Medical Tourism Market By Service Type (Therapeutic Service- Cardiovascular Treatment, Orthopaedic Treatment, Cosmetic Treatment, Bariatric Treatment, Dental Treatment, Ophthalmology Treatment, Infertility Treatment, Other Treatment Types; Wellness Service), By Service Provider (Public, Private), By Booking Channel (Phone Booking, Online Booking, In Person Booking), By Tourist Type (Domestic, International), By Customer Orientation (Men, Women, Children), By Duration of Stay (Short-Term, Long-Term), By Traveler Type (Individual Travelers, Group Travelers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 63469

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Service Type Analysis

- Service Provider Analysis

- Booking Channel Analysis

- Tourist Type Analysis

- Customer Orientation Analysis

- Duration of Stay Analysis

- Traveler Type Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

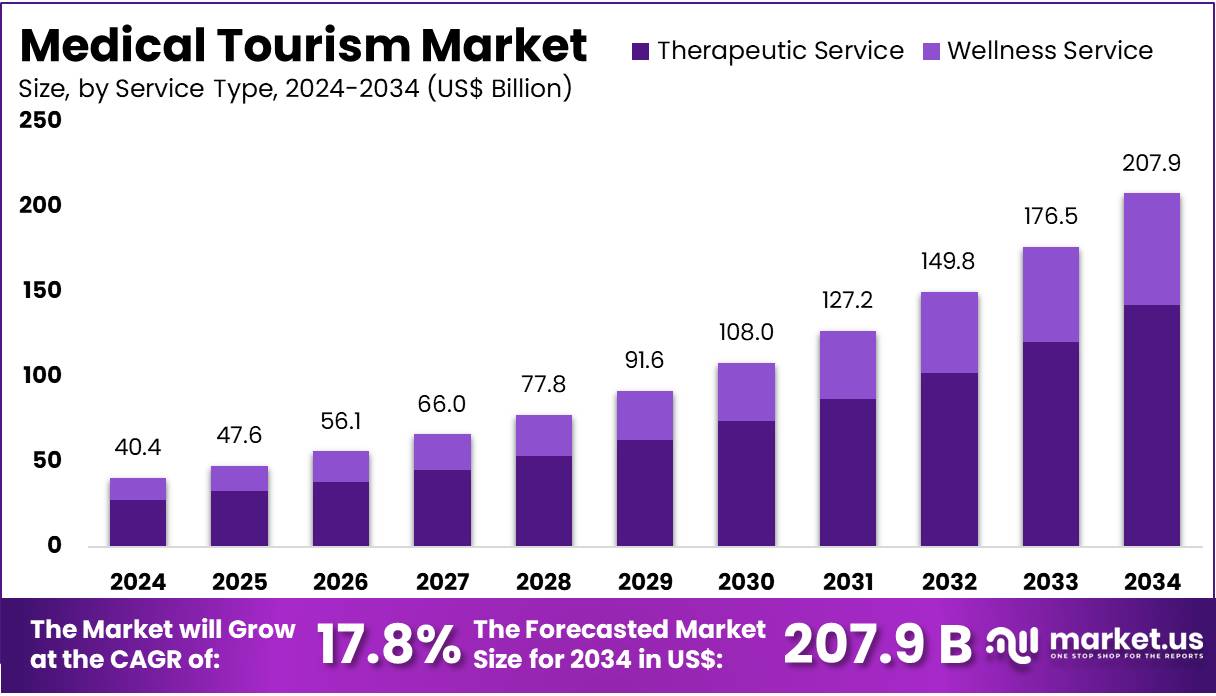

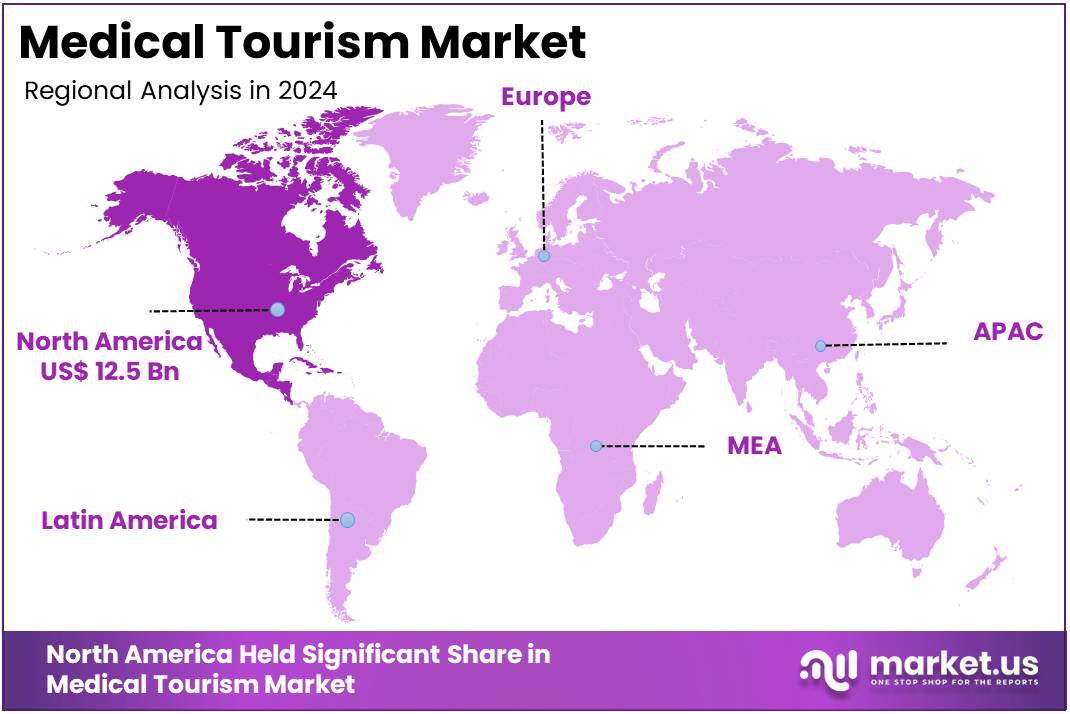

The Medical Tourism Market size is forecasted to be valued at US$ 207.9 billion by 2034 from US$ 40.4 billion in 2024, growing at a CAGR of 17.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 31% share and holds US$ 12.5 Billion market value for the year.

The medical tourism market has witnessed substantial growth over the past few years, driven by multiple factors such as high healthcare costs in developed countries, advancements in medical technology, and the increasing availability of affordable, high-quality treatments abroad. This growth is particularly prominent in regions such as Asia-Pacific, where countries like India, Thailand, and Malaysia have become popular destinations for patients seeking medical procedures at a fraction of the cost compared to developed nations. For example, a bypass surgery in India can cost around $10,000, while the same procedure in the US may exceed $100,000. Such significant cost savings make medical tourism an attractive option for many individuals, especially those in countries with expensive healthcare systems.

