Global Medical Spa Market By Service (Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, Other Services), By Age Group (Adolescent, Adult, Geriatric), By Gender (Male, Female), By Service Provider (Single Ownership, Group Ownership, Free-standing, Medical Practice Associated Spas, Other Service Providers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 103718

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

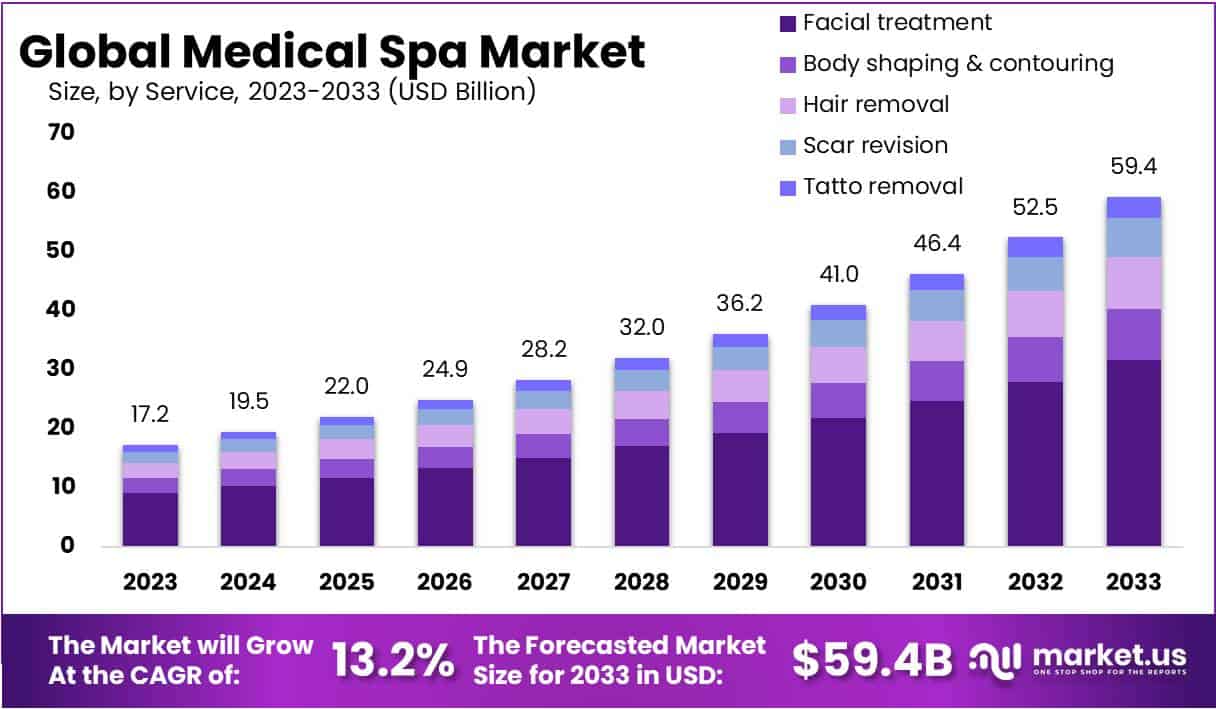

The Global Medical Spa Market size is expected to be worth around USD 59.4 Billion by 2033, from USD 17.2 Billion in 2023, growing at a CAGR of 13.2% during the forecast period from 2024 to 2033.

It is a facility that offers numerous cosmetic and medical procedures under the supervision of licensed medical professionals. In recent years, the market for medical spas has surged due to an increase in demand for non-invasive cosmetic procedures. Medical spas provide non-surgical cosmetic treatments such as dermal fillers & laser treatments that are less invasive than conventional surgical procedures.

Medical spas are in high demand among consumers who want cosmetic enhancements but are reluctant to undergo surgery. Medical spas provide a variety of services which include massage therapy, nutritional counseling, and acupuncture. This reflects the growing emphasis on wellness & self-care which has become more popular in recent years.

Key Takeaways

- Market Growth: The Global Medical Spa Market is set to reach USD 59.4 Billion by 2033, with an annual growth rate of 13.2% from 2024 to 2033.

- Driving Factors: Demand for non-invasive treatments, particularly dermal fillers and laser procedures, fuels market growth at a CAGR of 13.2%, supported by wellness awareness and technology.

- Restraining Factors: High treatment costs and competition from traditional spas hinder market expansion. Regulatory standards increase operational complexities and costs, impacting industry growth.

