MENA Syringes & Cannula Market By Product Type (Syringes and Cannulas), By Usage (Disposable and Reusable), By Distribution Channel (Institutional Sales, and Retail Sales), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170672

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

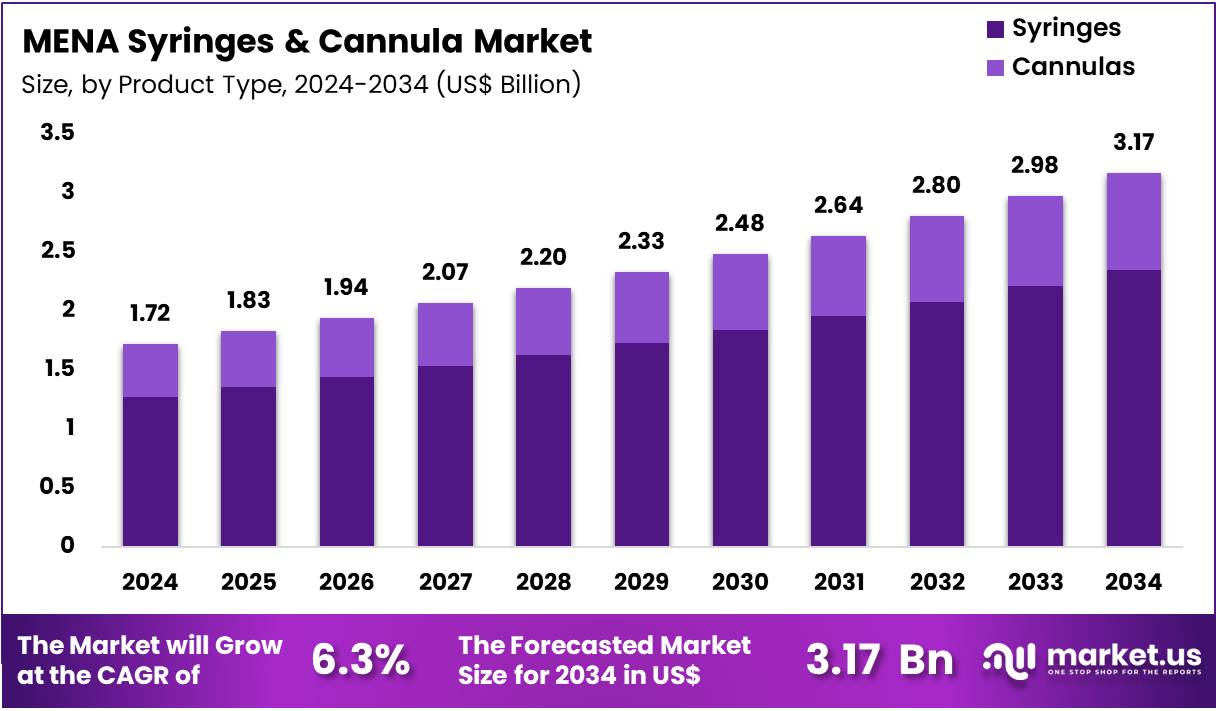

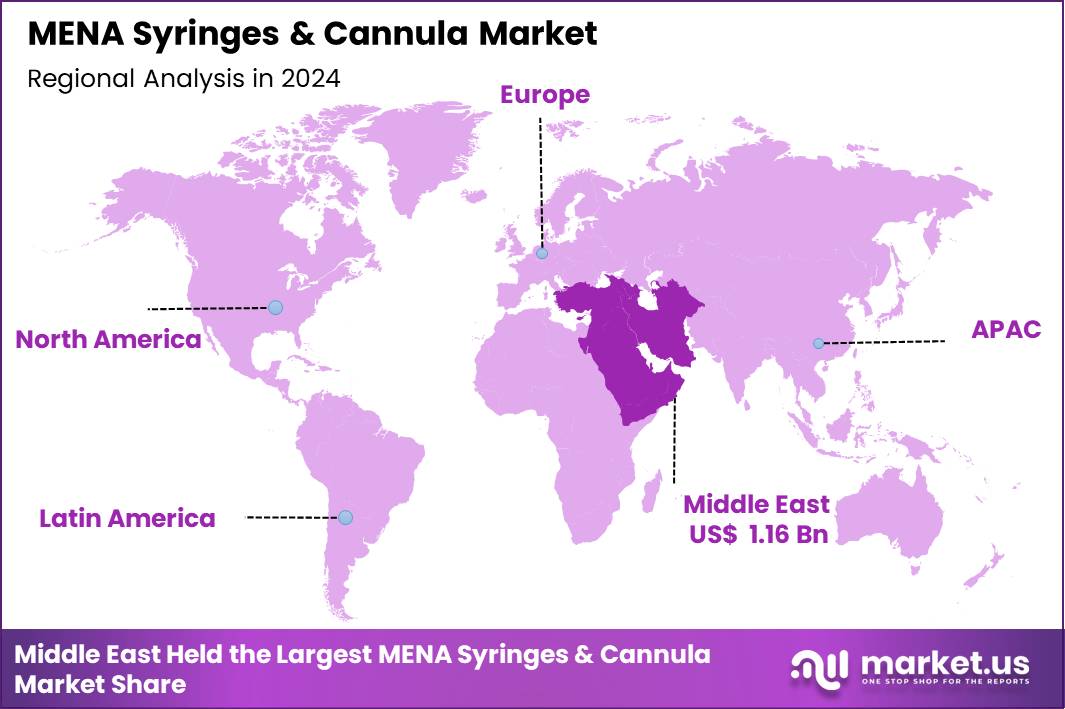

The MENA Syringes & Cannula Market size is expected to be worth around US$ 3.17 billion by 2034 from US$ 1.72 billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, Middle East led the market, achieving over 67.4% share with a revenue of US$ 1.16 Billion.

The MENA Syringes & Cannula Market represents a critical component of the region’s medical consumables ecosystem, driven by expanding immunization programs, rising chronic disease prevalence, and growing surgical and diagnostic procedure volumes. Countries across the Middle East and North Africa conduct hundreds of millions of injections annually for vaccination, diabetes management, IVF cycles, oncology infusions, and routine medical care.

Government-led immunization programs in Saudi Arabia, the UAE, Egypt, and Morocco administer millions of vaccine doses every year, significantly increasing syringe consumption for both pediatric and adult immunization schedules.

