Global Medical Thawing System Market By Product Type(Manual Devices, Automated Devices) By Sample(Blood, Ovum, Embryo, Semen, Other Samples) By End-User(Hospitals, Blood Bank & Transfusion Centers, Biotechnology & Pharma, Tissue Banks, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 59817

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

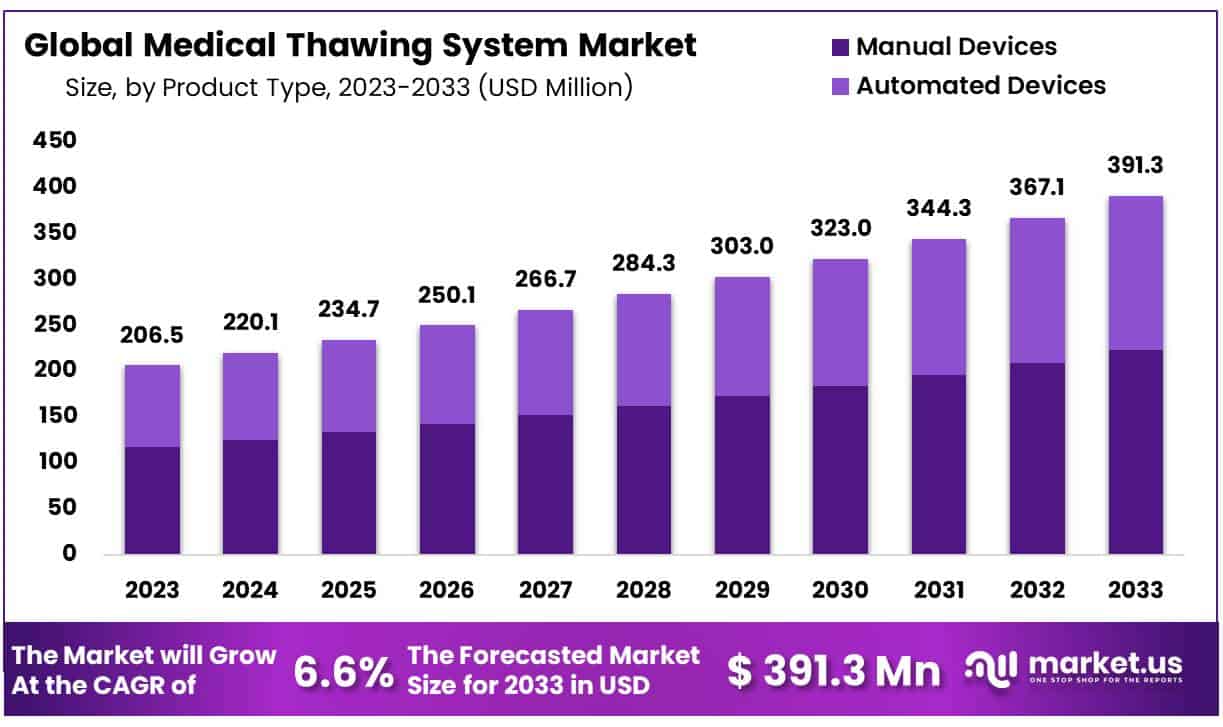

The Global Medical Thawing System Market size is expected to be worth around USD 391.3 Million by 2033 from USD 206.5 Million in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

Medical thawing plays an essential part in blood transfusion. Since blood and plasma products tend to be stored at cold temperatures, they must be defrosted properly to ensure safe transfusion. Thawing can be accomplished using systems equipped with microprocessors that regulate water bath temperature to reach an optimum thawing temperature, typically 30 to 37 degrees Celsius.

Due to an increasing usage of fresh frozen plasma and blood products, medical thawing systems have seen an increased demand. Thawing systems play a vital role in cryopreservation processes for both ovum and semen samples as well as cryopreservation procedures for cryopreservation purposes. Furthermore, expanding donor bases as well as rising awareness regarding blood donation are expected to positively influence the market growth trajectory.

The Medical Thawing Systems Market report offers extensive details about one or more market segments within multiple industries. It includes both quantitative and qualitative analysis from 2024-2033. Factors taken into consideration during its production include product pricing, penetration of services at national or regional levels, national GDP growth rates, dynamics between parent markets and subsidiary markets, industries where products find end applications, key players’ performance analysis, consumer behavior trends as well as economic, political, and social landscapes of various countries – to name just some of its findings. It also features segmented analysis in-depth from every angle possible to give an exhaustive picture.

