Global Metal Forging Market Size, Share Analysis Report By Raw Material (Carbon Steel, Alloy Steel, Aluminum, Magnesium, Stainless Steel, Titanium, Others), By Technology (Closed Die, Open Die, Others), By Application (Automotive, Oil and Gas, Construction, Agriculture, Power Generation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155713

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

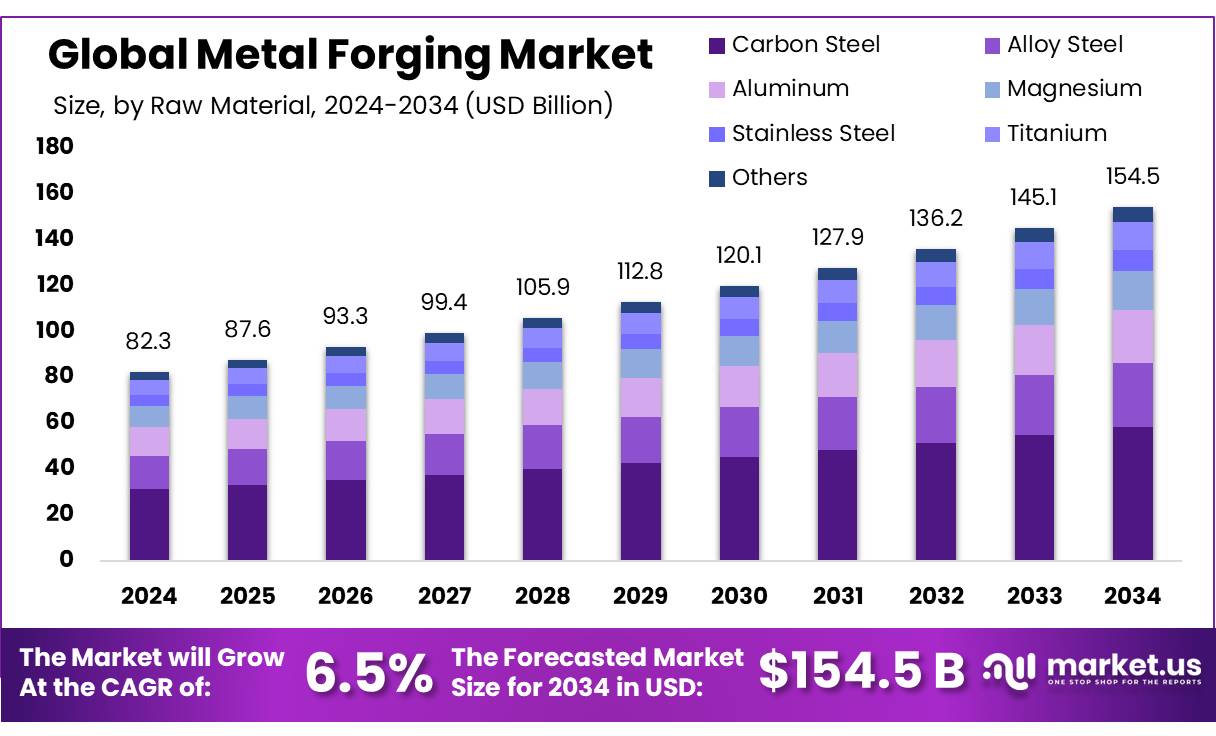

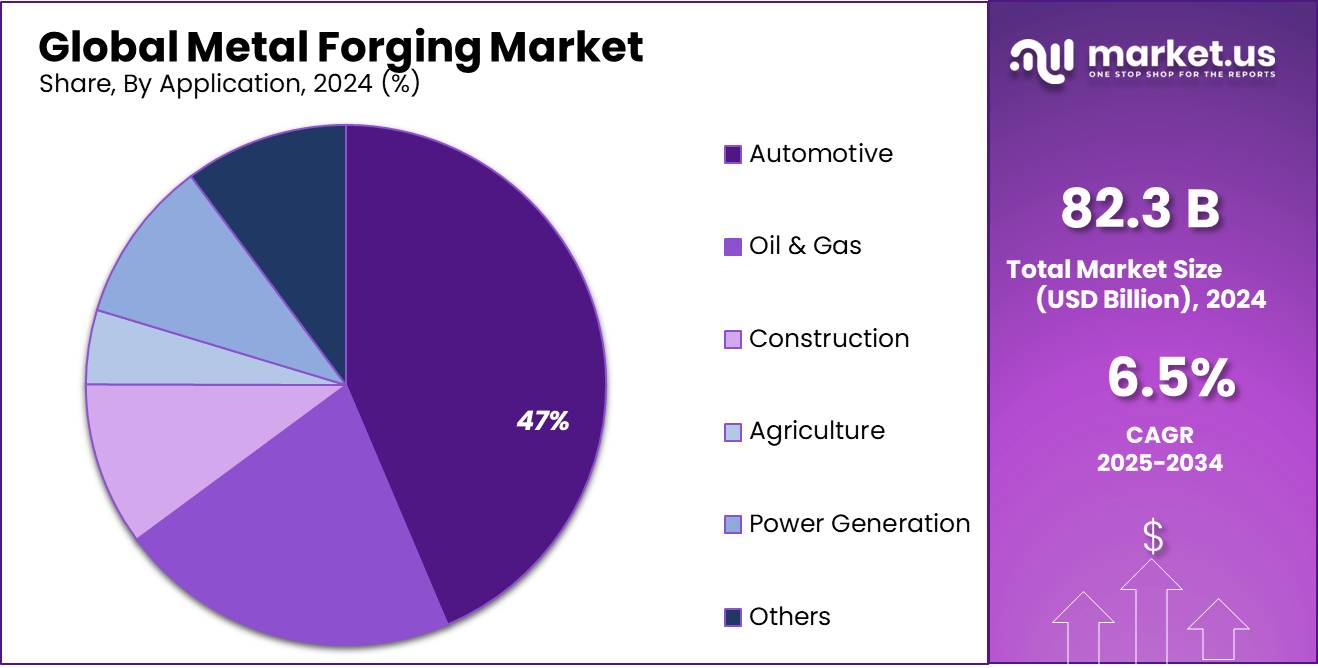

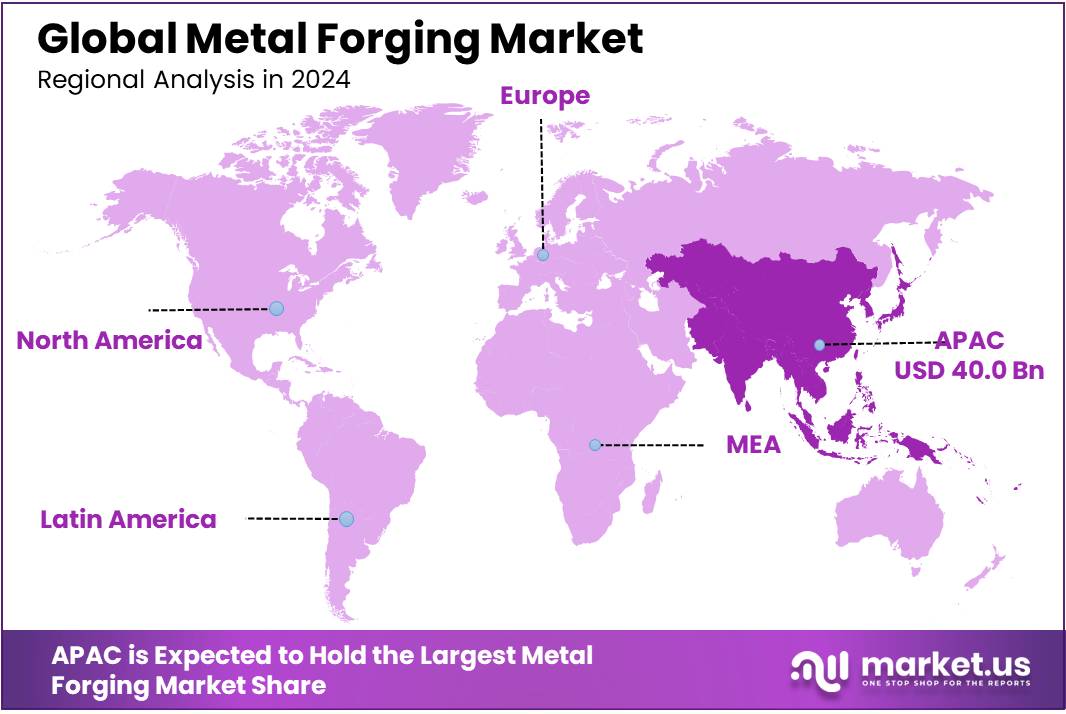

The Global Metal Forging Market size is expected to be worth around USD 154.5 Billion by 2034, from USD 82.3 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 48.7% share, holding USD 40.0 Billion revenue.

The metal forging market, a critical pillar of modern manufacturing, involves shaping metals through compressive forces to yield components exhibiting enhanced strength, resilience, and reliability. In India and globally, forgings are indispensable in automotive, aerospace, defense, railways, heavy machinery, construction, energy, and infrastructure sectors. The sector’s foundational importance reflects its role in manufacturing heavy-duty and precision-critical parts such as crankshafts, axles, turbine components, and structural elements.

