Global MEP (Mechanical, Electrical, and Plumbing) Software Market Size, Share Analysis Report By Component (Software, Services), By Deployment (On-Premises, Cloud-Based), By Application (Mechanical, Electrical, Plumbing), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151669

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

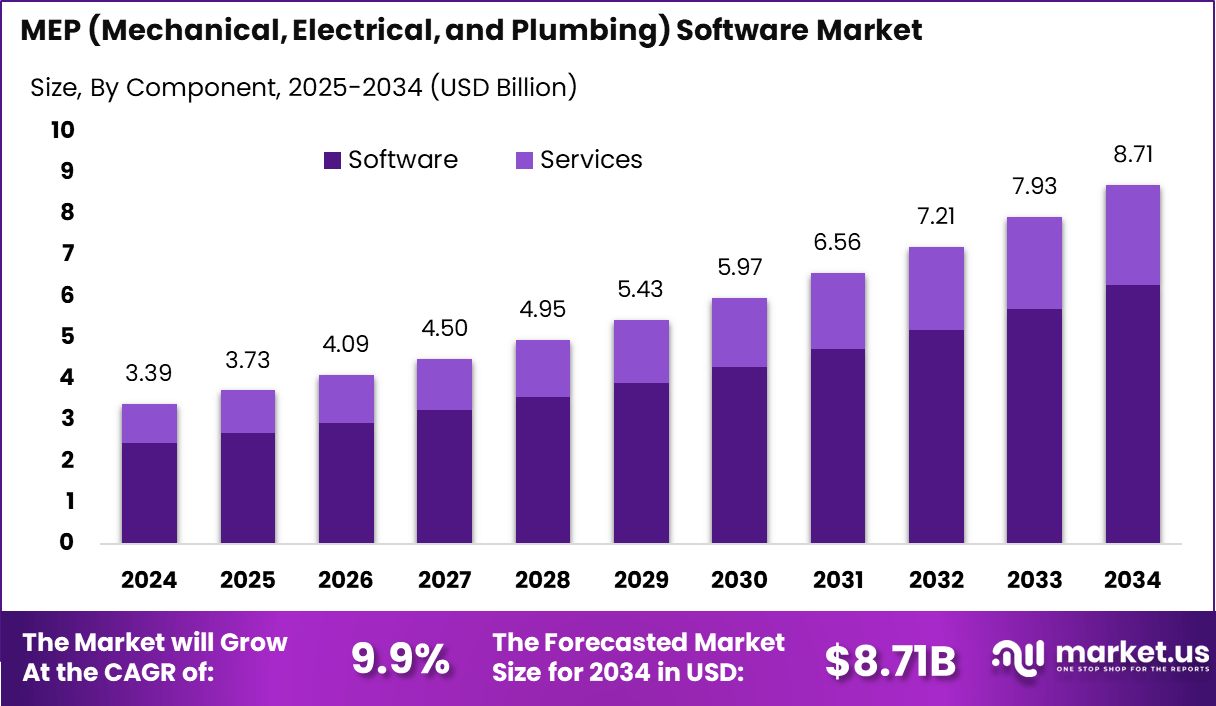

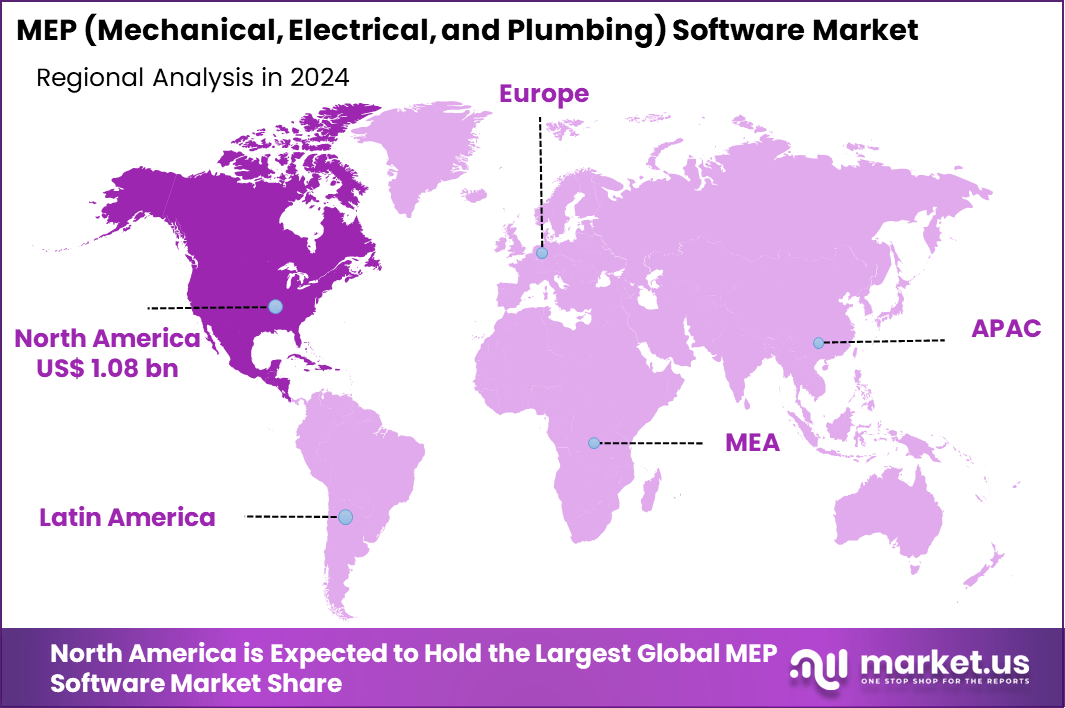

The Global MEP (Mechanical, Electrical, and Plumbing) Software Market size is expected to be worth around USD 8.71 billion by 2034, from USD 3.39 billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 1.08 billion in revenue.

The MEP software market encompasses digital platforms used to design, model, and manage mechanical, electrical, and plumbing systems in building infrastructure. These solutions range from BIM-integrated tools to CAD-based applications and support end-to-end project workflows. Increasing complexity in building systems and rising adoption of digital construction workflows underpin its acceleration.

Primary drivers include the growing need for enhanced collaboration among architects, engineers, and contractors. The integration of BIM technology has become pivotal, enabling real-time coordination between disciplines and reducing on-site revisions. Parallelly, expanding construction activity, especially in urban and infrastructure projects, fuels demand for advanced automation and design precision.

For instance, in November 2024, Trane Technologies and Autodesk announced a strategic collaboration aimed at accelerating and simplifying sustainable building design. The partnership focuses on leveraging advanced software solutions to enhance MEP system integration, improve energy efficiency, and meet environmental sustainability goals.

MEP software adoption is being driven by the rise of cloud deployments, which offer scalability and lower upfront infrastructure costs. Integration with AI, predictive analytics, VR and AR is enhancing design validation and facility maintenance workflows. The traction of BIM-first tools continues to reshape how engineers coordinate in a 3D environment.

For instance, In October 2024, Siemens introduced BIMPOWER, a specialized plug-in for Autodesk Revit, aimed at enhancing Building Information Modeling (BIM) processes for electrical systems. This tool enables engineers and contractors to convert electrical system requirements into accurate 3D models, streamlining the design-to-execution workflow. BIMPOWER also provides real-time feedback, improving design precision and coordination.

Innovation opportunities are particularly strong in markets advancing smart-building infrastructure and energy optimization. Vendors providing scalable, modular MEP platforms suitable for both small and large projects can capitalize on demand in emerging regions. Startups offering AI-powered simulation, automation, or mobile-deployment tools for field teams are also attracting investor interest.

Key Takeaways

- In 2024, the Software segment led the MEP software market, securing a dominant 72% share, as demand for advanced modeling and automation tools surged across design workflows.

- The On-Premises deployment model captured a 58% share, driven by enterprises prioritizing data control, system customization, and internal infrastructure integration.

