Medical Kiosk Market By Type (Self-service Kiosk, Check-In-Kiosk, Way Finding Kiosk, Payment Kiosk, and Telemedicine Kiosk), By Facility (Hospitals, Pharmacies, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158036

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

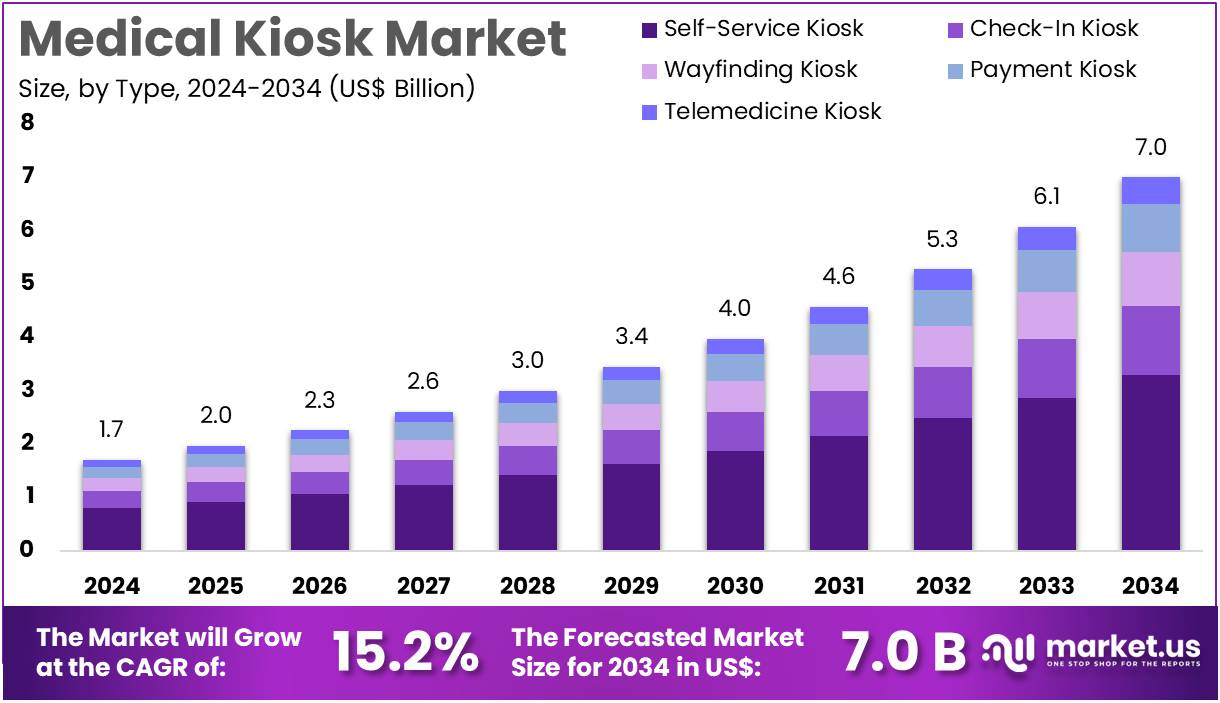

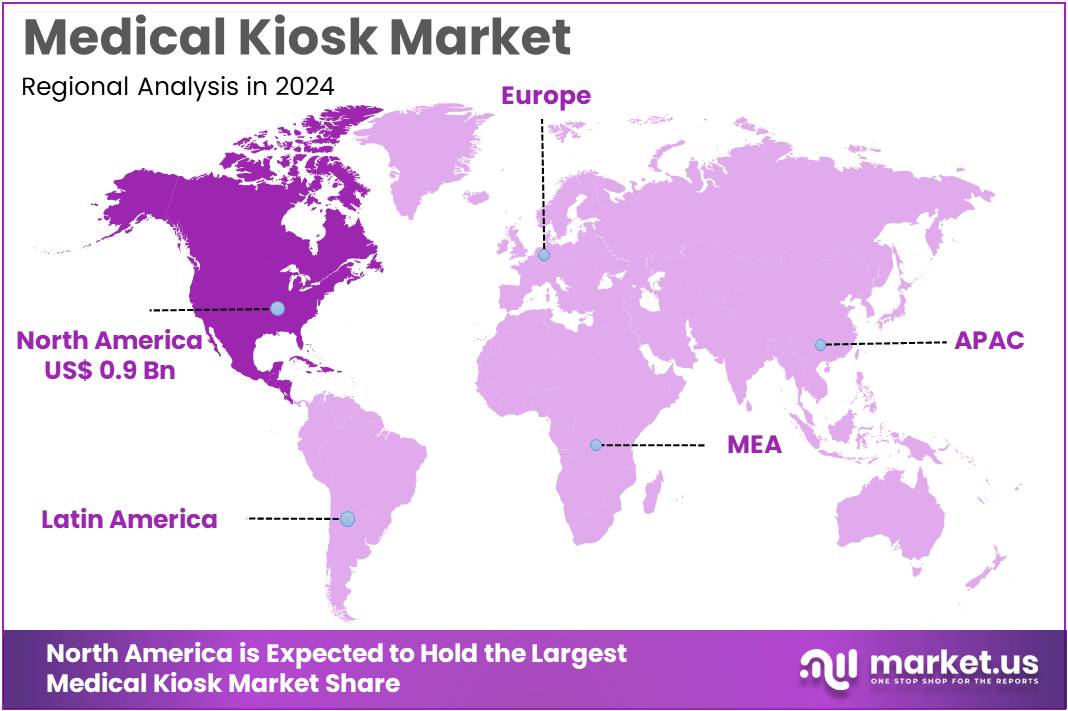

The Medical Kiosk Market Size is expected to be worth around US$ 7.0 billion by 2034 from US$ 1.7 billion in 2024, growing at a CAGR of 15.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 53.9% share and holds US$ 0.9 Million market value for the year.

Rising healthcare labor shortages and a growing emphasis on operational efficiency are primary drivers of the medical kiosk market. These automated systems are critical for handling routine administrative tasks, such as patient check-ins, insurance verification, and appointment scheduling, which frees up staff to focus on more complex patient care. The US healthcare industry faces a significant staffing crisis; the American Hospital Association estimates a shortage of up to 124,000 physicians by 2033, while the Bureau of Labor Statistics projects a need to hire at least 200,000 nurses a year. This widespread shortage of skilled personnel fuels the demand for technology that can automate processes and improve workflow.

Growing technological advancements and a shift toward comprehensive, virtual solutions are key trends shaping the market. Manufacturers are integrating artificial intelligence and advanced software into their kiosks, transforming them from simple check-in points into multi-functional platforms that can manage a wide range of tasks. For example, in March 2024, Olea Kiosks Inc. launched its Virtual Reception and Self-Service Kiosks to address growing labor shortages. This virtual reception system leverages advanced technology to manage tasks like answering calls and scheduling appointments, enabling businesses to operate more efficiently with reduced staffing requirements and enhancing the patient experience.

Increasing patient preference for self-service options and contactless interactions is creating significant opportunities for market expansion. Consumers are becoming more accustomed to using self-service technologies in other industries, and they expect similar convenience in healthcare settings. According to a 2024 report by the Health Resources and Services Administration (HRSA), over 75 million people currently live in a primary care Health Professional Shortage Area, highlighting the immense need for accessible care. Medical kiosks provide a critical solution by extending access to basic health services and information in diverse settings like pharmacies and retail stores, thereby reducing wait times and improving patient flow in overextended clinics and hospitals.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.7 billion, with a CAGR of 15.2%, and is expected to reach US$ 7.0 billion by the year 2034.

- The type segment is divided into self-service kiosk, check-in-kiosk, way finding kiosk, payment kiosk, and telemedicine kiosk, with self-service kiosk taking the lead in 2023 with a market share of 47.2%.