- Service Dominance: In 2023, facial treatment held a significant market share of 53.3%, projected to grow at a CAGR of 13.2%, driven by anti-aging demand.

- Age Group Dynamics: The adult segment, with 59.2% market share in 2023, thrives due to increasing interest in anti-aging and body contouring treatments.

- Gender Influence: The female segment dominated with an 89.4% market share in 2023, as women increasingly opt for aesthetic treatments, driving growth.

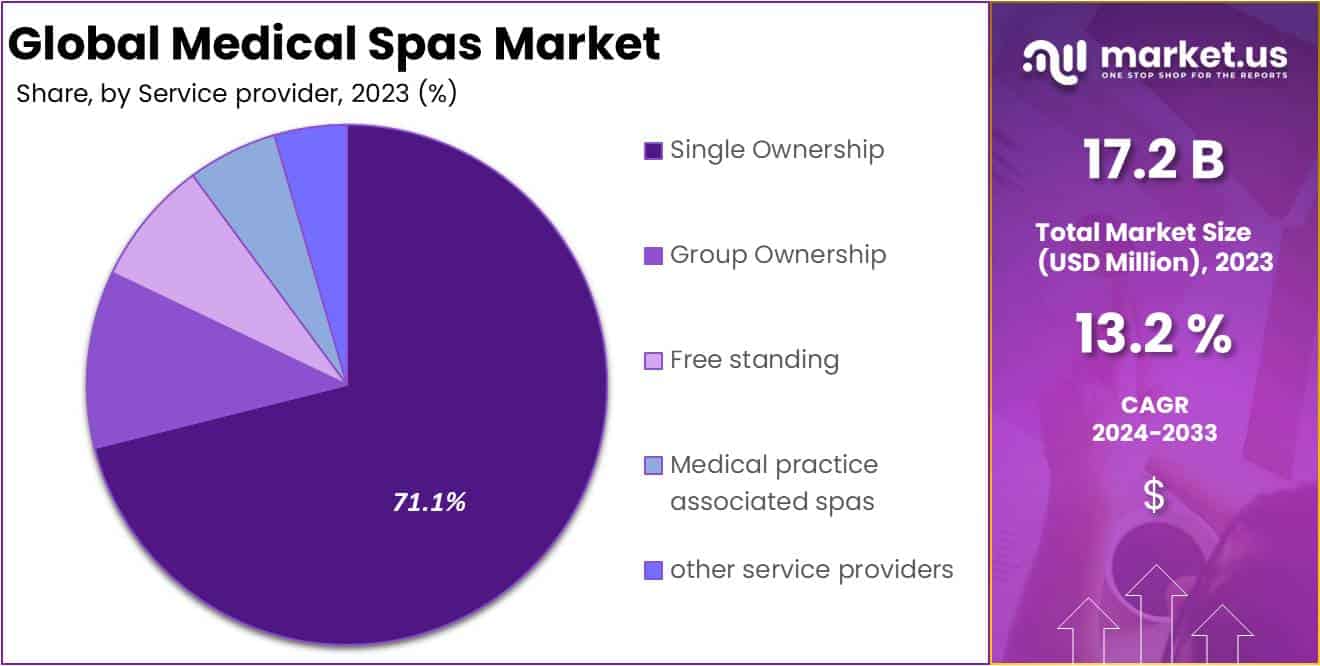

- Service Provider Landscape: Single ownership claimed a major share of 71.1% in 2023, with small, single-owner spas dominating the industry.

- Opportunities: The rising demand for laser and injectable treatments presents a significant growth opportunity, driven by the acceptance of minimally-invasive cosmetic procedures.

- Trends: Growing popularity of natural and organic treatments and the rise of medically-supervised spas are shaping the industry landscape.