Thailand’s medical tourism sector has emerged as a leading destination in Asia, drawing over 1.4 million international patients annually, with more than 60% seeking medical treatment. As Southeast Asia’s top medical tourism hub, Thailand is poised to capitalize on the global growth of this industry, with projections indicating a 43% market expansion, reaching $16 billion by 2030, according to Bumrungrad International Hospital. The Thai hospital sector, comprising nearly 1,300 hospitals, is dominated by public institutions, with 80% operated by the Ministry of Public Health (MOPH), as reported by Expatica. The healthcare system is organized into two primary sectors:

- Public Healthcare: The system is primarily funded through taxes, allowing the majority of the population to access affordable medical services. It is overseen by the Department of Medical Services under the Ministry of Public Health (MOPH), which manages public health facilities and government-run hospitals. A pivotal part of this framework is the Universal Coverage Scheme (UCS), introduced in 2002. This scheme provides a broad range of healthcare services to citizens, typically at minimal personal expense.

- Private Healthcare: Known for its high-quality services, state-of-the-art facilities, and skilled medical professionals. Many private hospitals in Thailand’s medical tourism sector employ internationally trained doctors and multilingual staff, providing personalized care for both local and international patients.

The most frequently sought-after procedures for medical tourism include dental care, cosmetic surgery, fertility treatments, organ and tissue transplants, and cancer treatments. To help attract more medical tourists, governments are investing in healthcare. Countries like Singapore, the UAE, and Turkey offer special programs to make it easier for people to travel for medical care. These include things like tax breaks, medical visas, and faster approval processes.

