Global Medical Waste Management System Market By Waste Type (Non-Hazardous Waste and Hazardous Waste (Infectious and Sharps, Pharmaceutical, Radioactive, Pathological and Others)), By Service (Segregation & Containment, Collection & Transportation, Treatment & Disposal (Chemical Disinfection, Autoclaving, Incineration, Microwaving, etc.), Recycling and Others), By Treatment Site (Off-Site and On-Site), By Waste Generator (Hospitals & Nursing Homes, Clinics, Diagnostic Laboratories, Research Centres, Blood Banks and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 172934

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

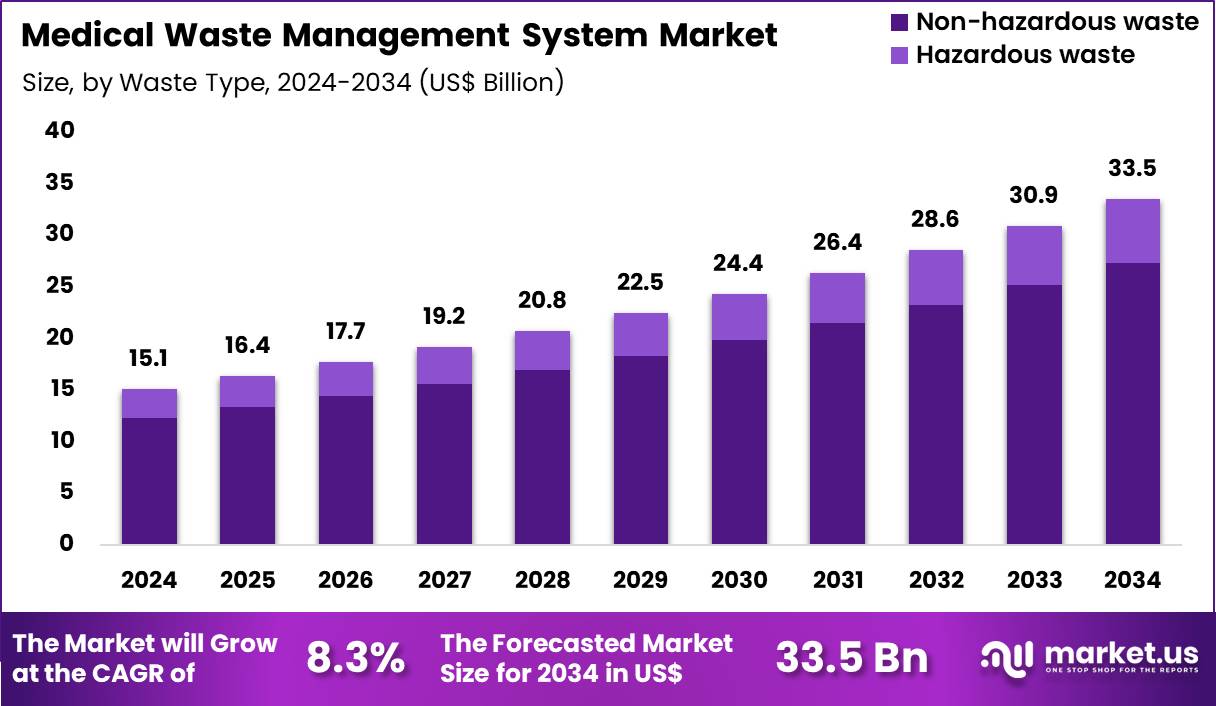

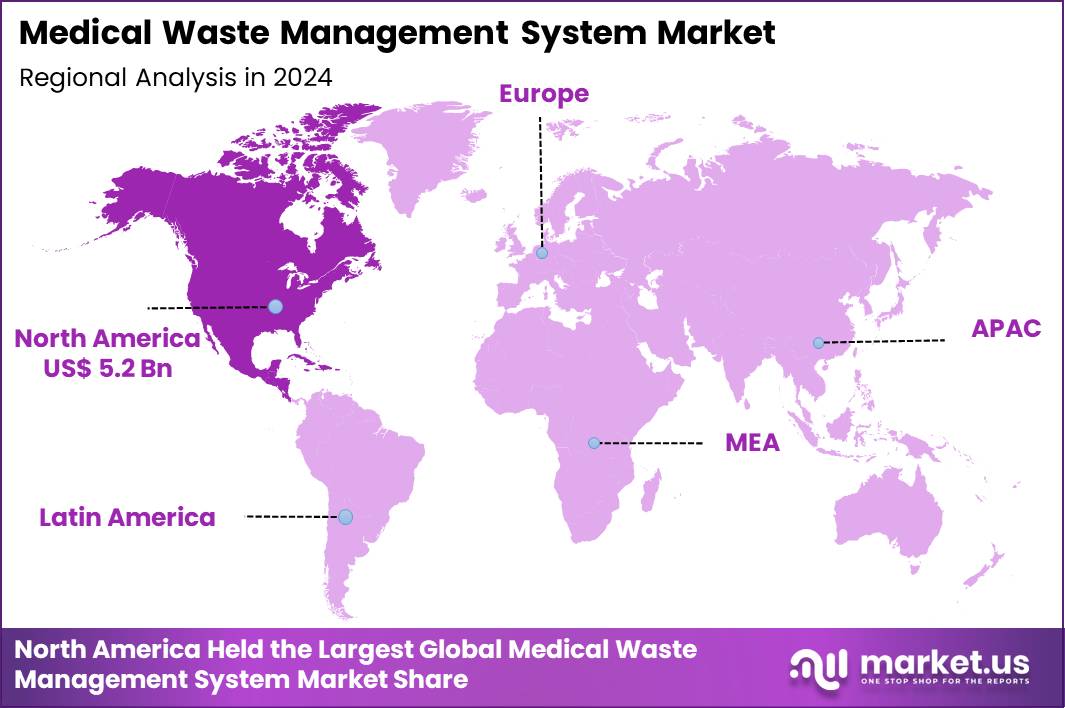

The Global Medical Waste Management System Market size is expected to be worth around US$ 33.5 Billion by 2034 from US$ 15.1 Billion in 2024, growing at a CAGR of 8.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 34.6% share with a revenue of US$ 5.2 Billion.

Increasing regulatory scrutiny and heightened awareness of infection control propel healthcare facilities to implement comprehensive medical waste management systems that ensure safe handling, treatment, and disposal of hazardous materials. Hospitals deploy these systems to segregate infectious waste such as sharps, blood-soaked materials, and pathological specimens at the point of generation, preventing cross-contamination. These platforms facilitate the processing of pharmaceutical waste, including expired drugs and chemotherapy residues, through secure collection and destruction methods.

Laboratories utilize automated systems to manage chemical and microbiological waste, maintaining compliance during routine diagnostic testing. Facilities apply these solutions for treating general biomedical waste like gloves, gowns, and bandages via non-incineration technologies that minimize environmental impact.

In February 2025, the Government of India inaugurated “Sṛjanam,” the nation’s first indigenous Automated Bio Medical Waste Treatment Plant, at AIIMS New Delhi. Developed by CSIR-NIIST, the system processes up to 400 kg of pathogenic waste daily without incineration. By utilizing automated disinfection and odor neutralization, the plant reduces human exposure to hazardous materials and lowers energy costs compared to traditional disposal methods.

Waste management providers pursue opportunities to integrate advanced non-thermal treatment technologies that enable on-site processing of infectious waste, reducing transportation risks and logistics costs for large healthcare networks. Developers engineer modular systems capable of handling diverse waste streams, including cytotoxic agents and radioactive materials from nuclear medicine departments.

These innovations expand applications in ambulatory surgery centers, where compact units process sharps and tissue waste efficiently during high-volume procedures. Opportunities arise in recycling disinfected plastics and metals from treated disposables, supporting circular economy initiatives in medical device manufacturing.