Syringes play an essential role in drug delivery, anesthesia administration, insulin therapy, contrast injection in radiology, and specimen extraction, while cannulas remain fundamental in blood collection, IV insertion, transfusions, and minimally invasive surgical procedures. Growing adoption of safety-engineered syringes, auto-disable syringes, and safety cannulas is shaped by WHO’s recommendations for needlestick injury prevention. MENA’s healthcare expansion including new hospitals in Saudi Arabia’s Vision 2030 program and the UAE’s continuous private sector investments further reinforces demand.

For instance, the number of syringes used in Middle East countries were Saudi Arabia which led with 4.1 billion units (58% of the total), followed by Turkey at 1.3 billion units and Israel at 350 million units. Per capita, Saudi Arabia averaged 113 units per person, well above the global average of 20.

Disposable syringes dominate due to stringent infection prevention norms, especially in outpatient clinics, emergency departments, dialysis units, and vaccination centers, where single-use compliance is mandatory. Cannula use is expanding in ICUs, oncology wards, and emergency medicine as IV therapy and infusion-related procedures grow. As medical tourism surges in the UAE, Egypt, Jordan, and Turkey, procedural volumes rise, increasing the consumption of both syringes and cannulas.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.72 Billion, with a CAGR of 6.3%, and is expected to reach US$ 3.17 billion by the year 2034.