Governments are increasingly collaborating with private sector entities—such as airlines and hotels—to streamline the medical tourism journey for international patients. These public-private partnerships aim to uphold high standards of care while improving overall accessibility and convenience. A notable example is Singapore, which has positioned itself as a leading hub for medical tourism. In 2024, the country attracted approximately 646,000 international patients, resulting in an estimated revenue of US$ 270 million from medical tourism activities.

Key Takeaways

- In 2024, the market for medical tourism generated a revenue of US$ 40.4 billion, with a CAGR of 17.8%, and is expected to reach US$ 207.9 billion by the year 2034.

- Among the service type segment, therapeutic service dominated the market with 68.3% share in 2024.

- Private service providers were the largest revenue generating segment in 2024 holding 57.5% share.

- In 2024, online booking channel held the largest share of 47.0% in the market.

- International tourist types were the largest as compared to domestic ones in 2024 holding 65.2% share.

- Among Customer Orientation segment, women dominated the market with 52.4% share in 2024.

- Short-Term duration of stay was the largest for medical tourism market generation a share of 72.8% in 2024.

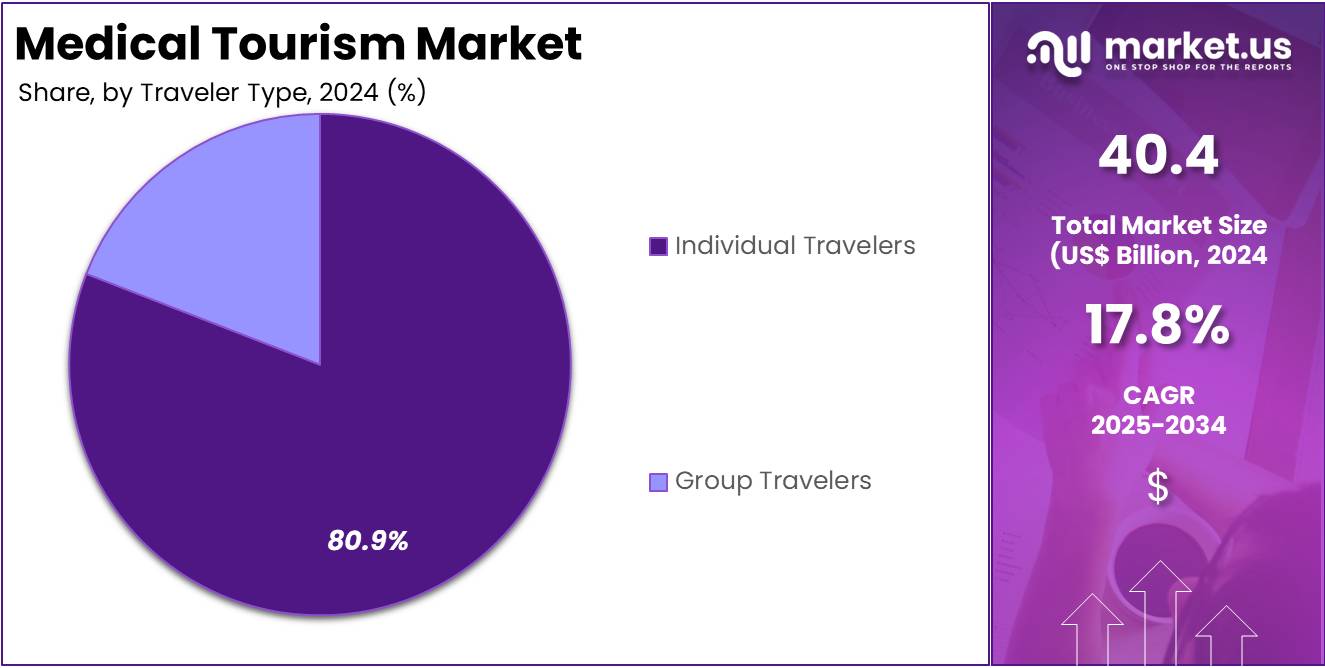

- By Traveler Type, Individual Travelers dominated the market with 80.9% share in 2024.

- North America had a considerable amount of shares in the market in 2024 (approximately 31.0%).

Service Type Analysis

Therapeutic services segment dominated the market with 68.3% share in 2024. Many countries with well-established healthcare infrastructures have become major destinations for individuals seeking high-quality, cost-effective therapeutic treatments. In particular, nations such as India, Thailand, and South Korea are attracting a growing number of medical tourists looking for a wide range of services, including cardiac surgery, cancer treatment, fertility treatments, cosmetic treatments, and orthopedic surgeries.