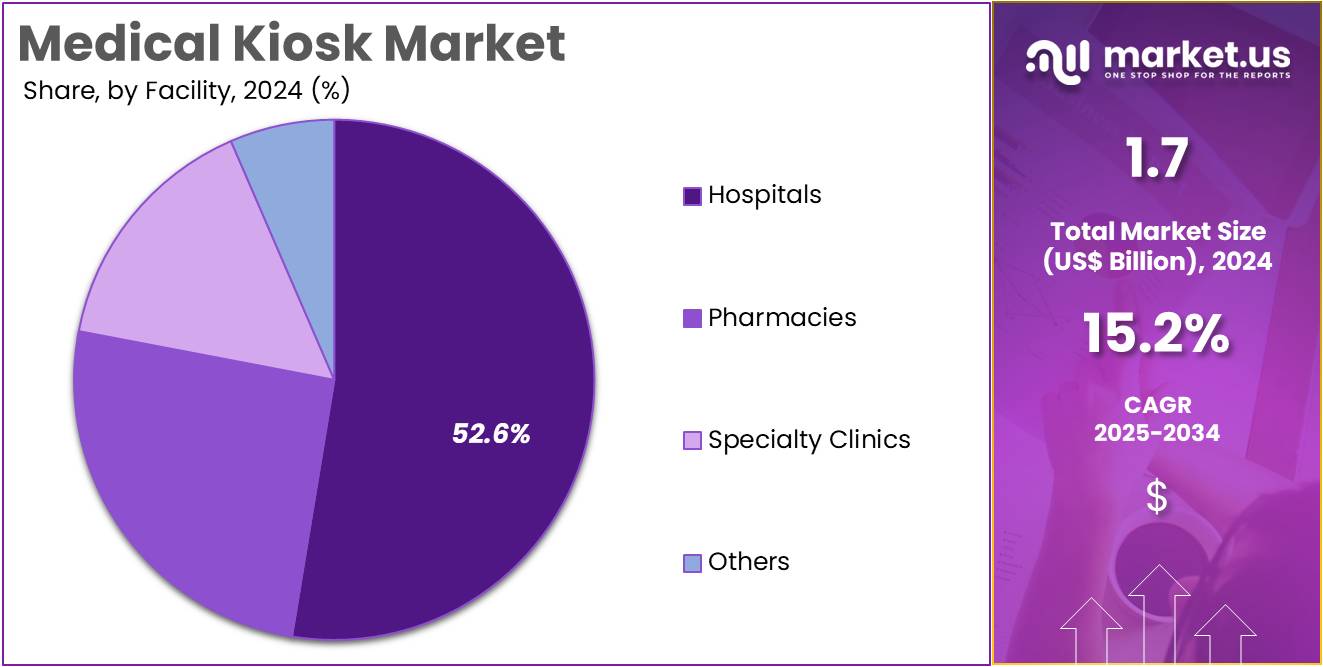

- Considering facility, the market is divided into hospitals, pharmacies, specialty clinics, and others. Among these, hospitals held a significant share of 52.6%.

- North America led the market by securing a market share of 53.9% in 2023.

Type Analysis

Self-service kiosks dominate the market with a share of 47.2%. This growth is expected to continue as healthcare facilities increasingly adopt self-service solutions to improve operational efficiency and reduce patient wait times. Self-service kiosks provide patients with the ability to check in, update personal information, make payments, and confirm appointments without the need for assistance from hospital staff. This reduces administrative workload and streamlines patient flow, resulting in time savings for both patients and staff.

The demand for self-service kiosks is also driven by the rising need for contactless interactions, particularly in response to the COVID-19 pandemic, where minimizing physical contact has become a priority. With advancements in technology, such as integration with electronic health records and payment systems, self-service kiosks are expected to become even more sophisticated, further enhancing their role in improving the healthcare experience. The growing focus on digital transformation and automation in the healthcare sector will continue to drive the adoption of self-service kiosks in various medical facilities.

Facility Analysis

Hospitals account for the largest share of 52.6% in the medical kiosk market. This segment’s growth is expected to continue as hospitals increasingly incorporate digital solutions to enhance patient care, improve efficiency, and streamline administrative processes. Medical kiosks in hospitals help patients check in, access healthcare information, make payments, and schedule appointments, which not only improves patient satisfaction but also reduces operational costs. As hospitals strive to enhance patient experience, self-service kiosks are becoming a vital part of their service offerings.

Moreover, as healthcare moves toward more patient-centric models, where patients are more involved in their care, the demand for self-service kiosks is anticipated to rise. Hospitals are also increasingly integrating kiosks with telemedicine capabilities, allowing patients to conduct virtual consultations while in the hospital, which aligns with the growing trend of remote healthcare services. As hospitals focus on improving patient engagement and reducing wait times, kiosks are likely to play a central role in their operational strategies.

Key Market Segments

By Type

- Self-service Kiosk

- Check-In-Kiosk

- Way Finding Kiosk

- Payment Kiosk

- Telemedicine Kiosk

By Facility

- Hospitals

- Pharmacies

- Specialty Clinics

- Others

Drivers

The increasing need for accessible healthcare is driving the market

The medical kiosk market is being driven by the growing demand for convenient and accessible healthcare services, especially in areas with a shortage of primary care providers. These kiosks offer a solution by providing a decentralized model of care, allowing individuals to access basic health screenings, consultations, and other services without needing to travel to a traditional clinic or hospital. This is particularly crucial in rural and low-income areas, which are often classified as healthcare deserts.

The ability of kiosks to provide essential services in easily accessible locations like pharmacies, workplaces, and community centers helps to bridge the gap in healthcare access and reduce the burden on crowded emergency rooms. According to the US Department of Health and Human Services (HHS), as of late 2023, there were over 8,350 designated Primary Care Health Professional Shortage Areas (HPSAs) across the United States. This statistic underscores the immense and persistent need for innovative solutions like medical kiosks to provide care to millions of Americans who lack sufficient access to healthcare.