Companies advance automated segregation tools that employ sensors to classify waste at source, enhancing accuracy in mixed-waste environments. Firms invest in energy-efficient shredding and microwave systems, broadening utility for rapid treatment in emergency departments and intensive care units.

Industry leaders introduce smart tracking platforms that monitor waste from generation to final disposal, providing audit-ready documentation for regulatory inspections. Developers refine chemical disinfection processes with eco-friendly agents that achieve high microbial inactivation rates while preserving material integrity for recycling.

Market participants prioritize odor-control mechanisms and low-emission designs to improve staff satisfaction in confined hospital spaces. Innovators incorporate real-time data analytics to optimize treatment cycles, minimizing downtime in continuous-operation facilities. Companies emphasize scalable solutions that adapt to varying waste volumes in multi-specialty hospitals and diagnostic laboratories. Ongoing advancements focus on hybrid systems combining mechanical and biological treatments, delivering sustainable outcomes across the full spectrum of medical waste applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 15.1 Billion, with a CAGR of 8.3%, and is expected to reach US$ 33.5 billion by the year 2034.

- The waste type segment is divided into non-hazardous waste and hazardous waste, with non-hazardous waste taking the lead in 2024with a market share of 81.4%.

- Considering service, the market is divided into segregation & containment, collection & transportation, treatment & disposal, recycling and others. Among these, treatment & disposal held a significant share of 37.9%.