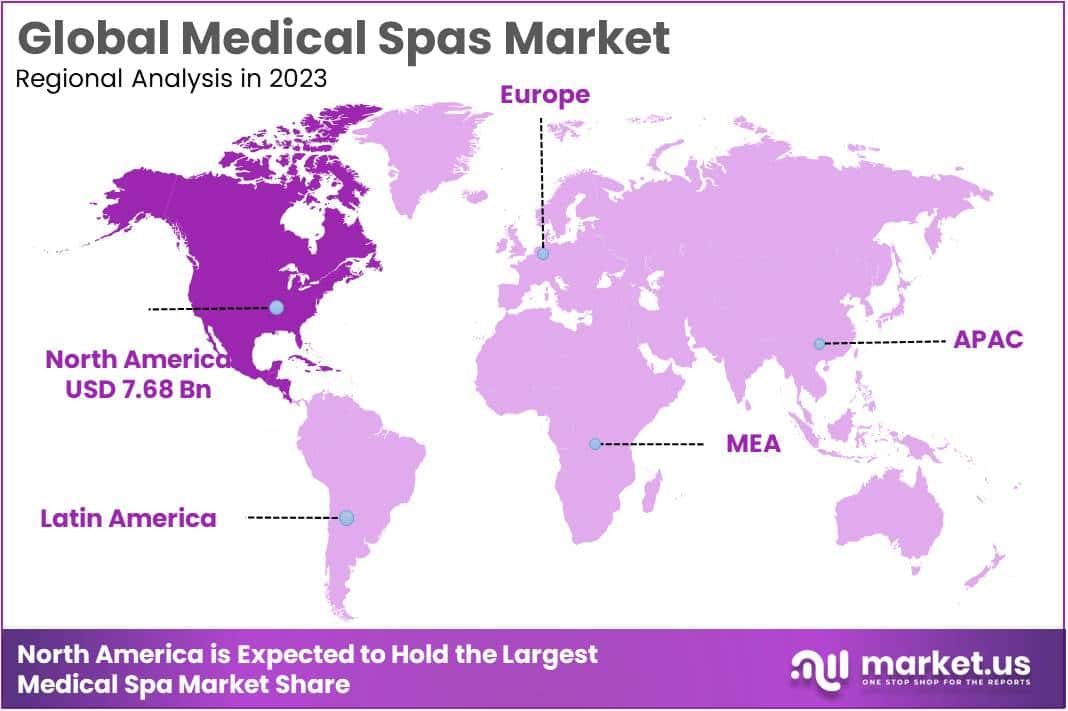

- Regional Dominance: North America led in 2023 with a 44.7% market share and USD 7.68 Billion, driven by higher expenditures on wellness tourism.

Driving Factors

Growing Demand for Non-invasive Procedures like Dermal Fillers

The global medical spa industry is growing rapidly. This growth is driven by numerous factors. One of the main driving factors is the growing demand for non-invasive cosmetic procedures like dermal fillers & laser treatments. The market’s growth is also influenced by a growing awareness of wellness, self-care & technology.

Another important driving force is the elderly population as people are seeking cosmetic treatments to maintain their youthful appearance. Social media also played a part in the growth of the market as medical spas could market their services to a larger audience via social media platforms.

Restraining Factors

High Cost and Alternative Procedures Become Major Restraints

The global medical spa market is growing at a substantial rate but some factors could limit its growth. The high cost of medical spa treatment may be a major factor in limiting its growth. The market is also facing competition from traditional salons & spas that provide similar services.

The rising regulatory standards for medical spa operators can also be a restraining force. These requirements and standards can increase the costs & complexity of operating a medical spa. The lack of standardization in the industry can also lead to inconsistencies between medical spas in terms of the quality of their treatments.

Service Analysis

In 2023, Facial Treatment segment held a dominant market position, capturing more than a 53.3% share.

Based on service, the market for the medical spa is segmented into facial treatment, body shaping & contouring, hair removal, scar revision, tattoo removal, and other services. Among these, the facial treatment segment is the most lucrative in the global medical spa market, with a projected CAGR of 13.2%.

The segment’s dominant share is attributed primarily to the growing demand for antiaging treatments like Botox, dermal fillers, and other similar products. The segment of body contouring & shaping is expected to grow the fastest during the forecast period. Noninvasive fat-reduction procedures are expected to surpass surgical methods like liposuction. The Medspa model is perfectly suited to the advancements in energy-based minimally-invasive devices. They are expected to provide new opportunities for aesthetic enhancement.

Age Group Analysis

In 2023, Adult segment held a dominant market position, capturing more than a 59.2% share.

By age group, the market is further divided into adolescent, adult, and geriatric. The adult is estimated to be the most lucrative segment in the global medical spa market, with a market share of 59.2% and a projected CAGR of 14.4%, in 2023. Due to the growing interest of adults in anti-aging and body contouring treatments, the majority of medspas customers are in their mid-30s.