The appeal of therapeutic medical tourism is driven primarily by the significant cost savings available in these destinations, where treatments that would cost tens of thousands of dollars in developed countries are available at a fraction of the price. For instance, despite having a population of 5.2 million, Costa Rica boasts a high rate of plastic surgeries, driven by its growing medical tourism sector. Similarly, the Czech Republic experiences a high per capita rate of plastic surgery, with a large portion of this demand stemming from medical tourism. According to a Yahoo Finance article, the number of foreign individuals seeking plastic surgery has increased by 15% annually.

Service Provider Analysis

Private service providers held the largest share of 57.5% in 2024. This trend can be attributed to several key factors, including the advanced medical facilities, shorter waiting times, and the superior level of personalized care offered by private institutions. Many international patients prefer private hospitals for these reasons, as they provide the high standard of medical treatment, comfort, and privacy that patients often seek when traveling abroad for healthcare.

In Thailand, for example, private hospitals such as Bumrungrad International Hospital in Bangkok have become well-known among medical tourists. The hospital attracts over a million patients annually, with a considerable portion coming from overseas. These private hospitals are equipped with state-of-the-art medical technologies and staffed by internationally trained professionals, ensuring that patients receive top-quality healthcare.

Similarly, India’s private healthcare institutions, like Apollo Hospitals and Fortis Healthcare, have earned a reputation for their high standards and affordable treatments, making them go-to destinations for patients seeking medical procedures ranging from complex surgeries to cosmetic treatments.

Panama is a prime destination not only for retirement or second homes but also for medical tourism. The country’s private hospitals provide top-quality care, with many affiliated with well-known North American hospitals. International travelers can access reasonably priced insurance plans that offer coverage in Panama and beyond. The medical staff is predominantly English-speaking, and Panama is a well-connected, developed country. Additionally, it features one of the world’s freest economies, and most visitors can stay visa-free for up to 180 days each year.

Booking Channel Analysis

The medical tourism market has seen a significant shift toward online booking channels, with digital platforms now dominating the market with 47.0% share in 2024, as the preferred method for international patients to arrange medical treatments abroad. This change has been driven by several factors, including the growing availability of online information, ease of comparing treatment options, and the convenience that digital services provide to patients. As a result, more patients are bypassing traditional intermediaries and turning to the internet to research healthcare providers, evaluate services, and schedule their treatments.

Online booking platforms have become indispensable tools for medical tourists, offering a convenient and streamlined process to arrange consultations, surgeries, and post-operative care. Websites and digital services dedicated to medical tourism allow users to browse a wide array of treatment options, access detailed profiles of hospitals and clinics, read patient reviews, and directly book appointments.

For instance, TravoCure provides a wide range of support services for medical and wellness travelers, assisting patients worldwide. With years of experience delivering exceptional service to global customers in various travel aspects, we aim to offer a similar high-quality experience for medical travelers seeking excellent treatments for any condition in preferred destinations such as India, Turkey, Dubai, Thailand, Saudi Arabia, UAE, Sri Lanka, Oman, Uzbekistan, Egypt, South Korea, and more.

Additionally, Universal Medical Travel is an independent company specializing in planning, coordinating, and managing patient journeys for medical or dental care abroad. As experienced Medical Tourism Facilitators, their main goal is to ensure patients receive superior healthcare services at affordable prices while enjoying a smooth and hassle-free travel experience.

Tourist Type Analysis

The international segment was the largest in the medical tourism market holding 65.2% share in 2024, with a growing number of patients traveling abroad to access affordable and high-quality medical treatments. In India, the medical tourism industry is thriving, with over two million international patients visiting each year. The country’s medical services are highly sought after for their affordability, with many procedures, such as cardiac surgeries and orthopedic treatments, costing only a fraction of what they would in developed countries.

In addition, in 2023, patients from the US represented the third-largest group of international health tourists to Thailand, which provided care to 2.86 million health tourists in total. The Middle East and Thailand’s neighboring countries ranked first and second, respectively. According to a recent report by the Dubai Health Authority (DHA), Dubai attracted over 691,000 health tourists from around the world in 2023, with total spending on healthcare services surpassing AED 1.03 billion (US$ 0.28 billion). These figures exceeded those of 2022, when international health tourist arrivals reached over 674,000, with spending amounting to AED 992 million (US$ 270.07 million).

