Global Metal Stamping Market Process(Blanking, Embossing, Bending, Others), Material Type(Steel, Copper, Aluminum), Material Thickness(Less than 0.4 mm, More than 0.4 mm), End-Use(Automotive, Aerospace, Consumer Electronics, Industrial Machinery, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Dec 2023

- Report ID: 21094

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

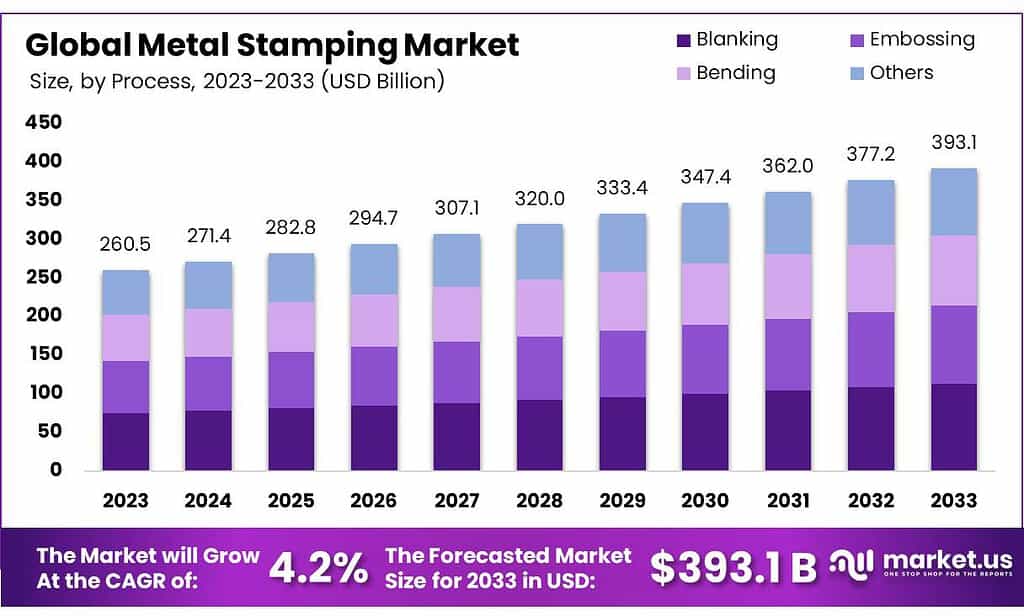

The Metal Stamping Market size is expected to be worth around USD 393.1 billion by 2033, from USD 260.5 Bn in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

Metal frames are employed in headphones, speakers, gamepads, and cell phones to promote growth. Stamping with metals is a complicated manufacturing process that converts flat metal sheets into specific forms by putting them in either the blank or coil form into a press for stamping.

Antennas, chassis, and lens holders for mobile phones are made using metal stamping. It offers great tolerance, electrical conductivity, corrosion resistance, and a smooth finish. According to the GSM Association, there were 5.31 billion unique mobile customers worldwide as of January 2021. This number is rising at a rate of 1.8% annually. This metal stamping market report gives a detailed analysis of the market size, share, growth, key trends, and other key factors.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size Projection: The Metal Stamping Market is poised to grow significantly, reaching an estimated worth of USD 393.1 billion by 2033, showing a substantial increase from USD 260.5 billion in 2023. This reflects a projected Compound Annual Growth Rate (CAGR) of 4.2% over the forecast period from 2023 to 2033.

- Primary Processes Driving Growth: Blanking Stood out as the leading process, holding over 28.8% of the market share, involving cutting out pieces of metal to create desired shapes or components. Embossing Showed steady growth due to its ability to create raised designs or patterns on metal surfaces.

- Material Trends and Demand: Steel Emerged as the dominant material type (over 33% market share) due to its durability, strength, and cost-effectiveness. Copper Renowned for conductivity and corrosion resistance, maintained a solid position in the market. Aluminum Showcased steady growth, valued for its lightweight properties and suitability for intricate designs.

- Material Thickness Preference: There’s a shift towards thinner materials (<0.4 mm), accounting for over 52% of the market share, driven by demands for precision in electronics and telecommunications. However, thicker materials (>0.4 mm) also hold a significant position, especially in applications requiring sturdier components.

