

- Diet & Nutrition

- Lifestyle & Stress

- Medical Apps

Service

- Monitoring Services

- Independent Aging Solutions

- Chronic Disease Management & Post-acute Care Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

Participants

- Mobile Operators

- Device Vendors

- Content Players

- Healthcare Providers

Drivers

Rise in Smartphones

The proliferation of smartphones has significantly contributed to the widespread adoption of mHealth apps and services. With smartphones becoming more accessible, mHealth apps can reach a larger audience, enabling convenient healthcare access for people worldwide.

Remote Monitoring

mHealth facilitates remote monitoring of patients, allowing healthcare professionals to track patients’ health conditions from a distance. This remote monitoring capability reduces the need for frequent hospital visits, enhancing the overall efficiency of healthcare delivery.

Health and Fitness Awareness

The growing awareness of health and fitness among individuals has spurred the adoption of mHealth solutions. People are increasingly interested in monitoring and improving their health, driving the demand for mHealth apps and services that cater to fitness tracking, nutrition management, and mental health support.

Restraints

Data Security Concerns

Worries about the security of personal health data act as a significant barrier to the growth of mHealth. Patients and healthcare providers are concerned about the potential breaches and misuse of sensitive health information, which hinders the widespread adoption of mHealth solutions.

Limited Smartphone Access

Not everyone has access to smartphones or reliable internet connections, especially in developing regions. The digital divide poses a challenge, as individuals without smartphones or internet access are unable to benefit from mHealth services, limiting the reach of these solutions.

Regulatory Compliance

Compliance with healthcare regulations can be complex and time-consuming. Navigating regulatory requirements and ensuring mHealth solutions adhere to standards and guidelines can slow down the development and implementation of innovative healthcare technologies.

Opportunities

Telehealth Expansion

Telehealth services have significant growth potential, especially in rural areas with limited access to healthcare facilities. mHealth can bridge the gap by offering remote consultations, monitoring, and diagnosis, improving healthcare accessibility for underserved populations.

Wearable Technology

Wearables like smartwatches and fitness trackers present opportunities to collect more health data. These devices enable continuous monitoring of various health metrics, providing valuable insights for both individuals and healthcare professionals, and enhancing personalized healthcare management.

Long-Term Health Condition Management

mHealth solutions offer innovative ways to manage long-term health conditions, such as diabetes, hypertension, and mental health disorders. Continuous monitoring, medication reminders, and personalized interventions can significantly enhance the quality of life for patients dealing with chronic illnesses.

Trends

Personalized Healthcare Recommendations

Advanced technologies enable the customization of healthcare recommendations based on individual health data. Personalized mHealth apps offer tailored advice, treatment plans, and lifestyle recommendations, optimizing healthcare outcomes for users.

Diverse App Ecosystem

The market is witnessing a proliferation of mHealth apps catering to various aspects of health and wellness, including fitness, nutrition, and mental health. This diverse app ecosystem allows users to choose specialized applications that meet their specific healthcare needs, promoting a holistic approach to well-being.

Prescribed Digital Treatments

Digital therapeutics, including prescribed apps and software, are gaining popularity as complementary or alternative treatments for certain medical conditions. These digital treatments, validated through clinical trials, offer evidence-based interventions for patients, expanding the scope of mHealth in healthcare delivery.

Regional Analysis

North America dominated mHealth markets and accounted for the largest revenue share with 36.8% in 2023. These factors include rising healthcare spending, increasing incidences, and chronic diseases, a growing geriatric population, and a well-developed network infrastructure.

Additionally, the rising popularity of mobile healthcare applications and favorable government initiatives are increasing the demand for mHealth in the region. A rising number of cardiovascular diseases is driving the demand for real-time monitoring. The availability of mHealth apps that provide real-time information on cardiovascular health can prevent major problems and lower the risk of sudden cardiac arrest.

The region’s growing smartphone penetration has resulted in lucrative growth. According to The Mobile Economy 2020 data, GSMA, the number of unique mobile subscribers in the Asia Pacific is expected to surpass 3000 million in 2025, which was 2800 million in 2019.

