Global Methanol-To-Olefin Market Size, Share, And Business Benefits By Product Type (Ethylene, Propylene, Butenes, Others), By End Use (Plastics and Polymers, Automotive, Packaging, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149987

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

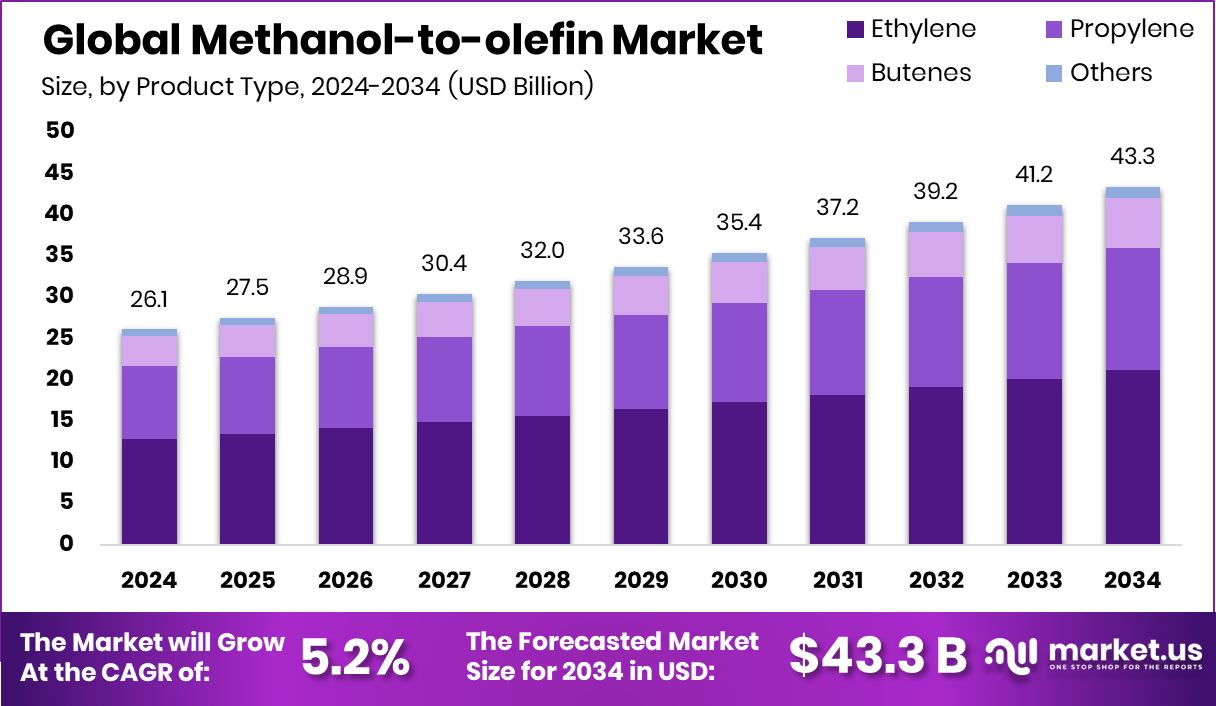

Global Methanol-To-Olefin Market is expected to be worth around USD 43.3 billion by 2034, up from USD 26.1 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034. Strong demand for plastics and methanol feedstock drove growth in the Asia-Pacific USD 11.9 Bn region.

Methanol-to-Olefin (MTO) is a chemical process that converts methanol, often derived from coal, natural gas, or biomass, into light olefins such as ethylene and propylene. These olefins are crucial raw materials used in making plastics, synthetic fibers, and chemicals. MTO technology allows countries rich in coal or gas but lacking oil reserves to produce olefins without depending on crude oil-based feedstocks.

The Methanol-to-Olefin (MTO) market revolves around the global deployment and expansion of plants using this technology to produce olefins. Driven by rising demand for plastics and synthetic rubber, especially in the packaging and automotive sectors, MTO provides an alternative supply route. Countries with abundant coal or natural gas are investing in MTO facilities to secure local olefin supply and reduce import dependency.

One of the key growth factors for the MTO market is the increasing global demand for ethylene and propylene. As consumer markets for plastic products grow—especially in developing countries—there’s rising pressure to find scalable and cost-effective production methods. MTO steps in as a strategic solution, especially for regions without strong oil refining capacity but with easy access to methanol feedstocks.