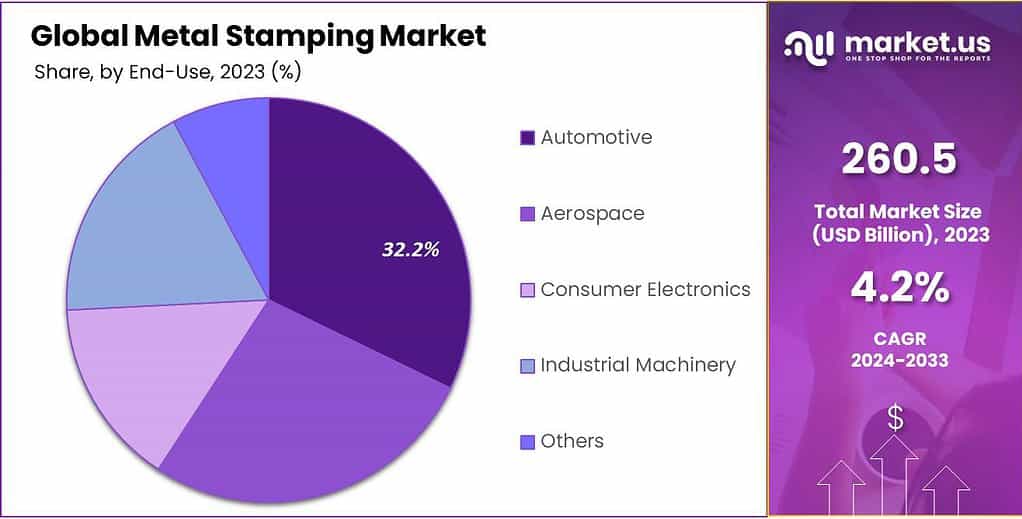

- Key End-Use Sectors: Automotive: Emerged as the dominant force (over 32.2% share), extensively using stamped metal components for vehicle manufacturing.

- Driving Factors and Challenges: Technology Advances Driving expansion, enhancing efficiency, and elevating precision. Automation’s role is instrumental in driving efficiency. Volatility in Raw Material Prices Poses a significant restraint, impacting profitability and competitive positioning, demanding agile strategies to mitigate effects.

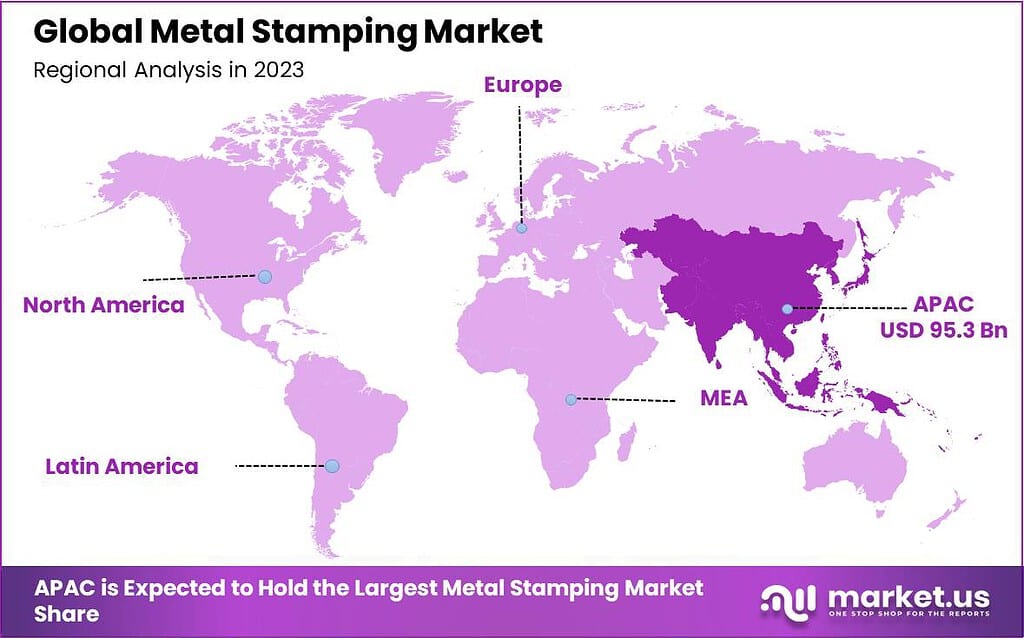

- Regional Analysis: Asia Pacific held the largest revenue share (over 43.6% in 2023), driven by rising demands in the automotive, electronics, and defense sectors. Europe, with strict regulations and demand for electric vehicles, also held a substantial share.

- Opportunities and Challenges Ahead: The Medical Industry Presents significant opportunities due to its expanding applications, driven by minimally invasive procedures and the need for smaller, high-quality components.