- The Product Type segment is divided into Syringes, and Cannulas, with Syringes taking the lead in 2024 with a market share of 74.1%

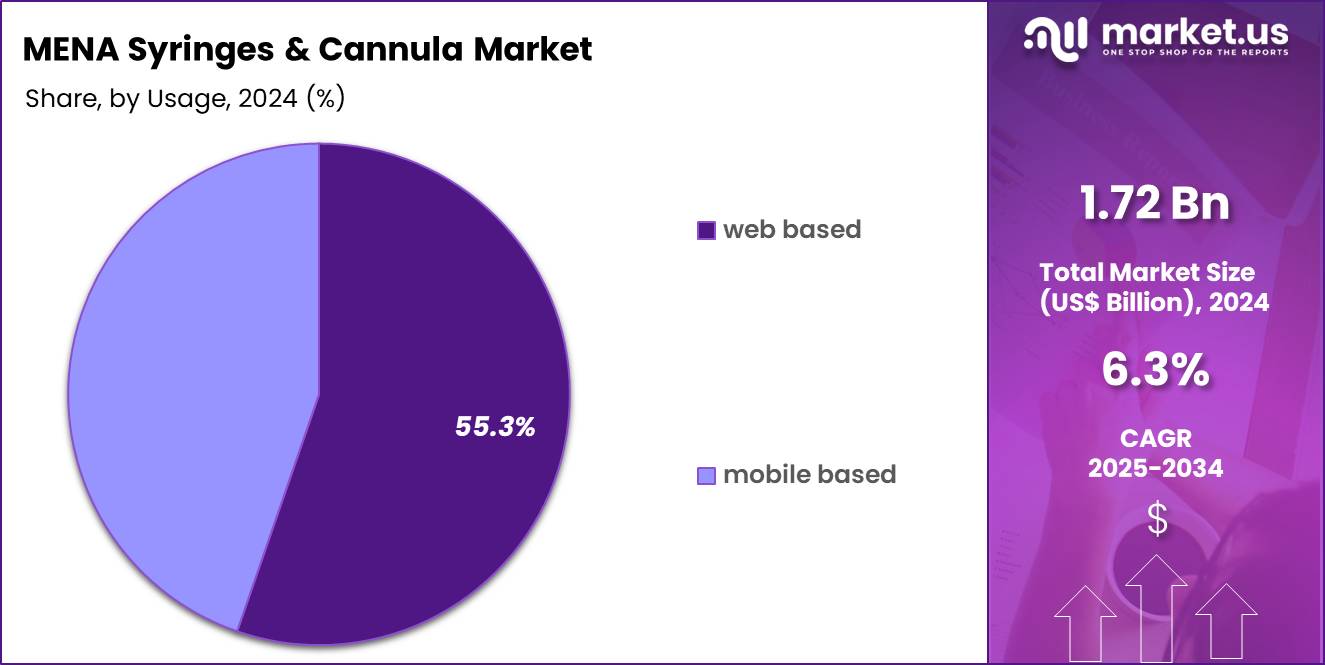

- The Usage segment is divided into Disposable, and Reusable, with Disposable taking the lead in 2024 with a market share of 81.2%

- The Distribution Channel segment is divided into Institutional Sales, and Retail Sales, with Institutional Sales taking the lead in 2024 with a market share of 76.5%

- Middle East led the market by securing a market share of 67.4% in 2024.

Product Type Analysis

Syringes account for the dominant share of 74.1% in 2024 due to their extensive integration into routine immunizations, chronic disease management, and medication administration across hospitals and primary-care centers. MENA countries collectively administer tens of millions of vaccine doses annually under national immunization programs, directly driving syringe consumption. Insulin syringes are widely used due to high diabetes prevalence Saudi Arabia, Kuwait, Qatar, and Egypt are among the world’s highest per-capita diabetic populations, increasing daily injection volume for insulin-dependent patients.

In emergency departments, syringes support rapid medication delivery, anticoagulant dosing, and emergency analgesics. Radiology units rely on syringes for contrast media injections used in CT and MRI procedures, while anesthesia teams utilize sterile syringes for regional blocks and perioperative drug management. Tattoo studios, aesthetic clinics, and IVF centers also add to syringe demand, particularly for controlled medication delivery and hormonal injections. With increasing preference for WHO-recommended auto-disable and safety syringes, countries such as Egypt and Morocco continue to expand procurement of single-use safety variants for vaccination programs.