In terms of demand, Asia has emerged as a strong hub for MTO plant expansion due to its massive appetite for polymers and the availability of coal-derived methanol. The region’s robust manufacturing and export-oriented economies continue to drive growth in olefins, ensuring sustained MTO deployment. Rising urbanization, increased use of packaged goods, and infrastructure development are collectively pushing the demand higher across sectors.

Key Takeaways

- Global Methanol-To-Olefin Market is expected to be worth around USD 43.3 billion by 2034, up from USD 26.1 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, Ethylene held a 48.9% share in the Methanol-To-Olefin Market by product type.

- In 2024, Plastics and Polymers captured 67.4% of the Methanol-To-Olefin Market by end use.

- The Asia-Pacific region recorded a total market value of USD 11.9 billion this year.

By Product Type Analysis

In 2024, Ethylene held a dominant 48.9% share in the Methanol-To-Olefin Market by product type.

In 2024, Ethylene held a dominant market position in the By Product Type segment of the Methanol-To-Olefin Market, with a 48.9% share. This strong lead can be attributed to the widespread demand for ethylene-based derivatives across industries such as packaging, construction, and textiles. Ethylene is a primary building block for polyethylene, ethylene oxide, and ethylene dichloride, which are extensively used in plastic manufacturing, antifreeze, solvents, and vinyl products.

The Methanol-To-Olefin process has gained favor for producing ethylene from methanol, especially in regions with limited oil resources but abundant coal or natural gas reserves. The growing focus on substituting naphtha-based cracking routes with methanol-based technologies further boosted ethylene’s share in the overall MTO product portfolio. In addition, Asia-Pacific’s surging demand for plastic products and infrastructure materials, supported by large-scale MTO plant commissioning, reinforced ethylene’s dominance in 2024.

The segment’s robust performance also reflects the strategic importance of ethylene as a base petrochemical with applications cutting across multiple end-use industries. With the continued development of energy-efficient catalysts and process optimization in MTO units, ethylene production is expected to maintain a strong foothold in the market’s product mix going forward.

By End Use Analysis

In 2024, Plastics and Polymers accounted for a 67.4% share in the Methanol-To-Olefin Market by end-use.

In 2024, Plastics and Polymers held a dominant market position in the By End Use segment of the Methanol-To-Olefin Market, with a 67.4% share. This dominance is directly linked to the high consumption of ethylene and propylene, key MTO products, in the production of polyethylene, polypropylene, and other essential polymers. These materials are foundational to a wide range of industries, including packaging, automotive, electronics, construction, and consumer goods.

The rapid growth in demand for lightweight, durable, and cost-effective plastic solutions has further reinforced the need for stable and scalable olefin supply, positioning MTO as a reliable production route. Emerging economies, particularly in Asia, have seen a surge in packaging and infrastructure-related applications, where polymers play a critical role.

The transition from conventional oil-based routes to methanol-based processes is also driving market interest in cleaner, more localized olefin production, especially where natural gas or coal resources are abundant. The plastics and polymers segment’s commanding share of 67.4% in 2024 reflects both the volume-driven nature of global polymer demand and the versatility of MTO-derived olefins in supporting it. Looking ahead, this segment is expected to remain central to MTO market growth due to ongoing industrialization and consumer product expansion.

Key Market Segments

By Product Type

- Ethylene

- Propylene

- Butenes

- Others

By End Use

- Plastics and Polymers

- Automotive

- Packaging

- Textiles

- Others

Driving Factors

Rising Demand for Plastics and Packaging Products

One of the biggest driving factors for the Methanol-To-Olefin (MTO) market is the fast-growing demand for plastics, especially in packaging. Products like bottles, containers, films, and wraps made from polyethylene and polypropylene are used in almost every industry, from food and beverages to healthcare and e-commerce.

As more people buy packaged goods, especially in developing countries, the need for raw materials like ethylene and propylene continues to increase. MTO is becoming a popular way to produce these materials because it doesn’t rely on oil. Countries with large coal or gas resources are turning to MTO to meet this growing demand for plastics more cheaply and reliably, helping the market grow steadily.