On the policy and energy‑efficiency front, the Government of India has launched several initiatives to bolster sector competitiveness. Under the National Mission for Enhanced Energy Efficiency (NMEEE), the “Perform, Achieve and Trade” (PAT) component targets energy‑intensive segments, aiming for avoided capacity additions of 19,598 MW, fuel savings of 23 million tonnes per year, and reduction of 98.55 million tonnes per year of greenhouse gas emissions.

Key drivers enhancing forging concentrate demand include the surge in demand from India’s automotive and aerospace sectors. The automotive industry, contributing about 7.1 percent of India’s GDP, employs over 37 million people, and is worth over USD 100 billion as of 2022. These sectors drive the need for lightweight, high‑strength forged parts—boosting the metallurgical technology and concentrate usage.

In a BEE‑commissioned study, forging (part of secondary‑steel MSME sub-sectors) was found to comprise 705 units, consuming 0.3 Mtoe per year of energy and emitting 1.6 Mt CO₂ per year. This benchmarking assists in identifying energy‑efficiency potential and shaping targeted interventions.

In India, the forging sector is emerging strongly. According to a BEE (Bureau of Energy Efficiency) mapping report, medium and large‑scale industries account for roughly 70 % of India’s forging production, while micro and small‑scale units constitute the remaining 30 %. The National Institute of Advanced Manufacturing Technology (NIAMT)—formerly NIFFT—is a government‑established institution (under the Ministry of Education) dedicated to developing skilled professionals and research in forging and foundry technologies.

Key Takeaways

- Metal Forging Market size is expected to be worth around USD 154.5 Billion by 2034, from USD 82.3 Billion in 2024, growing at a CAGR of 6.5%.

- Carbon Steel held a dominant market position, capturing more than a 37.8% share in the global metal forging market.

- Closed Die held a dominant market position, capturing more than a 67.9% share of the global metal forging market.

- Automotive held a dominant market position, capturing more than a 47.2% share of the global metal forging market.

- Asia Pacific emerged as the dominant region in the global metal forging market, securing an impressive 48.7% share valued at USD 40.0 billion.