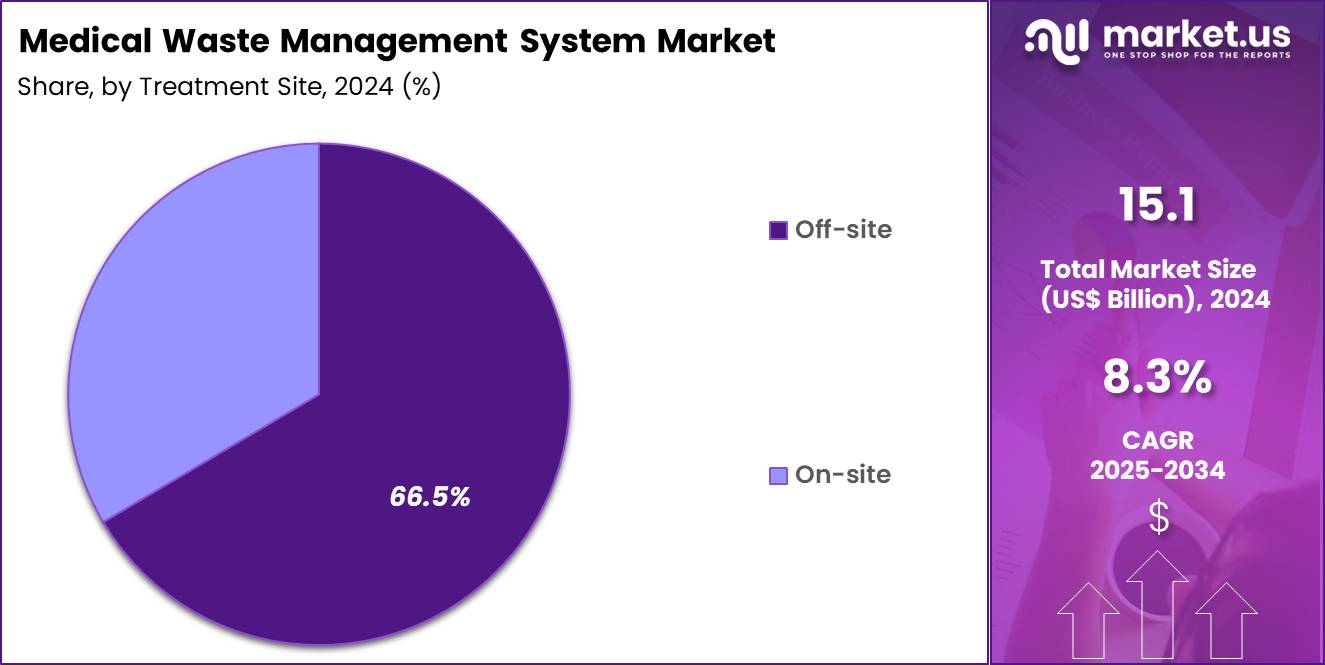

- Furthermore, concerning the treatment site segment, the market is segregated into off-site and on-site. The off-site sector stands out as the dominant player, holding the largest revenue share of 66.5% in the market.

- The waste generator segment is segregated into hospitals & nursing homes, clinics, diagnostic laboratories, research centres, blood banks and others, with the hospitals & nursing homes segment leading the market, holding a revenue share of 40.2%.

- North America led the market by securing a market share of 34.6% in 2024.

Waste Type Analysis

Non hazardous waste accounted for 81.4% of the medical waste management system market, reflecting the large volume of general healthcare waste generated daily. Hospitals and care facilities produce significant quantities of packaging materials, paper, food waste, and disposable supplies. Rising patient admissions and outpatient visits expand overall waste volumes. Increased use of single use medical products strengthens non hazardous waste generation.

Healthcare facilities prioritize efficient handling of this waste stream to control operational costs. Segregation initiatives improve identification and routing of non hazardous materials. Sustainability programs encourage recycling and volume reduction strategies. Regulatory frameworks support differentiated management approaches for non hazardous waste. Urban healthcare expansion sustains steady waste output. This segment is projected to maintain dominance due to sheer volume and routine healthcare operations.

Service Analysis

Treatment and disposal services represented 37.9% of the medical waste management system market, driven by strict regulatory requirements for safe waste elimination. Healthcare providers rely on specialized services to ensure compliance with environmental and public health standards. Treatment processes reduce infection risk and environmental contamination.

Growing regulatory scrutiny increases demand for certified disposal partners. Expansion of healthcare infrastructure elevates waste treatment needs. Advanced technologies improve efficiency and capacity of disposal facilities. Outsourcing preferences reduce the burden on healthcare staff. Centralized treatment ensures standardized safety protocols. Rising awareness of biosecurity strengthens service adoption. This service segment is anticipated to grow due to compliance driven demand and increasing waste volumes.

Treatment Site Analysis

Off site treatment accounted for 66.5% of the medical waste management system market, supported by cost efficiency and operational convenience. Healthcare facilities prefer off site services to avoid capital investment in treatment equipment. Specialized off site plants offer higher processing capacity and advanced technologies. Regulatory complexity encourages reliance on licensed external providers.

Logistics networks support timely waste collection and transport. Urban concentration of healthcare facilities favors centralized treatment models. Risk reduction strategies prioritize professional handling outside care premises. Contract based service models improve cost predictability. Infrastructure scalability supports growing waste streams. This segment is likely to sustain leadership due to economic and regulatory advantages.

Waste Generator Analysis

Hospitals and nursing homes generated 40.2% of the medical waste management system market, reflecting their high patient throughput and service intensity. Inpatient care produces continuous waste across diagnostic, treatment, and caregiving activities. Surgical procedures and long term care increase disposable usage. Infection control protocols drive frequent material replacement. Expansion of hospital networks increases waste generation points.

Aging populations elevate nursing home occupancy rates. Centralized waste management contracts support large volume handling. Compliance requirements reinforce structured waste management systems. Operational scale sustains steady service demand. Consequently, this waste generator segment is expected to remain dominant due to concentrated waste production and regulatory oversight.

Key Market Segments

By Waste Type

- Non-hazardous waste

- Hazardous waste

- Infectious, Sharps

- Pharmaceutical

- Radioactive

- Pathological

- Others

By Service

- Segregation & Containment

- Collection & Transportation

- Treatment & Disposal (Chemical disinfection, Autoclaving, Incineration, Microwaving, etc.)