Restraining Factors

High Capital Costs of MTO Plant Setup

One major restraining factor for the Methanol-To-Olefin (MTO) market is the high cost of building and operating MTO plants. Setting up an MTO facility requires a heavy investment in advanced equipment, reactors, and catalyst systems. These plants also need large amounts of energy and infrastructure for methanol production, handling, and olefin conversion.

For many developing regions, the initial spending and long payback time make it difficult to justify such investments. Even if the technology is promising, the upfront financial risk discourages new players from entering the market. As a result, only companies with strong financial strength or government backing can afford to scale operations, slowing down wider market growth in cost-sensitive regions.

Growth Opportunity

Growing Interest in Green Methanol Integration Pathways

A major growth opportunity in the Methanol-To-Olefin (MTO) market is the rising interest in using green methanol. Green methanol is made from renewable sources like biomass, captured carbon dioxide, or green hydrogen. By using green methanol instead of fossil-based methanol, companies can lower carbon emissions and support clean energy goals.

This is important as many industries and governments are now focusing on climate-friendly production methods. If MTO plants start using green methanol at a larger scale, they can produce more eco-friendly olefins. This shift opens the door for new investments and innovations. It also helps countries reduce their reliance on oil while meeting the increasing demand for sustainable plastic production.

Latest Trends

Advancements in Catalysts Enhancing MTO Efficiency

A notable trend in the Methanol-To-Olefins (MTO) market is the development of advanced catalysts aimed at improving process efficiency. These new catalysts are designed to increase the yield of desired olefins like ethylene and propylene while reducing unwanted by-products. By enhancing selectivity and activity, these catalysts contribute to more efficient conversion processes, leading to cost savings and reduced environmental impact.

The focus on catalyst innovation reflects the industry’s commitment to optimizing MTO technology for better performance and sustainability. As the demand for olefins continues to rise, the adoption of these advanced catalysts is expected to play a crucial role in meeting production needs and supporting the growth of the MTO market.

Regional Analysis

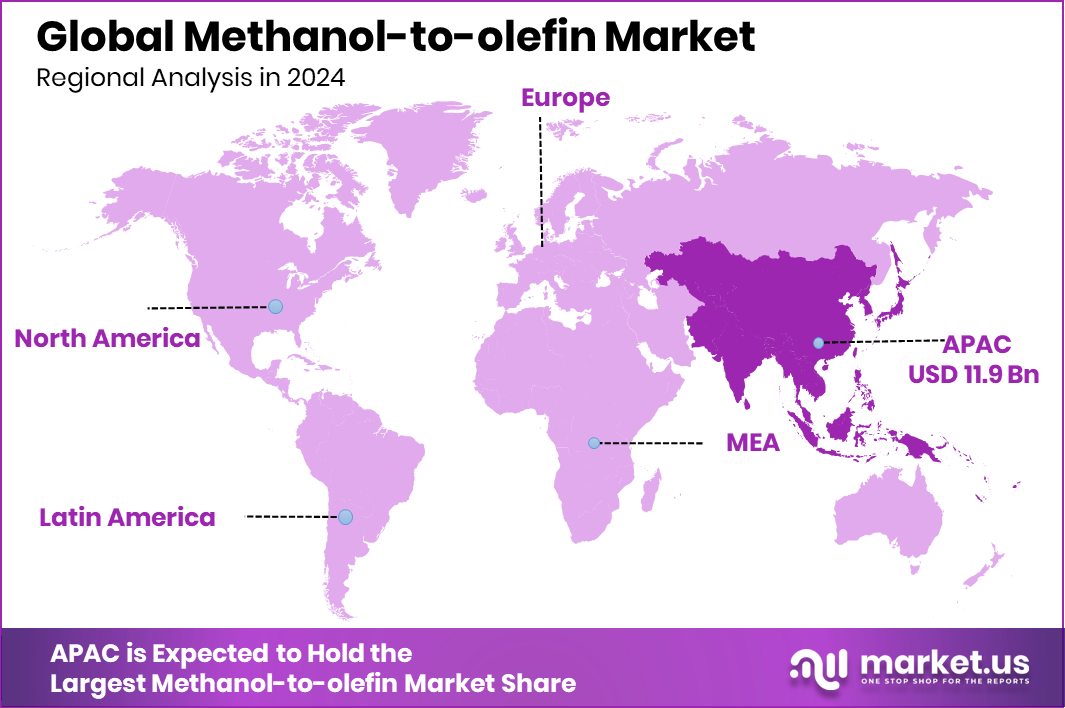

In 2024, Asia-Pacific led the Methanol-To-Olefin Market with 43.3% share dominance.