Restraints

The high initial capital cost is restraining the market

A significant restraint on the medical kiosk market is the high initial capital expenditure and ongoing operational costs associated with these units. While kiosks are designed to improve efficiency, the upfront investment can be a substantial barrier for potential buyers, particularly for small clinics, pharmacies, and non-profit organizations. The cost includes not only the hardware—such as the kiosk shell, integrated diagnostic tools, and touchscreen displays—but also the software, installation, and networking infrastructure required to connect to telehealth platforms and electronic health records.

Furthermore, regular maintenance, cleaning, and technical support add to the total cost of ownership. The price of a single, full-featured medical kiosk can range from tens of thousands to over a hundred thousand dollars, a figure that requires a significant financial commitment. This financial hurdle makes it difficult for many potential adopters to justify the investment, thereby limiting the market’s growth and widespread deployment.

Opportunities

The integration with telehealth and RPM is creating growth opportunities

A key growth opportunity for the medical kiosk market lies in the deep integration of telehealth and remote patient monitoring (RPM) services. Originally conceived as basic screening devices, medical kiosks are evolving into comprehensive, interconnected health stations. By linking a kiosk to a telehealth platform, a patient can perform a self-service health check, and their vitals and other data can be immediately transmitted to a remote physician for a real-time video consultation. This seamless integration transforms the kiosk from a simple data collection point into a full-fledged, virtual care clinic.

This opportunity is fueled by the growing acceptance and use of telehealth services. According to data from the Centers for Medicare & Medicaid Services (CMS), while telehealth utilization has declined from its pandemic peak, it remains significantly higher than pre-pandemic levels. By the last quarter of 2023, over 12.6% of Medicare beneficiaries received a telehealth service, proving that a large patient population is ready and willing to use virtual care, a trend that directly benefits the functionality of medical kiosks.

Impact of Macroeconomic / Geopolitical Factors

The medical kiosk market is significantly influenced by macroeconomic and geopolitical factors. The rising cost of healthcare and inflationary pressures are a major driver, as medical kiosks offer a cost-effective alternative for routine check-ups and telemedicine appointments, reducing the need for expensive in-person visits. However, these same economic pressures can also hinder the market, as hospitals and clinics facing budget constraints may postpone capital investments in new technology. The global supply chain for medical kiosks, which relies on a variety of electronic and hardware components from different regions, is vulnerable to geopolitical disruptions.

Current US trade policies have introduced significant cost volatility, with new tariffs on a wide range of imported goods. For example, a universal 10% tariff now applies to most imported medical devices and their components. This is compounded by country-specific duties, such as a 50% tariff on certain Chinese-made semiconductors and a 20% duty on goods from the EU. These tariffs raise the overall cost of manufacturing and acquiring medical kiosks, compelling companies to either absorb the expenses or pass them on to healthcare providers, which can ultimately impact the technology’s adoption and accessibility.

Latest Trends

The incorporation of AI for diagnostics and triage is a recent trend

A defining trend in the medical kiosk market in 2024 is the accelerated incorporation of artificial intelligence (AI) and machine learning for enhanced diagnostics and patient triaging. This innovation is transforming the kiosk from a simple data capture device into a smart health assistant. AI algorithms can analyze a patient’s self-reported symptoms and vital signs to provide a preliminary diagnosis, recommend the appropriate level of care, or connect them with the right specialist.

This capability reduces the burden on human healthcare professionals and helps to ensure that patients receive the most suitable care in a timely manner. This trend is strongly supported by intellectual property filings. The US Patent and Trademark Office (USPTO)’s patent search database for 2024 shows a steady increase in patents granted for medical devices that utilize AI, particularly for diagnostic and triaging purposes. These patents cover inventions like intelligent health kiosks that use deep learning to analyze health data and provide personalized health insights, signaling a significant strategic shift toward developing smarter, more autonomous kiosk systems.

Regional Analysis

North America is leading the Medical Kiosk Market

With a reported 53.9% share, North America has established itself as the dominant force in the global medical kiosk market. This significant growth is driven by the region’s advanced healthcare infrastructure, a strong push for digital health solutions, and the increasing demand for convenient, self-service options. The rising prevalence of chronic diseases and a growing emphasis on preventative care are key drivers, as kiosks offer accessible ways for patients to monitor their health.

According to the Centers for Disease Control and Prevention (CDC), chronic diseases are a leading cause of death and disability in the US, with six in ten Americans living with at least one chronic condition. This substantial disease burden necessitates the adoption of efficient, automated healthcare solutions.