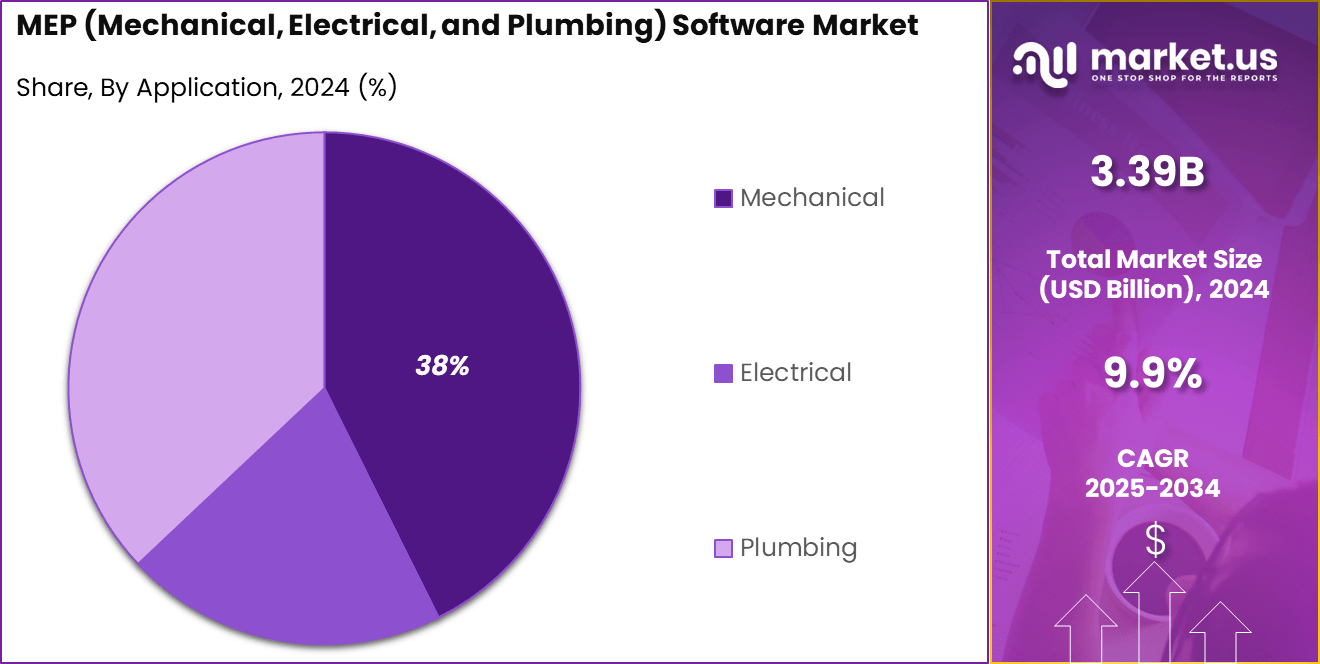

- The Mechanical application segment held the largest functional share at 38%, reflecting its critical role in HVAC systems, energy efficiency planning, and equipment layout optimization.