In 2024, Asia-Pacific emerged as the dominant region in the Methanol-To-Olefin (MTO) Market, capturing a substantial 43.3% share, equivalent to USD 11.9 billion. The region’s leadership is driven by the widespread deployment of MTO plants in China and other coal-rich economies, aiming to reduce dependency on oil-based olefin production.

The abundance of methanol feedstock derived from coal and natural gas, combined with robust demand for plastics and polymers in packaging, automotive, and construction sectors, has propelled market growth across Asia-Pacific. In contrast, North America and Europe represent mature but slower-growing markets, with limited new plant additions and a stronger focus on traditional naphtha-based routes.

Meanwhile, Middle East & Africa is exploring MTO potential leveraging its gas reserves, though still at an emerging stage. Latin America holds a smaller share, constrained by limited methanol availability and infrastructure development. Overall, Asia-Pacific continues to lead the MTO market due to favorable feedstock economics, industrial growth, and large-scale production capacities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Haldor Topsoe, now operating as Topsoe, has been instrumental in enhancing methanol production technologies. Their two-step methanol plant design, optimized for capacities ranging from 1,000 to 5,500 metric tons per day (MTPD), combines side-fired tubular steam methane reforming with oxygen-fired autothermal reforming. This configuration offers cost-effective and energy-efficient methanol production from a broad range of syngas sources.

Linde AG has demonstrated a strong commitment to sustainability within the MTO market. In 2024, the company achieved record wins for its small on-site solutions, driven by the electronics sector and decarbonization efforts. Linde’s development of a carbon management toolbox for sustainable olefins provides a comprehensive approach to reducing greenhouse gas emissions in olefin production, supporting the industry’s move towards net-zero targets.

Lummus Technology continues to lead in MTO process innovations with its Light Olefins Recovery Technology (LORT). LORT is recognized for its high product recovery rates, low energy consumption, and cost-effectiveness. The technology efficiently recovers over 99.7% of ethylene and propylene from MTO reactor effluents, maximizing production rates and operating margins.

Top Key Players in the Market

- CHINA SHENHUA

- ExxonMobil Chemical

- Fund Energy Ningbo Co., Ltd.

- Gas Chemical Complex

- Haldor Topsoe

- Linde AG

- Lummus Technology

- Maverick Synfuels

- Methanex Corporation

- Qatar Petroleum

- Reliance Industries Limited

- Royal Dutch Shell

- SABIC Innovative Plastics

- Sinopec Limited

Recent Developments

- In April 2025, Topsoe entered a collaboration with Worley to accelerate the deployment of standardized, modular e-methanol production plants in the U.S. Midwest. Each facility is designed to produce up to 600 tonnes of e-methanol per day, utilizing green hydrogen and biogenic CO₂ sourced from ethanol producers.

- In May 2024, construction commenced on the $5 billion complex, designed to process 1.3 billion cubic meters of natural gas and 430,000 tons of naphtha annually, producing approximately 1.1 million tons of polymer products each year.

Report Scope

Report Features Description Market Value (2024) USD 26.1 Billion Forecast Revenue (2034) USD 43.3 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ethylene, Propylene, Butenes, Others), By End Use (Plastics and Polymers, Automotive, Packaging, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CHINA SHENHUA, ExxonMobil Chemical, Fund Energy Ningbo Co., Ltd., Gas Chemical Complex, Haldor Topsoe, Linde AG, Lummus Technology, Maverick Synfuels, Methanex Corporation, Qatar Petroleum, Reliance Industries Limited, Royal Dutch Shell, SABIC Innovative Plastics, Sinopec Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CHINA SHENHUA

- ExxonMobil Chemical

- Fund Energy Ningbo Co., Ltd.

- Gas Chemical Complex

- Haldor Topsoe

- Linde AG

- Lummus Technology

- Maverick Synfuels

- Methanex Corporation

- Qatar Petroleum

- Reliance Industries Limited

- Royal Dutch Shell

- SABIC Innovative Plastics

- Sinopec Limited