Customer Orientation Analysis

Women represent the largest demographic in the medical tourism market holding 52.4% share in 2024, driven by their active pursuit of affordable, high-quality healthcare services abroad. This trend is particularly evident in areas such as cosmetic surgery, fertility treatments, and reproductive health, where women seek specialized care that may be more accessible or cost-effective outside their home countries.

In countries like South Korea, cosmetic surgery has become increasingly common among women. According to The Economist, in South Korea, 1 in 5 women have had plastic surgery, whereas in the US, it’s only 1 in 20. The South Korean government views medical tourism as a key national industry, and it actively implements medical, legal, and policy strategies to attract 700,000 foreign patients by 2027. In 2024, the number of foreign medical tourists reached a record high of 1.17 million, nearly double that of 2023. Dermatology was the leading specialty, with 705,000 patients (56.6%), followed by plastic surgery (11.4%), internal medicine (10%), and medical checkups (4.5%).

The growing demand for reproductive health services is evident in the increasing number of women seeking treatment for conditions like endometriosis, fibroids, and other gynecological issues. For example, a woman from the US traveled to Colombia for a hysterectomy, finding the procedure to be much more affordable than in the US, where costs range from $15,000 to $40,000. In Colombia, she received top-tier care in a luxury facility for around $4,000, demonstrating the financial accessibility of medical treatments abroad for women.

Duration of Stay Analysis

Short-term medical tourism is the dominant segment in the global medical tourism market in 2024 with 72.8% share, characterized by patients seeking medical treatments abroad for durations typically ranging from a few days to a couple of weeks. This trend is particularly prevalent among individuals undergoing elective procedures such as cosmetic surgeries, dental treatments, and minor orthopedic interventions, where the recovery period is brief, allowing patients to return to their home countries promptly.

For instance, in South Korea, a leading destination for cosmetic surgery, many international patients travel for procedures like rhinoplasty or eyelid surgery, which often require a hospital stay of only 2 to 3 days, followed by a short recovery period. Similarly, in Malaysia, patients seeking dental treatments or minor surgeries typically spend around 4 to 7 days in the country, combining their medical visits with brief leisure activities. This short-term stay model not only caters to the medical needs of patients but also aligns with their desire to explore new destinations during their brief visit.

Traveler Type Analysis

Individual travelers segment was the largest in the medical tourism market, driven by a combination of personal health needs, affordability, and access to specialized medical treatments abroad. The segment held 80.9% share in 2024. These travelers typically seek treatments that are either more affordable or more readily available in countries outside their own, and they often choose destinations that offer high-quality healthcare services at a lower cost compared to what they would pay in their home countries.

For instance, many individuals from countries like the US and the UK travel to destinations such as India, Thailand, and Turkey for procedures that range from cosmetic surgeries to complex cardiac and orthopedic treatments. In India, for example, individual travelers flock to cities like Delhi, Mumbai, and Chennai for affordable surgeries like heart bypasses or joint replacements. Individual travelers prefer a more personalized approach to their medical tourism experience, often choosing treatments based on their specific needs and conducting detailed research into medical facilities before making a decision.

Key Market Segments

By Service Type

- Therapeutic Service

- Cardiovascular Treatment

- Orthopaedic Treatment

- Cosmetic Treatment

- Bariatric Treatment

- Dental Treatment

- Ophthalmology Treatment

- Infertility Treatment

- Other Treatment Types

- Wellness Service

By Service Provider

- Public

- Private

By Booking Channel

- Phone Booking

- Online Booking

- In Person Booking

By Tourist Type

- Domestic

- International

By Customer Orientation

- Men

- Women

- Children

By Duration of Stay

- Short-Term

- Long-Term

By Traveler Type

- Individual Travelers

- Group Travelers

Drivers

Cost-Effective Treatments

Cost-effective treatments are attracting patients worldwide to seek high-quality healthcare services at a fraction of the cost in their home countries. In countries like India, Mexico, Thailand, and Turkey, patients can save substantial amounts on various medical procedures without compromising on quality.

For instance, a knee replacement surgery in the US can cost approximately $40,000, whereas the same procedure in Mexico is available for around $15,000. Similarly, dental implants that may cost up to $3,000–$4,500 in the US can be obtained in Mexico for as low as $750-$800. These significant savings make medical tourism an attractive option for patients seeking affordable healthcare solutions.