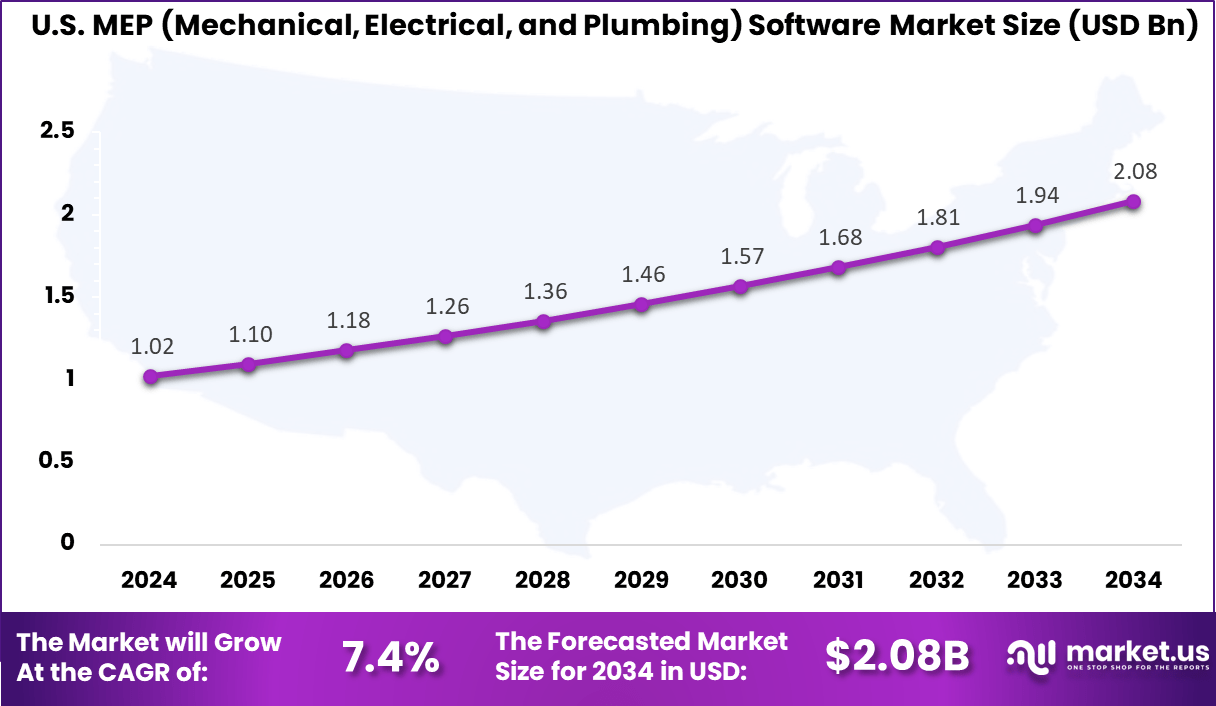

- The U.S. MEP Software Market reached a valuation of USD 1.02 billion in 2024, expanding at a healthy CAGR of 7.4%, supported by regulatory compliance needs and rapid urban development.

- North America maintained its leadership in the global market, accounting for over 32% of the total share, backed by strong adoption across construction, engineering, and facility management sectors.

U.S. MEP Software Market Size

The market for MEP Software within the U.S. is growing tremendously and is currently valued at USD 1.02 billion, the market has a projected CAGR of 7.4%. The market for MEP software in the U.S. is growing tremendously due to increased demand for energy-efficient buildings, stricter regulatory requirements, and widespread adoption of smart building technologies.

This growth is being fueled by the integration of BIM, cloud computing, and IoT into construction workflows. Furthermore, the emphasis on sustainability and the need for ongoing monitoring and optimization of building systems are driving the market in the U.S..

For instance, in November 2024, CESMII and NIST MEP entered into a strategic partnership aimed at accelerating the adoption of smart manufacturing technologies across the U.S. industrial sector. The collaboration emphasizes the integration of advanced Manufacturing Extension Partnership (MEP) solutions with intelligent systems to enhance operational efficiency and modernize production workflows.

In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 1.08 billion revenue in the global MEP software market. This regional leadership is primarily driven by early digital adoption, widespread use of Building Information Modeling (BIM), and stringent energy efficiency regulations.

Large-scale infrastructure redevelopment projects, including airports, data centers, and smart buildings across the United States and Canada, are fueling consistent demand for advanced MEP software solutions. Government policies promoting sustainable construction have further accelerated the uptake of intelligent design tools, especially those that integrate real-time energy modeling and system coordination.

The region also benefits from a well-established ecosystem of construction tech firms, engineering consultancies, and software providers that continually invest in innovation. The presence of numerous green building certification programs and mandatory energy codes compels contractors and design firms to deploy high-accuracy MEP software from early design stages.

For instance, in September 2024, Blackstone-backed Legence announced a partnership with BuildOps to revolutionize MEP services in North America. This collaboration focuses on leveraging innovative technology to streamline MEP operations, enhance service efficiency, and improve the overall lifecycle management of building systems. The partnership is set to transform the MEP landscape, driving the adoption of smart, data-driven solutions across North America.

Component Analysis

In 2024, the Software segment held a dominant market position, capturing a 72% share of the Global MEP Software Market. The dominance is due to the increasing use of advanced digital solutions like BIM platforms, cloud-based applications, and design tools, which improve project planning, real-time collaboration, and automation of complex MEP workflows.