By Raw Material Analysis

Carbon Steel leads with 37.8% due to its strength and wide industrial use

In 2024, Carbon Steel held a dominant market position, capturing more than a 37.8% share in the global metal forging market. Its popularity comes from its superior strength, durability, and cost-effectiveness, making it the preferred raw material for automotive, construction, oil & gas, and heavy machinery applications. Forged carbon steel components such as shafts, gears, axles, and connecting rods remain in high demand due to their ability to handle high stress and wear. In 2025, this demand is expected to rise further as industries continue to prioritize strong and affordable forged parts to support large-scale infrastructure and manufacturing projects. The material’s versatility across sectors ensures it remains a key driver of forged product demand, consolidating its role as a backbone material in the forging industry.

By Technology Analysis

Closed Die dominates with 67.9% owing to precision and mass production efficiency

In 2024, Closed Die held a dominant market position, capturing more than a 67.9% share of the global metal forging market. This technology is widely used because it delivers high accuracy, consistent quality, and the ability to produce complex shapes at scale, making it essential for automotive, aerospace, and machinery parts. Industries rely on closed die forging for components like crankshafts, connecting rods, and precision gears, where durability and strength are critical. By 2025, its share is expected to remain strong as demand for lightweight yet high-strength forged parts continues to grow in transport and defense sectors, further reinforcing its dominance in the forging industry.

By Application Analysis

Automotive leads with 47.2% driven by rising vehicle production and demand

In 2024, Automotive held a dominant market position, capturing more than a 47.2% share of the global metal forging market. The sector relies heavily on forged components such as crankshafts, gears, axles, and transmission parts, which are critical for vehicle durability and performance. Growth in electric vehicles (EVs) and hybrid models has further supported demand, as automakers increasingly require lightweight yet strong forged parts to enhance efficiency and safety. By 2025, the automotive industry is expected to maintain its leading share, supported by expanding production in emerging economies and ongoing investments in EV infrastructure, keeping automotive the strongest application segment for forged products.

Key Market Segments

By Raw Material

- Carbon Steel

- Alloy Steel

- Aluminum

- Magnesium

- Stainless Steel

- Titanium

- Others

By Technology

- Closed Die

- Open Die

- Others

By Application

- Automotive

- Oil & Gas

- Construction

- Agriculture

- Power Generation

- Others

Emerging Trends

Embracing Lightweight Materials: A Game-Changer in Metal Forging

The metal forging industry is undergoing a significant transformation, with a notable shift towards the adoption of lightweight materials like aluminum and titanium. This trend is particularly evident in sectors such as automotive, aerospace, and renewable energy, where the demand for high-strength yet lightweight components is on the rise.

The automotive industry is also experiencing a shift towards lightweight materials. Steel currently makes up about 54% of the average vehicle, with the potential to reduce vehicle weight by up to 25% using advanced high-strength steels (AHSS). Additionally, the amount of aluminum used in vehicles has increased by 62 pounds to 458 pounds between 2016 and 2020 and is projected to rise to 551 pounds by 2026.

This trend is not only about enhancing performance but also about meeting environmental goals. Lighter vehicles contribute to improved fuel efficiency and reduced emissions, aligning with global sustainability objectives. For example, the European steel industry is transitioning towards a circular economy by increasing the use of electric arc furnaces (EAFs), which can produce steel from scrap, thereby reducing carbon emissions.

Governments worldwide are recognizing the importance of this shift and are implementing initiatives to support the adoption of lightweight materials in manufacturing. In the United States, the Department of Energy’s Lightweight Materials Program aims to develop and deploy advanced materials technologies that reduce the weight of vehicles and improve fuel efficiency. Similarly, in the European Union, the Horizon 2020 program has funded projects focused on developing lightweight materials and manufacturing processes to enhance the competitiveness of the European industry.

Drivers

Government Initiatives Fueling Growth in India’s Metal Forging Industry

The Indian metal forging industry is experiencing robust growth, largely driven by strategic government initiatives aimed at enhancing domestic manufacturing capabilities. These policies not only bolster the sector’s competitiveness but also contribute significantly to the nation’s economic development.