Thailand has also become a popular destination for medical tourists, offering treatments at 50% to 75% less than in Western countries. A rhinoplasty in Thailand, for example, can cost around $2,000, compared to an average of $5,000 in the US In addition, a hair transplant in Turkey typically costs between $3,000 and $4,000, significantly less than the $10,000 to $15,000 charged in the US.

In Colombia, a woman with endometriosis and uterine fibroids underwent a hysterectomy for $4,000, a procedure that would have cost between $15,000 and $40,000 in the US. She received care in a luxury facility with professional staff, highlighting the significant cost savings available through medical tourism. These cost-effectiveness, along with comprehensive packages that include accommodation and transportation, has contributed to their popularity as a medical tourism destinations.

Restraints

Travel and Logistical Challenges

Travel and logistical challenges impact patients’ ability to access and benefit from healthcare abroad. These challenges encompass a range of issues, including complex travel arrangements, accommodation concerns, and the need for post-operative care coordination, all of which can complicate the medical tourism experience.

Coordinating travel logistics for medical treatment requires handling visa requirements, transportation, and accommodation. Managing these elements while addressing health concerns adds an additional layer of stress for medical tourists. A 2023 survey by the Global Healthcare Travel Council (GHTC) highlighted that over 25% of medical tourists reported difficulties in navigating travel logistics, including understanding visa requirements, flight bookings, and securing post-treatment accommodations that align with healthcare facilities. In addition, numerous journal articles and reference books on travel medicine indicate that between 22% and 64% of international travelers experience illness during or after their trip.

Furthermore, a patient undergoing surgery abroad may experience fatigue or discomfort due to travel, which can hinder the healing process and increase the risk of complications. Post-operative care and follow-up consultations pose additional challenges for medical tourists. Coordinating with healthcare providers in the destination country for continued care is crucial, and issues such as time zone differences and travel constraints may complicate this process.

Opportunities

Advancements in Medical Technology and Treatment Options

Advancements in medical technology are significantly transforming the landscape of medical tourism, offering patients access to cutting-edge treatments that were once limited to a few countries. These innovations not only enhance the quality of care but also improve patient outcomes, making medical tourism a more attractive option for individuals seeking specialized treatments abroad.

Robotic-assisted surgeries have revolutionized various medical fields, offering greater precision and minimally invasive options. For example, in India, the urology department at Ram Manohar Lohia Institute of Medical Sciences in Lucknow successfully completed 100 robotic surgeries within just three months of launching the robotic surgery facility. These procedures included surgeries for prostate, urinary bladder, and kidney cancers, as well as other advanced reconstructive urological procedures.

Germany is also a leading destination for high-quality care, particularly in cancer treatment, neurology, and orthopedics. With advanced medical institutions like Charité University Hospital in Berlin and the University Hospital of Heidelberg, the country attracts global patients seeking advanced treatments and clinical trials.

In November 2024, Resorttrust Group and Mitsubishi Corporation announced a collaboration to explore opportunities within medical tourism. As part of this partnership, Mitsubishi and Resorttrust Group’s subsidiary, Advanced Medical Care Inc., will assess the possibility of creating a joint venture to promote medical tourism to Japan.

The initiative will also focus on showcasing the country’s cutting-edge medical screening technologies and healthcare services on a global scale. Furthermore, in June 2025, Marhaba, the airport hospitality brand under Emirates Group’s dnata, teamed up with Prime Health to provide premium travel services for individuals arriving in Dubai for medical treatment. Prime Health patients will have access to Marhaba’s comprehensive services, including Meet and Greet, Check-In Anywhere, and Land and Leave options.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions, such as economic downturns, inflation, and currency fluctuations, can impact individuals’ ability to afford domestic healthcare, leading them to seek more affordable treatment options abroad. Economic slowdowns in regions like Europe and the US led to more patients seeking affordable healthcare alternatives abroad, especially in countries like Mexico, Costa Rica, and India, where treatments cost a fraction of what they would in their home countries.

For example, as healthcare costs in the US continue to rise, more patients are opting for medical treatments in countries like Mexico, where procedures such as dental work or bariatric surgery can be 60-70% cheaper. Currency fluctuations also play a crucial role in determining where patients choose to go for treatment. When the US dollar strengthens, countries like India and Thailand become even more attractive due to the favorable exchange rate.