- Standardization Challenges: Lack of uniform quality assessment measures poses hurdles for maintaining consistency and customer satisfaction.

- Key Players and Recent Developments: Notable players like Acro Metal Stamping, Manor Tool & Manufacturing Company, and D&H Industries play a significant role.

By Process

In 2023, Blanking stood out as the leading process in the metal stamping market, holding a significant market share of over 28.8%. This process involves cutting out a piece of metal to create a desired shape or component, contributing significantly to the market’s growth.

Embossing, another pivotal process in metal stamping, exhibited steady growth, driven by its ability to create raised designs or patterns on metal surfaces. This technique garnered attention due to its versatile applications across various industries.

Bending, a fundamental process in metal forming, maintained its position as a crucial segment within the market. Its flexibility in shaping metals into different angles and configurations continued to attract industries seeking precise metal components.

Other techniques within metal stamping showcased the potential for growth and innovation, contributing collectively to the industry’s expansion. These processes, including piercing, coining, and flanging, demonstrated adaptability to diverse manufacturing requirements.

The metal stamping market witnessed dynamic advancements across its segments, with each process playing a pivotal role in meeting the evolving demands of industries such as automotive, aerospace, and electronics. As technology continues to improve, these segments are poised for further development and innovation, driving the market forward in the coming years.

By Material Type

In 2023, Steel emerged as the frontrunner in the metal stamping market, seizing a commanding market share of over 33%. Its dominance stemmed from its widespread use across various industries, driven by its durability, strength, and cost-effectiveness as a preferred material for stamping.

Copper, renowned for its conductivity and corrosion resistance, maintained a solid position within the market. Its applications in electrical and electronic components contributed to its stable market presence.

Aluminum, valued for its lightweight properties and suitability for intricate designs, showcased steady growth in the metal stamping market. Its versatility in the automotive, aerospace, and consumer electronics industries propelled its adoption.

Other materials in the metal stamping landscape, such as alloys and specialty metals, exhibited promising potential for niche applications. These materials offered unique properties catering to specific industry needs, contributing to the market’s overall diversity.

The metal stamping market witnessed varying degrees of demand across different material types, influenced by factors like industry requirements, technological advancements, and material properties. As industries continue seeking materials that balance performance, cost, and sustainability, these segments are expected to evolve, presenting opportunities for innovation and market expansion in the future.

By Material Thickness

In 2023, the segment of metal stamping for thicknesses less than 0.4 mm took a commanding lead in the market, securing over 52% of the share. This dominance was fueled by the escalating demand for precision components in industries like electronics and telecommunications, where thin materials are crucial for intricate designs and miniaturization.

Metal stamping for thicknesses greater than 0.4 mm maintained a substantial position, favored in applications requiring sturdier components across sectors like automotive and construction. Its stability in these industries contributed to a consistent market presence.

The preference for thinner materials in metal stamping was driven by advancements in technology enabling finer and more intricate designs, alongside the growing trend toward lightweight and compact products. This trend propelled the dominance of the less-than-0.4-mm segment.

However, the more-than-0.4-mm segment remained essential for applications demanding structural integrity and durability, ensuring a balanced market landscape catering to diverse industry needs.

The metal stamping market’s segmentation by material thickness highlighted the evolving demands of various industries for precision, strength, and adaptability. As technological innovations continue to influence manufacturing capabilities, both segments are poised to witness further advancements, catering to a spectrum of industry requirements in the foreseeable future.

By End-Use

In 2023, the Automotive sector emerged as the dominant force in the metal stamping market, securing over 32.2% of the share. This stronghold was powered by the extensive use of stamped metal components in vehicle manufacturing, including body panels, chassis parts, and engine components.

The Aerospace industry maintained a substantial position within the market due to the stringent requirements for precision-engineered components. Metal stamping played a crucial role in producing intricate parts for aircraft and spacecraft, contributing to the sector’s technological advancements.

Consumer Electronics showcased a growing presence in the metal stamping market, driven by the demand for lightweight and compact components in devices like smartphones, laptops, and wearables. The precision offered by stamped metal parts supported the industry’s pursuit of sleek designs and enhanced functionality.

Industrial Machinery, another significant segment, relied on metal stamping to produce robust and precise components used in various equipment and machinery. Its role in ensuring durability and performance remained pivotal across manufacturing sectors.

Other industries, such as construction and healthcare, also leveraged metal stamping for specialized applications. These industries relied on stamped metal parts for specific requirements, contributing collectively to the market’s diversity.