Cannulas hold a significant and growing share, driven by rising surgical volumes, increased ICU admissions, and a surge in infusion-dependent therapies. Hospitals across MENA record high levels of IV fluid administration, blood transfusions, and antibiotic infusions, each requiring cannulation. GCC countries with rapidly expanding tertiary-care infrastructure use large quantities of cannulas in emergency medicine, oncology, cardiology, and trauma units.

Usage Analysis

Disposable products represent the largest share in MENA accounting for 81.2% market share in 2024, driven by stringent infection-control policies and WHO guidelines encouraging single-use injection devices. Countries across the region record high outpatient visits annually Saudi Arabia alone records tens of millions of outpatient consultations creating high turnover of syringes and cannulas. Disposable syringes are mandatory in vaccination drives, blood-draw stations, antenatal care, emergency resuscitation, and oncology injections.

Bloodborne pathogen risks including hepatitis B, hepatitis C, and HIV have led ministries of health to enforce strict single-use protocols. Auto-disable syringes, widely adopted globally for vaccine delivery, have been integrated into UAE, Jordan, and Egypt immunization programs. Disposable cannulas dominate in IV therapy due to contamination risks associated with reuse. Dental clinics, aesthetic centers, and home-care providers also rely heavily on disposable injection devices.

Reusable syringes and cannulas maintain a limited but functional presence, primarily in controlled clinical environments with strong sterilization infrastructure. Some laboratories and veterinary facilities use reusable syringe systems for repetitive dosing procedures. However, widespread adoption is restricted due to infection-control challenges, the need for validated sterilization cycles, autoclave dependency, and risks of cross-contamination if reprocessing is inconsistent.

Distribution Channel Analysis

Institutional sales constitute the majority procurement channel which accounted for 76.5% market share in 2024, reflecting large-scale purchasing by public hospitals, private hospital chains, military health systems, emergency medical services, and national immunization programs. Ministries of Health often issue tenders for tens of millions of syringes annually for vaccination campaigns, diabetic care programs, and hospital stock replenishment.

Hospitals require continuous supply for daily injections, IV insertion, postoperative analgesia, transfusions, and oncology cycles. Emergency medical services across the GCC handle thousands of trauma and cardiac emergencies annually, each involving multiple cannulations. Teaching hospitals and blood banks are among the largest institutional users, relying on high volumes of cannulas for blood donation drives and cross-matching procedures.

Retail distribution serves self-administration patients, home-care providers, diabetic populations, and community pharmacies. Diabetic patients in MENA who administer insulin daily rely heavily on pharmacy-distributed syringes and safety needles. Fertility treatments common in the UAE, Saudi Arabia, Jordan, and Egypt require patients to purchase hormone-injection syringes directly from pharmacies.

The growth of over-the-counter (OTC) medical devices has made syringes and cannulas accessible for home-care services, elderly care, and chronic disease management. Retail channels also support veterinary clinics, aesthetic practitioners, and private healthcare providers who prefer flexible, small-volume procurement models.

Key Market Segments

By Product Type

- Syringes

- Cannulas

By Usage

- Disposable

- Reusable

By Distribution Channel

- Institutional Sales

- Retail Sales

Drivers

Expansion of National Immunization Campaigns Across MENA

National immunization programs across the Middle East and North Africa drive substantial demand for syringes by supporting large-scale vaccine administration for infants, adolescents, adults, and high-risk groups. Countries such as Saudi Arabia, the UAE, Egypt, Qatar, and Morocco collectively administer tens of millions of vaccine doses annually, covering polio, measles, hepatitis B, influenza, tetanus, HPV, and COVID-19 boosters. Egypt alone conducts more than 40 million vaccinations each year under its expanded program, making auto-disable syringes essential for safe injections. The WHO estimates that 16 billion injections occur globally every year, and MENA contributes significantly due to high birth rates and population density in North Africa.

GCC countries maintain some of the highest childhood immunization coverage globally, often above 95%, requiring continuous procurement of single-use syringes. During the COVID-19 vaccination phase, the UAE administered one of the world’s highest doses per capita, highlighting the region’s extraordinary syringe utilization. Seasonal influenza campaigns also expand syringe demand, especially in Saudi Arabia, which vaccinates millions of Hajj and Umrah pilgrims annually to minimize cross-border disease transmission.