Due to the increasing need for effective design, construction, and facility management practices, as well as compliance with evolving sustainability goals in industry, the software market has become firmly established and continues to grow, fueling its growth.

For Instance, in October 2024, Autodesk introduced the MEP Content Editor, a tool designed to enhance the creation and customization of mechanical, electrical, and plumbing (MEP) systems within the BIM environment. This innovative tool allows engineers and designers to streamline the process of managing MEP content, improving accuracy and efficiency in system design and implementation.

Deployment Analysis

In 2024, the On-Premises segment held a dominant market position, capturing a 58% share of the Global MEP Software Market. The primary driving force behind the need for on-premises solutions in this industry is large corporations seeking to enhance data protection, management, and flexibility.

In particular markets, on-premise implementation has become the preferred option due to the emphasis on keeping critical project information in-house, adherence to strict regulatory standards, and complete control over software integration with existing systems.

For instance, in October 2024, Autodesk introduced AI-nurtured MEP modeling with automated patterns and engineering solutions, enhancing the design and simulation processes. While cloud-based solutions have gained traction, many organizations still prefer on-premises deployment for these AI-driven tools due to the need for greater control, security, and customization.

Application Analysis

In 2024, the Mechanical segment held a dominant market position, capturing a 38% share of the Global MEP Software Market. This dominance is due to the increasing complexity of mechanical systems in modern buildings, which require advanced design, simulation, and optimization tools.

The growing focus on energy-efficient HVAC (heating, ventilation, and air conditioning) systems, along with the need for precise load calculations, system integration, and compliance with sustainability standards, has driven the demand for specialized MEP software solutions in the mechanical sector.

For Instance, in October 2021, Trimble introduced a connected model-based estimating workflow specifically designed for mechanical, piping, and electrical contractors. This innovative workflow streamlines the estimation process by integrating BIM and real-time project data, allowing contractors to improve accuracy, reduce errors, and enhance efficiency in project delivery.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-Premises

- Cloud-Based

By Application

- Mechanical

- Electrical

- Plumbing

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

A key trend gaining traction in MEP software is the integration of augmented and virtual reality into design workflows. Engineers are now able to walk through digital twins using headsets, which helps them detect spatial clashes or system layout problems early. This immersive approach not only reduces rework but also enhances coordination between mechanical, electrical, and plumbing teams.

For instance, in May 2025, FARO introduced its new 3D reality capture solution, aimed at enhancing the accuracy and efficiency of capturing as-built data for MEP systems. This advanced tool allows professionals to scan and model building systems in real-time, significantly improving project timelines and ensuring precise integration with BIM and MEP design workflows.

Driver

Increasing Adoption of BIM (Building Information Modeling)

The increasing adoption of Building Information Modeling (BIM) is a major driver for the MEP software market. During construction, BIM integrates various stages of the process, from design to simulation and finally to building, creating a collaborative environment.

MEP software is a crucial element of this framework, enabling the efficient design and improvement of mechanical, electrical, and plumbing systems. BIM is becoming increasingly popular, and MEP software has become essential in terms of maintaining accuracy, reducing errors, and improving project outcomes.

For instance, in May 2025, Procore announced its acquisition of Novorender and Flypaper, enhancing its BIM streaming engine and incorporating advanced clash detection AI capabilities. This strategic move aims to further streamline construction project workflows, offering improved real-time collaboration and reducing errors in the MEP design and implementation process.

Restraint

Complexity in Integration with Existing Systems

The integration of MEP software with existing systems, such as CAD platforms or legacy applications, can be challenging due to technical issues. Multiple firms encounter issues with compatibility, leading to costly delays or requiring extensive modifications.

Organizations may face challenges in implementing new technologies due to the integration obstacles encountered, which can disrupt workflow processes and hinder the adoption of emerging technologies, ultimately costing them significant MEP investments.

Opportunity

Collaborations and Partnerships with Tech Giants

Collaborations with major technology companies like Autodesk, Microsoft, and Amazon Web Services present significant opportunities for MEP software providers to innovate and enhance their services. These software companies are industry leaders in providing resources, expertise, and technological advancements that enable the integration of advanced features such as AI, machine learning, cloud capabilities, etc.