The diverse landscape of end-use industries in the metal stamping market reflected the widespread applications and adaptability of stamped metal components across various sectors. As industries continue to evolve and demand tailored solutions, the metal stamping market is poised to witness continuous innovation and expansion to meet these diverse needs.

*Actual Numbers Might Vary In The Final Report

Key Маrkеt Segments

Process

- Blanking

- Embossing

- Bending

- Others

Material Type

- Steel

- Copper

- Aluminum

Material Thickness

- Less than 0.4 mm

- More than 0.4 mm

End-Use

- Automotive

- Aerospace

- Consumer Electronics

- Industrial Machinery

- Others

Drivers

Technology advances are driving the expansion of the metal stamping market. Technological progress has transformed manufacturing by significantly improving efficiency, cutting costs and elevating precision and accuracy. For instance, computer numerical control (CNC) machines have grown increasingly popular due to their superior precision when performing drilling, milling and turning tasks – these revolutionary devices being known for rapid yet cost-effective production of intricate parts and components meeting modern industry’s demands.

Automation has proven instrumental in driving forward the metal stamping industry. Its incorporation has not only increased efficiency but also reduced operational costs while simultaneously increasing productivity. Automation stamping machines have shown exceptional results by augmenting manufacturing processes consistently while decreasing reliance on manual labor through rapid completion of repetitive tasks by automated systems. Automation’s presence is revolutionizing metal stamping, shaping its growth trajectory through increased efficiencies, cost-effectiveness and production capabilities.

Restraints

The volatility in raw material prices stands as a significant restraint for the metal stamping market,

exerting a notable impact on the profitability and competitive positioning of companies within the industry. Metal stamping operations rely heavily on a spectrum of raw materials like steel, aluminum, copper, and various other metals to craft stamped parts and components. Fluctuations in the prices of these essential raw materials directly influence production costs.When the prices of raw materials surge, it leads to a corresponding increase in production expenses for metal stamping companies. This rise in costs can adversely affect profit margins, squeezing the financial viability of operations. The challenge arises when companies grapple with the decision of whether to pass on these escalated costs to their customers. Doing so risks a potential loss of clientele to competitors offering lower-priced alternatives.

The dilemma becomes apparent: absorbing increased production costs could dent profitability, while passing on these costs to customers might lead to decreased market share due to higher prices. This delicate balancing act amid price fluctuations challenges the competitiveness and sustainability of metal stamping companies in a market driven by price sensitivity and cost-efficiency. Consequently, these fluctuations in raw material prices pose a persistent hurdle for metal stamping enterprises, demanding agile strategies and adaptive measures to navigate and mitigate the impact on their bottom line.

Opportunities

The burgeoning scope of metal stamping within the medical industry presents a compelling opportunity, characterized by its significant and swiftly expanding applications. Metal stamping has carved a crucial niche in the medical sector, serving as a pivotal method for fabricating precise and high-quality metal parts vital for an array of medical devices, implantable tools, surgical instruments, and diagnostic equipment.

Several key factors are driving the escalating demand for metal stamping in the medical domain. The upward trajectory is fueled by the surging preference for minimally invasive surgical procedures, catering to patients’ needs for less traumatic interventions and quicker recovery times. Additionally, the expanding geriatric population, coupled with the rising incidence of chronic diseases, has amplified the necessity for advanced medical devices and implants, further bolstering the demand for stamped metal components.

The burgeoning trend towards medical device miniaturization is also playing a pivotal role in augmenting the utilization of metal stamping. As the medical industry relentlessly seeks innovation and advancement, the need for smaller, intricately designed components in devices is intensifying. Metal stamping’s capability to deliver precise, intricate, and small-scale parts aligns perfectly with this trend, driving its adoption within the medical sector.

The amalgamation of these factors underscores a promising opportunity for metal stamping companies to expand their foothold within the thriving medical industry. As technological advancements continue to evolve and healthcare demands grow more sophisticated, the trajectory for metal stamping in the medical sphere remains steep, presenting a lucrative avenue for innovation and market expansion.

Challenges

The absence of standardization poses significant challenges for both producers and customers within the metal stamping industry. This issue becomes particularly pronounced in ensuring uniform quality across various parts and orders, presenting a formidable hurdle for manufacturers. The lack of standardized measures for assessing the quality of stamped parts complicates efforts to maintain consistent quality levels.