- Recycling

- Others

By Treatment Site

- Off-site

- On-site

By Waste Generator

- Hospitals & Nursing homes

- Clinics

- Diagnostic laboratories

- Research centres

- Blood banks

- Others

Drivers

Rising volume of medical waste generation is driving the market

The medical waste management system market is propelled by the escalating volume of medical waste generation, stemming from expanded healthcare services and increased patient volumes in hospitals and clinics worldwide. This surge necessitates advanced management systems to handle hazardous materials safely, ensuring compliance with environmental standards. Key players in the industry respond by enhancing processing capacities to accommodate the growing waste streams from surgical procedures and diagnostic activities.

Government organizations underscore the need for efficient systems to prevent public health risks associated with improper disposal. Pharmaceutical and medical device expansions contribute to higher waste outputs, driving demand for integrated management solutions. Clinical laboratories adopt automated systems to manage biohazardous waste effectively, supporting operational efficiency. Global pandemics and disease outbreaks amplify waste generation, further stimulating market growth.

Academic institutions collaborate on system innovations to address capacity challenges in high-waste environments. Economic analyses highlight the long-term savings from robust management systems in mitigating environmental cleanup costs. Stericycle, a leading provider, treated 1.5 billion pounds of medical waste globally in 2022, reflecting the scale of generation requiring specialized handling.

Restraints

Stringent environmental regulations are restraining the market

The medical waste management system market is constrained by stringent environmental regulations, which impose rigorous requirements for waste segregation, treatment, and disposal to minimize ecological impact. Compliance demands significant investments in technology and training, burdening smaller facilities with financial strain. Regulatory agencies enforce strict guidelines on emissions from incinerators, limiting operational flexibility for management providers.

Manufacturers face delays in system approvals due to extensive validation processes for regulatory adherence. Healthcare institutions in developing regions struggle with infrastructure upgrades to meet international standards, hindering market expansion. Legal penalties for non-compliance discourage investment in new systems amid uncertain enforcement landscapes. Global variations in regulations create complexities for multinational operators, increasing administrative costs.

Clinical practices must allocate resources to documentation and auditing, diverting funds from innovation. Patient safety protocols intersect with environmental rules, adding layers of operational challenges. These regulatory pressures collectively slow market growth by elevating barriers to entry and scalability.

Opportunities

Expansion of healthcare infrastructure in emerging economies is creating growth opportunities

The medical waste management system market offers growth opportunities through the expansion of healthcare infrastructure in emerging economies, where new hospitals and clinics require comprehensive waste handling solutions. Developers can introduce cost-effective systems tailored to regional needs, facilitating safe disposal in underserved areas. Government initiatives in these regions prioritize waste management to support public health goals, opening avenues for partnerships.

Pharmaceutical growth in emerging markets generates additional waste streams, driving demand for scalable systems. Regulatory reforms encourage adoption of modern technologies to align with global standards, fostering market entry. Clinical expansions include outpatient facilities that benefit from modular waste systems for efficient operations.

Academic collaborations provide training on system implementation, enhancing local capabilities. Patient care improvements in remote areas rely on reliable waste management to prevent disease transmission. Economic development funds infrastructure projects, positioning the market for sustained expansion. These opportunities enable diversification and long-term revenue streams in high-potential regions.

Impact of Macroeconomic / Geopolitical Factors

Increasing healthcare budgets and stringent environmental regulations worldwide propel the medical waste management system market forward, as providers invest in innovative incineration and recycling technologies to handle growing volumes from hospitals and clinics. Company executives strategically form partnerships to capitalize on economic booms in emerging regions, enhancing efficiency and compliance amid rising demand for safe disposal solutions.