Key Takeaways

- Market Size: Medical Thawing System Market size is expected to be worth around USD 391.3 Million by 2033 from USD 206.5 Million in 2023.

- Market Growth: The market growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

- Product Type Analysis: Manual thawing systems dominated the market, with a share of 57 %.

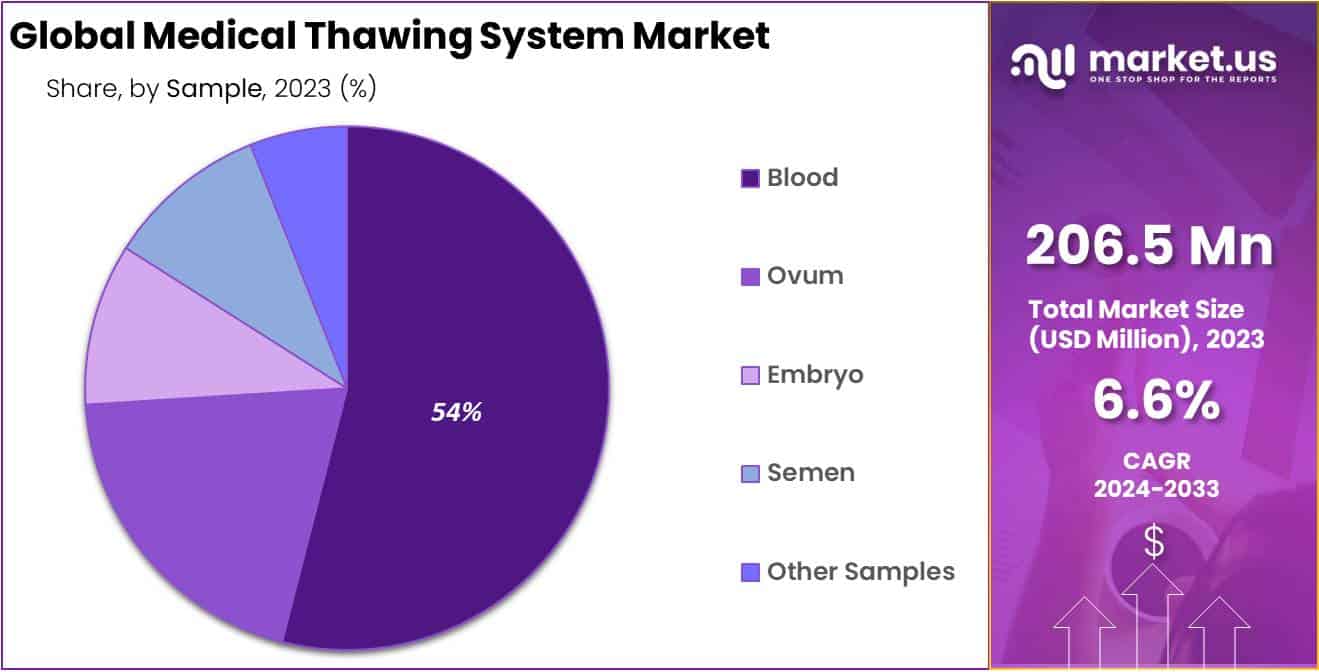

- Sample Analysis: A market share of 54.0% was held by the blood sample segment in 2023.

- End-Use Analysis: The market was dominated by the blood bank & transfusion centers segment with a share of 32% in 2023.