Furthermore, a 2024 data brief from the US Office of the National Coordinator for Health Information Technology (ONC) highlights that 99% of US hospitals had adopted patient engagement capabilities that allow patients to electronically view their health information, demonstrating a widespread commitment to digital tools that support kiosk integration. These devices streamline administrative tasks like check-in and payment, reducing wait times and improving the overall patient experience.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to grow as the fastest-growing market for medical kiosks during the forecast period. This is largely due to increasing government spending on healthcare infrastructure, a burgeoning population, and a growing focus on improving access to care in both urban and rural areas. Governments in the region are actively promoting digital health initiatives to enhance efficiency and reduce the burden on traditional healthcare facilities.

For instance, the Government of India has been actively promoting telemedicine through its e-Sanjeevani platform, which, as of February 2025, has successfully completed over 340 million consultations, demonstrating a massive public embrace of digital health. The rapid urbanization and increasing number of smartphone users are anticipated to drive demand for self-service healthcare solutions. The rise of chronic diseases and the need for continuous patient monitoring are also estimated to accelerate the adoption of these kiosks.

A November 2024 news release from Vietnam News confirmed that Da Nang Hospital officially inaugurated a smart medical kiosk system, a move that is part of a larger government initiative to implement 1,001 such kiosks at medical facilities nationwide by the end of 2025. A growing number of private hospitals and diagnostic centers in the region are projected to invest heavily in modernizing their facilities to improve patient flow and service quality, with these platforms being a central component of this strategy. Overall, a combination of technological advancements, supportive government policies, and a shift toward patient-centric care is poised to make Asia Pacific a major hub for this market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical kiosk market are driving growth by implementing several key strategies. They are heavily focused on integrating advanced diagnostic capabilities, leveraging artificial intelligence and biometric data to enhance screenings. Companies also pursue strategic partnerships with pharmacies and healthcare networks to improve accessibility and create a seamless patient journey. Furthermore, they are expanding their service offerings to include remote monitoring and telehealth consultations, providing a more comprehensive care solution. This combination of technological innovation and strategic business development is crucial for maintaining a competitive edge.

Higi, a prominent player in the market, operates with a business model centered on its extensive network of free-to-use Smart Health Stations. The company’s strategy involves leveraging its vast physical presence in high-traffic retail locations to gather valuable health data, which it then uses to connect consumers with its partner health systems and plans. This approach allows Higi to facilitate proactive health management at scale, empowering individuals to take control of their wellness and improving care outcomes by bridging the gap between physical and digital healthcare.

Top Key Players in the Medical Kiosk Market

- XIPHIAS Software Technologies

- RedyRef Interactive Kiosks

- Olea Kiosks Inc

- Meridian Kiosks

- Kiosks4business Ltd

- KIOSK Information Systems

- imageHOLDERS

- Frank Mayer and Associates, Inc

- Fabcon, Inc

- DynaTouch Corporation

Recent Developments

- In April 2025: The HERMES AI-powered kiosk was introduced as part of a pilot project to offer tailored guidance for over-the-counter drug choices. By utilizing sophisticated AI models such as GAMENet and GAT, the system can detect potential drug interactions in real time, while also offering multilingual support, accessibility features, and secure adaptive learning, ensuring a user-friendly public health tool.

- Between June and July 2025: OnMed rolled out CareStation telehealth kiosks in Bruni, Texas, and Bradley International Airport in Connecticut. These kiosks enable users to conduct remote consultations with healthcare providers, track vital signs, and access real-time medical support, improving healthcare availability in underserved rural areas and busy transportation hubs.

- In April 2024: DynaTouch, a leading provider of kiosk solutions, acquired KioWare, a company specializing in kiosk management software. This acquisition is expected to enhance DynaTouch’s ability to offer more integrated kiosk solutions, further solidifying its position in the market.

Report Scope

Report Features Description Market Value (2024) US$ 1.7 billion Forecast Revenue (2034) US$ 7.0 billion CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Self-service Kiosk, Check-In-Kiosk, Way Finding Kiosk, Payment Kiosk, and Telemedicine Kiosk), By Facility (Hospitals, Pharmacies, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape XIPHIAS Software Technologies, RedyRef Interactive Kiosks, Olea Kiosks Inc, Meridian Kiosks, Kiosks4business Ltd, KIOSK Information Systems, imageHOLDERS, Frank Mayer and Associates, Inc, Fabcon, Inc, DynaTouch Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- XIPHIAS Software Technologies

- RedyRef Interactive Kiosks

- Olea Kiosks Inc

- Meridian Kiosks

- Kiosks4business Ltd

- KIOSK Information Systems

- imageHOLDERS

- Frank Mayer and Associates, Inc

- Fabcon, Inc

- DynaTouch Corporation