Additionally, the mHealth market growth is expected to be driven by increasing government programs regarding the digitalization and modernization of healthcare systems in several emerging economies like India and China.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The healthcare industry is witnessing a surge in the demand for cutting-edge mobile health platforms and services, igniting intense competition among established participants. This heightened rivalry promises to create fresh avenues for new entrants as healthcare applications continue to gain popularity and attract a wider user base. As mHealth gains ground, we can anticipate newcomers capturing a significant share of this burgeoning market. This is partly due to the increasing consolidation within the industry, marked by major market leaders engaging in mergers and acquisitions. Additionally, key players are bolstering their mobile health app portfolios through substantial research and development initiatives.

These strategic moves are not only reshaping the mHealth landscape but also opening doors for innovative startups and emerging players to carve out their niches. In this dynamic environment, the healthcare sector is poised to embrace transformative digital solutions, ultimately benefiting patients and enhancing the overall quality of care. As competition continues to drive innovation, the future of mobile health promises to be both exciting and accessible to a broader spectrum of the population.

Market Key Players

- AT&T

- Telefonica S.A.

- SoftServe

- Google Inc.

- Airstrip Technologies Inc.

- Samsung Electronics Co Ltd.

- Allscripts Healthcare Solutions

- Apple Inc.

- Other Key Players

Recent Developments

- In March 2024: Google announced a major initiative to leverage its artificial intelligence capabilities in healthcare, specifically through its Fitbit platform. The company is developing a personal health large language model (LLM) to provide users with personalized health coaching based on their individual data. This AI-driven coaching is aimed to assist in early disease detection and enhance daily health management by analyzing health metrics like sleep patterns and exercise intensity.

- January 2024: Samsung Electronics enhanced its mHealth capabilities by expanding the Privileged Health Software Development Kit (SDK). This initiative aims to foster healthcare innovation by integrating the Galaxy Watch’s advanced sensor technology with various platforms, allowing real-time health monitoring and intelligent management. This expansion is part of Samsung’s broader strategy to create a seamless digital healthcare ecosystem and includes partnerships to provide comprehensive biometric data for patient-centered care through platforms like Biofourmis and Kencor Health.

- In December 2023: AirStrip Technologies Inc. partnered with GE HealthCare to commercialize integrated patient monitoring and cardiac data visualization systems. This collaboration, exclusively under GE HealthCare in the U.S., aims to advance patient care by enabling healthcare providers to access and monitor patient data remotely and in near real-time on mobile devices and the web. This strategic move leverages AirStrip’s mobile-first clinical surveillance technology, which is currently deployed across over 600 healthcare systems.

Report Scope

Report Features Description Market Value (2023) USD 63.2 Bn Forecast Revenue (2033) USD 187.7 Bn CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Component[Wearables (BP Monitors, Glucose Meters, Pulse Oximeters, Sleep Apnea Monitors (PSG), Neurological Monitors, Activity Trackers/ Actigraphs), mHealth Apps (Medical Apps (Women’s Health, Personal Health Record Apps, Medication Management Apps, Disease Management Apps, Diagnostic Apps, Remote Monitoring Apps, Others), Fitness Apps( Exercise & Fitness, Diet & Nutrition , Lifestyle & Stress)];

Service[Monitoring Services( Independent Aging Solutions, Chronic Disease Management & Post-acute Care Services), Diagnosis Services( Healthcare Systems Strengthening Services, Others)];

Participants [Mobile Operators, Device Vendors, Content Players, Healthcare Providers]Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AT&T, Telefonica S.A., SoftServe, Google Inc., Airstrip Technologies Inc., Samsung Electronics Co Ltd., Allscripts Healthcare Solutions, Apple Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AT&T

- Telefonica S.A.

- SoftServe

- Google, Inc.

- Airstrip Technologies Inc.

- Samsung Electronics Co Ltd.

- Allscripts Healthcare Solutions

- Apple Inc.

- Other Key Players