Manufacturers grapple with the complexity of ensuring uniformity and precision in their products when there’s a dearth of standardized quality control procedures. This deficiency in standardized metrics or benchmarks for evaluating and maintaining quality can result in inconsistencies across production lines. Such inconsistencies often lead to higher rejection rates, as variations in quality may not align with specified standards. Ultimately, these challenges culminate in a dent in customer satisfaction levels.

For customers, this lack of standardization can directly impact their experience and trust in the products they receive. Inconsistencies in quality might lead to discrepancies in performance or reliability, affecting the functionality of the end product. Such inconsistencies can erode customer confidence and satisfaction, potentially causing dissatisfaction or even loss of business for manufacturers.

Addressing the challenge of standardization within the metal stamping industry requires concerted efforts towards establishing and implementing standardized quality control protocols and benchmarks. By establishing clear and uniform criteria for assessing and ensuring quality across all production processes, manufacturers can mitigate inconsistencies and enhance customer satisfaction, thereby fortifying their competitive edge in the market. Achieving standardization will be pivotal in ensuring consistent quality, reducing rejection rates, and ultimately fostering higher customer confidence and loyalty.

Regional Analysis

Asia Pacific held over 43.6% of revenue share in 2023 due to rising car and electronics demand in the region, as well as fast projected growth over its forecast period. China, India, Bangladesh, Indonesia and Pakistan led growth through increasing phone and other electronic sales; industrial development projects, infrastructure expansion projects and defense sector expansion also added demand for machinery and equipment in this market.

The need for machinery and equipment will benefit from the increasing industrialization, infrastructural expansion, and rise in defense in the Asia Pacific. India and China are investing more money in the defense sector. For instance, China increased its defense spending by 6.8% to US$ 209 billion in 2021. Military equipment needs will fuel stamped product demand during the next several years.

Another market anticipated to be successful for metal stamping is India. The component output will increase, which will have a beneficial effect on the market expansion. It is anticipated that American producers may move their operations to India to avoid paying high export duties due to the current trade conflict between China, the U.S., and India.

In the next few years, the increasing production of aluminum hoods will drive demand for stamped products. In 2023, Europe held a large revenue share due to the growing consumer electronics sector and its automotive industry. This region is known for its strict regulations regarding fuel economy and increasing demand for electric vehicles.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global market is highly competitive with this industry’s many small- and big-scale players. Local players are competing with global companies that offer customized products and services. Local players can provide customized customization services to clients and offer standardized products to major industrial machinery manufacturers, automotive OEMs, and consumer electronics manufacturers.

Маrkеt Key Players

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd

- AAPICO Hitech Public Company Limited

- Gestamp

- Ford Motor Company

Recent Development

In January 2022, the key player named Ansys launched its first software based on metal stamping simulation in January, which is an all-inclusive product majorly equipped to meet industrial needs under one platform. Furthermore, Ansys Forming delivers predictive accuracy and a streamlined workflow to design digitally, validate, and simulate sheet metal forming throughout the processing of manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 9.3 Billion Forecast Revenue (2033) USD 15.4 Billion CAGR (2023-2032) 4.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Process(Blanking, Embossing, Bending, Others), Material Type(Steel, Copper, Aluminum), Material Thickness(Less than 0.4 mm, More than 0.4 mm), End-Use(Automotive, Aerospace, Consumer Electronics, Industrial Machinery, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Acro Metal Stamping, Manor Tool & Manufacturing Company, D&H Industries, Inc., Kenmode, Inc., Klesk Metal Stamping Co, Clow Stamping Company, Goshen Stamping Company, Tempco Manufacturing Company, Inc, Interplex Holdings Pte. Ltd., CAPARO, Nissan Motor Co., Ltd, AAPICO Hitech Public Company Limited, Gestamp, Ford Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is metal stamping?Metal stamping is a manufacturing process that involves shaping metal sheets or coils using a stamping press and custom-made dies to create various parts and components. It's commonly used in industries like automotive, aerospace, electronics, and more.

What industries use metal stamping?Metal stamping is used in various industries, including automotive (for car parts), aerospace (for aircraft components), electronics (for casings and connectors), appliances, construction, and more.

What is the future outlook for the metal stamping market?The market is expected to grow due to the increasing demand in automotive, aerospace, and electronics industries, alongside advancements in technology and materials, leading to more efficient and precise metal stamping processes.

What are the current trends in the metal stamping industry?Trends in the industry often revolve around advancements in automation, use of high-strength materials, implementation of advanced software for design and simulation, and sustainability initiatives focusing on reducing waste and improving energy efficiency.

-

-

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd

- AAPICO Hitech Public Company Limited

- Gestamp

- Ford Motor Company