Geopolitical factors also play a crucial role in medical tourism. Political stability, diplomatic relations, and international policies can affect the ease of travel and the safety of medical tourists. According to a report from the Times of India in April 2025, security concerns and terrorist attacks in India have severely impacted Pakistani patients seeking advanced treatment across the border. The number of visas issued has plummeted from over 1,600 in 2016 to just over 200 in 2024. The situation may come to a complete standstill following the most recent terrorist attack.

Medical Visas issued to Pakistan (2019-2024)

Year No of Medical Visas Issued 2019 554 2020 97 2021 96 2022 145 2023 111 2024 225 Latest Trends

Growing Interest in Wellness Tourism

Wellness tourism has become one of the most rapidly growing segments within the medical tourism market, reflecting a broader societal shift towards health, well-being, and self-care. As people become more health-conscious, many are seeking travel experiences that not only offer relaxation but also focus on improving their physical and mental well-being. Wellness tourism has expanded significantly in recent years, driven by factors such as increasing awareness of mental health, the desire to disconnect from daily stress, and the growing popularity of holistic treatments.

Destinations such as Bali, Thailand, and India are leveraging their deep-rooted traditions in yoga, meditation, and natural therapies to attract health-focused travelers. These countries are blending ancient healing methods with modern wellness services to meet global demand. Thailand, in particular, has emerged as a wellness tourism hub. This shift reflects a broader trend of integrating holistic practices with contemporary health approaches. The wellness offerings in these regions are aligned with rising consumer preferences for preventive health, mental well-being, and eco-conscious experiences.

The Global Wellness Institute (GWI), a leading nonprofit in the wellness sector, has renewed its partnership with BDMS Wellness Clinic for the third year. This collaboration supports ongoing access to in-depth research on Thailand’s position in the global wellness economy. According to GWI’s latest Wellness Economy Monitor, Thailand recorded the highest wellness market growth rate globally from 2022 to 2023. The country posted a remarkable 28.4% increase during this period. After a 31.6% contraction in 2020 due to the COVID-19 pandemic, Thailand’s wellness market has rebounded sharply and gained international attention for its recovery.

Wellness tourism has been a key driver of Thailand’s rebound. In 2023, the sector generated $12.34 billion in revenue, showing a 119.5% year-over-year growth. International wellness tourists in Thailand spent an average of $1,735 per trip, compared to $367 by domestic travelers. Additionally, segments such as wellness real estate and thermal/mineral springs have shown notable progress. These two areas grew by 11.4% and 14%, respectively, underscoring the country’s diverse wellness offerings and long-term potential in the $6.3 trillion global wellness economy.

According to the GWI, wellness travelers took 819.4 million international and domestic trips in 2022, a substantial increase from 483 million in 2020 and 608 million in 2021. Wellness trips made up 7.8% of all tourism trips in 2022 but accounted for 18.7% of total tourism expenditures, emphasizing that nearly one in five tourism dollars was spent on wellness-related travel.

Regional Analysis

North America held significant shares in the Medical Tourism Market

In North America, the medical tourism industry has been experiencing steady growth, particularly in the US, which serves both as a source and as a destination for medical tourists. In 2024, the region accounted for 31.0% of the global market share. Every year, millions of US residents travel abroad for medical care, with popular destinations including Mexico, Canada, as well as several countries in Central America, South America, and the Caribbean. According to the US Department of Commerce, spending by international visitors on medical, educational, and short-term worker expenditures represented 25% of total US travel and tourism exports in January 2024, highlighting the significant economic impact of these sectors, including medical travel.

The Asia Pacific region is experiencing high demand in the field of medical tourism

The Asia Pacific region has become a leading destination for medical tourism, offering a unique combination of high-quality medical services and affordable prices. Countries like Thailand, India, Malaysia, and Singapore are at the forefront of this trend, attracting patients from around the world seeking a wide range of treatments, from elective cosmetic surgeries to complex procedures like heart surgeries and organ transplants. For instance, according to credit rating agency Crisil, India welcomed approximately 73 lakh medical tourists in 2024, a rise from 61 lakh in 2023.