Inflationary trends, however, boost expenses for fuel, equipment maintenance, and labor, compelling firms to optimize operations and absorb costs that strain profitability during slowdowns. Geopolitical rivalries, including U.S.-China trade frictions and disruptions from conflicts in supply-critical areas, frequently halt shipments of essential containers and treatment units, leading to operational delays for reliant businesses. Current U.S. tariffs under Section 301 impose duties up to 25 percent on Chinese-origin medical waste equipment as of December 2025, heightening import costs for American distributors and compressing margins across the supply chain.

These tariffs further provoke retaliatory actions from international partners, restricting U.S. exports of advanced systems and impeding collaborative ventures. Despite these setbacks, the tariff structure motivates accelerated investments in domestic production facilities and alternative sourcing from allies like Europe, fortifying supply resilience. This proactive adaptation cultivates greater independence, spurs technological progress, and positions the market for steady, profitable advancement in the long run.

Latest Trends

Acquisition of key players for market consolidation is a recent trend

In 2024, the medical waste management system market has exhibited a notable trend toward consolidation through strategic acquisitions, allowing larger entities to enhance service offerings and geographic reach. Acquirers integrate acquired technologies to improve waste processing efficiency and compliance capabilities. Healthcare providers benefit from consolidated services that streamline vendor management and reduce operational complexities.

Developers leverage acquisitions to expand into regulated medical waste treatment and secure information destruction. Regulatory oversight ensures acquisitions maintain high standards in waste handling practices. Clinical facilities gain access to comprehensive solutions post-acquisition, supporting sustainability goals. Academic analyses highlight improved economies of scale in consolidated operations for cost-effective services.

Industry partnerships post-acquisition focus on innovation in waste minimization strategies. Ethical considerations guide integration to preserve service quality across expanded networks. Waste Management Inc. acquired Stericycle in 2024, resulting in 556,700 tons of medical waste treated under WM Healthcare Solutions that year.

Regional Analysis

North America is leading the Medical Waste Management System Market

In 2024, North America captured a 34.6% share of the global medical waste management system market, bolstered by heightened regulatory enforcement and a rise in healthcare facility expansions that necessitated advanced disposal technologies to handle infectious and hazardous materials safely. Hospitals and clinics amplified investments in autoclaving and microwave systems to comply with Environmental Protection Agency standards, addressing surges in waste from outpatient procedures and chronic care services.

Pharmaceutical manufacturers outsourced segregation and treatment processes to specialized firms, optimizing compliance with Occupational Safety and Health Administration guidelines while minimizing environmental impacts. Demographic aging contributed to increased waste volumes from long-term care facilities, prompting adoption of on-site shredding and chemical neutralization methods for sharps and pharmaceuticals. Biotechnology sectors integrated tracking software for real-time monitoring, enhancing traceability amid supply chain stabilizations post-pandemic.

Public health campaigns promoted sustainable practices, such as recycling non-hazardous components, fostering partnerships with waste haulers for efficient collection. Infrastructure upgrades in urban centers supported centralized incineration facilities, reducing landfill burdens and emissions. A 2023 review published by the National Institutes of Health indicates that the United States generates 8.4 to 10.7 kg of healthcare waste per bed per day.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts anticipate considerable advancement in medical waste management infrastructures across Asia Pacific over the forecast period, fueled by rapid urbanization and intensified infection control measures in expanding healthcare networks. Clinicians prioritize segregated collection protocols, equipping facilities with color-coded bins to streamline hazardous material handling in high-density populations.

Governments enforce mandatory treatment mandates, subsidizing steam sterilization units for rural clinics to curb open dumping practices amid monsoon vulnerabilities. Biotech innovators develop eco-friendly disinfection agents, customizing formulations for tropical pathogens prevalent in community outbreaks. Regional task forces launch audits on disposal compliance, empowering local authorities to upgrade landfills with liner systems for leachate containment.