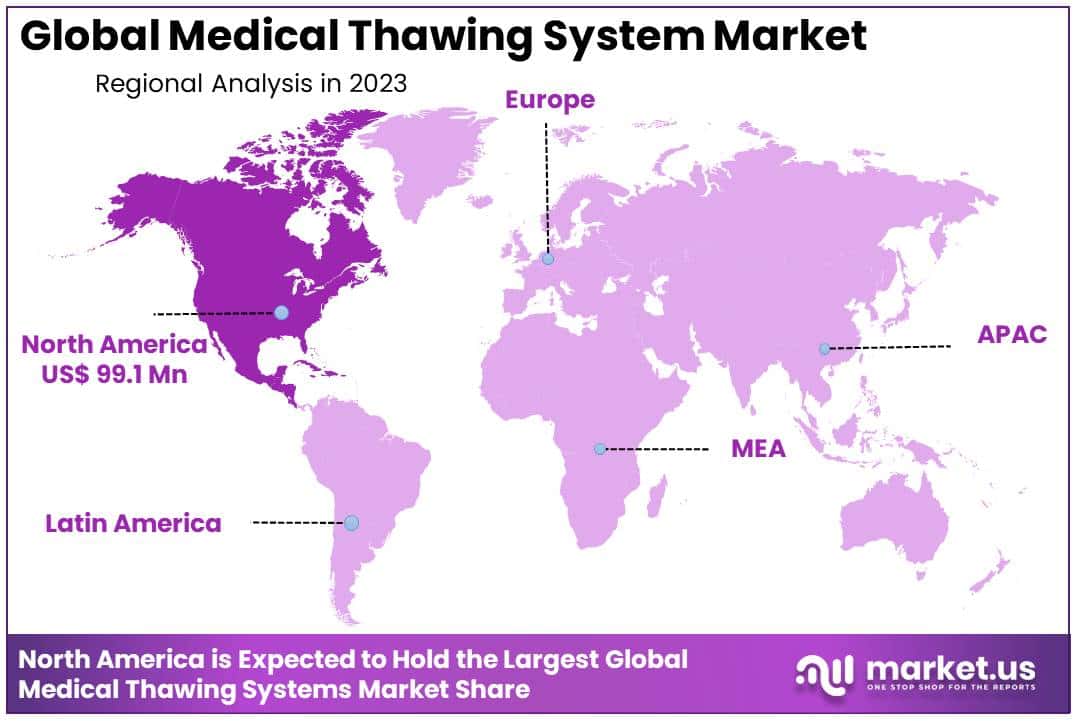

- Regional Analysis: North America held a dominant market share of 48% in 2023 and held USD 99.1 million market revenue in 2023.

Product Type Analysis

In 2023, manual thawing systems dominated the market, with a share of 57 %. This is mainly due to their wide selection of products and high usage because of affordable prices. Because of its features, such as portability and ease of use, the automated thaw machine is expected to grow at a rapid pace.

The segment’s growth is also being driven by the increasing demand for a thawing system in point-of-care settings. Technological advancements and partnerships between major industry players are driving growth in the market for automated heating devices. Pluristem Therapeutics Inc., for the distribution of thawing products, signed a license agreement in December 2018.

Sample Analysis

A market share of 54.0% was held by the blood sample segment in 2023. This dominance can be attributed to rising hemorrhage-related incidents and increasing demand for blood products.

The segment of embryos is expected to expand in the future. The embryo segment’s high growth rate can be attributed to the increase in live birth rate and pregnancy rate as a result. The demand for advanced thawing equipment is also increasing due to the growing adoption of IVF (in vitro fertilization) for infertility treatment.

According to the Centers for Disease Control and Prevention (CDC), there were more than 2.65 million attempts at in vitro fertilization in 2016. A variety of awareness campaigns are also increasing the number of embryo donor transfers. These factors are expected to boost the healthcare market for the forecast period.

End-Use Analysis

The market was dominated by the blood bank & transfusion centers segment with a share of 32% in 2023. This dominance can be attributed to the high use of thawing equipment in these blood banks or transfusion centers. According to the World Health Organization (WHO), there are 13,300 blood centers worldwide that collect 106 million donations. Market growth is expected to be fueled by the increasing number of these institutions and donations.

The fastest expected CAGR for the tissue bank segment will be during the forecast period. Tissue banks are institutions that store human cadaver tissues and allow them to be used for research and education. Skin, tendons, bone joints, and cornea are the most common issues that can be stored. Many of these tissues are useful in the treatment of burn patients.

The success rate of tissue transplantation procedures can be increased by using advanced thawing technology. Market growth is expected to be driven by the increasing use of tissue products and technological advancements.

Key Market Segments

Product Type

- Manual Devices

- Automated Devices

Sample

- Blood

- Ovum

- Embryo

- Semen

- Other Samples

End-User

- Hospitals

- Blood Bank & Transfusion Centers

- Biotechnology & Pharma

- Tissue Banks

- Other End-Users

Driver

Increased Demand for Organ Transplantation

With chronic diseases and organ failures on the rise worldwide, organ transplantation procedures have seen an enormous surge in global popularity. This surge has in turn stoked up demand for medical thawing systems that are necessary for defrosting frozen tissues, organs and blood components before transplant. As medical technology improves and more successful transplantation procedures are performed successfully, efficient thawing systems will only become more necessary over time.

Advanced thawing systems enable rapid thawing and maintain tissue quality. Additionally, the system’s space-saving design, LED digital thermometer, visual heater status indicator, audiovisual high-temperature alarm, and LED digital display make it more reliable. The demand for fast thawing of fresh frozen Plasma at the point-of-care, operating room, procedure area, at the patient’s bedside, or at the trauma site is expected to drive the market growth in the future.