Nearly 26,0% of female customers in the U.S. were between the ages of 35 and 54. The segment’s growth is fueled by the high spending power of people aged between 35 and 50, as well as an increasing demand for dermal fillers in this age group. Social media’s high influence is increasing the demand among teenagers for facial treatments.

Teenagers are increasingly using anti-aging treatments and products in their beauty regimens. They also want scar-free skin permanently so they opt for nonsurgical scar revisions. The geriatric market is expected to grow significantly during the forecast period. WHO estimates that the number of people over 60 will reach 1.4 billion in 2030. The desire to remain young and attractive in old age is a major factor in the growth of this segment.

Gender Analysis

In 2023, Female segment held a dominant market position, capturing more than an 89.4% share.

Based on gender, the market is segmented into male and female. Among these channels, the female gender is estimated to be the most lucrative segment in the global medical spa market, with a market share of 85% and a projected CAGR of 14.6%, in 2023. As women are the primary consumers, services geared towards women are increasingly being designed.

This positively impacts segment growth. Women’s increasing adoption of numerous aesthetic treatments is driving the segment growth. According to The Aesthetic Society, approximately 94.0% of all esthetic treatments are performed by women. Women use spa treatments to boost their physical happiness, self-esteem, and confidence. Women are increasingly seeking to improve their facial appearance. This has led to an increase in women visiting for Botox or dermal injections.

The male segment will experience lucrative growth over the forecast period. Men are increasingly adopting medical spa services as they realize these treatments can be healthy & relaxing. As a result, the industry has developed skin care products and services geared toward men. The segment is expected to grow due to the increasing number of male clients and the development of market strategies targeted at males.

Service Provider Analysis

In 2023, the Single ownership segment held a dominant market position, capturing more than a 71.1% share.

The market is segmented into single ownership, group ownership, free-standing, medical practice-associated spas, and other service providers based on the service provider. Among these, the single ownership segment is estimated to be the most lucrative segment in the global medical spa market, with the largest revenue share of 66% and a projected CAGR of 13.4% during the forecast period.

According to the American Med Spa Association, over 66% of medical spas are owned by a single person and employ an average of eight employees. Around 63% are owned by non-MDs/surgeons. The industry is dominated primarily by small, single-location, single-owner medical spas equipped with the most advanced technology.

Increasing burnout rates & decreasing reimbursements are also driving more physicians to become medical spa directors or sole or co-owners or owners of the facility. Spas associated with medical practices offer a holistic, integrated approach to healthcare & wellness. They also involve highly-skilled practitioners. These facilities integrate their wellness therapies and treatment with other hospital specialties, providing integrated care. These facilities have been in high demand over the past few years.

Key Market Segments

Based on Service

- Facial Treatment

- Body Shaping & Contouring

- Hair Removal

- Scar Revision

- Tattoo Removal

- Other Services

Based on Age Group

- Adolescent

- Adult

- Geriatric

Based on Gender

- Male

- Female

Based on Service Provider

- Single Ownership

- Group Ownership

- Free-standing

- Medical Practice Associated Spas

- Other Service Providers

Opportunities

Rising Demand for Laser & Injectable Treatments

The increasing demand for minimally-invasive cosmetic treatments such as laser & injectable treatments is a significant opportunity. This demand is driven primarily by the desire for less-painful & less-time-consuming procedures as well as an increasing acceptance of nonsurgical treatments. The growing popularity of wellness and self-care has also led to a rise in medical spas offering services other than cosmetic treatments.

These include massage therapy, nutritional counseling, and acupuncture. The medical spa market is also experiencing significant growth due to the aging population which seeks treatments that will maintain a youthful appearance. Medical spas are also expanding their service offerings owing to technological advancements like new laser technologies or non-surgical treatments.

Trends

Rising Popularity of Natural & Organic Treatments

The global medical spa industry is constantly evolving. Several trends are driving this market forward. One trend is the growing popularity of “natural” & “organic” treatments that use natural ingredients to achieve desired outcomes. A second trend is the rise in “medically-supervised” spas. These are staffed with medical professionals and provide numerous medical-grade treatments.

These spas assure customers that the treatments they receive are safe & effective because they are handled by trained medical professionals. Virtual consultations and online services have also become more popular, especially in the wake of the COVID-19 epidemic because they allow medical spas to reach clients who are unable to or unwilling to visit the spa.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 44.7% share and holds USD 7.68 Billion market value for the year. The dominance of the region is due to higher expenditures on wellness tourism (domestic traffic and international traffic) compared to other regions.