The increasing addition of HPV and adult vaccination schedules in the UAE, Qatar, and Bahrain further strengthens syringe consumption, making immunization a major driver of this market’s long-term momentum. In September 2024, B. Braun Medical Inc. (B. Braun), a prominent name in smart infusion therapy and pain management, announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for the Introcan Safety® 2 Deep Access IV Catheter, the latest extension of its Introcan Safety 2 IV Catheter portfolio.

Restraints

Needlestick Injuries and the Rising Cost of Safety Compliance

Needlestick injuries remain a major restraint for syringe and cannula adoption, as they trigger regulatory tightening, increase hospital liability, and elevate procurement costs for safety-engineered devices. Globally, WHO estimates 3 million healthcare workers experience needlestick injuries annually, with risks of exposure to hepatitis B, hepatitis C, and HIV.

Studies show hepatitis B transmission rates after a contaminated needlestick can reach 30%, making single-use safety devices essential. In MENA, large tertiary hospitals in Saudi Arabia, Egypt, and the UAE report thousands of sharps-related injuries each year despite safety protocols, particularly in emergency departments, blood-draw units, and high-volume outpatient clinics.

Safety syringes and cannulas featuring retractable needles, shields, or passive locking mechanisms—are significantly more expensive than traditional versions. For public health systems managing millions of injections, this creates budgetary strain. Import dependency further amplifies cost fluctuations; supply chain disruptions during pandemics caused syringe shortages and price spikes across MENA.

Many North African regions face additional constraints due to limited disposal infrastructure; improper waste segregation leads to used syringe recirculation risks, prompting stricter regulations that increase operational costs. Compliance requires training, monitoring, and specialized disposal containers.

Opportunities

Growing Adoption of Safety-Engineered Syringes and Cannulas

The movement toward WHO-aligned injection safety across MENA presents a major growth opportunity for manufacturers of safety-engineered syringes and cannulas. WHO’s global initiative to eliminate unsafe injections encourages exclusive use of auto-disable (AD) syringes for immunization programs. Countries such as Egypt, Morocco, Jordan, and Sudan have already integrated AD syringes into their routine vaccination schedules, driving demand for tens of millions of safety devices annually. Clinical studies show that safety syringes can reduce needlestick injuries by up to 80%, making them attractive to ministries of health and private hospital networks.

Rising volumes of inpatient admissions and chronic disease cases further expand this opportunity. Diabetes prevalence in Saudi Arabia, Kuwait, and Qatar ranges from 17% to 25%, contributing to millions of self-administered insulin injections daily. Adoption of safety insulin syringes and pen needles is increasing, particularly among elderly populations.

Safety cannulas also play a growing role in high-risk environments such as oncology wards, ICUs, and emergency medicine units. With more than 10,000 cardiac surgeries performed annually in Saudi Arabia alone and expanding cancer treatment centers across UAE and Egypt, demand for reliable, injury-preventing cannulas continues to rise. As governments shift procurement policy toward needlestick-free healthcare environments, manufacturers offering compliance-ready safety products stand to gain significantly.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic fluctuations and geopolitical uncertainties significantly influence the MENA Syringes & Cannula Market by affecting supply chains, raw-material availability, procurement cycles, and regional healthcare priorities. Natural disasters, political tensions, and global economic shifts frequently disrupt the medical supply chain, especially in countries that rely heavily on imported syringes, cannulas, or components. Over 80% of medical disposable supplies in several North African markets are imported, making them vulnerable to currency depreciation, customs delays, and inflation-driven procurement challenges.

Raw materials such as medical-grade plastics, stainless steel, and rubber often experience price volatility tied to global petroleum markets, which heavily impacts manufacturing costs for syringes and cannulas. In May 2021, BD initiated a voluntary recall of select batches of its Venflon Pro IV cannula after identifying a potential risk of leakage from the injection port.