Technological Advancements in Thawing Systems

The medical thawing system market is seeing constant advances in technology that aim to increase its efficiency, accuracy, and safety during thawing processes. Manufacturers are increasingly including innovative features like automated temperature control, precise monitoring sensors, user-friendly interfaces in their thawing systems. These advances not only speed up thawing times but also decrease damage risk while protecting fragile biological materials more safely – leading to widespread adoption of medical thawing systems worldwide.

The market is growing because of the increasing demand for thawed, frozen blood that can be quickly accessed for the treatment of major bleeding. Technology’s most advanced thaw system uses controlled temperature, agitation, and heat to reduce the time of thawing. This also helps ensure plasma safety and efficacy. You can choose from a range of sizes to best suit your needs, such as two bags, four bags, or eight bags.

Trend

Switch Toward Automated Thawing Solutions

Within the medical field, automated thawing systems have seen increasing adoption to streamline processes and minimize human errors as well as increase efficiency. Automated systems offer precise temperature control with consistent performance over manual methods; additionally these automated solutions comply with stringent regulatory requirements for handling tissues and organs more reliably than ever.

As healthcare facilities invest more heavily in automated thawing systems to increase workflow efficiency while meeting transplantation outcomes more reliably as well as ensure strict regulatory requirements are fulfilled for tissue and organ handling compliance regulations requirements set by regulators around tissue/organ handling regulations requirements that regulate tissue/organ handling regulations requirements governing tissue/organ handling practices.

Rising Preference for Portable Thawing Devices

One emerging trend in the medical thawing system market is an increasing preference for portable and compact thawing devices, which offer greater versatility of usage location and enable healthcare providers to perform thawing procedures at point-of-care, including ambulances, emergency rooms and remote healthcare settings. This trend reflects growing emphasis on decentralized healthcare delivery models where rapid access to thawing capabilities is vital for timely treatment or medical emergencies.

Restraint

High Cost of Advanced Thawing Systems

Although advanced medical thawing systems provide many advantages, their higher upfront costs remain an obstacle for market expansion in developing regions with limited healthcare budgets. Initial investments required to purchase and install sophisticated thawing equipment may be prohibitively costly for smaller healthcare facilities with limited resources; their adoption becomes harder when maintenance costs increase further over time, placing an added strain on budget-minded healthcare providers.

Limited Awareness and Infrastructure in Emerging Markets

Unfortunately, in many emerging economies there remains little awareness regarding the use of dedicated medical thawing systems for optimal tissue and organ handling. Furthermore, inadequate healthcare infrastructure prevents widespread adoption of thawing systems; efforts to raise awareness about its benefits as well as investments into healthcare infrastructure development must be prioritized to overcome such barriers and unlock their market potential in emerging economies.

Opportunity

Expanded Adoption of Regenerative Medicine

Regenerative medicine’s growing adoption for treating various chronic conditions and degenerative diseases provides medical thawing system market with an attractive growth opportunity. Regenerative medicine relies on transplanting living cells, tissues or organs from donors into recipients in order to restore normal function or promote tissue regeneration – driving demand among regenerative medicine practitioners and research laboratories worldwide.

Expanded Applications in Biobanking and Research

Medical thawing systems have expanded beyond clinical settings to become an essential tool in biobanking facilities and research laboratories, providing promising opportunities for market expansion. Biobanks store stem cells, tissues, genetic materials for research and therapeutic uses while thawing systems play an essential role in retrieving frozen samples for analysis, experimentation, preservation purposes. As demand for these services and activities continues to increase so too will need for reliable yet efficient thawing solutions increase, driving further market expansion in coming years.

Regional Analysis

North America held a dominant market share of 48% in 2023 and held USD 99.1 million market revenue in 2023. The market is divided regionally into North America (Asia Pacific, Latin America, Europe, and the Middle East and Africa). High adoption rates, growing incidence of chronic conditions, as well as the presence of market leaders are some of the key factors that will drive North America’s market during the forecast period.

The Asia Pacific will likely experience the fastest rate of growth during the forecast period. It is comprised of developing countries, including India, China, and Japan. These countries have a large patient base with a high rate of chronic disease.