Pharmaceutical distributors adopt reverse logistics for expired drugs, reducing illicit resale risks in informal markets. Community cooperatives train waste handlers on personal protective gear usage, bridging gaps in occupational safety for informal sector workers. The World Health Organization documented that medical waste generation in Asian countries increased 10 times during the COVID-19 pandemic compared to normal times.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Medical Waste Management System market drive growth by offering end-to-end solutions that cover segregation, collection, transport, treatment, and compliant disposal for hospitals and laboratories. Companies in the Medical Waste Management System market strengthen differentiation through traceability tools, barcoded containers, and documentation workflows that support audits and regulatory reporting.

Commercial strategies in the Medical Waste Management System market emphasize multi-year service contracts with healthcare networks, supported by reliable pickup schedules and emergency-response capacity. Innovation priorities in the Medical Waste Management System market include safer sharps containment, on-site treatment options, and process efficiency that lowers total handling costs.

Geographic expansion in the Medical Waste Management System market targets regions tightening biomedical waste rules and expanding healthcare infrastructure. Stericycle represents a leading company in the Medical Waste Management System market through its large-scale regulated waste services footprint, established compliance expertise, and broad customer base across healthcare facilities.

Top Key Players

- SUEZ S.A.

- Stericycle, Inc (Acquired by WM in late 2024)

- Sharp Compliance, Inc

- Republic Services, Inc

- BioMedical Waste Solutions, LLC

- Veolia Environnement S.A.

- REMONDIS SE & Co. KG

- Clean Harbors, Inc.

- Waste Management, Inc (WM)

- Daniels Health

- Bertin Technologies

- Environmental Solutions Group

- Gamma Waste Systems

- MedPro Disposal

- Triumvirate Environmental

Recent Developments

- In November 2024, WM (formerly Waste Management) completed its acquisition of Stericycle, Inc. for approximately US$ 7.2 billion. This merger established the WM Healthcare Solutions division, integrating Stericycle’s regulated medical waste (RMW) network into WM’s logistics platform. The company expects more than US$ 125 million in annual cost synergies by optimizing disposal assets across the US and Canada.

- In November 2025, Veolia announced a definitive agreement to acquire Clean Earth from Enviri Corporation for US$ 3 billion. The deal, expected to close in mid-2026, will double Veolia’s hazardous and medical waste footprint in the US. The acquisition adds 19 EPA-permitted treatment facilities to Veolia’s network, specifically targeting high-growth sectors like healthcare and retail that require specialized remediation for emerging contaminants.

Report Scope

Report Features Description Market Value (2024) US$ 15.1 Billion Forecast Revenue (2034) US$ 33.5 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Waste Type (Non-Hazardous Waste and Hazardous Waste (Infectious and Sharps, Pharmaceutical, Radioactive, Pathological and Others)), By Service (Segregation & Containment, Collection & Transportation, Treatment & Disposal (Chemical Disinfection, Autoclaving, Incineration, Microwaving, etc.), Recycling and Others), By Treatment Site (Off-Site and On-Site), By Waste Generator (Hospitals & Nursing Homes, Clinics, Diagnostic Laboratories, Research Centres, Blood Banks and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape SUEZ S.A., Stericycle, Inc, Sharp Compliance, Inc, Republic Services, Inc, BioMedical Waste Solutions, LLC, Veolia Environnement S.A., REMONDIS SE & Co. KG, Clean Harbors, Inc., Waste Management, Inc, Daniels Health, Bertin Technologies, Environmental Solutions Group, Gamma Waste Systems, MedPro Disposal, Triumvirate Environmental Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Waste Management System MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Waste Management System MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SUEZ S.A.

- Stericycle, Inc (Acquired by WM in late 2024)

- Sharp Compliance, Inc

- Republic Services, Inc

- BioMedical Waste Solutions, LLC

- Veolia Environnement S.A.

- REMONDIS SE & Co. KG

- Clean Harbors, Inc.

- Waste Management, Inc (WM)

- Daniels Health

- Bertin Technologies

- Environmental Solutions Group

- Gamma Waste Systems

- MedPro Disposal

- Triumvirate Environmental