Geopolitical conflict zones such as Syria, Yemen, and parts of Libya experience severe disruptions in healthcare delivery, increasing reliance on humanitarian aid. International organizations like WHO and UNICEF often administer millions of emergency vaccine doses in these regions, temporarily increasing syringe demand while simultaneously straining logistics networks.

During global crises such as COVID-19, export restrictions imposed by key manufacturing countries led to shortages of syringes and cannulas worldwide. For example, several Asian nations temporarily restricted syringe exports, delaying shipments to Gulf countries and North Africa. Additionally, rising fuel costs impact transportation expenses, while port congestion in the Red Sea and Mediterranean can prolong delivery timelines by weeks.

Latest Trends

Rapid Growth of Micro-Cannulas in Aesthetic and Minimally Invasive Procedures

A major market trend in MENA is the accelerating adoption of micro-cannulas in dermatology and aesthetic medicine, driven by rising demand for minimally invasive cosmetic procedures. The UAE and Saudi Arabia are among the world’s fastest-growing hubs for medical aesthetics, with clinics performing millions of procedures annually, including dermal fillers, PRP injections, lip augmentation, and facial contouring.

Micro-cannulas, known for reducing bruising, improving precision, and minimizing tissue trauma, are increasingly replacing traditional needles. Studies show micro-cannulas can lower injection-site complications by up to 70%, making them preferred by dermatologists and cosmetic surgeons.

Turkey—one of MENA’s key medical tourism leaders conducts over 1.5 million aesthetic procedures annually, fueling rapid cannula consumption. Clinics across Dubai, Riyadh, and Doha are shifting to cannulas with flexible shafts and rounded tips for safer filler placement. In parallel, minimally invasive surgeries are increasing across orthopedics, gynecology, cardiology, and gastroenterology, expanding the use of specialized cannulas.

The rise of day-care surgery centers and outpatient cosmetic clinics broadens adoption even further. With patient preference shifting toward quicker recovery and reduced downtime, micro-cannulas have become a defining trend shaping the evolution of injection and infusion technology across the region.

Regional Analysis

Middle East is leading the MENA Syringes & Cannula Market

The Middle East leads the MENA Syringes & Cannula Market with 67.4% market share due to advanced healthcare infrastructure, strong public-health investment, and consistently high procedure volumes. Saudi Arabia alone records over 90 million outpatient visits annually, each involving routine injections, blood draws, or IV therapy that require syringes and cannulas. The region also has some of the world’s highest diabetes rates, with adult prevalence reaching over 24% in Saudi Arabia and nearly 20% in Kuwait, driving millions of insulin injections each day.

The UAE performs more than a million radiology scans annually, where syringes are essential for contrast administration. High surgical volumes across GCC hospitals, combined with rapid expansion of emergency medical services—such as Saudi Red Crescent’s millions of yearly emergency responses—create consistent cannula usage. Large-scale immunization programs, including annual influenza vaccination for Hajj and Umrah pilgrims exceeding 10 million people, further boost syringe consumption. Together, strong procurement capacity and high clinical activity make the Middle East the dominant regional market.

The North Africa region is expected to experience the highest CAGR during the forecast period

North Africa is experiencing rapid growth in syringe and cannula consumption due to expanding public-health programs, rising procedural loads, and growing population density. Egypt, with more than 105 million residents, operates one of the region’s largest healthcare networks, conducting tens of millions of vaccine doses annually, significantly increasing syringe usage.

The country also manages one of the largest dialysis patient populations in MENA, exceeding 60,000 active patients, driving high cannula utilization for regular treatments. Morocco and Algeria have expanded surgical and emergency services, with Morocco reporting over 2 million emergency admissions annually, each requiring frequent IV insertion and medication delivery.

Tunisia and Algeria continue to scale national immunization programs, achieving coverage rates above 90% for childhood vaccinations, which directly elevates syringe demand. Growth in private clinics, diagnostic laboratories, and fertility centers across North Africa contributes further, especially as IVF cycles rise steadily in Egypt and Tunisia.