One of the cornerstone initiatives is the Atmanirbhar Bharat (Self-Reliant India) program, launched in 2020. This policy framework emphasizes reducing dependence on imports and promoting indigenous manufacturing across various sectors, including metal forging. By encouraging local production, the initiative aims to strengthen the domestic supply chain and create employment opportunities.

Complementing this, the Make in India campaign, introduced in 2014, focuses on transforming India into a global manufacturing hub. It seeks to attract both domestic and foreign investments, enhance skill development, and foster innovation. The campaign has led to the establishment of new industrial corridors and manufacturing clusters, facilitating the growth of industries like metal forging.

Additionally, the Production-Linked Incentive (PLI) Scheme has been instrumental in incentivizing large-scale manufacturing in key sectors. By offering financial rewards based on incremental sales, the scheme encourages companies to increase production and invest in advanced technologies. This has led to improved efficiency and quality in the metal forging industry.

The government’s focus on infrastructure development further supports the sector’s expansion. Initiatives such as the National Infrastructure Pipeline (NIP), which plans investments in transportation, energy, and urban infrastructure, create a demand for forged components used in construction and machinery. This infrastructure push has significantly boosted the development of the forging sector.

Restraints

Supply Chain Disruptions in Metal Forging for the Food Industry

The metal forging industry, integral to producing essential components for the food sector, faces significant challenges that impact its efficiency and reliability. One of the most pressing issues is the disruption of supply chains, which affects the timely delivery of critical forged parts like stainless steel components used in food processing equipment.

Supply chain disruptions in metal forging have been exacerbated by several factors. The COVID-19 pandemic led to factory shutdowns, labor shortages, and transportation bottlenecks, causing delays in production and delivery.

For instance, lead times for certain materials, such as titanium, have extended up to nine months, while specific steel alloys now have lead times of 70 to 80 weeks. These delays hinder the food industry’s ability to maintain continuous production lines, leading to potential shortages and increased operational costs.

Additionally, geopolitical tensions and trade policies have introduced uncertainties in the global supply chain. Tariffs and trade barriers disrupt the flow of forged products and raw materials, compelling manufacturers to adapt their strategies, such as diversifying suppliers or focusing on local markets. Such disruptions can lead to increased costs and delays in the food sector, affecting everything from packaging materials to processing equipment.

The food industry, heavily reliant on timely deliveries of forged components, faces challenges in maintaining production schedules due to these supply chain issues. Delays in receiving essential parts can lead to halted production lines, inventory shortages, and ultimately, supply shortages of food products. This not only affects the profitability of food manufacturers but also impacts consumers who may experience reduced availability of certain food items.

Opportunity

Government Support for Food Processing: A Growth Opportunity for Metal Forging

The Indian government’s robust initiatives to bolster the food processing sector present a significant growth opportunity for the metal forging industry. As the food processing industry expands, the demand for high-quality, durable equipment and infrastructure increases, creating a favorable environment for metal forging companies to thrive.

To support this growth, the Indian government has implemented several initiatives aimed at enhancing the food processing sector. The Pradhan Mantri Kisan Sampada Yojana (PMKSY) received an increased financial allocation of ₹6,520 crore, with an additional ₹1,920 crore infused through FY26 to promote agro-processing infrastructure and improve the efficiency and competitiveness of the agricultural sector .

Furthermore, the establishment of Mega Food Parks across the country aims to create direct linkages from farm to processing and then to consumer markets, enhancing value addition and reducing post-harvest losses . These parks are expected to generate significant employment opportunities and stimulate regional economic development.

The expansion of the food processing sector necessitates the development and procurement of advanced machinery and equipment, which in turn drives the demand for high-quality forged components. Metal forging companies specializing in producing durable and precise components are well-positioned to capitalize on this growing demand.

Regional Insights

Asia Pacific commands 48.7% share worth USD 40.0 billion, leading the global metal forging industry.