For instance, in April 2025, OneClickLCA announced a strategic partnership under the MEP2040 initiative, focused on accelerating the decarbonization of mechanical, electrical, and plumbing (MEP) systems in buildings by the year 2040. This collaboration aims to promote sustainable design practices by equipping MEP engineers with advanced tools to model, measure, and minimize carbon emissions throughout the building lifecycle.

Challenge

Regulatory and Compliance Issues

The construction industry is characterized by a complex and dynamic regulatory framework that incorporates diverse building codes, safety regulations, and environmental laws, with variations depending on the area.

To ensure compliance with these regulations, MEP software providers must regularly update and adapt their offerings. Adding significant complexity to the software development process means that companies must ensure that their products are compliant with the latest requirements and can meet the diverse demands of global markets.

Key Player Analysis

The MEP software market is led by key players such as Autodesk, Inc., Trimble Inc., and Bentley Systems, Inc., who offer advanced BIM-integrated tools for efficient MEP design and coordination. These companies focus on improving design accuracy and project collaboration through cloud-enabled platforms and real-time modeling.

Firms like Dassault Systèmes, MagiCAD Group, and Nemetschek Group play a crucial role in driving innovation across European markets. Their solutions emphasize simulation, compliance with regional standards, and open BIM compatibility to support seamless multidisciplinary workflows.

Other notable players include AVEVA Group, Bricsys, Trimble SketchUp, and Hilti Group, which contribute through tools aimed at industrial facilities, early-stage design, and on-site MEP layout. Together, these companies enhance digital adoption across construction through automation, AI, and integrated project delivery.

Top Key Players Covered

- Autodesk, Inc.

- Trimble Inc.

- Bentley Systems, Inc.

- Dassault Systèmes

- MagiCAD Group

- Nemetschek Group

- AVEVA Group

- Bricsys

- Trimble Sketchup

- Hilti Group

- Others

Recent Developments

- In June 2025, MagiCAD 2026 was released for advanced MEP design, offering new features and enhancements that improve design accuracy, efficiency, and collaboration in MEP projects. The updated version integrates seamlessly with popular platforms like Revit, AutoCAD, and BricsCAD, providing users with a more versatile toolset for creating complex and energy-efficient building systems.

- In May 2025, DeWalt launched its mSuite Hangers software, specifically designed for MEP contractors. The new software streamlines the design and installation of hangers and supports increased efficiency in the construction process. With improved capabilities for precise system layout and better collaboration, it aims to reduce errors and save time, making it a valuable tool for MEP professionals in the industry.

- In January 2025, Stratus secured USD 32 billion in funding to accelerate its efforts in transforming construction technology, with a strong focus on MEP contractors. The capital will be used to scale its operations and strengthen its suite of digital solutions, aiming to modernize workflows and increase productivity within the construction sector.

- In November 2024, Trane Technologies and Autodesk entered a strategic partnership to advance sustainable commercial design. The collaboration focuses on integrating Trane’s energy-efficient software with Autodesk Revit, leveraging AI to improve the precision and efficiency of mechanical, electrical, and plumbing (MEP) processes, thus promoting smarter building systems.

- In September 2024, Legence, backed by Blackstone and known for its expertise in energy efficiency and sustainability, partnered with BuildOps to enhance its MEP service capabilities. Through the integration of BuildOps’ project management software, Legence aims to streamline operations and improve service delivery, reinforcing its position in the smart building and infrastructure solutions market.

Report Scope

Report Features Description Market Value (2024) USD 3.39 Bn Forecast Revenue (2034) USD 8.71 Bn CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (On-Premises, Cloud-Based), By Application (Mechanical, Electrical, Plumbing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Autodesk, Inc., Trimble Inc., Bentley Systems, Inc., Dassault Systèmes, MagiCAD Group, Nemetschek Group, AVEVA Group, Bricsys, Trimble Sketchup, Hilti Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Autodesk, Inc.

- Trimble Inc.

- Bentley Systems, Inc.

- Dassault Systèmes

- MagiCAD Group

- Nemetschek Group

- AVEVA Group

- Bricsys

- Trimble Sketchup

- Hilti Group

- Others