India is home to nearly 1,000 recognized nurse-training centers, primarily linked to teaching hospitals, which graduate around 10,000 nurses each year. In February 2025, India’s Union Finance Minister presented the annual budget, which included several key announcements, with medical tourism being one of the most notable. Among the significant initiatives, the government plans to add 10,000 new seats in medical colleges next year, with an additional 75,000 seats to be created over the next five years. Furthermore, all district hospitals will be equipped with daycare cancer centers, with approximately 200 such centers set to be established in 2025-26.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Spain

- Czech Republic

- Germany

- France

- The UK

- Italy

- Turkey

- Rest of Europe

- Asia Pacific

- Thailand

- China

- Japan

- South Korea

- India

- Australia

- Malaysia

- Singapore

- Taiwan

- Indonesia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Colombia

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- Israel

- UAE

- Oman

- Rest of MEA

Key Players Analysis

The competitive landscape within the medical tourism industry is shaped by a variety of players, ranging from healthcare providers in destination countries to medical tourism facilitators and online platforms. The competition is fierce, driven by the increasing number of patients seeking affordable, high-quality healthcare abroad. For example, major Indian hospitals like the All India Institute of Medical Sciences (AIIMS), Medanta, and Apollo Hospitals have built strong reputations for delivering high-quality care at a fraction of the cost compared to Western countries.

Top Key Players in the Medical Tourism Market

- KPJ Healthcare Bhd

- Apollo Hospitals

- MOHW Hengchun Tourism Hospital

- Bumrungrad International Hospital

- Mount Elizabeth Hospitals

- Raffles Medical Group

- B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Mission Hospital

- Miot Hospital

- VFS Global Group

- Manipal Health Enterprises Pvt. Ltd.

Recent Developments

- In June 2025: KPJ Healthcare Bhd announced its strategic focus on expanding its medical tourism segment, specifically targeting patients from Indonesia. Chin Keat Chyuan, the company’s president and managing director, stated that the group aims to capture a significant share of the large number of Indonesians who travel abroad for healthcare. Currently, approximately 20% of Indonesia’s 270 million population, or around 54 million people, seek medical treatment in countries like Singapore, Malaysia, Thailand, and Vietnam.

- In April 2025: Raffles Medical Group signed a collaboration agreement with Renji Hospital, one of Shanghai’s most prominent public hospitals. This partnership will create a “dual circulation” service system, allowing Raffles patients to benefit from the expertise of Renji specialists, while Renji Hospital will gain access to Raffles’ affluent clientele across Asia.

- In March 2025: Bumrungrad International Hospital Phuket announced that it started the construction of its cutting-edge healthcare facility. This new development is set to enhance Thailand’s reputation as a leading global destination for medical excellence and health tourism.

Report Scope

Report Features Description Market Value (2024) US$ 40.4 billion Forecast Revenue (2034) US$ 207.9 billion CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Therapeutic Service- Cardiovascular Treatment, Orthopaedic Treatment, Cosmetic Treatment, Bariatric Treatment, Dental Treatment, Ophthalmology Treatment, Infertility Treatment, Other Treatment Types; Wellness Service), By Service Provider (Public, Private), By Booking Channel (Phone Booking, Online Booking, In Person Booking), By Tourist Type (Domestic, International), By Customer Orientation (Men, Women, Children), By Duration of Stay (Short-Term, Long-Term), By Traveler Type (Individual Travelers, Group Travelers) Regional Analysis North America – US, Canada; Europe – Spain, Czech Republic, Germany, France, The UK, Italy, Turkey, Rest of Europe; Asia Pacific – Thailand, China, Japan, South Korea, India, Australia, Malaysia, Singapore, Taiwan, Indonesia, Rest of APAC; Latin America – Brazil, Mexico, Colombia, Argentina, Costa Rica, Rest of Latin America; Middle East & Africa – Saudi Arabia, Israel, UAE, Oman, Rest of MEA Competitive Landscape KPJ Healthcare Bhd, Apollo Hospitals, MOHW Hengchun Tourism Hospital, Bumrungrad International Hospital, Mount Elizabeth Hospitals, Raffles Medical Group, Dr. B. L. Kapur Memorial Hospital, Kasemrad Hospital International Rattanathibet, Mission Hospital, Miot Hospital, MedRetreat, VFS Global Group, Manipal Health Enterprises Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- KPJ Healthcare Bhd

- Apollo Hospitals

- MOHW Hengchun Tourism Hospital

- Bumrungrad International Hospital

- Mount Elizabeth Hospitals

- Raffles Medical Group

- B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Mission Hospital

- Miot Hospital

- VFS Global Group

- Manipal Health Enterprises Pvt. Ltd.