In 2024, Asia Pacific emerged as the dominant region in the global metal forging market, securing an impressive 48.7% share valued at USD 40.0 billion. The region’s leadership is anchored in its vast manufacturing ecosystem, high automotive output, rapid infrastructure expansion, and a deeply integrated supply chain.

China, India, and Japan continue to serve as the industrial engines, with China alone producing more than 1 billion tonnes of crude steel in 2024, representing over 55% of global steel output according to the World Steel Association. India further reinforced this trend, producing 127.38 million tonnes of crude steel in FY 2023–24, retaining its spot as the world’s second-largest steel producer.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ATI Ladish LLC is a longtime U.S.-based forging expert, known for crafting high-performance forgings in materials like titanium, nickel, stainless steel, and superalloys. It plays a vital role in aerospace and defense supply chains, supplying major contractors like Lockheed Martin, GE, and BAE Systems. With deep roots in the Milwaukee area and integration into ATI Inc.’s specialty metals network, ATI Ladish brings precision, reliability, and advanced alloy expertise to critical applications across industries.

China First Heavy Industries (CFHI), founded in 1954, is a major state-owned heavyweight in China’s forging and machinery sector. Its vast setup includes design institutes, national R&D centers, and one of the world’s largest heavy equipment plants in Tianjin. CFHI produces a wide portfolio—from metallurgical and forging equipment to castings and heavy forgings—serving industries like metallurgy, energy, transportation, petrochemicals, and defense, both domestically and abroad.

Celsa Group is a top European steel manufacturer known for producing low-emission, circular steel via electric arc furnaces, with the largest circular supply chain in Europe. The group’s forging division offers a broad range of heat-treated and machined forging products tailored to sectors like energy, mining, machinery, and oil & gas. Based in Spain but active across Europe, Celsa combines sustainability in steelmaking with the ability to supply diverse, durable forged components.

Top Key Players Outlook

- ATI Ladish LLC

- Bruck GmbH

- Celsa Group

- China First Heavy Machinery Co., Ltd.

- Consolidated Industries, Inc.

- ELLWOOD Group, Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Larsen & Toubro Ltd

- Lolu Alloys Ltd

- Nippon Steel Corp.

- Otto Fuchs KG

- Ovako AB

- Pacific Forge Incorporated

- Precision Castparts Corp.

Recent Industry Developments

In 2024, ATI Ladish LLC—part of ATI Inc.—continued to demonstrate its strength in forging when Allegheny Technologies reported aerospace revenues up 4.5% and defense revenues surging 22% for the year, a clear sign that demand for high‑performance forged components is rising across key sectors.

In 2024, Brück GmbH, based in Saarbrücken, Germany, continued impressively in the forging world with sales of approximately USD 87.21 million, according to Dun & Bradstreet, placing it among the reliable mid‑sized players in heavy industry.

Report Scope

Report Features Description Market Value (2024) USD 82.3 Bn Forecast Revenue (2034) USD 154.5 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Carbon Steel, Alloy Steel, Aluminum, Magnesium, Stainless Steel, Titanium, Others), By Technology (Closed Die, Open Die, Others), By Application (Automotive, Oil and Gas, Construction, Agriculture, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ATI Ladish LLC, Bruck GmbH, Celsa Group, China First Heavy Machinery Co., Ltd., Consolidated Industries, Inc., ELLWOOD Group, Inc., Jiangyin Hengrun Heavy Industries Co., Ltd., Larsen & Toubro Ltd, Lolu Alloys Ltd, Nippon Steel Corp., Otto Fuchs KG, Ovako AB, Pacific Forge Incorporated, Precision Castparts Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ATI Ladish LLC

- Bruck GmbH

- Celsa Group

- China First Heavy Machinery Co., Ltd.

- Consolidated Industries, Inc.

- ELLWOOD Group, Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Larsen & Toubro Ltd

- Lolu Alloys Ltd

- Nippon Steel Corp.

- Otto Fuchs KG

- Ovako AB

- Pacific Forge Incorporated

- Precision Castparts Corp.