Key Countries

- Saudi Arabia

- Turkey

- UAE

- Egypt

- Morocco

- Qatar

- Kuwait

- Iran

- Rest of MENA

Key Players Analysis

Key players in the market include Becton, Dickinson and Company (BD), B. Braun Melsungen (B. Braun), Terumo Corporation, Nipro Corporation, Cardinal Health, Medline Industries, Inc., Hindustan Syringes & Medical Devices Ltd., Ambu A/S, ICU Medical, Inc., Teleflex Incorporated, Smiths Medical, CONMED Corporation, and Others.

Becton, Dickinson and Company remains one of the most influential players in the MENA Syringes & Cannula Market, driven by its broad portfolio of safety syringes, insulin syringes, auto-disable syringes, and IV cannulation systems. BD’s safety-engineered devices are widely adopted across Saudi Arabia, the UAE, and Qatar due to the region’s emphasis on reducing needlestick injuries and improving injection safety.

B. Braun is a significant contributor to the syringes and cannula landscape in MENA, particularly through its high-precision IV cannulas, needle-free connectors, infusion accessories, and sterile single-use syringes. The company’s Introcan Safety cannulas are widely utilized in hospitals across Saudi Arabia, the UAE, and Kuwait due to their passive safety mechanisms and proven ability to reduce sharps-related injuries.

Terumo Corporation plays a prominent role in the MENA Syringes & Cannula Market through its advanced injection systems, insulin syringes, hypodermic needles, venous access devices, and renowned Terumo SurGuard safety needles. Terumo’s thin-wall and ultra-fine needle technologies are especially favored in diabetic populations across GCC nations, where daily insulin injection volumes are among the highest globally due to elevated diabetes prevalence.

Top Key Players

- Becton, Dickinson and Company (BD)

- Braun Melsungen (B. Braun)

- Terumo Corporation

- Nipro Corporation

- Cardinal Health

- Medline Industries, Inc.

- Hindustan Syringes & Medical Devices Ltd.

- Ambu A/S

- ICU Medical, Inc.

- Teleflex Incorporated

- Smiths Medical

- CONMED Corporation

- Others

Recent Developments

- In October 2025, West Pharmaceutical Services, Inc. (NYSE: WST), a global leader in advanced injectable drug delivery solutions, introduced its West Synchrony™ Prefillable Syringe (PFS) System at CPHI Worldwide. The launch represents a major advancement in drug delivery, providing a fully verified, single-source platform expected to enter commercial availability in January 2026.

- In September 2024, BD, a leading global medical technology firm, announced the commercial launch of its BD Neopak™ XtraFlow™ Glass Prefillable Syringe, along with a new capacity expansion for the BD Neopak™ Glass Prefillable Syringe platform. These developments aim to support the rising demand for biologic therapies.

- In October 2022, Hindustan Syringes & Medical Devices (HMD), a major producer of disposable and auto-disable syringes, scaled down its syringe output from more than 40 lakh AD units per day to about 5–6 lakh. This reduction followed the government’s decision to suspend or postpone orders amid declining vaccination demand.

Report Scope

Report Features Description Market Value (2024) US$ 1.72 Billion Forecast Revenue (2034) US$ 3.17 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Syringes and Cannulas), By Usage (Disposable and Reusable), By Distribution Channel (Institutional Sales, and Retail Sales) Country Analysis Saudi Arabia, Turkey, UAE, Egypt, Morocco, Qatar, Kuwait, Iran, and Rest of MENA Competitive Landscape Becton, Dickinson and Company (BD), B. Braun Melsungen (B. Braun), Terumo Corporation, Nipro Corporation, Cardinal Health, Medline Industries, Inc., Hindustan Syringes & Medical Devices Ltd., Ambu A/S, ICU Medical, Inc., Teleflex Incorporated, Smiths Medical, CONMED Corporation, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  MENA Syringes & Cannula MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

MENA Syringes & Cannula MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company (BD)

- Braun Melsungen (B. Braun)

- Terumo Corporation

- Nipro Corporation

- Cardinal Health

- Medline Industries, Inc.

- Hindustan Syringes & Medical Devices Ltd.

- Ambu A/S

- ICU Medical, Inc.

- Teleflex Incorporated

- Smiths Medical

- CONMED Corporation

- Others