The availability of various services & products in The US and Canada for different aesthetic procedures is anticipated to surge market growth. Asia Pacific will likely register the highest CAGR during the forecast period due to the growing popularity of wellness tourism & the rising expenditure on wellness tourism. The regional market will be driven by the increasing interest in experiential travel, as well as the affordability of flights and other travel options.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Companies offer numerous services including non-invasive cosmetic procedures such as laser treatments & injectables as well as wellness services and self-care. These key players are constantly developing and innovating new technologies & services to maintain their market position and stay ahead of their competition. They also engage in strategic collaborations and partnerships to expand their service offerings and reach.

Market Key Players

- Chic La Vie

- Clinique La Prairie

- Kurotel Longevity Medical Center and Spa

- Lanserhof Lans

- The Orchard Wellness Resort

- Biovital Medspa

- Allure Medspa

- Longevity Wellness Worldwide

- Serenity Medspa

- Vichy Celestins Spa Hotel

- Brenners Park-Hotel & Spa

- Sha Wellness Clinic

- Other Key Players

Recent Developments:

- In January 2024, Moving on to Clinique La Prairie, they introduced a new wellness and rejuvenation program. This program showcases advanced anti-aging treatments and personalized wellness plans, underscoring their dedication to holistic health.

- In December 2023, Chic La Vie recently revealed a strategic collaboration with a leading medical technology company. This partnership aims to integrate cutting-edge aesthetic procedures into their spa services, ultimately elevating the overall experience for their clients.

- In September 2023, As for Lanserhof Lans, they made waves by introducing a groundbreaking regenerative therapy. This innovative approach leverages stem cell research to address various age-related health concerns, positioning Lanserhof Lans as trailblazers in the field of regenerative medicine.

- In March 2023, Kurotel Longevity Medical Center and Spa successfully merged with a renowned international wellness group. This merger not only expanded their global reach but also broadened their spectrum of wellness services.

Report Scope:

Report Features Description Market Value (2023) USD 17.2 Bn Forecast Revenue (2033) USD 59.4 Bn CAGR (2024-2033) 13.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, and Other Services), By Age Group (Adolescent, Adult, and Geriatric), By Gender (Male and Female), By Service Provider Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Chic La Vie, Clinique La Prairie, Kurotel Longevity Medical Center, and Spa, Lanserhof Lans, The Orchard Wellness Resort, Biovital Medspa, Allure Medspa, Longevity Wellness Worldwide, Serenity Medspa, Vichy Celestins Spa Hotel, Brenners Park-Hotel & Spa, Sha Wellness Clinic, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical Spa market in 2023?The Medical Spa market size is USD 17.2 billion in 2023.

What is the projected CAGR at which the Medical Spa market is expected to grow at?The Medical Spa market is expected to grow at a CAGR of 13.2% (2024-2033).

List the segments encompassed in this report on the Medical Spa market?Market.US has segmented the Medical Spa market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Service market has been segmented into Facial Treatment, Body Shaping & Contouring, Hair Removal, Scar Revision, Tattoo Removal, Other Services. By Age Group market has been segmented into Adolescent, Adult, Geriatric. By Gender market has been segmented into Male, Female. By Service Provider market has been segmented into Single Ownership, Group Ownership, Free-standing, Medical Practice Associated Spas, Other Service Providers.

List the key industry players of the Medical Spa market?Chic La Vie, Clinique La Prairie, Kurotel Longevity Medical Center and Spa, Lanserhof Lans, The Orchard Wellness Resort, Biovital Medspa, Allure Medspa, Longevity Wellness Worldwide, Serenity Medspa, Vichy Celestins Spa Hotel, Brenners Park-Hotel & Spa, Sha Wellness Clinic, Other Key Players

Which region is more appealing for vendors employed in the Medical Spa market?North America is expected to account for the highest revenue share of 44.7% and boasting an impressive market value of USD 7.68 Billion. Therefore, the Medical Spa industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical Spa?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical Spa Market.

-

-

- Chic La Vie

- Clinique La Prairie

- Kurotel Longevity Medical Center and Spa

- Lanserhof Lans

- The Orchard Wellness Resort

- Biovital Medspa

- Allure Medspa

- Longevity Wellness Worldwide

- Serenity Medspa

- Vichy Celestins Spa Hotel

- Brenners Park-Hotel & Spa

- Sha Wellness Clinic

- Other Key Players