Thawed blood will be in demand due to an increase in the incidence of chronic diseases that can lead to organ dysfunctions. These countries are developing new technologies and offering many advanced surgical treatment options through booming healthcare tourism. Patients are attracted to the region by its relatively low cost of treatment. These factors are expected to fuel the Asia Pacific region’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Player Analysis

The top players in this industry include Helmer Scientific Inc., BioCision LLC, SARSTEDT AG & Co. KG, Boekel Scientific, GE Healthcare, Cardinal Health, Barkey, Sartorius AG, CytoTherm,. These companies have a large product portfolio and continue to innovate. These companies offer products for blood banks, hospitals, and tissue centers.

The market is growing due to the increased number of product launches, and the speedy FDA approval. BioCision LLC released two thaw units for 1.5 mL cryogenic vials and 6mL AY closed Vials in January 2016.

These companies are working to develop advanced thawing devices that can be used in different cell therapies. Technology advancements are expected to increase due to increased awareness about cell therapies and the high demand for specialized systems for different cell types. These advanced thaw systems are rapidly being adopted by the medical industry for general research as well as incorporation into in-process clinical trials and manufacturing.

Key Market Players

- Helmer Scientific Inc.

- BioCision LLC

- SARSTEDT AG & Co. KG

- Boekel Scientific

- GE Healthcare

- Cardinal Health

- Barkey

- Sartorius AG

- CytoTherm

Recent Developments

- March 2023: Boekel Scientific announced a new distribution agreement with Thermo Fisher Scientific to sell its thawing systems to Thermo Fisher’s customers in North America.

- April 2023: Helmer Scientific announced a partnership with CryoLogic, a provider of cryogenic storage solutions, to offer a combined solution for the storage and thawing of biological samples.

- September 2023: SARSTEDT launched the SARSTEDT CryoPlus, a new line of cryogenic storage and thawing containers designed for optimal temperature control and sample protection. The CryoPlus containers are available in a variety of sizes and configurations to meet the needs of different applications.

- October 2023: Barkey launched the ThawingMaster Pro, a new thawing system that features a touch-screen interface, real-time temperature monitoring, and data logging capabilities. The ThawingMaster Pro is designed to improve the safety and efficiency of thawing a variety of biological samples, including blood plasma, stem cells, and tissues.

Report Scope

Report Features Description Market Value (2023) USD 206.5 Million Forecast Revenue (2033) USD 391.3 Million CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type-(Manual Devices, Automated Devices); By Sample-(Blood, Ovum, Embryo, Semen, Other Samples); By End-User-(Hospitals, Blood Bank & Transfusion Centers, Biotechnology & Pharma, Tissue Banks, Other End-Users) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Helmer Scientific Inc., BioCision LLC, SARSTEDT AG & Co. KG, Boekel Scientific, GE Healthcare, Cardinal Health, Barkey, Sartorius AG, CytoTherm, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Medical Thawing System?A medical thawing system is a device used to safely and efficiently thaw frozen biological materials such as blood, plasma, and tissue samples for medical procedures or research purposes.

How big is the Medical Thawing System Market?The global Medical Thawing System Market size was at USD 206.5 Million in 2023 and is expected to reach USD 391.3 Million in 2033.

What is the Medical Thawing System Market growth?The global Medical Thawing System Market is expected to grow at a compound annual growth rate of 6.6%. From 2024 To 2033

Who are the key companies/players in the Medical Thawing System Market?Some of the key players in the Medical Thawing System Markets are Helmer Scientific Inc., BioCision LLC, SARSTEDT AG & Co. KG, Boekel Scientific, GE Healthcare, Cardinal Health, Barkey, Sartorius AG, CytoTherm.

How does a Medical Thawing System work?Medical thawing systems typically use controlled temperature environments, often employing water baths or dry heat methods, to gradually thaw frozen biological materials. This ensures the preservation of sample integrity and minimizes the risk of damage or contamination.

What are the key features of a Medical Thawing System?Key features of medical thawing systems include precise temperature control, uniform thawing capabilities, adjustable settings to accommodate various sample types and sizes, and safety features to prevent overheating or sample exposure.

What are the applications of Medical Thawing Systems?Medical thawing systems are used in various healthcare settings such as hospitals, blood banks, research laboratories, and pharmaceutical facilities for thawing blood products, cryopreserved cells, tissues, and other biological specimens before transfusion, testing, or experimentation.

Medical Thawing System MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Thawing System MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Helmer Scientific Inc.

- BioCision LLC

- SARSTEDT AG & Co. KG

- Boekel Scientific

- GE Healthcare

- Cardinal Health

- Barkey

- Sartorius AG

- CytoTherm